31 Mar The Wire China : The Chinese EV Price War Goes Global

Media Source : The Wire China

The fierce competition between Chinese automakers has the potential to reshape EV markets around the world — and stoke resistance.

When BYD kicked off its latest marketing campaign last month, it used a simple slogan: “Electric Is Cheaper Than Gasoline.” In the two weeks after the Lunar New Year, the Chinese automaker matched its words with actions, launching newer versions of eight models with lower prices. Its cheapest car, a compact called Seagull, now costs as little as 69,800 yuan — just under $10,000.

With the discounts, which cover around 90 percent of its products, BYD effectively extended and escalated a price war started by Tesla the year before.

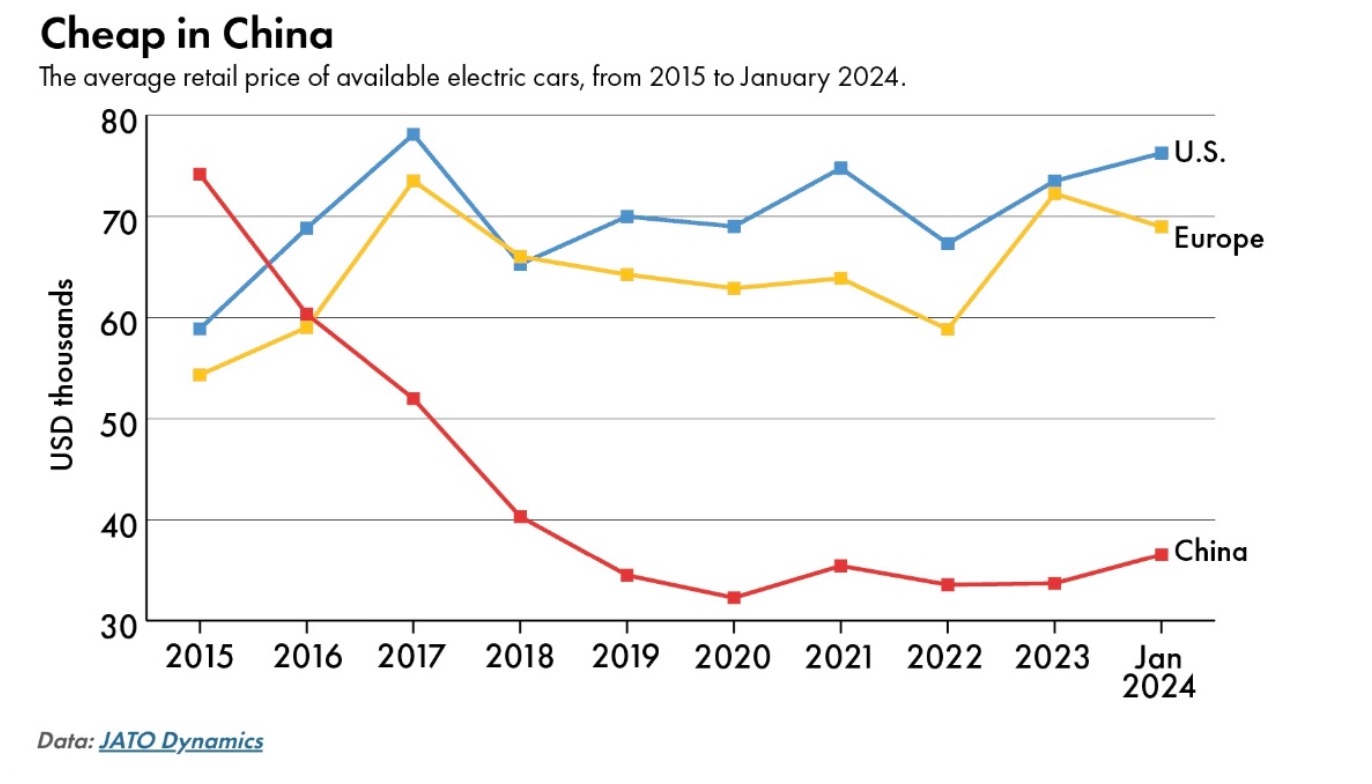

“China has electric vehicles for almost every segment, while in the West — not only Europe, but also the U.S. and Korea — electric vehicles have been positioned as premium vehicles,” says Felipe Munoz , an analyst at JATO Dynamics, a London-based automotive intelligence firm.

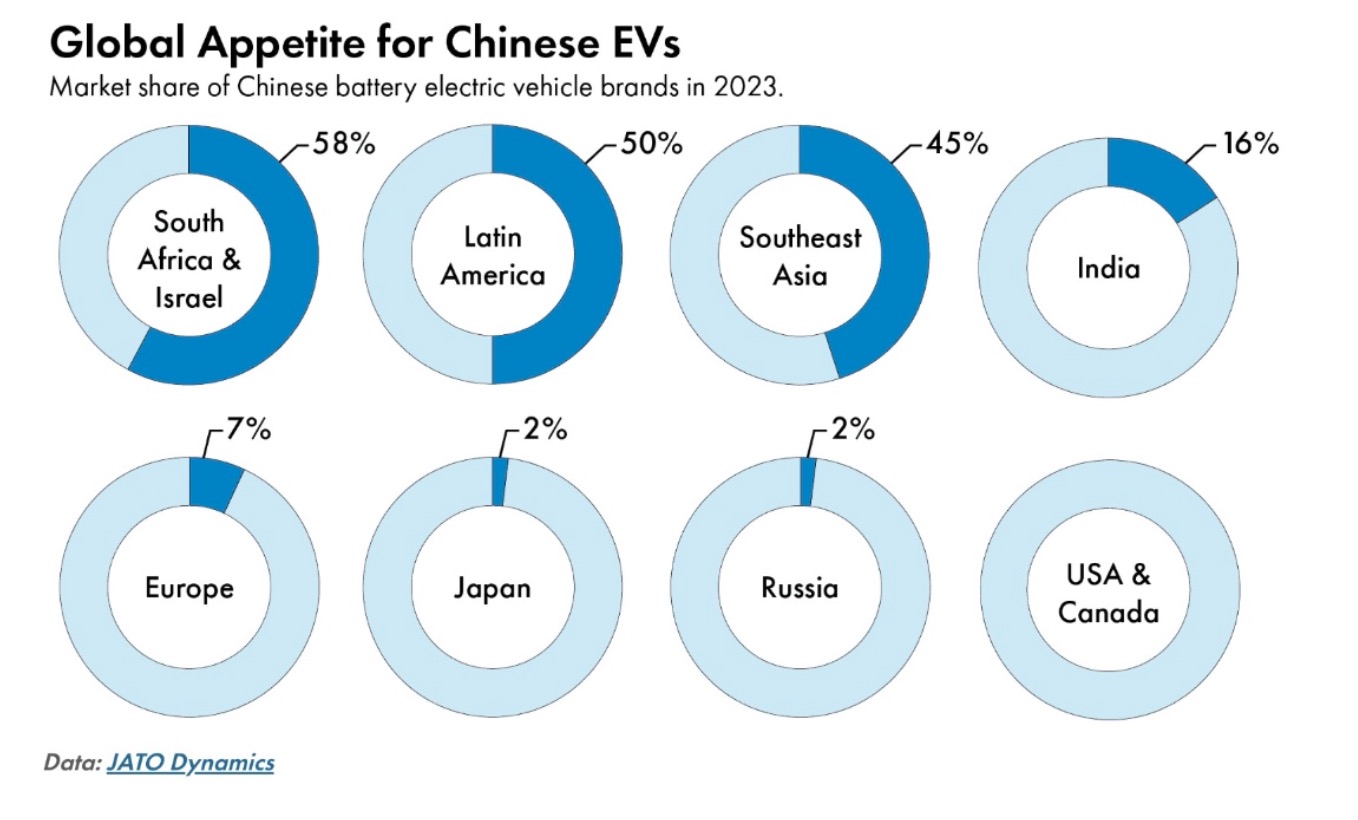

Yet despite growing fears in some countries of a flood of Chinese EVs that could swamp home champions, the likes of BYD may not have things all their own way.

The EU’s probe into Chinese EV subsidies is one sign of the backlash brewing across developed markets. Although that probe has yet to conclude, the bloc started requiring customs registration of imports of Chinese EVs earlier this month, noting a “substantial increase” in imports since its investigation began in October.

“At this stage it is possible that…the injury, which would be difficult to repair, started to materialize even before the end of the investigation,” the EU said in the document, noting that more European producers would suffer from “diminishing sales and reduced production levels.” Import registration could pave the way for retrospective tariffs on Chinese EVs, which are expected to be around 10 percent, according to several analysts.

The UK is considering a similar investigation into Chinese EV subsidies, Politico reported last month. Meanwhile, Chinese EVs will also likely remain largely closed off from the U.S., where they face an additional 25 percent tariff imposed under the Trump administration on top of the 2.5 percent tariff on all imported vehicles.

In recent weeks, both Republican and Democratic senators have urged the U.S. government to increase existing tariffs and plug loopholes amid concerns that Chinese companies may be using Mexico as an export backdoor. At his campaign rally last Saturday, Trump vowed to slap a 100 percent tariff on imports of Chinese cars, including those coming from Mexico, if he wins this autumn’s election.

“There will be more pressure and resistance from different parts of the world,” says Ernan Cui, a China consumer analyst with Gavekal Dragonomics. “Right now, the major movement going forward is for Chinese automakers to move their production lines to other countries, which is regarded as an acceptable solution to deal with protectionism or trade conflicts.”

BYD is building factories in Uzbekistan, Hungary, Brazil, and Thailand, and scouting locations for another plant in Mexico. The Chinese state- controlled SAIC Motors , which owns MG, Maxus and other brands, in July announced plans to construct its first factory in Europe.

Chinese EV makers have other hurdles to overcome, such as lingering consumer skepticism.

But room for growth in those markets may also shrink. Brazil, where Chinese EV sales tripled from June to December last year, is already pushing back against imports of other Chinese industrial goods, such as steel and chemicals. Chinese auto sales to Russia are meantime tapering off after a record-breaking year.

For sure, Chinese EV makers may gain a more sympathetic reception from those who argue that the spread of affordable EVs could help governments achieve the transition to cleaner energy more quickly.

“If the world’s goal to decarbonize is better served with a pivot from oil and gas and combustion-based transportation sector to EV, then how are we helping by adding tariffs to the supply chain and the countries that have made EVs more affordable?” he asks.

Rachel Cheung is a staff writer for The Wire China based in Hong Kong. She previously worked at VICE World News and South China Morning Post , where she won a SOPA Award for Excellence in Arts and Culture Reporting. Her work has appeared in The Washington Post, Los Angeles Times, Columbia Journalism Review and The Atlantic, among other outlets.

Source : The Wire China

Sorry, the comment form is closed at this time.