06 Jan Bloomberg : US Considering Hiking Tariffs on China EVs, Solar Products, WSJ Reports

Media Source : Bloomberg

by Katrina Nicholas

Thu, 21 December 2023 at 12:11 am GMT-8·4-min read

(Bloomberg)–The US is considering raising tariffs on Chinese electric cars and other goods as it tries to limit reliance on Asia’s biggest economy and shield its own green industry, the Wall Street Journal reported Thursday, citing people it didn’t identify.

While officials in President Joe Biden’s administration have largely left in place Trump-era tariffs on around $300 billion of Chinese goods, the White House and other agencies are debating the levies again, the people said, with an eye on completing a review of the tariffs early in the new year.

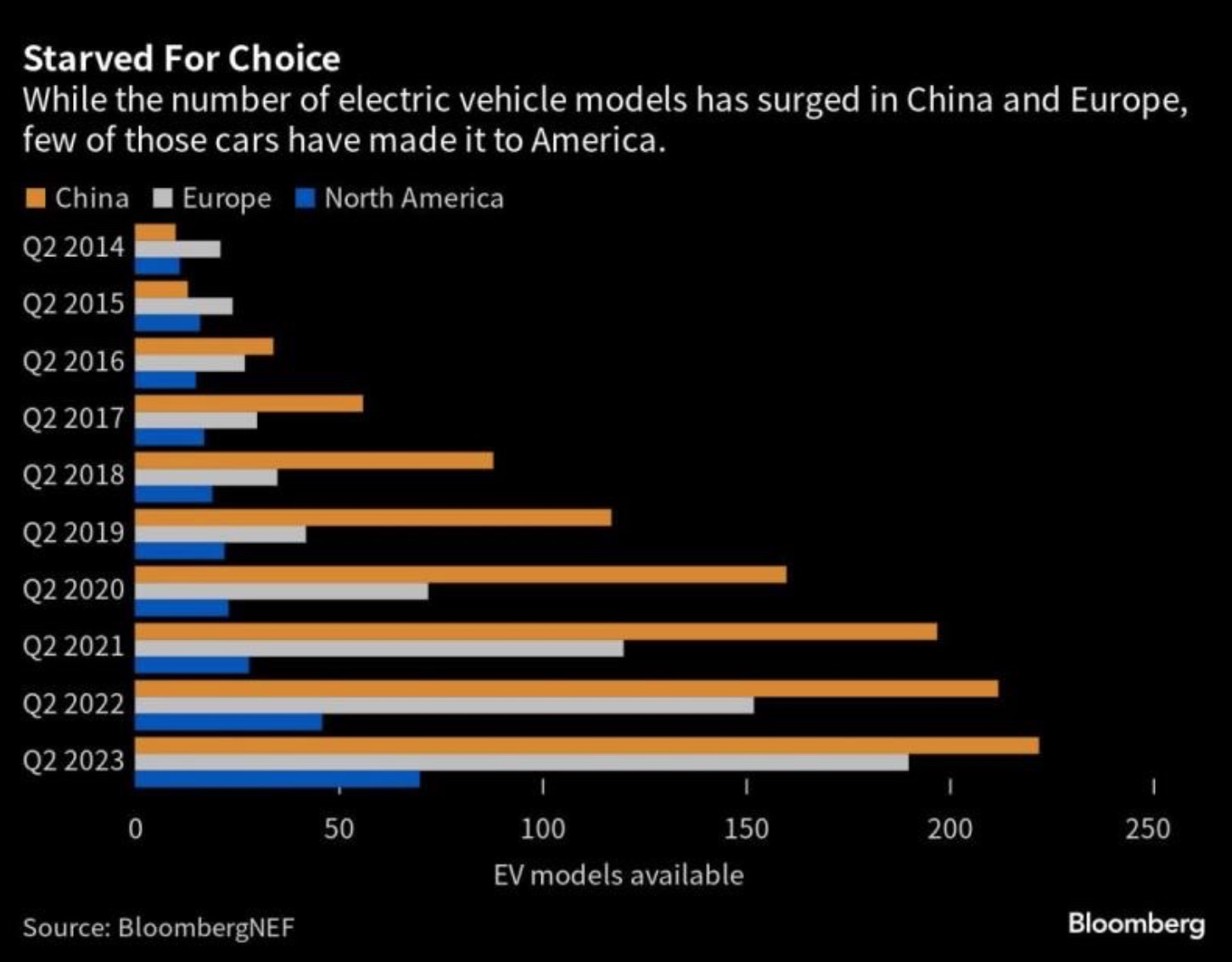

China has become a global powerhouse in electric cars, with BloombergNEF earlier estimating that the country was expected to account for about 60% of the world’s 14.1 million new passenger EV sales in 2023. That dominance has led to tension elsewhere — most prominently in Europe, which in September launched a probe into state subsidies for Chinese EVs with EU officials claiming that China was unfairly flooding the market with cheap cars. Beijing has called that investigation a breach of World Trade Organization rules.

The EV landscape in Europe is different than in the US, where tariffs are already high enough to deter competition from China. China exported nearly 48,000 electric cars to North America as of October this year, compared to the more than 564,000 vehicles it sent to Western Europe.

Chinese electric vehicles are currently subject to a 25% levy in the US, limiting their ability to enter the market. China’s BYD Co., for example, doesn’t retail its passenger vehicles in North America — despite being on the cusp of overtaking Elon Musk’s Tesla Inc. as the world’s biggest seller of electric cars.

Raising those EV tariffs would therefore likely have little immediate impact on US consumers, according to the Journal report.

Asked Thursday about the report, a spokesman for China’s foreign ministry told reporters that tariffs “violate the principles of market economy and fair competition and undermine the security of the global industrial supply chain.”

“China firmly opposes this and urges the US side to abide by the WTO rules and provide a fair, just and nondiscriminatory business environment,” Wang Wenbin said at a regular press briefing, describing such measures as “protectionism.”

If the tariffs are raised, it would “limit access to affordable EVs and components, which will reduce the potential for scaling this technology,” said Bill Russo, founder and chief executive officer of Shanghaibased advisory firm Automobility Ltd.

Even so, there has been increased political pressure in recent weeks in the US to ramp up tariffs against China. A bipartisan group of lawmakers earlier this month recommended raising tariffs on goods from China and further restricting investment into the country. And Republican Senator Lindsey Graham on Wednesday said he’d help draft sanctions “from hell” to impose on China if Beijing tried invading Taiwan.

The US is also gearing up for a presidential election next year, which may further fuel political tensions involving China. The Republican frontrunner is former President Donald Trump, who launched the trade war during his tenure as he argued that Beijing had taken advantage of the US.

“Ahead of a Presidential election, no candidate of any party loses votes by sounding tough on China trade,” said Robert Carnell, regional head of research for Asia-Pacific at ING Groep NV.

Increasing tensions over trade could hurt the recovery in China’s yuan, which is among the worstperforming currencies in Asia this year. The offshore yuan pared its gains after the Journal report, and is little changed against the dollar at 7.1484.

“Overall, it seems not to be a broad-based tariff hike, and the impact on the yuan and broader Chinese markets should be limited,” said Ken Cheung, chief Asian FX strategist at Mizuho Bank. “The tariffs news is only in discussion so far.”

Other targets for potential tariff-rate increases are Chinese solar products and EV battery packs, the people familiar with the matter told the Journal. While the US now primarily imports solar material from Southeast Asia, China is still a huge supplier of EV batteries. Contemporary Amperex Technology Co. Ltd., based in Ningde, Fujian, is the world’s biggest maker of EV batteries.

The Biden administration is also considering lowering tariffs on some Chinese consumer products that officials don’t see as strategically important, according to the Journal.

–With assistance from Karl Lester M. Yap, Iris Ouyang, Fran Wang, Linda Lew and Allen Wan.

(Updates with China MOFA response and more analyst comments.)

Most Read from Bloomberg Businessweek

SOURCE: https://au.finance.yahoo.com/news/us-considering-hiking-tariffs-china-060803501.html

Sorry, the comment form is closed at this time.