23 Nov State of China’s Auto Market – November 2023

Comments from Bill Russo, Founder & CEO of Automobility Ltd.

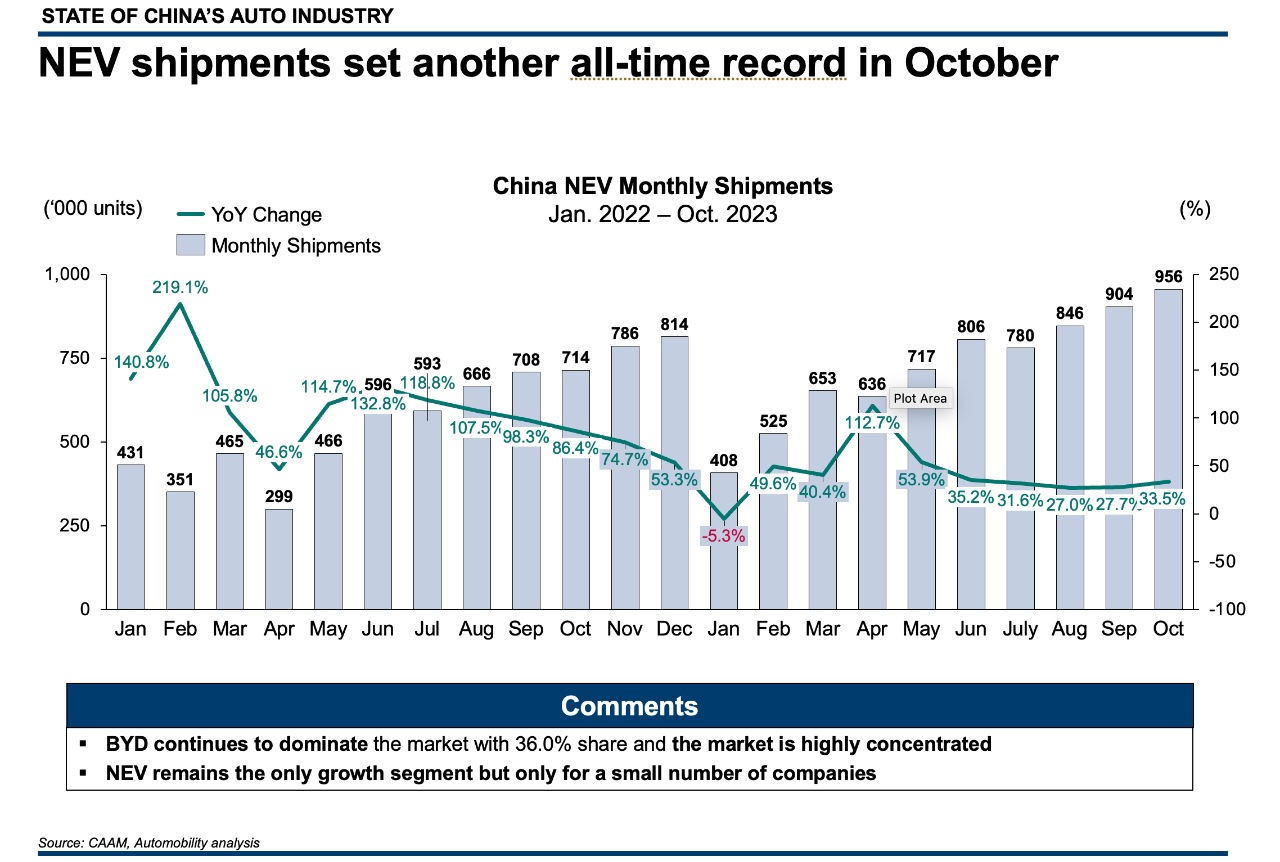

Year-over-Year Shipments Changes from January to October:

NEV +37.8%

ICE -0.05%

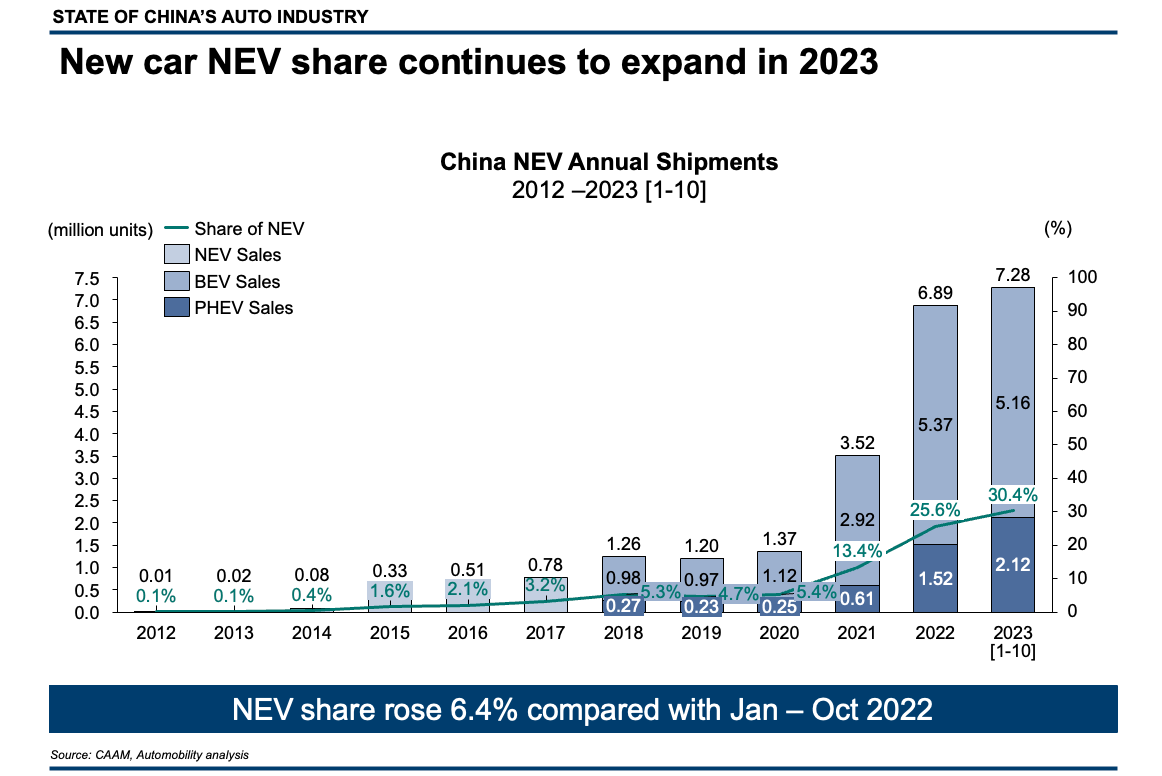

NEV Breaks Annual Sales Record in 10 months

Shipments of New Energy Vehicles in China surpassed the full year of 2022 over the first 10 months of 2023. Through October, 7.28 million NEVs were produced versus 6.89 million for the full year of 2022. This includes 5.16 million Battery Electric Vehicles (BEV) amd 2.12 million Plug-in Hybrid Electric Vehicles (PHEV). NEV share of overall production now stands at 30.4% for the year.

By comparison, 16.7 million ICE vehicles were shipped through October, a decline of 0.05% from the same period of last year.

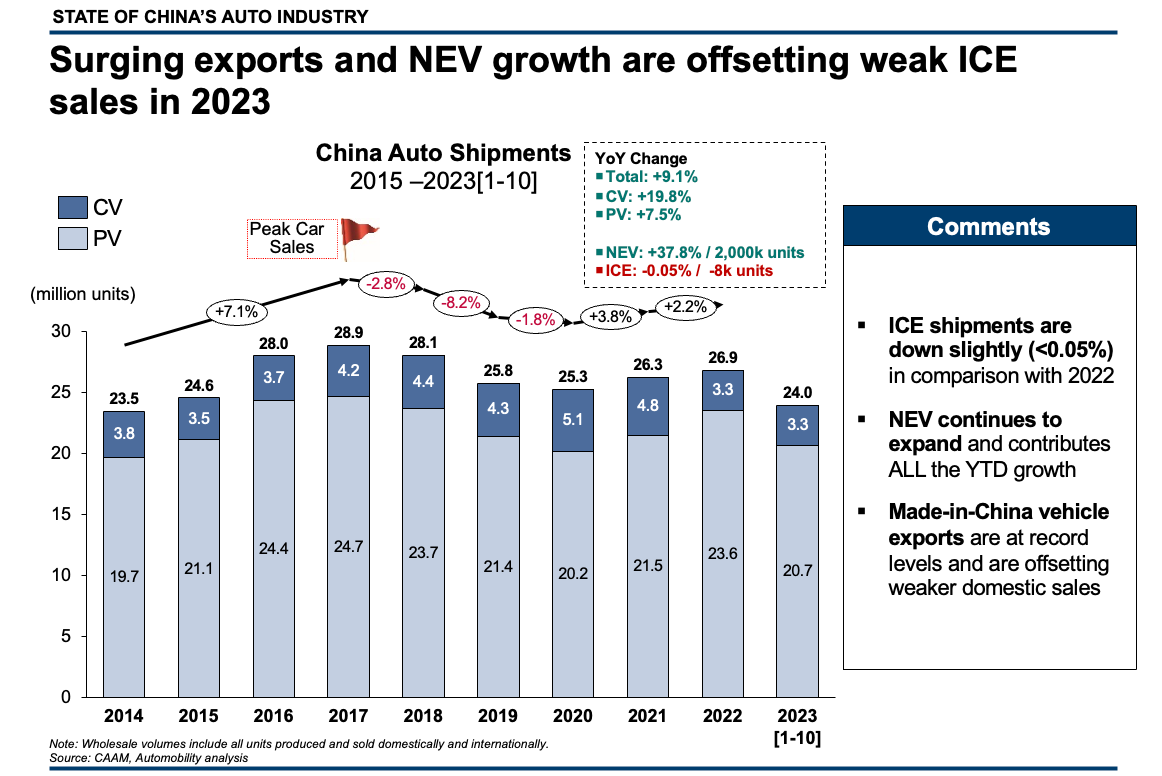

24 million vehicles were shipped through the month of September, including 20.7 million passenger vehicles and 3.3 million commercial vehicles. This was an increase of 9.1% over the same period of 2022.

Recapturing Growth with Massive Exports

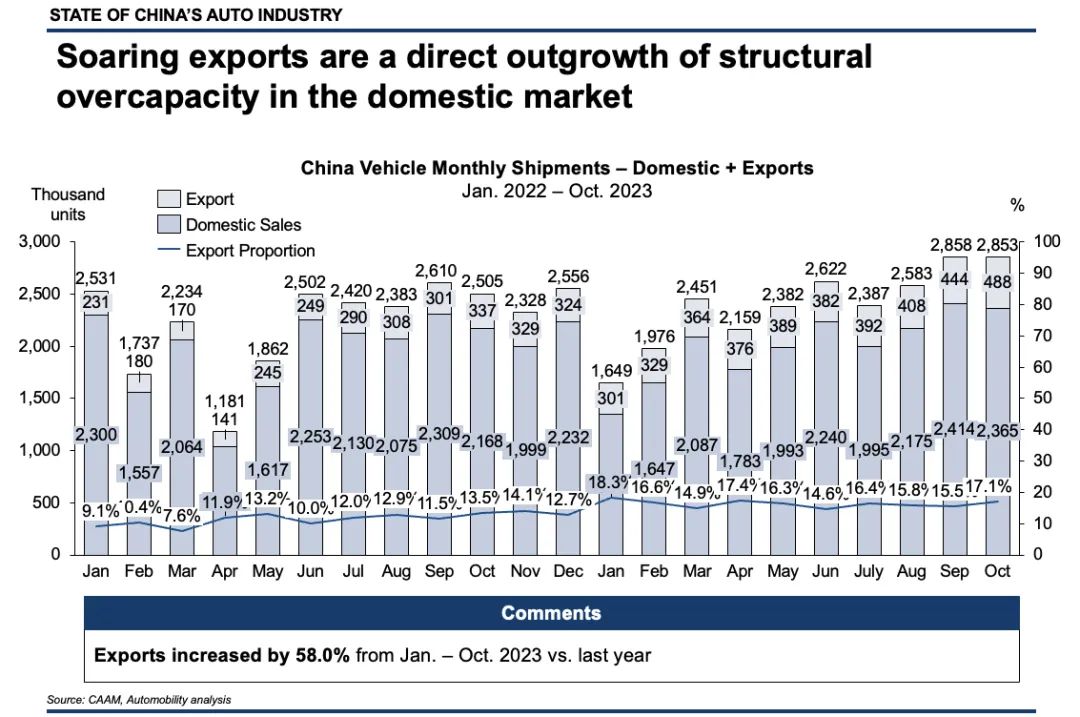

Of the 24 million cars shipped so far in 2023, 3.92 million have been exported, an increase of 58% over the same period of 2022. Three-quarters of the vehicles exported from China are powered by an internal combustion engine.

Top export destinations for Made-in-China vehicles are Russia (17%), Mexico (8%), and Australia (5%). Europe, Middle East, and other Asia Pacific markets are also importing large quantities of vehicles from China.

When viewed on a monthly basis, we see how exports play an increasingly important role in filling excess capacity in China, now representing over 17% of vehicles produced in China.

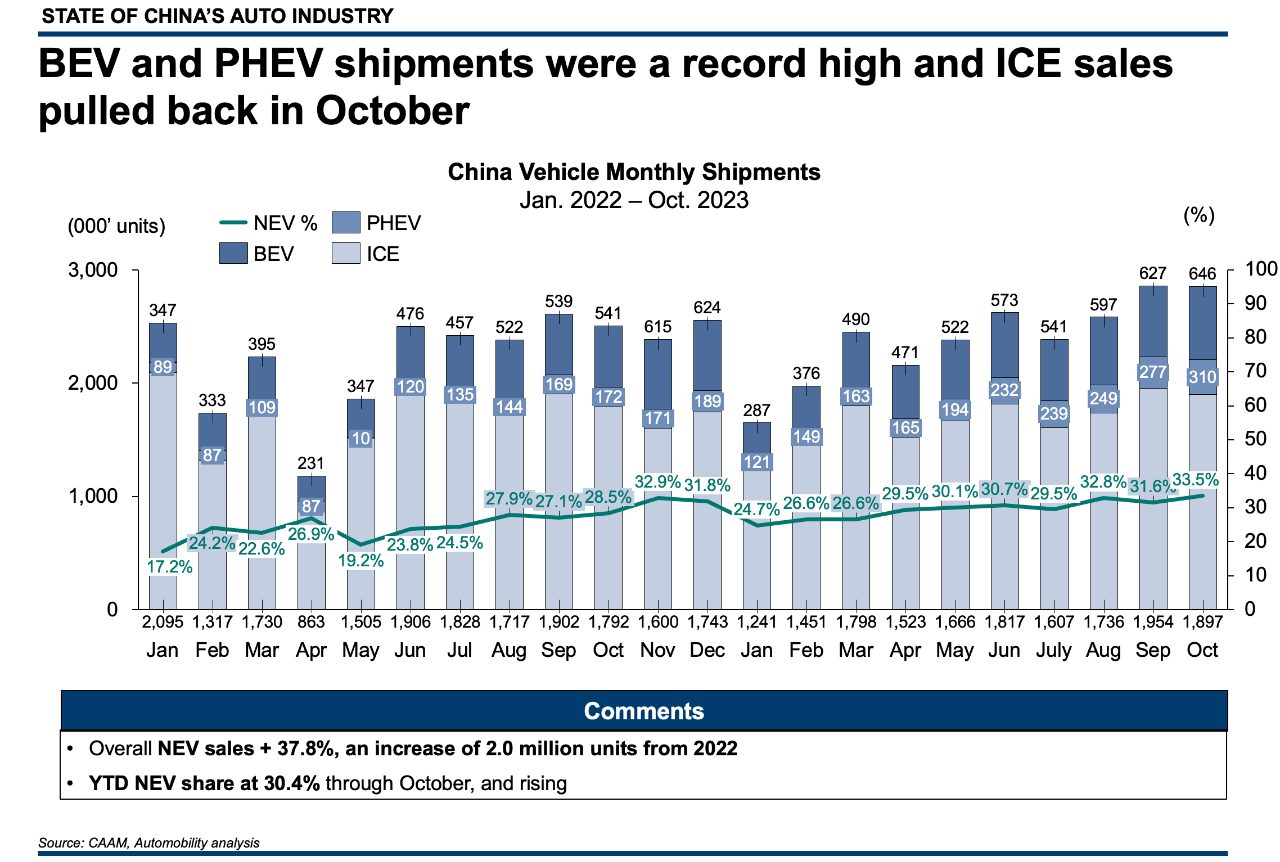

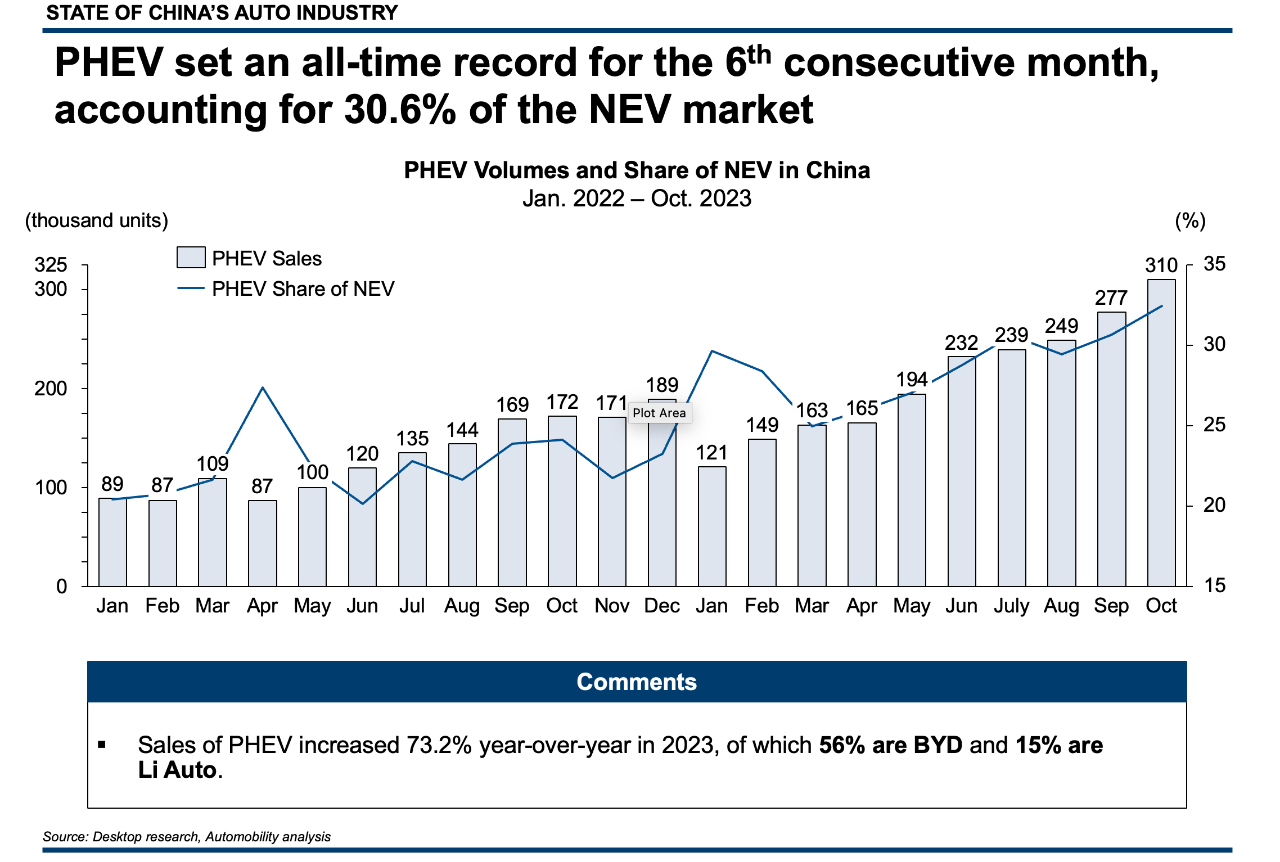

China’s NEV Tide Continues to Rise – Especially for Plug-in Hybrid EVs

With the end of purchase subsidies in 2022, a pull-back in demand for electric vehicles was expected. This proved to be short-lived. New Energy Vehicle shipments have climbed to record highs and represent more than one-third of all vehicles produced in China.

October NEV shipments were a record 956,000 units, a growth of 33.5% over the previous October (which was also a record month). With its third consecutive month of record-breaking numbers, China will likely surpass 9 million units of total NEV shipments in 2023.

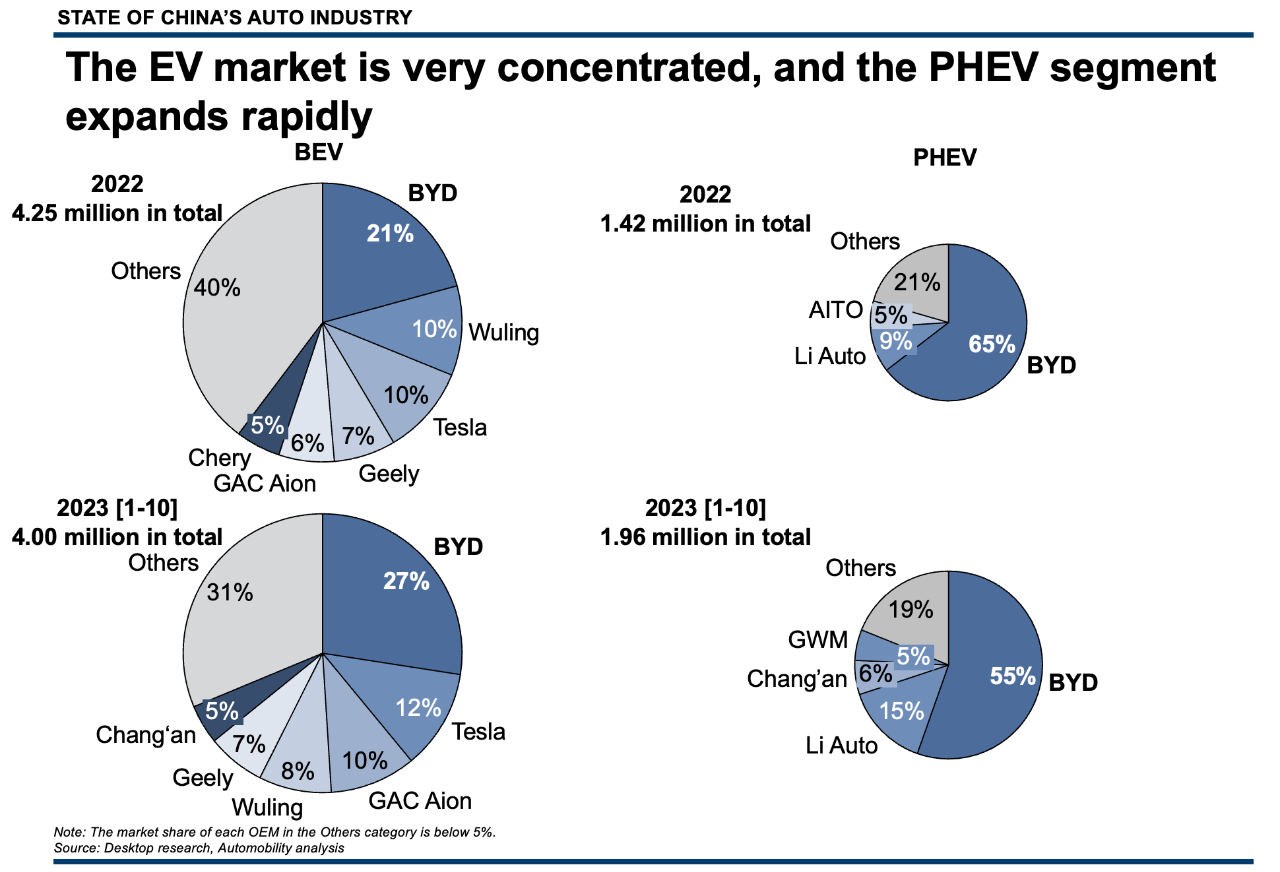

Both BEV and PHEV sales were at an all-time high. However, sales of Plug-in Hybrid vehicles are white hot, rising to 310,000 units, a 6th consecutive monthly sales record. This segment has grown 73.2% over last year, and represents about one-third of all NEVs produced. BYD (56%) and Li Auto (15%) are the clear PHEV leaders.

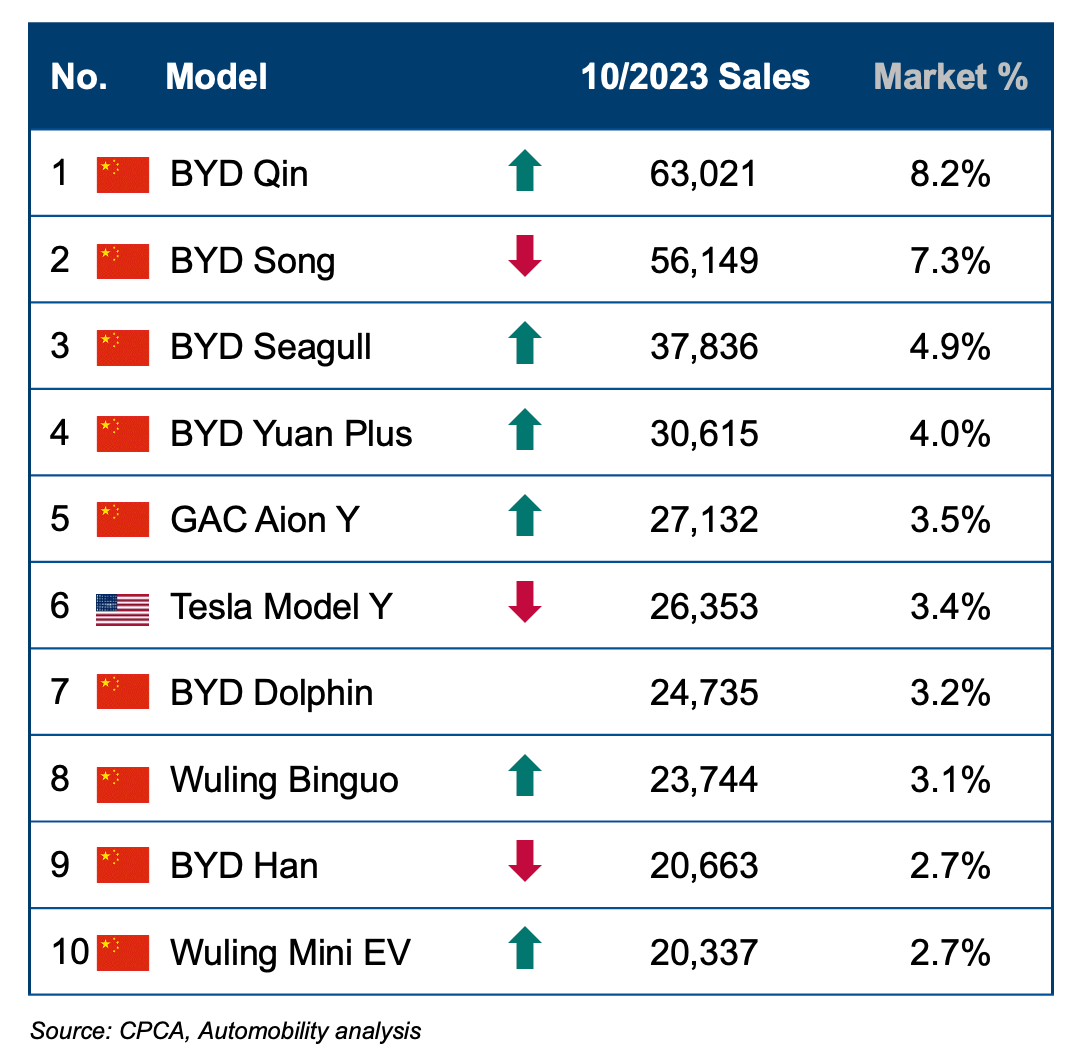

October NEV Sales Leaderboard

The NEV retail sales leaderboard for October includes some up and down positional moves. Tesla Model Y fell to 6th place (down from 3rd), and BYD Qin traded places with BYD Song for the top spot, and BYD Seagull has risen to 3rd place and is now the top selling BEV in China. Wuling’s Binguo moves up to 8th position (from 9th), and Wuling’s Honguang Mini EV moved back onto the top 10 list, displacing GAC’s Aion S (previously 9th).

Top 10 NEV Models

October Retail Sales

The October Top 10 NEV Group sales leaderboard has one new entrant, with Xpeng moving into the number 10 position, replacing Leap Motor in 10th place on the leaderboard. Positional moves include Tesla falling to 8th place. Also of note was the more than doubling of NEV sales for Geely group brands, as well as a new milestone for LI Auto – hitting its first-ever 40,000 units sales month for its popular lineup of plug-in hybrid SUVs.

Top 10 NEV Corporate Group

October Retail Sales

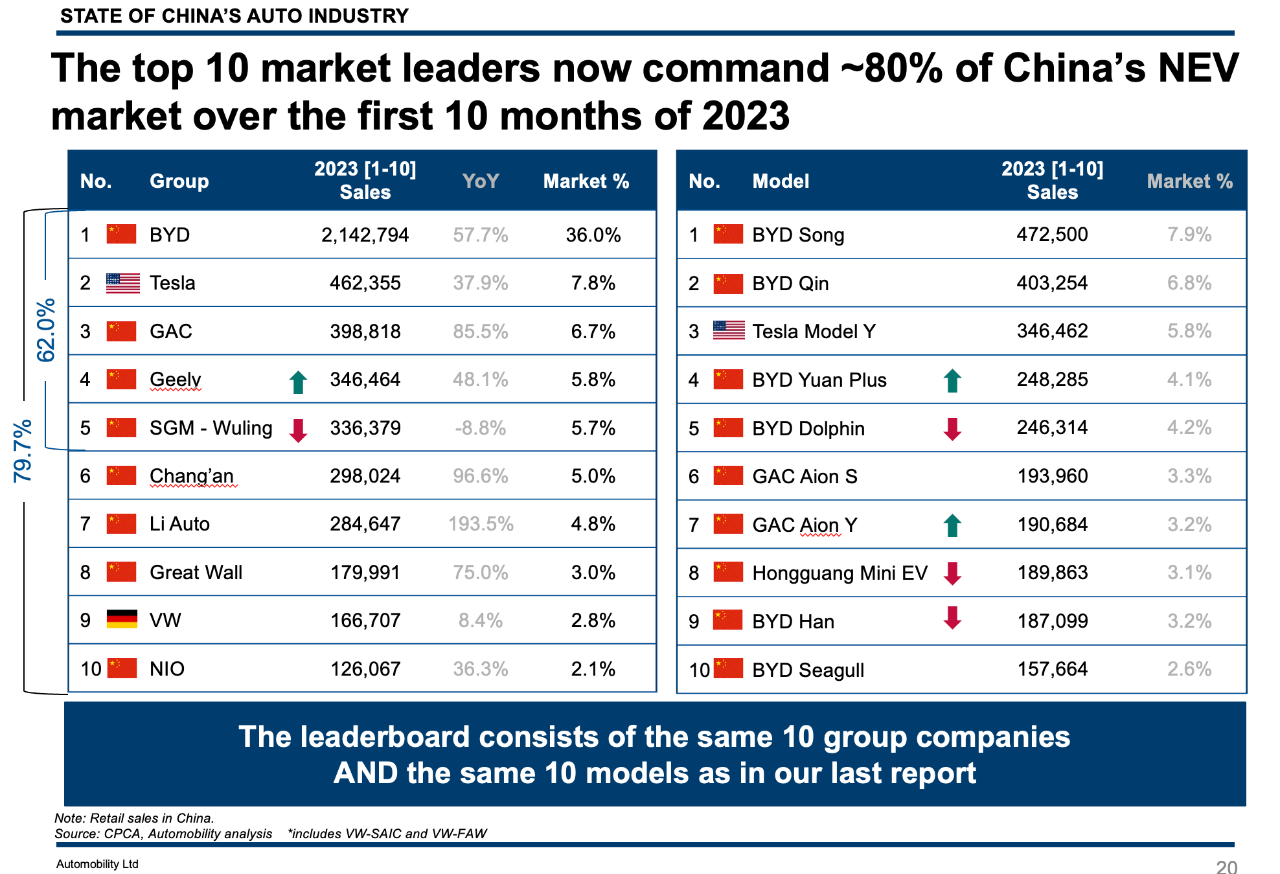

2023 Overall NEV Sales Leaderboard through October

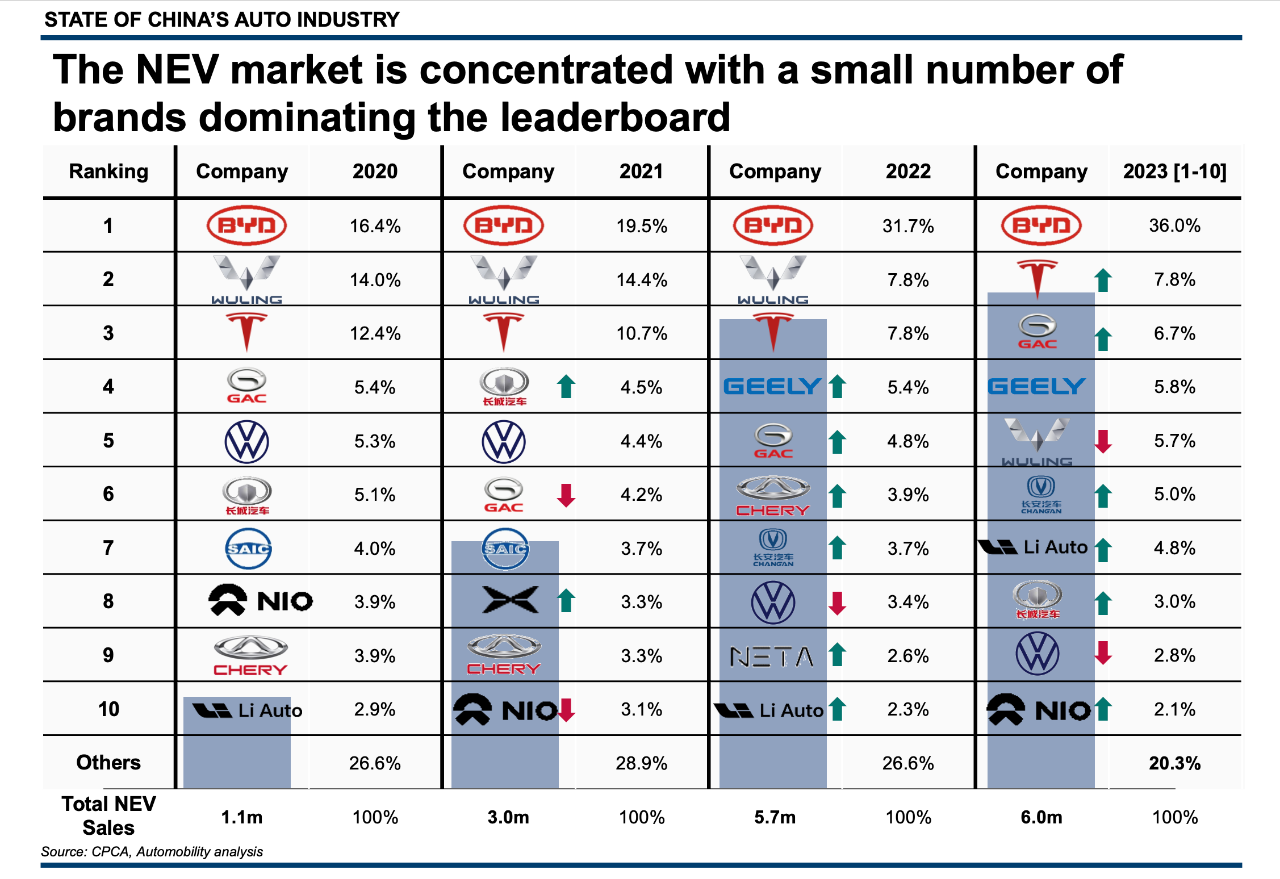

Chinese brands continue to dominate the NEV sales leaderboard in 2023, and the top 10 NEV Sales Leaderboard for 2023 has the exact same group companies and nameplates as reported last month.

Several noteworthy observations:

- The Top 10 companies command 79.7% of the NEV market

- The Top 5 companies command 62.0% of the NEV market

-

BYD commands 36.0% of the NEV market

Additional points to note:

- #1 BYD outsells #2 Tesla by over 1.68 million units, and #10 NIO by over 2 million units.

- Wuling is the only top 10 brand with declining sales, due to heavy price discounting and is being challenged by new low-priced competition.

It is also noteworthy that while NEV sales have surpassed the full year 2022 (and continues to climb steadily), there has been very little movement among the companies represented on this list over a multi-year period. Since 2020, BYD has been the perennial market leader, and has more than doubled its market share. While some companies move up/down slightly, the list in 2023 has 8 of the companies that were on the list in 2020 (only SAIC and Chery falling out and Geely and Changan coming in). The winners in the race to the future of electric mobility are pretty clear – and there are far more losers than winners in this new game.

The Race to Electric Mobility is Won By Chinese Brands

The secular shift to NEV is a race that has been won by Chinese brands. Overall, foreign brand total market share has fallen to 45% in 2023, down from 64% in 2020, the year when the EV tide began rising. Brands from Japan and Germany are down this year, proving that there is no immunity from the structural impact this is having on the global carmakers, who are rapidly losing their lane of relevancy in China, as their ICE (including conventional hybrid) strategy loses traction.

The dilutive impact this is having on their market share performance is apparent when you compare the ICE and NEV market performance for the top 15 automotive groups in China.

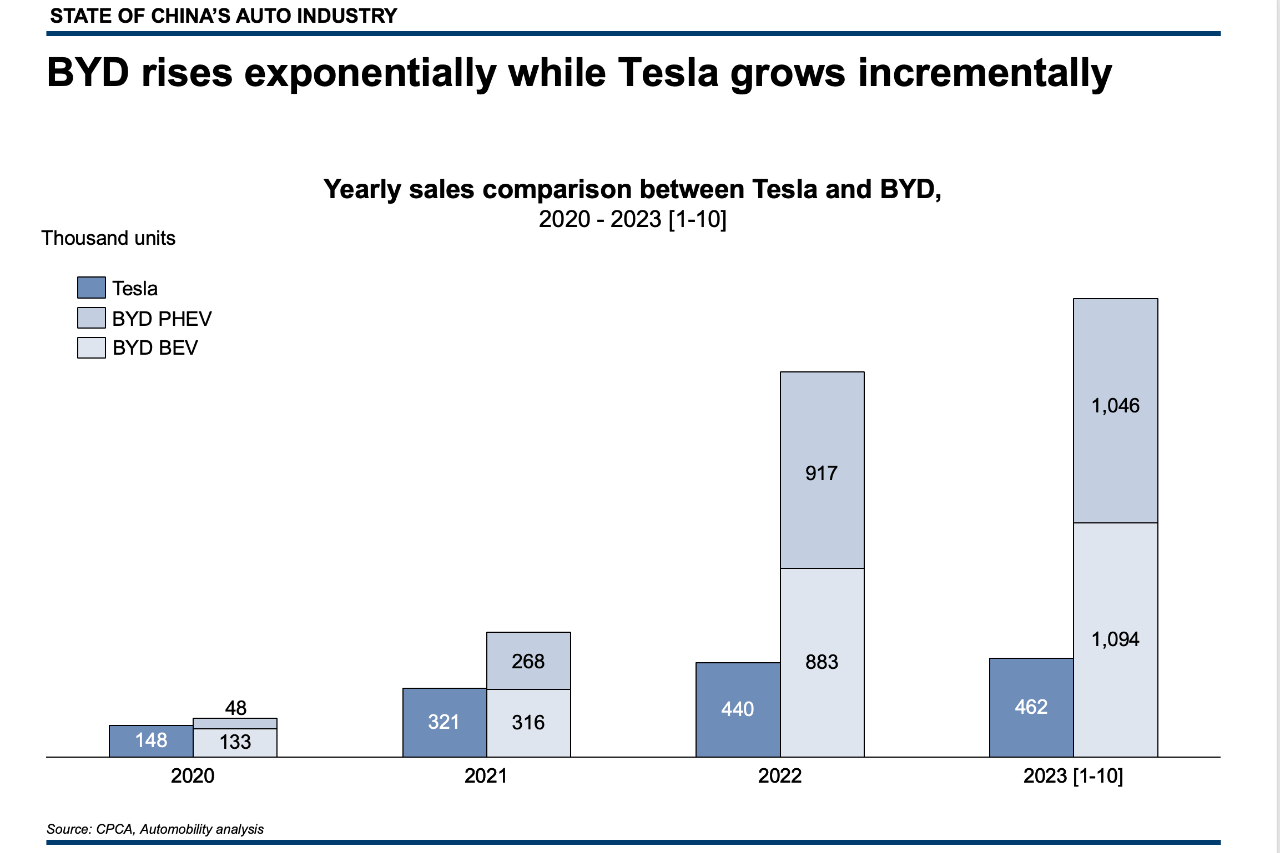

The top performing global NEV brand in China is Tesla, holding on to its number 2 position by waging a fierce price war. However, all of Tesla’s aggressive pricing moves have not resulted in market share gains. Tesla’s NEV share in 2022 is exactly the same as in 2023 at 7.8%, which begs the question: what would Tesla’s share be if they HAD NOT launched the price war?

We can also see that BYD has a significant lead over Tesla in BEV sales – and their PHEV portfolio gives BYD access to a lane that is growing at a far faster rate than the pure BEV lane – and PHEV is a weapon that Tesla does not have.

However, China plays a very important role for Tesla beyond being a large EV market. Tesla’s Shanghai Gigafactory has produced most of the cars that Tesla sells outside of the USA, and is an important supply chain aggregator, enabling Tesla to lower its overall system cost for producing EVs at scale. However, with new capacities coming online in Austin, Berlin and eventually Monterrey, it is becoming clear that Tesla’s position as the global EV market leader is at risk.

– What will be the outcome of the EU audit of China’s EV subsidy policies?

– Will tariff protections help to improve the competitiveness of global brands ? How will this impact the cost of EVs to the consumers internationally?

– After VW and Stellantis, who will be the next global automaker to invest in Chinese EV companies?

– EV’s are not scaling rapidly anywhere except in China. Will they ever, or will foreign brands give up the race?

A FEW MORE THINGS

Our commentary on the divergence between China’s approach to electrification and the rest of the world – and a video from Beijing Auto Show in 2016 where we anticipated recent developments.

Bill Russo commented on BYD’s origins as a battery company and how Tesla helped accelerate the consumer interest in electric vehicles in this BBC Report.

How BYD Became one of the World’s Biggest Brands [Video]

Tesla recently celebrated the production of 2,000,000 vehicles at its Shanghai Gigafactory.

Automobility CEO Bill Russo offered his views on how Tesla sparked the exponential rise of EV sales in China, and the important role China plays in Tesla’s global supply chain.

Bill Russo Commentary on Tesla in China [CGTN VIDEO]

You can follow us for regular updates on these online channels by scanning the QR codes:

If your organization would like a custom briefing on the State of China’s Auto Market, please reach out to us at [email protected]

About Bill Russo

Bill is a contributing author to the book Selling to China: Stories of Success, Failure, and Constant Change (2023), where he describes how China has become the most commercially innovative place to do business in the world’s auto industry – and why those hoping to compete globally must continue to be in the market.

About Automobility

Contact us by email at [email protected]

Sorry, the comment form is closed at this time.