19 Jun REUTERS : Tesla’s China expansion hits speed bump amid industry overcapacity

Media Source : REUTERS

16 JUN 2023

A view of a Tesla sign at its factory in Shanghai, China June 12, 2023. REUTERS/Aly Song

- China cautious about approving new EV production -analysts

- Tesla has aimed to produce 450,000 cars a year at new site

- Chinese EV production as much as 20% cheaper than elsewhere -Nio

SHANGHAI, June 16 (Reuters) – Tesla’s (TSLA.O) ambitious plan to boost auto production in Shanghai, its most valuable plant globally, hinges on China’s approvals to develop 70 hectares (172 acres) of former farmland that is currently overgrown with wildflowers.

Once courted by Beijing to help spur the development of a domestic electric vehicle (EV) industry, Tesla may now be a victim of its own success in the world’s biggest auto market, challenging plans to use its cost advantage from Chinese production to power exports.

China’s state planner, the National Development and Reform Commission (NDRC), has been cautious about approving new electric vehicle (EV) production plans by all automakers because of concerns about overcapacity and a deepening price war launched by Tesla, according to executives at rival companies and analysts.

Bill Russo, the Shanghai-based founder and CEO of advisory firm Automobility, estimated that China had excess auto production capacity of about 10 million vehicles a year – equivalent to two-thirds of all North American output in 2022.

“You could argue that as Tesla, I’ve got new products, I need to have a new factory to build them in,” he said. “But viewed from the China government’s point of view, all they see is a market that’s oversupplied.”

Tesla had detailed plans to add 450,000 vehicles of annual capacity at the new Shanghai site around 3 km (1.9 miles) from its current plant in an effusive May 2022 letter that thanked the local government for its support during the Shanghai lockdown over COVID-19. Based on retail values, the annual production would be worth more than $18 billion.

While it was not disclosed in official remarks by Tesla CEO Elon Musk or Chinese authorities, the topic of the expansion came up during his whirlwind visit to China at the end of last month, according to a person with direct knowledge of the matter.

After meetings with senior Chinese officials including Vice Premier Ding Xuexiang, Musk told a small group of Tesla staff that he saw “positive progress” in discussions about the expansion without elaborating, said the person, who was not authorised to speak publicly.

Tesla and the NDRC did not respond to requests for comment.

“Tesla is doubling down on China, and while it’s hit some snags over the last year we believe Musk’s trip to China has soothed the situation over and we expect progress announcements over the coming months,” said Dan Ives, an analyst at Wedbush Securities.

Construction of Tesla’s Shanghai plant took less than a year to complete after it broke ground on the site in 2019.

WHY TESLA NEEDS CHINA

Tesla’s reliance on China is a complication in the United States, where Biden administration incentives reward automakers for producing batteries and vehicles locally.

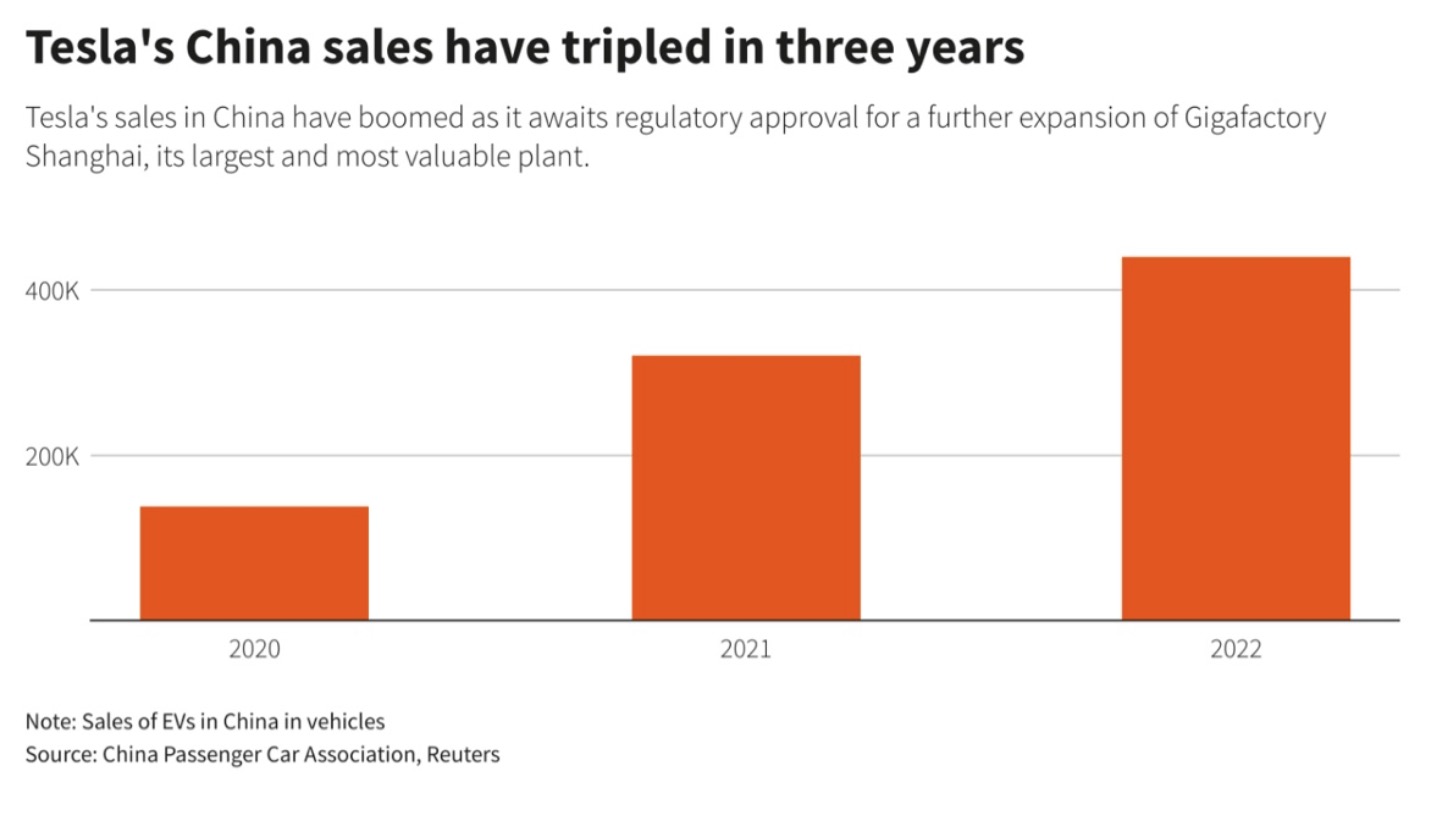

But Tesla’s Shanghai plant, which produced almost 711,000 Model 3 and Model Y vehicles last year and has lifted annual maximum capacity to more than 1 million, has been crucial to its cost advantage over its rivals and propelled exports to Southeast Asia and Canada.

With a goal of selling 20 million cars globally by 2030, up from 1.31 million in 2022, Tesla has been in discussions with India about potential manufacturing investments and has been courted by governments including South Korea and Indonesia.

Production in China, however, brings a cost advantage of as much as 20% over EVs made elsewhere, rival Nio (9866.HK) has said, citing the country’s grip over the supply chain and raw materials.

But as government concerns about oversupply rise and Tesla pushes for its Shanghai expansion, progress by aspiring market entrant Chinese consumer electronics maker Xiaomi (1810.HK) to gain a production permit has been slow.

U.S. luxury EV maker Lucid Group (LCID.O) is also keen to make cars in China but has been advised that the possibility was low, industry sources said.

Xiaomi and Lucid did not respond to requests for comment.

Tesla’s wait for approvals compares with a warm welcome when it first inked its deal to open its Shanghai factory five years ago.

At that time, analysts suggested China was using Tesla to help spur local EV development because its strength would force weaker players to move faster to survive.

“The script has definitely flipped,” said Automobility’s Russo. “China needed Tesla to open the market for retail consumers, but Tesla needs China, because the supply chain benefits of being here and the competitive bar that’s set here makes Tesla a more competitive company globally. And that’s the missed opportunity if they don’t get that unit of capacity.”

Reporting by Zhang Yan and Brenda Goh; Editing by Jamie Freed

Sorry, the comment form is closed at this time.