26 Oct How the Smart EV Powers the Transition to Smart Energy Management

In/Around/Beyond Internet of Energy (IoE) Architecture

By Bill Russo, Bevin Jacob, Benjamin Fan, and Twyla Zhang

The automotive industry is on the front line of a high-tech battle for sustainable economic development – and control of the supply chain of materials needed to power transportation will determine the winner.

Throughout history, mobility innovation has accelerated economic development. Powering the future of mobility requires control of critical technologies and supply chains and securing these will become the key to sustainable development. This is due to the critical importance of the energy supply chain in the transportation sector.

The transition to sustainable mobility has brought tremendous opportunities for upstream players in the automotive industry, especially battery cell and pack assemblers who control the key technology and intellectual property vector for the propulsion system of the vehicle. Access to the materials needed to scale the technology needed to power transportation is a key competitive position in the battle for sustainable economic development

The Secular Shift and Exponential Rise of Electrification

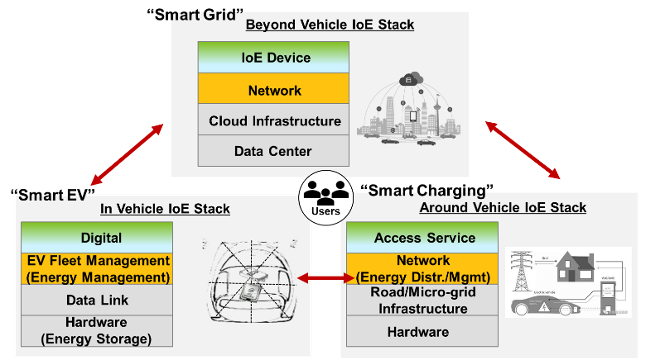

The challenge for large-scale EV commercialization has historically been linked to the cost and performance limitations of electric propulsion versus the internal combustion engine (ICE). Batteries are currently the highest cost components of electric vehicles, however rapid advancements over the past decade have lowered the cost per kilowatt-hour (see Figure 1) such that the electric vehicle is now able to compete with vehicles powered by an internal combustion engine (ICE).

Breakthroughs in battery chemistry and material technology have had a great impact on overall performance. The resultant cost improvements have helped accelerate market adoption, encouraging further investments to deploy giga-factories at scale, which enable further supply chain efficiency. Upstream technology innovation, while critical, does not fully contribute to the exponential rise of electrification we are now seeing in the market.

Figure 1 | EV Battery Cost Trajectory from 2010-2020

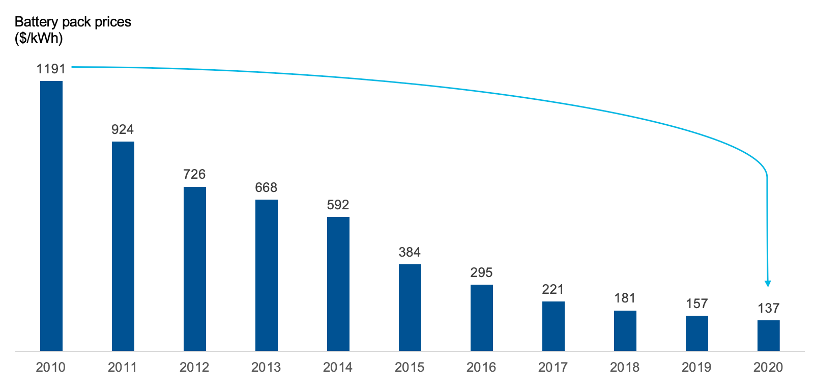

In terms of current regional market acceptance, Europe took the lead (in sales of electric and plug-in hybrid vehicles) over China in 2020. However, China regained the lead over Europe during the first half of 2021, with nearly double the sales. Surging sales of electric vehicles have put China far ahead of the rest of the world, and on track to meeting its 2025 objective of 20% market share (by as early as 2022). There are multiple driving forces behind the exponential rise of electrification in China.

Figure 2 | Leading Global EV Markets in 2020

The Role of Public and Private Partnerships (PPP)

Having embraced electrification as a national strategy since the beginning of this century, China has built a tremendous early mover advantage in the EV supply chain. China has skillfully navigated its way to EV supply chain dominance with well-funded central policies together with public infrastructure investments that de-risk investments from the private sector, providing a foundation of support for investment into emerging technology fields. Public private partnerships (PPP) have been critical to sparking innovation and to de-risking investments in new technology sectors.

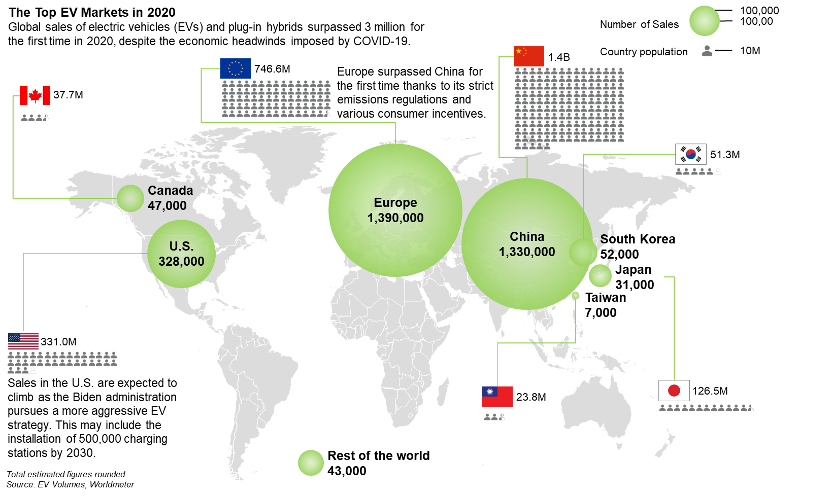

EV charging infrastructure is the tangible manifestation and outgrowth of this PPP approach to implementing a national electrification strategy. As shown in Figure 3, China has the largest deployment of public and private charging infrastructure in the world, addressing one of the historical barriers to purchase consideration: namely, the convenience of getting an EV charged. Such investments, combined with purchase subsidies and license plate restrictions in several large cities, have sparked EV sales.

As a result, China’s EV population is by far the largest in the world, with over 44% of the global EV car parc in 2020. It is estimated that China’s new energy vehicle ownership will amount to ~18 million units by 2025 and the number of charging piles will expand to 9.4 million units.

Figure 3 | Global EV Parc and Charger Stock by Regions in 2020

Upstream Supply Chain Aggregation

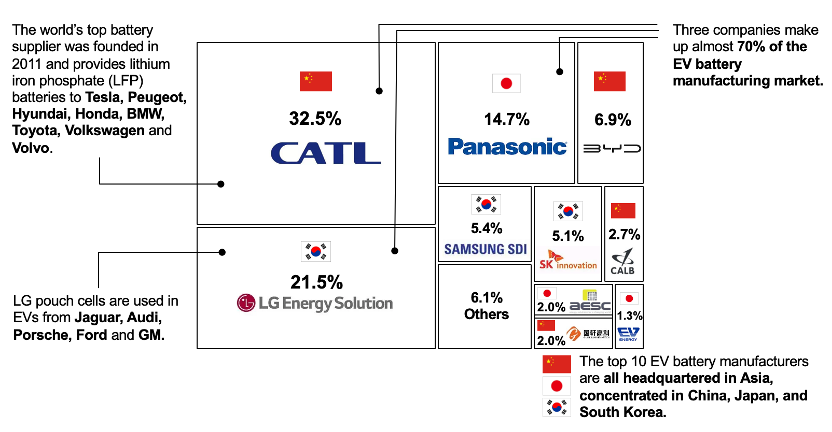

In addition to leading the downstream investment in charging infrastructure, China has massively invested in the upstream battery supply chain and pack assembly. The ability to produce battery cells at scale has greatly contributed to the improving cost competitiveness of electric propulsion. As shown in Figure 4, the top 10 EV battery manufacturers are all headquartered in Asia, concentrated in China, Japan, and South Korea. Two of the largest players, CATL and BYD capture nearly 40% of the global market and dominate in the lithium iron phosphate (LFP) category, where there is the highest potential to scale in the entry to mid-priced segments internationally.

Figure 4 | The Top 10 Battery Makers in the World

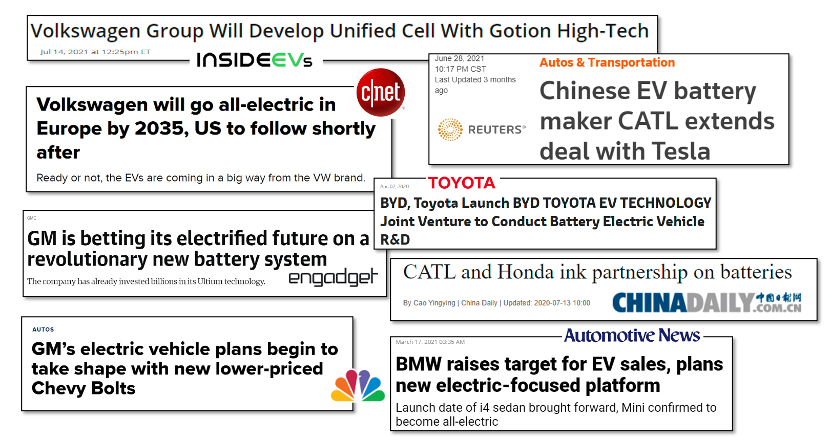

As the battery supply chain becomes concentrated, global OEMs find themselves in a race to build partnerships with battery supply chain aggregators to secure the ingredients needed to build their products (see Figure 5). Carmakers do not wish a repeat of the scenario that has unfolded in the semiconductor supply chain, where they are competing with larger-scale consumer electronics giants for capacity allocation of chips.

Figure 5 | Recent Battery Supply Chain Partnerships and Investments

Upstream Battery Technology Innovation

While downstream infrastructure and upstream energy supply chain investments have secured China’s first mover advantage in the race to an electric future, this does not ensure long-term sustainable competitive advantage. With the recent massive influx of capital investment, propulsion and battery technology innovation will likely experience a period of rapid advancement.

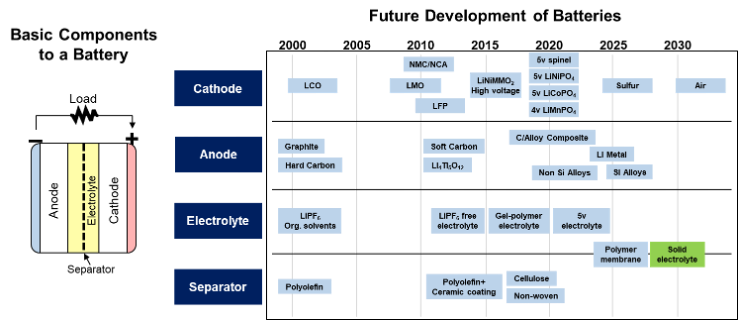

While lithium and electrolyte-based battery technology have become state-of-the-art and has reached the performance required for new energy vehicles, we expect an accelerated wave of technology innovation, as illustrated in Figure 6. To stay competitive, EV manufacturers will invest in technologies that further improve cost and performance that target specific mobility use cases.

Optimizing cost and performance for specific use cases will become the challenge for the ecosystems being formed through new automaker-battery supply chain partnerships. We envision an entry-level segment of size that prioritizes cost over vehicle performance and range. This is where China’s initial advantage in LFP chemistry is rooted and is the main motivation for Tesla’s recent partnership with CATL. More performance-minded or higher duty-cycle use cases may require higher energy density or fast charging characteristics which push for a new generation of innovation around the battery structure (for example, silicon alloys, lithium metal or lithium sulfur), or solid-state battery technology to replace the current liquid electrolyte solution.

Figure 6 | Battery Technology Roadmap

Smart Energy Management and Downstream Service Innovation

Securing long-term competitive advantage will require automaker-battery supply chain partnerships to extend their focus beyond the upstream (supply chain) and midstream (pack and car assembly) areas of the value chain. As the battery technology improves, innovative ways to transfer, store and manage energy will also emerge, which requires a focus on the downstream business of smart energy management.

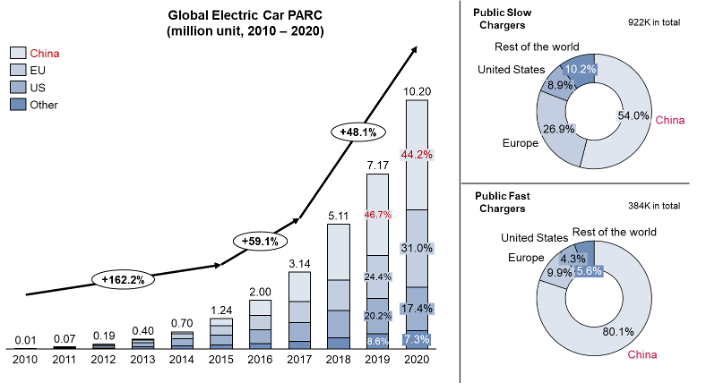

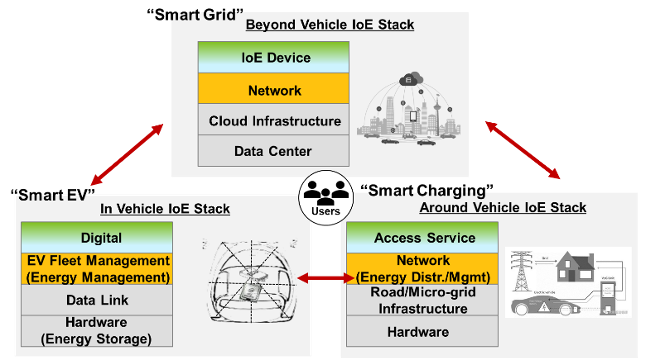

In our recent article The Rise of Smart Electric Vehicles and the Digital Internet of Mobility, we highlighted the emergence of a three legged “in, around and beyond” smart solutions architecture that generates recurring revenue from multiple sources, including mobility, energy, and digital services, offering exponential growth.

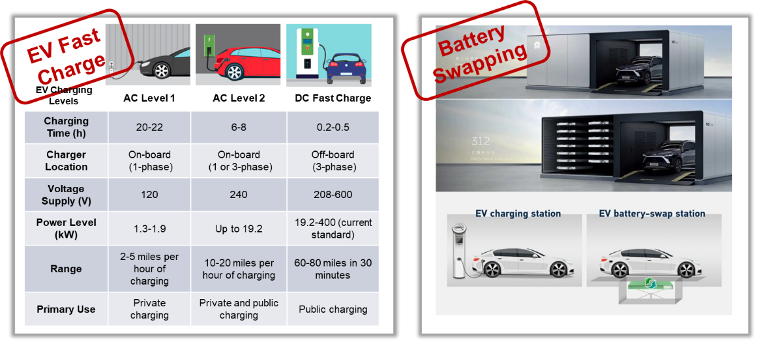

Mitigating charging time as a pain point has already received considerable focus for services innovation. While this is important for personally owned vehicles, keeping a mobility device moving is especially important for vehicles deployed in a transportation-as-a-service use case. Several options exist for recharging a vehicle, with two areas of focus for minimizing down time: Fast Charging and Battery Swapping (as shown in Figure 7).

Figure 7 | Options for EV Charging

The commercialization of fast / high-voltage charging requires technology innovation in the battery structure, thermal management, as well as the charging infrastructure, electric grid, and utility services to deliver the energy to the vehicle. Building such fast-charging network capacity will require significant investments to upgrade the grid and utility management, so this is likely to occur mainly in markets like China with strong PPP.

Battery Swapping requires a huge investment in infrastructure for quick battery removal and installation. Despite this, battery swapping offers perhaps the fastest and most convenient way to keep a vehicle productive in service. Such a solution also offers the car owner or equipment operator some protection from obsolescence as the battery can easily be replaced or upgraded when a new battery or technology becomes available.

The ability to use the smart battery as an energy storage and trading platform is another way to unlock the downstream revenue generating potential of a battery in service. The internet era has made it possible to harness the intelligence linking the Internet of Mobility (IoM) device with the Internet of Energy (IoE) through an in/around/beyond architecture. A 3-legged Internet of Energy (IoE) architecture that links Smart EV, Smart Charging and Smart Grid products and services is depicted in Figure 8.

Figure 8 | In/Around/Beyond Internet of Energy (IoE) Architecture

From Smart EV to the Smart Energy Management

The advent of the Smart EV era marks a transition of the automotive industry from a “dumb manually-actuated device, powered by a combustion engine” to a “smart self-driven powered by electricity”. Embedding intelligence in/around/and beyond the vehicle is the enabler for a Smart Energy Management solutions architecture designed to optimize the generation, storage, and utilization of energy.

For automakers to stay relevant in the IoE era, they must conceive of the mobility device as a Smart EV, with a “full stack” of smart energy management features that allow the vehicle to participate in the IoE ecosystem that exists around and beyond the vehicle.

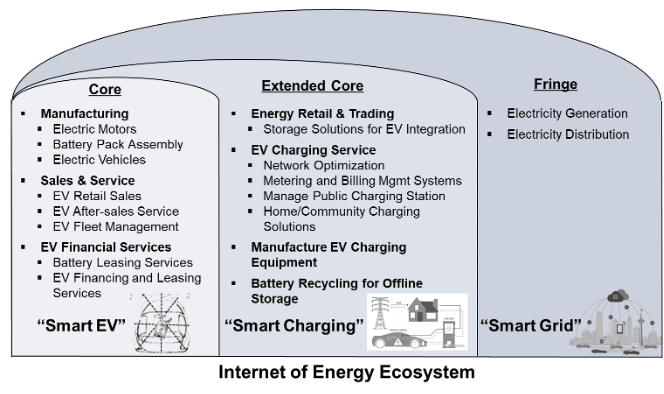

Smart EV makers invest in technologies that are optimized not just for the vehicle ownership experience, but also for unlocking downstream revenues from services. Investing together with downstream partners who are actively building the Smart Charging and Smart Grid infrastructure would ensure participation in the ecosystem (see Figure 9).

Figure 9 | Expanding from Core to Fringe in the IoE Ecosystem

The automotive industry is being transformed by waves of technology innovation that are transforming not just the product, but the entire business model. It is critical that all three of these dimensions be viewed concurrently when making strategic decisions on how to best position for capturing value.

In the smart device era, there is a legitimate question as to whether positioning as a manufacturer the best placement, especially if the smartness is designed to generate recurring revenue from downstream services. Of course, we believe the value of a branded product as a platform for the user experience has value, provided the experience is enabled through technology that can be deeply embedded in the product.

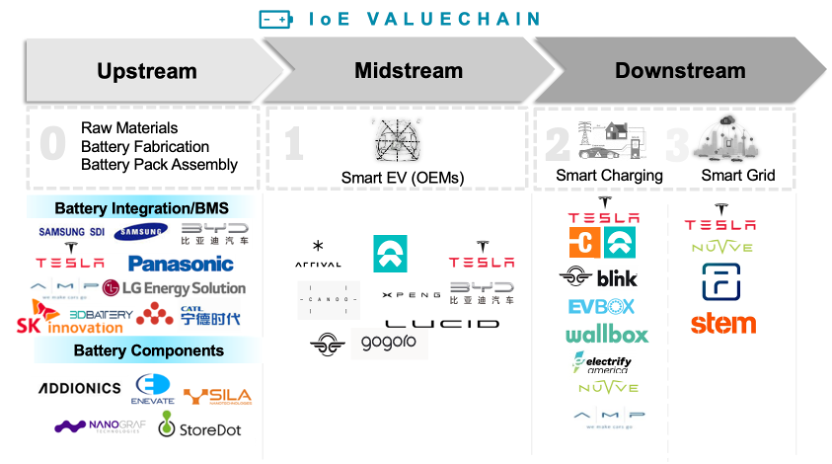

Figure 10 | Technology innovators along the Internet of Energy Value Chain

As a smart device powered by a battery, we believe that smart energy management will be a competitive weapon for the players the new game. Exponential growth will accrue to those players along the IoE Value Chain (see Figure 10) that generate recurring revenue from multiple sources, including mobility, energy, and digital services. Leading Smart EV makers seek competitive advantage upstream by securing the required material supply chain, while recognizing that their device exists and should be monetized across the full “in, around and beyond” smart solutions ecosystem.

_________________________________________________________________________

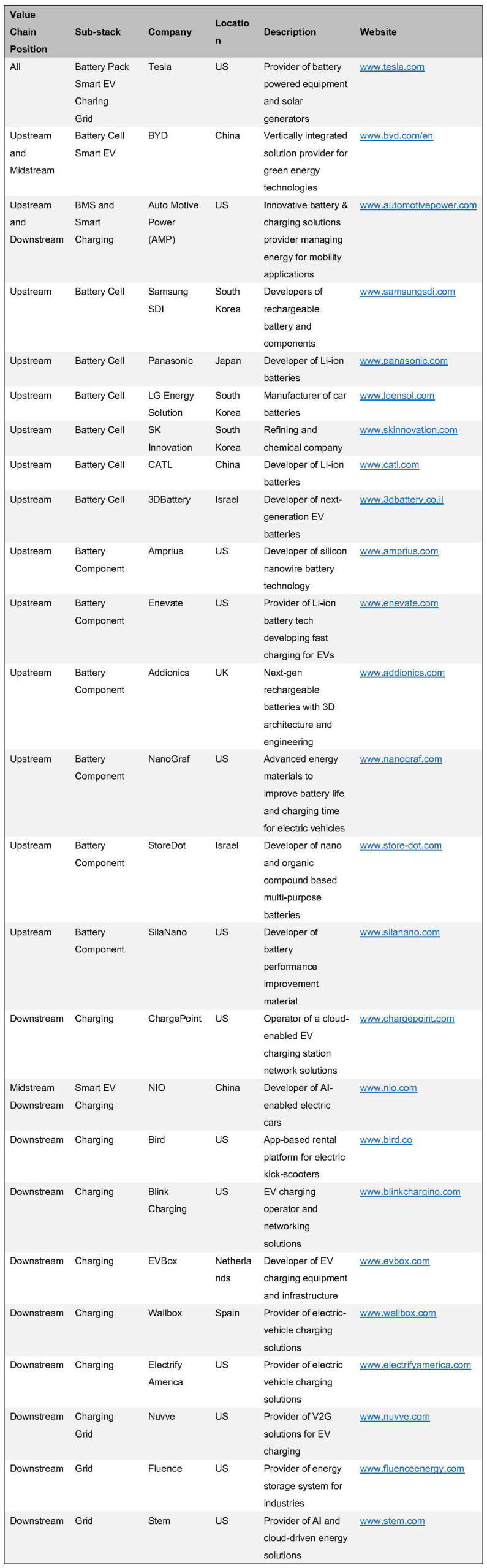

Table I: Smart EV and Smart Energy Management Technology Players

About the Authors

Bill Russo is the Founder and CEO of Automobility Limited. His over 35 years of experience includes 15 years as an automotive executive with Chrysler, including 17 years of experience in China and Asia. He has also worked nearly 12 years in the electronics and information technology industries with IBM and Harman. He has worked as an advisor and consultant for numerous multinational and local Chinese firms in the formulation and implementation of their global market and product strategies. Bill is also currently serving as the Chair of the Automotive Committee at the American Chamber of Commerce in Shanghai.

Contact Bill by email at [email protected]

Bevin Jacob is a Partner & Co-Founder of Automobility Limited. He has over 20 years of experience in Investment Advisory, Business Development, Product Management, Mobility Startup Incubation & Engineering of Autonomous Transportation Systems and On-Demand Mobility Services for Shared Mobility, E-Retail, Automotive Infotainment and Telematics. He has also worked nearly two decades in the electronics and information technology industries with Continental, LG Electronics and Start-ups in Greater China, USA, South Korea & India.

Contact Bevin by email at [email protected]

Benjamin Fan is a Senior Consultant at Automobility Limited. He has more than 8 years of experience in Market Research, Market Entry, Marketing & Branding Strategy and Organizational Development. He is passionate about the future of the automotive industry, and brings insights from both Consumer Goods and Healthcare industry to help shape the future of mobility with his clients.

Contact Benjamin by email at [email protected]

Twyla Zhang is a Senior Consultant at Automobility Limited. She has communications, marketing, and consulting experiences in cross-industry sectors, including energy, automotive, FMCG, finance and healthcare. She led several projects in market entry, market insights, marketing communications, and new product development. Twyla holds a Bachelor’s degree in Marketing from Michigan State University and an MBA from CEIBS.

Contact Twyla by email at [email protected]

Sorry, the comment form is closed at this time.