17 Oct State of China’s Auto Market – October 2023

Comments from Bill Russo, Founder & CEO of Automobility Ltd.

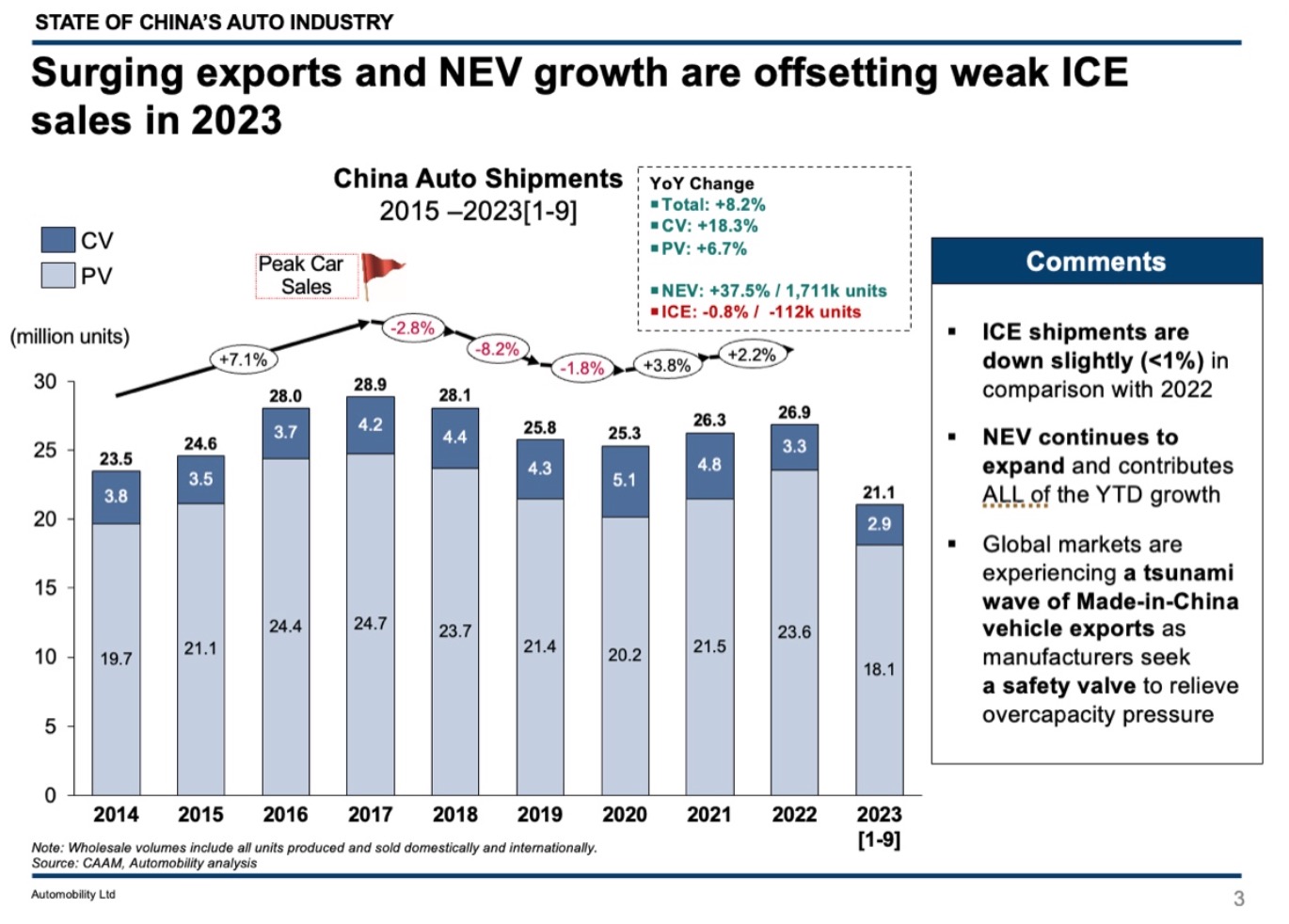

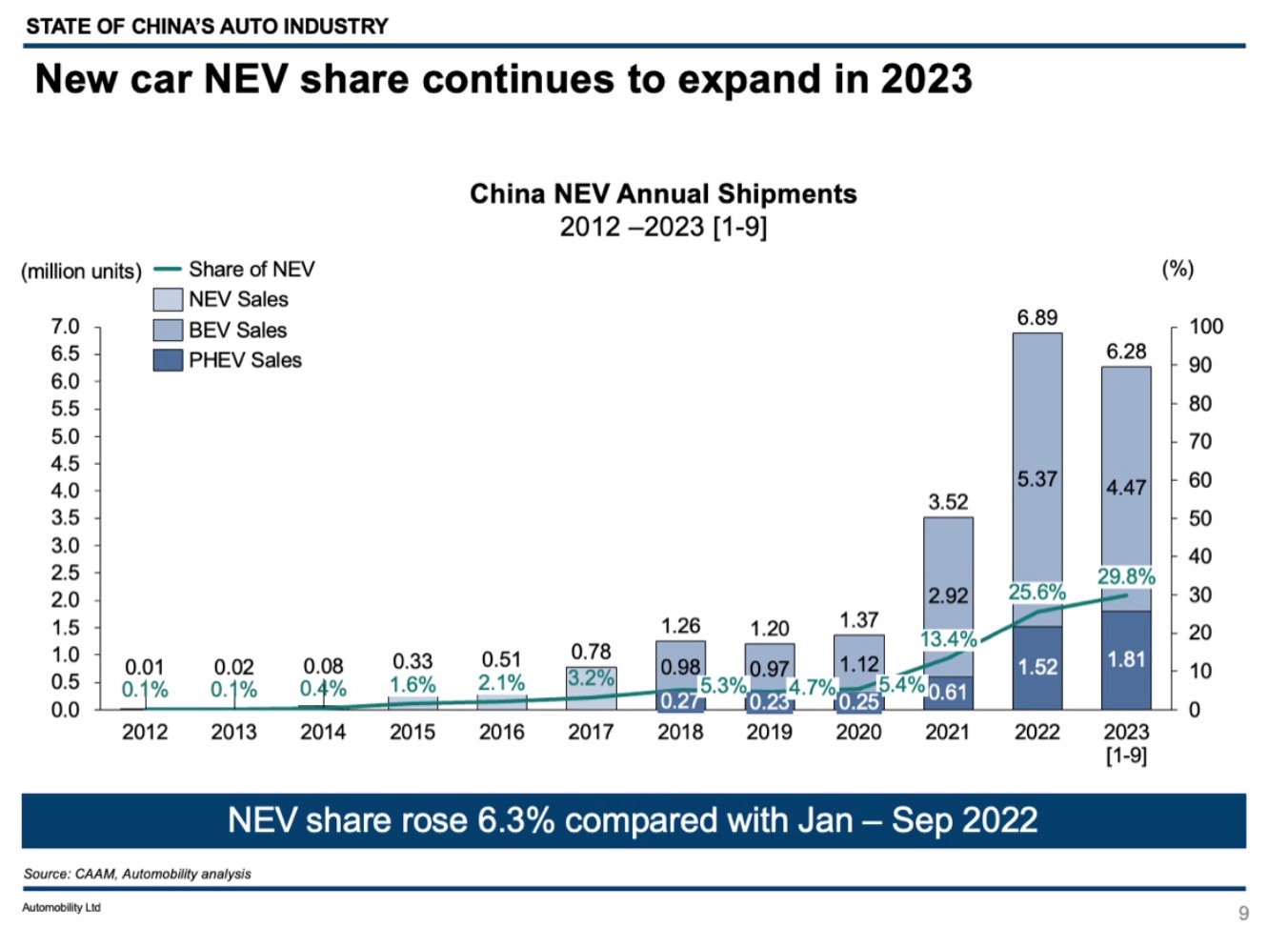

Year-over-Year Shipments from January to September: NEV +37.5% ICE -0.8%

Please Note:

NEV = New Energy Vehicles (including Battery, Plug-in Hybrid and Fuel Cell Electric Vehicles) ICE = Pure Internal Combustion Engine Vehicles

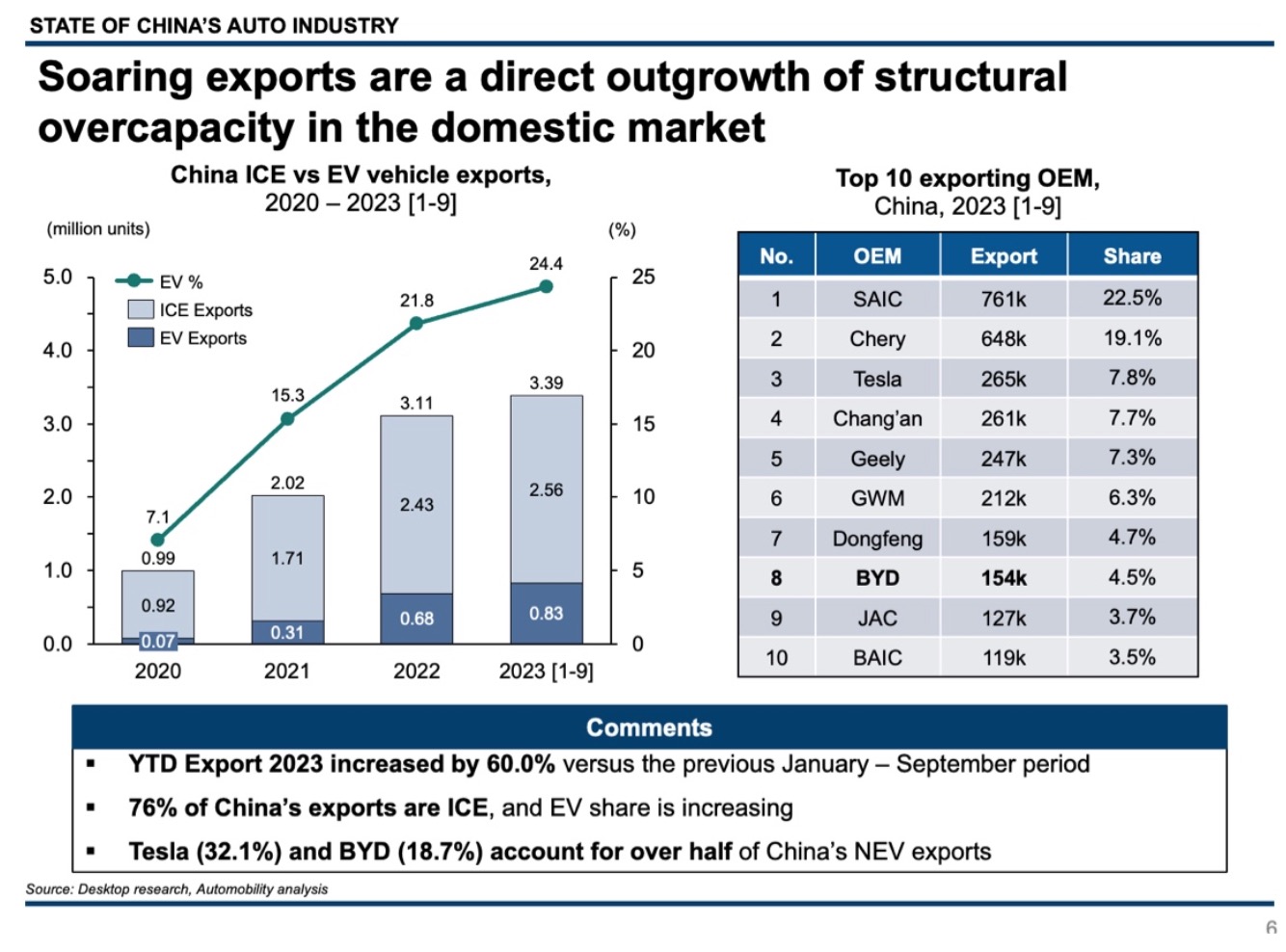

Made-in-China Exports Surpass the Full Year 2022

Market Momentum is Concentrated on NEV Sales and Exports

On the back of a 37.5 percent rise in NEV sales and record exports, 21.1 million vehicles were shipped through the month of September, including 18.1 million passenger vehicles and 2.9 million commercial vehicles. This was an increase of 8.2% over the same period of 2022.

As shown earlier, 3.39 million of the 21.1 million shipments were exported from China, representing 16% of all cars produced. It is very clear that Chinese carmakers are using exports to relieve a significant capacity overhang, especially for the relatively weak ICE segment.

Record Exports and NEV Growth Provide Momentum

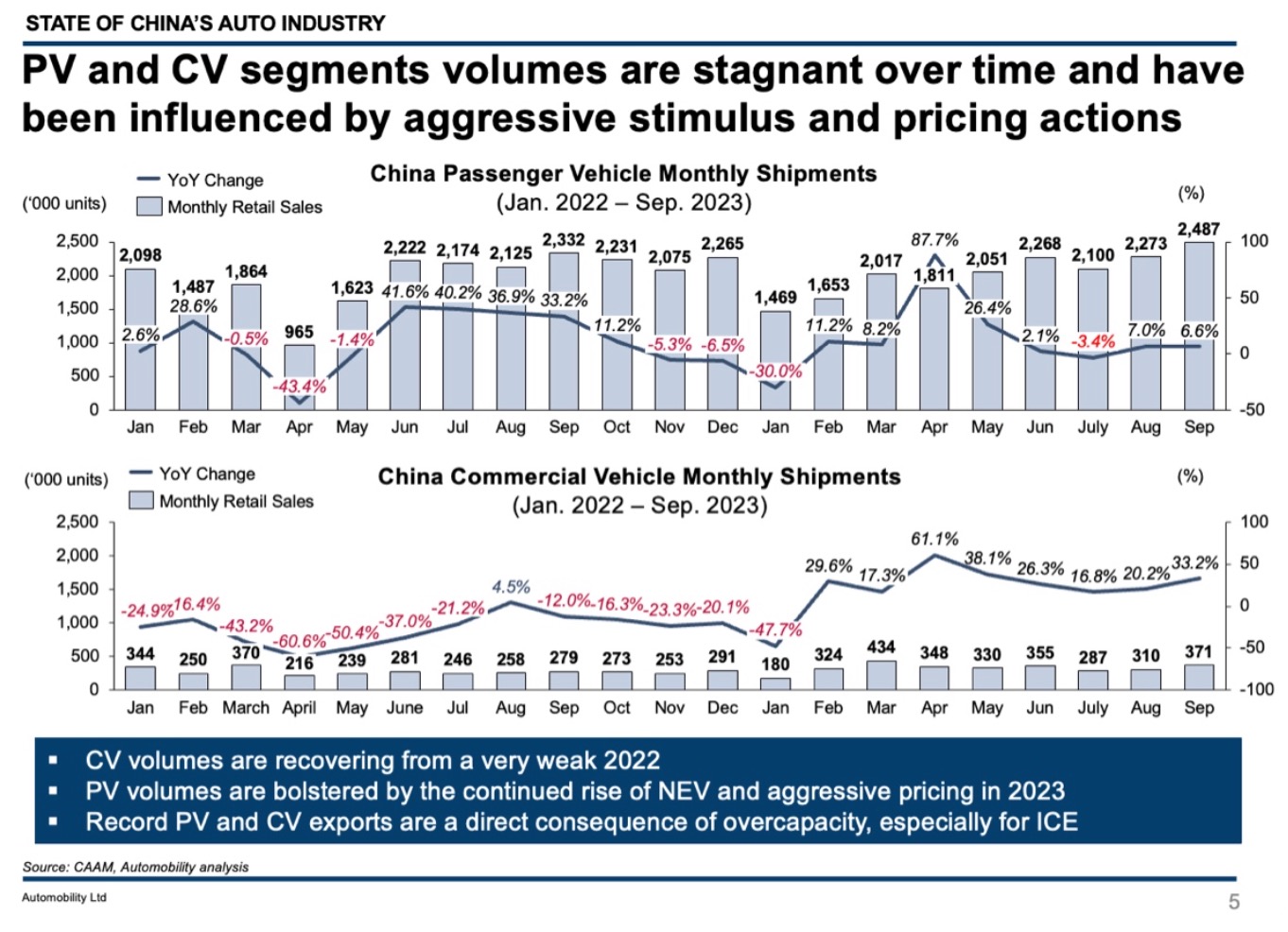

Passenger Vehicle and Commercial Vehicle shipments improved in September, with PV sales up 6.6% and CV sales up 33.2% from the prior year. A positive trend from the third quarter period indicates that a recovery of momentum is underway.

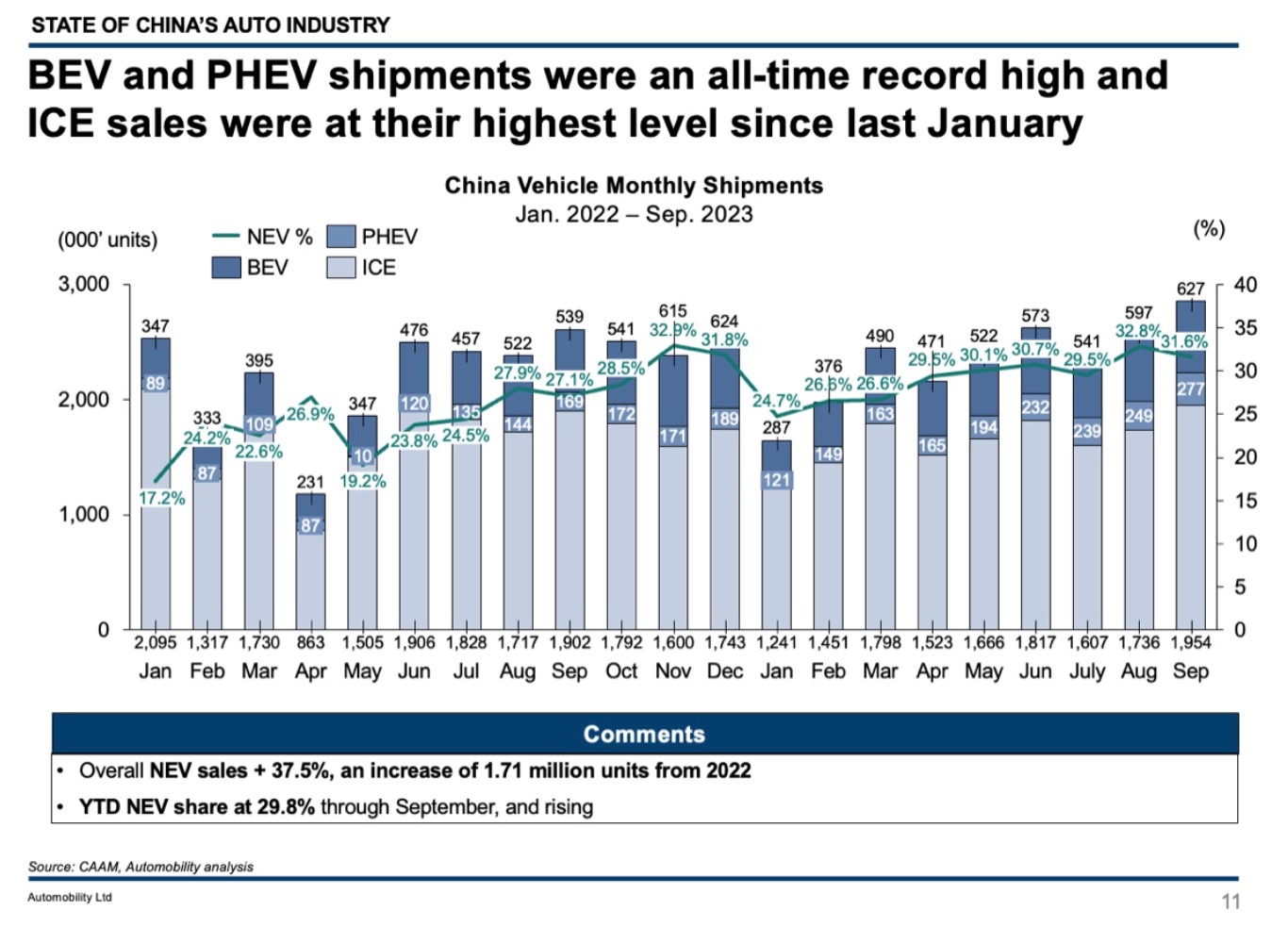

New Energy Vehicle shipments set an all-time monthly record of 904,000 units in September, growing 27.7% from last year.

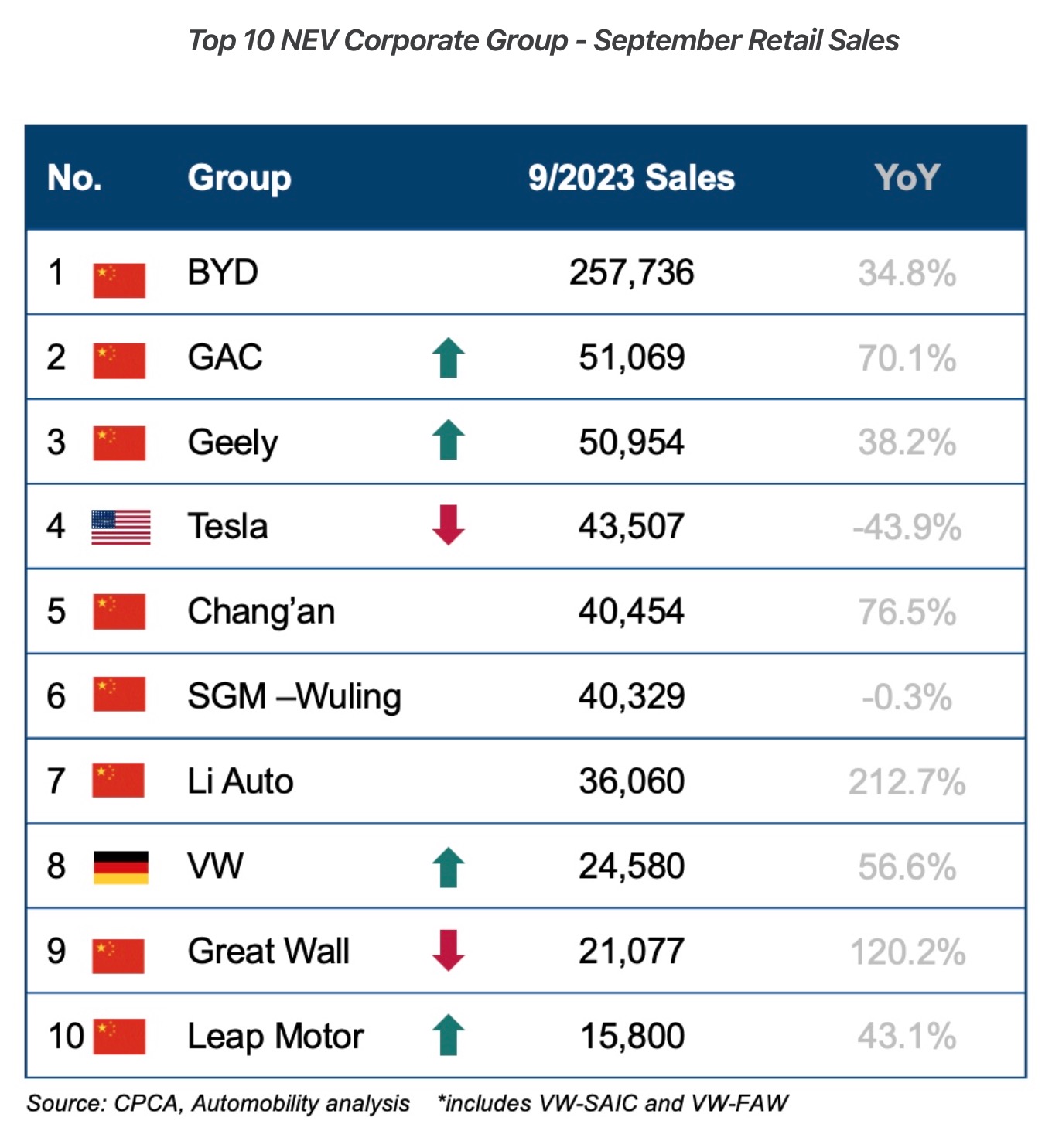

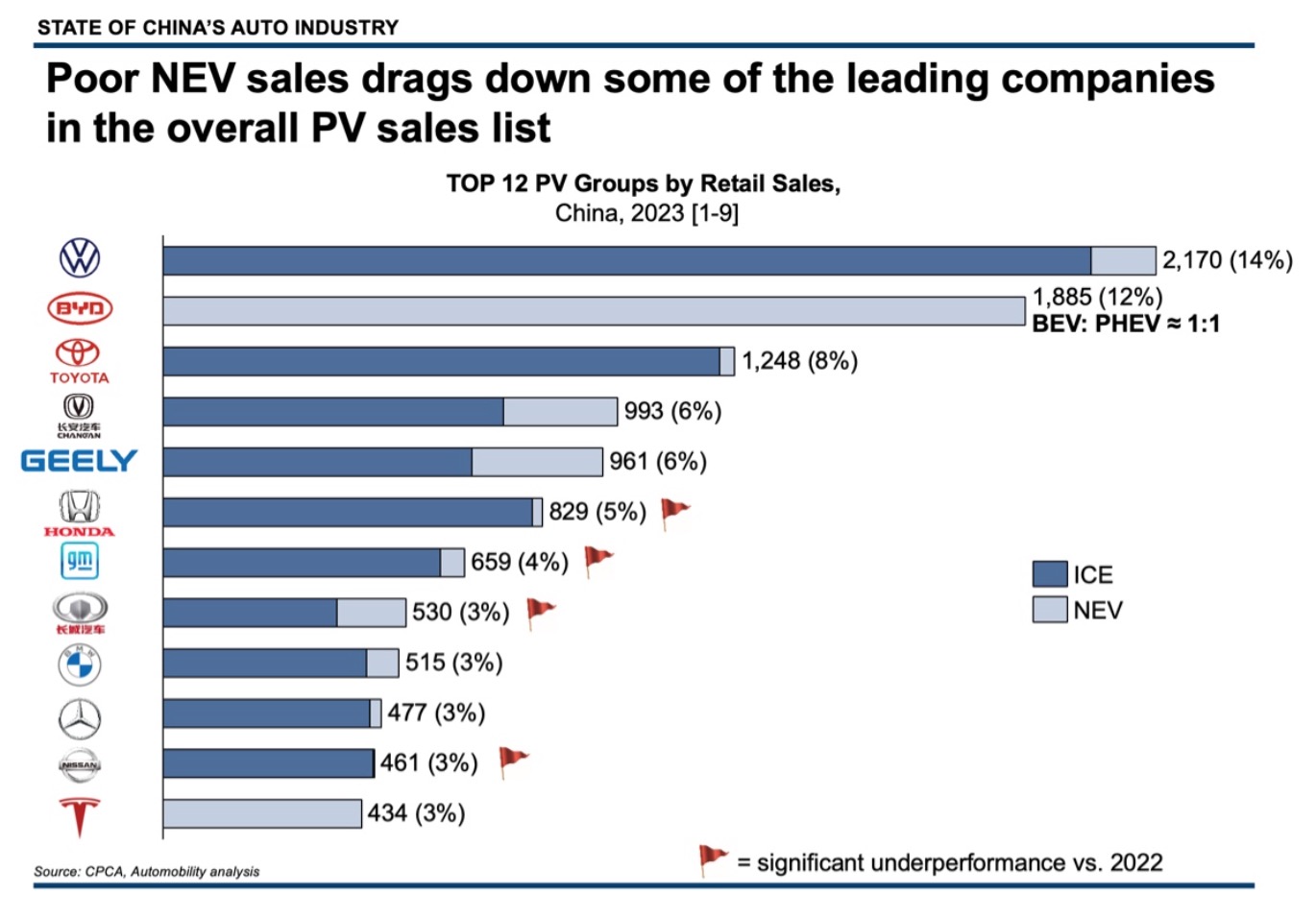

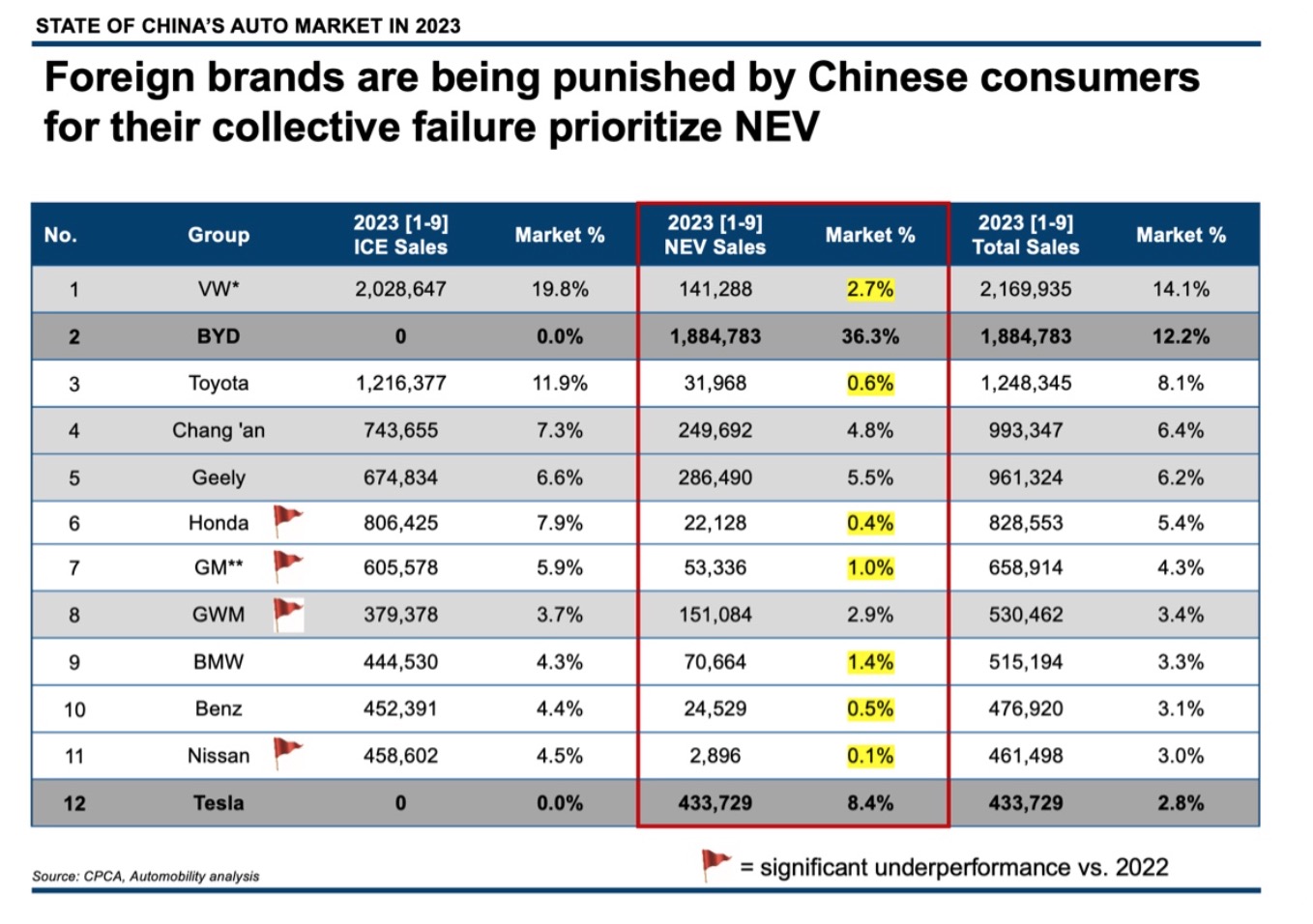

The NEV market is also remains highly concentrated and is dominated by just a small number of players, with BYD eating 36.3% of the NEV pie.

Full year NEV share rose to 29.8%, with a total of 6.28 million NEVs shipped to through September, of which 4.47 million were BEV and 1.81 million were PHEV. NEV sales will surpass the full year 2022 total in October, and will approach 9 million units in 2023.

On a monthly basis, NEV represents 31.6% of all vehicles shipped, with BEV and PHEV recording all-time record sales in September.

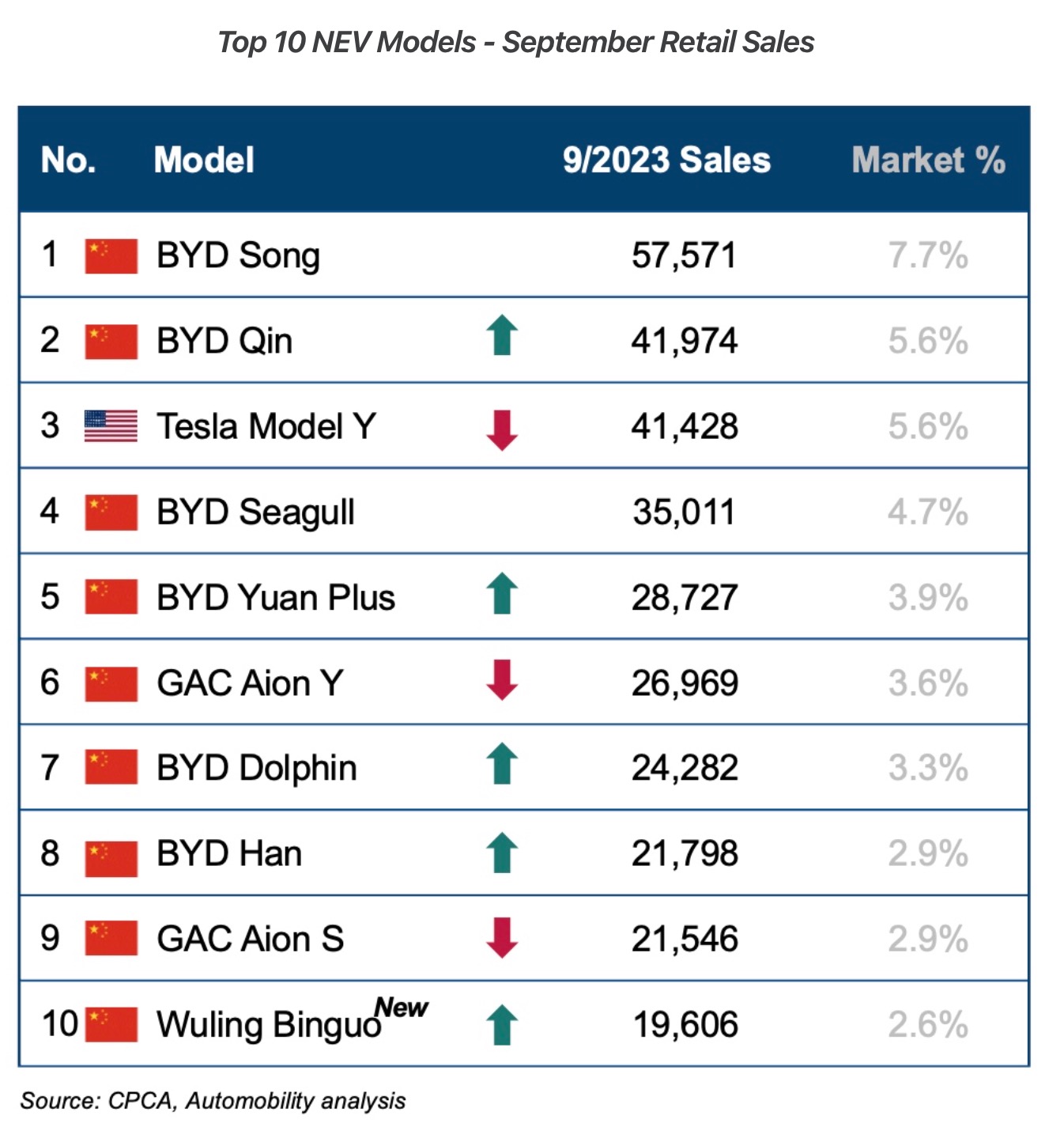

September NEV Sales Leaderboard

The NEV sales leaderboard for September includes some up and down positional moves, but the same 4 companies are represented: BYD, Tesla, GAC, and Wuling. Tesla Model Y and BYD Qin traded places, as did BYD Yuan Plus and GAC Aion Y. 2 BYD Models (Dolphin and Han) jumped ahead of GAC Aion S. Wuling’s Binguo replaced Wuling’s Honguang Mini EV in the number 10 slot.

The September Top 10 NEV Group sales leaderboard has one new entrant, with Leap Motor leaping over NIO to move into the number 10 position. Positional moves include Tesla falling to 4th place with a weaker performance resulting from a changeover to the refreshed Model 3. Volkswagen NEV sales increased as a result of aggressive ID3 price reductions, overtaking Great Wall in September sales.

2023 Overall NEV Sales Leaderboard through 3rd Quarter

Year-to-Date NEV growth stands at 37.5%, and market share through September is 29.8%, and local brands continue to dominate.

The Top 10 NEV Sales Leaderboard for 2023 also has the exact same group companies and nameplates as shown last month.

Additional points to note:

The End of Foreign Brand Dominance in China

Several questions to consider:

A FEW MORE THINGS

For a deeper analysis of the topic of Made-in-Chna Vehicles Going Global, please have a listen to this excerpt from last Month’s AmCham Shanghai Automotive Committee webinar:

We are very proud to share the news that our book “Selling to China” has risen to the #1 ranking in the International Business section of the Amazon bookstore! The book can be ordered on Amazon or directly from the publisher by scanning the QR code, or following this link: https://bit.ly/3NYkbxw

If your organization would like a custom briefing on the State of China’s Auto Market, please reach out to us at [email protected]

____________________________________

In his role as AmCham Shanghai’s Automotive Committee chairman, Bill Russo will chair AmCham Shanghai’s annual 2023 Automotive Conference on Wednesday, October 18 from 8:30 to 15:30 at Hualuxe Shanghai Twelve at Hengshan.

If you wish to join, please register here by scanning the QR code:

2023 AmCham Shanghai Automotive Conference

____________________________________

About Bill Russo

Bill Russo is the Founder and CEO of Automobility Limited, and is currently serving as the Chairman of the Automotive Committee at the American Chamber of Commerce in Shanghai. His over 40 years of experience includes 15 years as an automotive executive with Chrysler, including 19 years of experience in China and Asia. He has also worked nearly 12 years in the electronics and information technology industries with IBM and Harman. He has worked as an advisor and consultant for numerous multinational and local Chinese firms in the formulation and implementation of their global market and product strategies.

Bill is a contributing author to the book Selling to China: Stories of Success, Failure, and Constant Change (2023), where he describes how China has become the most commercially innovative place to do business in the world’s auto industry – and why those hoping to compete globally must continue to be in the market.

Automobility Limited is global Strategy & Investment Advisory firm based in Shanghai that is focused on helping its clients to Build and Profit from the Future of Mobility. We help our clients address and solve their toughest business and management issues that arise in midst of fast changing, complicated and ambiguous operating environment. We commit to helping our clients to not only “design” the solutions but also raise or deploy capital and assist in implementation, often together with our clients.

Contact us by email at [email protected]

_______________________________________

Sorry, the comment form is closed at this time.