30 Nov Auto|Mobility Investment Pulse Check – Issue #66

July 1 – October 31, 2024

Autonomous Driving

Robotics startup Cartken raises $22.5M to advance autonomous navigation

4 July

German robotics startup Cartken has secured a substantial $22.5 million in funding, with the most recent round adding $10 million to its coffers. This capital will fuel the development of Cartken’s autonomous navigation system, which is designed to operate seamlessly across diverse environments, from industrial settings to urban neighborhoods. The company’s hardware-agnostic software leverages cost-effective sensors and cameras, making it an accessible solution for a variety of vehicle types.

Led by 468 Capital, the funding round saw participation from Incubate Fund, LDV Partners, and Vela Partners, along with support from global mobility technology leaders. This investment is poised to accelerate Cartken’s growth, as the company aims to make autonomous technology a common feature in transportation and logistics. With a mission to enhance productivity and ensure safety across industries, Cartken is set to expand its operations globally, recently launching in Tokyo in partnership with Uber Eats and Mitsubishi Electric.

Horizon Robotics Prices IPO at Top of Range to Raise $696 Million

22 October

China’s Horizon Robotics is set to make waves in the technology and financial sectors with its upcoming initial public offering (IPO) in Hong Kong. The company, a leader in artificial intelligence (AI) chips and autonomous driving solutions, aims to raise $696 million by pricing its shares at the top end of the indicated range. This move reflects strong investor confidence in Horizon’s market potential as global demand for advanced AI technologies and autonomous systems continues to rise. Scheduled for launch, this IPO positions Horizon Robotics as a significant player ready to tap into fresh capital to support its research and development endeavors and international expansion plans.

The fundraising milestone comes at a pivotal moment for the AI industry and underlines Hong Kong’s role as a prominent financial hub for tech-driven public offerings. Horizon’s entry to the public market is anticipated to invigorate investment interest in AI and automotive tech, industries poised for substantial growth. As China’s push for technological self-reliance intensifies, Horizon Robotics’ advancements in automotive AI further cement its strategic importance, providing critical tools for domestic automakers aiming to enhance vehicle automation and intelligence.

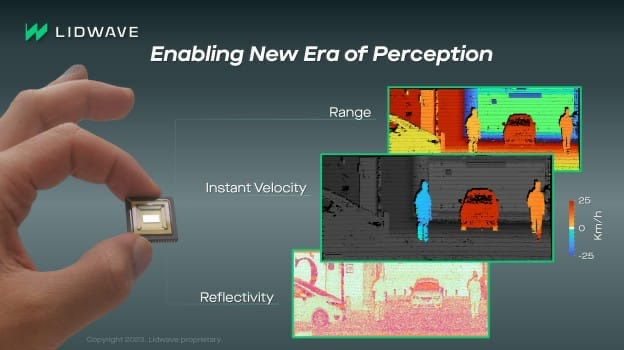

Lidwave Secures $10M for 4D LiDAR Development

24 October

Lidwave, a company specializing in the development of 4D LiDAR solutions, has successfully secured $10 million in funding. This significant capital injection will be instrumental in advancing the company’s cutting-edge technology, which is pivotal for applications in autonomous vehicles, robotics, and various other industries requiring high-precision sensing and perception.

The recent funding round will enable Lidwave to further develop its 4D LiDAR technology, enhancing its capabilities to provide real-time, three-dimensional mapping with velocity data. This advancement is crucial for improving the safety and reliability of autonomous systems. The investment is also expected to support the company’s market expansion efforts, as the demand for sophisticated LiDAR solutions continues to grow globally. Lidwave’s 4D LiDAR technology stands to play a significant role in the future of autonomous mobility and intelligent systems.

Waymo Raises $7.5 Billion to Expand Autonomous Ride-Hailing Service

28 October

Waymo, Alphabet’s autonomous driving division, has secured a substantial $7.5 billion in new funding to expand its autonomous ride-hailing service. This significant investment will be instrumental in accelerating the deployment of Waymo’s self-driving technology across various markets. The funding round underscores the growing confidence in Waymo’s ability to reshape the future of transportation with its safe and efficient autonomous driving solutions.

With this capital injection, Waymo is poised to enhance its service offerings, expand into new regions, and continue to innovate in the autonomous vehicle space. The investment will also support the company’s ongoing research and development efforts, ensuring that Waymo remains at the forefront of autonomous technology.

Rosh.Ai Secures $1 Million in Seed Funding for Autonomous Driving Solutions

21 August

Rosh.Ai, a Kochi-based deep-tech company specializing in vehicle-agnostic end-to-end Autonomy Stack development, has successfully raised $1 million in a seed investment round led by Ev2 Ventures/Caret Capital, with participation from ThinKuvate. Founded in 2021, Rosh.Ai is committed to revolutionizing mobility by providing advanced autonomous driving solutions that enhance safety, efficiency, and sustainability in the automotive industry. The company serves as a development partner to automotive OEMs, including EVs, seaport and airport operators, and the mining sector, offering rapid AV prototype development and ADAS test platforms.

The company’s recent funding will support its efforts to address critical issues in sea port congestion and mining productivity by tackling driver shortages and equipment inefficiencies. With this investment, Rosh.Ai is poised to accelerate its innovation in autonomous vehicle systems, aiming to set new standards in the industry and drive forward the future of autonomous mobility. The company’s co-founder and CTO, Rajaram Moorthy, brings over two decades of experience in robotics and AI, contributing to the development of India’s first driverless car revolution.

Zelos Secures $100 Million in Series B1 Funding for Autonomous Delivery Vehicles

31 October

Zelos, a developer of autonomous logistics delivery vehicles, has successfully completed its Series B1 funding round, raising $100 million to advance its L4 autonomous driving technology for urban logistics. The round was led by CDH BAIFU and Blue Lake Capital, with support from existing investors. Zelos has made significant strides in autonomous vehicle development, launching five iterations within 18 months of its founding and releasing the mass-produced L4 urban delivery vehicle series, the Z5, in Q4 of 2023. The company has since expanded its lineup with four additional L4 models to cater to various operational needs.

Zelos has rapidly deployed over 1,000 autonomous vehicles across 130 cities, delivering more than 100 million orders to date. The company has reported a substantial reduction of 62% in operational costs for its clients and has accumulated 4 million kilometers of L4 autonomous driving distance, increasing by approximately 1 million kilometers per month. This funding will further bolster Zelos’ efforts to revolutionize urban logistics with its advanced autonomous vehicle technology.

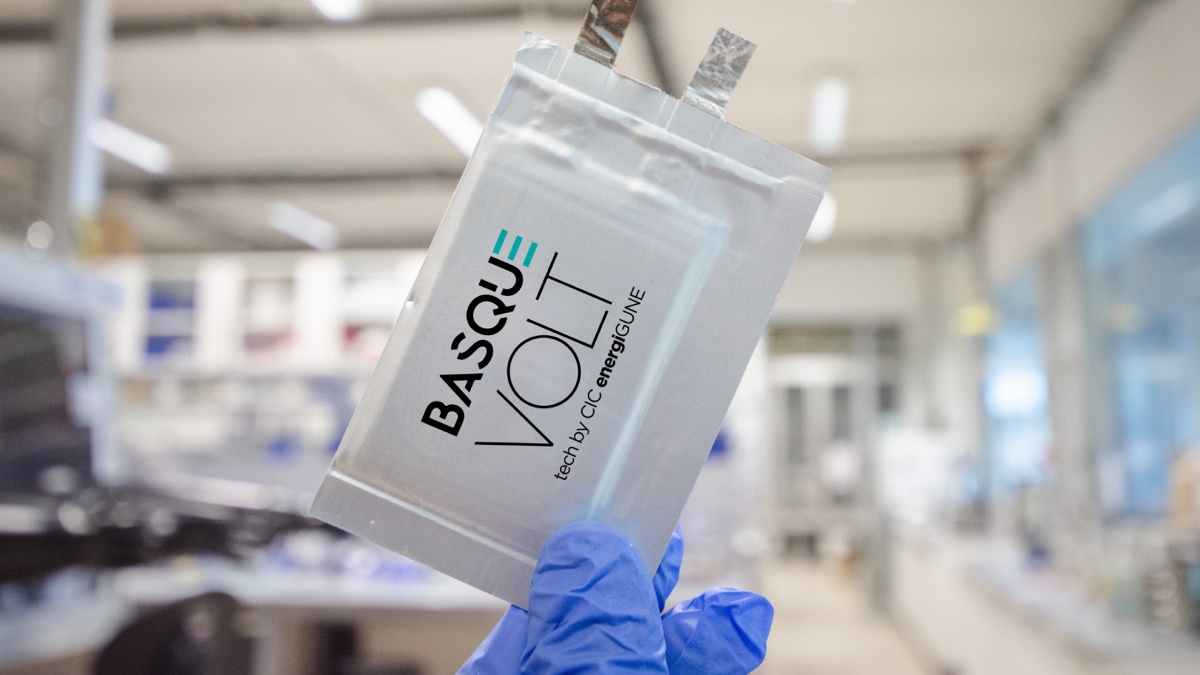

Basquevolt Secures Investment for Solid-State Battery Development

24 July

Basquevolt, a solid-state battery development company, has received a significant investment from the CDTI through its Innvierte program, along with EIT InnoEnergy and Enagás. The CDTI’s commitment amounts to €2.025 million, joining other foundational investors in the initiative that was established in June 2022. This partnership supports Spain’s mission to drive forward energy innovation and bolster its green transition through advanced energy storage technologies.

Basquevolt’s cutting-edge batteries offer greater energy density, safety, and efficiency compared to traditional lithium-ion alternatives. This investment aligns with Basquevolt’s goal to become a European leader in solid-state batteries, targeting the development of advanced materials and cells for widespread electric transportation, stationary energy storage, and advanced portable devices.

Solid-state battery firm Talent New Energy closes Series B round

27 August

Chongqing Talent New Energy Co., Ltd. has announced the completion of its Series B strategic financing round, raising hundreds of millions of yuan. This funding round was jointly led by Anhe Fund, a subsidiary of Changan Automobile, along with several funds under China South Industries Group Corporation. Talent New Energy, a key player in China’s solid-state battery sector, specializes in the development and commercialization of next-generation solid-state lithium batteries and critical materials. The company has a comprehensive capability across the industry chain, from key materials to system integration, and boasts nearly 500 patents resulting from over a decade of R&D in solid-state battery technology.

The new capital will support Talent New Energy’s continued innovation in solid-state batteries, a critical area as the global market for new energy vehicles (NEVs) rapidly expands. The company has independently developed several cutting-edge technologies, including “High Conductivity Lithium-Oxygen Polymer Composite Technology” and “Interface Softening Technology,” which enhance battery safety and performance. In response to market demands, Talent New Energy has also pioneered the development of advanced solid-state battery systems, such as 4C ultra-fast charging semi-solid-state batteries.

Energy Storage System

Clean Electric Secures $6 Million in Series A Funding for Energy Storage Solutions

10 September

Clean Electric, a startup offering energy storage solutions, has announced that it has raised $6 million in a Series A funding round. The round was co-led by Info Edge Ventures, Pi Ventures, and Kalaari Capital, with additional investments from Lok Capital and other strategic investors. Since its founding in 2016, Clean Electric has been developing advanced battery solutions for electric vehicles, notably its rapid charging technology capable of fully charging EVs in under 12 minutes, a substantial improvement over the standard 40 minutes.

The newly acquired funds will be directed towards expanding Clean Electric’s research and development, as well as enhancing sales operations and product development. The startup plans to broaden its reach within the electric vehicle market by extending its battery technology to electric four-wheelers and commercial vehicles. With these investments, Clean Electric aims to escalate its annual revenue from $1.2-1.5 million to nearly $10 million by the following September. The company has already achieved commercialization of its battery packs for electric two-wheelers and is preparing to scale up production for three- and four-wheelers. Clean Electric is also working towards obtaining the necessary regulatory certifications for its four-wheeler battery packs by the end of the year, reinforcing its commitment to efficient battery and energy storage systems.

New Fund Launch

CATL to Raise $1.5 Billion Fund to Expand Global Supply Chain

12 July

Chinese battery manufacturing giant CATL is reportedly in discussions to raise a $1.5 billion offshore fund aimed at expanding its global supply chain. The fund will focus on financing the corporate ecosystem necessary for production expansion in Europe and other international markets, as reported by the Financial Times. This move comes amidst challenges posed by China’s overseas direct investment rules, which limit large international investments. CATL, which contributed RMB 289 billion yuan ($40 billion) in cash as of March 31, plans to invest about 15 percent of the fund alongside global investors, targeting companies that can supply CATL in Europe.

The $1.5 billion fund, managed by Hong Kong-based Lochpine Capital, will primarily seek investments from overseas sovereign wealth funds, family wealth management offices, and European manufacturers. CATL has approached entities like Mercedes-Benz and other automakers for potential investments. The initiative underscores CATL’s ambition to facilitate the global energy transition with support from partners worldwide. As the world’s largest battery maker, holding a 37.5 percent share of the global EV battery market from January to May, CATL’s strategic move reflects its commitment to addressing supply gaps and enhancing its international footprint, particularly with ongoing projects in Germany and Hungary.

Japan Launches $400 Million Hydrogen Fund to Boost Supply Chain

16 September

Japan has introduced a $400 million hydrogen fund aimed at fostering a low-carbon hydrogen supply chain, an essential step in its path toward energy transition. The initiative, supported by leading firms, is set to promote the development and global adoption of hydrogen solutions, strengthening sustainable energy frameworks.

The fund focuses on projects spanning production, storage, and transport, enhancing Japan’s leadership in clean energy technologies. This move underscores a commitment to creating a resilient and scalable hydrogen infrastructure amid global decarbonization efforts.

Saudi Arabia’s Wa’ed Ventures Targets AI Startups with $100 Million Investment

27 October

Saudi Arabia’s venture capital fund, Wa’ed Ventures, a subsidiary of Aramco, has pledged $100 million to invest in artificial intelligence startups, aiming to establish the Kingdom as a global AI hub and to foster economic growth through technological innovation. The fund has also established an advisory board consisting of prominent figures in the AI sector to facilitate deal sourcing and to support the localization of global talent. This strategic move is expected to guide Wa’ed in identifying high-potential AI investments and to accelerate the integration of advanced technologies within Saudi Arabia.

The investment by Wa’ed Ventures comes amidst projections that AI could contribute an estimated $135 billion to Saudi Arabia’s economy by 2030, according to PwC, making it one of the nation’s most significant economic drivers. The fund has already begun investing in innovative companies such as Korea’s AI chipmaker Rebellions and California-based aiXplain, which focuses on essential infrastructure for accelerated development. These investments demonstrate Wa’ed Ventures’ dedication to supporting high-potential technology companies and infrastructure players within the AI field, positioning Saudi Arabia to capture a considerable share of the global AI economy, which McKinsey & Co. estimates will contribute more than $13 trillion by 2030.

About Automobility

Automobility Limited is global Strategy & Investment Advisory firm based in Shanghai that is focused on helping its clients to Build and Profit from the Future of Mobility. We help our clients address and solve their toughest business and management issues that arise in midst of fast changing, complicated and ambiguous operating environment. We commit to helping our clients to not only “design” the solutions but also raise or deploy capital and assist in implementation, often together with our clients.Contact us by email at [email protected]

Official Website:http://automobility.io/

Hong Kong

Tel Aviv

Sorry, the comment form is closed at this time.