22 Mar State of China’s Auto Market – March 2022

Will Supply Chain Disruptions Halt the Rise of EV?

Comments from Bill Russo, Founder & CEO of Automobility Ltd.

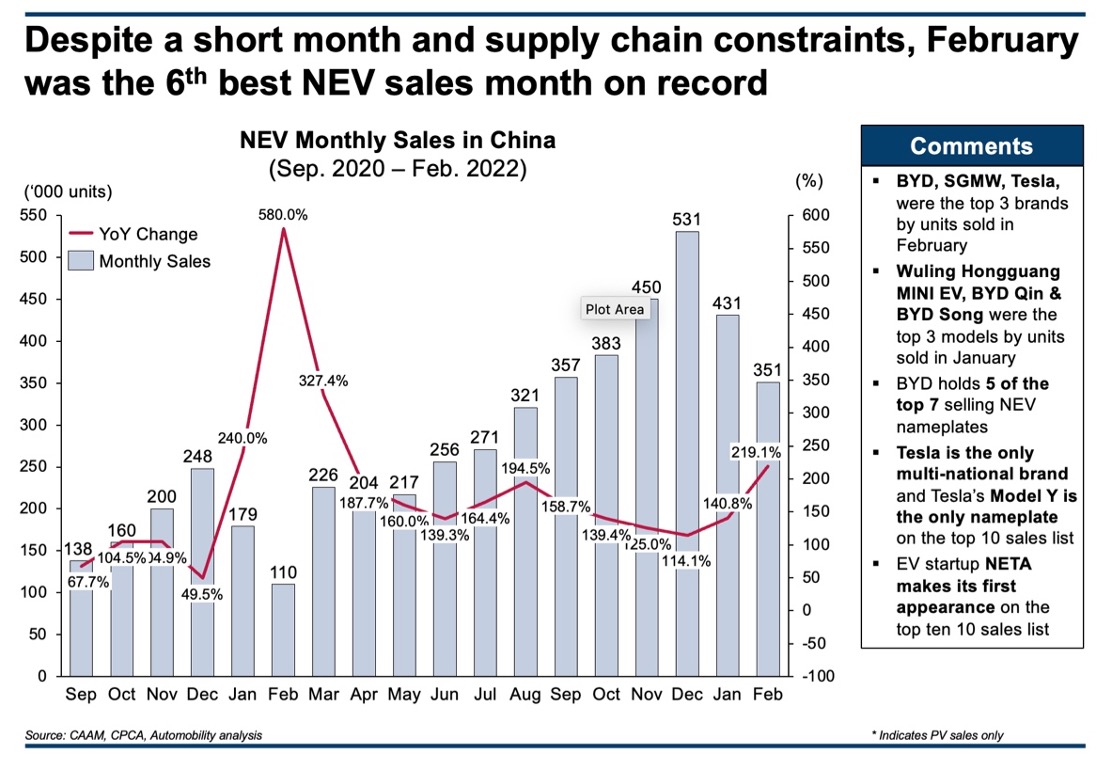

Overall automotive sales in February were up 19.4% year-over-year (YOY) in China, which when combined with a positive month of January sales, represent a solid opening for 2022. The timing of the Chinese lunar new year holiday, which was earlier in 2022, is a factor when making YOY comparisons in the first 2 months of the calendar year. Considering this, along with chip supply chain constraints, there is solid evidence of ongoing demand-side strength in the China auto market.

As has been the trend since mid-2020, overall sales performance has been buoyed by rising demand for New Energy Vehicles. 351,000 NEVs were sold in February in China – representing the sixth best sales month on record in a holiday-shortened selling period.

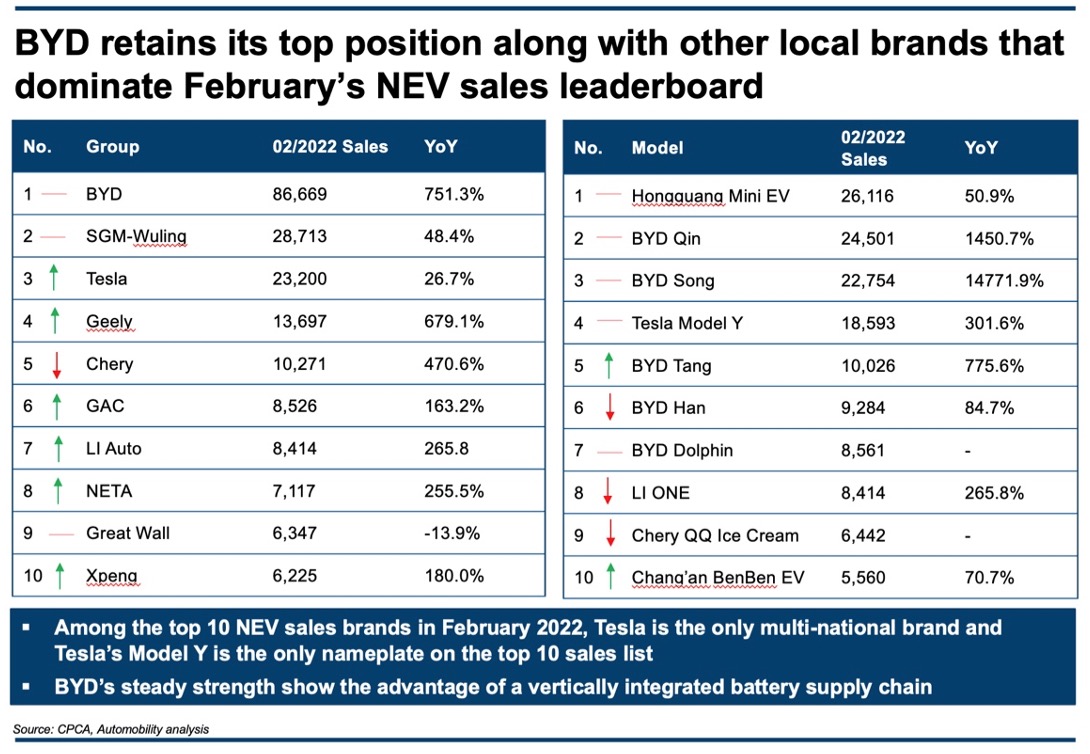

This month’s NEV sales leaderboard shows BYD’s continued dominance in the market. BYD’s February sales are higher than the total sales of the next five companies on the list. Five out of the top seven NEV models were produced by BYD. As a vertically integrated manufacturer of battery cells and vehicles, BYD is apparently leveraging its supply chain advantage as the market for EV expands.

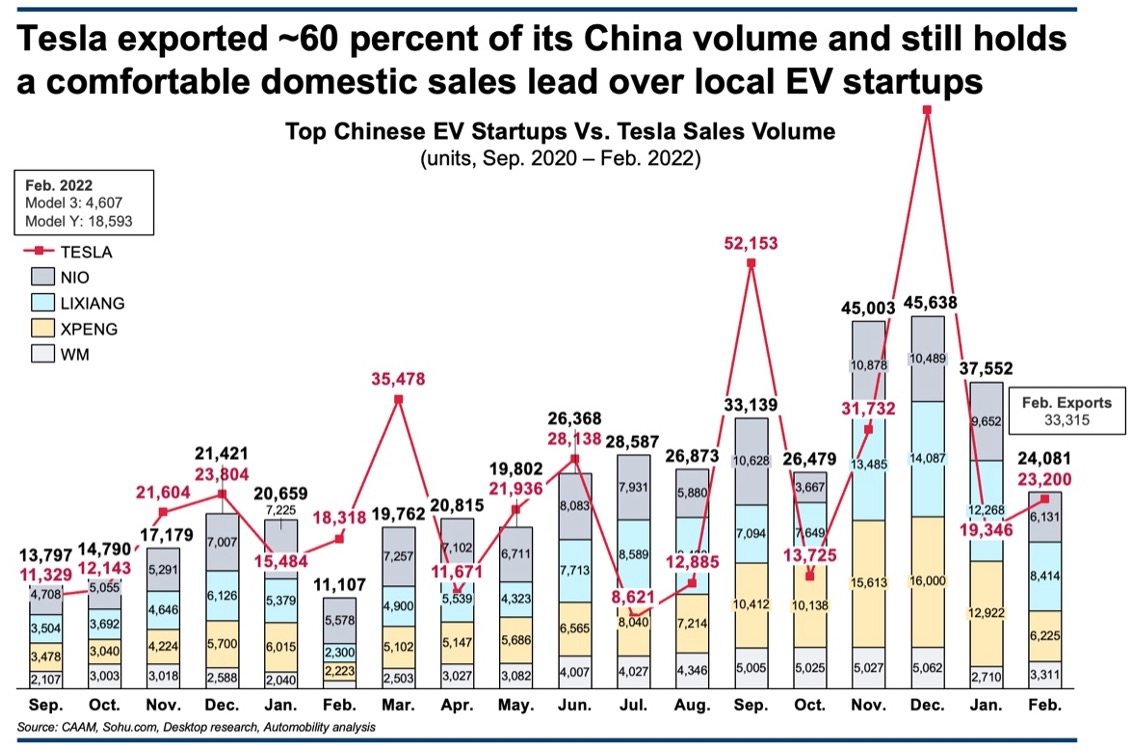

Among multinational brands, only Tesla appears on the monthly EV sales leaderboard. The US company ranked 3rd overall, despite exporting nearly 60% of its made-in-China vehicles to other markets. As I remarked on CNBC last August (see link below), Tesla has an advantage over all global carmakers: its China factory – which gives Tesla a supply and cost advantage for producing EVs at scale in the world’s largest market.

CNBC interview from August 20, 2021: Tesla’s edge in global EV space: its China factory [VIDEO]

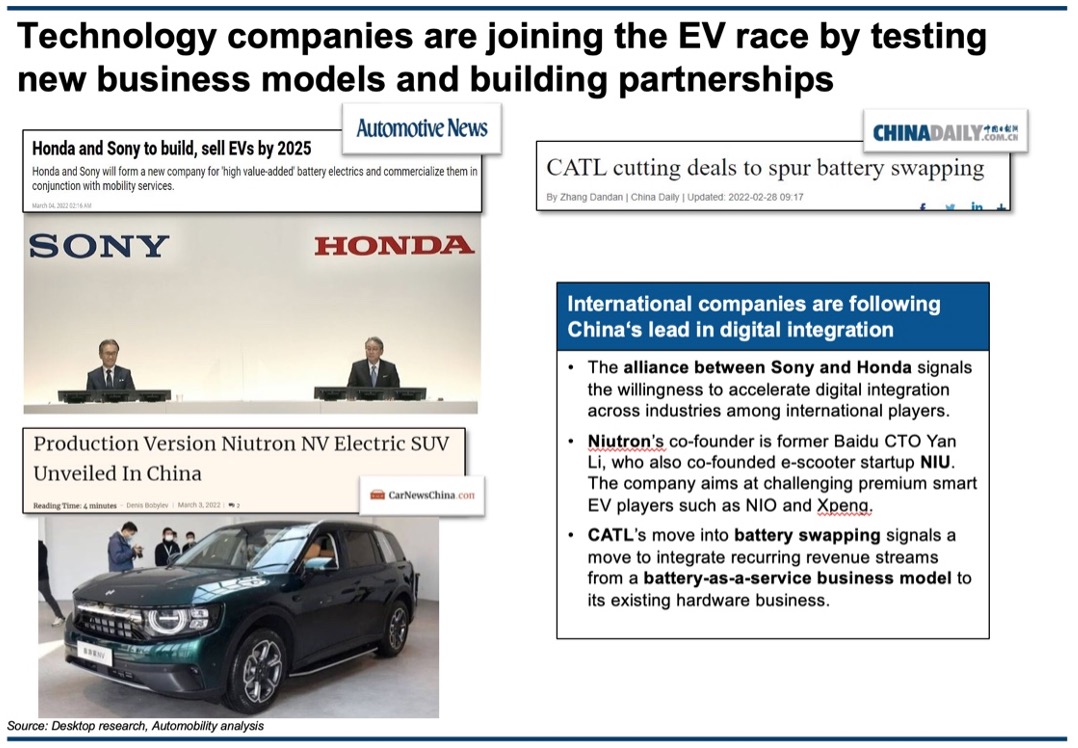

BYD and Tesla’s strength shows that vertically integrated supply chains are key competitive weapons in the EV market. It comes as no surprise that multinational OEMs are following this path by partnering up with technology companies that are seeking to join the EV race.

In the meantime, Chinese battery giant CATL is expanding beyond its core manufacturing business by exploring battery-as-a-service business models.

It has become clear that the global carmakers are making strong commitments to EV, and in some cases forging new partnerships in order to secure supply chain and other technology advantages. Sony’s partnershiip with Honda is an indication of a new technology partnership for embedded intelligence and for creating a differentiated user experience. New players are also entering the game from other sectors, including the scooter maker Niu, who recently unveiled their Niutron electric SUV.

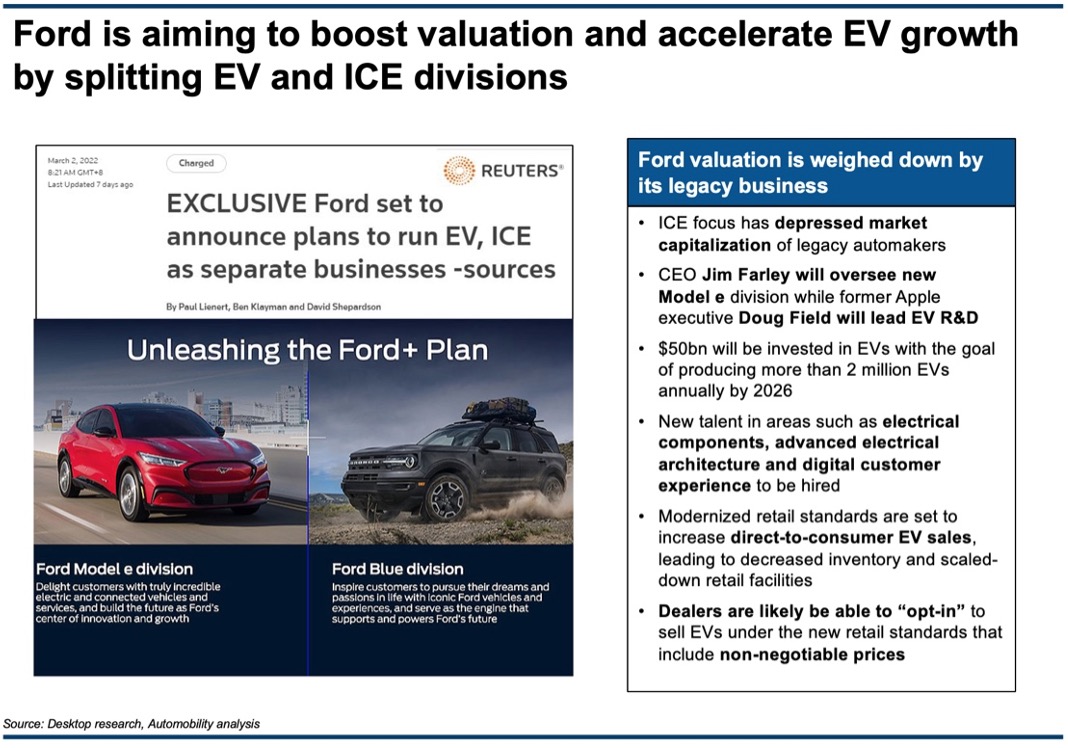

In addition, Ford and Stellantis have each declared plans to increase their competitiveness in the EV market, with Ford going so far as to split the company into EV and ICE units to unlock valuation and accelerate growth.

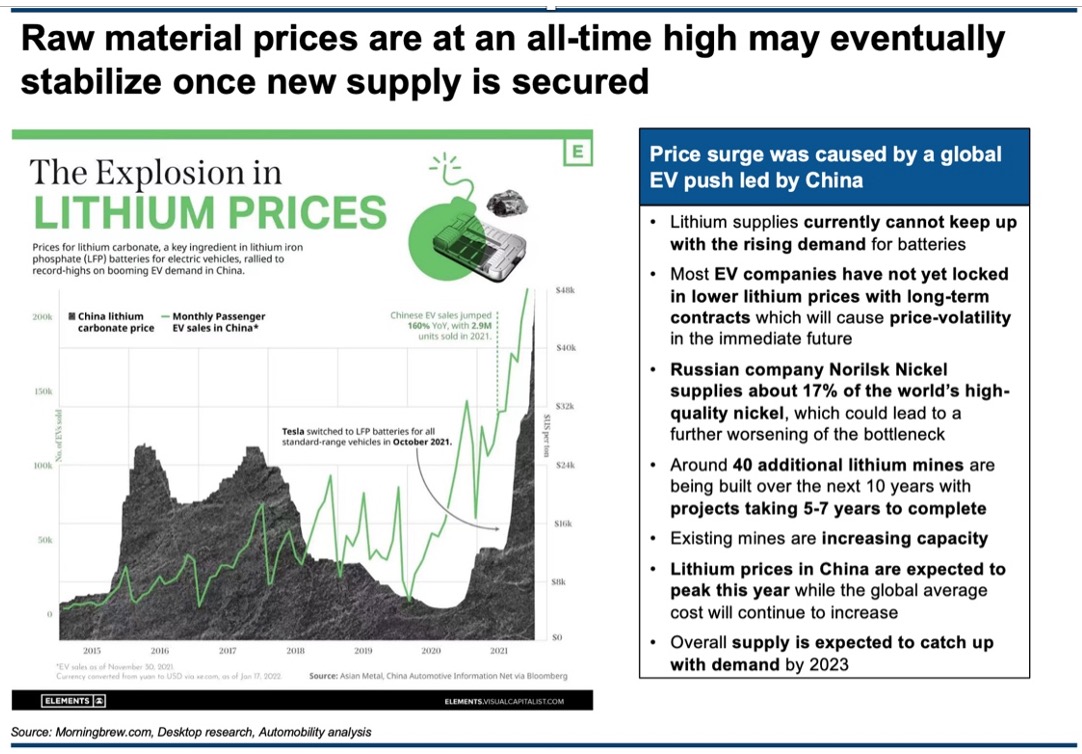

Despite continued market interest in electrification, it is very clear that there are significant headwinds present that may constrain and ultimately curtail the rise of EV. Price inflation for lithium, cobalt, nickel and other elements needed for producing EVs are forcing carmakers to either shut down certain unprofitable models or otherwise raise prices, which will slow market acceptance.

Other significant headwinds such as the impact of the Ukraine-Russia war and the resurgence of COVID-19 in China also represent significant risks in the near-term outlook for the market.

Several questions to consider::

-Only 1 Chinese EV startup appears on the top ten EV nameplate list (LI ONE). Are EV startups just the “pioneers”, eventually to be replaced by more traditional players like BYD, SAIC, ChangAn and Chery?

-Is a vertically integrated supply chain for chips and batteries necessary in the age of technology disruption? Can this be an efficient way to achieve scale?

-Should traditional carmakers carve out their ICE business to unlock valuation? How will the workforce adapt to such a configuration?

-Will supply chain price inflation Make ICE Great Again (M-ICE-G Again)?

Pronounced like our favorite US auto capital

Please click here for a video of our Status of China’s Automotive Market briefing at the AmCham Shanghai Automotive Committee Event on February 22, 2022

If you wish to join our monthly AmCham Automotive Committee webinar on the State of China’s Auto Industry, you can contact us at [email protected], or add me on WeChat @billrusso (or use QR code below).

About Bill Russo

Bill Russo is the Founder and CEO of Automobility Limited, and is currently serving as the Chairman of the Automotive Committee at the American Chamber of Commerce in Shanghai. His 40 years of experience includes 15 years as an automotive executive with Chrysler, including 18 years of experience in China and Asia. He has also worked nearly 12 years in the electronics and information technology industries with IBM and Harman. He has worked as an advisor and consultant for numerous multinational and local Chinese firms in the formulation and implementation of their global market and product strategies.

Sorry, the comment form is closed at this time.