28 Apr State of China’s Auto Market – April 2025

Written by Bill Russo, Founder & CEO of Automobility Ltd.

Before jumping into the commentary on the 1st quarter, I’m very excited to share the first episode of our all-new “Auto Insider” podcast, where I aim to bring you stories from the front-line experience of the pioneers who have devoted themselves to building the future of mobility, and bridging the gaps between past, present and future. Our first episode features industry veteran Jack Cheng, the current Chairman & CEO of M Mobility, a provider of integrated smart solutions utilizing EV and AI technologies.

Auto Insider #1: Jack Cheng on Smart EVs and the Smart Tier 0.5 Supply Chain

《车圈局内人》播客重磅上线!首期对话行业传奇人物 解码Tier0.5供应链新范式

Jack’s track record includes CEO of Foxconn’s MIH | Mobility in Harmony Alliance and Co-Founder of NIO a leading Tencent-backed Smart EV maker. Jack also led the China business for Fiat Chrysler Automobiles, the Asia Pacific Business for Magnetti Marelli and served many positions over nearly 2 decades at Ford Motor Company.

You can stream the Auto Insider podcast on your preferred platform – and don’t forget to like and subscribe to be notified of future Auto Insider podcasts! (Please copy and paste the below links to your browser)

YouTube: @AutomobilityLtd

Spotify: AUTO INSIDER

Apple Podcasts: AUTO INSIDER

Youku: AUTO INSIDER

https://v.youku.com/video?vid=XNjQ2NjI1MTQ3Mg%3D%3D

Highlights through 1st Quarter 2025

- Year-to-date market performance is favorable in 2025 versus the prior year. New Energy Vehicle (NEV) shipments are up 47.1%, while gasoline powered (ICE) vehicle sales are down 5.1% versus last year’s 1st quarter.

- Made-in-China (MIC) exports are up 7.3% versus last year’s pace. NEV exports are expanding, reaching 31.1% of total exports.

- All of the year-over-year increase in NEV exports can be attributed to BYD, which exported 214,000 units in the 1st quarter – an increase of 115,000 units from the 1st quarter of 2024.

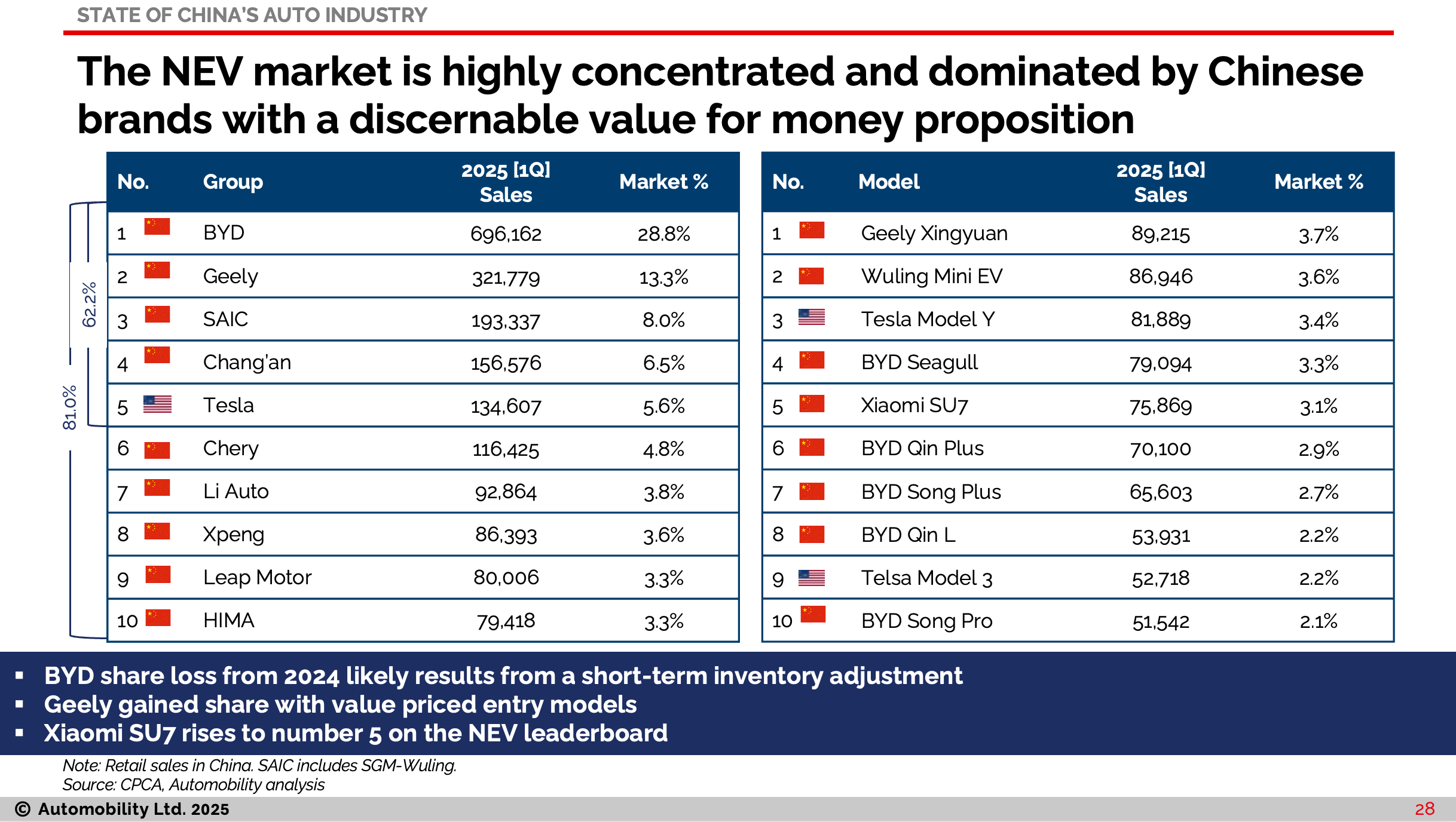

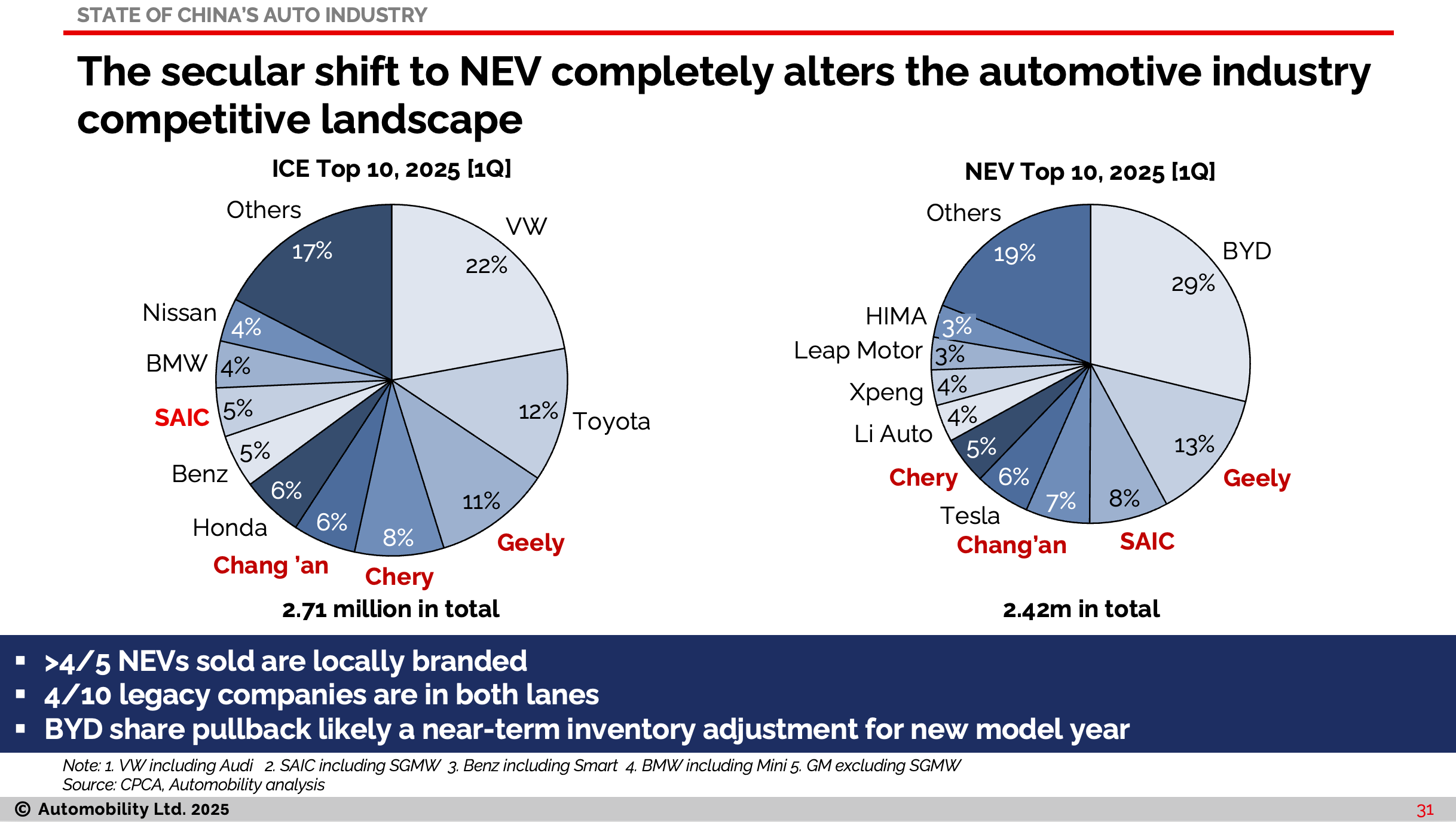

- BYD domestic NEV share has declined to 28.8 %, but remains the dominant player. Market concentration has increased, with the top 10 NEV players holding 81% share of the segment.

- Legacy companies (BYD, Geely, SAIC and Chang’an) hold the top 4 positions in the NEV race with a combined 56.6% share of the NEV market.

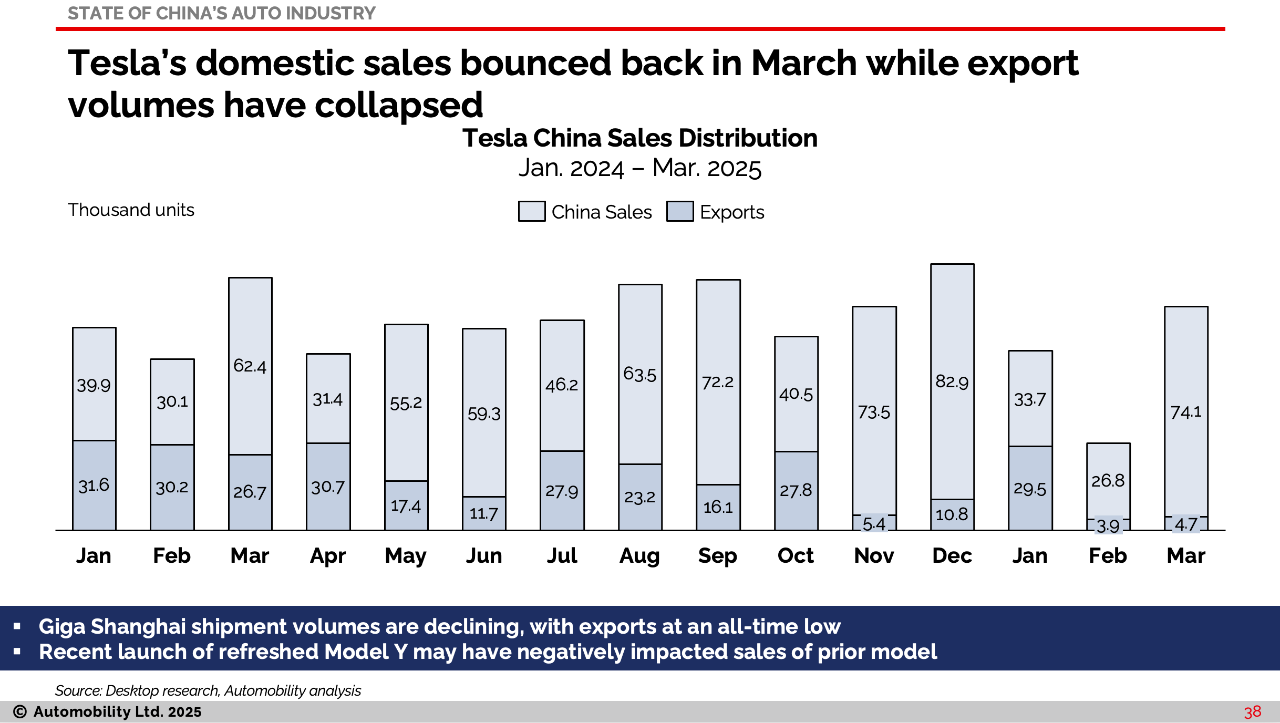

- Tesla remains as the only non-Chinese brand on the top 10 leaderboard, but their NEV segment share in China has fallen to 5.6%. Exports of Made-in-China vehicles fell to ~38,000 units, Tesla’s weakest export performance since the launch of their Shanghai Gigafactory.

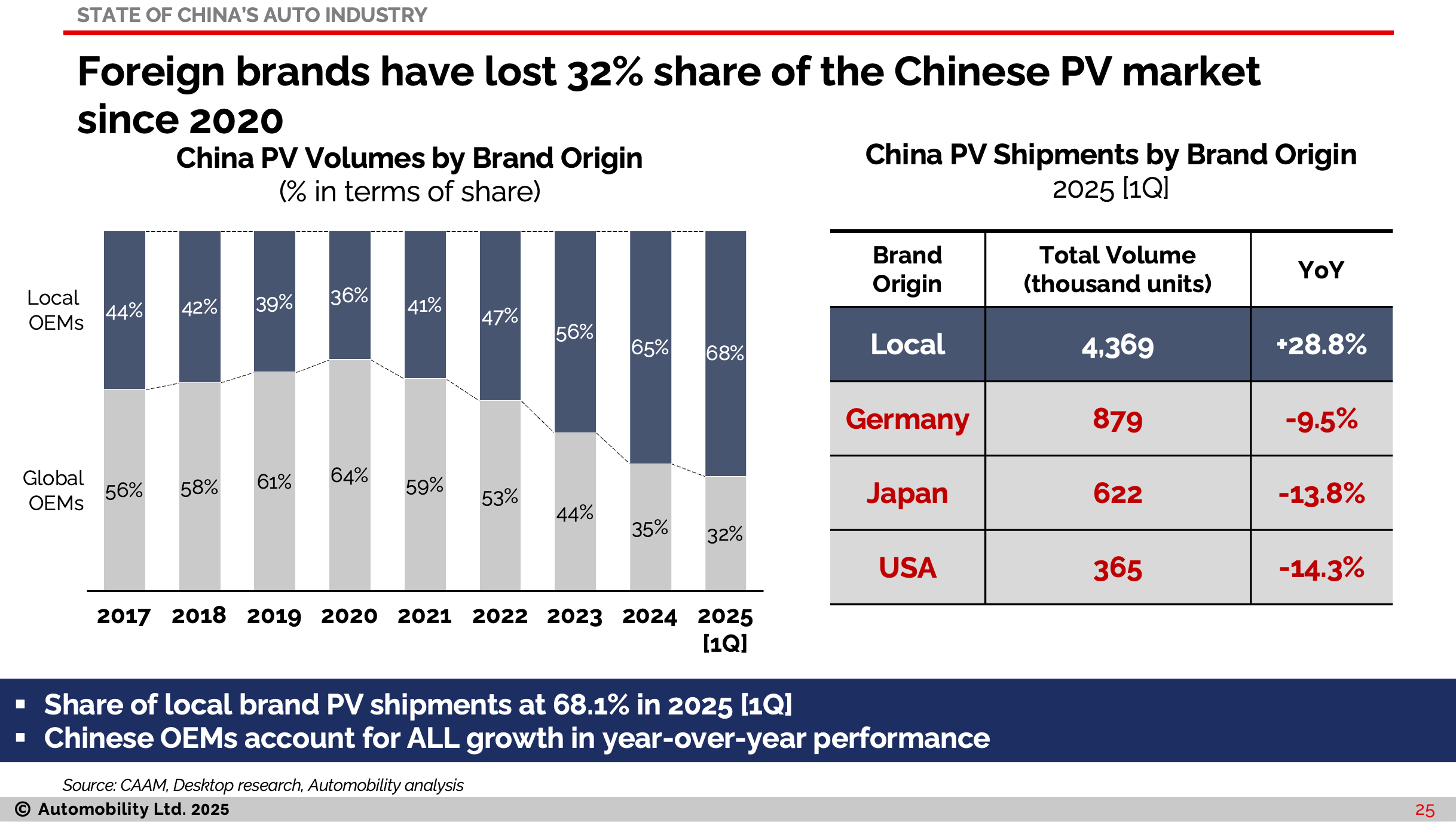

- Foreign brand share of the Chinese passenger vehicle market fell to 32%, which is half of what it was as recently as 2020.

Double Digit Growth

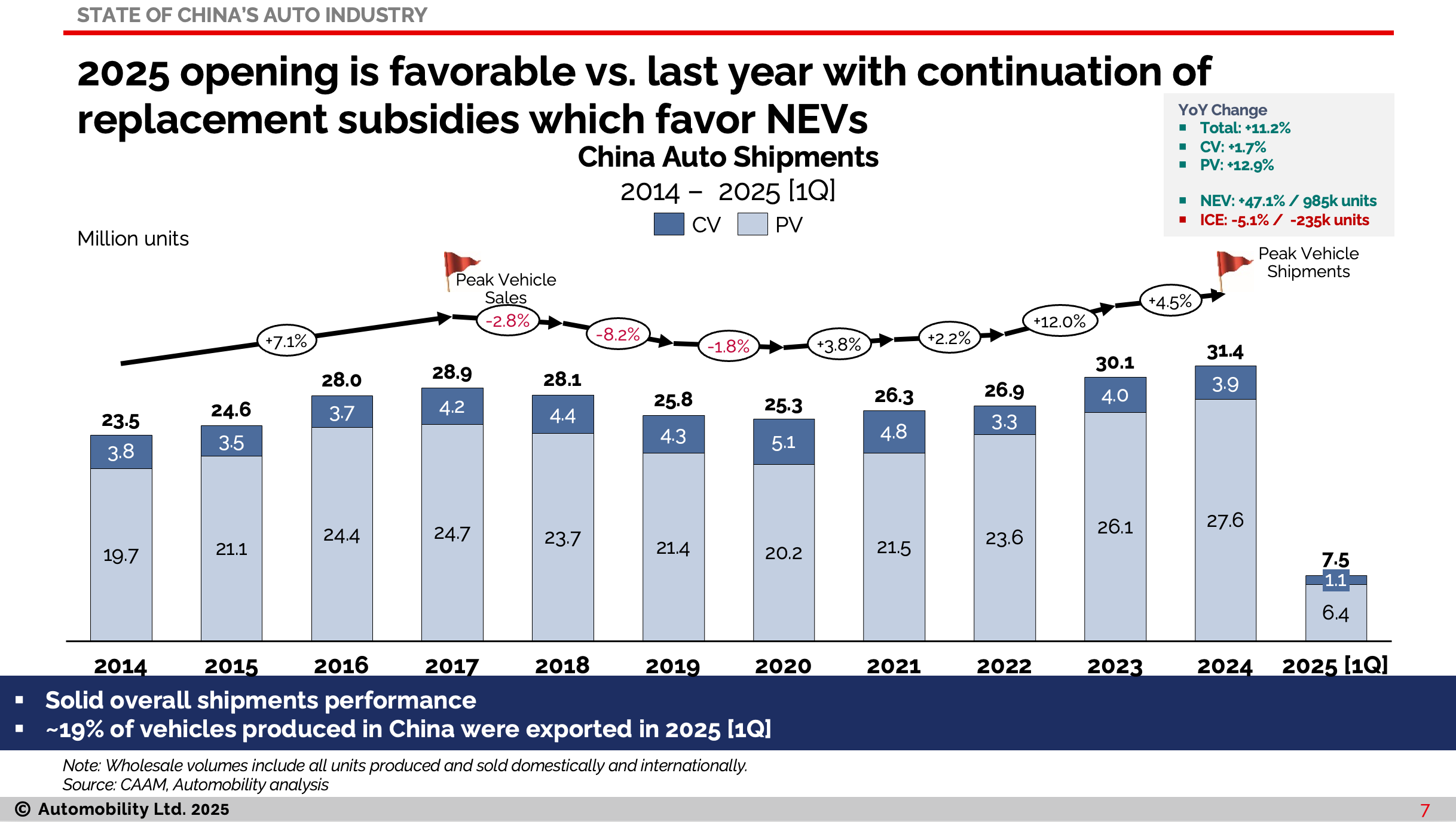

Ex-factory shipments grew 11.2% in the 1st quarter of 2025, with domestic deliveries up 12.1% and Made-in-China exports up 7.3%.

Combined 1st quarter passenger and commercial vehicle shipments reached 7.5 million units, with NEV shipments up 47.1% (+985,000 units) and ICE shipments down 5.1% (-235,000 units) from last year’s same quarter.

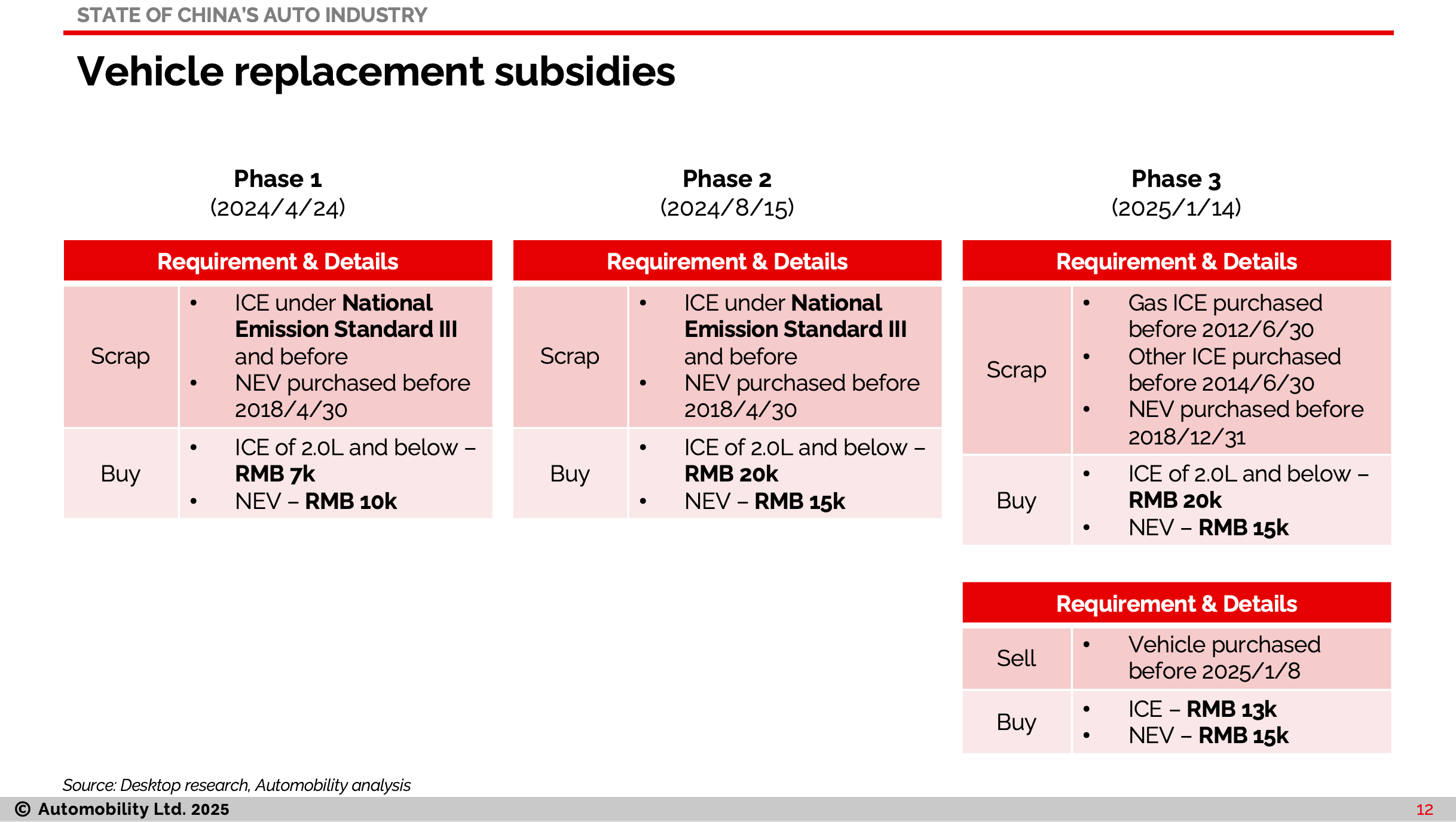

The momentum is mainly on the passenger vehicle segment, which was up 12.9% offer last year. This is mainly attributable to the presence of vehicle replacement subsidies which were implemented in the 2nd quarter of 2024 (therefore not present in last year’s 1st quarter). Phase 3 of these subsidies expanded their coverage to include all used vehicles types.

BYD Exports Rise & Tesla Exports Fall

Made-in China (MIC) exports rose 7.3% over last year’s 1st quarter,with BYD more than doubling export volumes to 214,000 units (+116.2%) from last year. As a result, NEV share of exports increased to 31.1%, all of this increase attributable to BYD’s rising (46.5%) share of MIC exports.

Korean brand Kia rose to 10th place on the export leaderboard at 39,000 units – displacing Tesla which fell fell off the top-10 list at 38,000 units.

It is also notable that Tesla’s MIC exports fell 57% from last year’s performance in an export market that grew 7.3% over last year’s same period.

NEV Domestic Sales Regain Lead

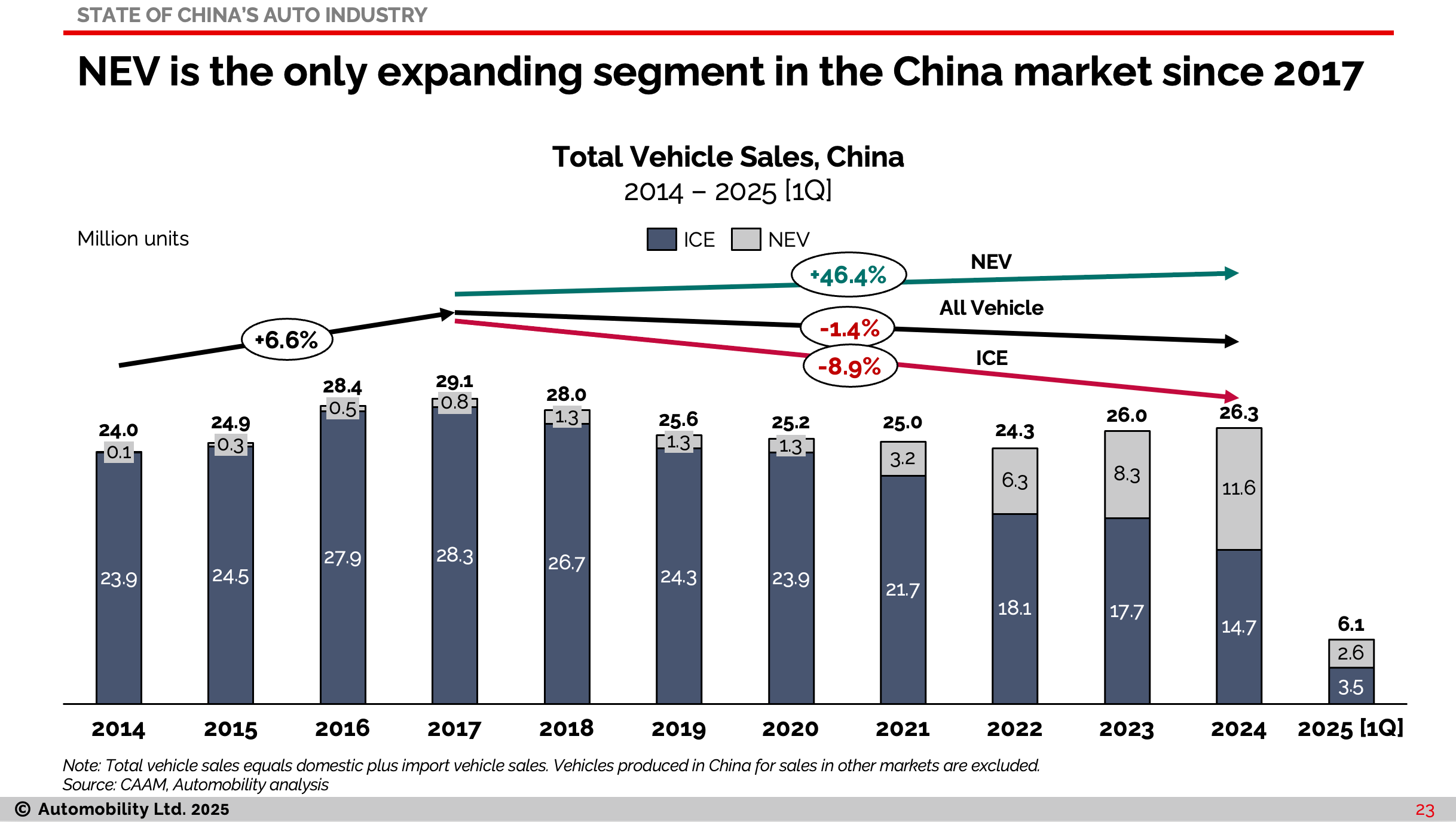

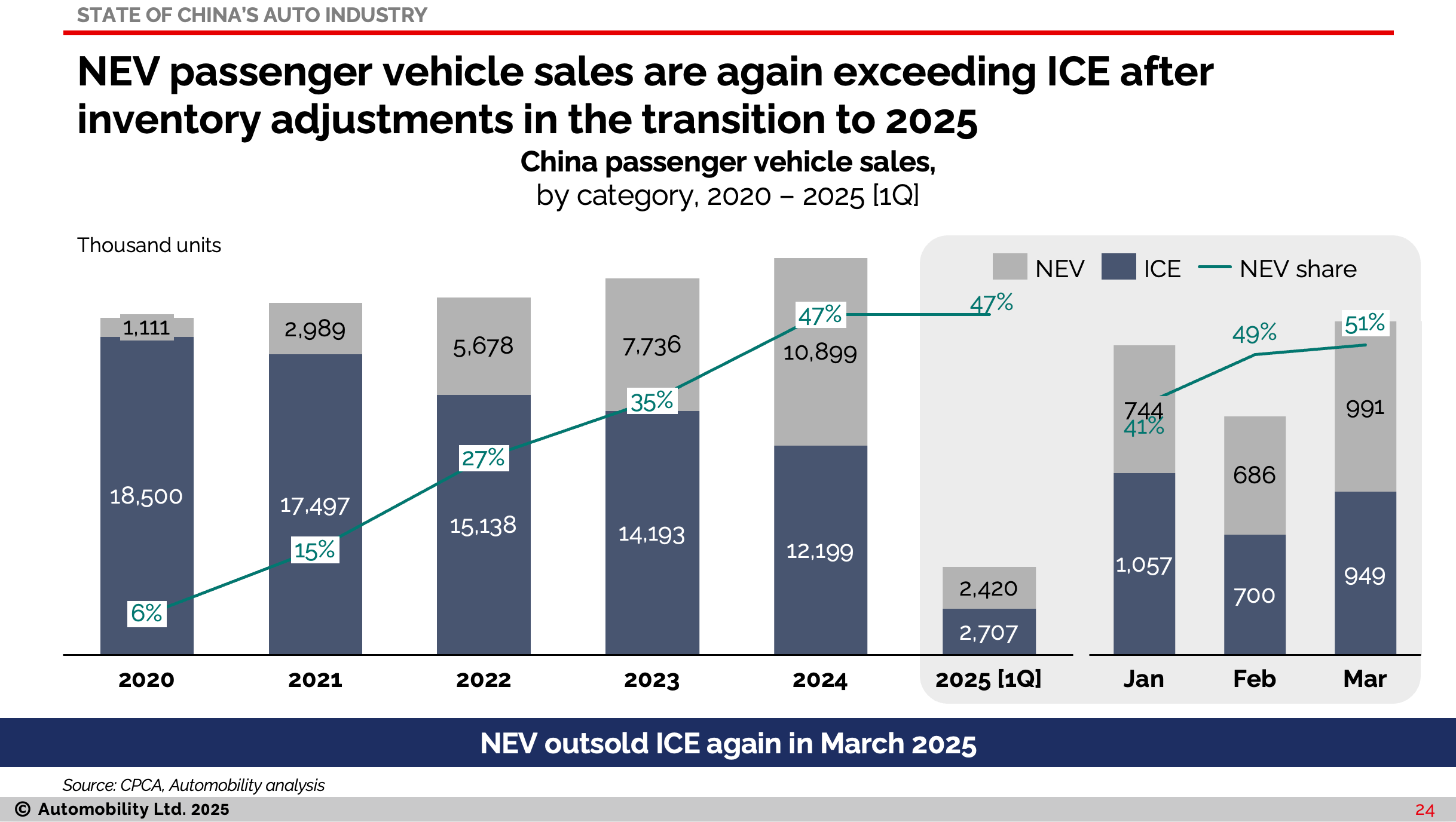

NEV has been the is only growth segment in the China domestic market since 2017, with 46.4% compound annual growth over a 7 year period in a market that declined 1.4% CAGR over the same period. This shift from ICE to NE continues in the 1st quarter.

NEV Share of total domestic passenger vehicle sales was 47% in the 1st quarter, which was equal to the full year share from 2024. However, NEV outsold ICE in March, and we expect this will be the case for the remainder of the year as this is where the focus is being placed by the carmakers seeking growth. Our prediction is that NEV share will exceed that of ICE in the passenger vehicle segment in the full year of 2025, a significant historical milestone.

For the first quarter of 2025, market leader BYD sold 696,162 units, with NEV share at 28.8%. Geely group has risen to the 2nd position with 321,779 units registered as sold, a share gain of 5.4% over last year.

Market concentration has increased, with the top 10 NEV players holding 81% share of the segment, and top 5 holding 62.2% of the market. Legacy companies (BYD, Geely, SAIC and Chang’an) hold the top 4 positions in the NEV race with a combined 56.6% share of the NEV market – proving that legacy ICE players can indeed successfully pivot into the growth lane.

In fact, legacy carmakers may actually have the advantage of being able to milk the old (ICE) cow as they invest to build the new (NEV) cow. NEV-only startups often struggle to scale the new cow and have not yet proven the sustainability of their business performance.

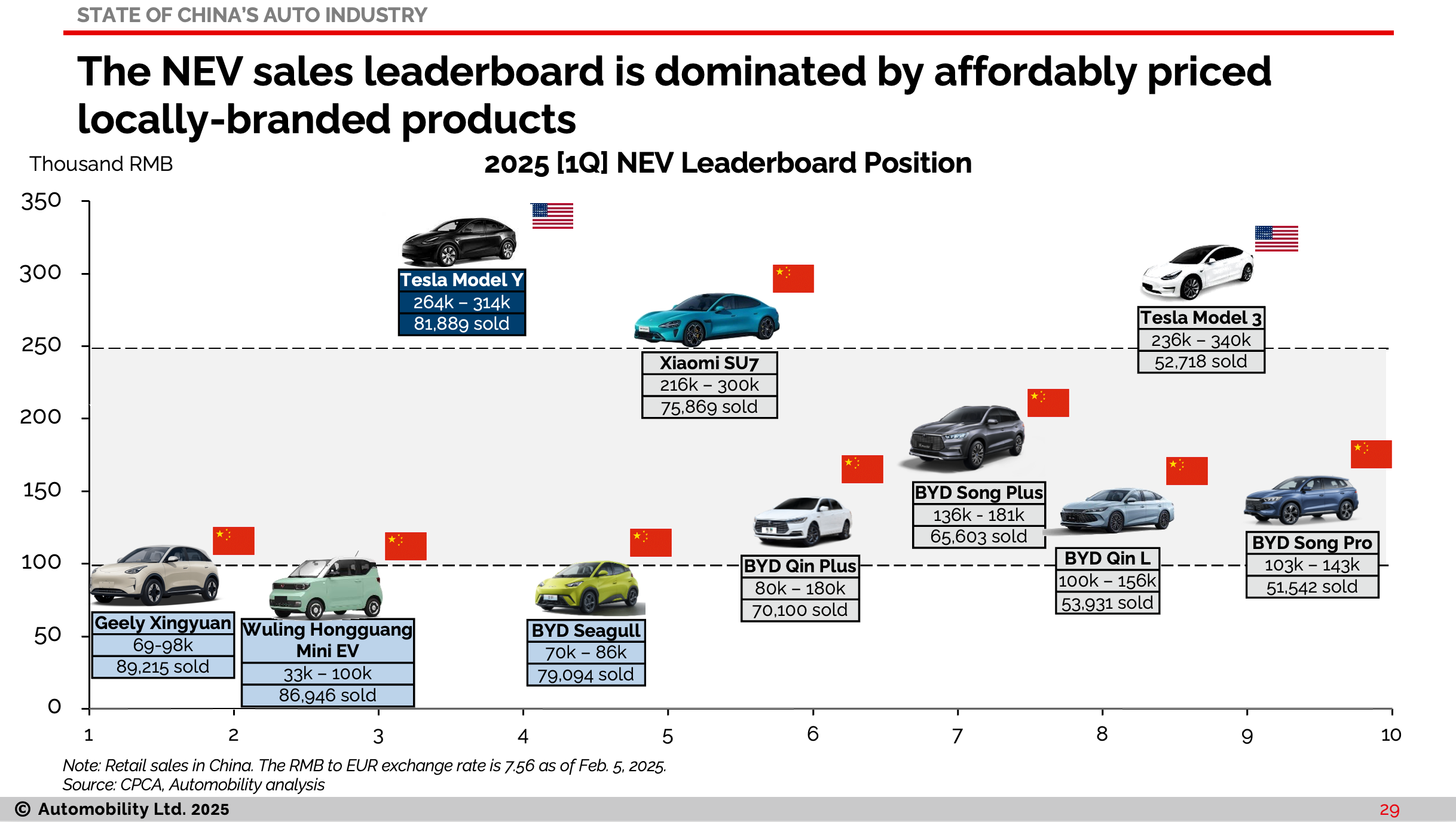

The top selling models come from 5 companies: Geely (Xingyuan), SGM Wuling (Hongguang Mini EV), Tesla ( Models Y and 3), BYD (Seagull, Qin, Song), and Xiaomi (SU7).

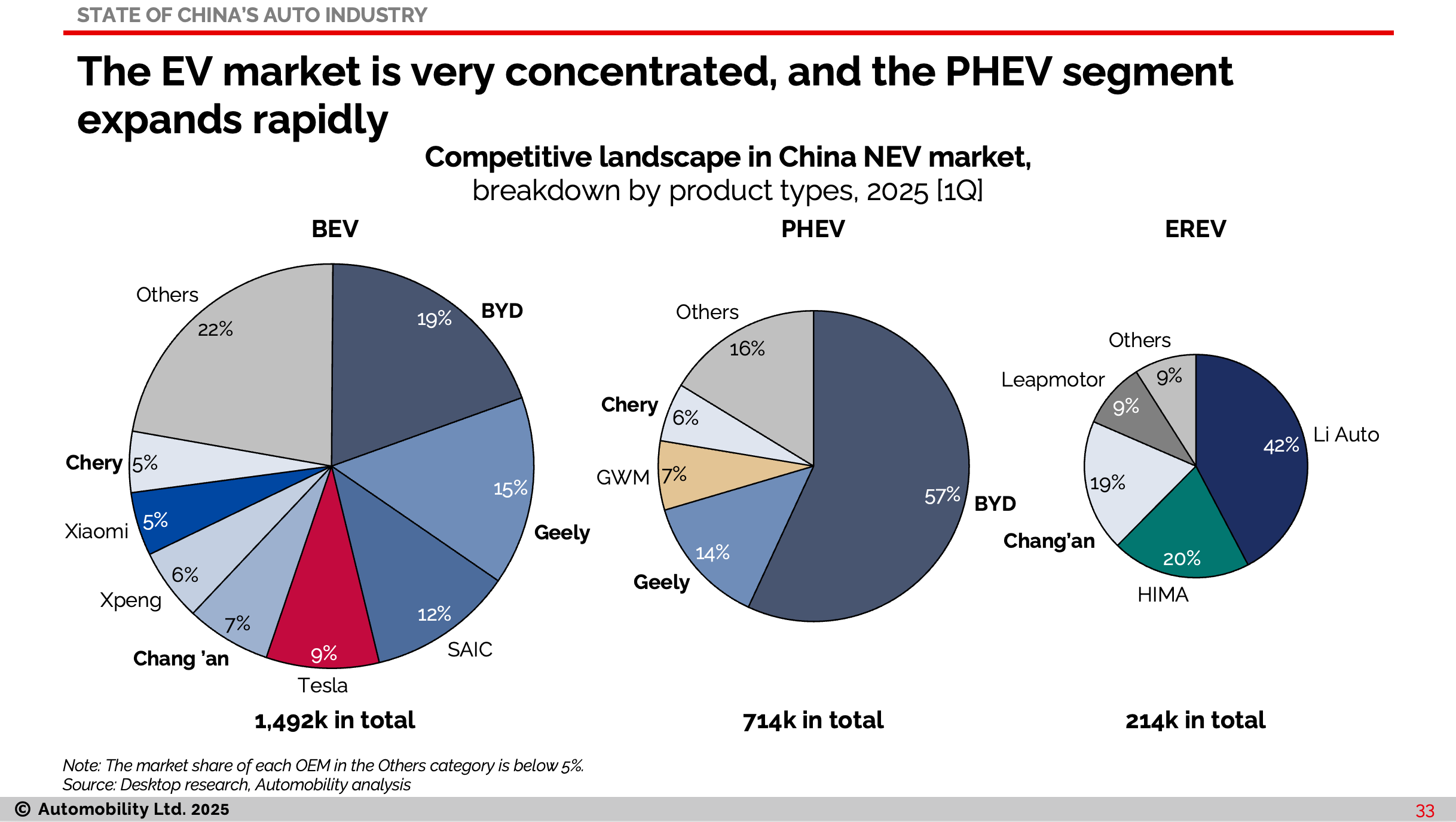

BYD regained its lead in the BEV segment, but is facing increased competition on price from Geely and Wuling.

BYD remains dominant in the PHEV sub-segment, while Li Auto and HIMA’s brand affiliates lead in the popular Extended Range Electric Vehicle (EREV) sub-segment.

Tesla’s domestic sales volumes recovered to 74,100 units in March after the launch of its refreshed Model Y. However, Made-in-China exports declined dramatically with 1st quarter as its worst performance since the launch of the Shanghai Gigafactory.

Overall Market Leaders

Chinese brands share of domestic passenger vehicle market share in the first quarter reached 68.1%. Year-over-year growth of Chinese brands was 28.8%, with American brands taking the biggest hit, down 14.3%.

While foreign brands continue to lose overall share as Chinese brands dominate the NEV segment, it is also evident that Chinese brands are also gaining share in the gasoline ICE powered vehicle segment.

In terms of overall volumes, BYD regained its position as overall volume leader, recording 18.8% growth from last year. Chinese brands including Geely, Chery and SAIC also put up solid year-over-year growth.

Foreign brand shareis half of what it was as recently as 2020, with weak performance across the board for all brands except Toyota. Among the legacy foreign brands, Toyota posted a solid single digit growth with their ICE-heavy portfolio. However, Toyota made a bold announcement of their plans to locally manufacture Lexus branded NEVs in China.

Recap of Auto Shanghai 2025

The 21st Shanghai International Automobile Industry Exhibition (hereinafter referred to as “Auto Shanghai 2025”) is scheduled to take place from April 23 to May 2 with the theme of “Embracing Innovation, Empowering the Future”.

Join AmCham Shanghai’s Automotive Committee to recap the Auto Shanghai 2025 highlights on May 7th, from 9:00 am – 11:00 am in the AmCham Shanghai Conference Room. Join me as well as Tu Le from Sino Auto Insights and Ron Zheng from Roland Berger as we highlight our top picks from the show and share our perspectives on China’s role in shaping a new paradigm of high-quality collaboration and mutually beneficial cooperation—driving the next leap forward in the global automotive industry’s development.

Don’t miss this comprehensive coverage of China’s biggest car show, and the insights that can be gleaned from the exhibits.

Register here: Recap of Auto Shanghai 2025

-

China Bizz Podcast #6: Automobility Ltd Founder & CEO Bill Russo recently joined the China Bizz podcast with Jacob Johansen to discuss the existential question now facing the global automotive industry:

“Can MNCs Still Compete in China?”

China’s s competitive landscape is shifting fast. Domestic brands are no longer following—they’re leading.

🔹 72% of Chinese consumers now prioritize innovation over brand reputation.

🔹 Chinese automakers are redefining the car experience with smart, user-centric features.

🔹 The rise of digital services and AI-powered ecosystems is transforming industries.

MNCs must evolve—or risk becoming obsolete. Tune into on your favorite platform for the full breakdown. 🎧👇

Spotify: https://lnkd.in/dbHXrpxh

Apple Podcast: https://lnkd.in/de6PDbqs

Xiamalaya: https://lnkd.in/d5WGaEpd

XaioyuzhouFM: https://lnkd.in/d4WwsTxX

-

This Man Knows Everything About China’s Auto Industry, and Now He’s Warning the West: “A Wave of Revolution is Coming” [Iltalehti]

– The third wave of the revolution is coming. The first wave was mobility as a service, but that didn’t start in China either. Nothing really starts there. China, on the other hand, is a superscaler of innovation, it’s on that path. If your goal is anything that’s been invented anywhere in the world, the Chinese will scale it up so that it’s available to everyone, not just the rich.

– The Chinese have already superscaled mobility as a service so that it’s the cheapest way to get around. You can’t go to work every day with Uber here. Or you can, but you’ll go bankrupt. With Chinese services, it’s different. That’s the first wave.

– The second wave is the smart electric car, but the smart adjective has not yet received any attention outside of China. The Chinese are super-scaling it, which allows them to lower costs and make it affordable for everyone.

– The third wave is going to be the AI-powered self-driving car, and that’s something to watch out for with the Chinese. They’re going to take a different path, just like they did with the electric car. The Western world didn’t even seriously think about making the electric car affordable from the start, because at the end of the day, we make our money with traditional combustion engine cars.

Translated article in English:

https://coats-share-oiq.craft.me/IcgiNnqNCb1g9e

Original article in Finnish:

https://www.iltalehti.fi/autouutiset/a/2148bf86-b474-4aa5-9244-19ae27ff4e7f

-

Storm warning for Europe: One car manufacturer has launched 129 models in a few years [Iltalehti]

Russo says that since 2020, the market share of electric cars in China has grown from one percentage point to almost 50 percent, and sales of plug-in hybrids have increased 14-fold. The market share of plug-in hybrids in China is about 40 percent and it is still growing.

– Tesla ignited consumer interest in electric cars, and due to investments, when demand started, Chinese brands were ready with their entire product range. Let me give you an example. Since the China launch, Tesla has released the Model 3, Model Y and one update of each model. You can count them on the fingers of one hand, Russo illustrates.

– In the same time, since 2020, BYD has launched 129 different models and variants, brands. They now have BYD, Fangchengbao, Denza which they got from Mercedes and their own supercar brand. This has happened in the last five years alone. The scale is absolutely incredible, Russo says.

Translated article in English:

https://coats-share-oiq.craft.me/IIla5ZNMruJysK

Original article in Finnish:

https://www.iltalehti.fi/autouutiset/a/86f4adbf-9120-4d5a-b2dc-01c94bc87647

About Bill Russo

Bill is a contributing author to the book Selling to China: Stories of Success, Failure, and Constant Change (2023), where he describes how China has become the most commercially innovative place to do business in the world’s auto industry – and why those hoping to compete globally must continue to be in the market.

About Automobility

Contact us by email at [email protected]

PLEASE NOTE: The information and analysis shared in this newsletter, including the charts and style of materials presented, is the intellectual property of Automobility Ltd. While we share it as a way to serve our existing and new clients, it is not to be used without our express consent and then only with attribution. Any publication, reproduction or other use of this material without the express written consent of Automobility Ltd is prohibited.

No Comments