06 Aug Auto|Mobility Investment Pulse Check – Issue #65

May 1 – June 30, 2024

Hyundai invests $475M in self-driving firm Motional

3 May

Hyundai Motor Group announced an investment of $475 million in the autonomous driving company Motional to strengthen its position in the autonomous technology sector. Additionally, Hyundai purchased an 11% stake in Motional from Aptiv for $448 million, increasing its ownership from 50% to 85%. This move underscores Hyundai’s commitment to advancing autonomous technology by supporting Motional’s R&D and market expansion.

Motional, a $4 billion joint venture established by Hyundai and Aptiv in 2020, focuses on autonomous driving technology. The investment will support the planned launch of robotaxi services later this year using driverless Hyundai Ioniq 5 vehicles. They also plan to collaborate with prominent ride-hailing companies like Uber, Lyft, and Via to bring their robotaxi services to the mass market. This transaction significantly enhances Hyundai’s influence and authority in the autonomous technology field, reflecting its confidence and strategic emphasis on the future of autonomous driving.

Wayve Raises $1.05 Billion in Series C Funding

7 May

Wayve, a market-leading company in embedded AI for autonomous driving, announced a $1.05 billion Series C funding round led by SoftBank Group, with new investor NVIDIA and existing investor Microsoft participating. This funding aims to accelerate Wayve’s mission of reimagining autonomous mobility through built-in intelligence.

Built-in AI represents the next frontier of AI innovation, surpassing generative AI and large language models. Integrating built-in AI into vehicles and robots will lead to a paradigm shift in machine interaction with human behavior and learning in real-world environments. This innovation has significant potential to enhance the usability and safety of autonomous systems, enabling confident navigation without strict adherence to rules or patterns, such as unexpected behaviors from drivers, pedestrians, or environmental elements.

Wayve has invested years of extensive research and development to become a leader in the AV2.0 market. They have developed hardware-independent AI driving models, achieved map-free autonomous driving, and created a range of innovative technologies such as fleet learning, data infrastructure, evaluation, and simulation platforms. These efforts aim to rapidly improve their AI models using both simulated and real-world data. Advanced intelligence is redefining mobility and connectivity, contributing to a more convenient and safer society.

Isuzu invests $30 million in California self-driving truck maker Gatik

14 May

The Japanese automaker Isuzu Motors Ltd. has invested $30 million in Gatik AI Inc., the California manufacturer of self-driving trucks, with the shared goal of launching an autonomous commercial vehicle business in 2027. More specifically, the agreement is focused on the development of “middle mile” autonomous driving, which Gatik defines as medium-distance and intermediate logistics that connect individual distribution centers and stores. The investment will also include the design and development of a new chassis (called a redundant chassis) that is designed to ensure safety when equipped with an autonomous driving system.

Gatik uses Class 3-7 autonomous driving trucks to deliver goods, with a focus on business to business (B2B) logistics for large companies. In 2021 the company completed fully driverless commercial middle mile deliveries, and says its Class 3-7 autonomous driving trucks are currently commercially deployed in Arkansas, Texas, and Ontario.

Motivation of Investors: To address pressing issues facing the industry, such as the worsening driver shortage and rapidly increasing delivery needs in North America

Use of proceeds: The new funding will help enhance the development of Isuzu’s Level 4 autonomous driving business in North America.

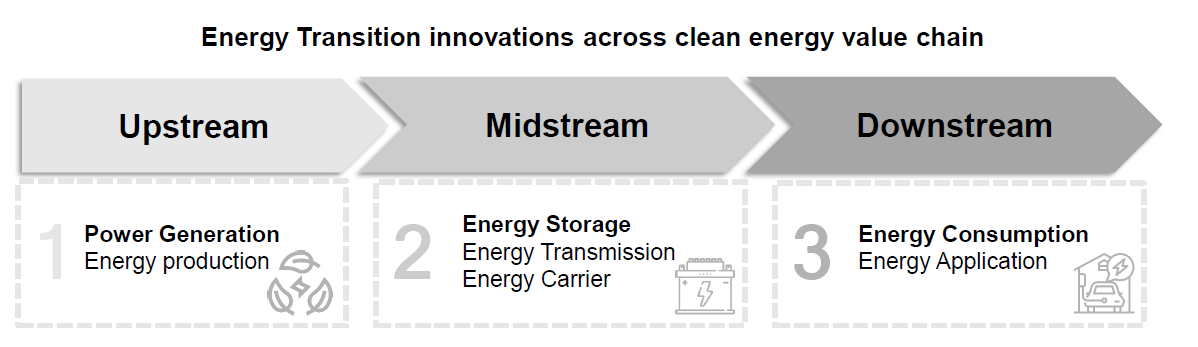

Battery Swapping

NIO’s Strategic Partnerships and Market Expansion

8 May

NIO has significantly expanded its presence in China’s EV market through strategic partnerships with major automotive companies. NIO’s alliance with GAC Group seeks to establish a unified battery standard and develop a broader, more efficient battery swapping network. The partnership with FAW Group focuses on developing comprehensive battery charging and swapping infrastructure to standardize and streamline these processes. The collaboration with SAIC Motor’s IM Motors aims to leverage resources and expertise to enhance NIO’s market dominance.

Furthermore, NIO has already partnered with Chang’an Automobile, Geely Holding Group, Chery Automobile, JAC Group, and Lotus to create a standardized, unified power infrastructure network with broader coverage. Additionally, NIO is engaged in comprehensive cooperation on battery swapping with energy sector companies, including SINOPEC, CNOOC, Shell, State Grid Corporation of China, China Southern Power Grid, Anhui Wenergy, and Zhong’an Energy. These efforts are aimed at developing a fast-growing battery swapping ecosystem and providing more efficient and convenient recharging experiences.

BP’s Castrol to invest up to $50M in Gogoro

25 June

BP’s subsidiary Castrol has announced a significant investment of up to $50 million in Gogoro, a global leader in battery-swapping technology for electric vehicles. This strategic investment aims to accelerate the adoption and expansion of Gogoro’s battery-swapping platform, which is particularly prevalent in the electric scooter market. Gogoro has produced nearly two million batteries and facilitated hundreds of millions of battery swaps, positioning itself as a leader in this space.

The investment will initially see Castrol invest $25 million to acquire a 5.72% stake in Gogoro, with the remaining amount to be invested based on performance milestones. This partnership is part of Castrol’s broader strategy to diversify its portfolio and stay relevant as the transportation sector transitions to electric mobility.

Motivation of Investors: As part of Castrol’s plans to diversify operations beyond its core lubricants and fluids business, investing in infrastructure supporting electric vehicles and marking a significant step towards its goal of becoming a leading integrated energy company.

Use of proceeds: To expand Gogoro’s operations more rapidly and enhance its smart, sustainable energy solutions for urban mobility.

Energy Storage System

Tesla Breaks Ground on New Megafactory in Shanghai

23 May

Tesla has officially begun constructing a new Megafactory in Shanghai, China. At the end of December 2023, Tesla acquired a 19.7-hectare site for 222.42 million yuan (around $31.13 million). This site is adjacent to Tesla’s existing factory that produces Model 3 and Model Y vehicles.

In early spring 2024, the Office of the Management Committee of Lingang New Area, China (Shanghai) Pilot Free Trade Zone approved the construction plan for the Tesla Megafactory project in the South Fengjie River Management Area.

During its 2023 Investor Day, Tesla unveiled Master Plan 3, highlighting the expansion of energy storage batteries worldwide. Currently, Tesla has one Megafactory producing Megapacks in the US, but increasing demand necessitates further development. The new Megafactory in China represents a significant step towards achieving the goals outlined in Master Plan 3.

Electric Vehicle

Zeekr prices upsized US IPO at top end of range

10 May

Chinese electric vehicle maker Zeekr Intelligent Technology has priced its US IPO at the top of its range, raising $441 million with a valuation of about $5.2 billion. The premium brand of Geely sold 21 million American Depositary Shares (ADSs) at $21 each, initially planning to sell 17.5 million ADSs priced between $18 and $21. Underwriters have an option to purchase an additional 3.15 million ADSs, potentially increasing the offering to $507.2 million. Zeekr’s ADSs debuted on the NYSE under the ticker symbol “ZK,” marking the largest US listing by a China-based company since Didi Global’s IPO in 2021. The oversubscription of Zeekr’s IPO indicates strong demand from investors.

Use of Proceeds: The proceeds from this IPO will help Zeekr expand its operations and meet the growing demand for electric vehicles.

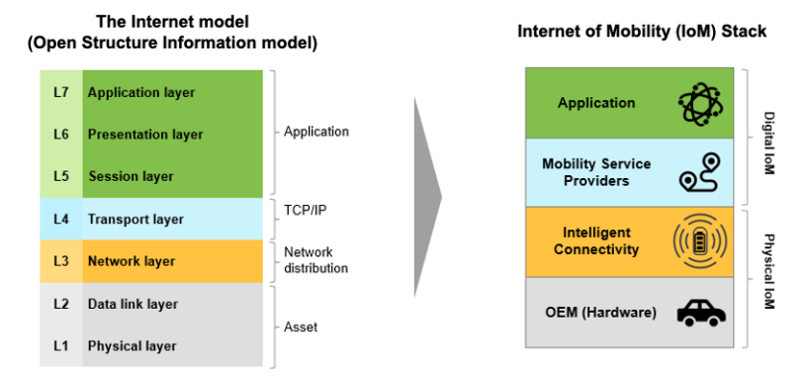

You can follow us for regular updates on these online channels by scanning the QR codes: If your organization would like a custom briefing on our thesis on the Digital Internet of Mobility and Energy Transition, please reach out to us at info@automobility.io

About Bill Russo Bill Russo is the Founder and CEO of Automobility Limited, and is currently serving as the Chairman of the Automotive Committee at the American Chamber of Commerce in Shanghai. His over 40 years of experience includes 15 years as an automotive executive with Chrysler, including 21 years of experience in China and Asia. He has also worked nearly 12 years in the electronics and information technology industries with IBM and Harman. He has worked as an advisor and consultant for numerous multinational and local Chinese firms in the formulation and implementation of their global market and product strategies. Bill is a contributing author to the book Selling to China: Stories of Success, Failure, and Constant Change (2023), where he describes how China has become the most commercially innovative place to do business in the world’s auto industry – and why those hoping to compete globally must continue to be in the market.

About Automobility

Automobility Limited is global Strategy & Investment Advisory firm based in Shanghai that is focused on helping its clients to Build and Profit from the Future of Mobility. We help our clients address and solve their toughest business and management issues that arise in midst of fast changing, complicated and ambiguous operating environment. We commit to helping our clients to not only “design” the solutions but also raise or deploy capital and assist in implementation, often together with our clients. Contact us by email at info@automobility.io

Official Website:http://automobility.io/

Tel China +86 139 1757 7148 USA +1 775 316 0851 bill.russo@automobility.io Website http://www.automobility.io Shanghai Automobility Limited Corporate Avenue One, No.222 Hubin Road Shanghai China 200021 Tel +86 139 1757 7148

Hong Kong Automobility Limited RM 2507, 25/F C C WU BLDG 302 Hennessy RD Wanchai Hong Kong

Tel Aviv Automobility Limited 101 Rokach Blvd, Tel Aviv, 6153101, Israel Tel +972 54 5424074

Sorry, the comment form is closed at this time.