08 Oct State of China’s Auto Market – September 2023

Comments from Bill Russo, Founder & CEO of Automobility Ltd.

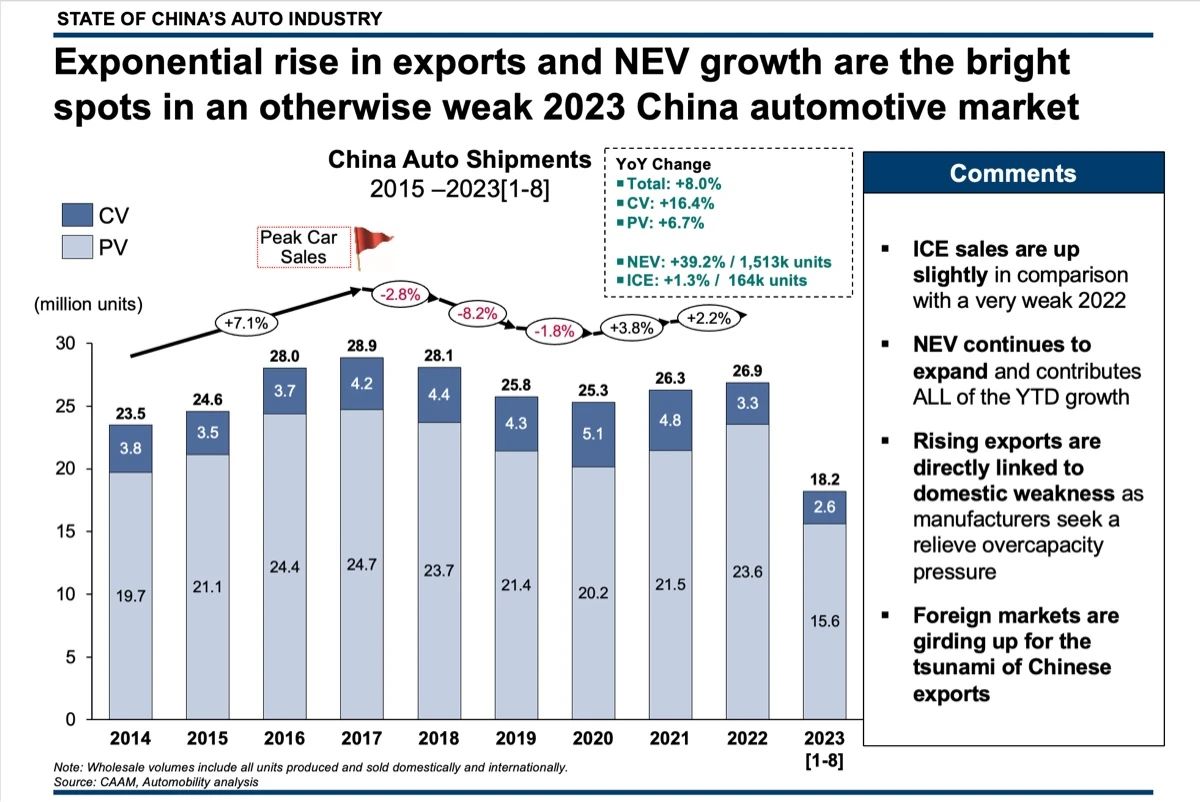

Year-over-Year Shipments Changes from January to August:

NEV +39.2%

ICE +1.3%

Please Note:

NEV = New Energy Vehicles (including Battery, Plug-in Hybrid and Fuel Cell Electric Vehicles)

ICE = Pure Internal Combustion Engine Vehicles

China Goes Global at IAA Mobility – and the EU Pushes Back

Outside of China, there are five internationally recognized auto shows, including the Internationale Automobil-Ausstellung (IAA) or the International Motor Show in Germany, Paris Motor Show, International Geneva Motor Show, North American International Auto Show in Detroit, and the Tokyo Motor Show.

IAA is the oldest and was, before the rise of Auto China, the largest auto show in the world. It began in 1897 and was held every two years in September. It was originally held in Berlin and moved to Frankfurt in 1957 and Munich in 2021.

The IAA Frankfurt Motor Show began to experience decline in 2017. That year, many car companies including Nissan, Infiniti, Tesla, Peugeot, Volvo, Jeep, Mitsubishi, Alfa Romeo were absent in 2017. Statistics compiled after after the 2017 IAA Frankfurt showed that the number of visitors that year shrank to 560,000, off 60% from the peak.

In 2019, many famous car companies withdrew from the auto show, including top car companies such as Toyota, PSA, and General Motors.

Due to a significant decline in the number of exhibitors and the change in the concept of the exhibition under the wave of electrification, the venue of the 2021 IAA was moved from Frankfurt to Munich and renamed IAA MOBILITY. Munich is closer to the heart of the German car industry. BMW is headquartered in Munich, while Audi’s headquarters is in Ingolstadt, 60 kilometers away from Munich.

The declining influence of the European auto shows coincides with the shift in the center of gravity of the global auto industry towards the east and China. However, the world had not seen first hand the metamorphosis of China to leadership in the commercialization of new mobility technology. This changed at IAA Mobility this month.

IAA Mobility witnessed the most Chinese exhibitors at an international automotive event, with over 70 participating companies showcasing their latest achievements. The commonly used term of “China Speed” is now being talked about as if it were an entirely new concept by European automotive executives.

While the presence of Chinese automakers and suppliers at the show is noteworthy, the presence of Chinese cars – powered by both gasoline and electricity – is increasingly common all over the world. As we noted in our August State of China Auto newsletter, exports of made-in-China cars are soaring, fueled by a slowdown in demand and the growing overcapacity situation in China’s domestic market.

While the world is increasingly aware of China’s emergence as an EV powerhouse, the fact is that 75 percent of vehicle exports from China this year are powered by an internal combustion engine, which is where the overcapacity problem is most acutely felt.

Indeed, China aims to become a global player in the electric vehicle era. However, nearly one-third of all EV exports from China come from Tesla, having exported 235,000 vehicles this year from Gigafactory Shanghai. China’s leading NEV player BYD is also rising rapidly on the EV export list, exporting over 25,000 units in August, for a full year total of 125,000 units so far in 2023.

Alarmed about the potential impact of this on the EU markets, European Commission president Ursula von der Leyen announced an anti-subsidy investigation into Chinese electric vehicles and how they are “distorting” the market. It will be interesting to hear this case, as it seems to ignore the fact that Tesla is the top exporter of EVs from China to Europe. They should explain why such measures were not taken for carmakers from other nations that have entered Europe, many of which have been historically supported by their national governments.

NEV and Exports continue to expand

The continued rise of New Energy Vehicle volumes, together with an exponential rise of exports, are the only bright spots in China’s auto industry in 2023. 18.2 million vehicles were shipped through the month of August, including 15.6 million passenger vehicles and 2.6 million commercial vehicles. This was an increase of 8.0% over the same period of 2022.

However, the shift in mix toward NEV was clearly evident, with NEV volumes increasing by 39.2% (an increase of 1.51 million units), and ICE increasing by just 164,000 units over last year. It is noteworthy that exports are inside these figures. If we remove the 2.2 million ICE exports from the shipments, the domestic ICE market in China would be negative for the year. China is clearly using exports of ICE powered vehicles to relieve pressure from structural overcapacity.

Where are these cars going? ICE cars are going to Russia and the emerging markets, while NEVs are heading to Europe and the regional markets in Asia-Pacific. A large number of these are made by Tesla, who have exported 235,000 cars from China so far this year – mostly to Europe.

Record exports and NEV growth deliver an August rebound

Overall vehicle shipments for August were up 8.4% (an increase of 199,000), and export volumes were up 100,000 units from last August, setting an all-time monthly record of 408,000 units. Export share stood at 15.8% of total shipments reported by the Chinese Association of Automobile Manufacturers (CAAM) in August. Export shipments have soared 62% year-over-year, offsetting domestic demand weakness.

NEV Shipments for August were up 180,000 from last year, so all of the year-over-year market favorability is explained by NEV and export growth.

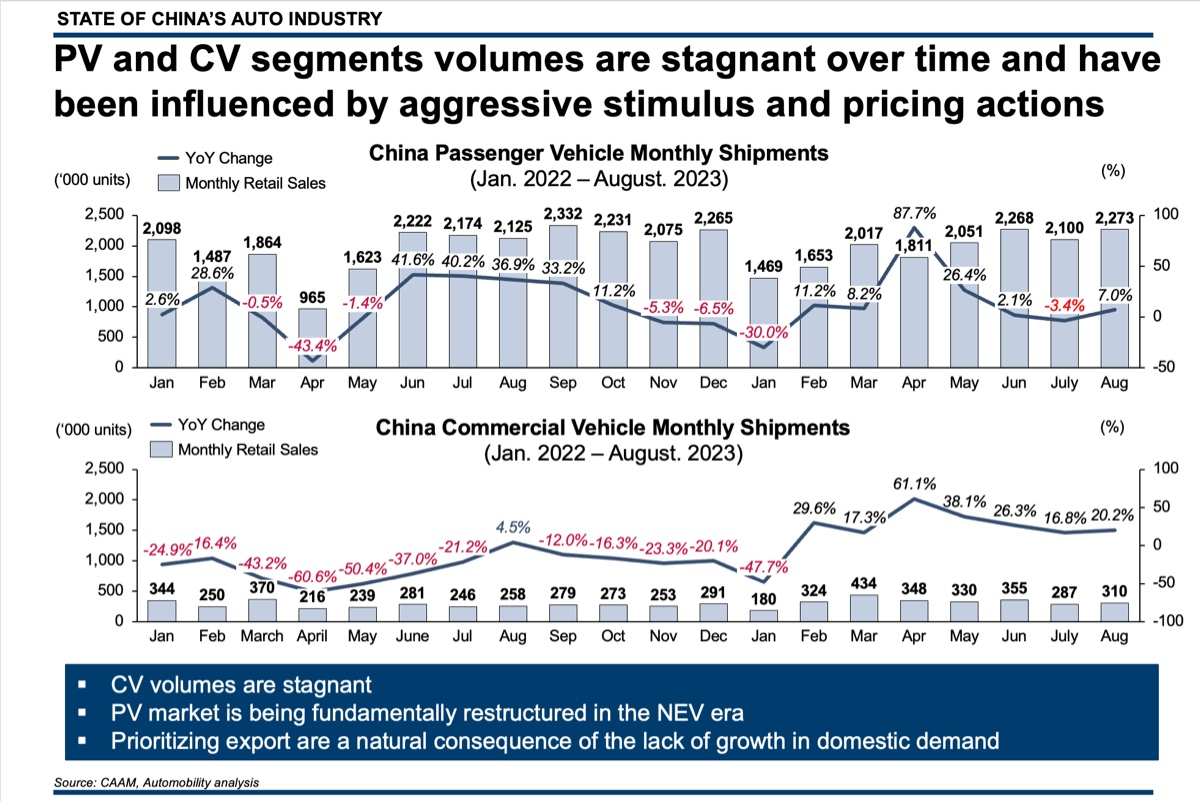

Passenger Vehicle and Commercial Vehicle shipments improved in August, with PV sales up 7% and CV sales up 20.2% from the prior year, but clearly not signaling any sustainable upward momentum when viewed over the longer-term period.

Viewed through this lens, we clearly see the importance of exports in sustaining the level of factory utilization in China.

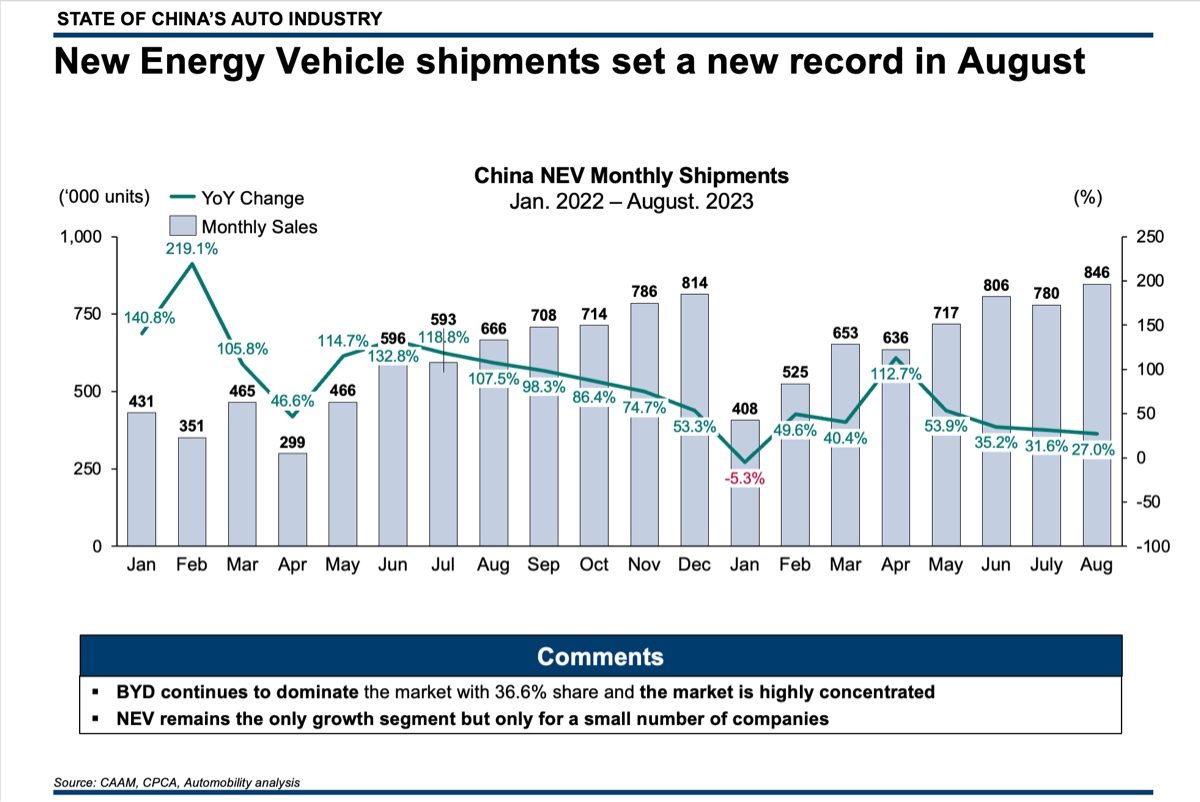

New Energy Vehicle shipments set an all-time monthly record of 846,000 units in August, growing 27% from last year. However, NEV demand is substitutional for ICE sales, as the overall domestic demand is stagnant.

The NEV market is also remains highly concentrated and is dominated by just a small number of players, with BYD eating 36.6% of the NEV pie.

NEV took 32.8% of total shipments in August, and Plug-in Hybrid Electric Vehicles (PHEV) sales had its 4th consecutive record month, with 249,000 units shipped. BYD (60%) and Li Auto (14%) dominate the relatively uncrowded PHEV segment.

August NEV Sales Leaderboard

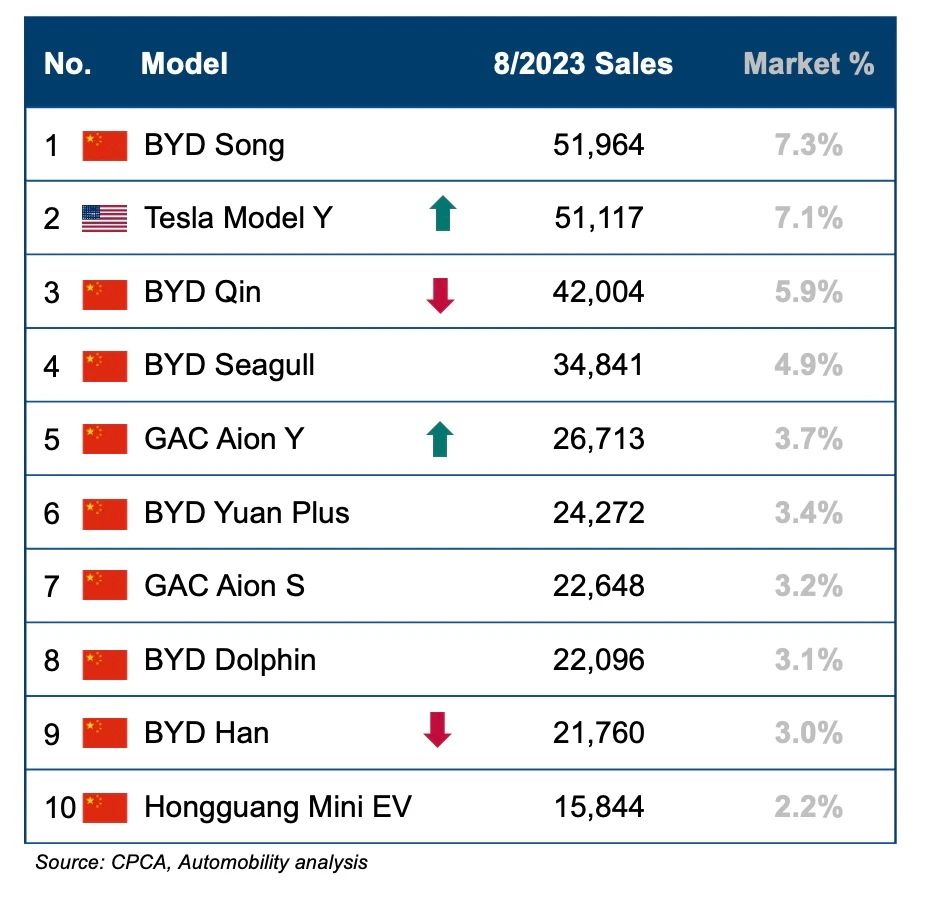

The NEV sales leaderboard for August has exactly the same 10 nameplates as last month. This has been a consistent pattern for some time as the foam has already risen to the top. While some new bubbles may appear (BYD Seagull), and others may gradually fizzle out as new competition enters the picture (Honguang MiniEV – because of the BYD Seagull), there is very little movement in terms of who is on the list: it is consistently led by models from BYD, Tesla, GAC and Wuling.

A few changes are noteworthy in the August NEV Models leaderboard. Tesla’s Model Y rose to the number 2 position, as they repeat their pattern of rebalancing domestic and export sales in the 3rd quarter. As Tesla was introducing a refreshed Model 3 this month, they clearly remixed their production in favor of Model Y in August.

BYD Seagull sales have risen as they ramp up production and fill the distribution channel, with a month-over-month sales increase of nearly 10,000 units. The affordably-priced Seagull (which starts at RMB 78,800) is eroding sales of lower priced BEV offerings from Wuling, Chery and others.

Top 10 NEV Models

August Retail Sales

As further evidence of the foam rising to the top, the Top 10 NEV Group sales leaderboard also has exactly the same list of names.

The only positional move was Tesla regaining their (distant) second place position as they prioritized domestic Model Y sales in August. The same 10 companies are on the leaderboard, with 8 out of 10 showing substantial gains from last August. Noteworthy exceptions are Wuling and VW group who “fizzled out”versus last August.

Top 10 NEV Corporate Group

August Retail Sales

2023 Overall NEV Sales Leaderboard

Year-to-Date NEV growth remains robust at 39.2%, and market share through August is 29.5%, an increase of 6.6% versus the same period from last year. While there is some concern that impact of price discounts on consumer enthusiasm will moderate going forward, it is now quite clear that Chinese consumers have embraced electric vehicles, and that local brands are the prime beneficiary of this shift in consumer preference.

The Top 10 NEV Sales Leaderboard for 2023 also has the exact same group companies and nameplates as shown last month. The foam has risen to the top:

- The Top 10 companies command 80.2% of the NEV market

- The Top 5 companies command 63.2%of the NEV market

-

BYD commands 36.6% of the NEV market

Additional points to note:

- #1 BYD outsells #2 Tesla by over 1.23 million units, and #10 NIO by over 1.53 million units.

- GAC’s Aion brand is a clear and consistent Top 5 leader, nearly doubling their volumes so far in 2023.

- While spreading its investments across a wide range of brands, Geely is rising to the top as a Top 5 leader with a consistent growth in volumes.

- Chang’An, Li Auto and Great Wall have shown strong growth among the Top 10 companies.

- Wuling, VW and NIO have struggled to maintain momentum in a hyper-competitive market.

-

Companies that are not in the Top 10 will struggle to gain a foothold in the China NEV market, as there is very little observable movement into this list over the course of several years of following this market.

The Overall Market and the NEV Restructuring

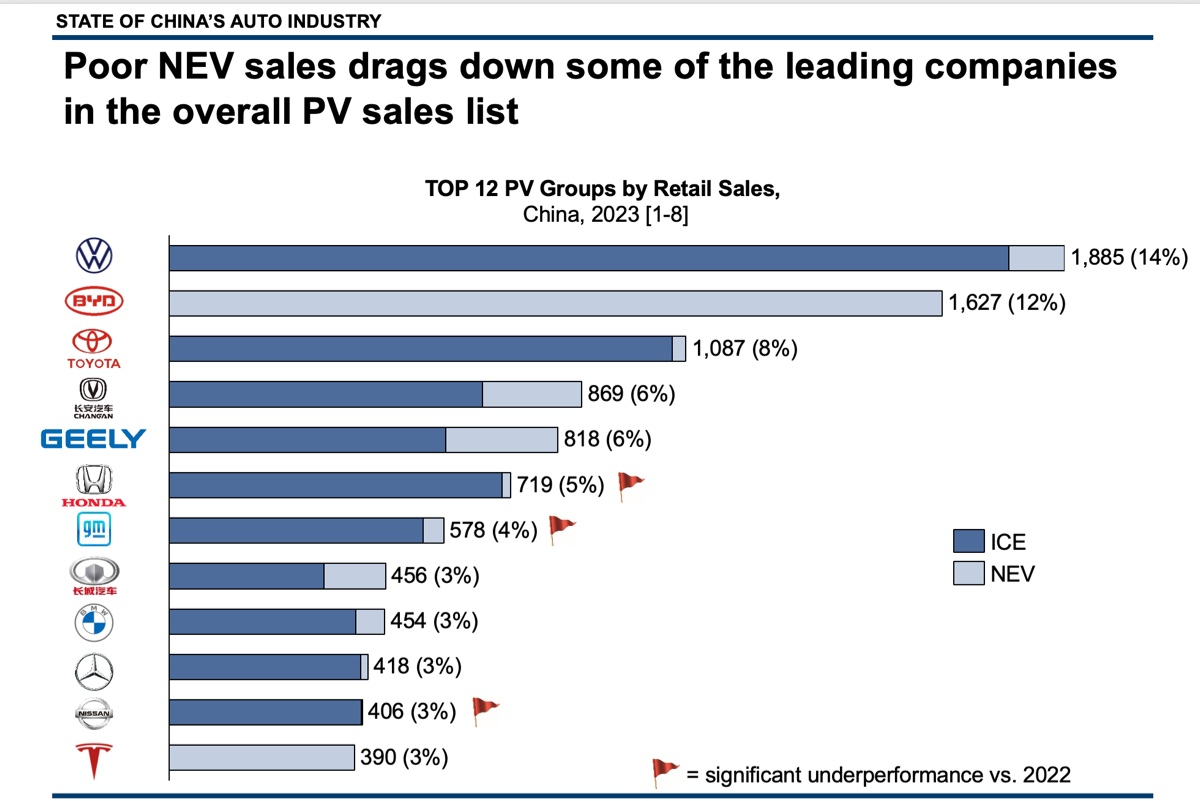

Historically dominant foreign players were slow to reposition themselves as NEV players, and those that have attempted to do so have found that Chinese consumers do not consider them as authentic NEV brands. To illustrate this point, we rank the aggregate sales of the top 12 passenger vehicle OEMs in China. Please note that this includes ALL BRANDS of the groups listed (for example, VW Group includes VW, Audi, Skoda, Seat, Jetta, etc).

It is clear that we are witnessing in China a sudden and dramatic restructuring of brand dominance in the electric vehicle era.

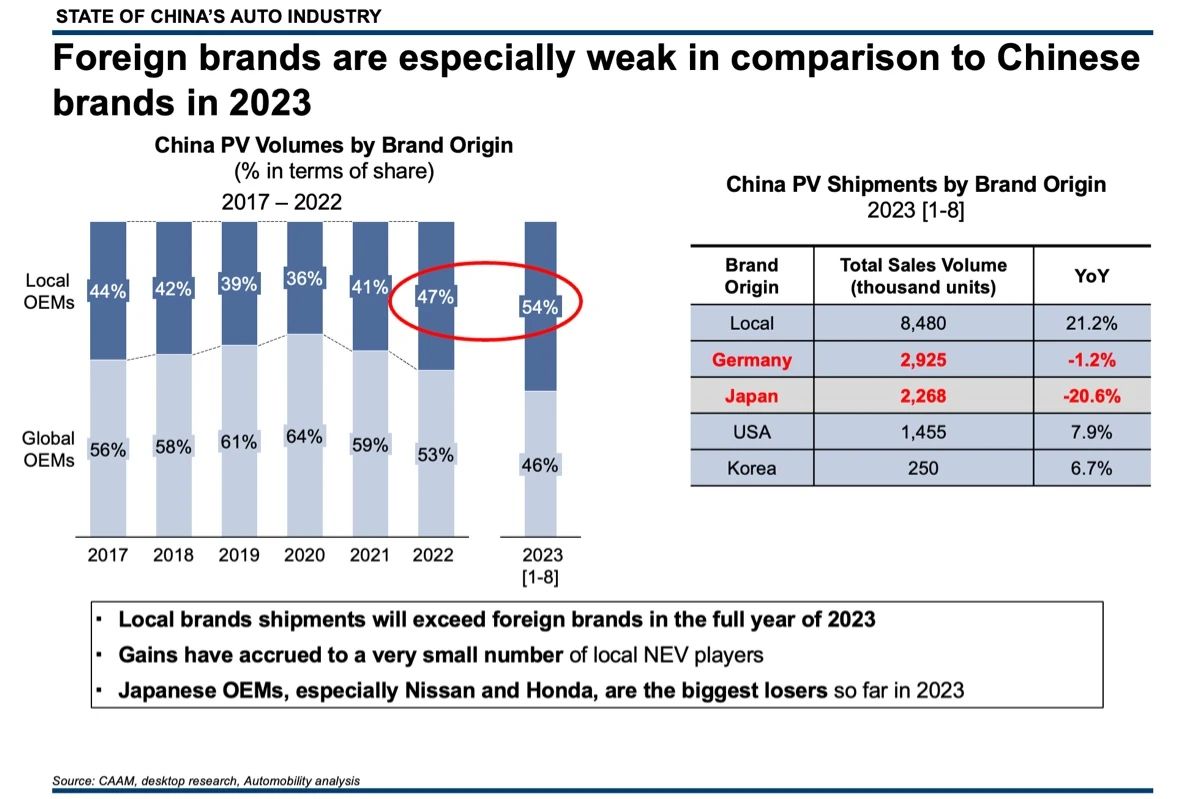

It is very clear that ICE still dominates the sales mix for legacy foreign carmakers like VW, Toyota, Honda, Nissan, Mercedes, BMW. Their slow embrace of NEV has put them in the situation that they now face in China, where Chinese brands now outsell foreign brands.

Since Tesla launched its Model 3 and began selling in mid-2020, retail consumers in China have been shopping for electric vehicles. Chinese brands, led by BYD, were ready and are offering a superior overall value proposition in the NEV segment.

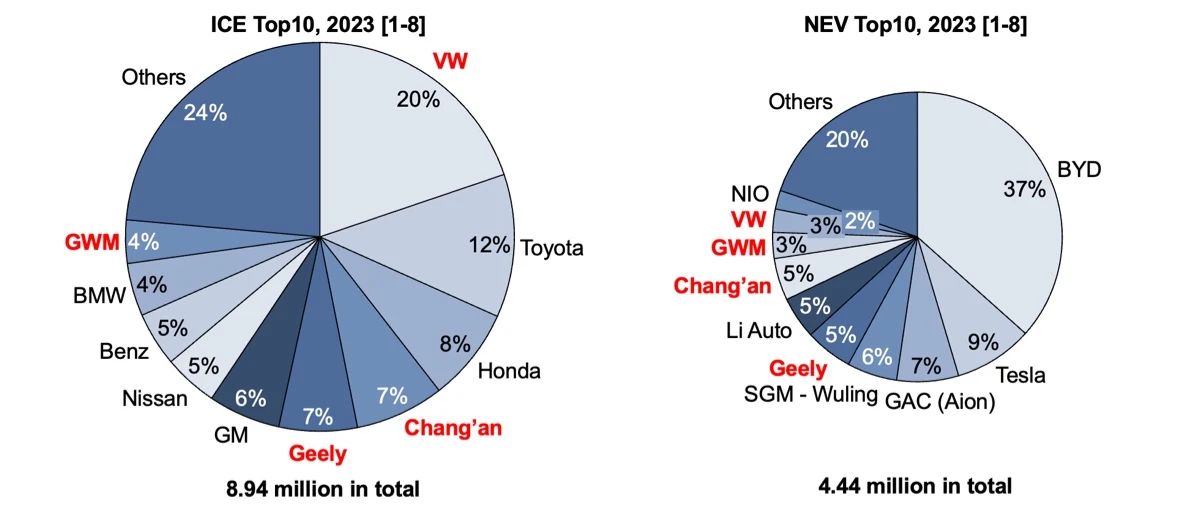

This is clearly evident when you consider that very few legacy ICE leaders have pivoted to the NEV lane and those that have have not sustained their historical leadership position. Volkswagen’s 20% share of ICE translates to 3% share of NEV. All other traditional foreign players fall into the “Other” (below top 10) category.

Top 10 ICE and NEV Corporate Groups in the ICE and NEV segments

2023 [1-8]

Several traditional Chinese companies have successfully pivoted to the NEV lane. This includes BYD, who historically made ICE vehicles and boldly stopped doing so when the retail NEV market manifested itself after Tesla’s entry in 2020. GAC, Geely, Chang’An and Great Wall are all legacy carmakers who have found success in the NEV market while maintaining a presence in the shrinking ICE market.

It is very clear that the future of the Chinese auto market is electric, and Chinese brands are leading the transition. For the first time since China opened up the market to foreign investment, Chinese local brands will outsell foreign brands in China in 2023. This has struck at the very heart of the German auto industry, who are experiencing declines for the first time in their largest and most profitable market. Also slow to pivot were the Japanese OEMs, who lacked EV conviction and are now stuck in a shrinking ICE and conventional hybrid lane.

Several questions to consider:

– Will the European Commission anti-subsidy investigation stop the rising tide of Chinese exports?

– Will this help the European aut industry regain competitiveness, or will it slow the rate of commercialization of EVs in Europe? How will this impact the cost of EVs to the European consumer?

– Consolidation is unavoidable. Which companies will survive the transition, and who will be next to restructure or exit their China business?

– Are cross-border partnerships less likely to happen in a decoupled world?

A FEW MORE THINGS

I was very pleased to share my views in the cover story for AmCham Shanghai’s INSIGHT magazine’s story The End of the ICE Age: The Rise of Chinese NEV. You can read the article here or listen to the interview:

- The End of the ICE Age [AmCham Shanghai INSIGHT Article]

-

The End of the ICE Age [AmCham Shanghai INSIGHT VIDEO]

I was also a keynote speaker at Morgan Stanley’s Asia Tech Conference 2023, held in Beijing on August 30, 2023, where I spoke on this same topic:

MORGAN STANLEY: The End of the ICE Age: Rise of Chinese NEVs

You can follow us for regular updates on these online channels by scanning the QR codes:

If your organization would like a custom briefing on the State of China’s Auto Market, please reach out to us at [email protected]

In his role as AmCham Shanghai’s Automotive Committee chairman, Bill Russo will host the monthly State of China’s Auto Market online webinar on Thursday, September 21, at 9am in China.

If you wish to join, please register here by scanning the QR code:

Webinar | State of China Auto Market Monthly Briefing (September)

About Bill Russo

Bill is a contributing author to the book Selling to China: Stories of Success, Failure, and Constant Change (2023), where he describes how China has become the most commercially innovative place to do business in the world’s auto industry – and why those hoping to compete globally must continue to be in the market.

Bill’s chapter is titled “China’s Auto Industry: The Race to a Sustainable Future”. You can order using the QR code:

About Automobility

Contact us by email at [email protected]

Sorry, the comment form is closed at this time.