07 Apr Bloomberg : China’s battery king faces scrutiny over EV market dominance

Media Source : Bloomberg

Rapid expansion of billionaire founder Robin Zeng’s CATL group raises concerns in the US and his homeland

CATL’s Robin Zeng © FT montage/Bloomberg

04 APR 2023

Edward White in Seoul, Cheng Leng in Hong Kong and Claire Bushey in Chicago

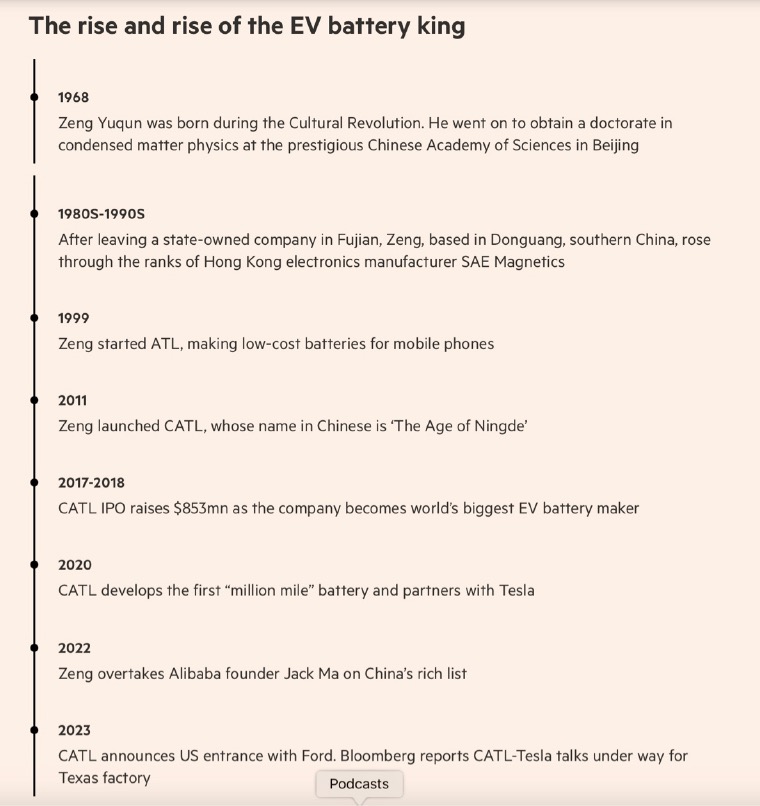

Chinese billionaire Robin Zeng spent most of the past decade in blissful obscurity, as his little-known Contemporary Amperex Technology group cornered more than a third of the global electric vehicle battery market from its base in Ningde, a former fishing village in south-east China.

Today, undisputed leadership of the sector has put his company squarely in the crosshairs of regulators and political leaders in Washington and Beijing alike, as the rival superpowers fret over a single corporation’s dominance of the highly strategic and fast-growing industry.

Zeng has raised political hackles in the US with carmakers deepening their alliances with CATL, despite national security fears that are driving a bipartisan push to keep Chinese companies off American soil.

The 55-year-old chemistry expert has been attacked as an alleged “high-ranking member of the Chinese Communist party’s ‘United Front’” by Marco Rubio, Republican vice-chair of the Senate intelligence committee, in a reference to the party organisation charged with exerting Chinese president Xi Jinping’s push for global influence.

Rubio’s remarks — echoed by other prominent anti-China voices in Washington — followed the announcement of Ford’s plans to license CATL technology to use in a $3.5bn Michigan factory. It intends to use its cheaper lithium iron phosphate (LFP) batteries in two of its models.

“Ford’s massive project will bring 2,500 new jobs to Marshall’s small, historic farming community, but it will also bring America’s greatest geopolitical adversary into the heartland,” Rubio said in a statement.

On Friday, shares in CATL edged higher following reports that the group was also in talks for another US tie up, with Elon Musk’s Tesla, in Texas.

The Ford licensing arrangement contrasts with a series of joint ventures between Korean battery makers and US carmakers in which the companies jointly build and operate the factories.

The deal appears to provide the Chinese group with an important foothold in the US market, despite the Biden administration’s Inflation Reduction Act aimed at boosting domestic manufacturing and cutting American economic dependency on China.

Under the IRA, vehicles made with components manufactured in “foreign entities of concern”, including China, would be ineligible after 2024 for generous consumer tax credits. However, long-awaited guidance, issued on Friday, failed to clarify the Biden administration’s stance on the origin of battery components.

The deal “has definitely shaken the industry”, said Vivaswath Kumar, who was a manager in Tesla’s battery team before founding the battery start-up Mitra Chem.

“It was structured so that it wouldn’t be blocked . . . it would be to the detriment of the United States not to let that technology transfer happen,” Kumar said.

Tu Le, of Sino Auto Insights, an advisory group in Beijing, described the potential CATL-Tesla deal in Texas as “huge”.

Despite the IRA, “they are able to get two of the biggest US players to effectively pave their way into the US,” he said.

Henry Sanderson, author of the book Volt Rush on the battery industry and a former FT journalist, said Zeng had demonstrated “ruthlessness” in his ascent but had sought a low profile, unlike billionaire peers, including Alibaba founder Jack Ma or rival battery tycoon and Envision founder Zhang Lei.

Zeng had a reputation as a hands-on technical manager. But he and his top lieutenants had “from day one” been paranoid about external threats, including rivals’ technology and being caught in geopolitical tensions, Sanderson said.

“CATL would rather not be in the limelight. They’ve always worried about this day, when it would come, and it looks like it has come,” he said.

In an auto industry once dominated by the likes of Ford, Volkswagen and Toyota — who between them share nearly 300 years in operation — CATL has grown rapidly to become one of the world’s most important manufacturing companies.

Its founder rose from a poor rural upbringing. He built on his earlier success with ATL, which makes lowcost lithium phone batteries, including for Apple and Samsung. In 2011, CATL, or The Age of Ningde, as it is known in China, was born as Zeng targeted Beijing’s plans to end its reliance on oil imports and combat unpopular air pollution by developing a domestic EV industry.

The group now supplies almost all major carmakers, including Tesla, BMW and Volkswagen, and is expanding production into Germany and Hungary.

Critics attribute CATL’s rapid growth to Beijing’s support and its blocking of foreign suppliers. According to estimates by the Center for Strategic and International Studies, a US think-tank, cumulative state spending on the EV sector in China totalled close to $60bn from 2009 to 2017. Spending jumped a further $66bn from 2018 to 2021.

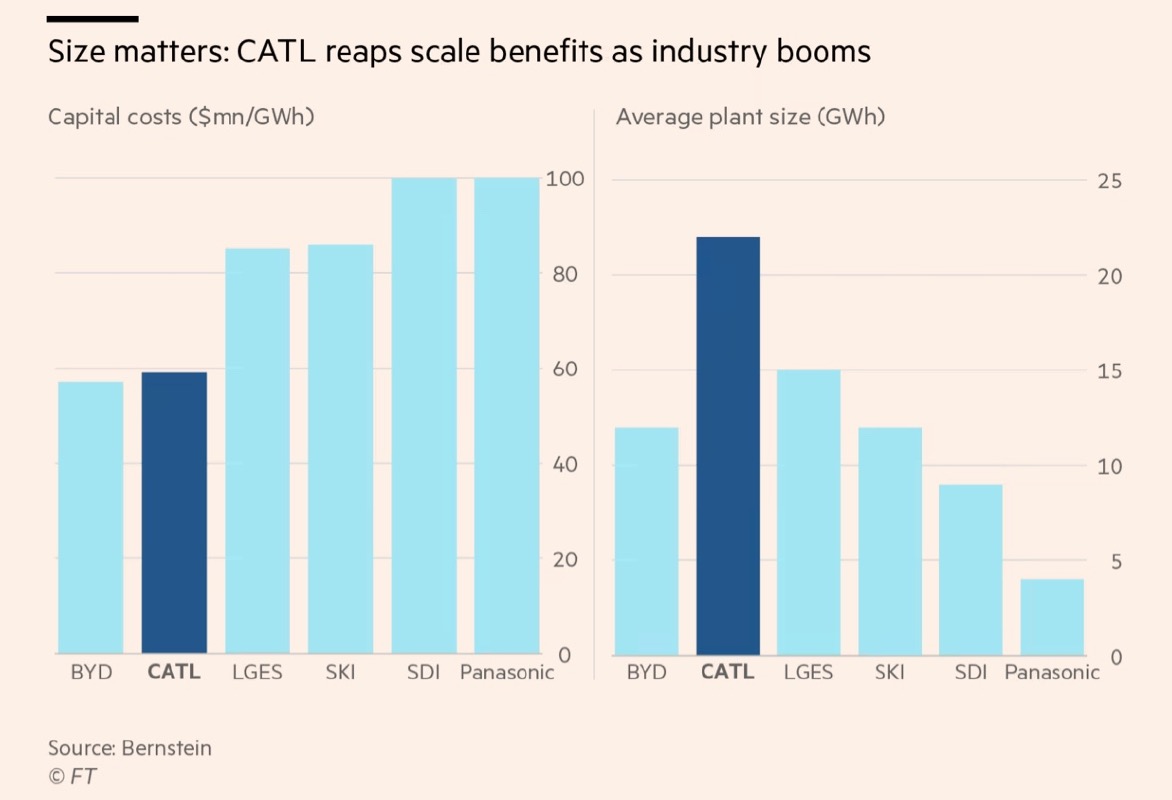

Today, CATL’s scale makes it difficult for rivals to compete.

The average size of a battery factory is doubling every four or five years, while the cost of building China’s factories is forecast to shrink to about $50mn/GWh in the coming years, from about $60mn/GWh today, according to Bernstein researchers.

That compares with $120mn/GWh for the cost of new European battery plants as well as a global average of about $78mn/GWh over the next 10 years.

CATL’s cheaper LFP batteries represent stiff competition for those with nickel-rich chemistries produced by the leading Korean battery makers, LG, SK and Samsung.

It also outspends LG on research and development and, according to Dealogic data, CATL has spent more than $4.5bn on acquisitions over the past five years, deepening its holdings across the battery supply chain from mines to charging equipment.

However, last month, a rare direct intervention by Xi led to Beijing’s regulators firing a warning at CATL to rein in the pace of expansion.

In early March, Xi told Zeng himself at a meeting of business leaders in Beijing he was both “pleased and concerned” by CATL’s dominance.

The Chinese leader pointed to the risk of overexpansion and the potential for a boom and bust cycle — which has befallen some fast-growing Chinese industries, including property and solar.

Xi “stressed that authorities should introduce industry policies and advance the development of industries in a steady and prudent manner”, state media reported.

Days after the meeting, the China Securities Regulatory Commission (CSRC), the country’s top market watchdog, issued window guidance — the industry term for informal instructions — for CATL to downsize to $1bn or less its plan to raise $5bn via a Swiss secondary listing, two bankers familiar with the matter told the Financial Times. The guidance prompted CATL to pause the listing, one of the bankers said.

The reprimand for Zeng and CATL was the latest example of the years-long reassertion of CCP control over China’s business elite under Xi.

“Is the company too big for its own good in the eyes of the state? That is one of the things they have to be leery of,” said Bill Russo, founder of Shanghai-based consultancy Automobility, and the former head of Chrysler in China.

CATL and CSRC did not comment. Bankers warned the regulator’s actions could chill fundraising plans by smaller players like CALB and Svolt Energy Technology.

Zeng’s bold US entrance also reflected his customer-driven flexibility, which was at the heart of CATL’s success, experts said.

Daniel Chng, an associate professor of strategy and entrepreneurship at China Europe International Business School in Shanghai, who is also a consultant to CATL, said the company “learnt very quickly” to find value by focusing on “what the customer wants”.

However, Chng sees a longer-term risk facing the modest “Ningde boy” if US-China tensions increase and American officials deem the company to be a strategic threat, as it did with Chinese telecommunications company Huawei.

“If it decided to kill CATL, it could,” he said.

SOURCE: https://www.ft.com/content/9f411244-eb72-493f-86d2-e7bf77de757e

Sorry, the comment form is closed at this time.