14 May Auto Shanghai 2025: Rewriting the Rules of the New Game

by Bill Russo and Lorenzo Song

The 2025 edition of Auto Shanghai was more than just a car show—it was a bold declaration that China has not only caught up to the traditional automotive world, but is now redefining its future. With halls spanning smart electric sedans, luxury SUVs, and concept vehicles from legacy brands and upstarts alike, the show was a showcase of technological ambition and market disruption.

From April 23 to May 2, Auto Shanghai attracted global attention with major product introductions from Chinese upstarts like NIO, Xiaomi, and Zeekr, alongside global names such as Toyota, Volkswagen, and Audi. The overwhelming message: China’s automotive industry has pivoted decisively toward intelligent, connected, and electrified mobility.

This article explores five critical takeaways from the event, offering insights into how China’s carmakers are setting new benchmarks in a rapidly evolving global industry.

Five Key Takeaways

1. Redefining Premium: Smart Features Over Heritage

In today’s China, the definition of a premium vehicle has shifted. No longer tied to a brand’s historical prestige or European lineage, the new standard for premium lies in intelligence, user-centric digital experiences, and interior comfort that rivals airline business class.

Chinese consumers now view smart features as basic requirements rather than luxuries. Vehicles like the Xiaomi SU7 and NIO’s new Firefly demonstrate how local brands are elevating the in-cabin experience with intuitive software, large screens, AI assistants, and seamless connectivity with mobile ecosystems. Premium is now measured by how well the car integrates into the digital lives of consumers.

Legacy automakers focusing on traditional design cues or combustion-era brand equity are becoming less relevant. The gap between perception and reality has narrowed—smartness, not backstory, sells in today’s China.

2. Smart EVs as Tech Platforms: Cars Become Smartphones on Wheels

The most prominent trend on display at Auto Shanghai 2025 was the elevation of the EV from vehicle to tech platform. Brands like Xiaomi, Huawei, and Li Auto are positioning their cars not merely as transport, but as extensions of consumers’ digital lifestyles.

Huawei’s AITO and Xiaomi’s SU7 are being marketed with the same language used to sell high-end smartphones. These vehicles come equipped with operating systems, third-party app ecosystems, facial recognition, and advanced voice control. Xiaomi’s SU7 Ultra, for example, supports over-the-air updates, multi-device synchronization, and even smartphone-like gesture controls.

The strategy is clear: leverage smart device DNA to create a tech-first car. These new entrants see the vehicle as a “technology dispenser,” capable of continuous improvement and personalization—far beyond what traditional automakers have offered. This makes the user experience more sticky and opens the door to recurring software-based revenues.

3. Hardware Innovation is Fast and Cheap: Commoditization at Hyper-Speed

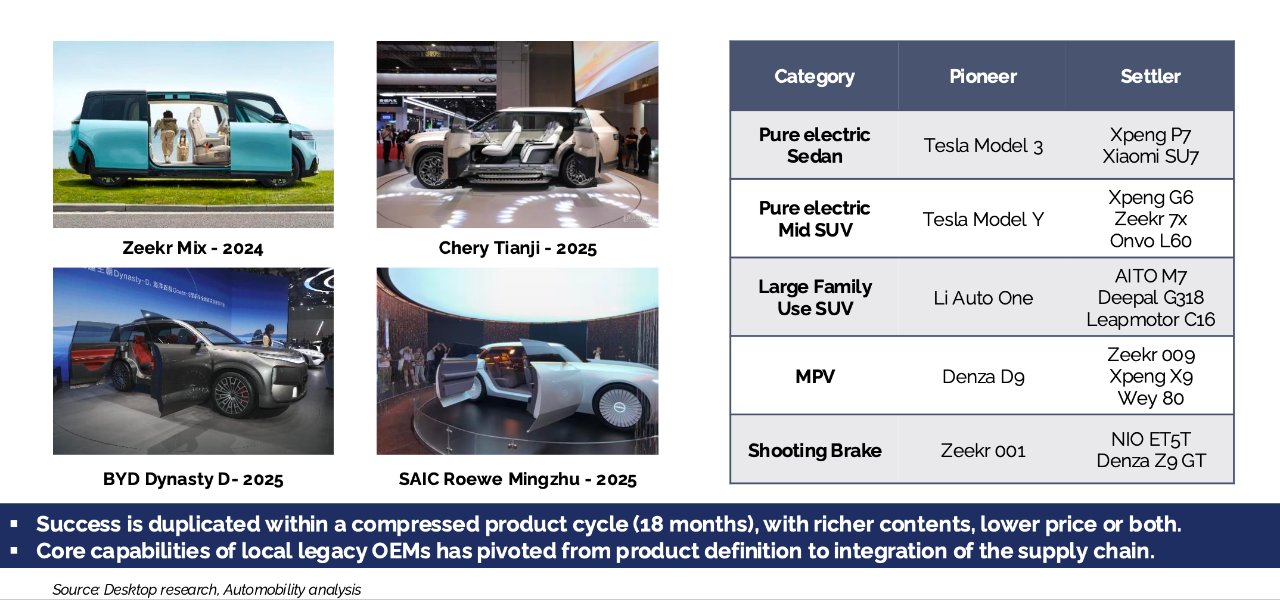

While China’s automakers embrace software and connectivity, they’re also moving at blistering speed on the hardware side. A major theme at Auto Shanghai was how quickly physical innovations—design, packaging, and features—are copied and commoditized.

What once took legacy OEMs 3–5 years to bring to market is now duplicated in as little as 18 months by Chinese players, often at a lower price and with additional features. This is made possible by China’s deep supply chain, integrated ecosystem, and a faster innovation culture.

Cars like the BYD Dynasty D, Zeekr Mix, and Chery Tianji offer bold new forms and tech-laden interiors. But more importantly, they exemplify how quickly innovation cycles have shrunk. Tesla’s once-disruptive Model 3 and Model Y are now surrounded by a sea of competitive lookalikes—Xpeng P7, Zeekr 7x, Onvo L60—offering similar or better performance at more accessible price points.

Hardware is no longer a long-term differentiator; it’s a temporary advantage. The winners will be those who can continuously iterate and integrate.

4. Three Technology Domains Shape the Future of Automaking

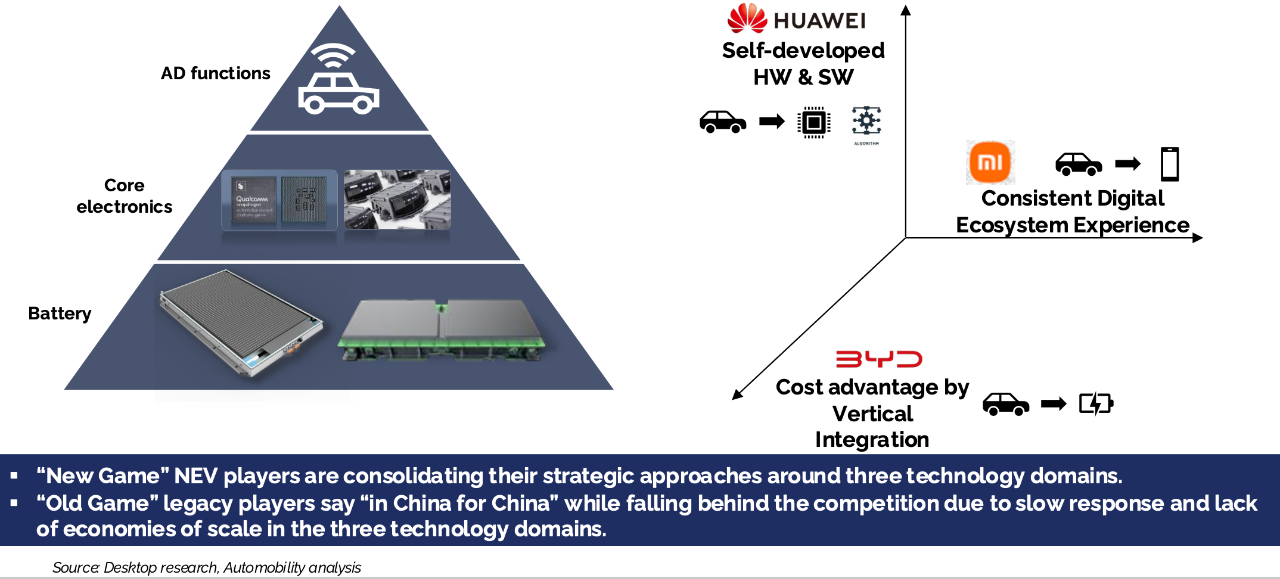

Behind the rapid evolution of products lies a deeper strategic shift in the industry. The auto game is now being played across three critical technology domains: batteries, core electronics, and autonomous driving (AD) systems.

Chinese automakers are consolidating their capabilities across these pillars. Battery innovation, once centered around range, now includes fast charging, thermal management, and solid-state breakthroughs. Core electronics refer to the “nervous system” of the vehicle—ECUs, infotainment systems, and chipsets—which are increasingly developed in-house or through tight vertical partnerships.

AD capabilities are also becoming key differentiators. While L2+ ADAS (Advanced Driver Assistance Systems) are becoming table stakes, the goal for many is to offer reliable L3 and L4 features under real-world conditions. However, achieving this requires not just hardware, but massive investments in AI training, fleet data collection, and real-time processing.

Importantly, the ability to scale these technologies across millions of units while maintaining cost competitiveness is what separates disruptors from legacy players. Players like BYD and Huawei, who manage end-to-end production and invest heavily in R&D, are pulling ahead.

5. Safety is Standardized—But No Longer a Differentiator

A subtle but important theme at Auto Shanghai was the shift in how safety is marketed. Following a fatal accident involving the Xiaomi SU7, safety became a touchy but critical topic. Regulators and consumers alike are demanding more transparency, especially in how ADAS features are presented.

Auto brands now emphasize safety as a compliance requirement rather than a competitive edge. Terms like “covers 90% of driving scenarios” or “no driver takeover needed” are being scrutinized. Overpromising on AD capabilities is no longer acceptable.

Yet, safety alone won’t win customers. With most EVs offering similar crash structures, radar setups, and sensor suites, differentiation must come from user experience, performance, and digital value. The key takeaway: safety is expected, but not exciting

Conclusion: China’s New Playbook for Global Auto Leadership

Auto Shanghai 2025 marks a turning point for the global automotive industry. It shows that China is not only the largest market but also the most dynamic, innovative, and digitally forward-thinking. Chinese automakers are rewriting the rules by merging smart device logic with mobility, embracing vertical integration, and scaling technological innovations faster than ever before.

For global players, the message is clear: adapt or fall behind. The future of mobility is not just electric—it’s intelligent, connected, and China has the advantage.

About the Authors

Bill Russo is the Founder and CEO of Automobility Limited, and is currently serving as the Chairman of the Automotive Committee at the American Chamber of Commerce in Shanghai. His over 40 years of experience includes 15 years as an automotive executive with Chrysler, including 21 years of experience in China and Asia. He has also worked nearly 12 years in the electronics and information technology industries with IBM and Harman. He has worked as an advisor and consultant for numerous multinational and local Chinese firms in the formulation and implementation of their global market and product strategies. Bill is a contributing author to the book Selling to China: Stories of Success, Failure, and Constant Change (2023), where he describes how China has become the most commercially innovative place to do business in the world’s auto industry – and why those hoping to compete globally must continue to be in the market.

Contact Bill by email at [email protected]

Lorenzo Song is a Consultant at Automobility Limited. He has several years of experience in the automotive industry as a consultant particularly focusing on the innovation and financing.

Contact Lorenzo by email at [email protected]

About Automobility

Contact us by email at [email protected]

PLEASE NOTE: The information and analysis shared in this newsletter, including the charts and style of materials presented, is the intellectual property of Automobility Ltd. While we share it as a way to serve our existing and new clients, it is not to be used without our express consent and then only with attribution. Any publication, reproduction or other use of this material without the express written consent of Automobility Ltd is prohibited.

No Comments