22 Jan State of China’s Auto Market – January 2025

Written by Bill Russo, Founder & CEO of Automobility Ltd.

A Look Back at 2024 Results

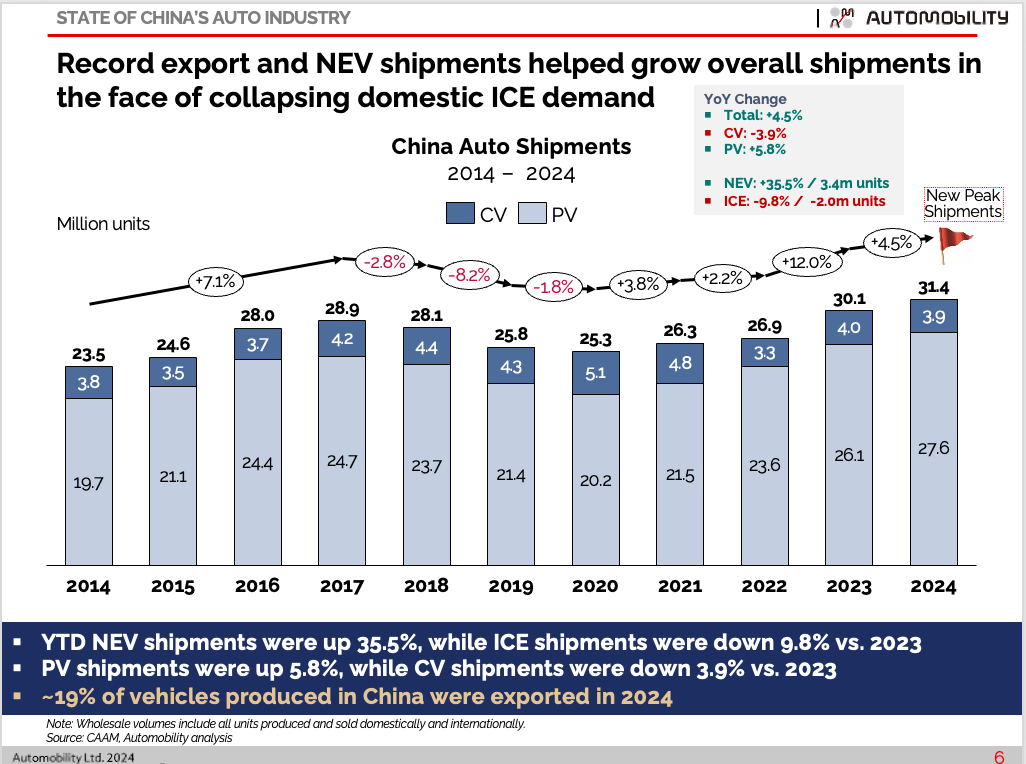

- Ex-factory shipments in China reached a record high of 31.4 million units in 2024, with New Energy Vehicles representing ~41% of vehicles produced (~12.9 million units).

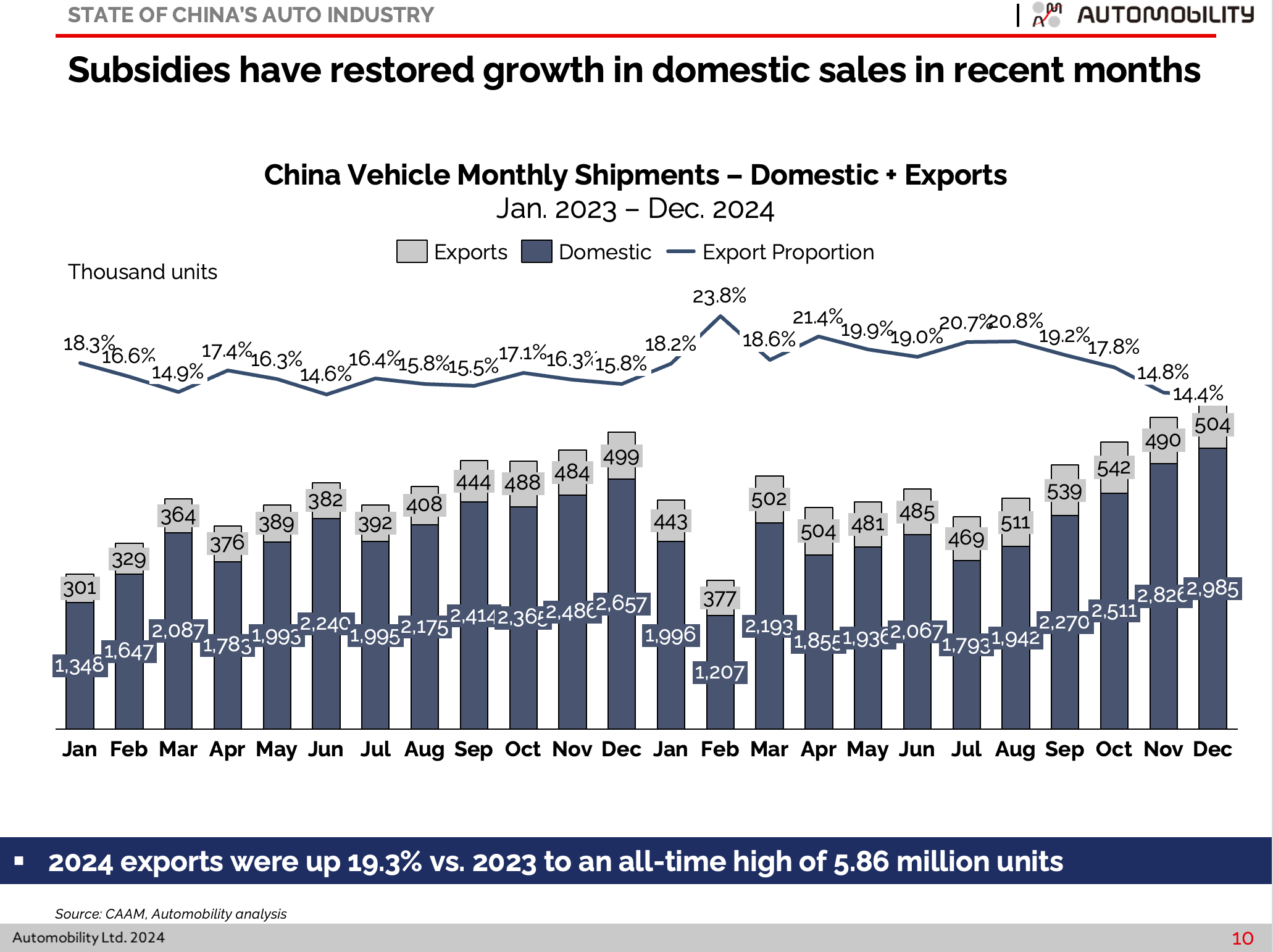

- Made-in-China vehicle exports totaled 5.86 million units, an expansion of 19.3% over 2023. ~78% of China’s exports are powered by gasoline.

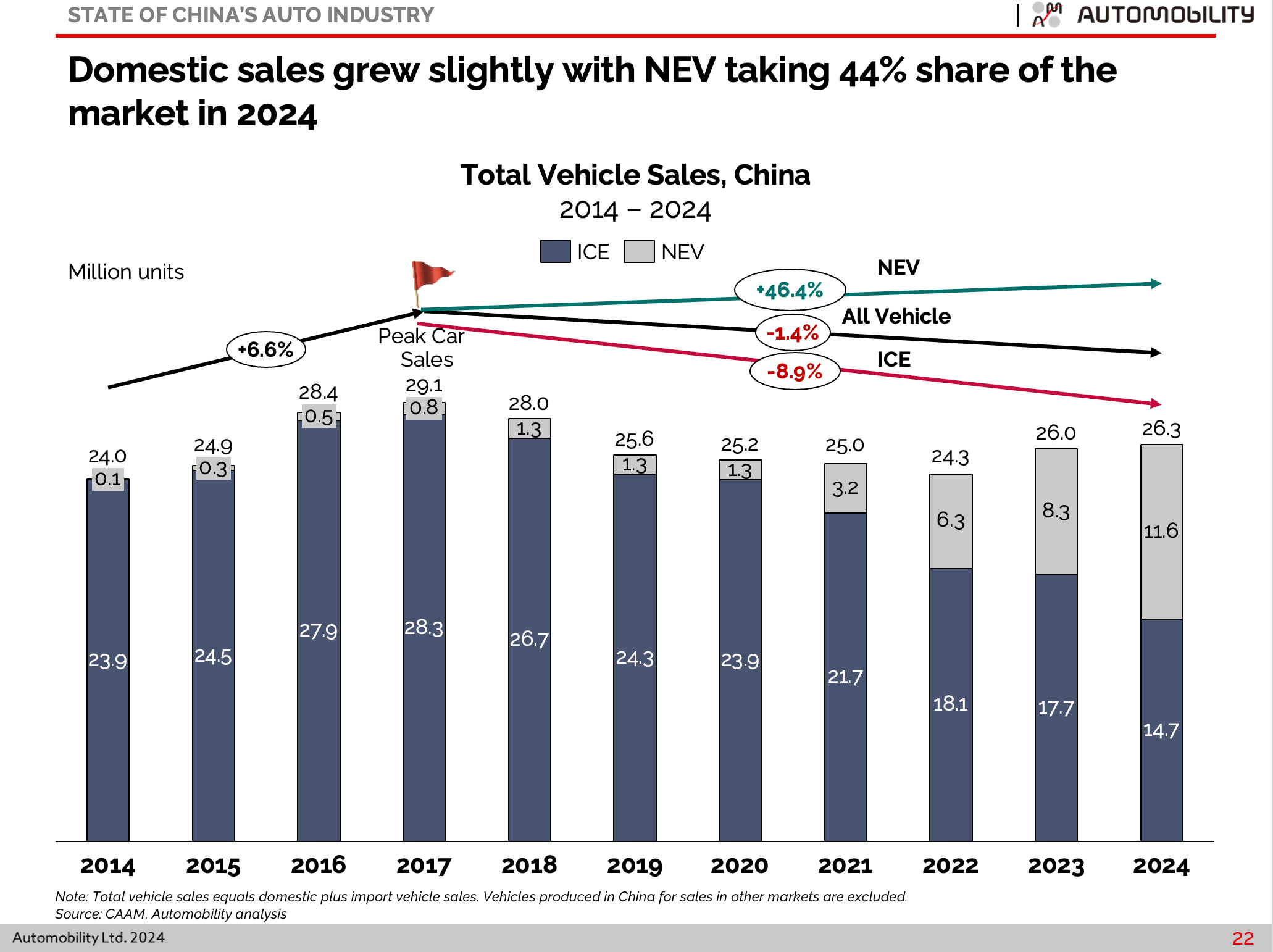

- Domestic sales grew to 26.3 million units, a gain of 0.3 million units, with sales of New Energy Vehicles up 3.3 million, while sales of pure Internal Combustion Engine (ICE) powered vehicles were down 3 million units compared with last year..

- New Energy Vehicles represented 47% of all passenger vehicles sold in 2024, and Chinese local brands have captured 65% share of this market.

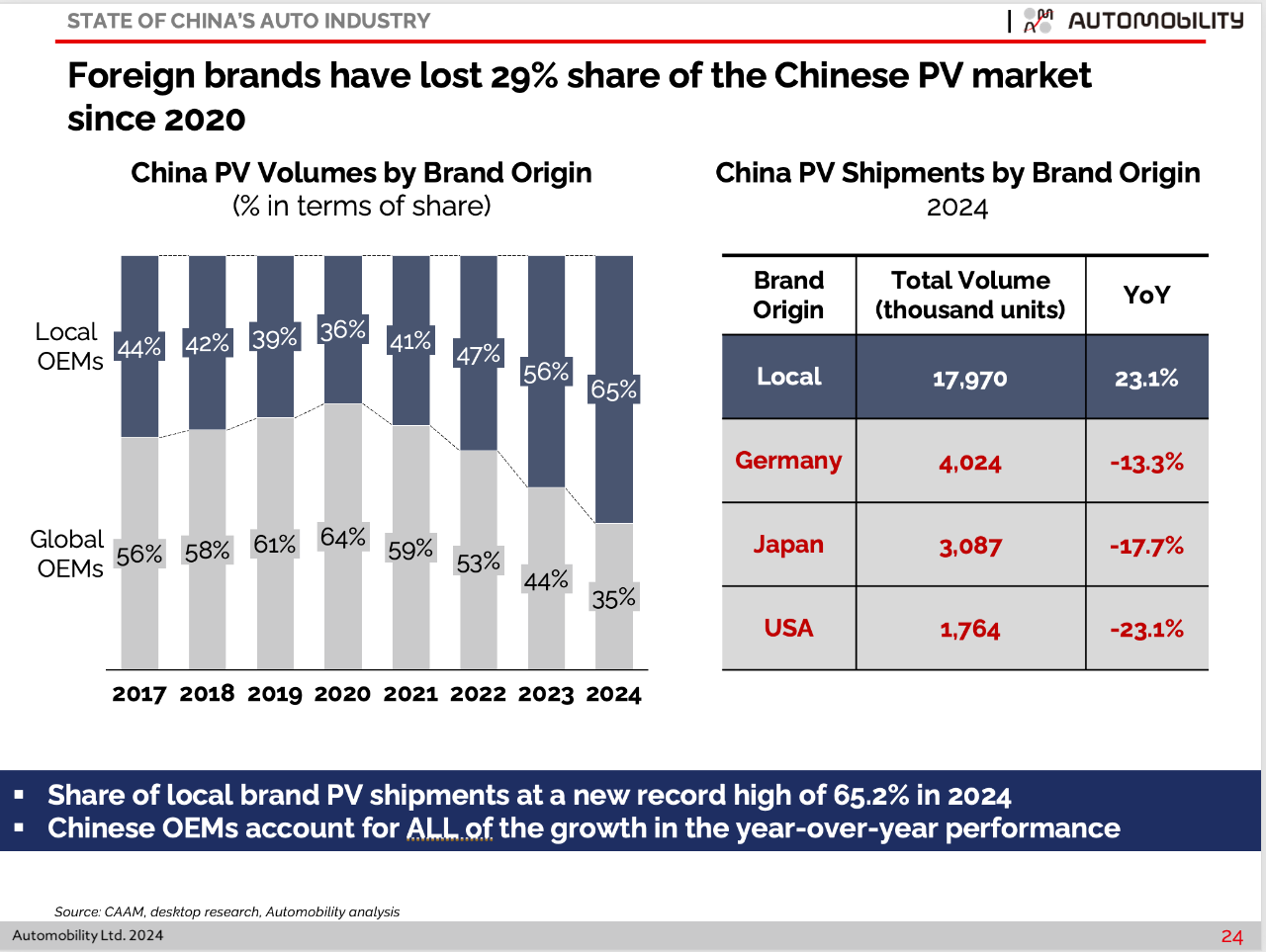

- Chinese brands increased sales volume by 23% versus last year, in a market that only grew by 1%.

- Foreign brands lost 29% share of the Chinese PV market since 2020.

A Look Back: Seismic Shifts in the Market Since 2017

China produced a record 31.4 million vehicles in 2024, representing more than one-third of all vehicles produced in the world. China also produced a record 12.9 million New Energy Vehicles, and 11.6 million of these were sold in China. More than two-thirds of the world’s electrified vehicles were made in China.

China has clearly become the “super scaler” of electric mobility technology.

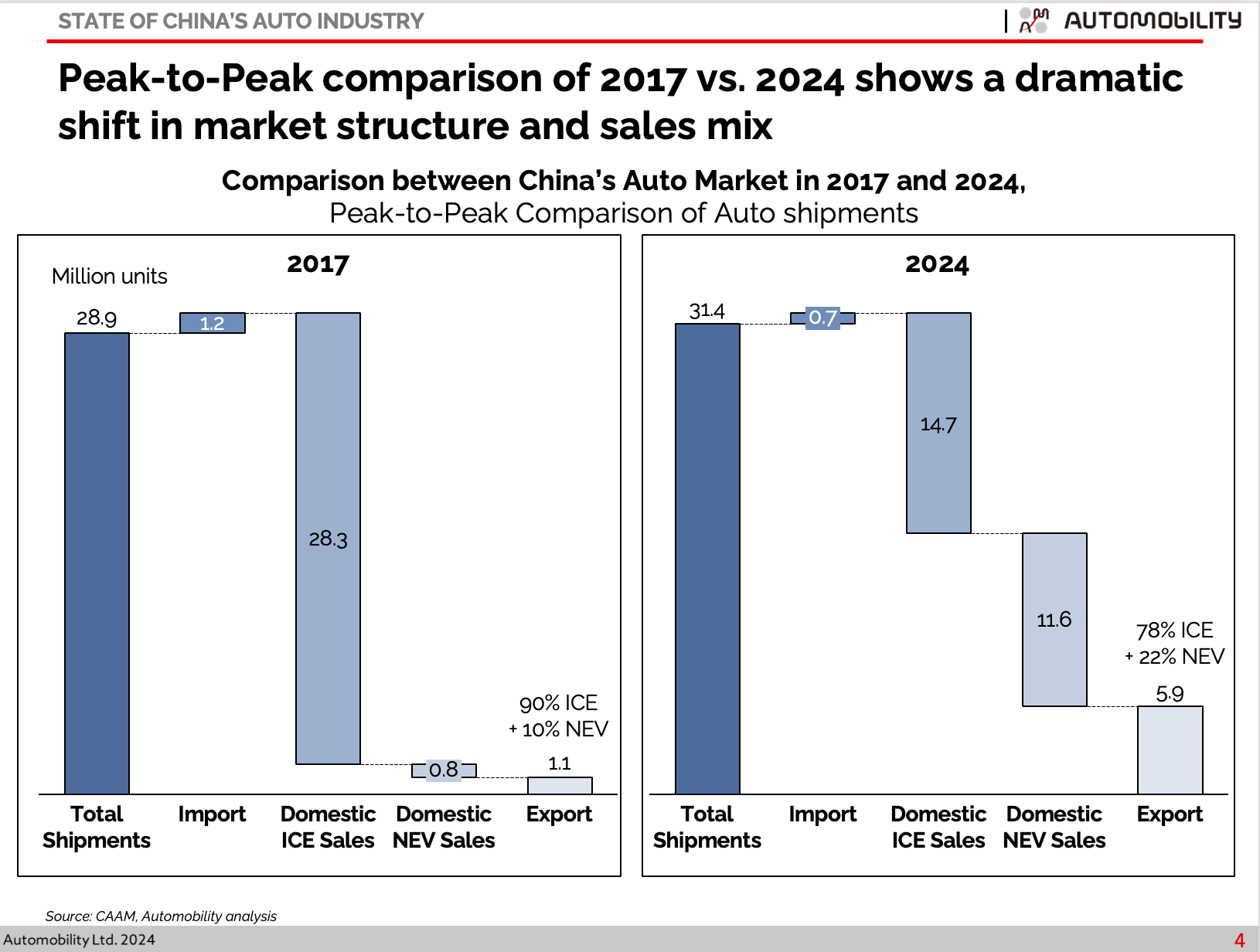

However, domestic vehicle sales in 2024 were 26.3 million units, which is 9.6% below the peak of 29.1 million units reached in 2017. A peak-to-peak comparison of 2017 vs. 2024 reveals a stark depiction of the dramatic structural change that has occurred over this period, most notably: the collapse of domestic ICE (-48.1%) and the exponential rise of NEV (14.5X growth) and Made-in-China (MIC) exports (5.4X growth).

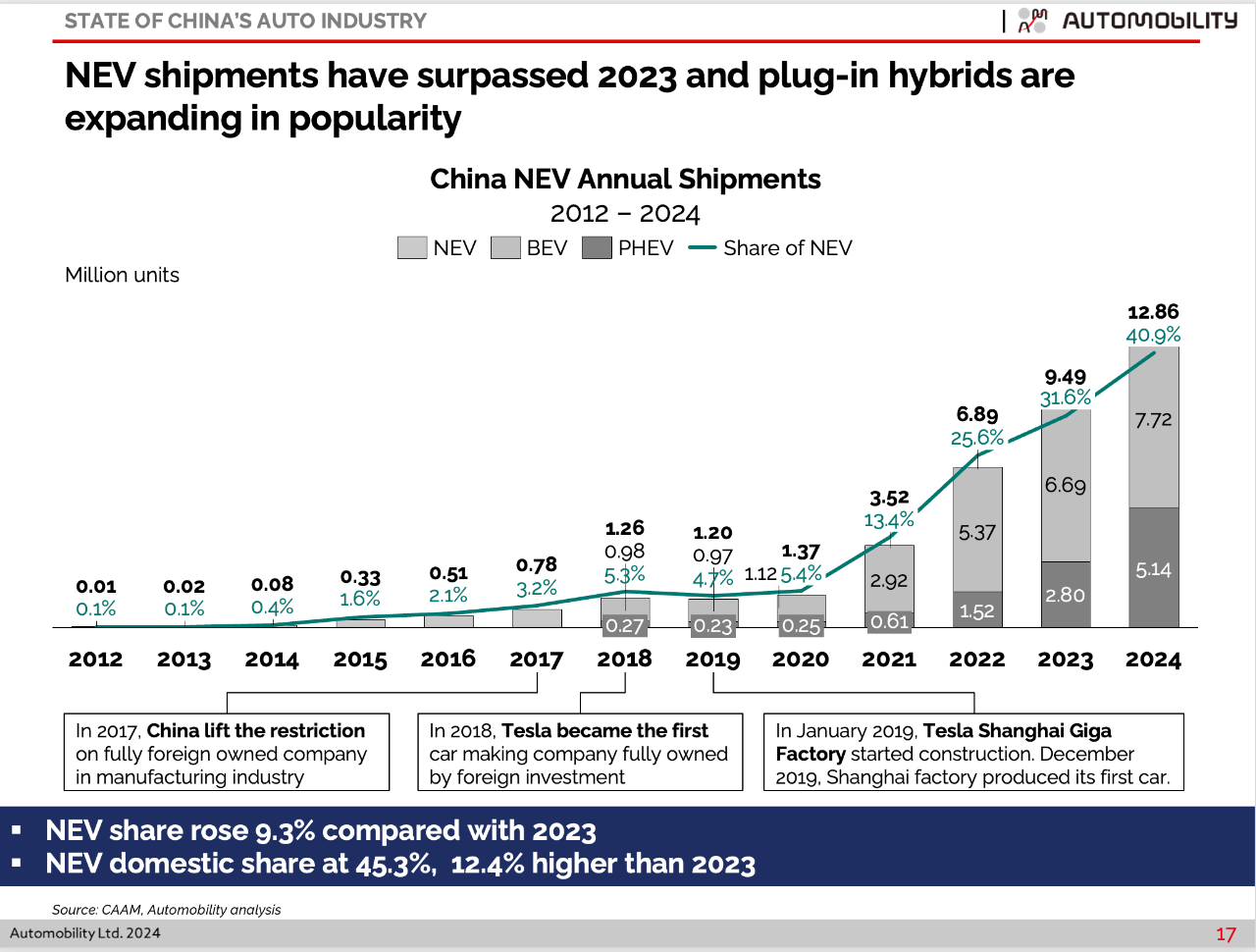

Perhaps the most startling shift has been the rapid rise of NEV and how much this has altered the supply chain and global balance of automotive industry power. It is noteworthy that up until 2020, the NEV market in China was bumping along and mainly driven by heavy incentives and free license plates. This completely changed when Tesla entered the market with their locally produced Model 3.

In 2024, NEVs now comprise ~45% of all vehicles produced in China and 47% if all passenger vehicles sold. This market is dominated by local Chinese brands.

The 9.6% decline in domestic vehicle sales since 2017 was a shock to global carmakers who were attracted to invest in China to access profitable growth opportunities that did not exist in the rest of the world. All of the automotive industry growth since the turn of this century can be attributed to the economic expansion of China and the corresponding rise in demand for mobility.

However, global carmakers were slow in adjusting to the seismic shifts happening in China in recent years and the industry is now over-invested in capacity to produce ICE vehicles that are no longer in demand, while struggling to make the business model work to justify investment in NEVs.

Faced with sluggish domestic demand, Chinese companies also prioritized growth through global exports, and China has risen to become the largest automobile exporting nation, surpassing Japan in 2023. MIC exports reached 5.86 million units in 2024, and 78.1% of these exports were ICE powered vehicles – reflecting a massive capacity bubble which exists in China for producing such vehicles and their components.

Current State of China’s Auto Industry: 2024 Volume Mix and Segment Performance

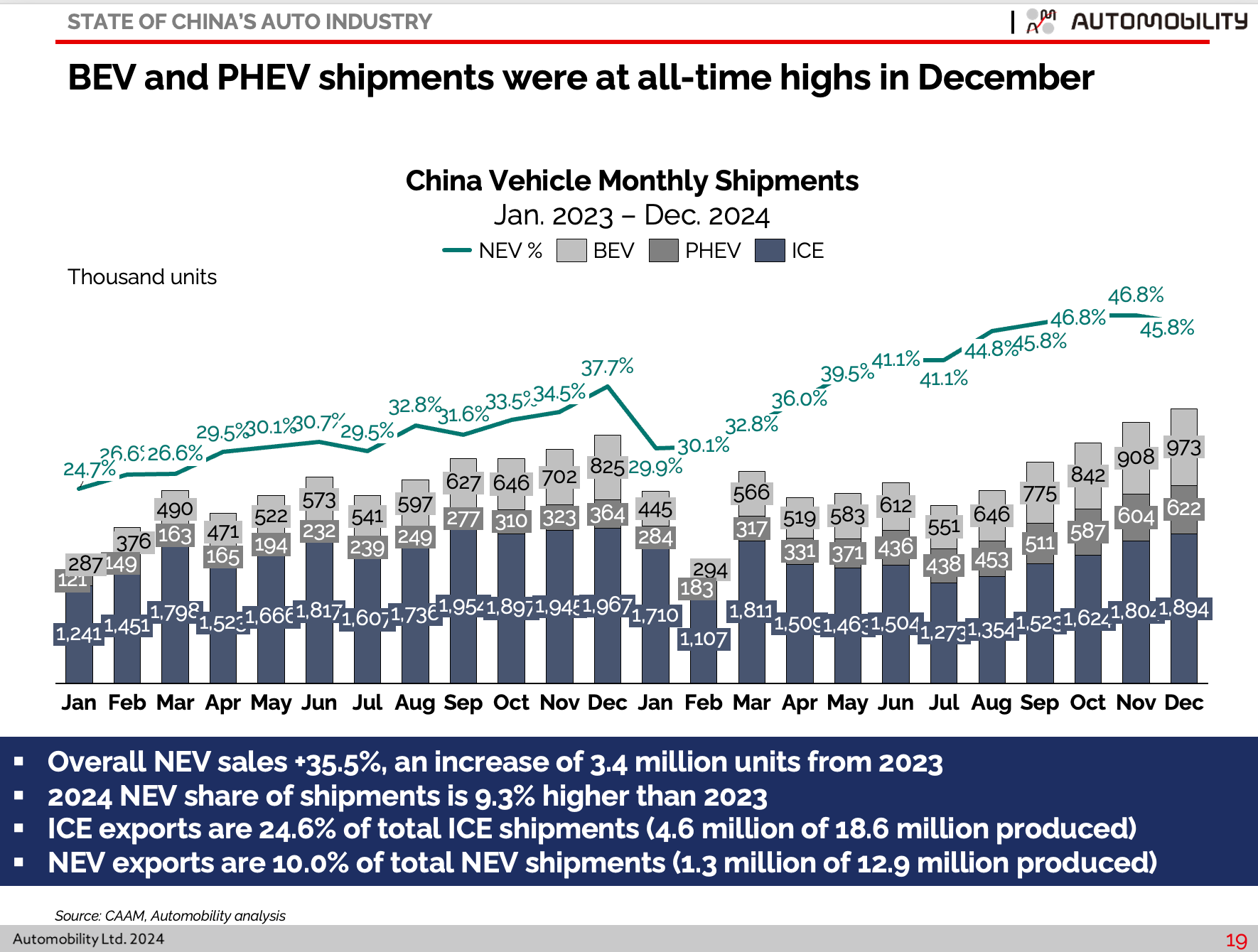

Shipment volumes (domestic + export) were up 4.5% over 2023. A record total of 31.4 million vehicles were built in China in 2024. NEV shipments were up 3.4 million units while Internal Combustion Engine (ICE) volumes were down 2 million units.

The 31.4 million cars and trucks produced through November includes ~5.86 million Made-in-China (MIC) vehicles exported from China (~19% of total production volume).

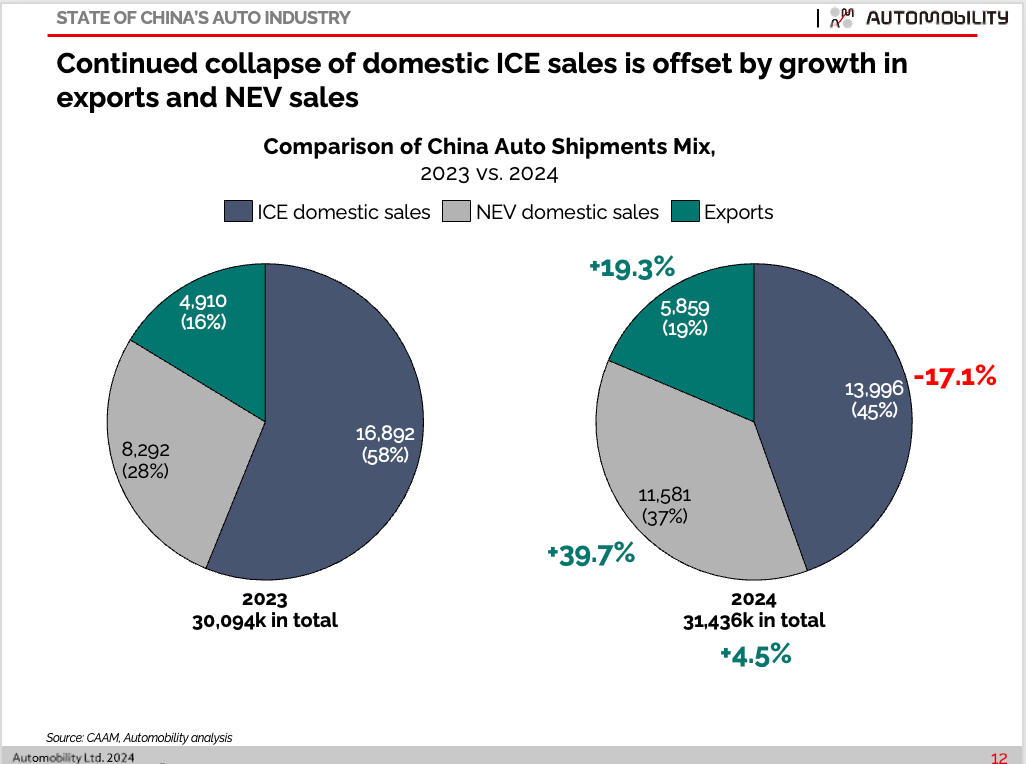

Ex-factory shipment volumes between 2023 and 2024 are compared in the pie charts below. Domestic ICE sales stand at 14 million units (down 17.1%), a loss of 2.9 million units year-to-date. This was the 7th consecutive year of ICE sales decline, which peaked in 2017.

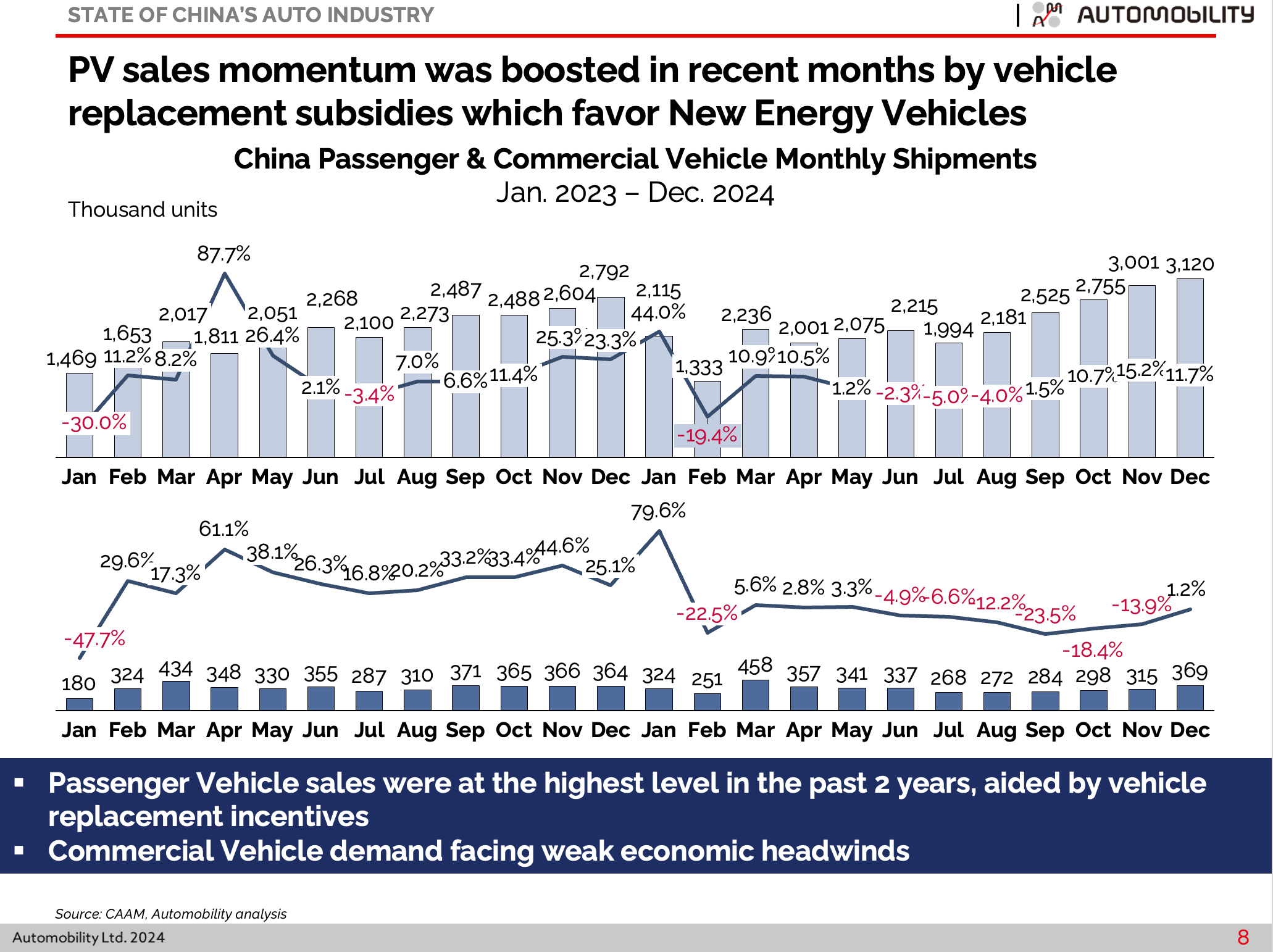

Passenger Vehicle volumes in December were at the highest levels in the past 2 years, and have been supported by vehicle replacement incentives that were launched by the Ministry of Commerce in mid-2024. However, Commercial Vehicles shipments remained weak in the second half of 2024, underscoring continued weakness in the Chinese domestic economy.

Made-in-China (MIC) export volumes ticked back above the half million mark in December. For the full year, exports are up 19.3% with full year export volumes reaching a record 5.86 million units. 19% of all cars made in China in 2024 were exported for sale in other markets.

NEV shipments set a single month record at 1.595 million units, with record monthly volumes for both BEVs and PHEVs. PHEV volumes set a seventh consecutive monthly shipments record, at 622,000 units. BEV set a record for the second consecutive month, with 973,000 units shipped.

Domestic Sales Trends and Market Leaders

Domestic sales grew to 26.3 million units, a gain of 0.3 million units, with sales of New Energy Vehicles up 3.3 million. Sales of pure Internal Combustion Engine (ICE) powered vehicles were down 3 million units compared with last year. NEVs comprised 44% of domestic vehicle sales.

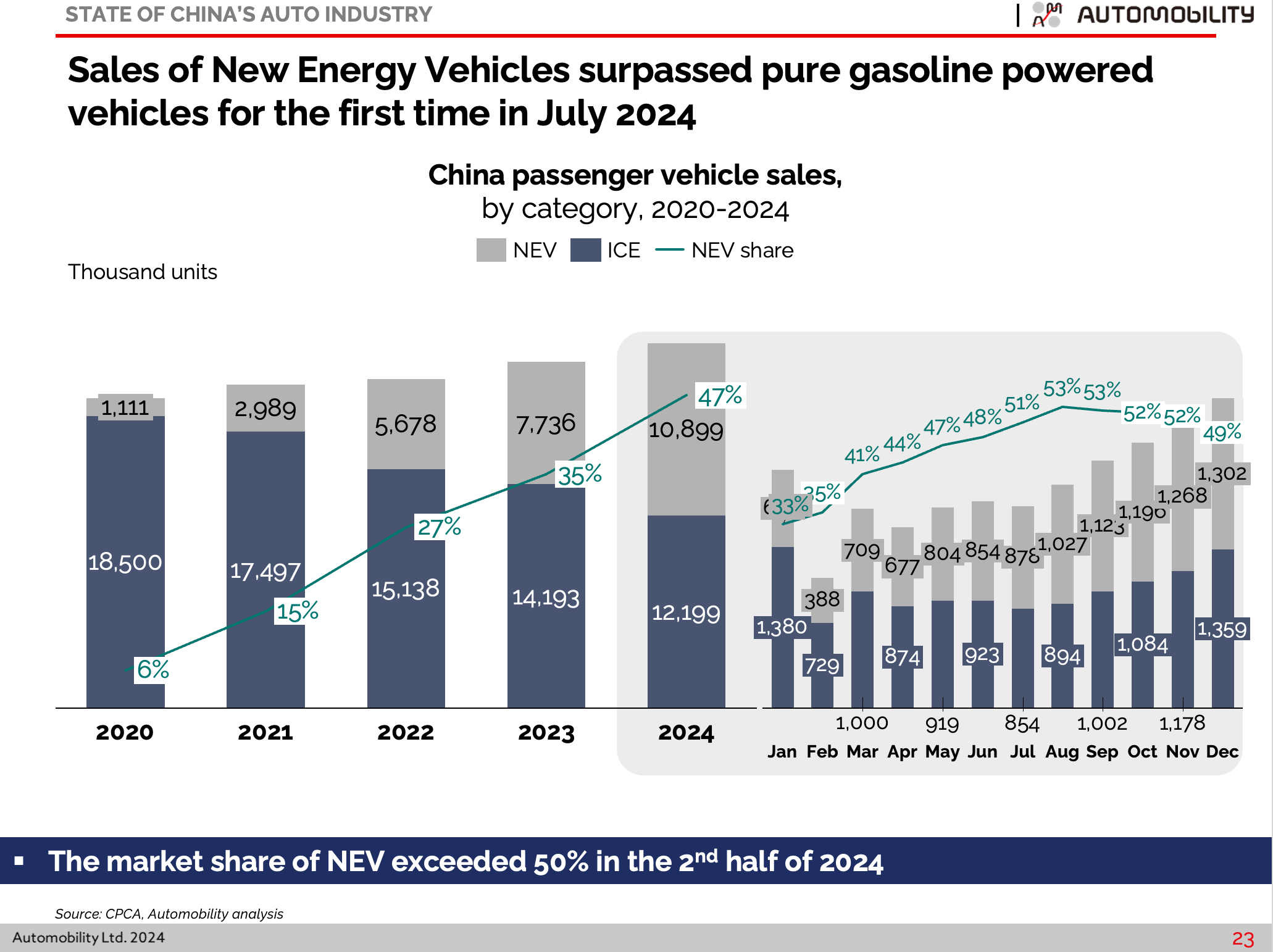

Within the Passenger Vehicle category, NEV sales comprised 47% of sales in 2024, up from just 6% in 2020. NEVs outsold ICE powered vehicles in the 2nd half of 2024, and NEV volumes have increased by 10X over this 5-year period.

The impact of the NEV shift on the competitive landscape is profound. Since the NEV acceleration began in 2020, foreign brands have lost 29% share of the passenger vehicle market in China – with Chinese local brands commanding nearly two-thirds of domestic passenger vehicle sales. Chinese brands extended their dominance in 2024, recording a 23% year-over-year gain in sales versus 2023.

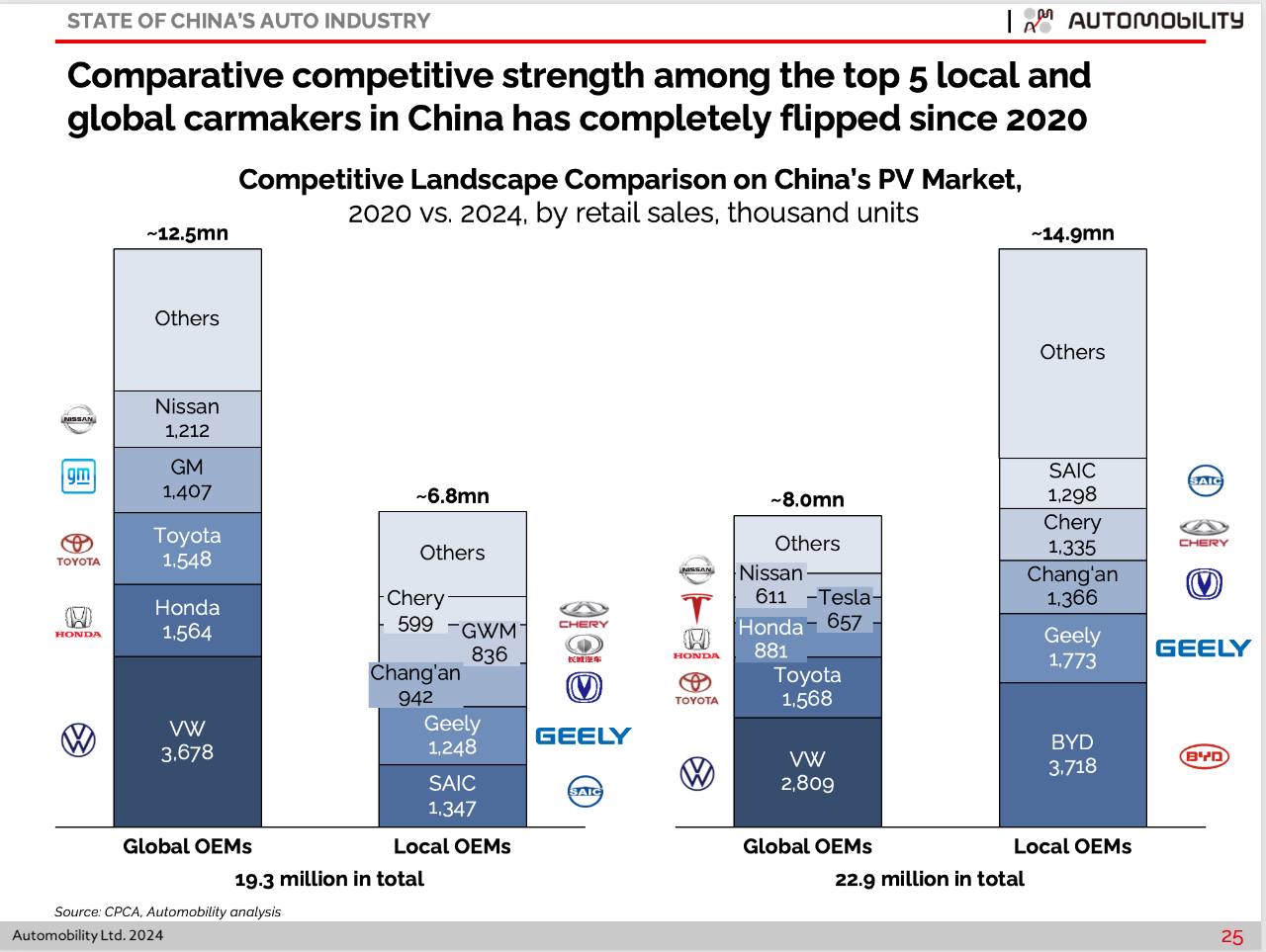

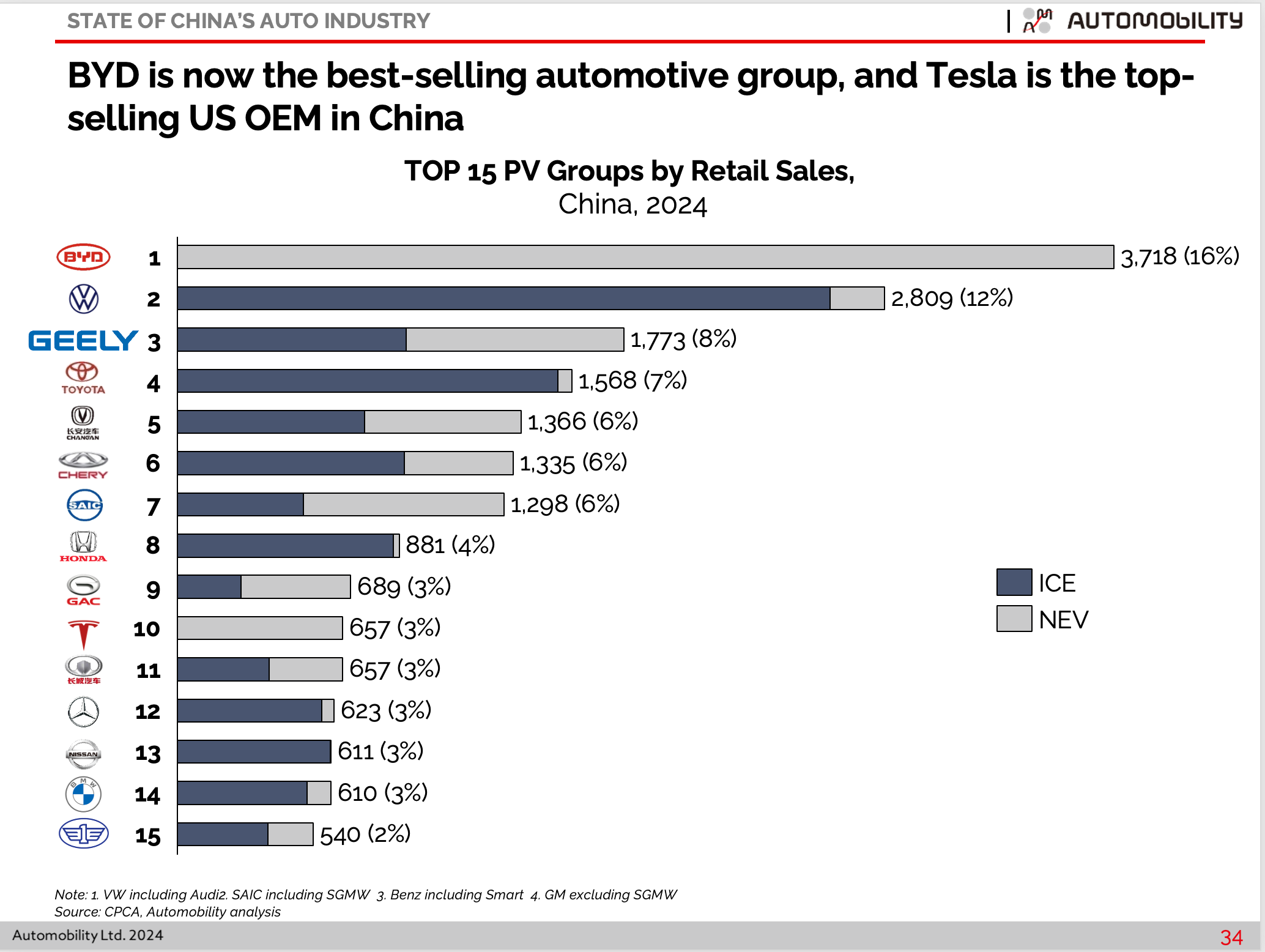

Since 2020, the comparative retail strength of domestic vs. foreign passenger vehicle brands has completely flipped, as shown below. BYD became the largest volume car manufacturer in China in 2024 (surpassing Volkswagen group), and they were not even among the top local brands in 2020!

The most shocking factor for the global carmakers has been the quickness among Chinese consumers to shift their buying preference to local brands offering a more attractive value proposition.

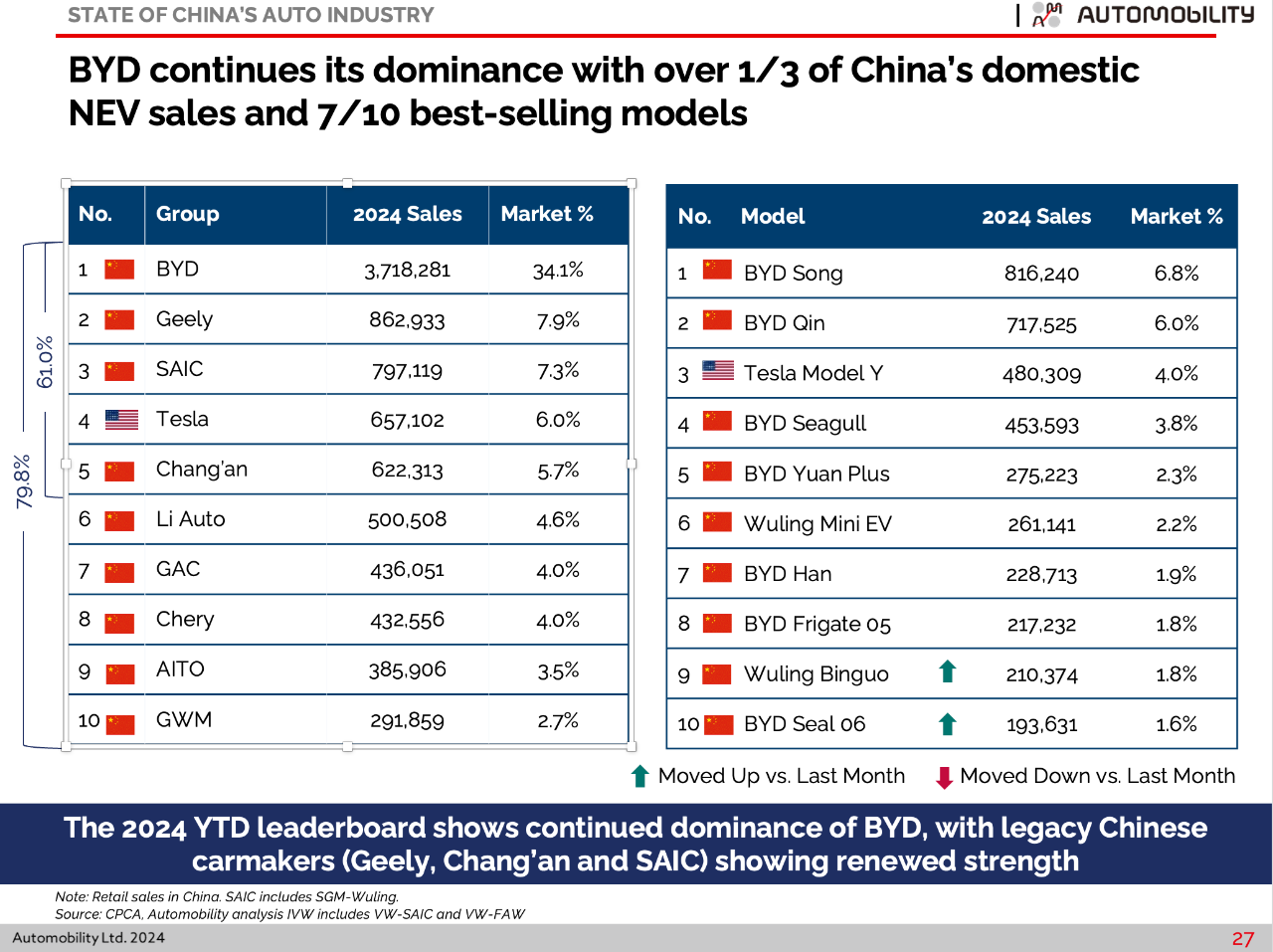

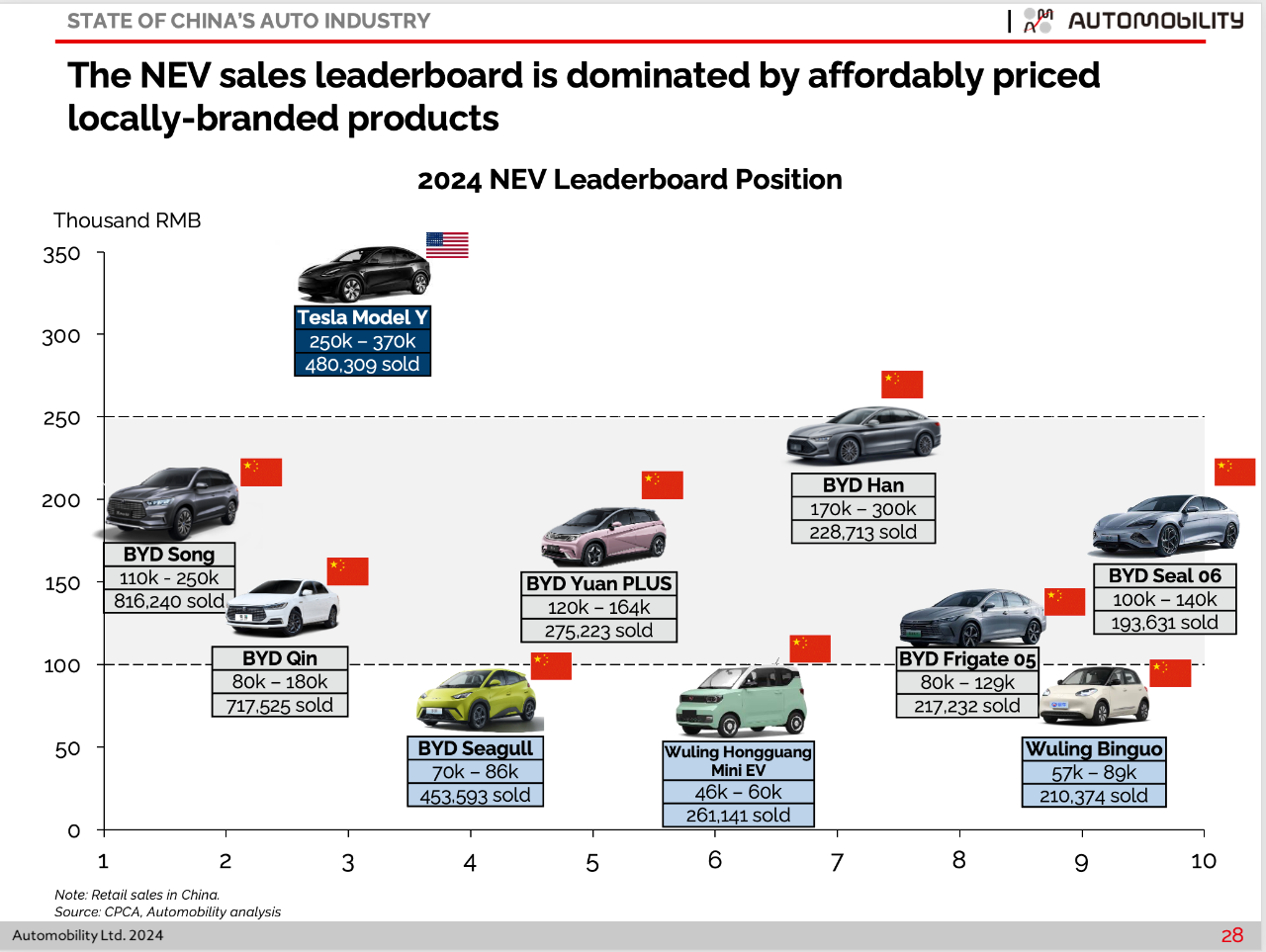

Chinese brands have led the transition to New Energy Vehicles, which is the tailwind driving this dominant performance. For the full year, BYD dominated the NEV segment with ~34% share and 7 of the top 10 best selling vehicles in 2024. Tesla is the only non-Chinese carmaker on the NEV sales top 10 leaderboard.

BYD’s vertical integration and battery supply chain scale has helped them to gain pricing power over their NEV competitors. BYD also offers a very high mix of Plug-in Hybrid Electric Vehicles – a sub segment in China that has become increasingly popular.

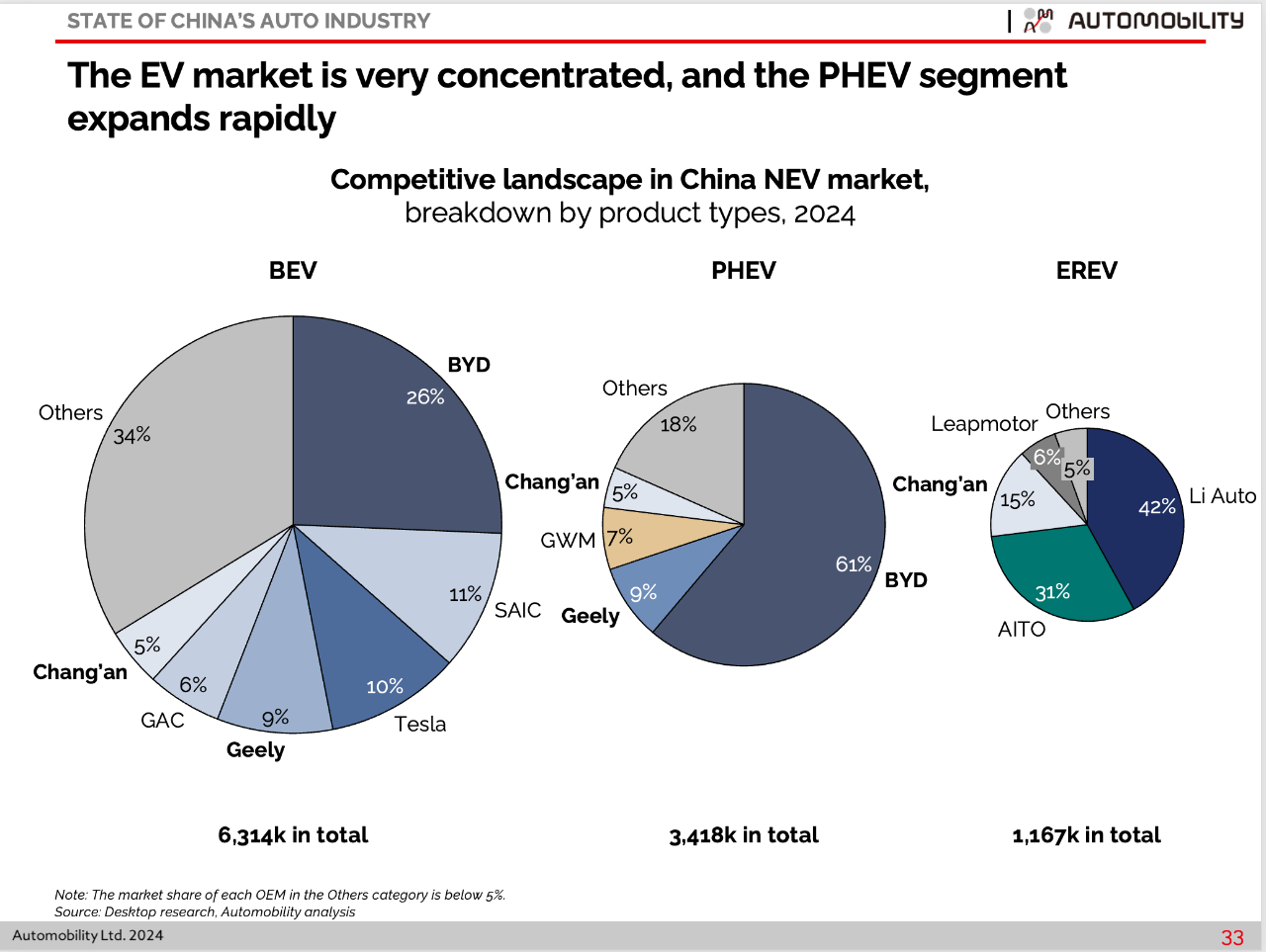

BYD dominates both the BEV and PHEV sub-segments, while Li Auto and AITO are the leaders in the Extended Range Electric Vehicle (EREV) sub-segment.

A Global Industry at the Crossroads

The domestic ICE market in China is in free fall, with a 15% decline in the past year, and is 48% smaller than its peak year of 2017. There is no reversing this trend in the market.

The impact of this on the market structure is profound. BYD surpassed Volkswagen group sales in 2024 for the first time, and their full-year volumes are now over 900k units higher than VW. The collective failure among foreign brands to pivot to the new consumer preference for NEV is the common denominator in explaining their loss of relevancy to Chinese consumers.

Legacy Chinese brands like BYD, Geely, Chang’an, Chery, SAIC, GAC, Great Wall and FAW are all rising while VW, Toyota, Honda, Nissan, Mercedes and BMV have fallen among the top 15 volume leaders. American brands other than Tesla have fallen completely off the list.

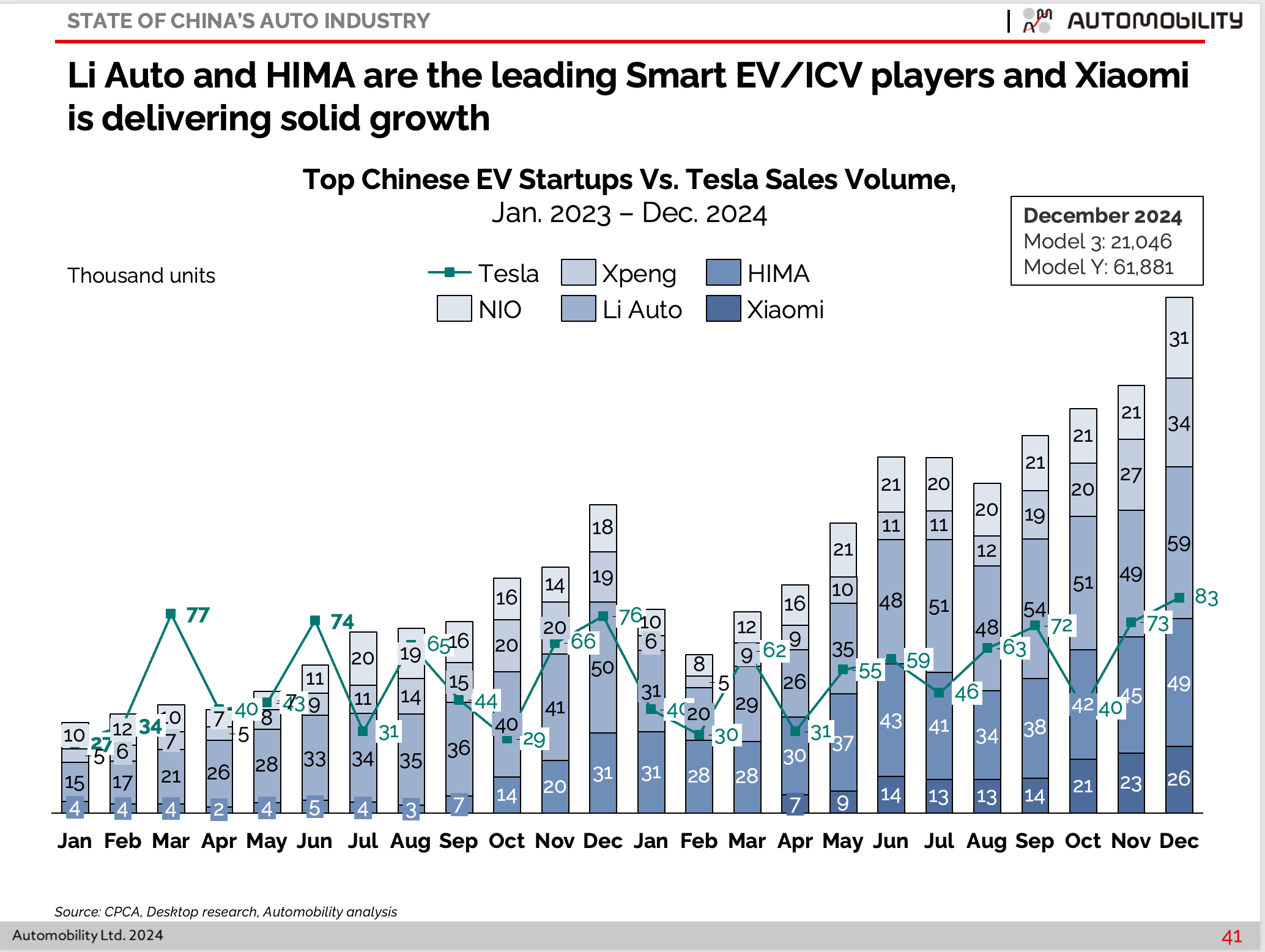

Another noteworthy trend to watch going forward is the rising performance of brands with Smart EV/Intelligent Connected Vehicle (ICV) technology features. Such players are typically newcomers backed by internet ecosystems and include NIO, Xpeng, Li Auto, Xiaomi, and Huawei’s Harmony Intelligent Mobility Alliance (HIMA). Sales for this group of technology players are growing and several may break away and ultimately challenge traditional mass market players by offering a more compelling set of features for consumers seeking a “smart phone on wheels” mobility experience.

Look Back & Look Ahead: Automotive Industry Outlook in 2025 & Beyond

-

The retreat from the world’s largest auto market has begun [CNN]

Western automakers tried to stay the course with gasoline-powered cars, and for the most part, so did their JV partners. Now those companies — other than Tesla, which has a factory in Shanghai — are trailing far behind in an effort to keep up with lower priced EVs and hybrids from Chinese automakers, such as BYD.

It was a massive miscalculation by Western automakers, said Bill Russo, head of Shanghai-based investment advisory firm Automobility and head of Chrysler’s Northeast Asia operations from 2004 to “The foreign brands didn’t prioritize it. They didn’t see it coming,” he said.

He said much of the shift in the market took place during 2020 and early 2021. The Covid-19 pandemic made it difficult for the top executives of Western automakers to travel to China, making it easier for them to miss the earthquakes in the market. And while Western automakers have all announced plans to sell more electric cars, they’ll be selling gasoline-powered vehicles for at least the next 10 years.

And they’re still losing money on EV production, even as Chinese competition gobbles up market share.

“They thought they had time that they didn’t have,” Russo said.

Russo said it would be another huge mistake for Western automakers to abandon China just because they’re not competitive now.

(Please copy and paste the link to your browser:

-

China’s Auto Transformation: Interview with Bill Russo [VIDEO]

Automobility CEO Bill Russo speaks with China digital marketing expert Ashley Dudarenok and comments on China’s automobile sector, the country’s innovation ecosystem, and the three waves of mobility innovation.

China’s Auto Transformation: Interview with Bill Russo [VIDEO]

Markham Hislop interviewed Automobility’s Bill Russo, a former Chrysler’s top executive in China on the development of the electric vehicle market.

Energi Talks – Recent Developments in the China Market [PODCAST]

-

GM Led in China for Years. Here’s How It Ended Up 16th in Sales [New York Times]

“It is not just G.M.,” said Mr. Russo, the former Chrysler executive, who is now a Shanghai electric car consultant. “Everyone among the foreign automakers had a condescending, arrogant attitude toward the capability of the Chinese companies to embrace innovation.”

(Please copy and paste the link to your browser: https://www.nytimes.com/2024/12/19/business/gm-china.html?unlocked_article_code=1.ik4.ZDW9.zcnL4-__MO5J&smid=url-share

- China tech giant Huawei ramps up EV unit despite US sanctions [Financial Times]

Bill Russo, the former head of Chrysler in China and founder of the consultancy Automobility, said Huawei was among a group of Chinese internet giants and device makers — which also includes Baidu, Alibaba, Tencent and Xiaomi — unlocking new and “recurring” revenue streams linked to EVs.

(Please copy and paste the link to your browser:

-

Tesla posted record China sales in 2024. But this year is going to be tough as competition heats up [CNBC]

https://www.cnbc.com/2025/01/06/tesla-china-sales-2025-as-competition-heats-up-.html)

-

Tesla China abruptly launches redesigned Model Y at higher price [Tech Node]

https://technode.com/2025/01/10/tesla-china-abruptly-launches-redesigned-model-y-at-higher-price/)

-

China’s EVs may change the world in unimaginable ways [Japan Times]

If your organization would like a custom briefing on the State of China’s Auto Market, please reach out to us at info@automobility.io

About Bill Russo

Bill is a contributing author to the book Selling to China: Stories of Success, Failure, and Constant Change (2023), where he describes how China has become the most commercially innovative place to do business in the world’s auto industry – and why those hoping to compete globally must continue to be in the market.

About Automobility

Contact us by email at info@automobility.io

PLEASE NOTE: The information and analysis shared in this newsletter, including the charts and style of materials presented, is the intellectual property of Automobility Ltd. While we share it as a way to serve our existing and new clients, it is not to be used without our express consent and then only with attribution. Any publication, reproduction or other use of this material without the express written consent of Automobility Ltd is prohibited.

Sorry, the comment form is closed at this time.