30 Nov NY TIMES : What Elon Musk Needs From China

Media Source : NY Times

What Elon Musk Needs From China

From electric cars to solar panels, Mr. Musk has built businesses in high-tech manufacturing sectors now targeted by Beijing for Chinese dominance.

Reporting from Beijing

November 22, 2024

No American business leader has more visibly and lavishly supported President-elect Donald J. Trump than Elon Musk — and few if any have a more complex relationship with China, a country that Mr. Trump has vowed to confront with higher tariffs and other measures.

Mr. Musk has a lot on the line. His best-known company, the electric vehicle maker Tesla, makes half its cars in China. Tesla sells more cars in China than anywhere except the United States, and his local competition is getting stronger. Chinese regulators have not yet allowed Tesla to offer its latest assisted- driving and self-driving car technology, while allowing Chinese automakers to race ahead with similar systems.

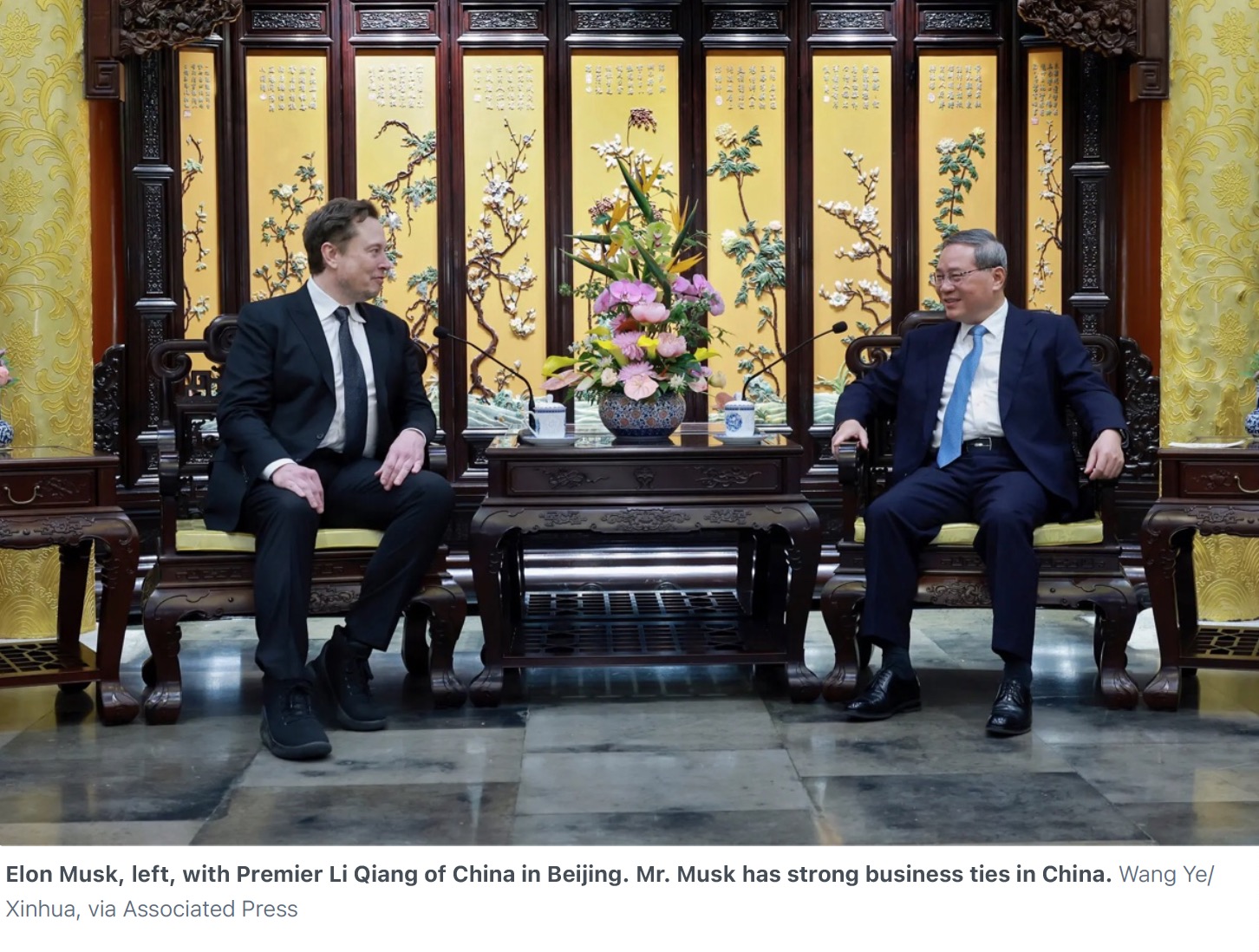

Mr. Musk has personally appealed to China’s premier, Li Qiang, for permission to proceed with what Tesla calls Full Self-Driving as the company’s market share in China has dwindled. Some experts have suggested that Beijing may be able to turn Mr. Musk into an influential ally in trying to persuade Mr. Trump to take a more conciliatory approach on trade.

“When Chinese leaders have an important message to convey to President Trump, Elon Musk would clearly be the best conduit,” said Michael Dunne, a longtime China automotive consultant now based in San Diego.

Competition from China is getting tougher.

Many of Mr. Musk’s other companies, including his ventures in solar energy and large batteries, face formidable competition from Chinese businesses. Some of his businesses might benefit from a decoupling of the Chinese and American economies. Steep tariffs, initially imposed by Mr. Trump in his first term and increased by President Biden, have stopped a push by Chinese automakers into the American market.

“Frankly, I think if there are not trade barriers established, they will pretty much demolish most other companies in the world,” Mr. Musk said on a Tesla earnings call in January.

Practically all of Mr. Musk’s rivals in Silicon Valley and Seattle have focused on digital technologies, but Mr. Musk has built factories in high-tech manufacturing industries.

Mr. Musk is competing in global industries that the Chinese government finances heavily — not only electric vehicles but also batteries, solar energy and space launches. China’s state-controlled banking system ramped up net lending to industry to $670 billion last year from $83 billion in 2019.

“In just about every area where his companies focus, there are many Chinese competitors,” said Scott Kennedy, a Chinese business and economics specialist at the Center for Strategic and International Studies in Washington. “He is basically in industries where the Chinese are the opponents as opposed to his partners.”

Mr. Musk’s rocket company, SpaceX, which tested its giant Starship on Tuesday with Mr. Trump among the guests, faces emerging rivalries with state-linked Chinese companies that also want to offer launches. Tesla Energy produces large battery packs used by electricity grids for energy storage in combination with solar or wind power, in a growing market otherwise dominated by China.

China is now the world’s main supplier of solar panels, but Tesla Energy, in partnership with Qcells of South Korea, still has a foothold in that sector. And at a time when China produces most of the world’s giant tunneling machines for the construction of subways, water systems and military bases, Mr. Musk has established his own Boring Company in southern Texas.

Tesla is still waiting on approval for full self-driving.

Mr. Musk faces tough competition from China in most of his businesses, but the electric car sector is more complicated.

In addition to being a critical consumer market for Tesla, China is home to the company’s biggest single assembly plant, built in less than a year.

That factory, in Shanghai, also supplies much of the European market after the company encountered political obstacles and even arson at its factory in Germany. Tesla has also imported electric car battery packs from China to the United States to supplement its own production in Nevada.

Chinese regulators have not yet allowed Tesla to introduce Full Self-Driving on Chinese roads. But numerous Chinese companies, including Nio, Huawei and Baidu, have been allowed to introduce similar or more advanced alternatives. Premier Li, who met with Mr. Musk in the spring, helped Tesla rush its factory construction in Shanghai five years ago when he was the city’s Communist Party secretary. Still, Tesla is awaiting approval for its latest self-driving technology.

Tesla is “at a complete disadvantage in the Chinese market because they don’t have an intelligent driving system,” said Tu Le, the managing director of Sino Auto Insights, a Detroit consulting firm specializing in China’s automotive sector.

When Tesla’s cars became available in large numbers in 2020, their instant popularity transformed the Chinese car market by making electric vehicles seem fashionable and appealing, said Bill Russo, an electric car consultant in Shanghai.

Since then, state-controlled banks have lent billions of dollars at low interest rates to Chinese automakers, which have used the money to wage fierce price wars that have wrecked profit margins. Tesla has participated in the price competition, but its China sales have grown more slowly than those of its local rivals.

Like most American businesses in China, Tesla faces potential political risks, even with Mr. Musk’s close relationship with Mr. Trump.

Citing national security, the Biden administration has begun a regulatory proceeding to prohibit the import or sale in the United States of cars from China or Russia with connections to digital networks. If that proceeding continues in the Trump administration and results in a ban on such cars, Chinese regulators could retaliate by limiting Tesla cars, which rely on extensively photographing their surroundings to provide even basic driving assistance.

China has already banned Tesla cars in some sensitive locations, like military bases.

The biggest question for Mr. Musk’s influence on Sino-American commercial relations lies in how long his alliance with Mr. Trump will last. Mr. Musk contributed more than $100 million to Mr. Trump’s election effort. But some analysts already question whether their friendship can endure long enough to make a difference.

“The largest two egos in the world are eventually going to have a falling-out,” Mr. Le said.

Keith Bradsher is the Beijing bureau chief for The Times. He previously served as bureau chief in Shanghai, Hong Kong and Detroit and as a Washington correspondent. He has lived and reported in mainland China through the pandemic.

Sorry, the comment form is closed at this time.