30 Nov China’s Auto Market – November 2024

Posted at 14:46h

in

Newsletter

by editor

Written by Bill Russo, Founder & CEO of Automobility Ltd.

WHERE WE STAND IN 2024

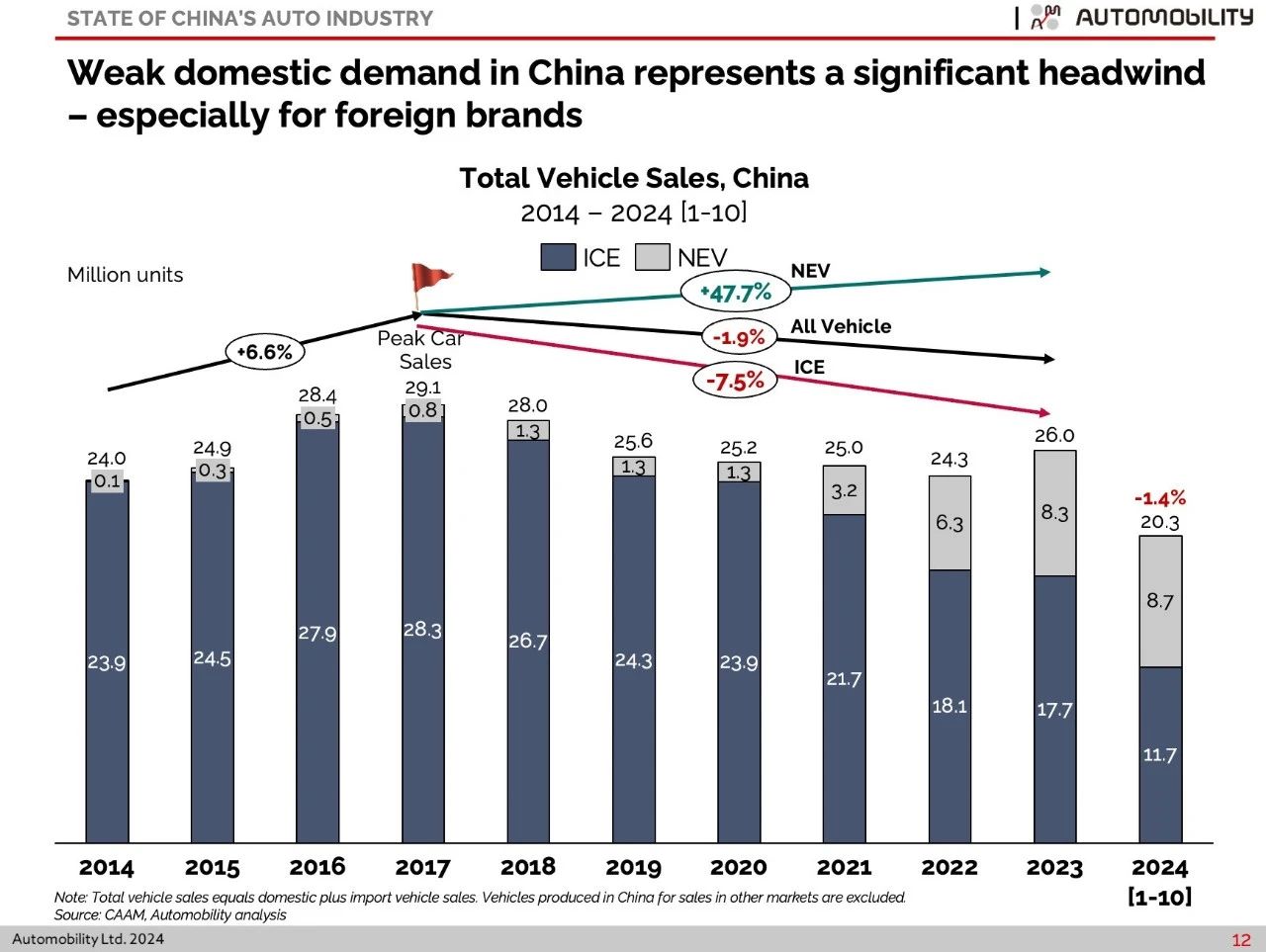

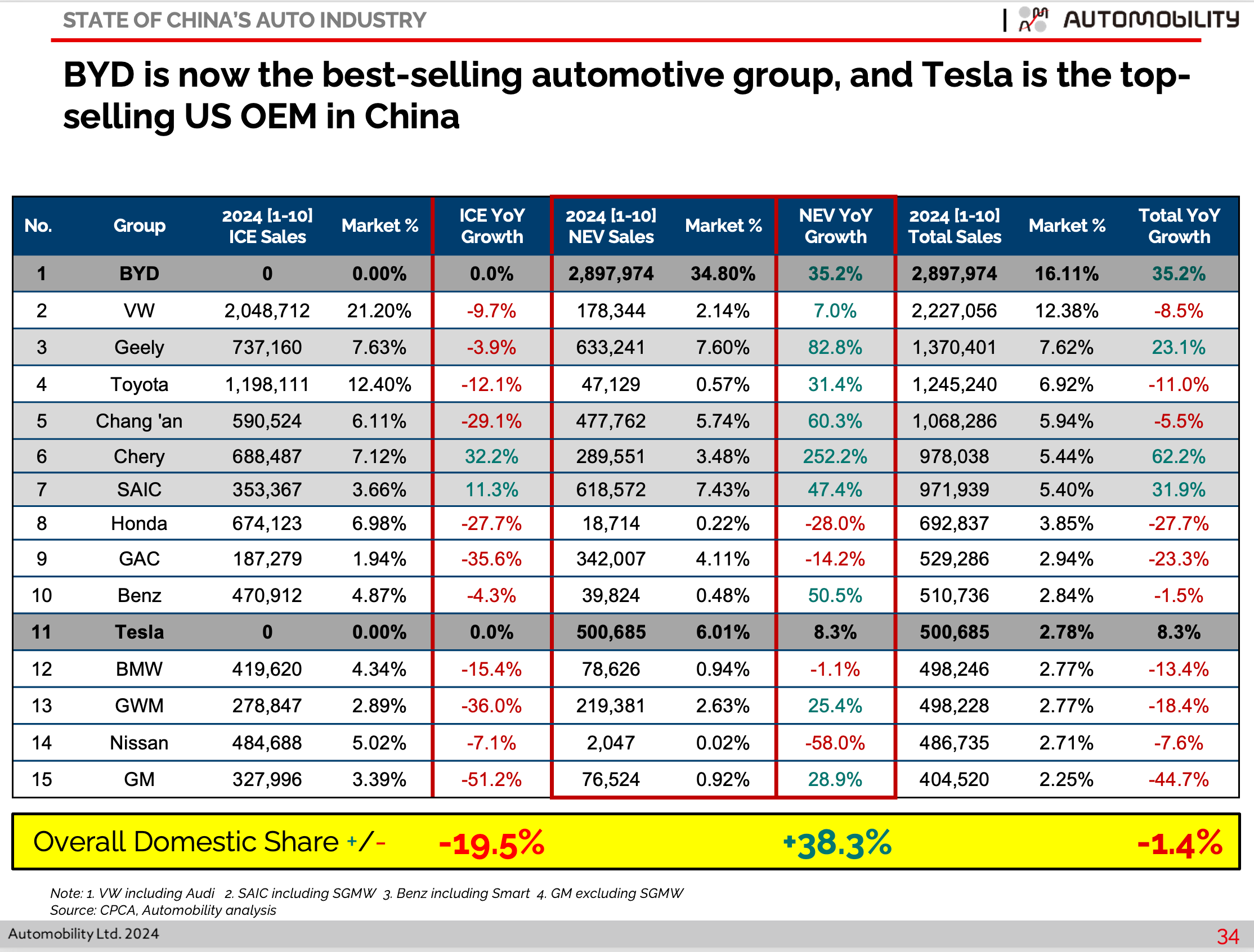

- Overall domestic sales declined 297k units (-1.4%) over the first ten months compared with last year.

- Sales of New Energy Vehicles are up 38.3% (+2.4 Mn), while sales of pure Internal Combustion Engine (ICE) powered vehicles are down 19.5% (-2.7 Mn) over the first ten month compared with last year.

- Passenger vehicle NEV share was over half of new car sales for each month since July.

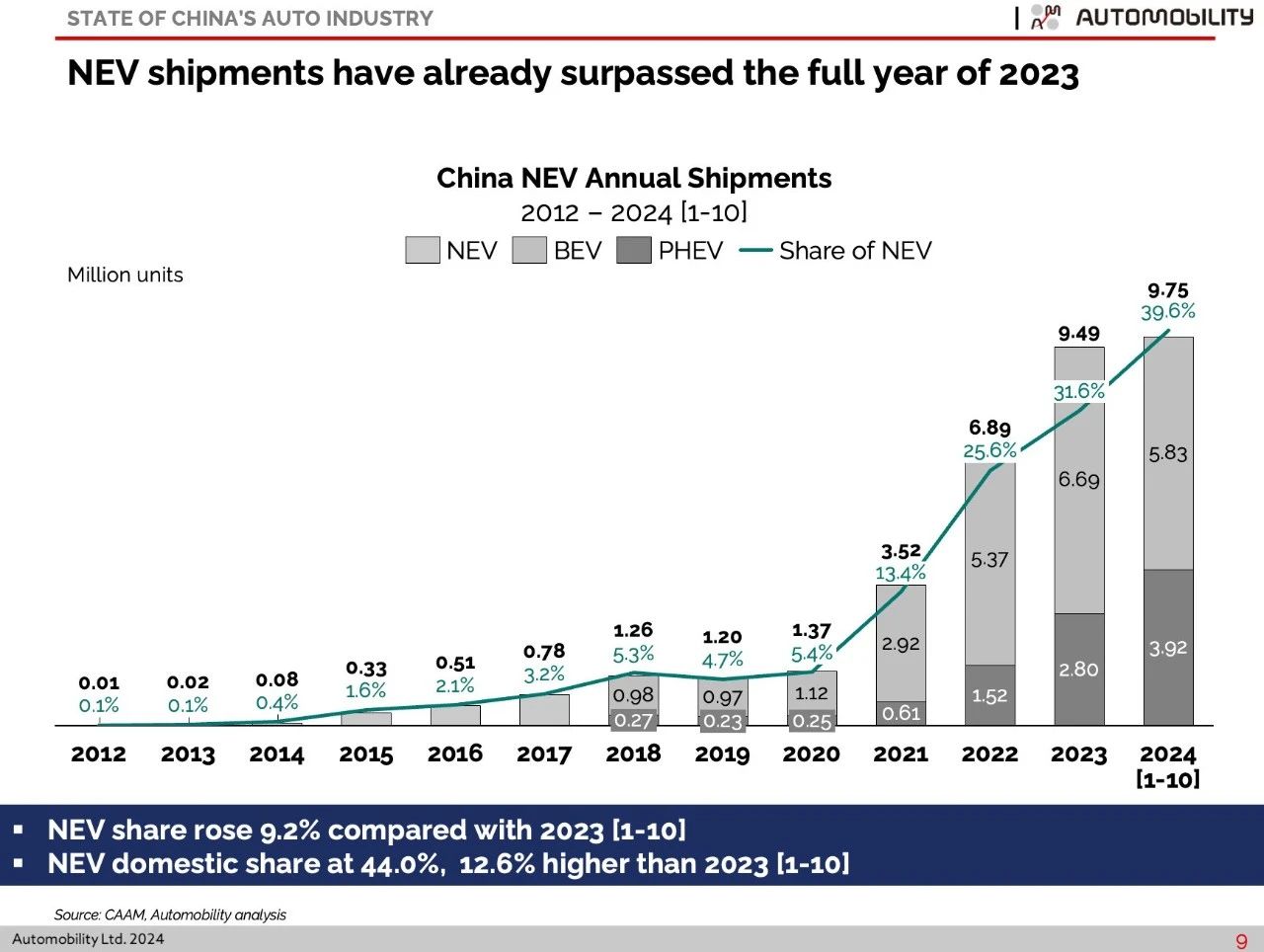

- NEV total shipments (9.8 Mn) as well as NEV domestic sales (8.7 Mn) have surpassed the full year 2023 totals.

- Battery Electric Vehicle (BEV) deliveries set a new monthly volume record for at 842,000 units.

- Plug-in Hybrid Electric Vehicle (PHEV) deliveries set a new monthly volume record for the 6th consecutive month at 587,000 units.

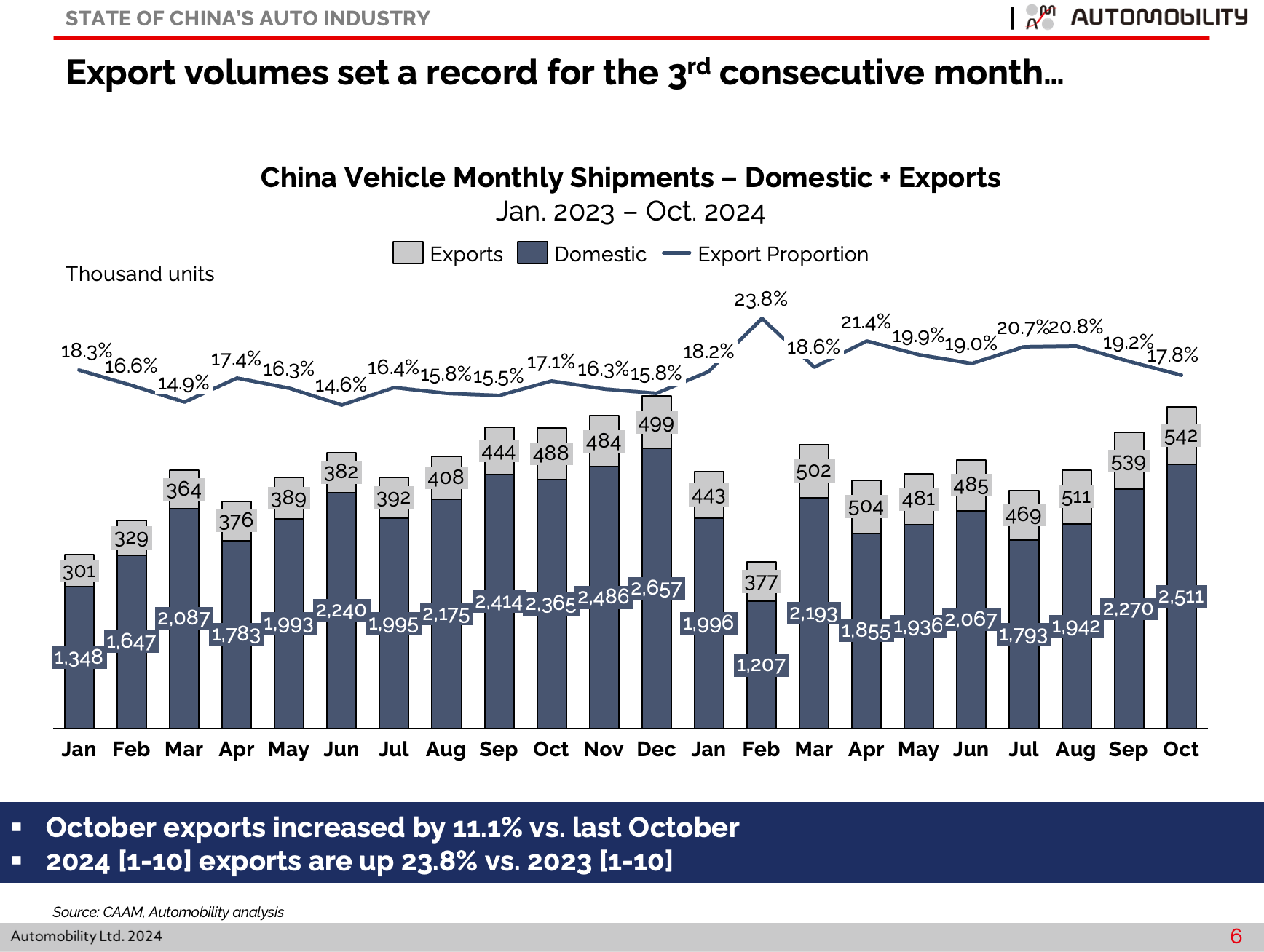

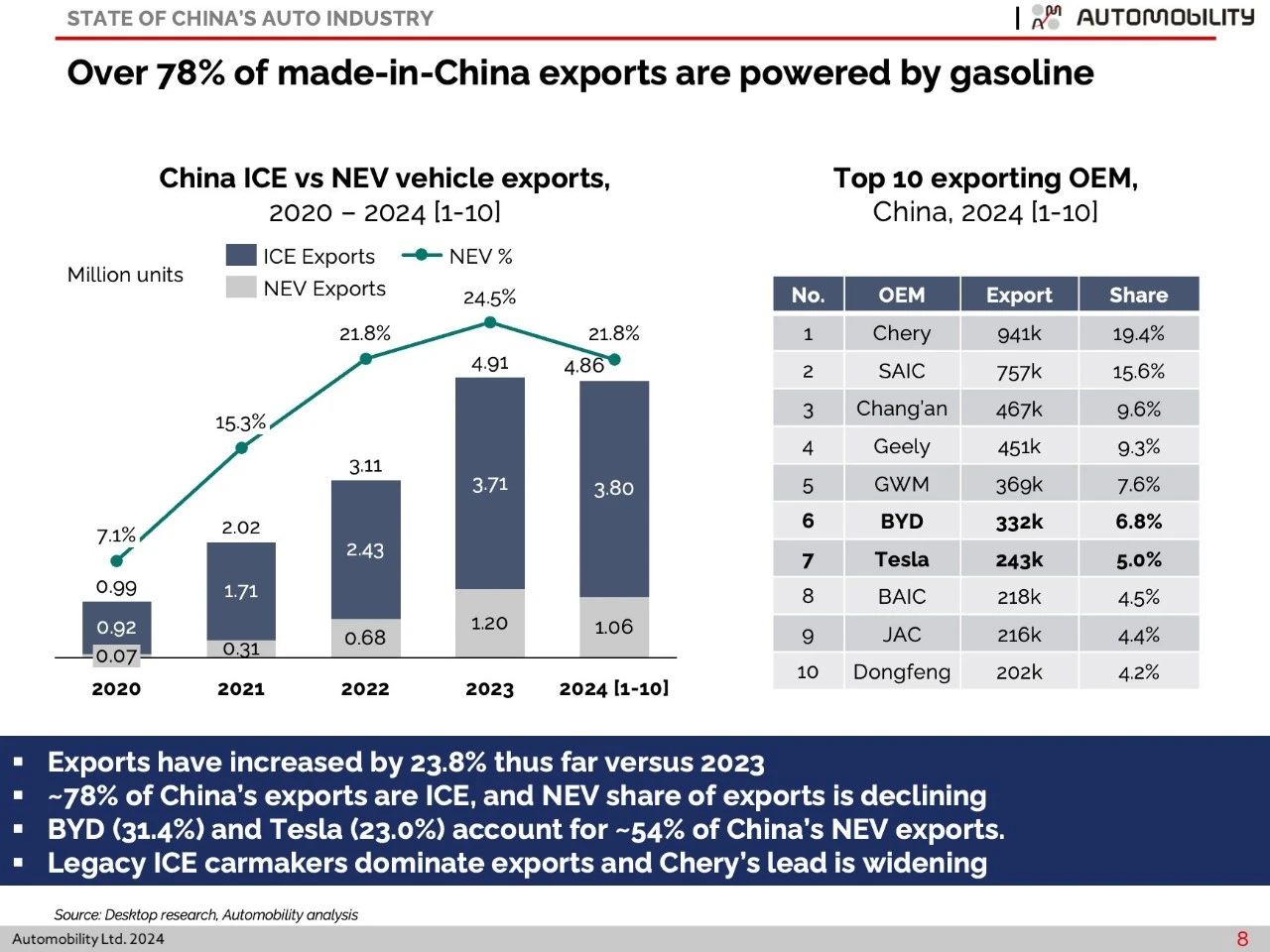

- Made-in-China vehicle exports are up 23.8% in 2024, and exports of ICE vehicles (3.8 Mn) surpassed the full year 2023 totals and represent 78.2% of Made-in-China exports.

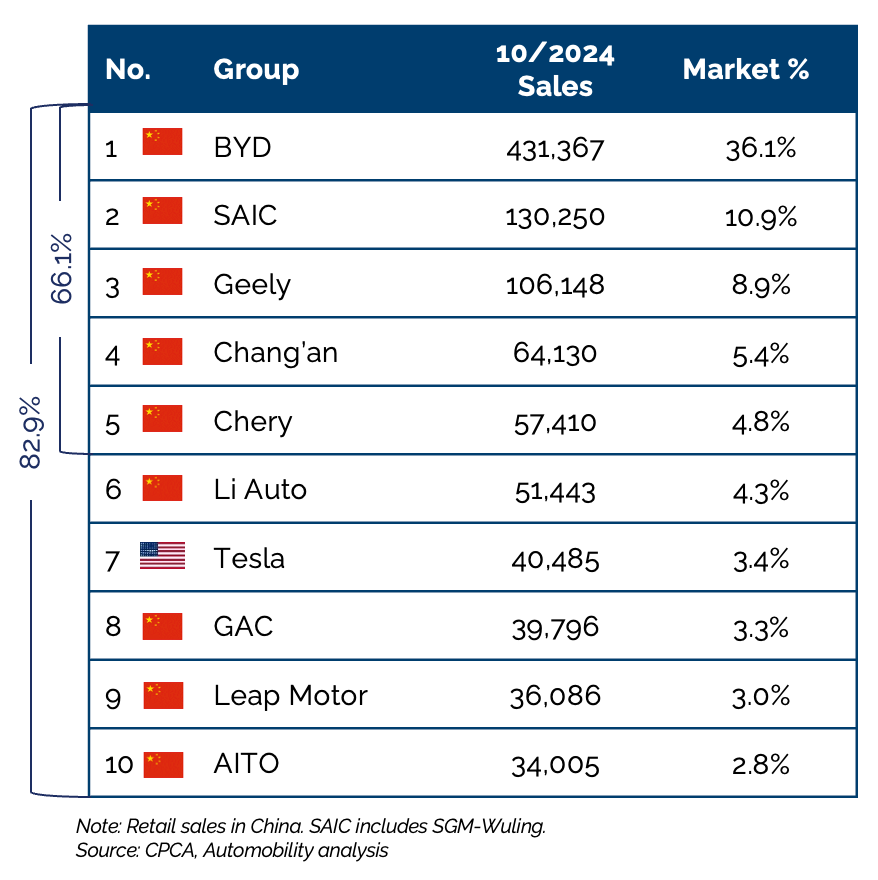

- BYD had it best sales month, with ~431,000 domestic sales across all its group brands. BYD’s full year domestic NEV share is 35.2%.

Collapsing ICE sales in China

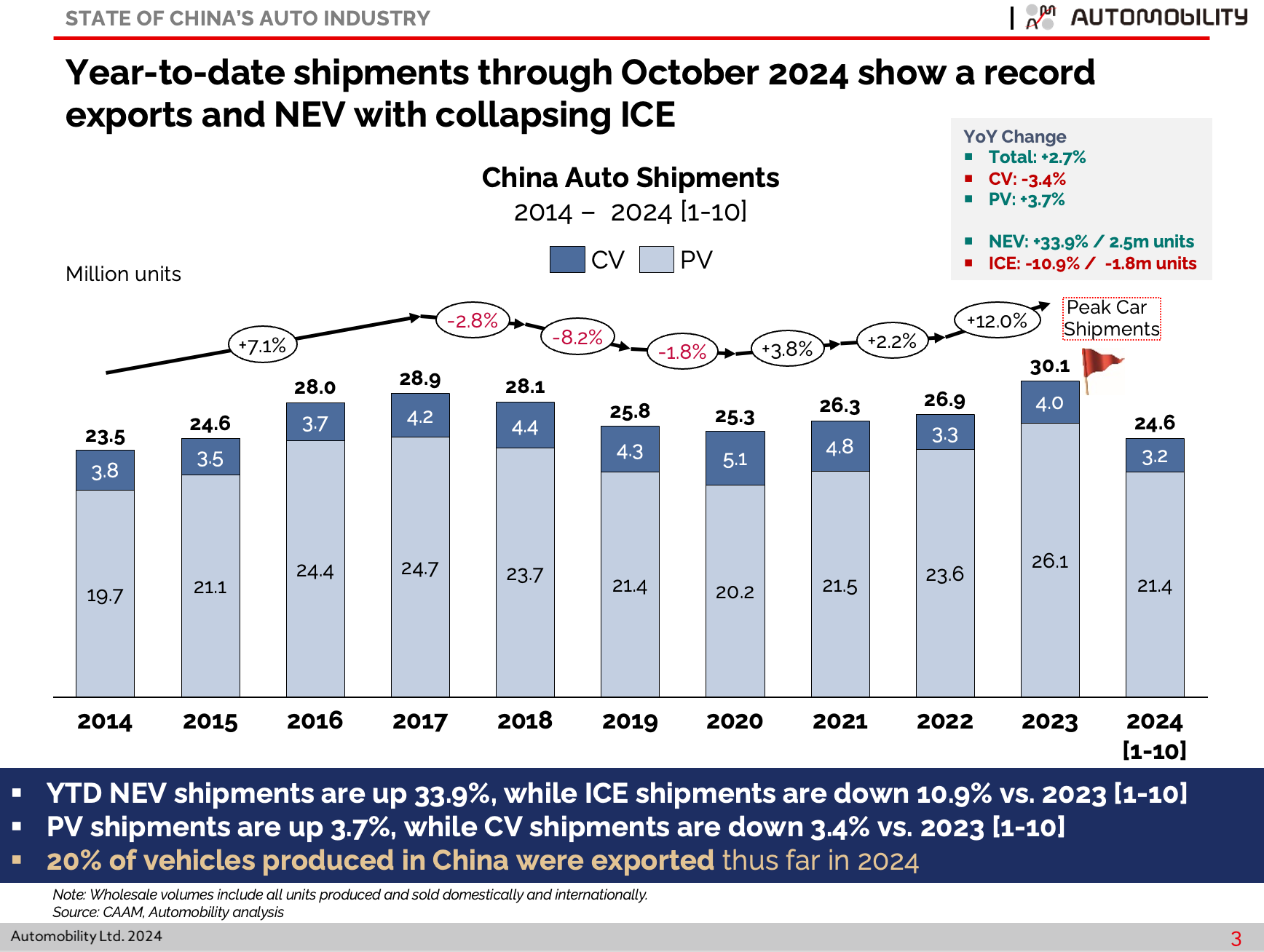

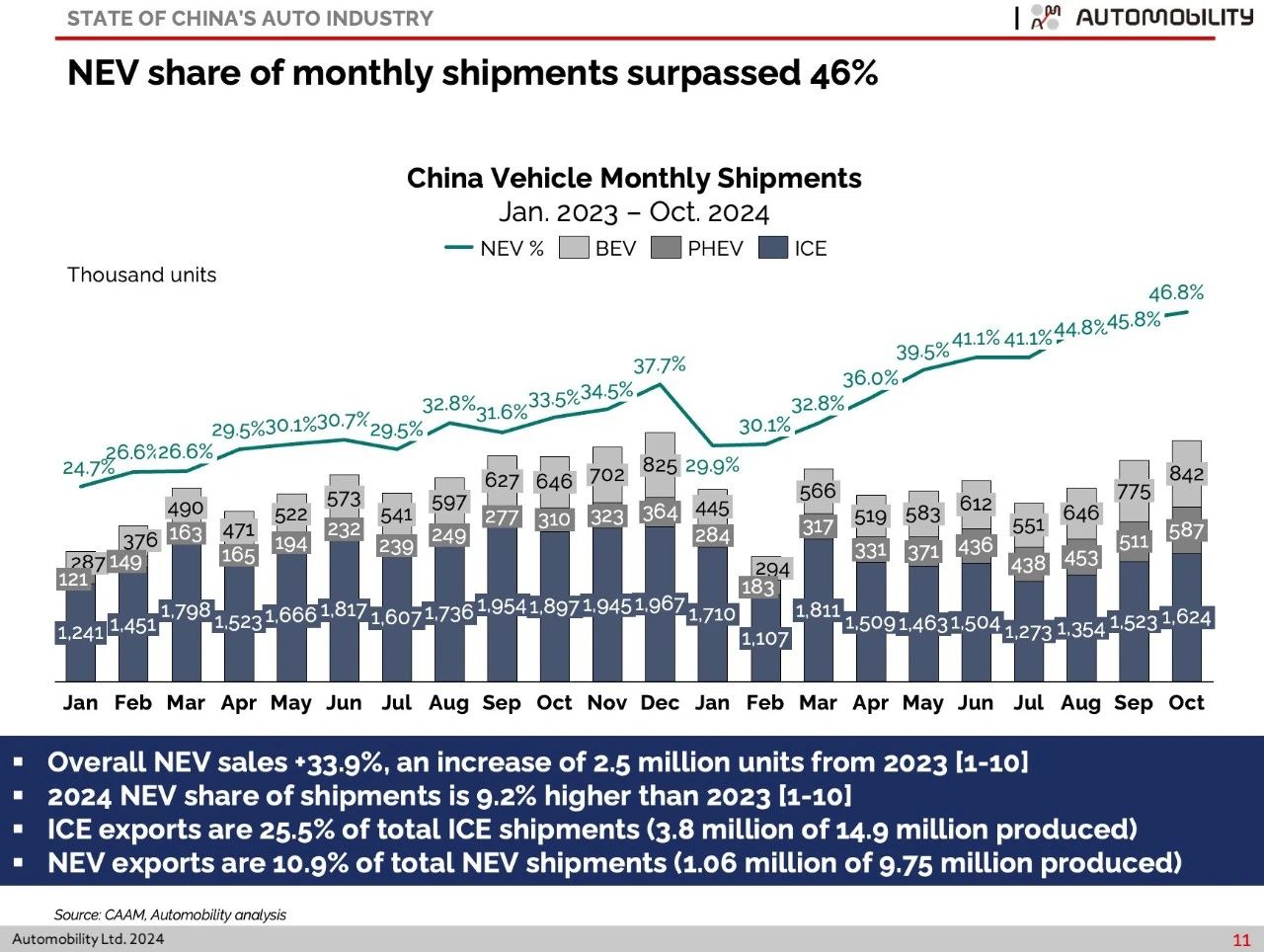

To understand the dramatic change that has occurred in the auto market since 2020 we need to drill down below the top-line numbers. Ex-factory vehicle shipments are up 2.7% through October, and the growth is driven by a 33.9% increase in NEV shipments plus a 23.8% rise in exports versus the same period from last year. Internal Combustion Engine (ICE) vehicle shipments are down 10.9%.

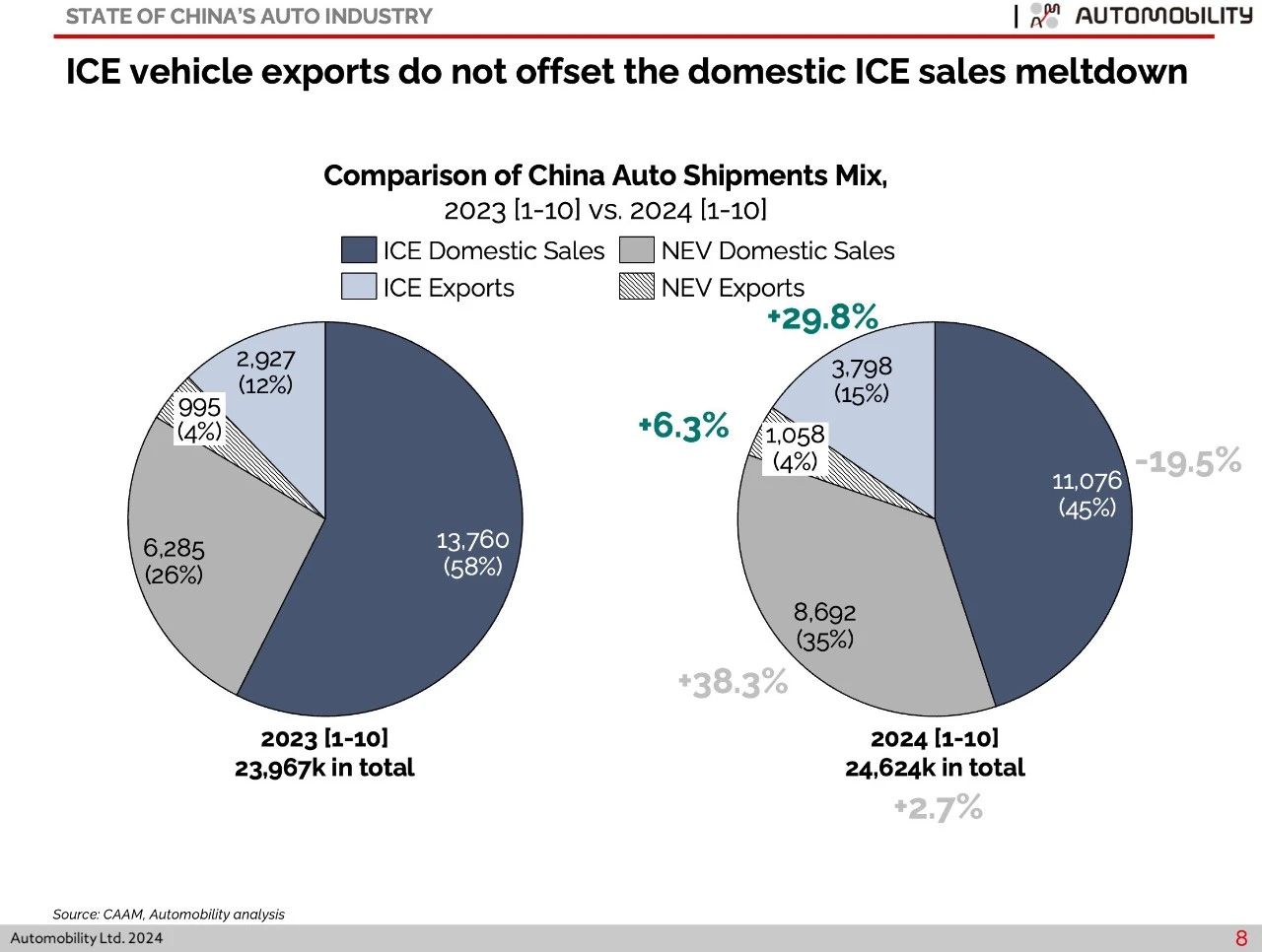

The 24.6 million cars and trucks produced through October includes ~4.86 million Made-in-China (MIC) vehicles exported from China (~20% of total production volume). Of these exports, 78.2% were powered by an ICE engine.

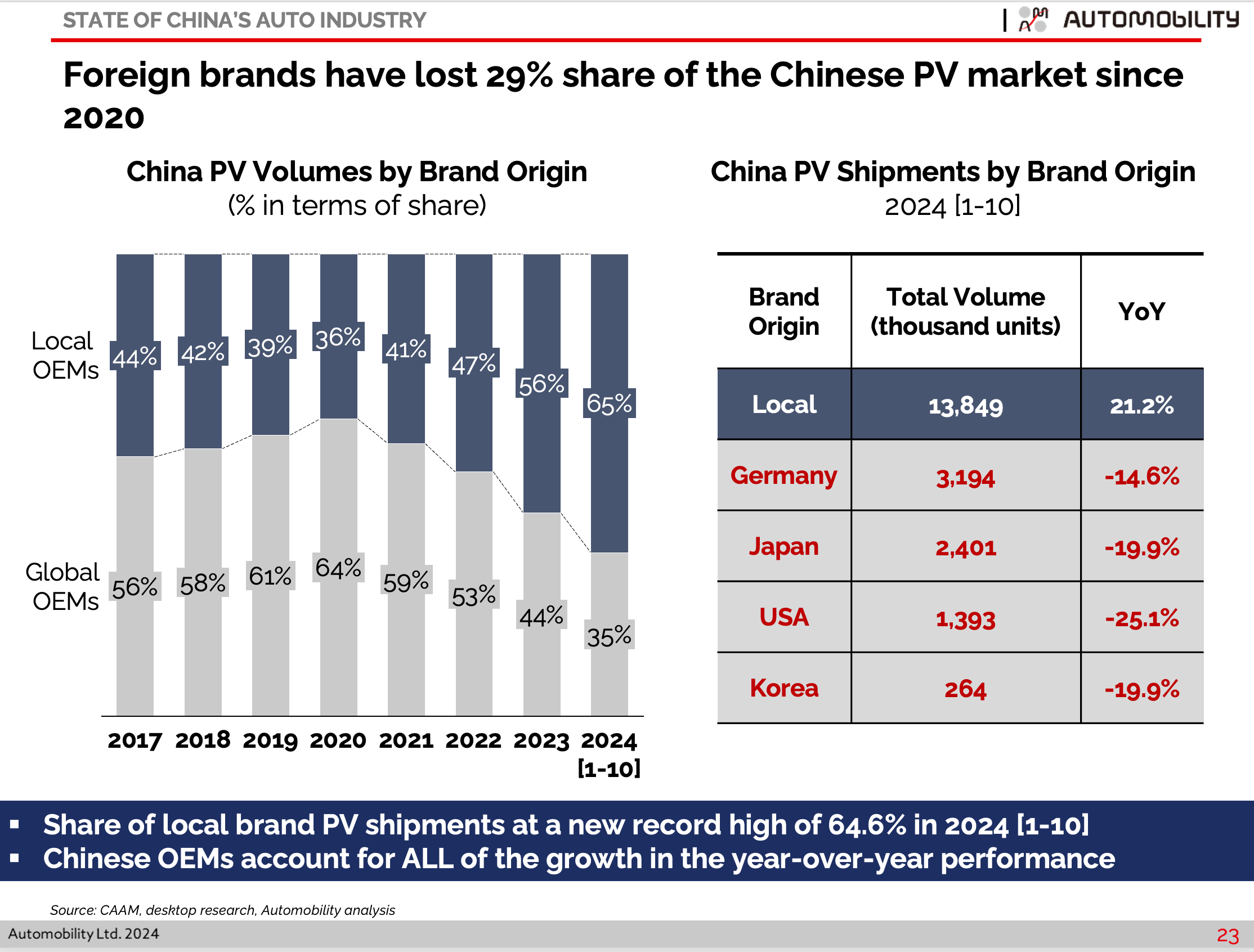

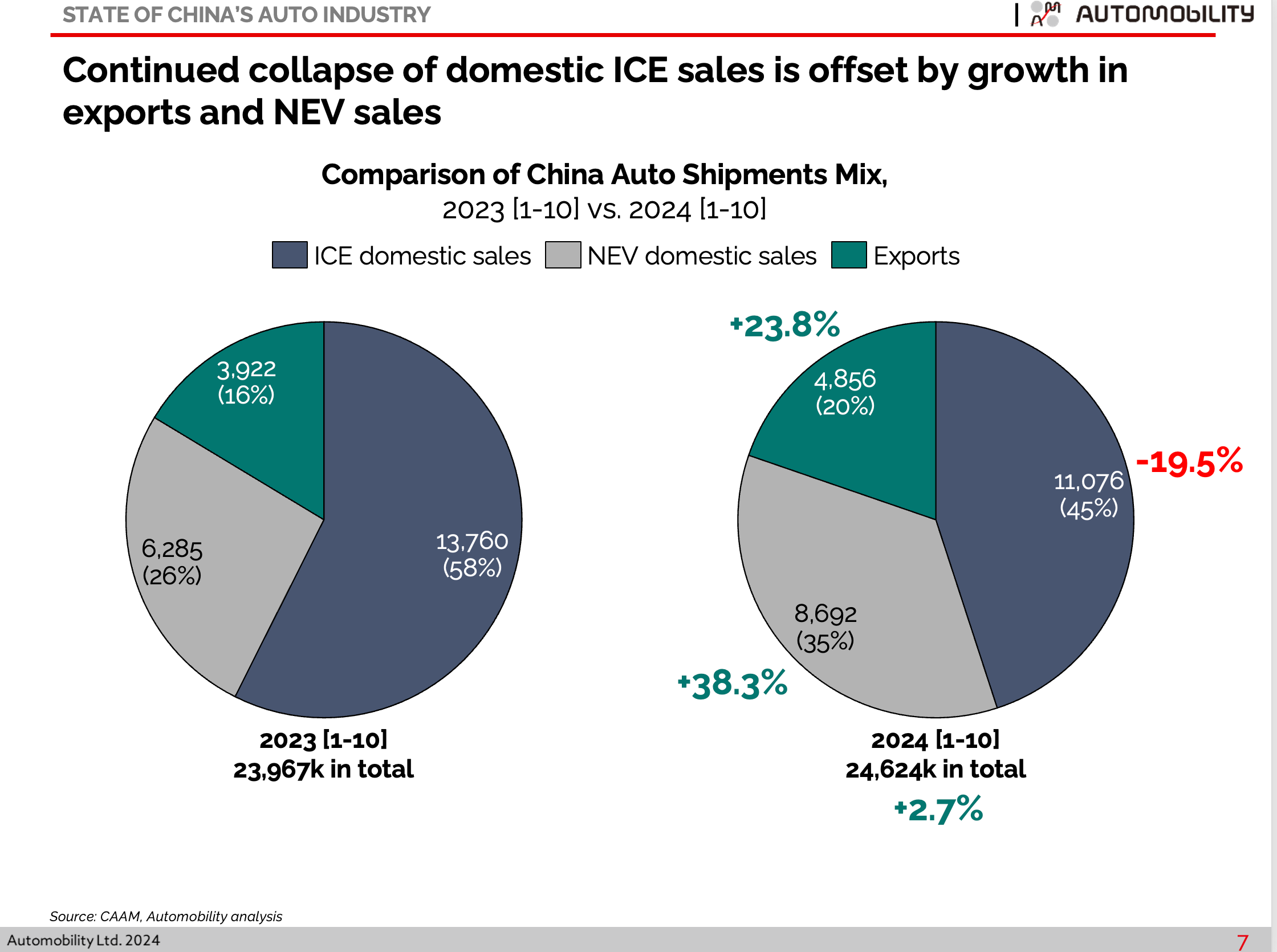

Ex-factory shipment volumes between 2023 and 2024 over the ten month period are compared in the pie charts below. Domestic ICE sales collapsed by 19.5%, a loss of 2.7 million units from last year. Domestic ICE sales are now just 45% of shipments, down 13% from the same period of 2023.

During this period, domestic New Energy Vehicle (NEV) sales grew by 2.4 million units, and exports expanded by 934,000 units which explains the slight improvement in overall shipments. Exports have become the safety valve to release the oversupply pressure, especially for ICE vehicles which have become increasingly less popular in China.

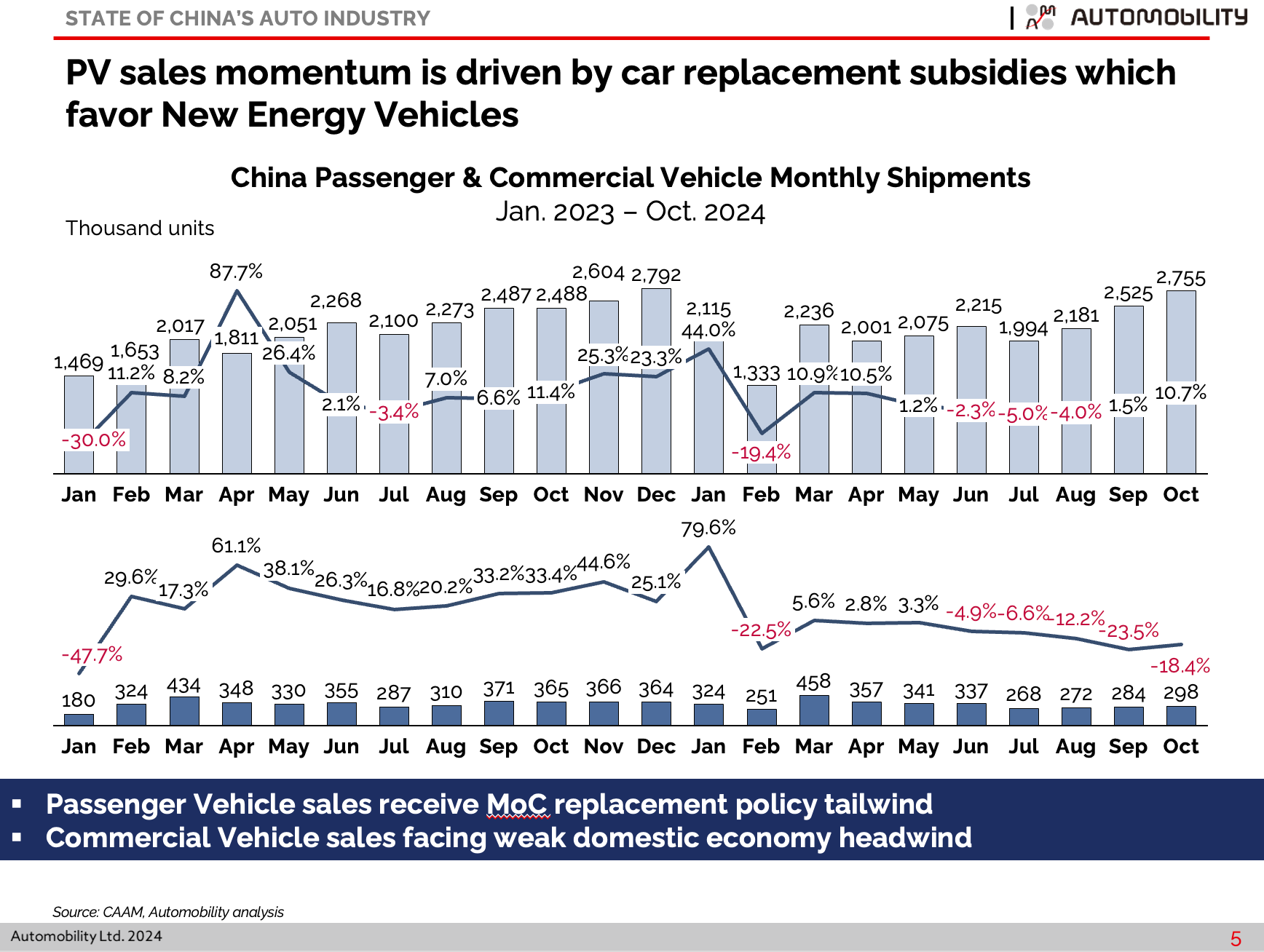

Passenger vehicle shipment volumes were up 10.7% year-over-year in October, as the Ministry of Commerce implemented a vehicle replacement subsidy in the second half of the year to spark sales in an otherwise weak Chinese market. Commercial vehicle sales remain weak and were down 18.4% year-over-year.

Made-in-China (MIC) export volumes are at record levels for the 3rd consecutive month at 542,000 units. Whole vehicle exports are up over 11% from last year’s October and will set an new annual record in November, as China pulls further ahead of Japan as the top automotive export nation on the planet.

The year-over-year loss of 2.7 million domestic ICE sales is only partially offset by an increase of 871,000 ICE exports. Through October, 1.8 million fewer ICE cars were shipped from factories in China in 2024.

Made-in-China exports totalled 4.86 million units through October, and will surpass the last year’s record this month. Chery is the top Made-in-China exporter by an widening margin over SAIC. BYD and Tesla produced more than half of the ~1.1 million NEV exports this year.

Record Domestic NEV Volumes

NEV shipments stood at nearly 9.8 million units through October, setting a new record for a calendar year. Nearly 40% of all cars manufactured in China this year were NEVs.

NEV shipments set a single month record at 1.43 million units, with record monthly volumes for both BEVs and PHEVs. PHEV volumes set sixth consecutive monthly record, at 587,000 units shipped. BEV volumes broke the record set last December, with 842,000 units shipped.

Sales Summary through 3rd Quarter

Domestic sales are down 1.4% through October. However, NEV sales broke the full year record set last year. NEVs represent the majority of vehicles sold in the China domestic market in the second half of 2024.

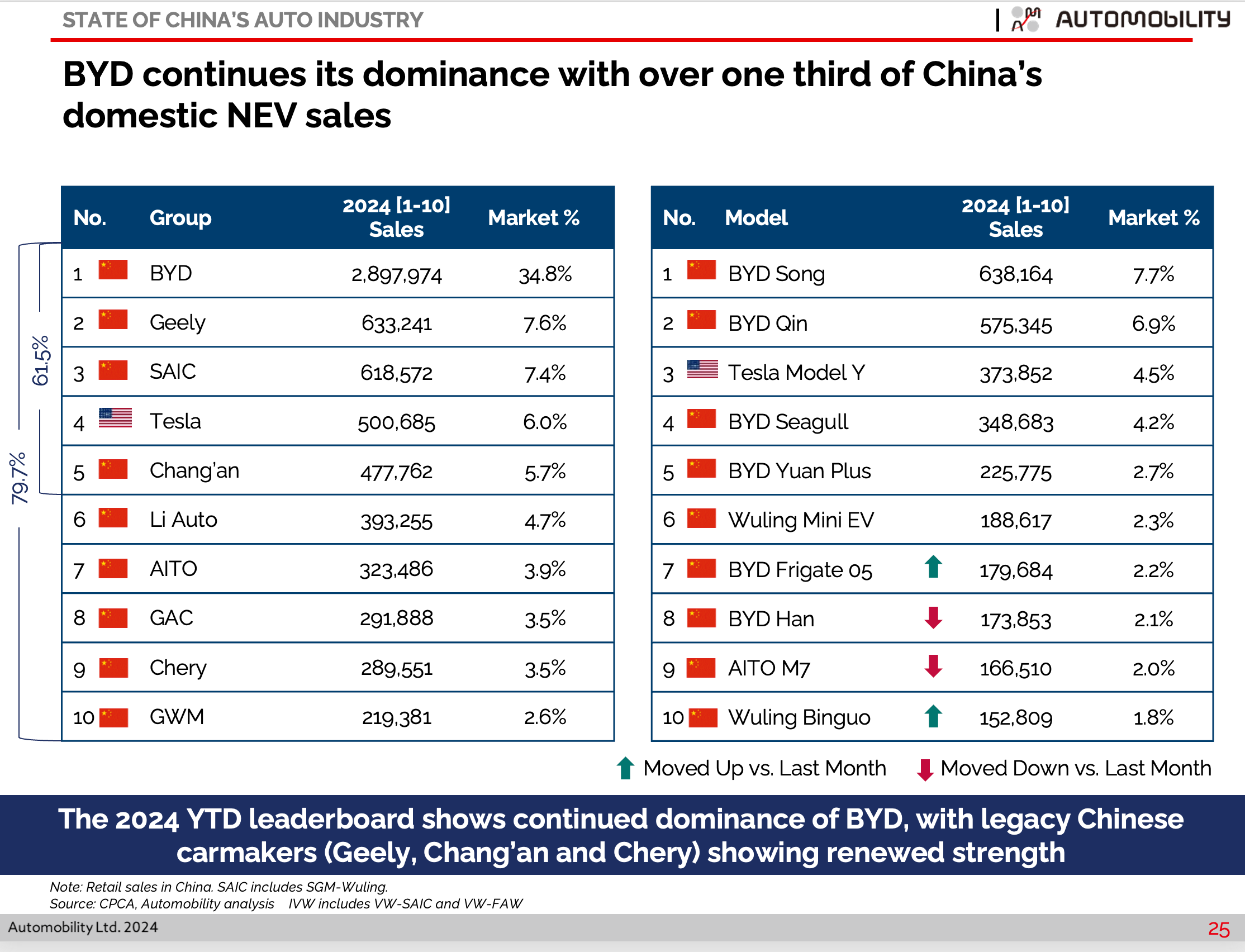

BYD reinforced its dominant position with a staggering monthly sales performance of 431k units in October, representing over 36% of NEVs sold. The top 5 companies took two-thirds of the NEV market. All five are local legacy ICE carmakers, underscoring that the market is open for companies that pivot from their ICE origins.

For the full year through October, BYD dominates with ~35% share and 6 of the top 10 best selling vehicles in 2024. Tesla is the only non-Chinese carmaker on the NEV sales top 10 leaderboard.

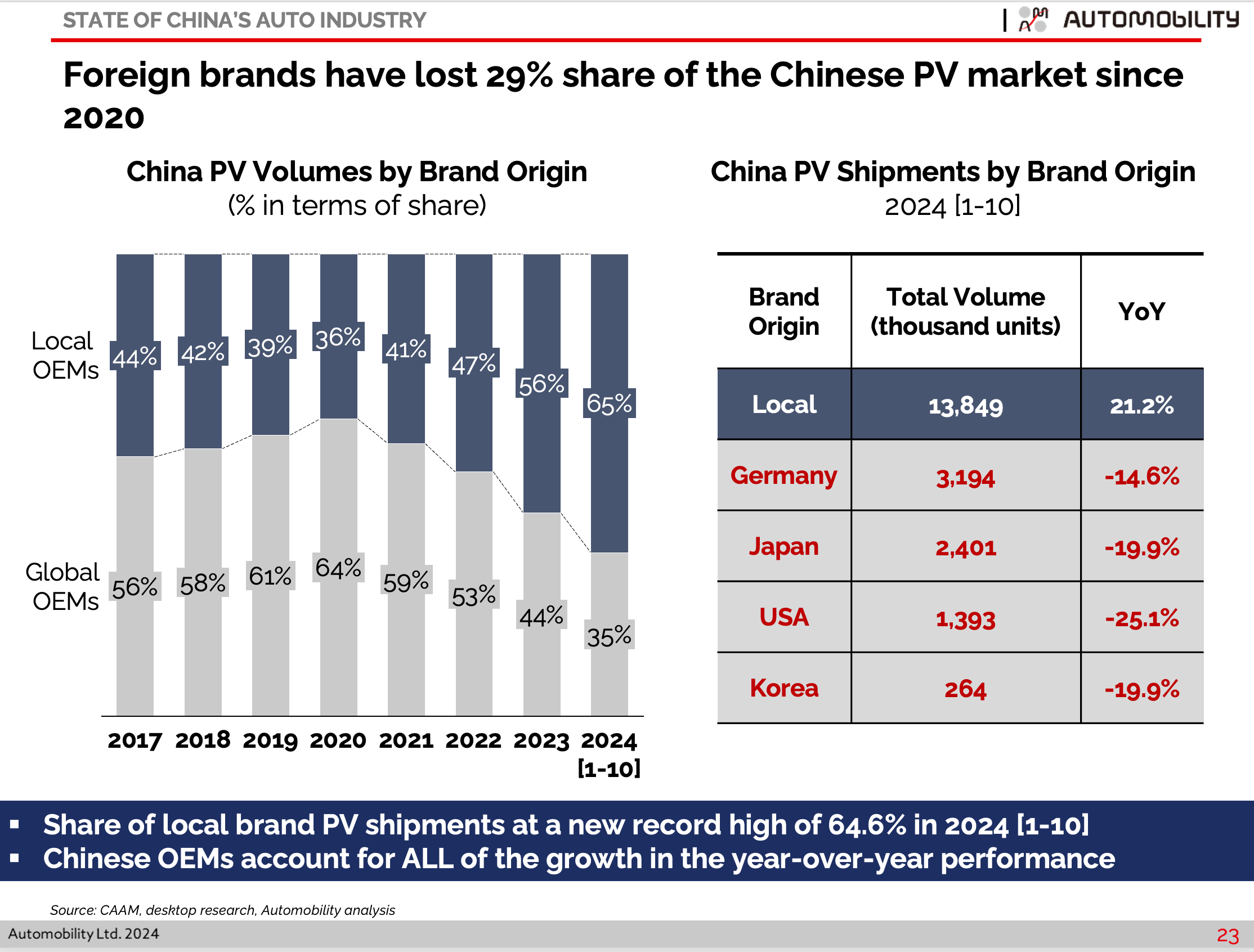

The End of Foreign Brand Dominance in China

Putting the full picture together, it is clear that the domestic ICE market is in free-fall, sweeping away the foreign brand dominance of the China auto market. Looking across segments, we conclude that only a handful of local brands have been able to sustain performance as the market declines and shifts to NEVs. Only BYD, Geely, Chery, SAIC and Tesla have outperformed the domestic market’s -1.4% performance. However, Tesla’s 8.3% growth is far below the NEV segment’s 38.3% expansion. Tesla’s market share in China stands at ~6%.

Remarkably, Chery and SAIC have managed to grow their domestic sales volumes across both the ICE and NEV segments. Both companies are also the leading Made-in-China exporters.

As a net result of their lack of relevancy in the higher growth NEV segment, foreign brands ceded 29% share to the local brands – who now sell 65% of all passenger vehicles in China.

Premium and ultra luxury European brands are not immune to the shift. As noted here, all of the import carmakers, long considered the most aspirational brands among Chinese consumers, have lost their appeal in China this year.

Join us on Tuesday, December 17 at 9am China time for our monthly State of China Auto Market webinar, hosted by the American Chamber of Commerce in Shanghai.

Webinar | State of China Auto Market Monthly Briefing (December) | AmCham Shanghai (Scan the below QR to register)

Automobility Original Article on Autonomous Mobility

We recently published another original article describing how the China market is about the enter the next wave of technology acceleration: The Third Wave of Disruption: Autonomous Mobility on Demand.

The article is also available in Chinese: 汽车产业智能化变革的第三次颠覆性浪潮:自动驾驶按需出行

The rapid evolution of the internet economy and its intersection with automotive advancements have significantly shaped the automotive landscape in China. However, what happens in China will not stay in China. As the world’s largest automotive market, disruptions emanating from China are profoundly influencing global auto industry dynamics. To remain competitive and relevant in this evolving landscape, it is crucial to adopt a user-centric mindset and embrace a more service-oriented approach to mobility. This approach will be key to navigating the future of transportation, as we move towards a more connected, electrified, and autonomous Automobility 3.0 era.

This article was also published by Sense Media Group in advance of their November AutoSens China event, which will be held from November 19-21 in Hefei, China.

You can find our article on the AutoSens website, which also includes information on upcoming events.

Please copy and paste the link to your browser: https://auto-sens.com/the-third-wave-of-disruption-autonomous-mobility-on-demand/

- EV industry watching Musk’s role in tariff fixing

“As Elon Musk played a very important role in funding Trump’s campaign, he will no doubt have the ear of the U.S. president and play a role that will help shape policies that are advantageous to Tesla and his other businesses,” Bill Russo, founder and CEO of Automobility Limited, a Shanghai-based strategic consulting and investment platform, told VOA.

To be sure, Musk opposed U.S. tariffs on China-made EVs last May. “Neither Tesla nor I asked for these tariffs. In fact, I was surprised when they were announced. Things that inhibit freedom of exchange or distort the market are not good,” Musk said after the Biden administration enhanced tariffs on Chinese EVs.

“Tesla is in China because Elon Musk needs the scale and efficient cost structure of the Chinese supply chain to make the company more competitive around the world,” Russo said.

(Please copy and paste the link to your browser: https://www.voanews.com/a/ev-industry-watching-musk-s-role-in-tariff-fixing/7857946.html)

-

BYD: The top electric car maker that is not Tesla

“There’s demand everywhere in the world for affordability. And that’s a universal value proposition,” says Bill Russo, the founder and CEO of Automobility.

And the place that can offer that to the world right now, he adds, is China.

(Please copy and paste the link to your browser:

-

Musk Could Prove China’s Ace in Dealing With Trump

Bill Russo, China-based founder of Automobility and Chrysler’s former head in the region, said he expects such diplomacy to take place but is skeptical that Musk will get a large share of the market for autonomous Chinese EVs. “Tesla’s going to get a lane, but it’s going to be a thin lane,” he said. “Fully self-driving vehicles deployed at scale in China—good luck with that.”

(Please copy and paste the link to your browser:

-

Why Europe’s car crisis is mostly made in China

But even if China’s product-centric car industry can become a service-orientated “mobility” sector, it is uncertain whether such technology is exportable to some western countries. Consumer behaviour in Europe is different and there would be regulatory obstacles around data transfer, privacy and insurance.

“The portability of these solutions outside of China is going to be much more challenging to the Chinese companies, because the ecosystems for autonomy are built locally,” Russo says. “But that doesn’t take away from the accumulated experience of learning and training the algorithms and building the solution sets, which will commercialise much faster in China.”

(Please copy and paste the link to your browser:

You can follow us for regular updates on these online channels by scanning the QR codes:

If your organization would like a custom briefing on the State of China’s Auto Market, please reach out to us at info@automobility.io

About Bill Russo

Bill Russo is the Founder and CEO of Automobility Limited, and is currently serving as the Chairman of the Automotive Committee at the American Chamber of Commerce in Shanghai. His over 40 years of experience includes 15 years as an automotive executive with Chrysler, including 21 years of experience in China and Asia. He has also worked nearly 12 years in the electronics and information technology industries with IBM and Harman. He has worked as an advisor and consultant for numerous multinational and local Chinese firms in the formulation and implementation of their global market and product strategies.

Bill is a contributing author to the book Selling to China: Stories of Success, Failure, and Constant Change (2023), where he describes how China has become the most commercially innovative place to do business in the world’s auto industry – and why those hoping to compete globally must continue to be in the market.

About Automobility

Automobility Limited is global Strategy & Investment Advisory firm based in Shanghai that is focused on helping its clients to Build and Profit from the Future of Mobility. We help our clients address and solve their toughest business and management issues that arise in midst of fast changing, complicated and ambiguous operating environment. We commit to helping our clients to not only “design” the solutions but also raise or deploy capital and assist in implementation, often together with our clients.

Contact us by email at info@automobility.io

PLEASE NOTE: The information and analysis shared in this newsletter, including the charts and style of materials presented, is the intellectual property of Automobility Ltd. While we share it as a way to serve our existing and new clients, it is not to be used without our express consent and then only with attribution. Any publication, reproduction or other use of this material without the express written consent of Automobility Ltd is prohibited.

Sorry, the comment form is closed at this time.