31 Oct State of China’s Auto Market – October 2024

Posted at 15:36h

in

Newsletter

by editor

Comments from Bill Russo, Founder & CEO of Automobility Ltd.

WHERE WE STAND IN 2024

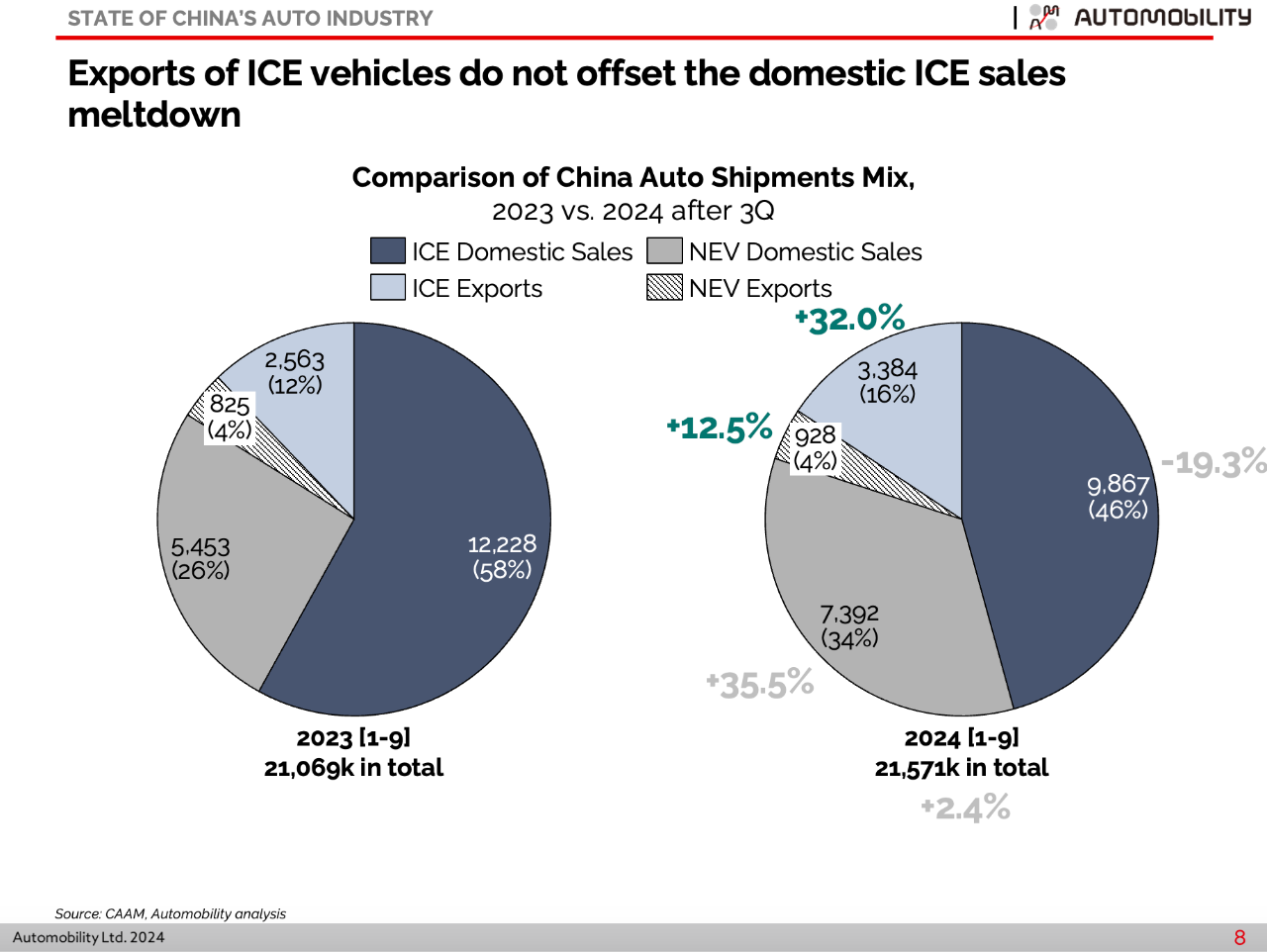

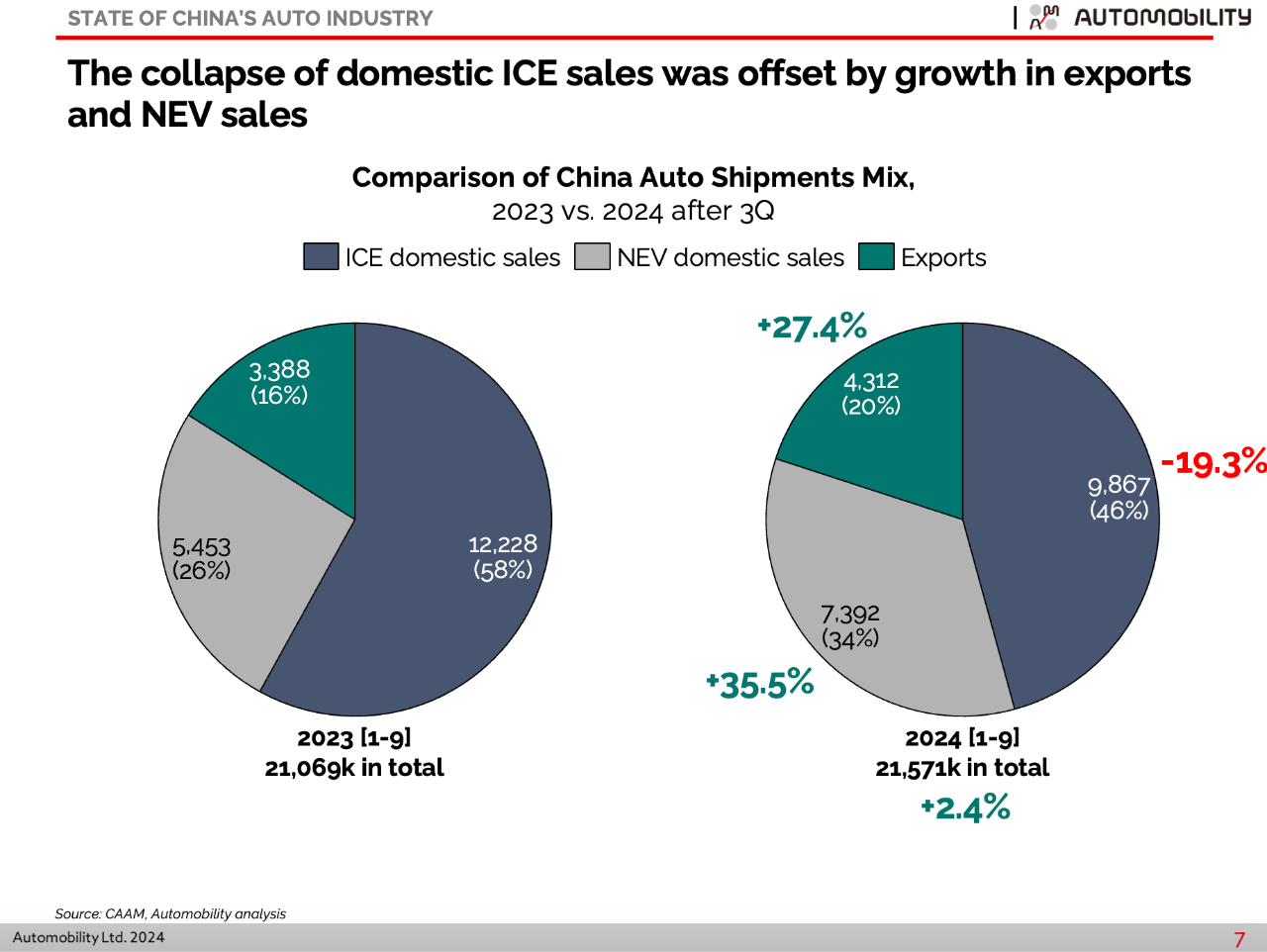

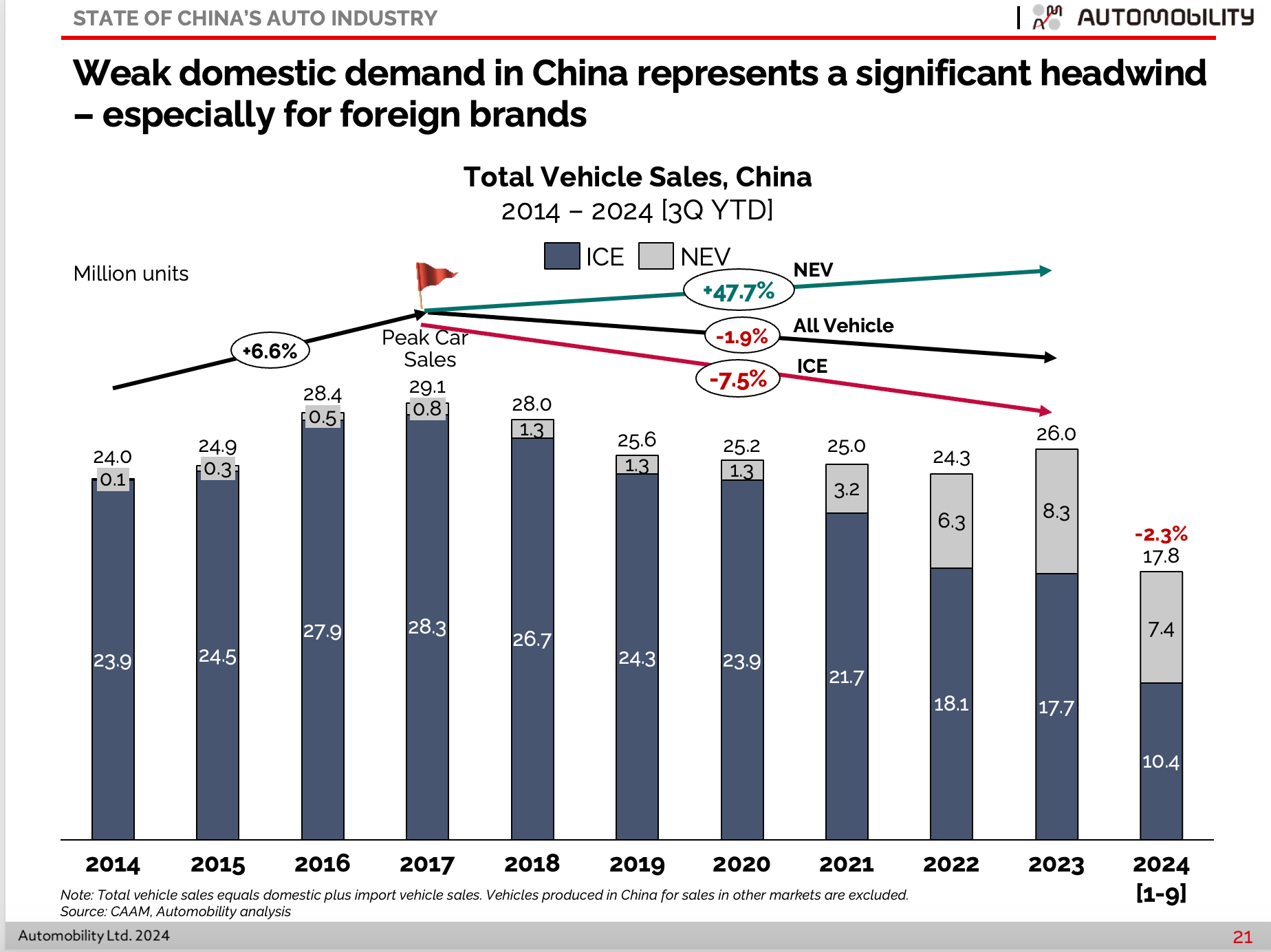

- Overall domestic sales declined 579k units (-2.3%) over the first three quarters compared with last year.

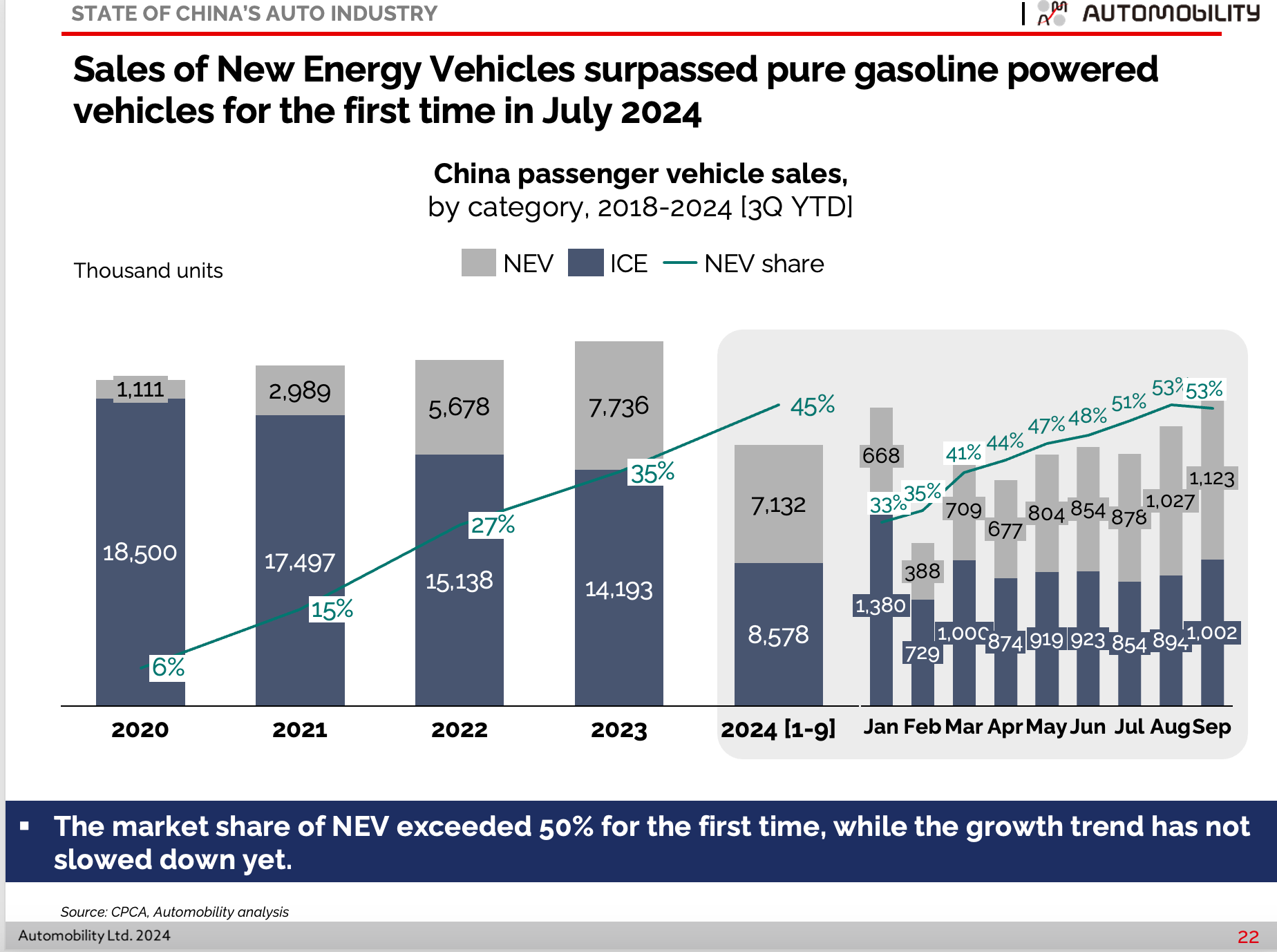

- Sales of New Energy Vehicles are up 35.5%, while sales of pure Internal Combustion Engine (ICE) powered vehicles are down 19.3% over the first three quarters compared with last year.

- Passenger vehicle NEV share was over half of new car sales for each month in the 3rd quarter of 2024

- NEV shipments in September set a new volume record at 1.29 million units

- Plug-in Hybrid Electric Vehicle (PHEV) deliveries set a new record for the 5th consecutive month at 511,000 units

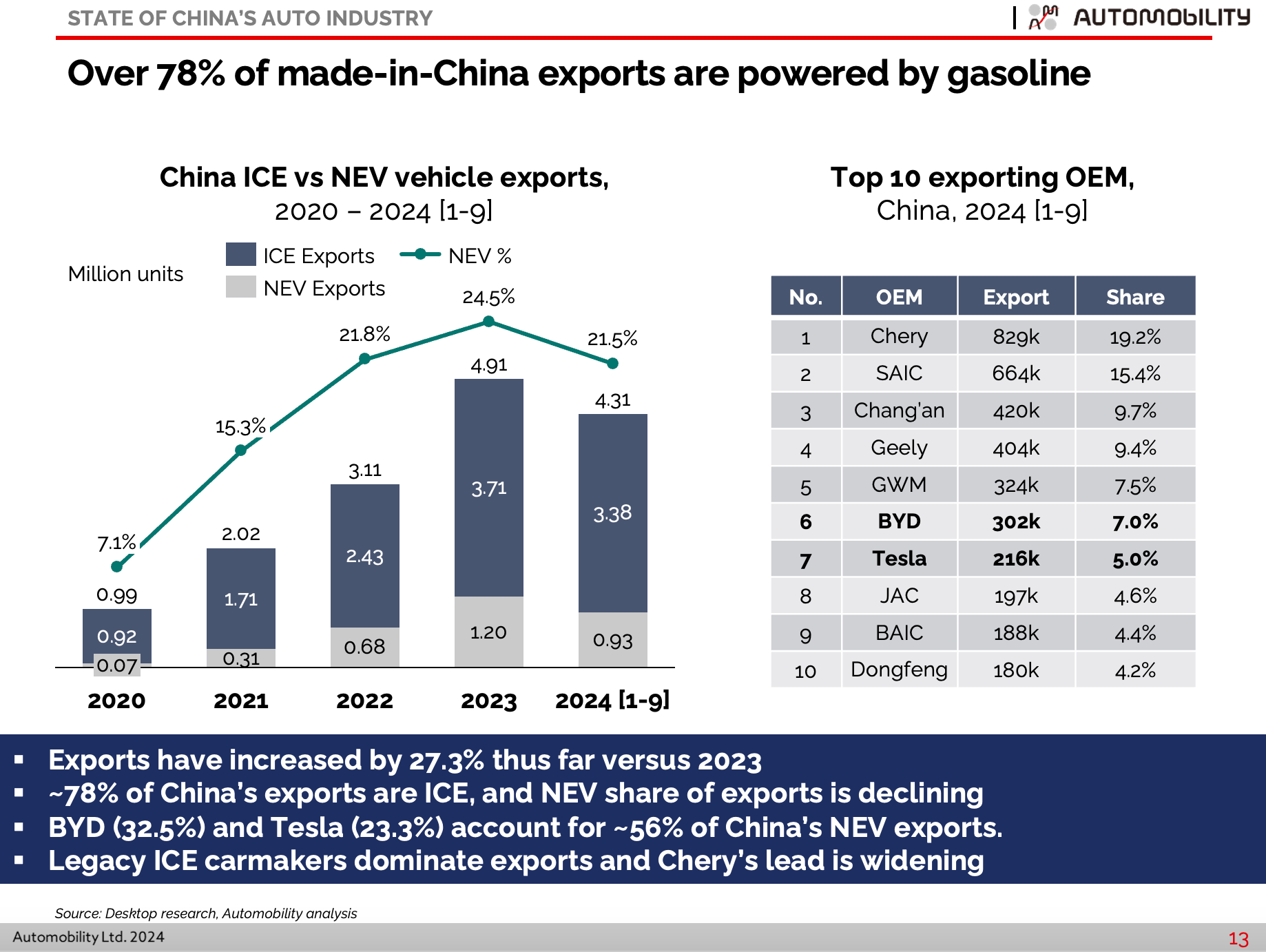

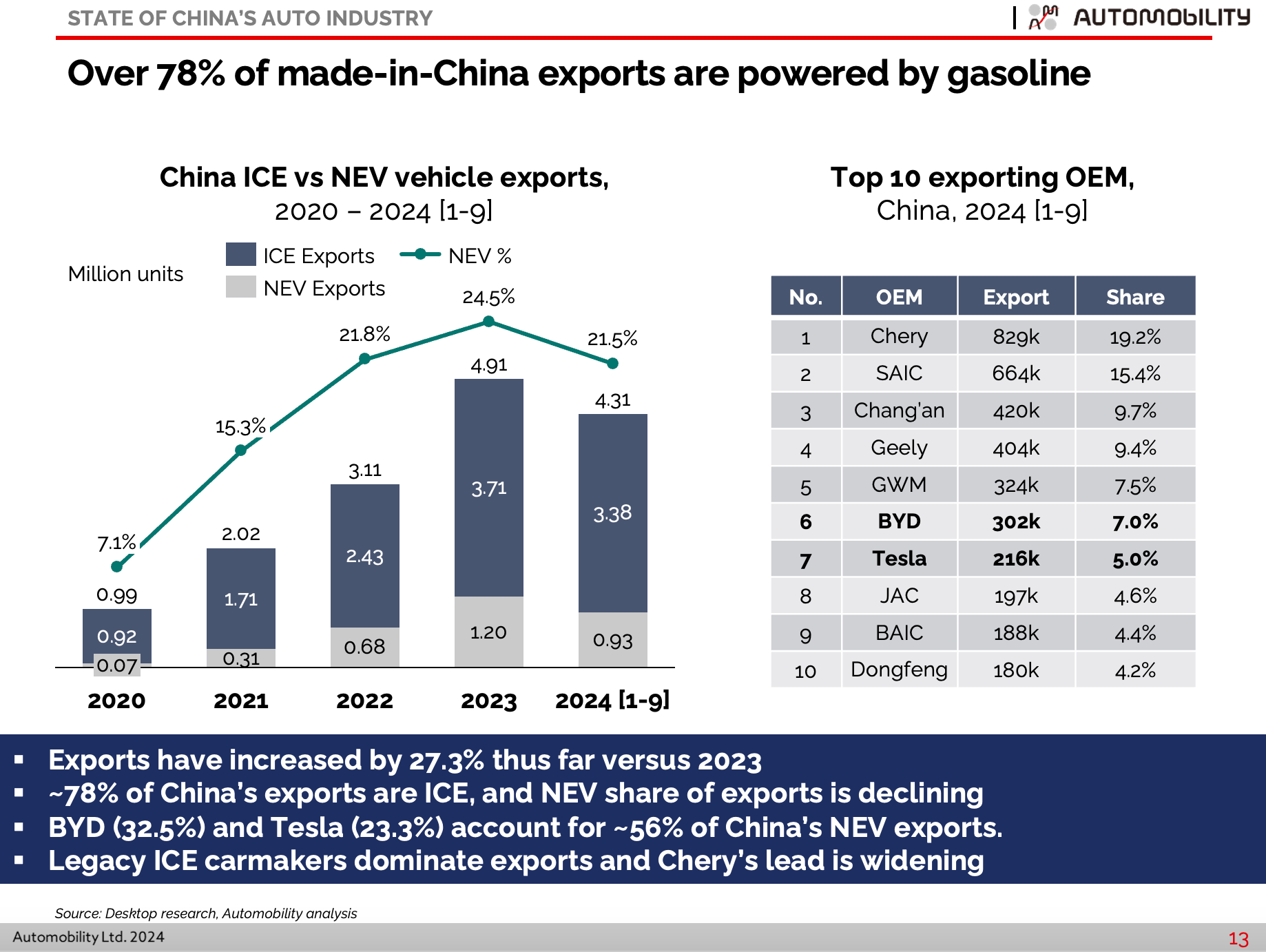

- Made-in-China vehicle exports are up 27.4% in 2024, and 78.5% of exports are ICE

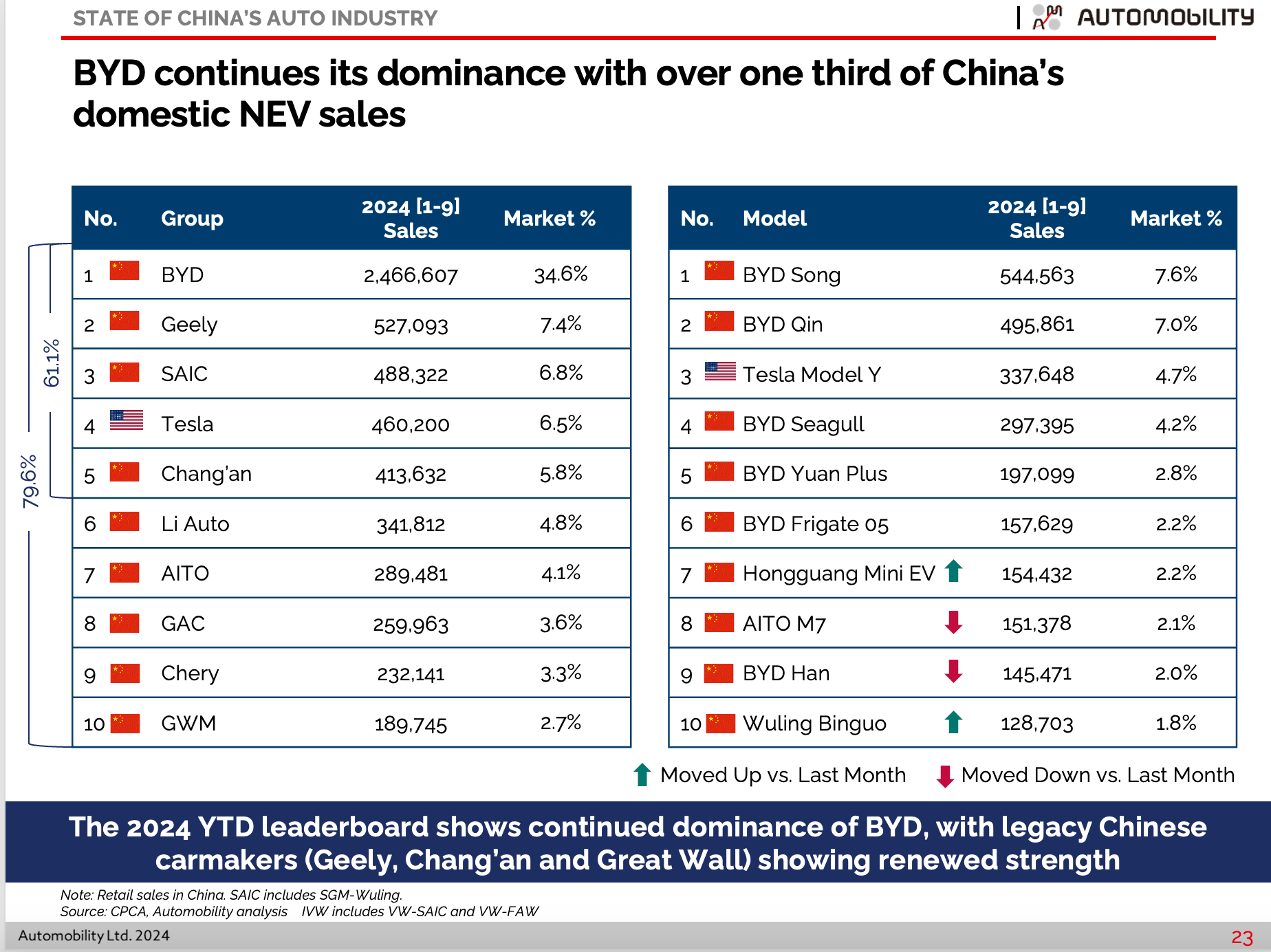

- BYD had it best sales month, with ~387,000 domestic sales across all its group brands. BYD’s full year domestic NEV share is 34.6% and overall PV market share is 16%.

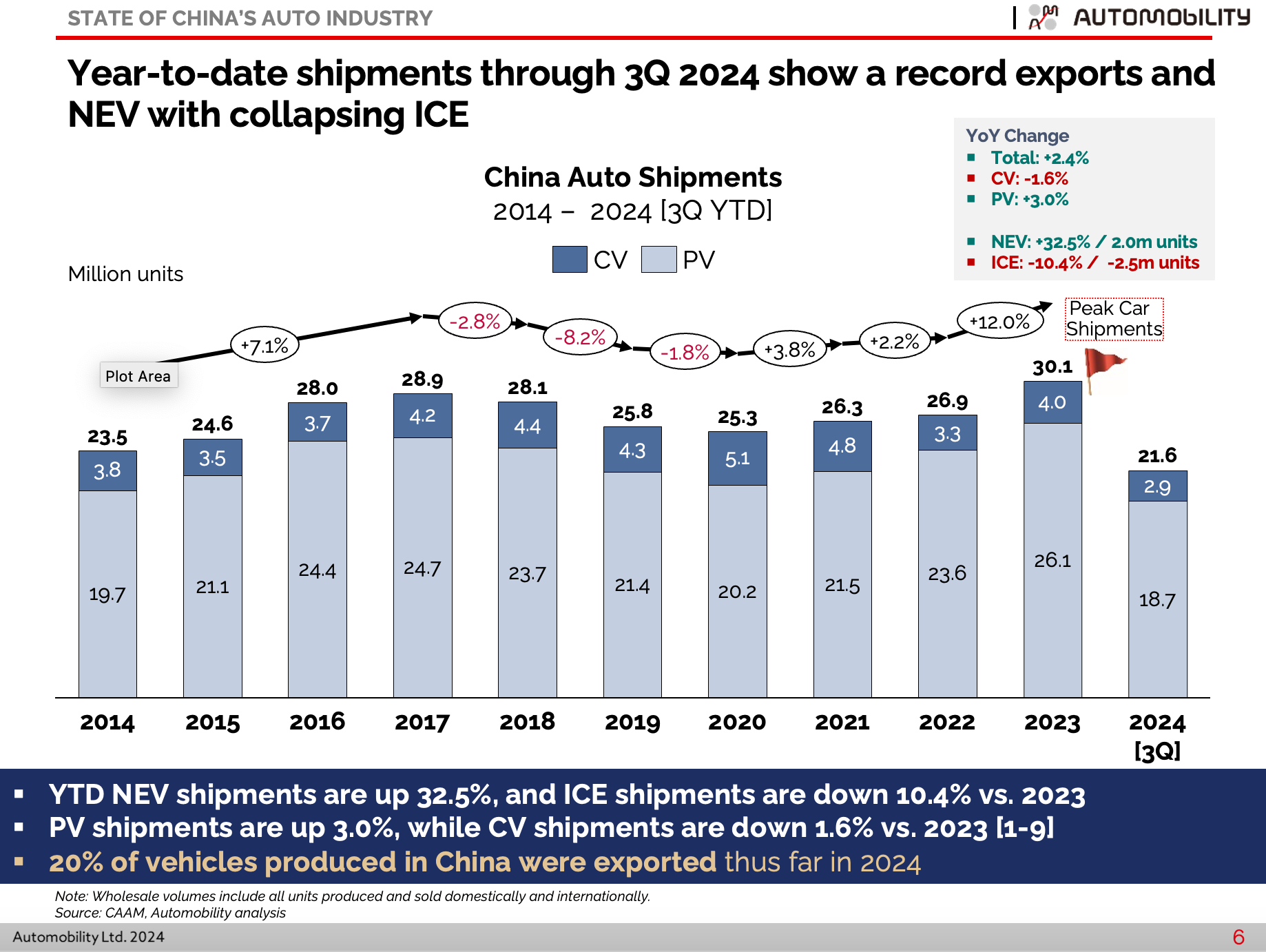

ICE Meltdown

The trends observed in the China auto market have remained consistent throughout the year and have in fact accelerated the meltdown of the domestic ICE market. Overall vehicle shipments are up 2.4% through September, driven by a 32.5% increase in NEV shipments and a 27.4% rise in exports versus the same period from last year.

Shipments of vehicles powered purely by an Internal Combustion Engine (ICE) are down 10.4%. The 21.6 million units produced through September includes ~4.3 million Made-in-China (MIC) vehicles that were exported from China (~20% of total production volume). One of every 5 cars that are built in China are leaving the country. Of these, 78.5% are powered by a gasoline engine.

NEV includes Battery Electric Vehicles (BEV), Plug-in Hybrid Electric Vehicles (PHEV), and Fuel Cell Electric Vehicles (FCEV)

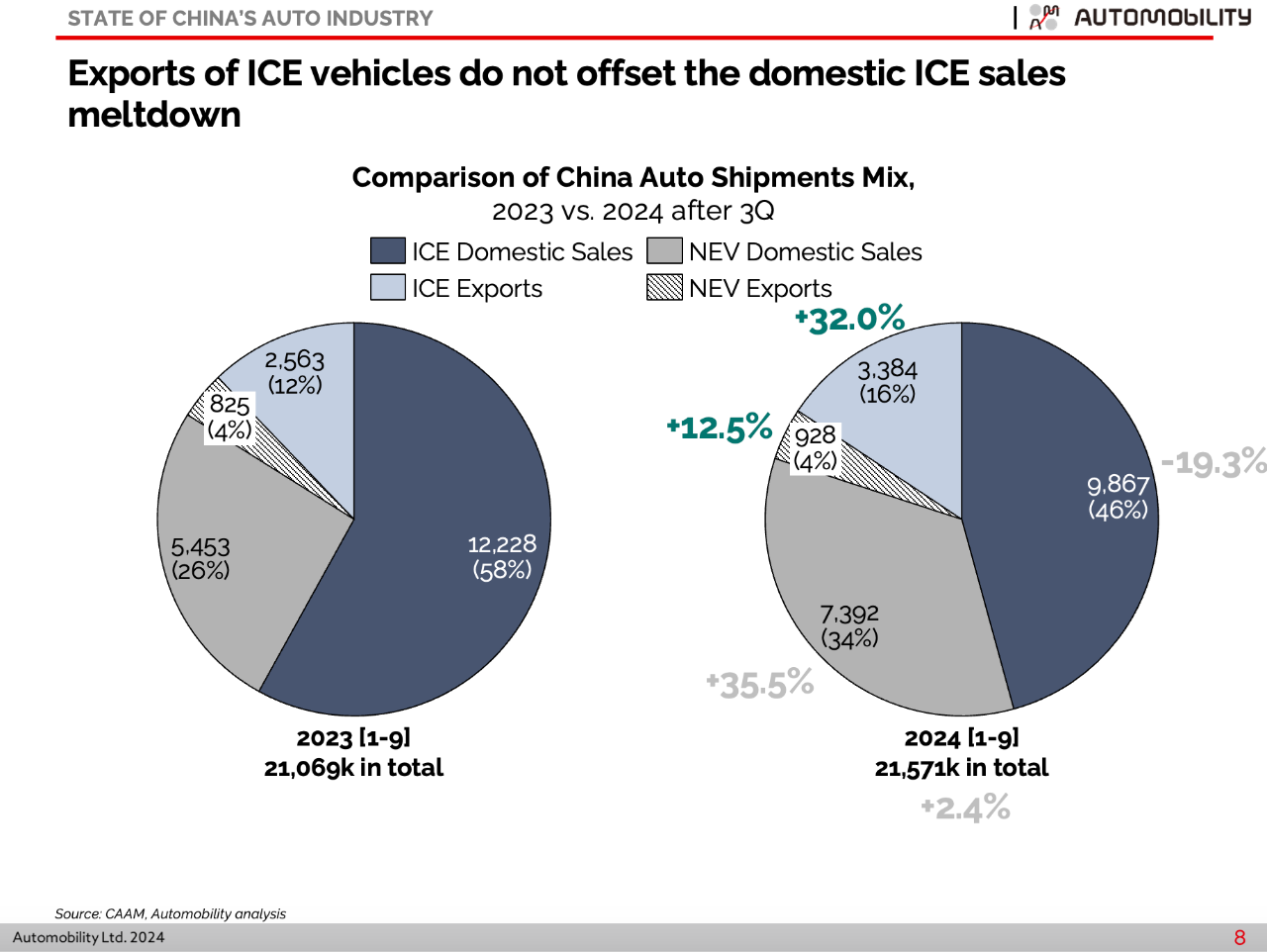

To highlight the dramatic changes in domestic market mix, we compare auto shipments between 2023 and 2024 over the same nine month period in the pie charts below. Clearly, the 2.4% growth in shipments is owed entirely to domestic NEV sales growth (+35.5%) and export growth (+27.4%). Domestic ICE sales collapsed by 19.3% over this period.

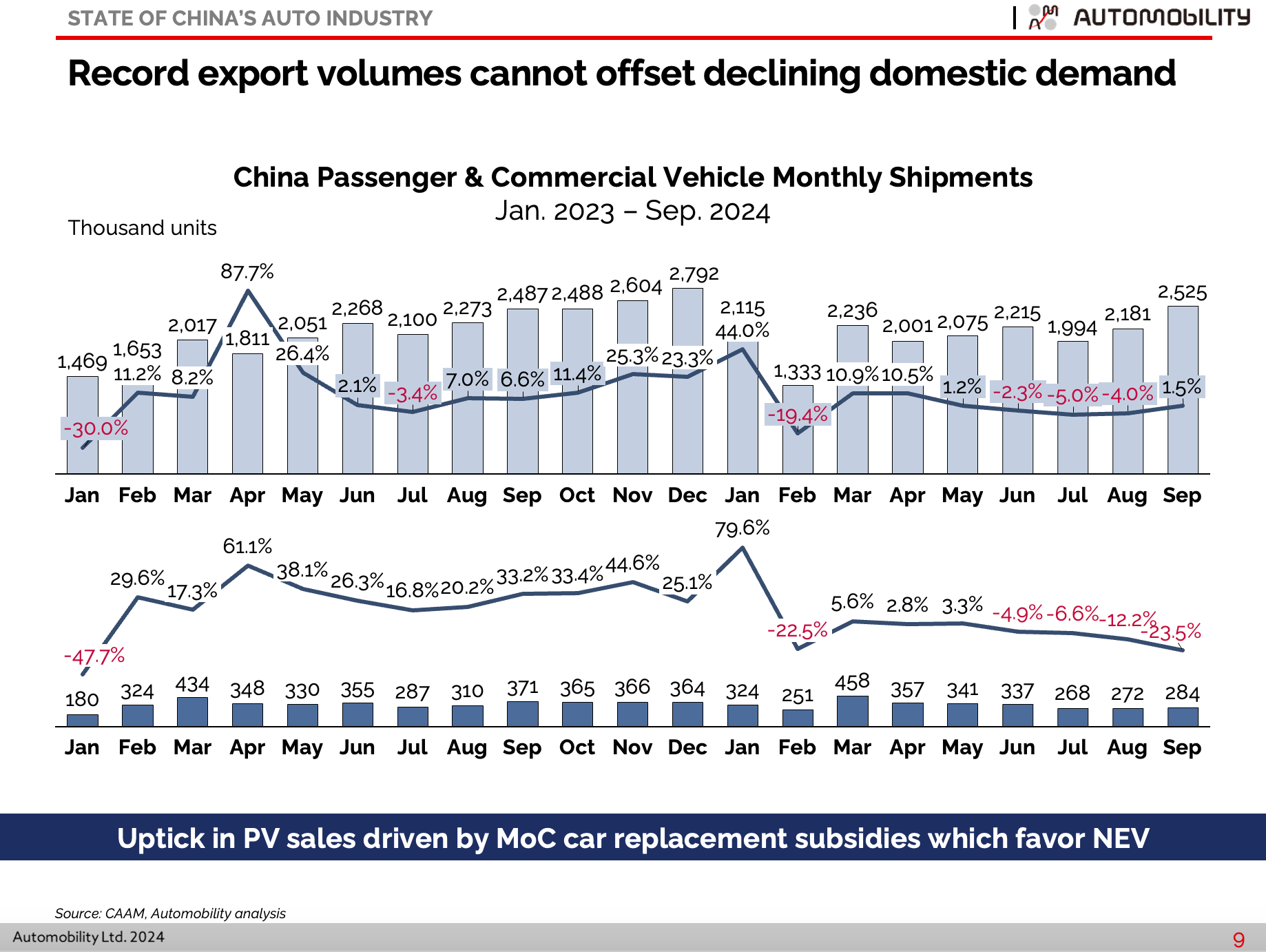

Monthly passenger vehicle shipment volumes improved slightly in September, owing to an aggressive replacement subsidy policy, however commercial vehicle sales remained weak.

Monthly MIC export volumes set an all-time record of 539,000 units, reaching 19.2% of all vehicles produced. Through September, exports are up 27.3% versus record volumes from last year. Exporting excess capacity has become a safety valve for companies seeking to offset their lost domestic ICE sales.

As shown earlier, domestic ICE volumes declined by a net 2.36 million units over the nine month period from last year. However, ICE exports increased by 821,000 units, an overall net loss of over 1.5 million ICE units.

MIC exports totalled 4.31 million units through September, and will easily surpass the 4.91 million units shipped from China last year. Legacy carmakers dominate the export category, and Chery has widened its lead over SAIC as the top Made-in-China exporter. BYD and Tesla have produced 56% of the 930,000 NEV exports this year.

Record Domestic NEV Volumes

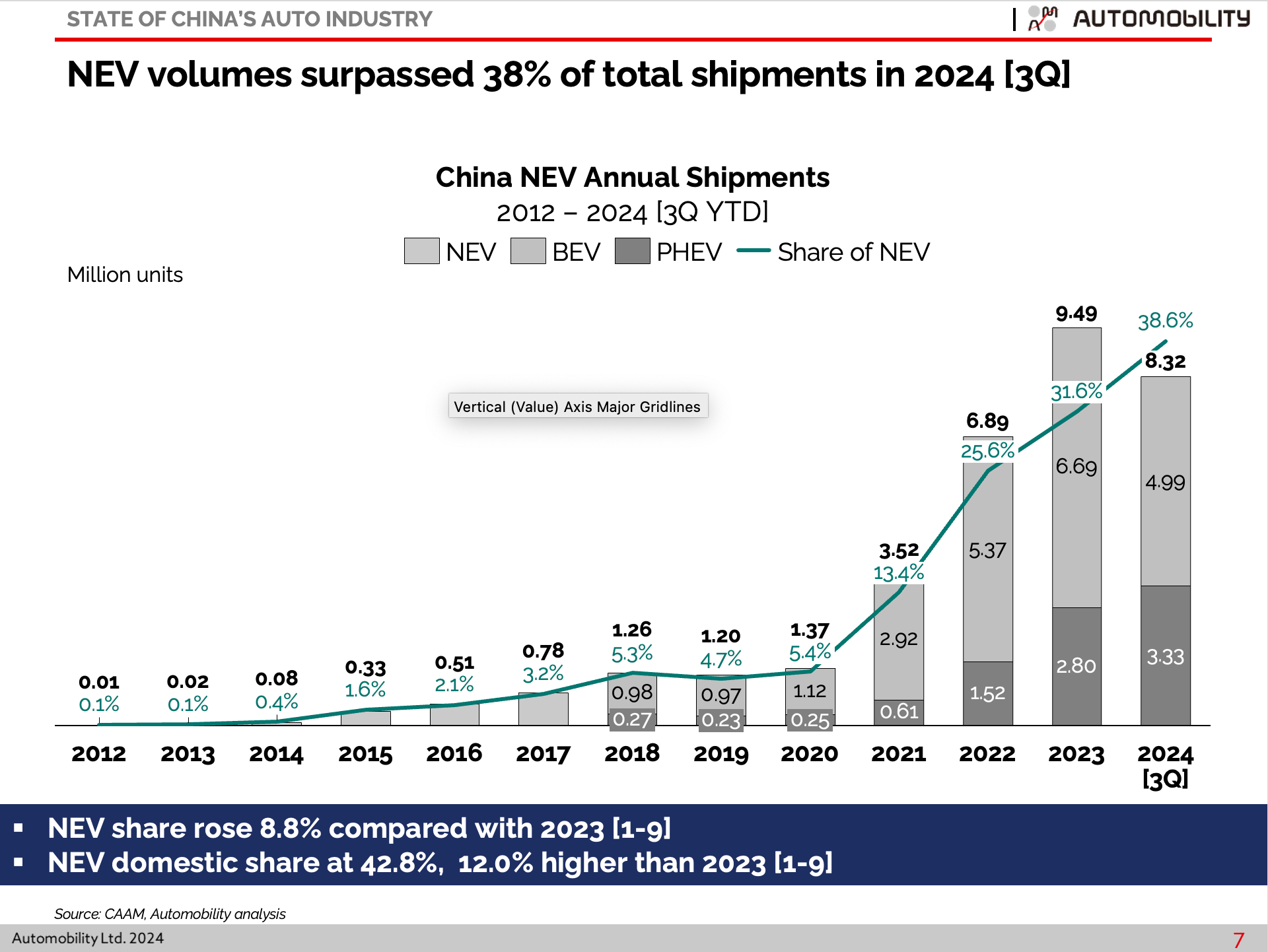

NEV shipments topped 8.3 million units through September, and will pass last year’s total in October. 3.33 million Plug-in Hybrid Electric Vehicles were shipped through September, and NEVs now represent over 38% of vehicles built in China. Nearly two-thirds of all electric vehicles made in the world this year were made in China.

NEV shipments set a new single month record at 1.29 million units. PHEV volumes continue to expand at a blistering pace. For the fifth consecutive month, PHEV shipments set a new record at 511,000 units.

Sales Summary through 3rd Quarter

When exports are removed from the shipment volumes, domestic sales are down 2.3% through September. The new car sales market in China has been declining since 2017, and the domestic ICE market is in meltdown.

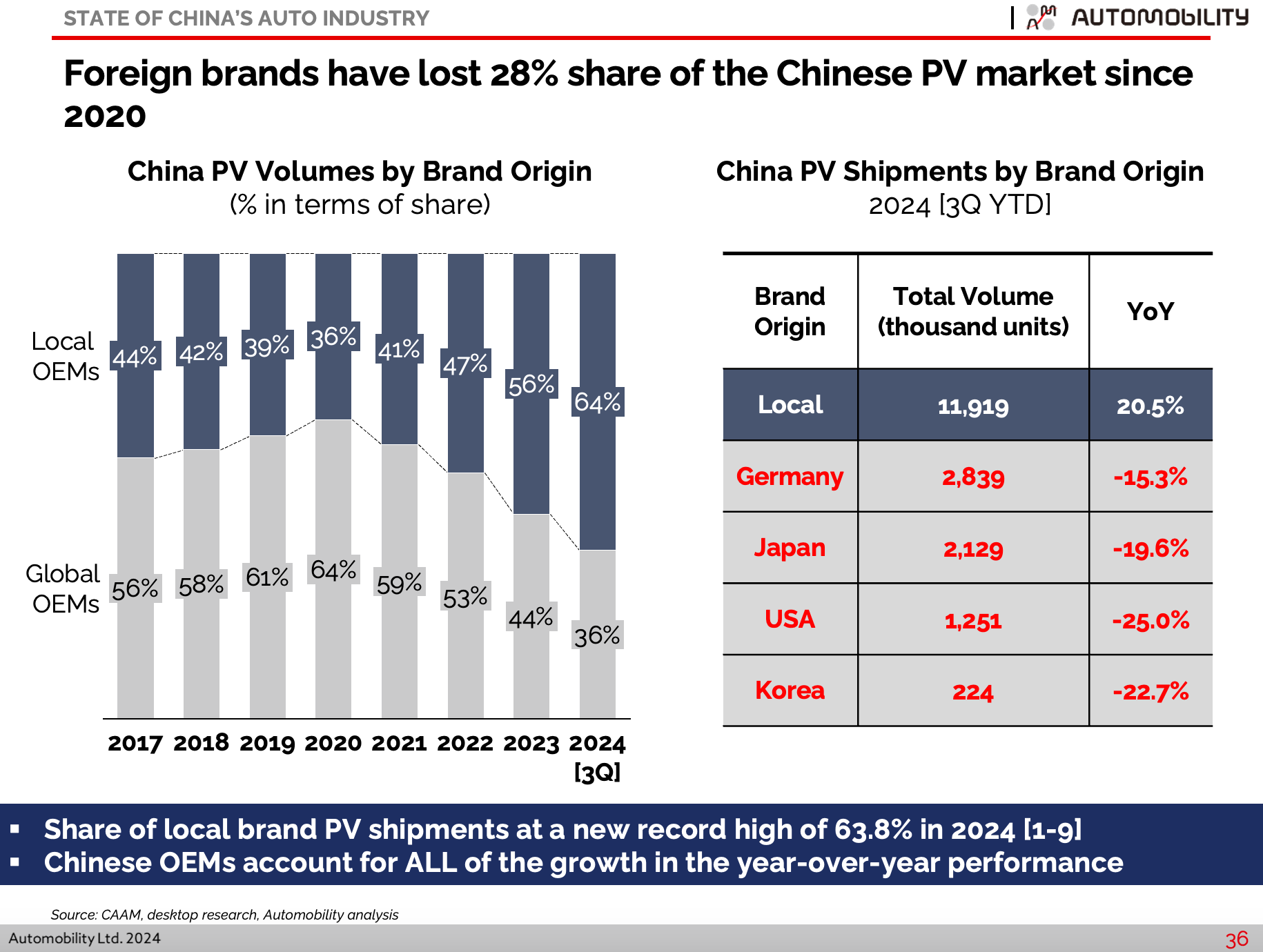

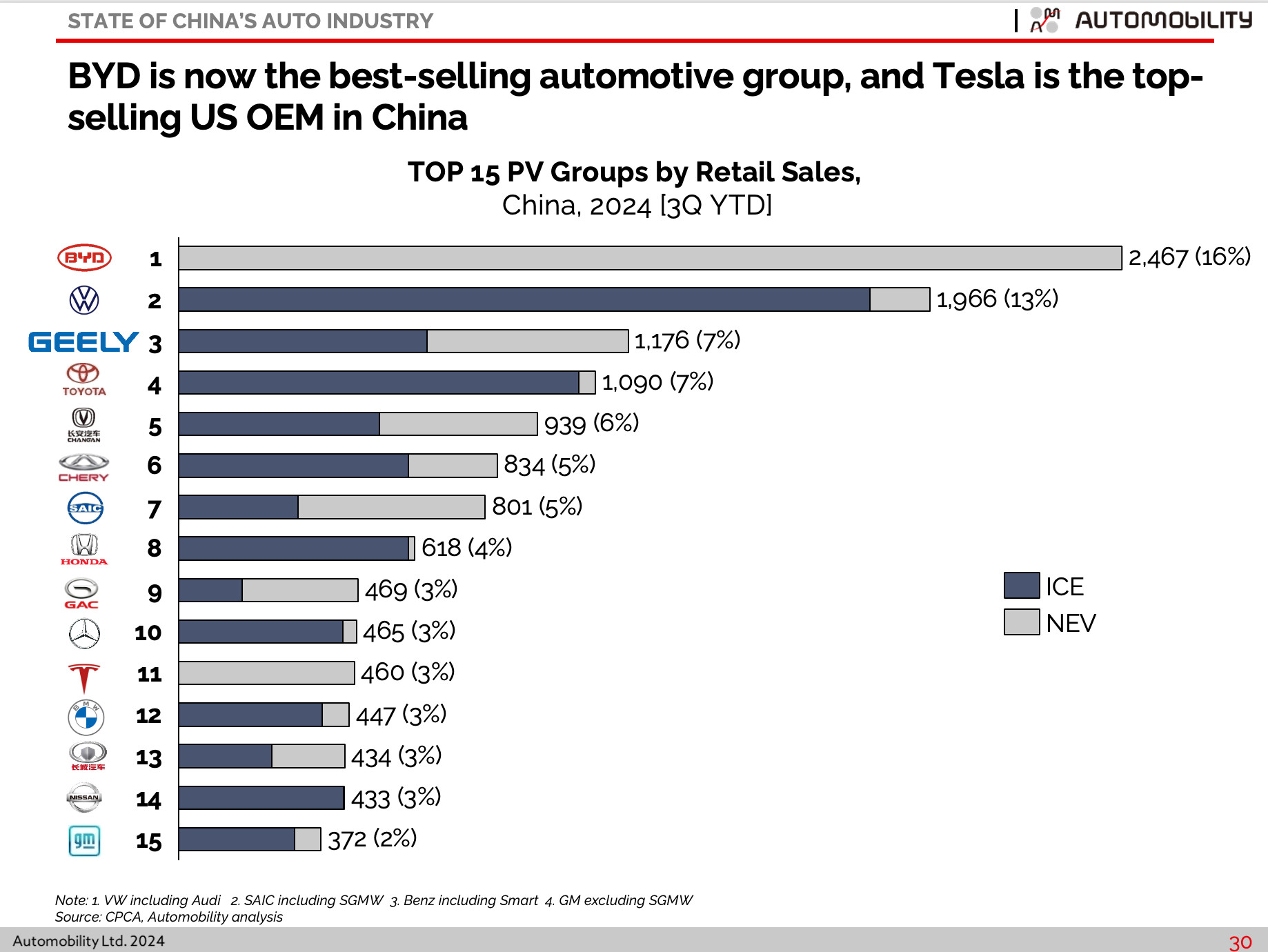

BYD is now the clear leader in the market, with 16% overall share, with a 3% lead over Volkswagen. Foreign carmakers remain stuck on the melting ICE segment.

The 2024 NEV sales YTD leaderboard shows a concentrated market with 5 group companies command 60% and the top 10 group companies hold ~80% of the NEV market. BYD dominates with ~35% share and 6 of the top 10 best selling vehicles in 2024. Legacy Chinese carmakers (Geely, SAIC, Chang’an, GAC, Chery and Great Wall) all appear on the leaderboard – showing that it is possible to pivot successfully from the ICE to the NEV lane.

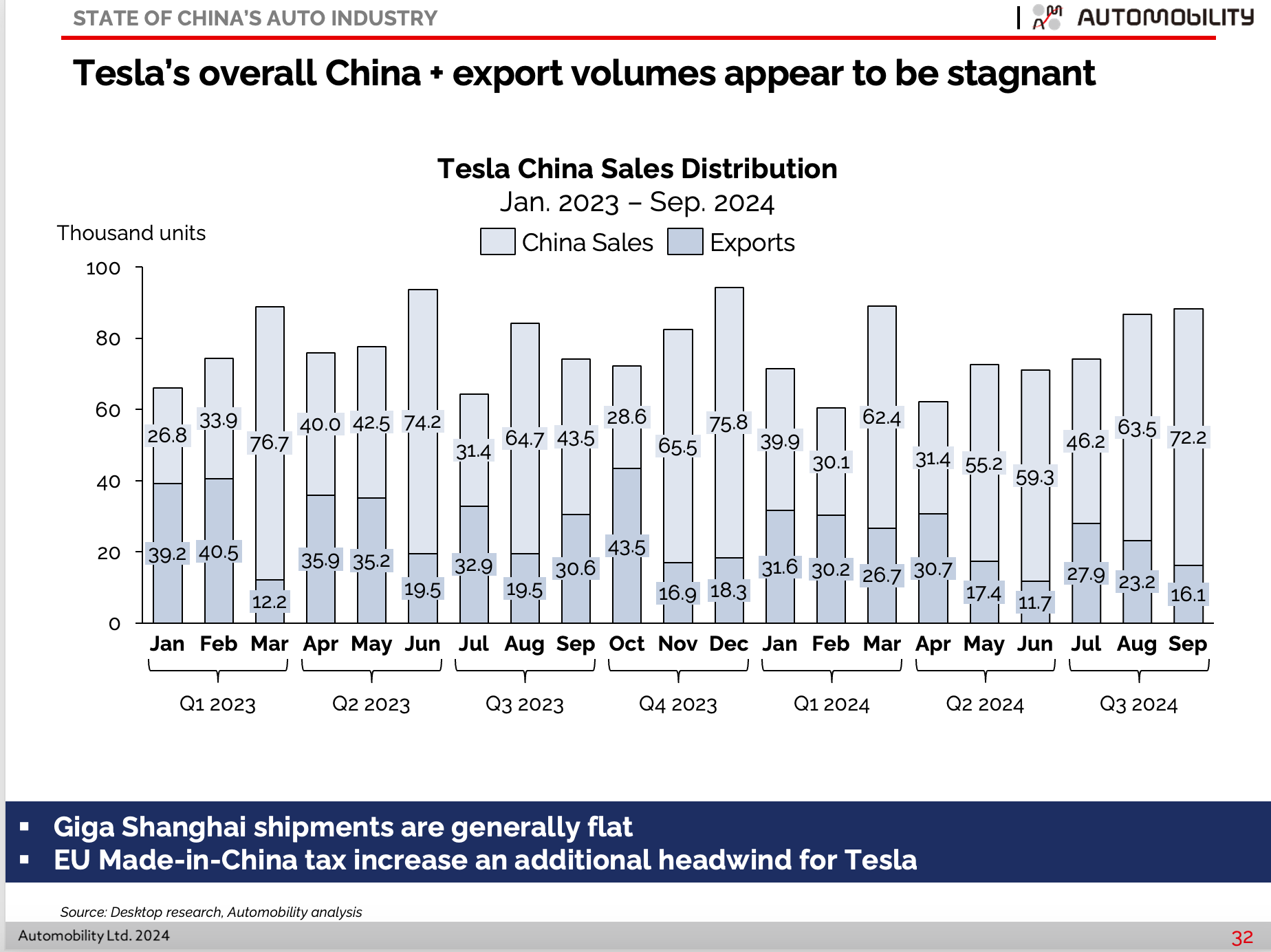

Tesla remains as the last foreign branded carmaker standing among the NEV leaders in 2024, but while their monthly sales have recently ticked upward, overall shipments from Giga Shanghai have stagnated over an extended period. Export volumes have declined in recent months and will face new challenges from increased EU tariffs, even though Tesla MIC vehicles will be taxed lower than their Chinese branded competitors.

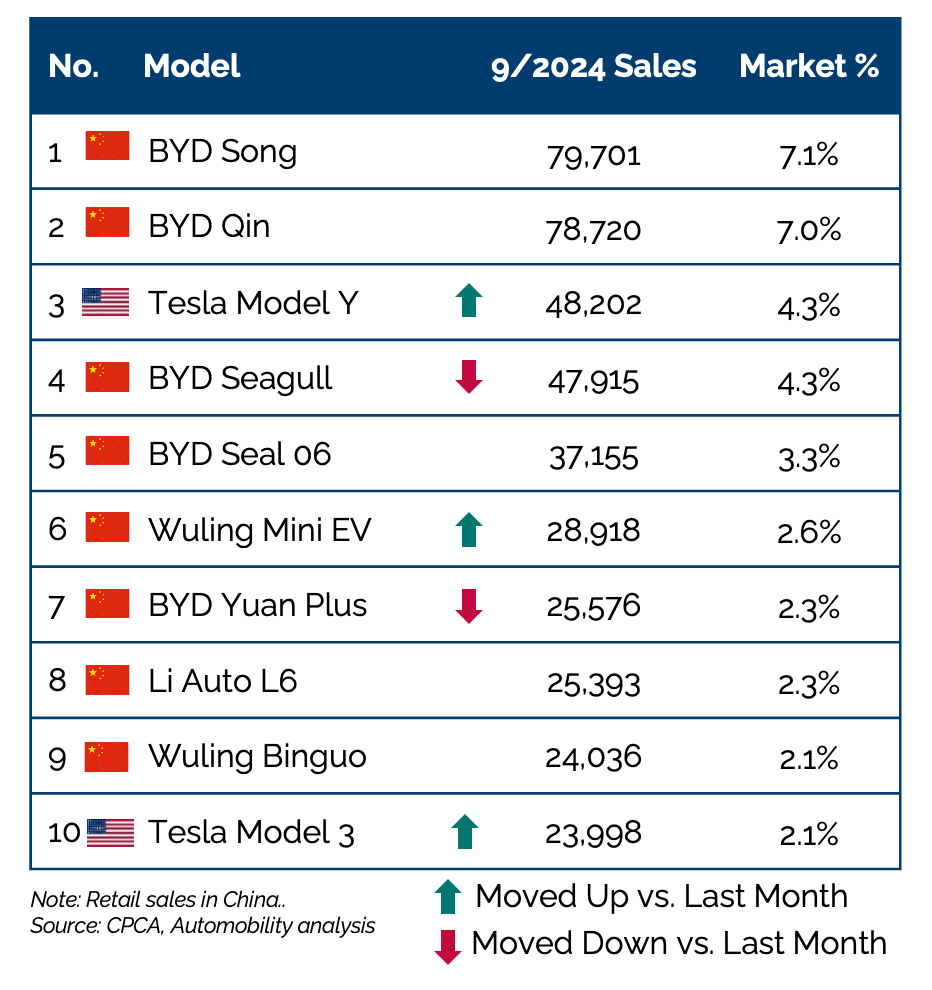

For the month of September, BYD holds 5 of the top 7 positions on the top 10 NEV models leaderboard. Other than BYD, Tesla took 3rd and 10th place with the Model Y and Model 3, Wuling took 6th and 9th place with their Honguang MiniEV and Binguo BEV offerings. Li Auto’s L6 took 8th place.

Retail Sales of Top 10 NEV Models in September 2024

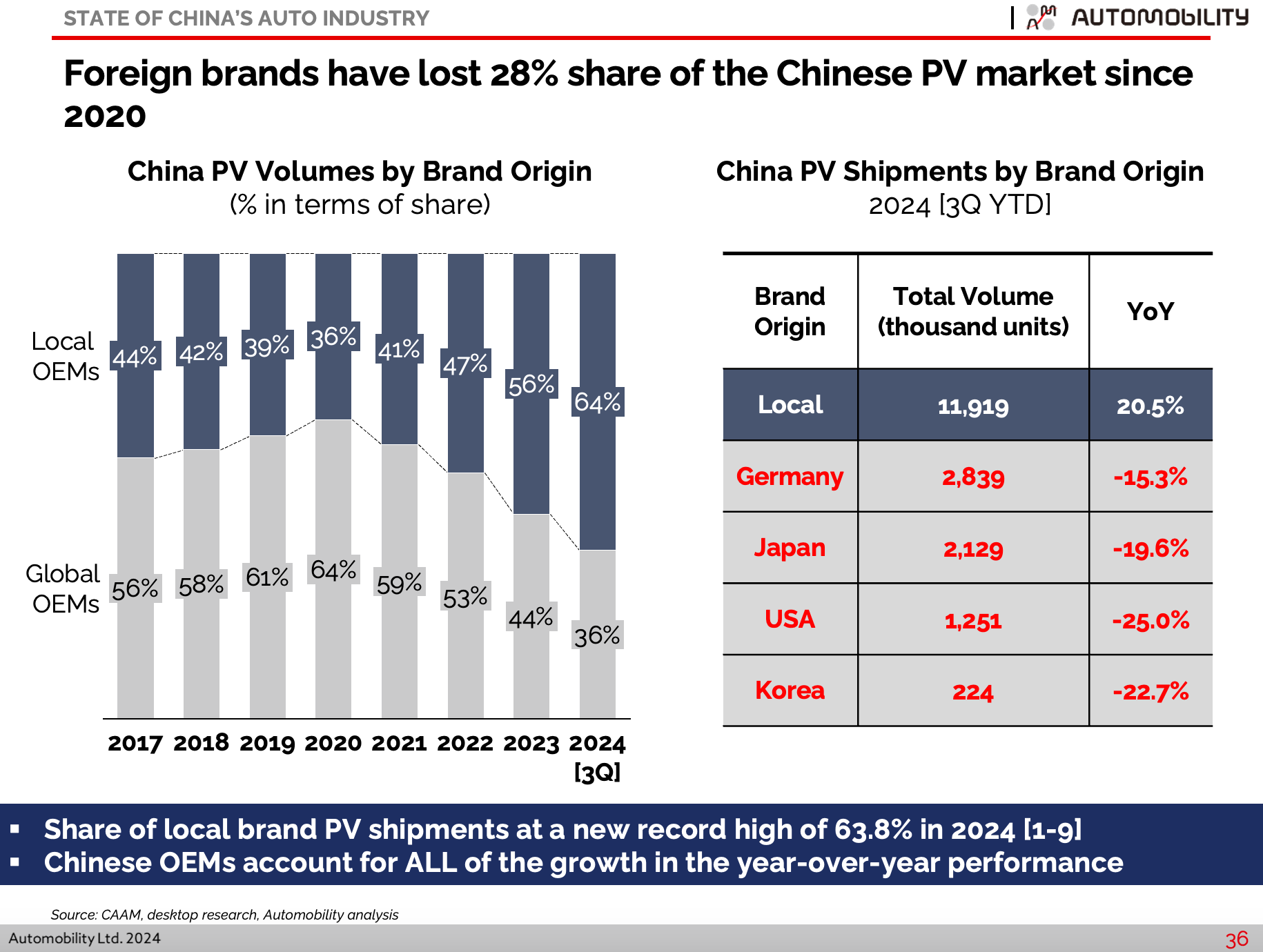

Since 2020, Chinese brands have successfully flipped the script. In 2020, Foreign brands sold 64% of all passenger vehicles in China. So far in 2024, Chinese brands have sold 64% of passenger vehicles – a stunning reversal of market dominance. This is in large part a result of prioritizing NEV and convincing Chinese consumers to consider purchasing this type of vehicle.

While much credit should deservedly be given to the guiding hand of government policy, the story is far more nuanced and simply attributing this to the apparatus of state craft. I point the reader to our recent article The Path to Globalization of China’s Automotive Industry – 2024 Edition for more in depth analysis of the backstory. This article reflects on how far the China auto market has come since I wrote an article with the same title in 2009. The original article written 15 years ago predicted the emergence of Chinese brands as global players, and described a plausible path for this to occur. China surpassed Japan in 2023 to become the world’s largest exporter of vehicles, and surpassing this milestone represents an appropriate time to revisit this topic.

While much credit should deservedly be given to the guiding hand of government policy, the story is far more nuanced and simply attributing this to the apparatus of state craft. I point the reader to our recent article The Path to Globalization of China’s Automotive Industry – 2024 Edition for more in depth analysis of the backstory. This article reflects on how far the China auto market has come since I wrote an article with the same title in 2009. The original article written 15 years ago predicted the emergence of Chinese brands as global players, and described a plausible path for this to occur. China surpassed Japan in 2023 to become the world’s largest exporter of vehicles, and surpassing this milestone represents an appropriate time to revisit this topic.

The journey that China has taken to flipping the script in China was also the subject of my chapter of the book Selling to China – Stories of Success, Failure and Constant Change, titled “China’s Auto Industry: The Race to a Sustainable Future”.

Write us at info@automobility.io if you wish to purchase a copy in China.

Join us on Tuesday, October 22 at 9am China time for our monthly State of China Auto Market webinar, hosted by the American Chamber of Commerce in Shanghai.

Webinar | State of China Auto Market Monthly Briefing (October) | AmCham Shanghai (Scan the below QR to register)

Automobility Original Article on Autonomous Mobility

This month, we published another original article describing how the China market is about to enter the next wave of technology acceleration: The Third Wave of Disruption: Autonomous Mobility on Demand.

The rapid evolution of the internet economy and its intersection with automotive advancements have significantly shaped the automotive landscape in China. However, what happens in China will not stay in China. As the world’s largest automotive market, disruptions emanating from China are profoundly influencing global auto industry dynamics. To remain competitive and relevant in this evolving landscape, it is crucial to adopt a user-centric mindset and embrace a more service-oriented approach to mobility. This approach will be key to navigating the future of transportation, as we move towards a more connected, electrified, and autonomous Automobility 3.0 era.

This article was also published by Sense Media Group in advance of their November AutoSens China event, which will be held from November 19-21 in Hefei, China. You can register by following the QR code in this link:

You can find our article on the AutoSens website, which also includes information on upcoming events.

Please copy and paste the link to your browser: https://auto-sens.com/the-third-wave-of-disruption-autonomous-mobility-on-demand/

Automobility to Sponsor Doon Insights’ Mobility Tech Workshops

On November 12th, the 10th annual Mobility Tech Workshop will delve into the latest trends and challenges in the mobility sector. The workshop will feature a lineup of 10+ promising startups and discussion panels on “The State of the Global Battery Supply Chain” and “From Private Placement to IPO: The New Path for Mobility Tech.” The program will also include 10+ “Something on My Mind” (SOMM) interactive mini sessions, led by industry leaders, investors, and technologists. This year’s event will take place at the scenic Cocoanut Grove in Santa Cruz, with an evening reception in Bonny Doon, allowing attendees to experience both the coastal and mountainous landscapes of California.

On November 13th, we are excited to introduce a new workshop, Manufacturing for Mobility in Mexico. This event will focus on Mexico’s emerging role as a near-shoring hub for EV production and the mobility supply chain. Industry experts and a delegation of policymakers, industrialists, and investors from Mexico will discuss the benefits of the USMCA, supportive Mexican government policies, and Mexico’s strategic importance in the global automotive and aerospace industries. This workshop will take place in Bonny Doon, CA.

Scan the below QR for details and register:

Bill Russo to Speak at FISITA World Mobility Summit in Detroit

On November 14th at 11:00 am, Bill Russo and Tu Le from Sino Auto Insights will speak on a panel on the topic “East meets West in the transition to clean mobility”. The event will be held at the General Motors Technical Center in Warren Michigan on November 13-14.

Follow the link for more information on the event: Please copy and paste the link to your browser: https://events.fisita.com/event/Summit2024/summary

AUTOMOBILITY MEDIA

- China’s Top Carmaker Dominates Foreign Rivals With $14,000 Plug-In Hybrid

In April, the BYD group’s sales volume in China surpassed that of the Volkswagen group, said Automobility, a Shanghai-based strategy firm. For the first nine months of the year, BYD’s market share stood at about 16%, while the Volkswagen group—including brands such as Volkswagen, Audi and Skoda but not imported vehicles such as Porsche—was at around 13%, data from Automobility showed. Volkswagen’s China head said in April that it is focused on profitability.

(Please copy and paste the link to your browser: https://www.wsj.com/business/autos/chinas-top-carmaker-dominates-foreign-rivals-with-14-000-plug-in-hybrid-79f93bf5?st=4qHE5J&reflink=desktopwebshare_permalink)

-

The biggest loser in Joe Biden’s Chinese car ban? It could well be Elon Musk

But it is likely, experts warn, that China could retaliate. Bill Russo, founder and chief executive of Shanghai-based investment advisory firm Automobility Ltd told Bloomberg that any ban would be “met with reciprocity” that will impact US business in China.

(Please copy and paste the link to your browser:

-

US Curbs on Chinese EV Software Tech Risk Spreading Much Further

Bill Russo, founder and chief executive officer of Shanghai-based investment advisory firm Automobility Ltd, questioned the US strategy given the proliferation of Chinese software in other consumer products.

“If it’s OK in something other than a car, it’s OK if it’s in a TV set or a smart device, what is the end game here?” he said. “If the goal is to de-risk China software, where do you draw the line?”

(Please copy and paste the link to your browser:

He added that an outright ban would only ratchet up existing political tensions between the two superpowers and would be met with reciprocity that will impact US business in China.

-

Volkswagen is the anti-Tesla and China is to blame

“There’s been too much procrastination, too much analysis-paralysis among foreign companies thinking ‘is [the combustion engine] going to come back?’” Russo said.

“That was a lot of wishful thinking.”

(Please copy and paste the link to your browser:

You can follow us for regular updates on these online channels by scanning the QR codes:

If your organization would like a custom briefing on the State of China’s Auto Market, please reach out to us at info@automobility.io

If your organization would like a custom briefing on the State of China’s Auto Market, please reach out to us at info@automobility.io

About Bill Russo

Bill Russo is the Founder and CEO of Automobility Limited, and is currently serving as the Chairman of the Automotive Committee at the American Chamber of Commerce in Shanghai. His over 40 years of experience includes 15 years as an automotive executive with Chrysler, including 21 years of experience in China and Asia. He has also worked nearly 12 years in the electronics and information technology industries with IBM and Harman. He has worked as an advisor and consultant for numerous multinational and local Chinese firms in the formulation and implementation of their global market and product strategies.

Bill is a contributing author to the book Selling to China: Stories of Success, Failure, and Constant Change (2023), where he describes how China has become the most commercially innovative place to do business in the world’s auto industry – and why those hoping to compete globally must continue to be in the market.

About Automobility

Automobility Limited is global Strategy & Investment Advisory firm based in Shanghai that is focused on helping its clients to Build and Profit from the Future of Mobility. We help our clients address and solve their toughest business and management issues that arise in midst of fast changing, complicated and ambiguous operating environment. We commit to helping our clients to not only “design” the solutions but also raise or deploy capital and assist in implementation, often together with our clients.

Contact us by email at info@automobility.io

PLEASE NOTE: The information and analysis shared in this newsletter, including the charts and style of materials presented, is the intellectual property of Automobility Ltd. While we share it as a way to serve our existing and new clients, it is not to be used without our express consent and then only with attribution. Any publication, reproduction or other use of this material without the express written consent of Automobility Ltd is prohibited.

Sorry, the comment form is closed at this time.