06 Aug State of China’s Auto Market – July 2024

Comments from Bill Russo, Founder & CEO of Automobility Ltd.

2024 HALF YEAR HIGHLIGHTS

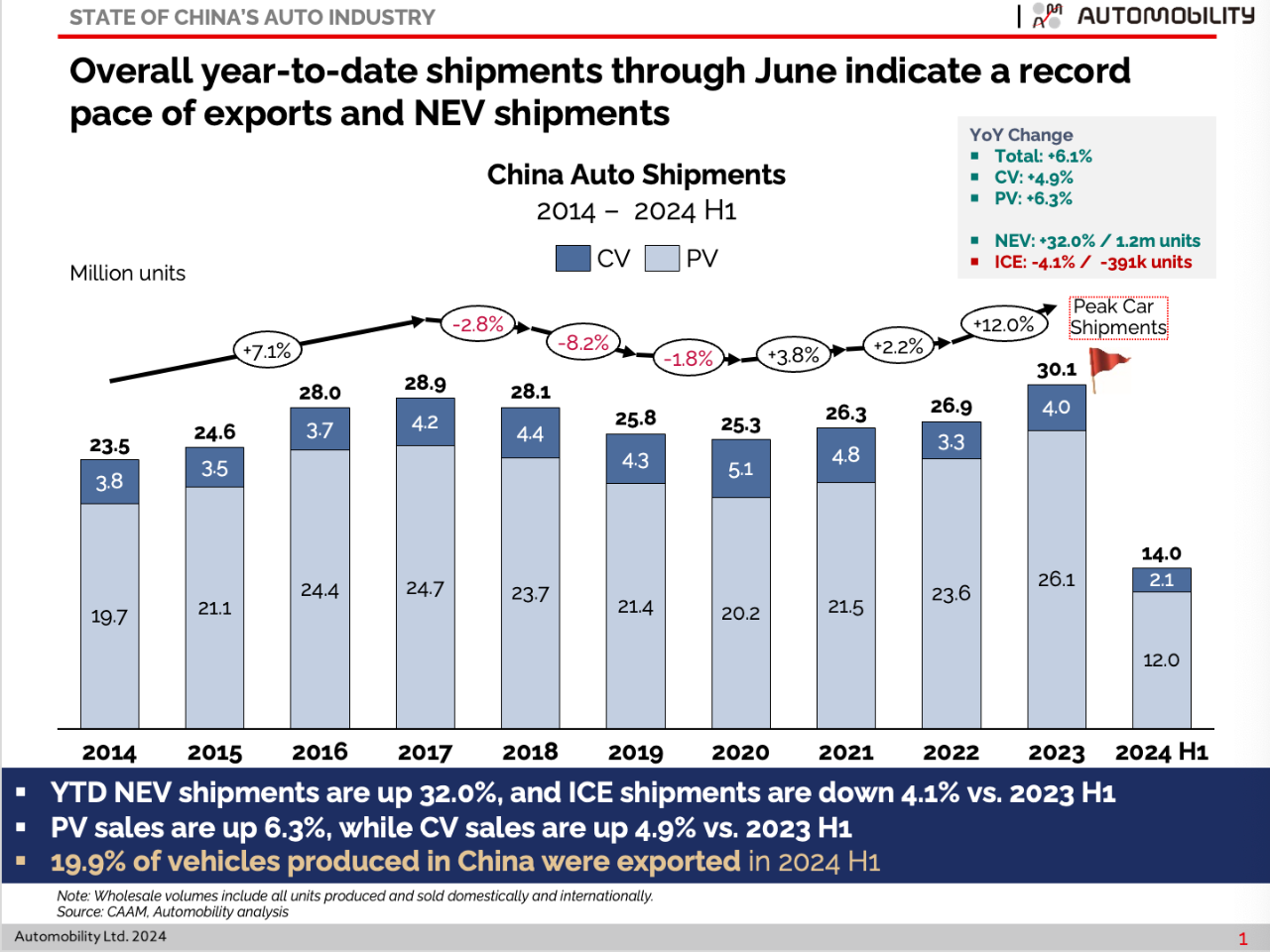

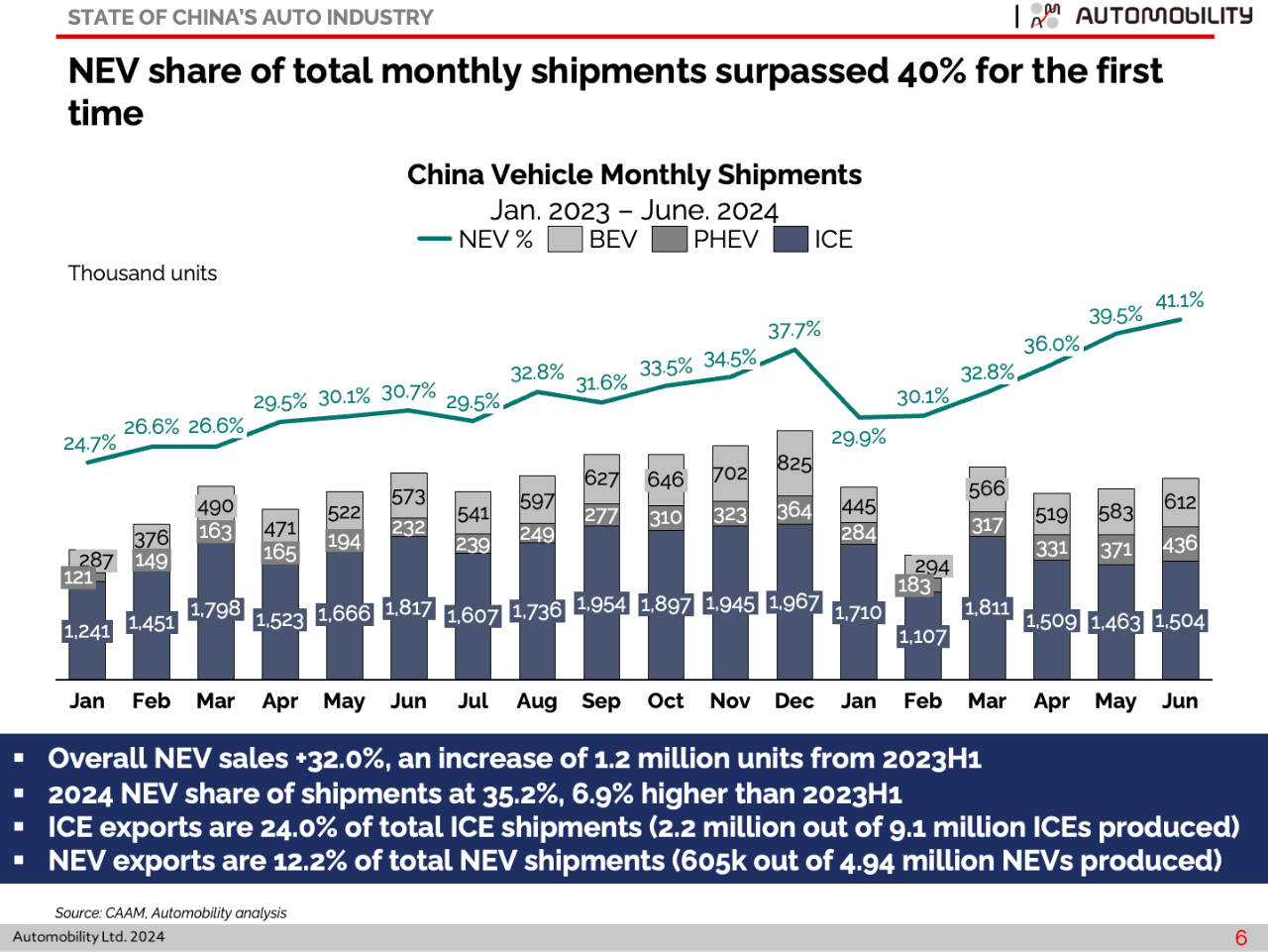

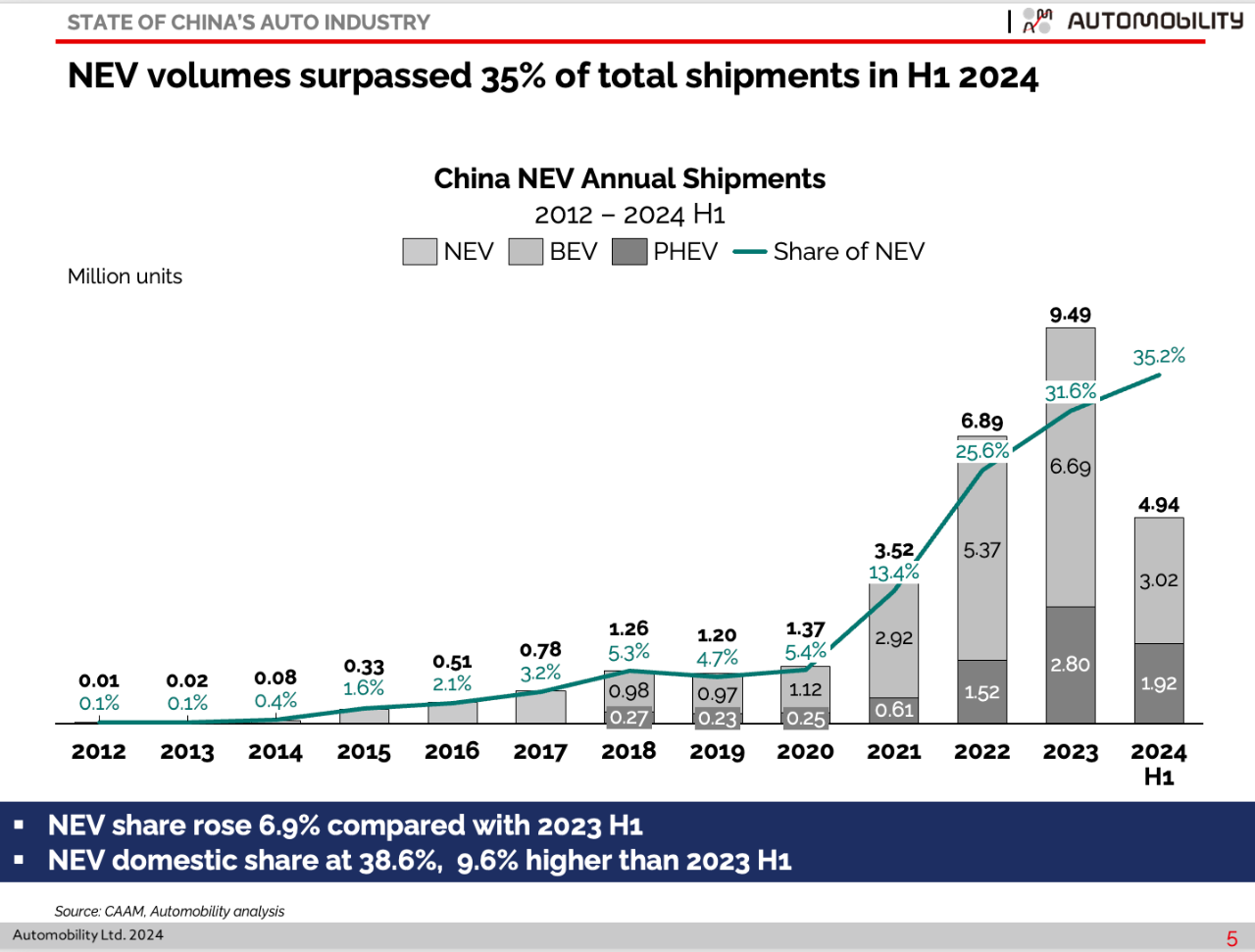

- Shipment volumes are up 6.1%, with New Energy Vehicle (NEV) shipments up 32% while gasoline powered vehicle shipments are down 4.1% versus H1 2023

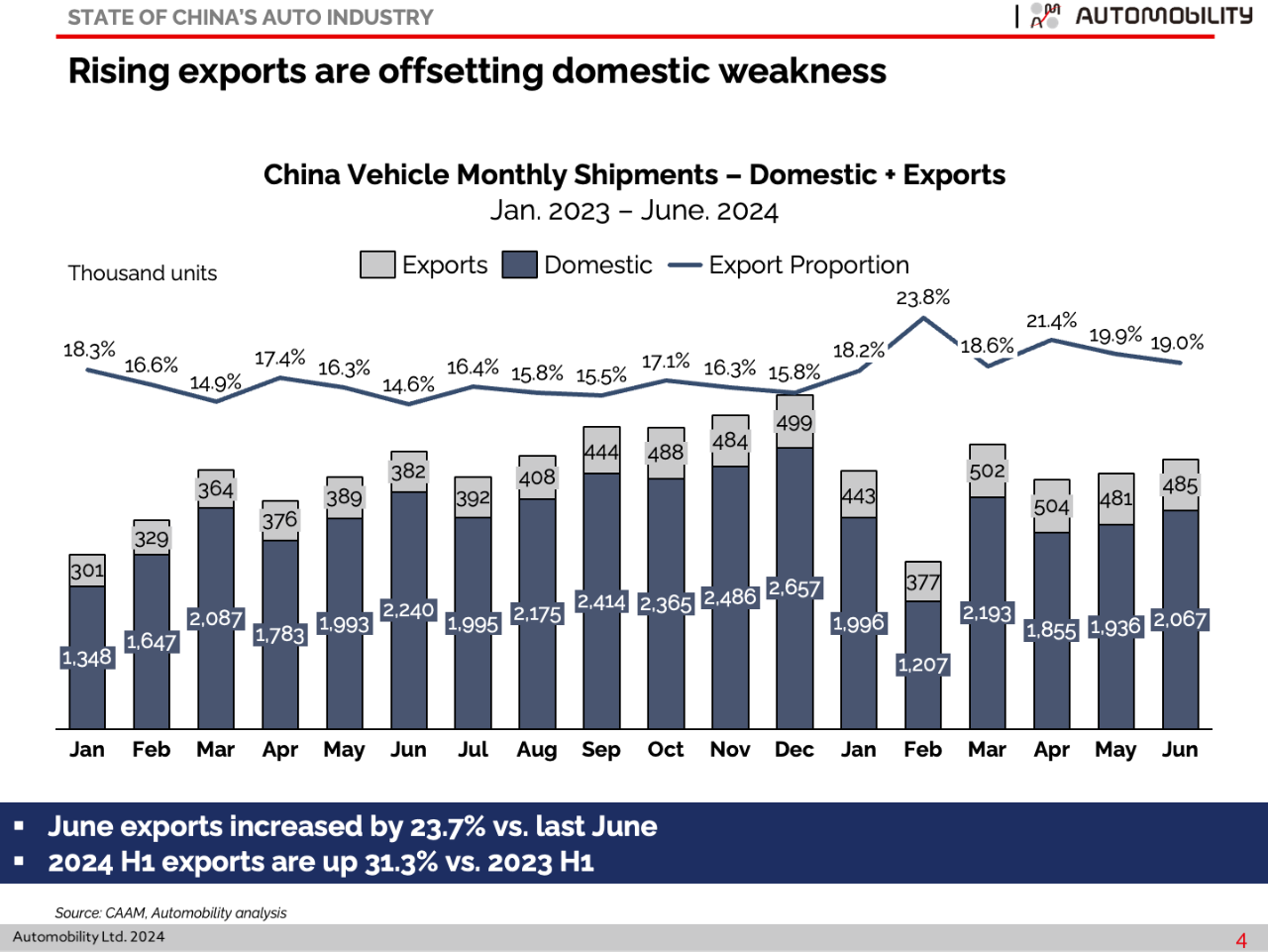

- 1 in 5 Made-in-China cars are exported, with exports up 31.3% versus H1 2023.

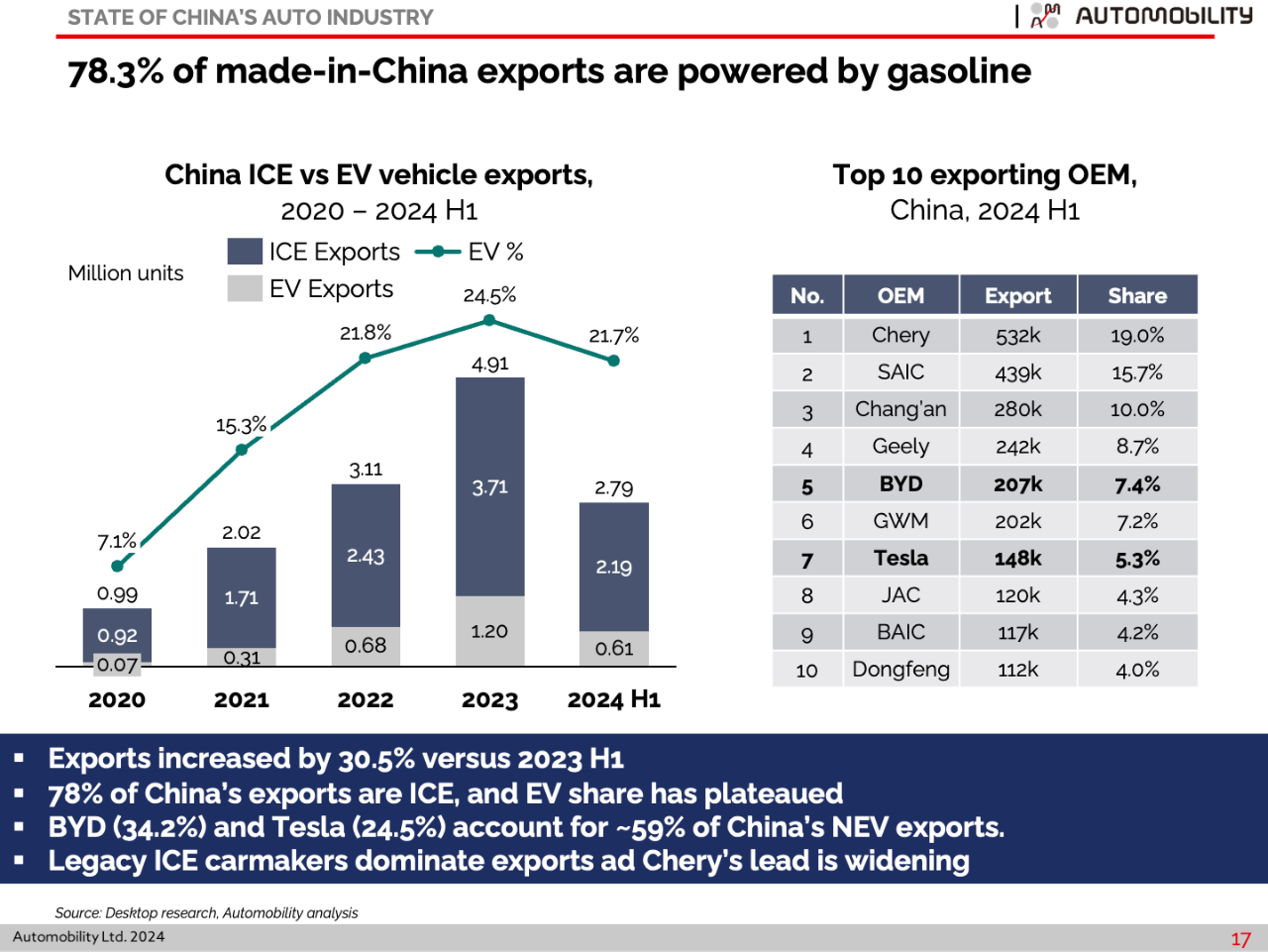

- Over 78% of Made-in-China exports were gasoline powered due to the dramatic decline in domestic demand for these vehicles in China.

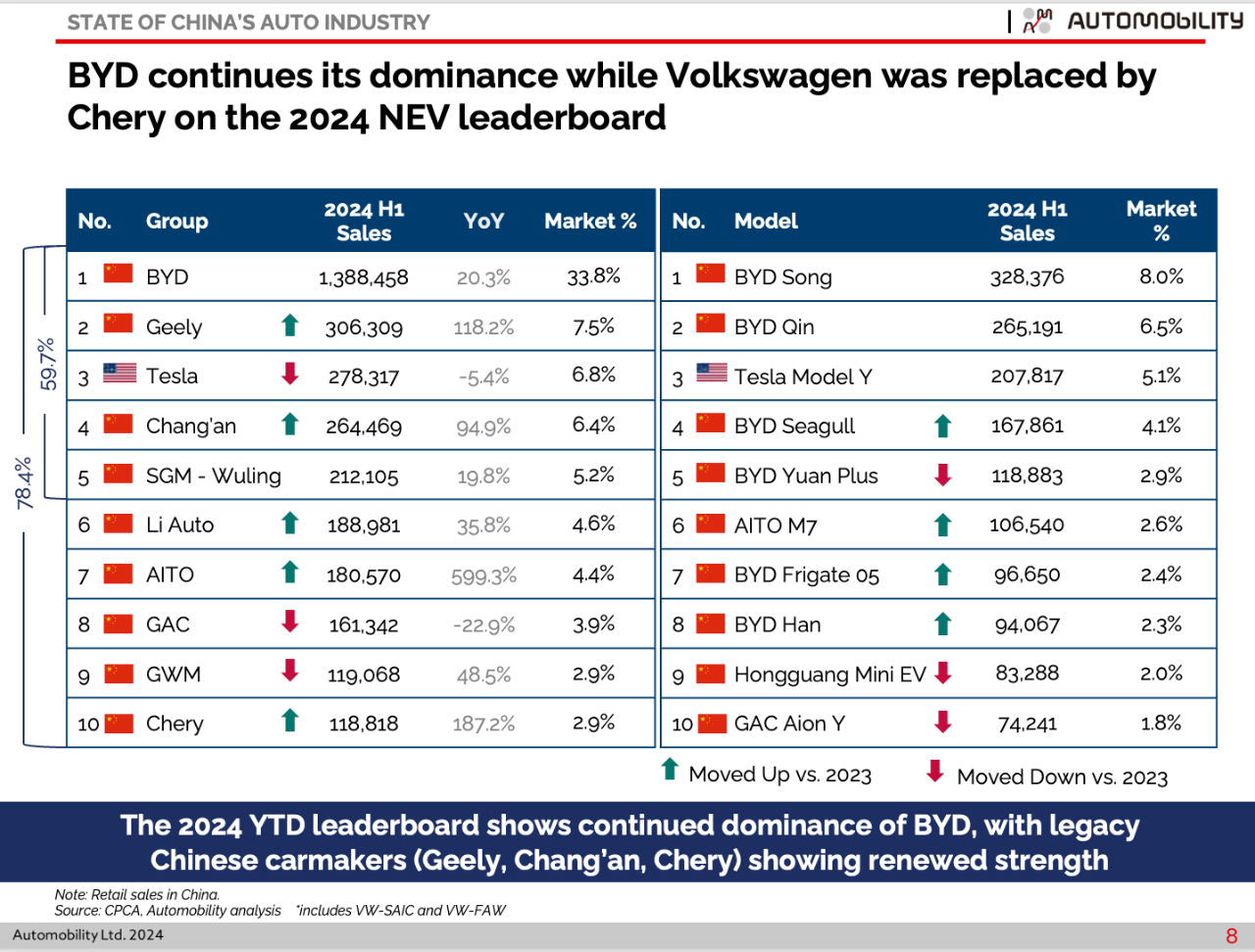

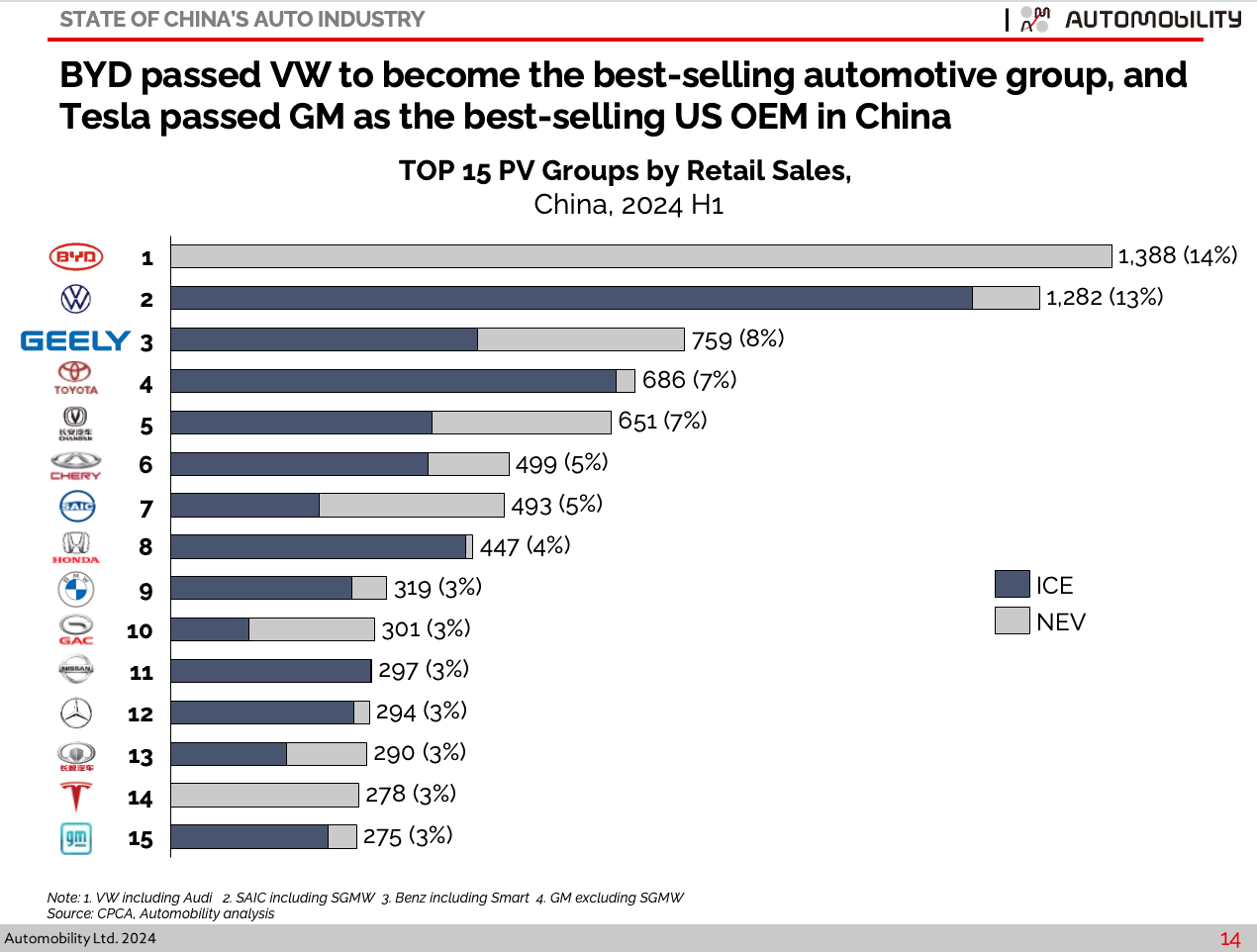

- BYD passed Volkswagen to become the best-selling automotive group in China (based on total sales of all brands within their respective portfolios).

- Tesla is the only non-Chinese brand remaining on the top-10 NEV leaderboard, and has surpassed GM to become the top selling American brand in China.

- Chery has emerged as the top vehicle exporter, and has displaced Volkswagen on the top-10 list in domestic NEV sales.

- Plug-in Hybrid Electric Vehicles (PHEV) including Extended Range Electric Vehicles (EREV) are popular, with over 41 percent of NEV sales in June.

-

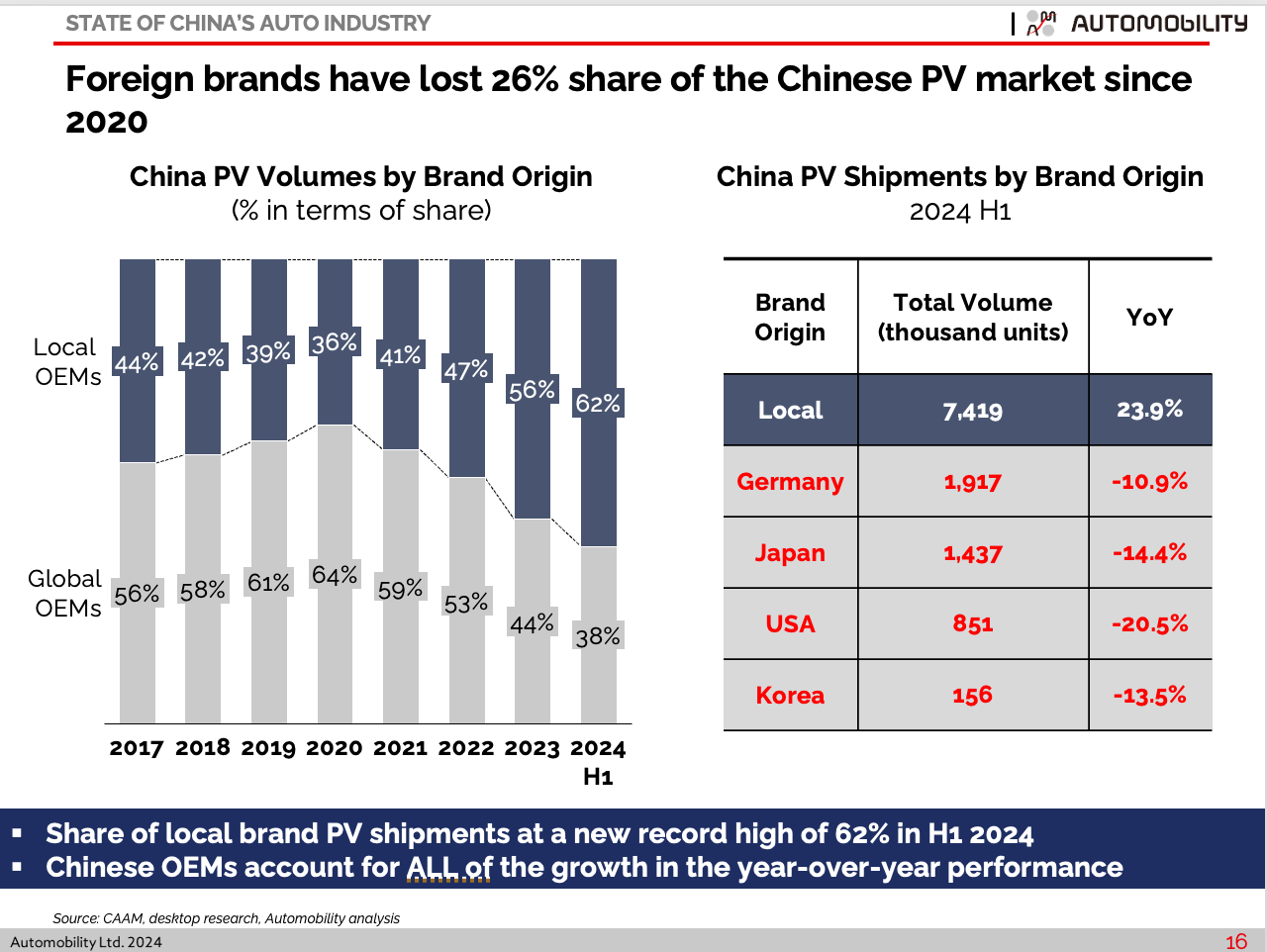

Foreign brand passenger vehicle market share has fallen to 38% in China in H1 2024 – a loss of 26% since 2020.

At the halfway mark on the 2024 calendar, market trends observed in recent years remain true: sluggish domestic demand has shifted to NEV, carmakers seek growth via exports, and dramatic market share losses continue for foreign brands in China. Foreign brands have collectively failed to pivot when confronted with changing Chinese consumer preferences, and have lost over a quarter of their passenger vehicle market share since 2020.

Faced with a sudden and unexpected loss of market share in China, global carmakers stand at the crossroads of a rapidly transforming industry: should they stay the course, retreat and run out, or take the high road and reinvest to stay in the game? It is ultimately a strategic choice with huge repercussions to their global business and their ability to compete internationally.

It is our Automobility Ltd opinion that “Staying the Course” while retreating behind a tariff wall is not a winning formula. However, that has not stopped governments in mature markets from resorting to tariff protections to stem the tide of “Made-in-China Cars Going Global”

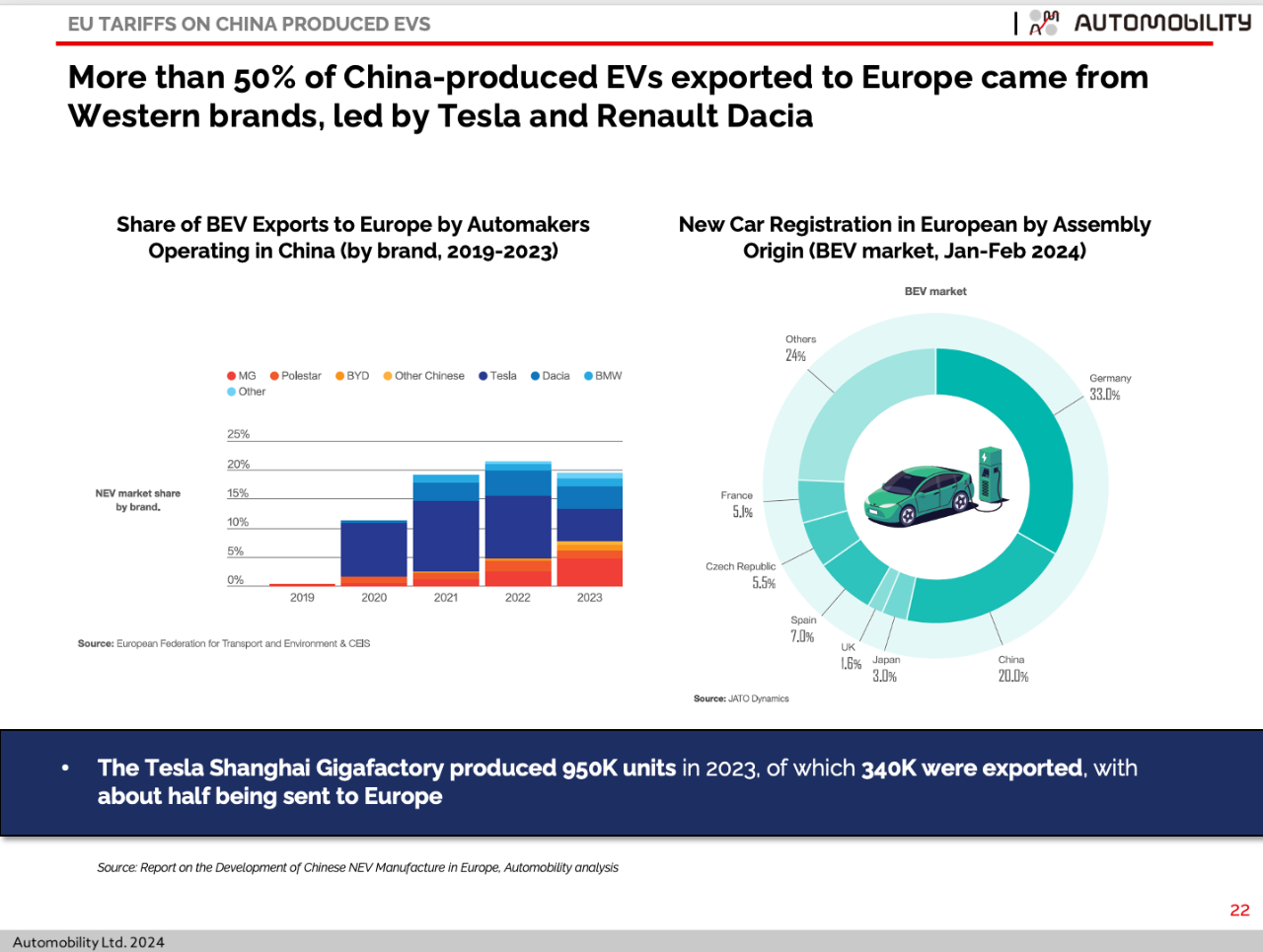

EU Announces Duties on Made-in-China BEVs

Following the US imposition of an additional 100% duty on Made-in-China products, the European Union announced provisional duties on Made-in-China battery electric vehicles.

Ex-Factory Shipments Up in China’s Weak Domestic Market

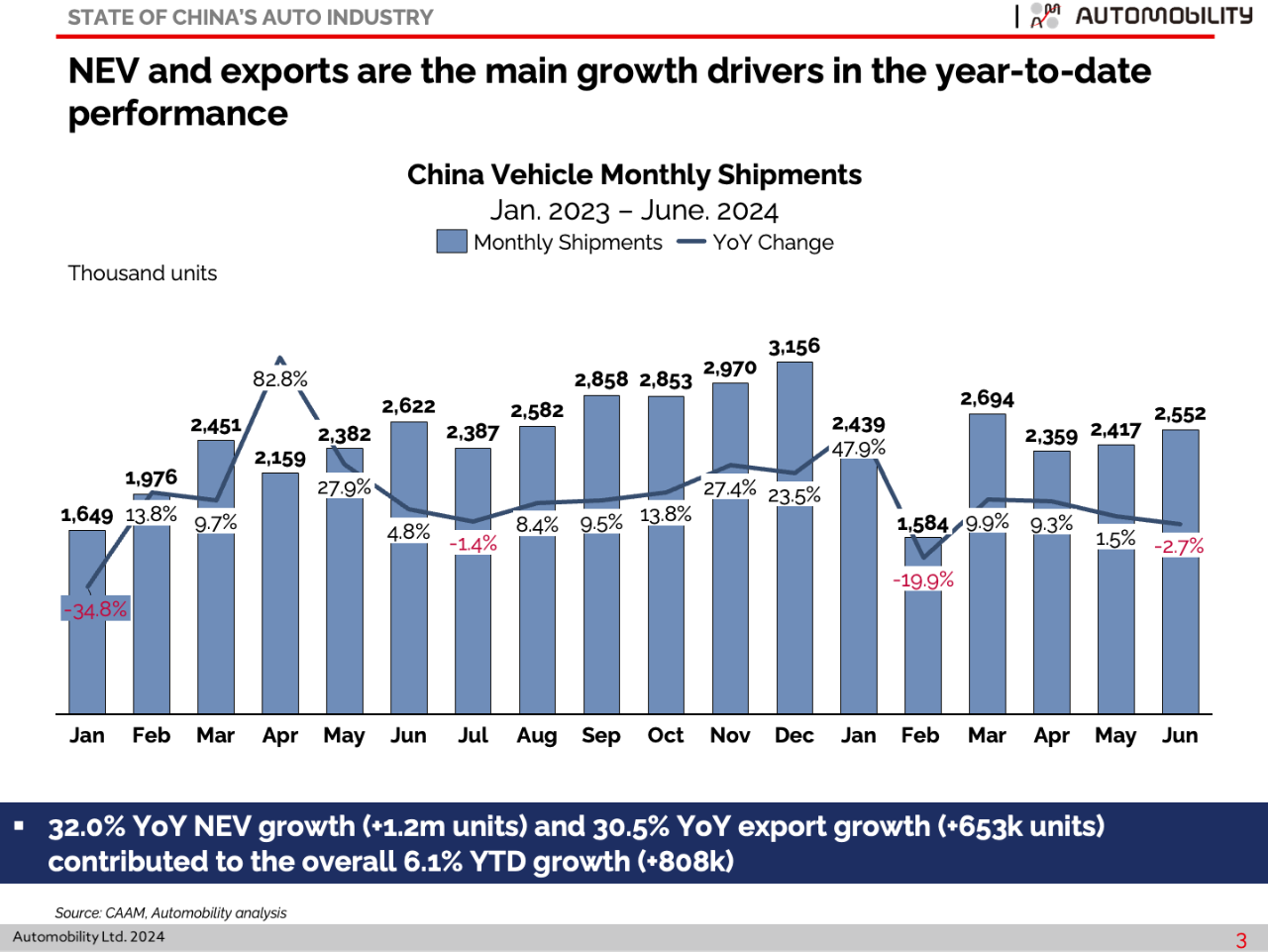

Shipments were up 6.1% in the first half versus last year. Through June, vehicle shipments reached 14 million units, and NEV shipments are up 32% while ICE shipments are down 4.1%. Nearly 20% of all cars produced in China were exported so far this year.

NEV includes Battery Electric Vehicles (BEV), Plug-in Hybrid Electric Vehicles (PHEV), and Fuel Cell Electric Vehicles (FCEV)

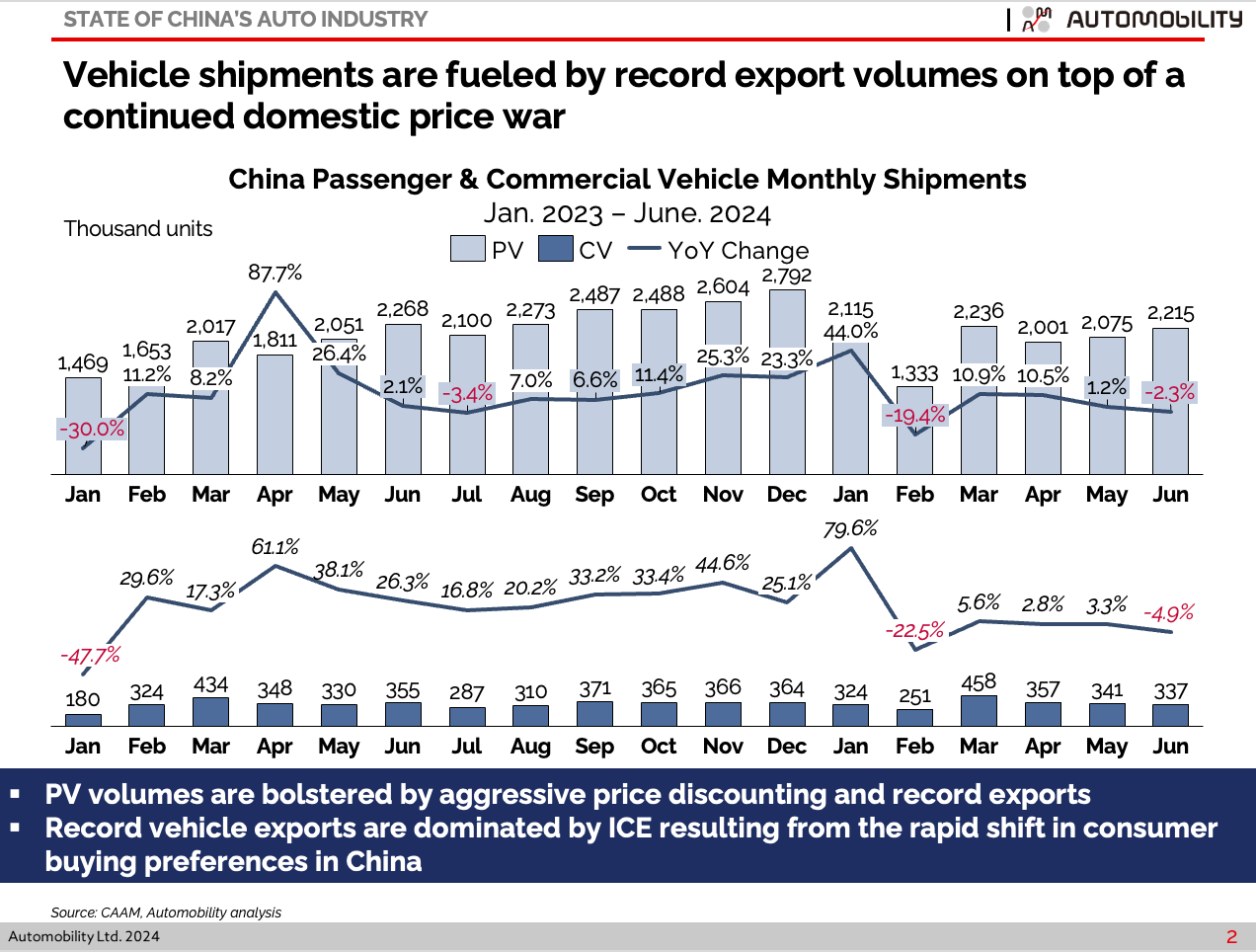

Monthly shipment volumes have been flat for passenger vehicles and negative for commercial vehicles since Chinese New Year. This is in spite of the re-ignition of the price war after the holiday. If such pricing actions were not taken, domestic sales would be considerably worse.

June shipments were down 2.7% over the prior June, with 2.55 million units produced. New Energy Vehicle shipments in June were 1,048,000 of this total, along with 485,000 vehicles produced for sale in other markets.

Excess ICE Capacity Fuels Record Exports

Monthly NEV share surpassed 40% of all vehicles produced in China in June, with no indication of a slowdown in this shift in consumer preference. Within this total, sales of plug-in vehicles (PHEV and EREV) are far ahead of last year’s pace, while BEV sales have remained relatively flat as Chinese consumer preferences have shifted to the plug-in variety. This is bad news for BEV-only players like Tesla, NIO, XPENG, GAC AION and many others.

It is noteworthy that while the EU trade action exclusively targets Made-in-China BEVs, more than half of these BEVs were produced by western brands. Tesla, Renault and BMW historically comprise over half of the Made-in-China BEV exports, while Chinese brands comprised about 20% of the total BEV registrations in the early months of 2024. The tariff action seems to anticipate that, left unchecked, Chinese BEVs will eventually to dominate the market. However, it completely ignores the challenge of anything other than Made-in-China BEVs.

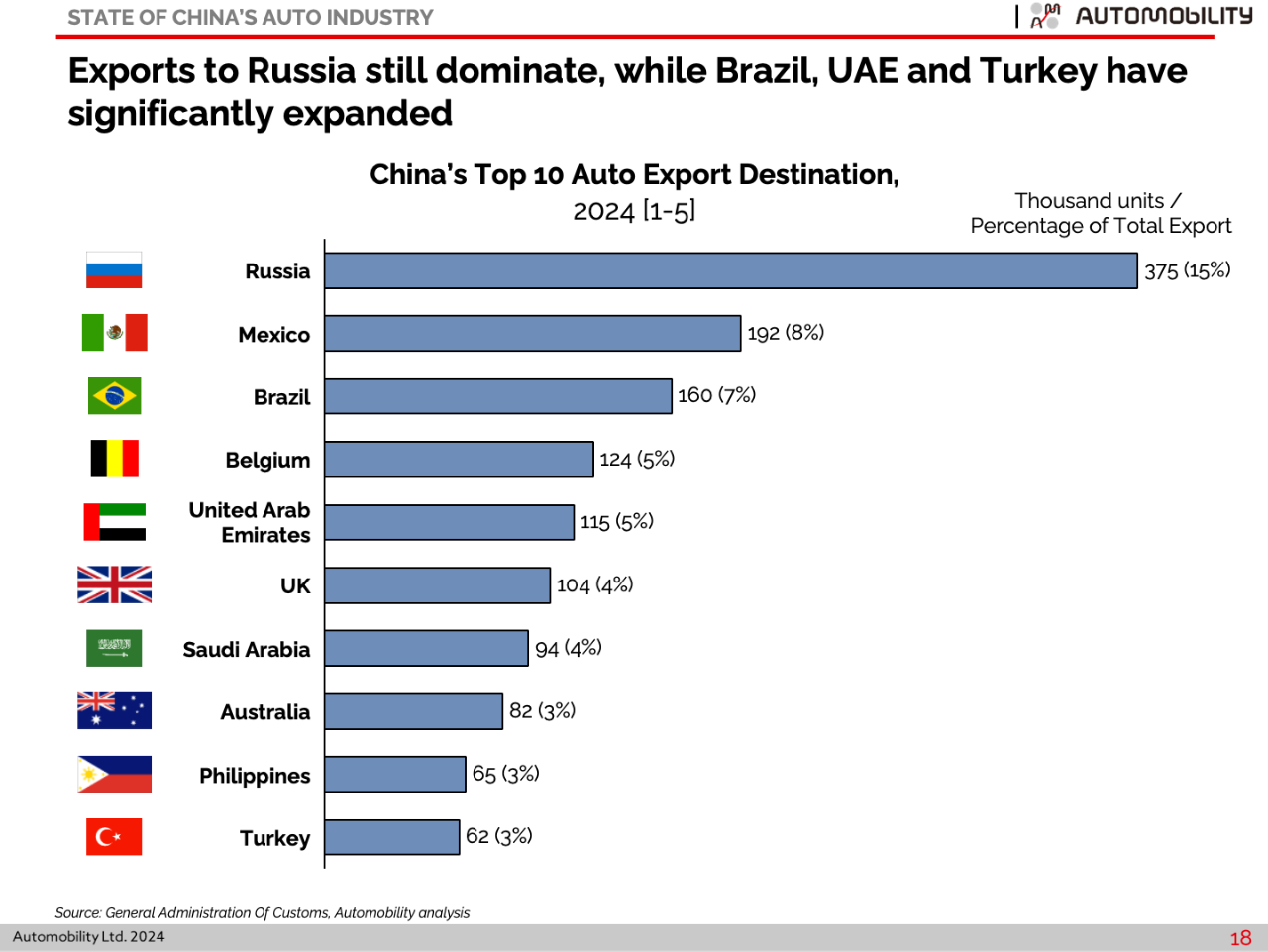

As noted earlier, the imposition of duties by the EU (and elsewhere) will likely have a significant impact on the mix and destination of Made-in-China exports. Through May, Russia was by far the leading destination for Made-in-China exports, while Brazil, UAE and Turkey have risen rapidly.

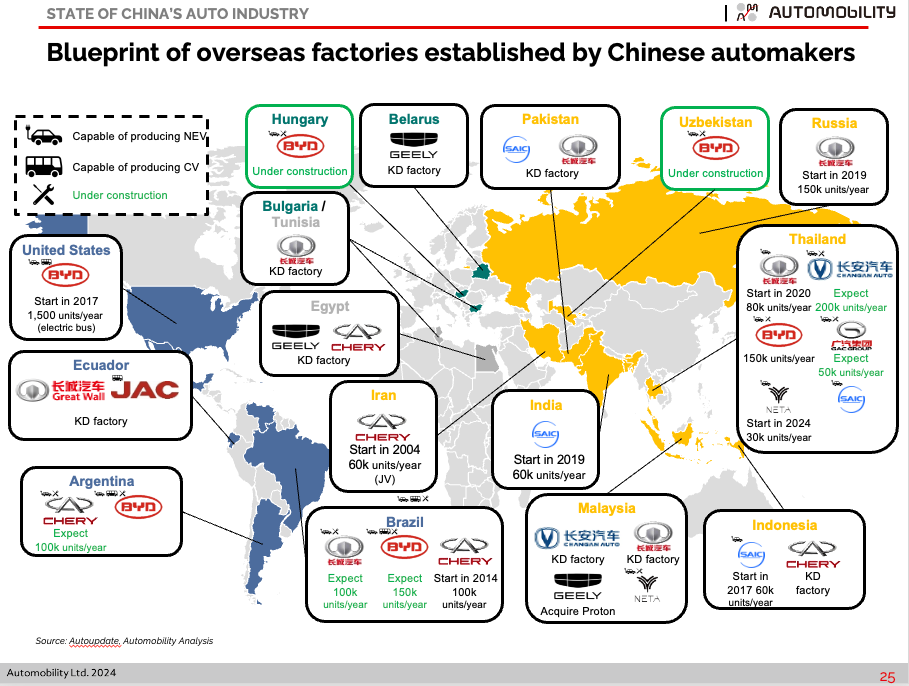

We believe tariff policies will incentivize Chinese brands to go global even faster. Chinese brands have already made moves to globalize their footprint by building knock-down (KD) as well as fully localized production in markets around the world.

1st Half NEV Sales Summary

Over 35% of vehicles manufactured in China this year were New Energy Vehicles, in spite of the heavy ICE export mix which dilutes this percentage. NEV share of domestic sales is ~39%. 4.94 million NEVs were produced in the first half of 2024, an increase of 6.9% over last year’s first half.

The first half leaderboard is dominated by BYD, with ~34% share of the NEV market. Aggressive pricing moves were taken in order to secure this dominant position. Several rising stars are emerging, including Huawei’s AITO brand, which has emerged as a smart EV challenger to Li Auto. Both companies are producing popular and well-contented extended range SUVs.

Significant year-over-year gains have accrued to legacy Chinese carmakers in this segment, with Geely (+118%) and Chang’an ( +95%) and Chery (+187%) climbing rapidly with their new offerings, proving that legacy carmakers can become relevant NEV brands in China.

It is also worth noting that Tesla is the sole foreign brand on the NEV domestic sales leaderboard, but their sales are down 5.4% versus last year as their aging BEV-only product portfolio is limited.

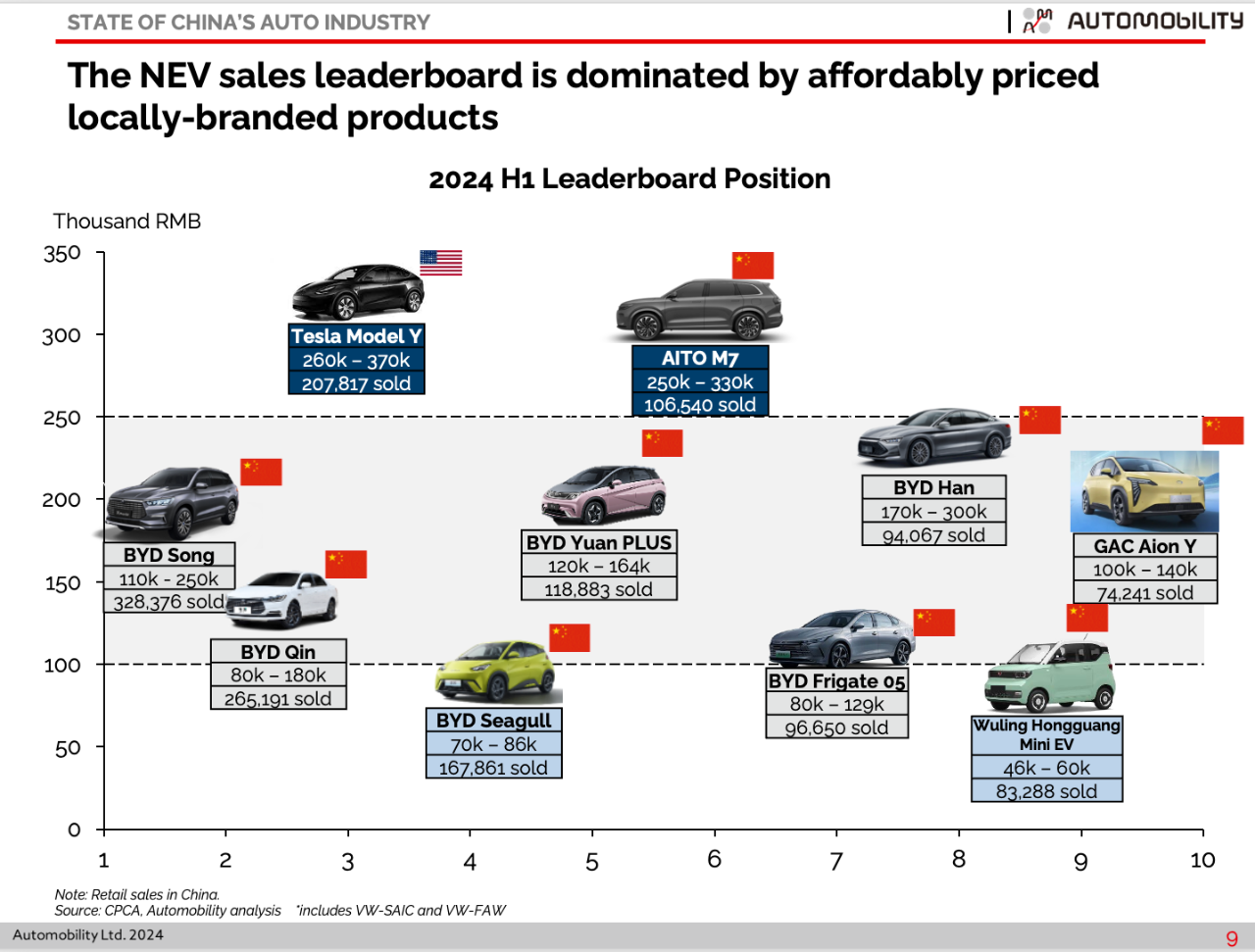

Affordably priced vehicles dominate the top-10 list of best-selling NEVs. At current exchange rates [1 USD = 7.25 CNY], Chinese branded NEVs are competing favorably on price versus ICE vehicles while offering far more technology.

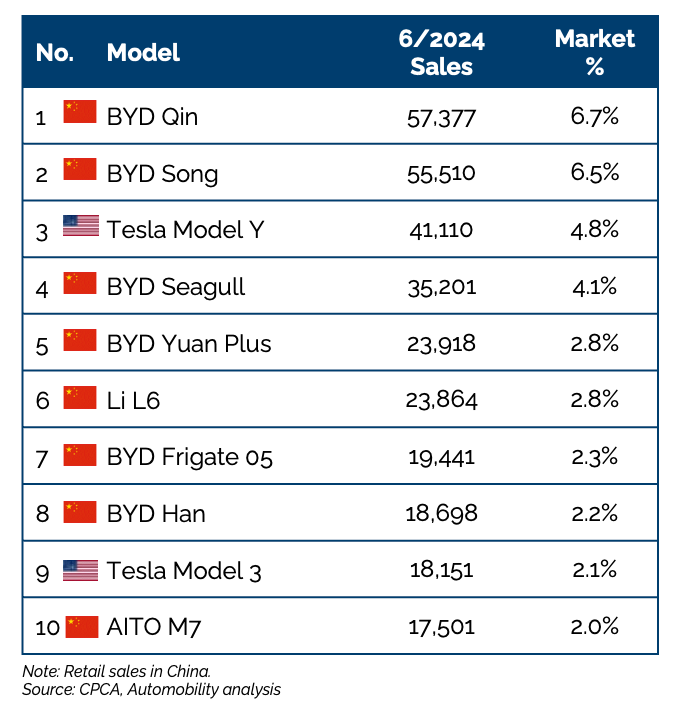

A few movements were seen on the June top-10 NEV Models leaderboard, with BYD holding 6 of the top 8 slots. Li Auto’s newly launched L6 took 6th place and AITO’s N7 placed 10th. The remaining slots were held by Tesla. It is noteworthy that there are just 4 brands on this list: it is already a very concentrated market.

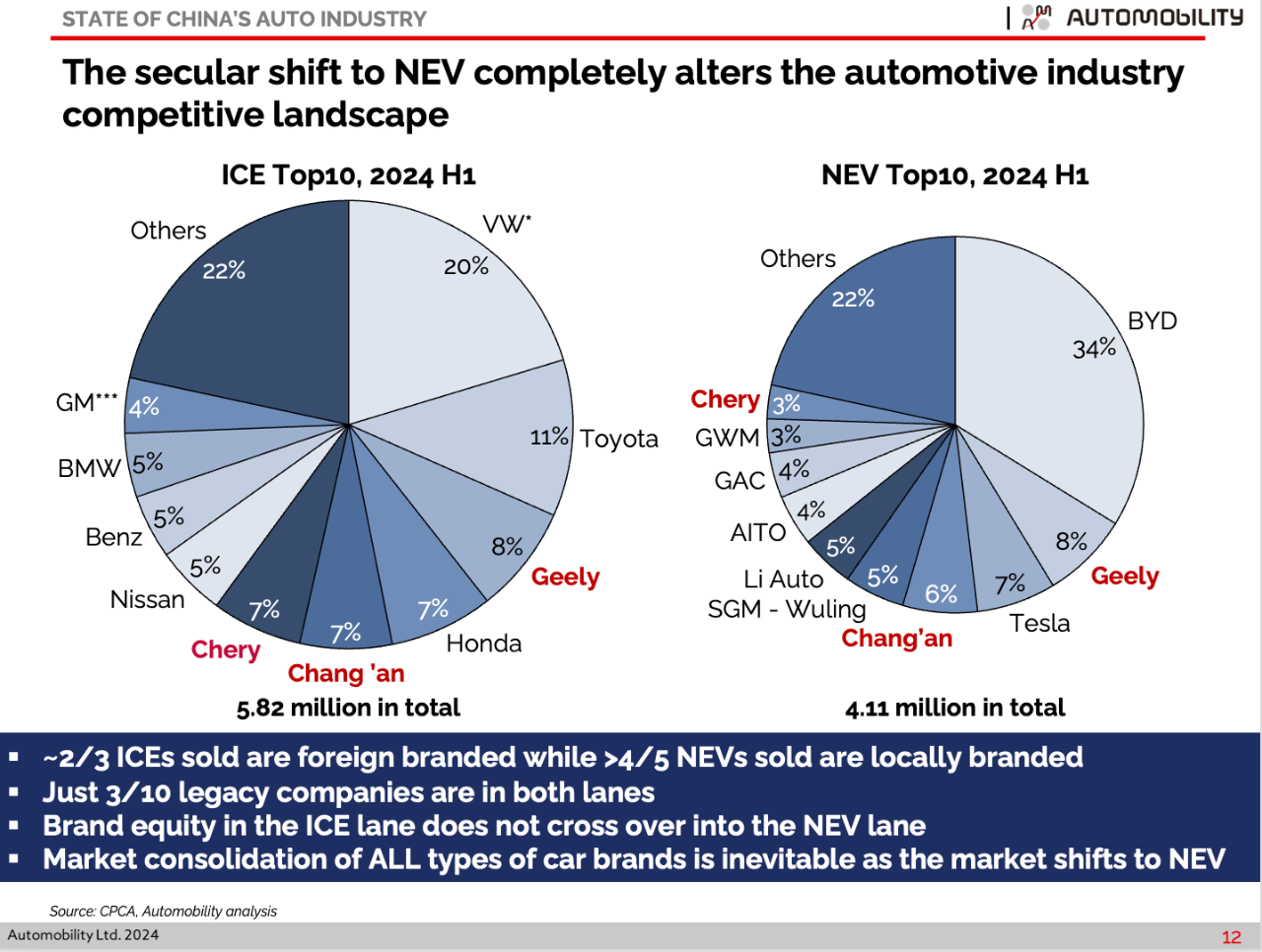

The ICE pie shrinks as the NEV pie expands, signaling the end of foreign brand dominance of the China auto market. Nine of the top 10 NEV carmakers are Chinese – with Tesla the only exception. Leadership and brand equity in the ICE lane does not carry over to the NEV lane. However, there are legacy brands in the NEV lane: and all of them are Chinese. BYD, Geely, Chang’an, Wuling, GAC, Great Wall and Chery were all making ICE powered vehicles before they began making NEVs.

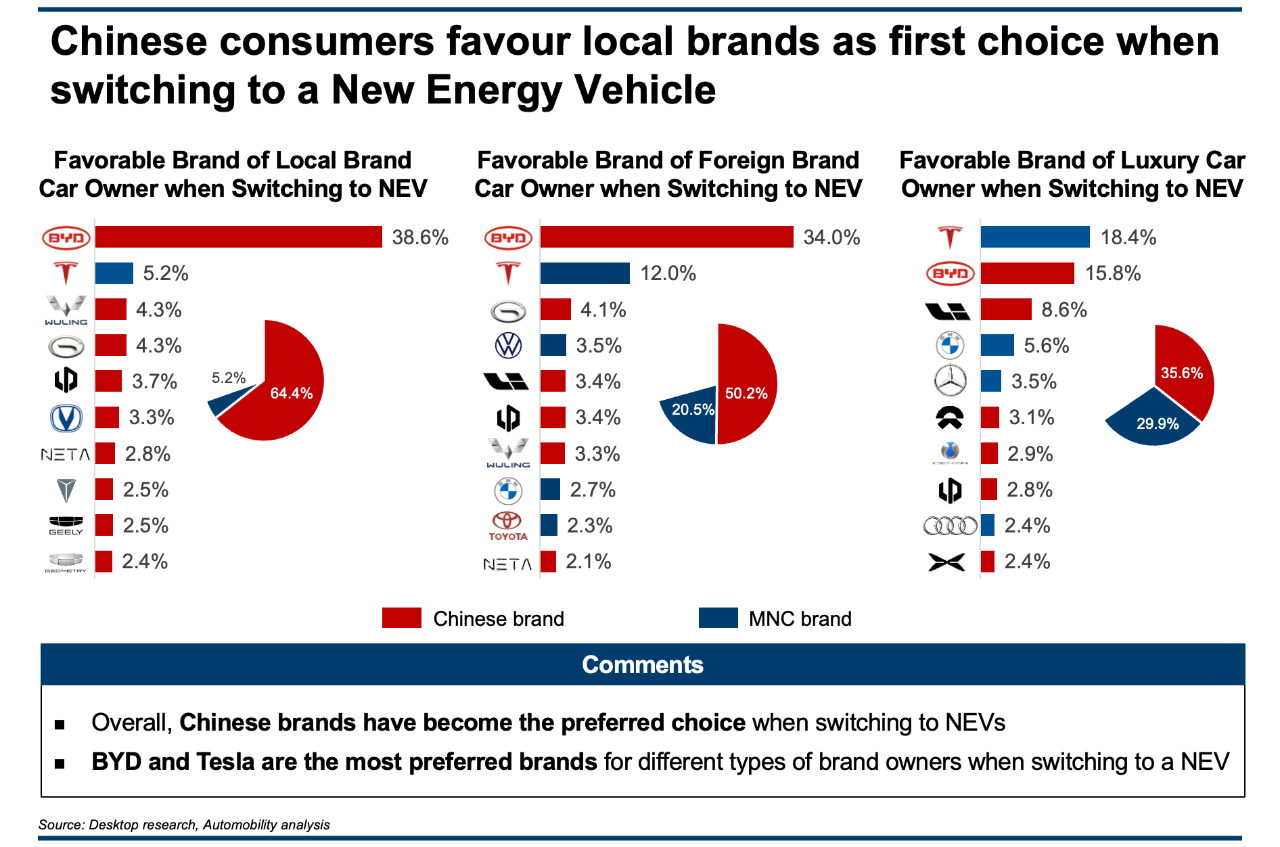

In addition, our research indicates that Chinese consumers favor local brands when switching from a gasoline powered vehicle to a new energy vehicle. Even owners of foreign luxury brands signal a higher preference for Chinese brands when switching to NEV. This was inconceivable just a few years ago.

The net result, when we combine sales for all passenger vehicles, is that Chinese brands are dominating the market as it shifts to NEV. For the first time, BYD has taken the number 1 position as an automotive OEM in China (as a group company across all its brands).

In spite of its struggles to grow in China, Tesla has moved ahead of General Motors to become the largest American carmaker in China.

With their dominance of the NEV segment, Chinese brands now command 62% share of passenger vehicles market in China, a swing of 26% since 2020. Double-digit passenger vehicle share losses have continued into 2024 for brands from all the major auto producing countries.

Webinar | State of China Auto Market Monthly Briefing (July)

AUTOMOBILITY MEDIA COMMENTARY ON TARIFF TOPIC

- China’s EV makers can ride the tariffs backlash [The Exchange Podcast – June 17]

- How Chinese EV makers are slowly taking over the world [Business Insider – June 22]

- China targets Morocco as launchpad into Europe’s green auto market [Politico – June 26]

-

Will China EVs Survive Europe Tariffs [BLOOMBERG TV – July 4] -

EU hits Chinese electric cars with new tariffs [BBC – July 4]

“It’s a well architected plan to encourage companies to shift their investments to the EU, instead of relying on exporting from China,” said Bill Russo, from Shanghai-based consulting group Automobility Ltd.

-

China EV makers brace for tariffs as Beijing, EU engage in talks [Reuters – July 4]

“The immediate impact is it will force companies that are using made-in-China exports as their business model to reconsider that strategy and to localize more or to push some of that capacity outside of China in the direction of the markets that they’re serving.”

About Bill Russo

Bill is a contributing author to the book Selling to China: Stories of Success, Failure, and Constant Change (2023), where he describes how China has become the most commercially innovative place to do business in the world’s auto industry – and why those hoping to compete globally must continue to be in the market.

About Automobility

Contact us by email at info@automobility.io

PLEASE NOTE: The information and analysis shared in this newsletter, including the charts and style of materials presented, is the intellectual property of Automobility Ltd. While we share it as a way to serve our existing and new clients, it is not to be used without our express consent and then only with attribution. Any publication, reproduction or other use of this material without the express written consent of Automobility Ltd is prohibited.

Sorry, the comment form is closed at this time.