21 Jun State of China’s Auto Market – June 2024

Comments from Bill Russo, Founder & CEO of Automobility Ltd.

PLEASE NOTE: The information and analysis shared in this newsletter, including the charts and style of materials presented, is the intellectual property of Automobility Ltd. While we share it as a way to serve our existing and new clients, it is not to be used without our express consent and then only with attribution. Any publication, reproduction or other use of this material without the express written consent of Automobility Ltd is prohibited.

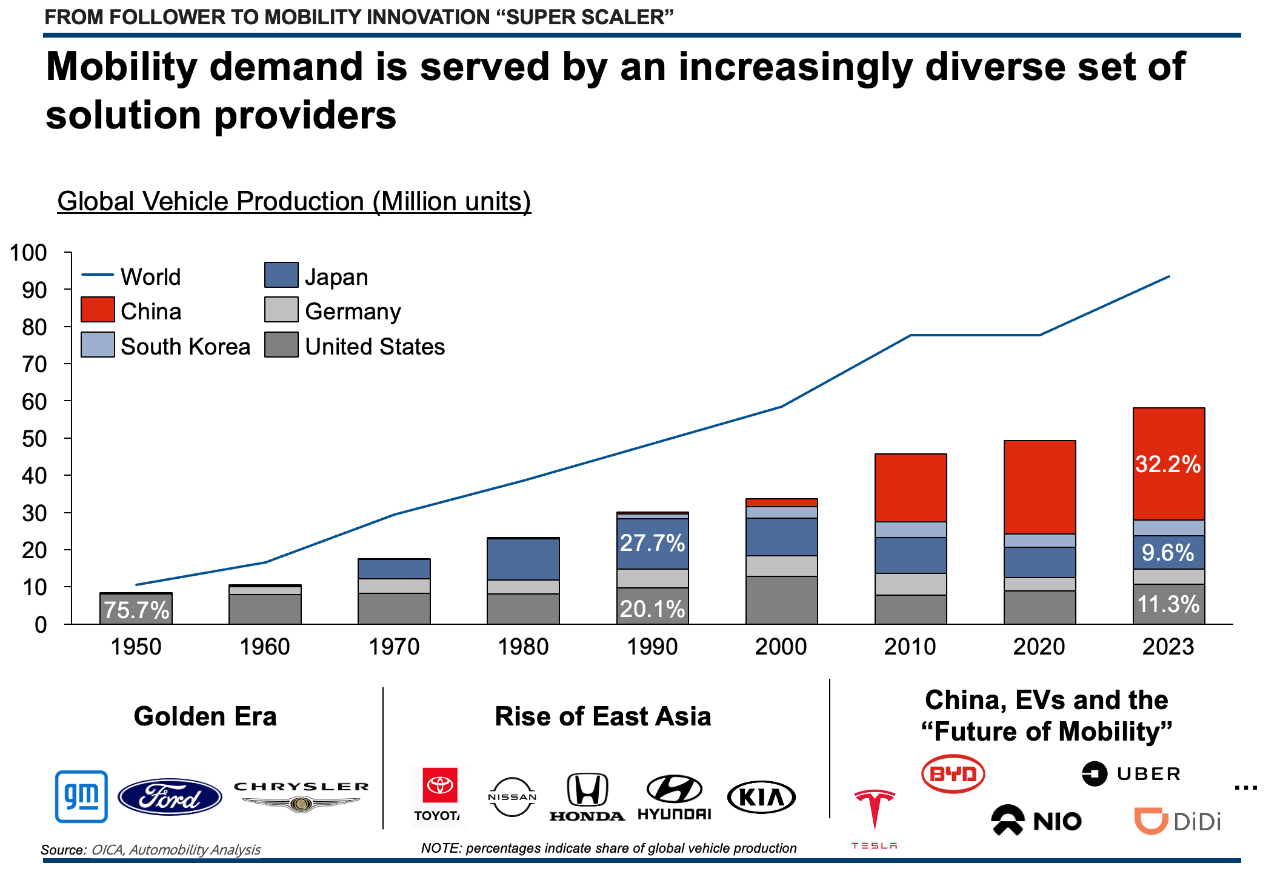

2024 YEAR-TO-DATE HIGHLIGHTS

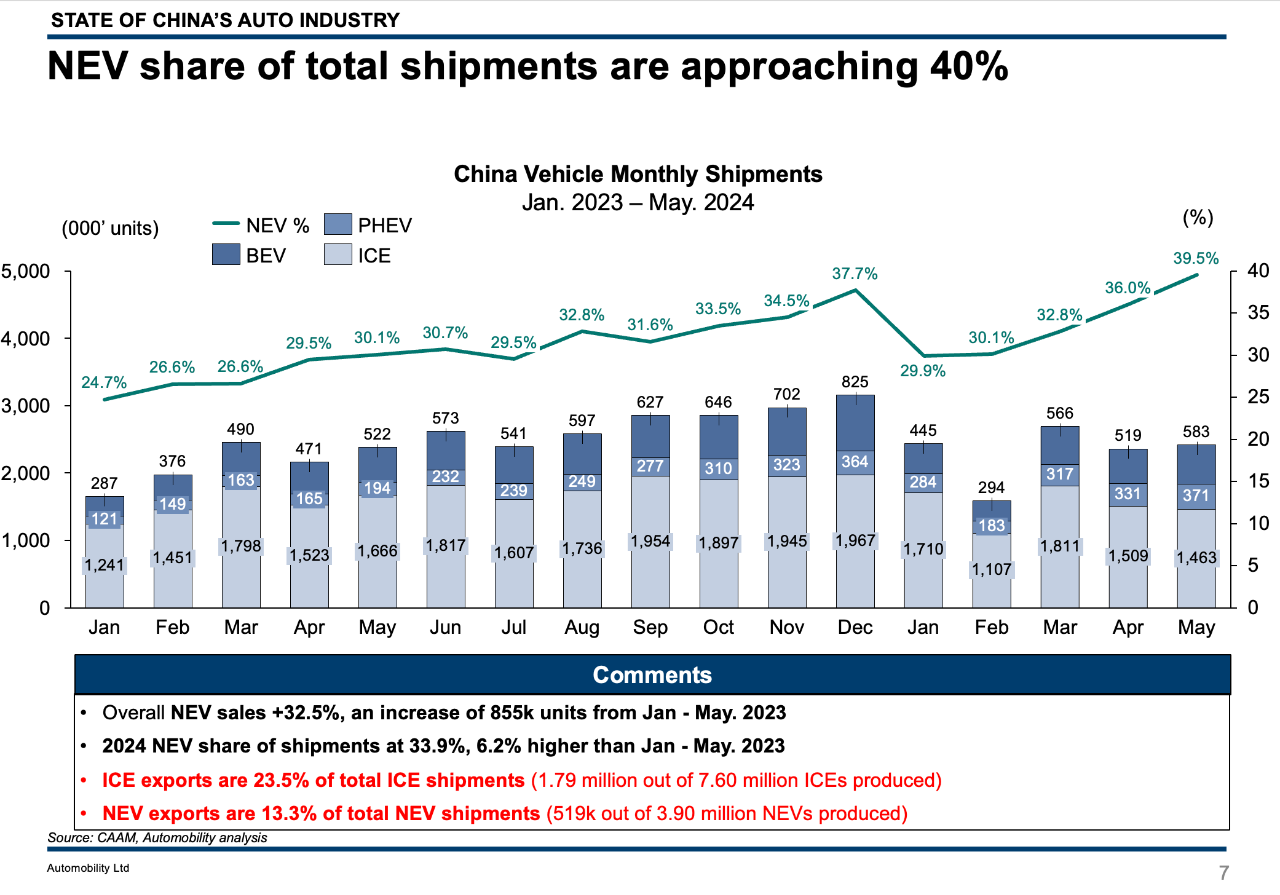

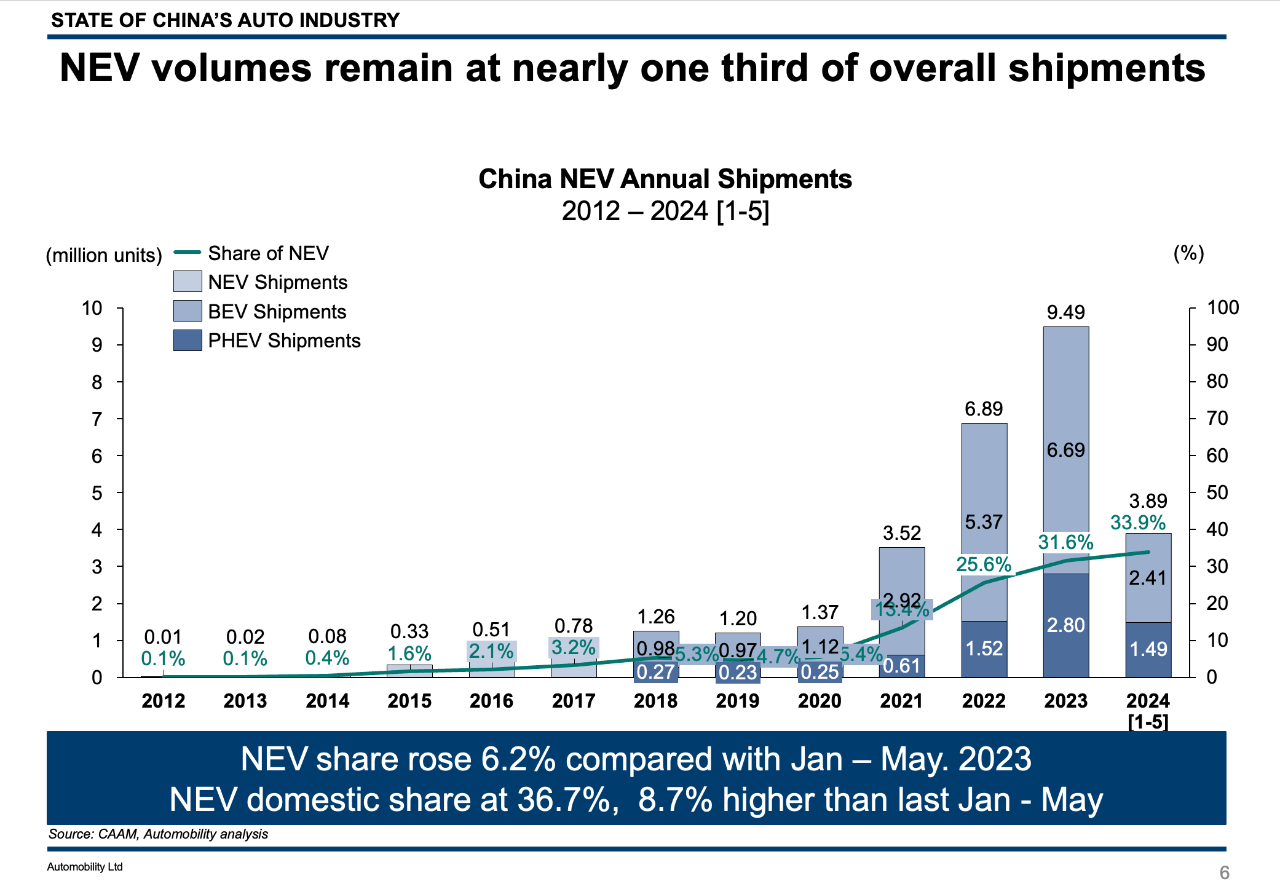

- Shipment volumes are up 8.3%, with NEV growth ~33% higher than last year through May

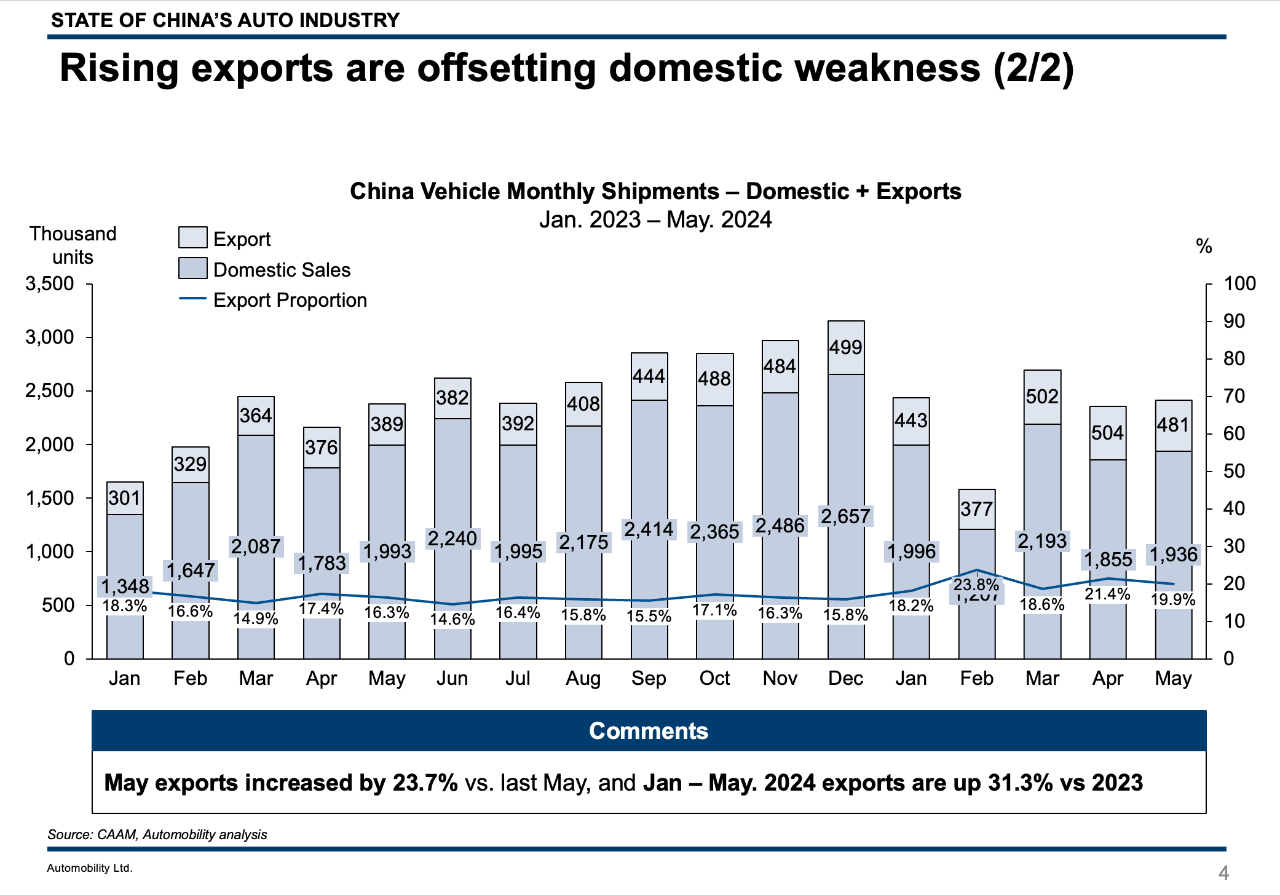

- More than 20% of cars manufactured in China are now exported

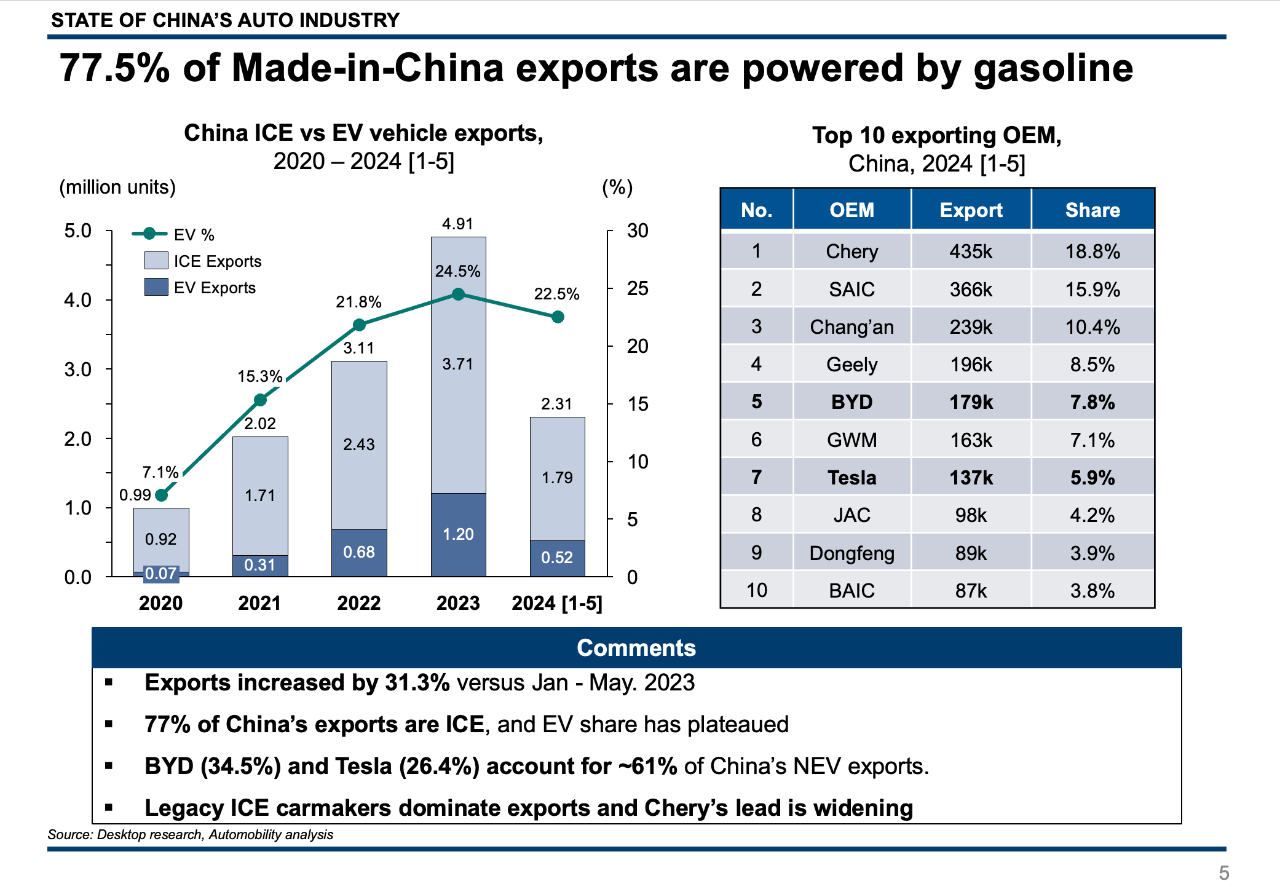

- 77.5% of exports are conventional internal combustion engine (ICE) cars

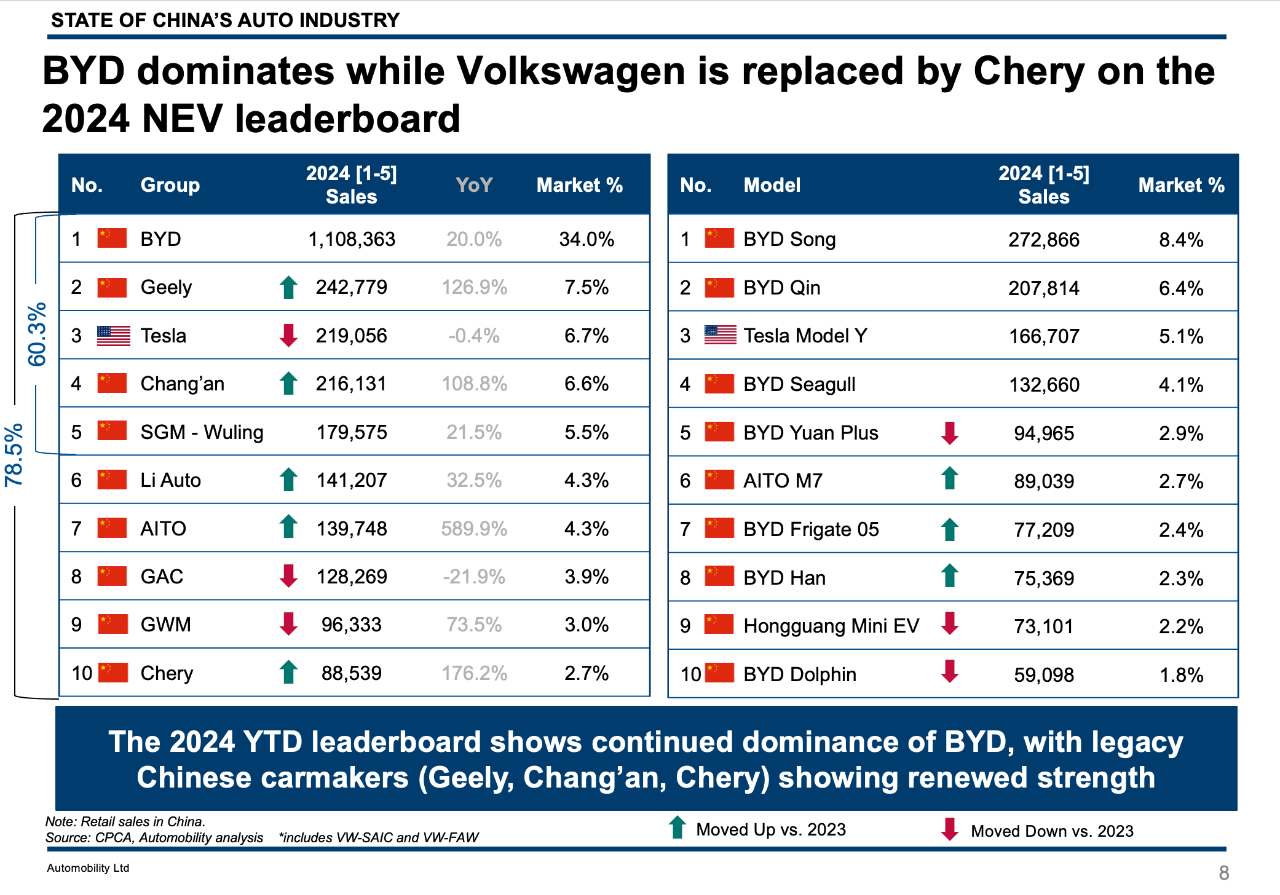

- Chery now has ~19% of all made-in-China exports and has jumped onto the top 10 domestic NEV sales leaderboard

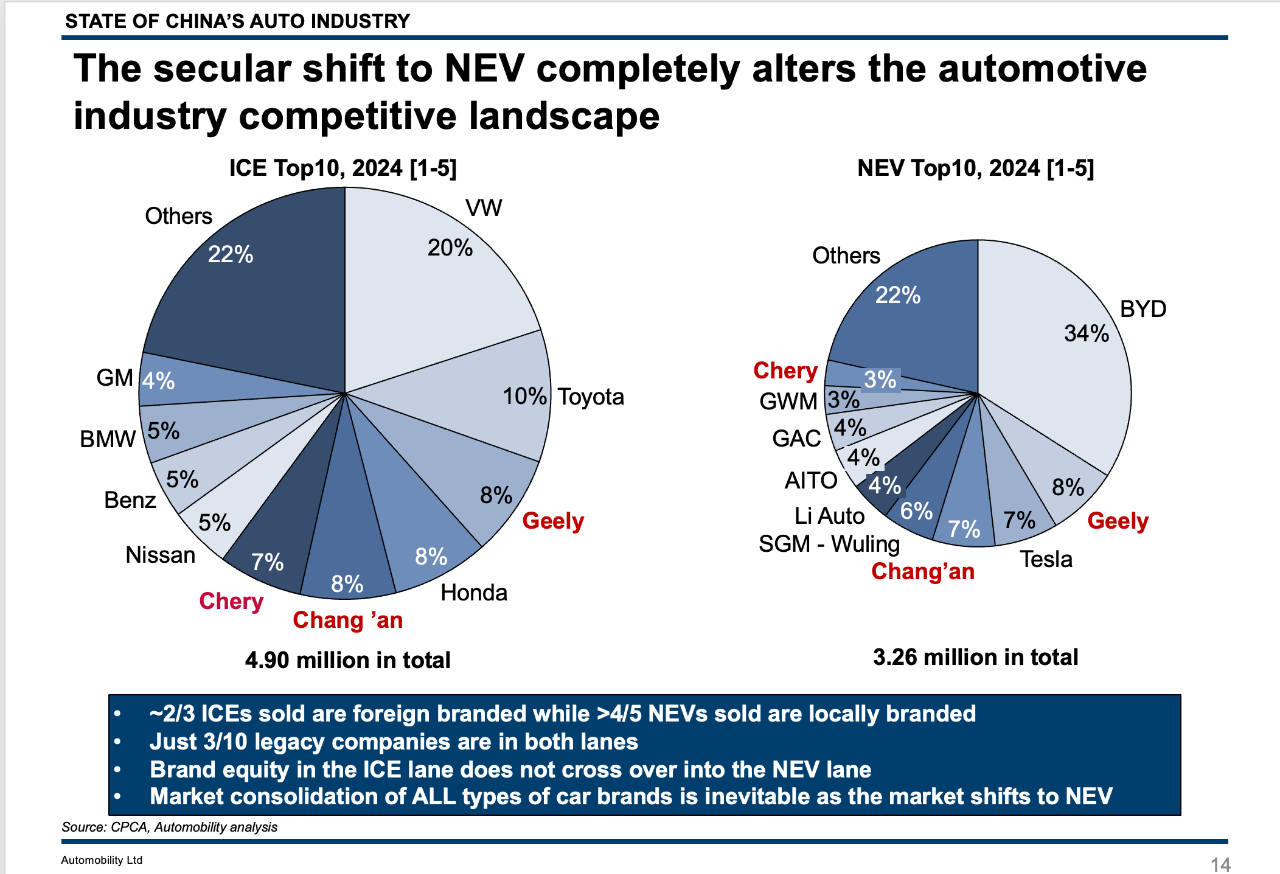

- Volkswagen fell from the top 10 list in NEV sales, and Tesla is the only foreign brand that remains on the leaderboard

It’s been another very busy month with a growing interest in the developments in China. I just returned to Shanghai from a whirlwind travel period where I spoke in at dealer conferences in Italy and Denmark, and joined investor conferences in Hong Kong and Sydney. In between international trips, I also spoke at events in Suzhou (DUSA’s Captain’s Dinner Event) and the China Automotive Chongqing Summit (CACS 2024) on the topic of “Navigating the Chinese-Western Automotive Nexus”.

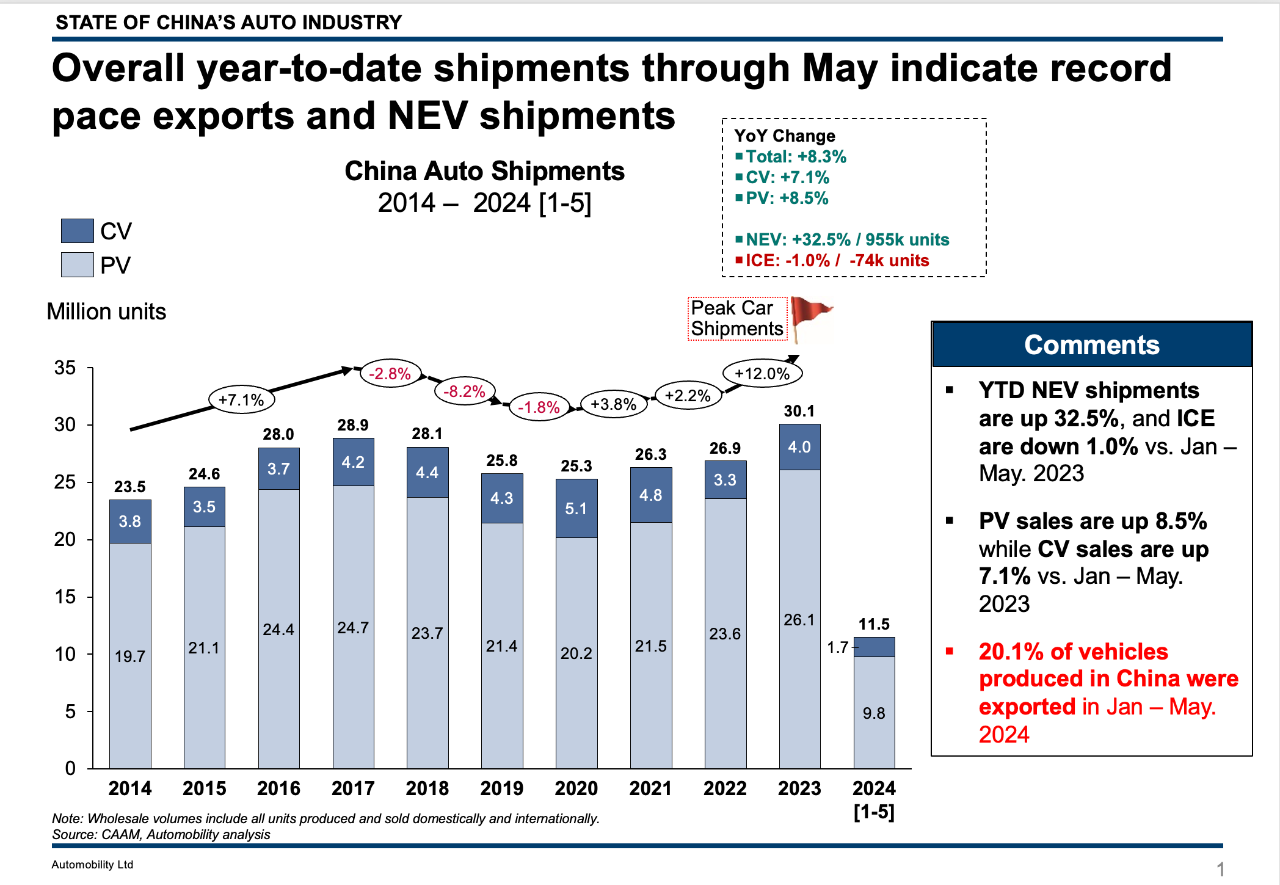

Record Pace of Exports and NEV Shipments

Ex-factory shipments are up 8.3% through May when compared with last year. Through May, vehicle shipments reached 11.5 million units, and NEV shipments are up 32.5% while ICE shipments are down 1%. Shipment volumes include exports, which now represent more than 1 of every 5 cars made in China.

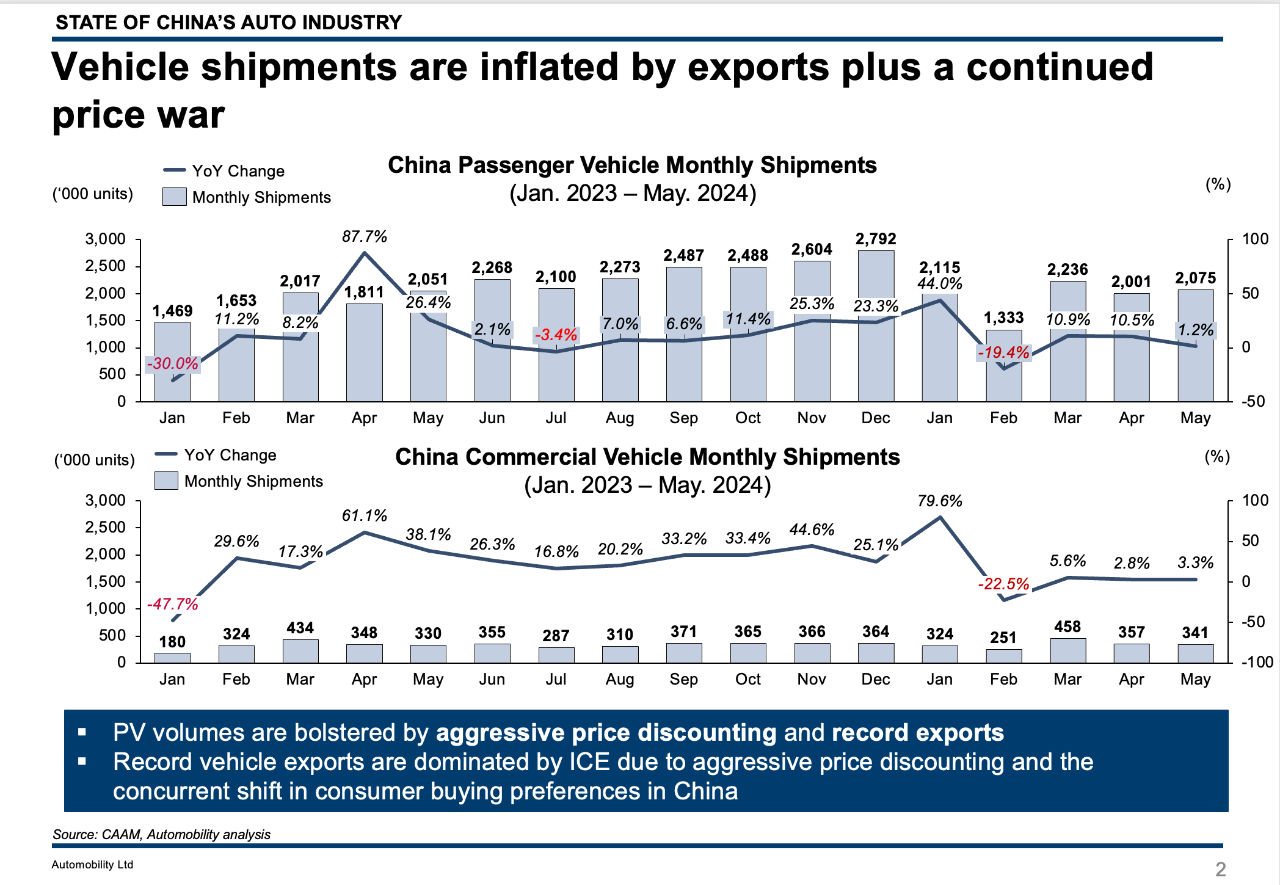

Viewed on a monthly basis, we see a relatively flat development of volumes in recent months. After a slight bump in volume after BYD re-ignited the price war (as reported in our March newsletter), volumes have settled in to a new normal (and relatively weak) pattern. It is pretty clear that without the price war, overall domestic industry volumes would be significantly worse.

May shipments were up 1.5% over the prior May, with 2.42 million units produced. New Energy Vehicle shipments in March were 955,000 of this total, along with 481,000 vehicles destined for sales outside of China.

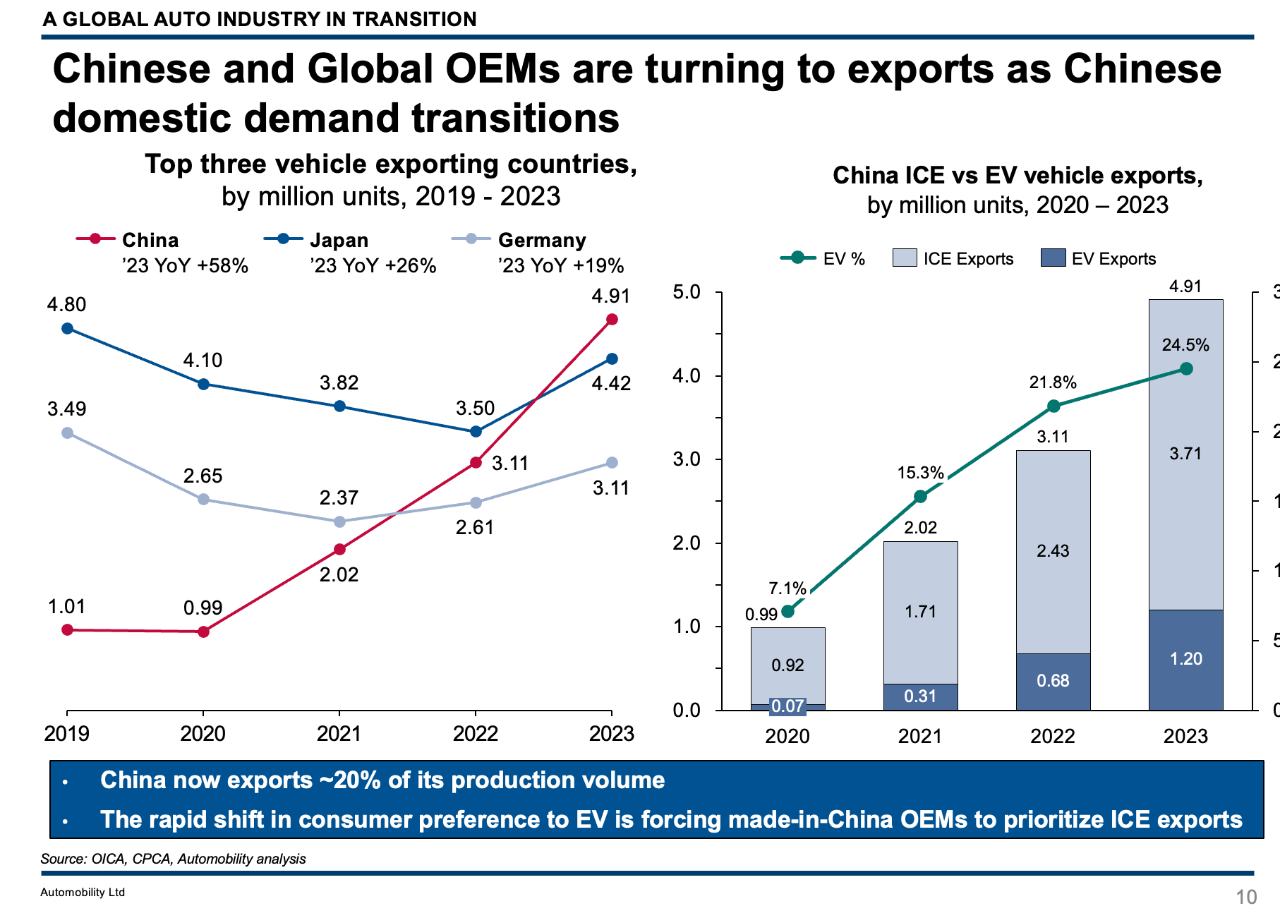

Exports on Record Pace in 2024

NEVs are approaching 40% of vehicles manufactured in China, and this share is increasing steadily. The 1.46 million ICE vehicles produced in May are increasingly being shipped to countries that remain stuck in the “ICE age”. Through May, 23.5% of all made-in-China ICE powered vehicles were sold outside of China. This includes vehicles produced by the joint ventures of multi-national carmakers including General Motors, Nissan, Honda, Hyundai and many others who are faced with excess capacity as Chinese consumer preferences have shifted rapidly.

Exports of Made-in-China vehicles are up 31.3% in 2024 versus last year, and now represent ~20% of all vehicles produced in China. Stripping this away, it becomes clear that the domestic market is weak, leaving both domestic and global carmakers with the challenge of excess capacity. The choice is clear: close unnecessary factories or pivot to export. Exports are the preferred safety valve to relive pressure of excess supply available in China.

2.31 million vehicles were exported from China from January through May, nearly 78% of which were powered by an Internal Combustion Engine (ICE). As we have reported in prior months, this is a reflection of the significant overhang in ICE capacity that exists in China, as NEV sales have cannibalized retail consumer demand for gasoline powered cars. As a result, carmakers have pivoted to prioritizing sales of these vehicles in other markets.

BYD is now the leading NEV exporter with ~35% of the half million NEV exports from China. Together with Tesla, these two companies comprise 61% of NEV exports from China.

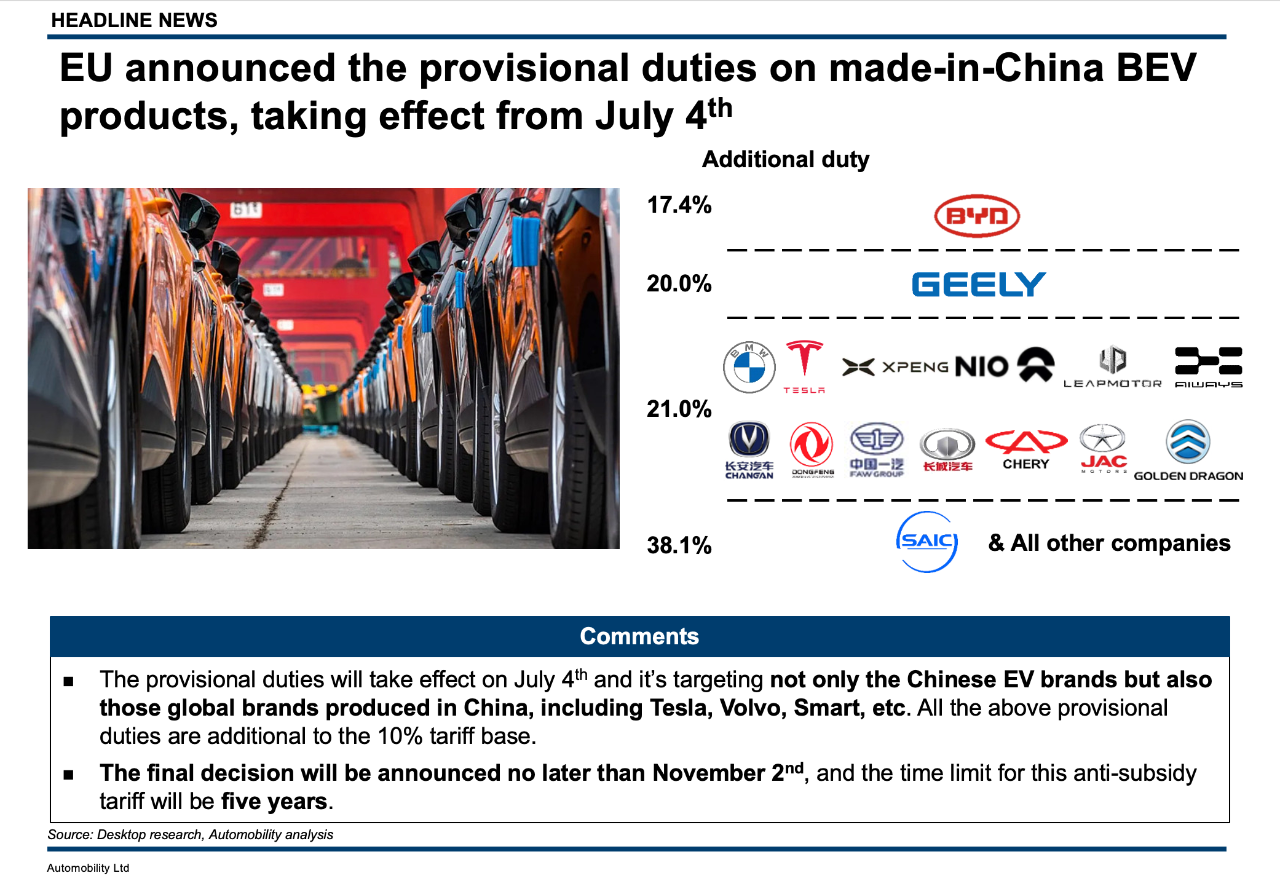

The recent US action to increase tariffs on Chinese EVs to over 100% is a clear indication that the US government seeks to protect its domestic carmakers from the threat of affordably priced Chinese EVs. Comparatively, the EU action sends a very different message. The EU action places a higher burden on government-backed companies with limited investments in EU production. This is a signal that the EU is open to localization of Chinese supply chains and car manufacturing and is discouraging made-in-China exports.

We shared our opinions on EV tariffs in this CNBC special report: Why EV Tariffs Won’t Stop Chinese Cars [CNBC VIDEO]

Asia Matters: Why China Is Winning the EV Race [PODCAST]

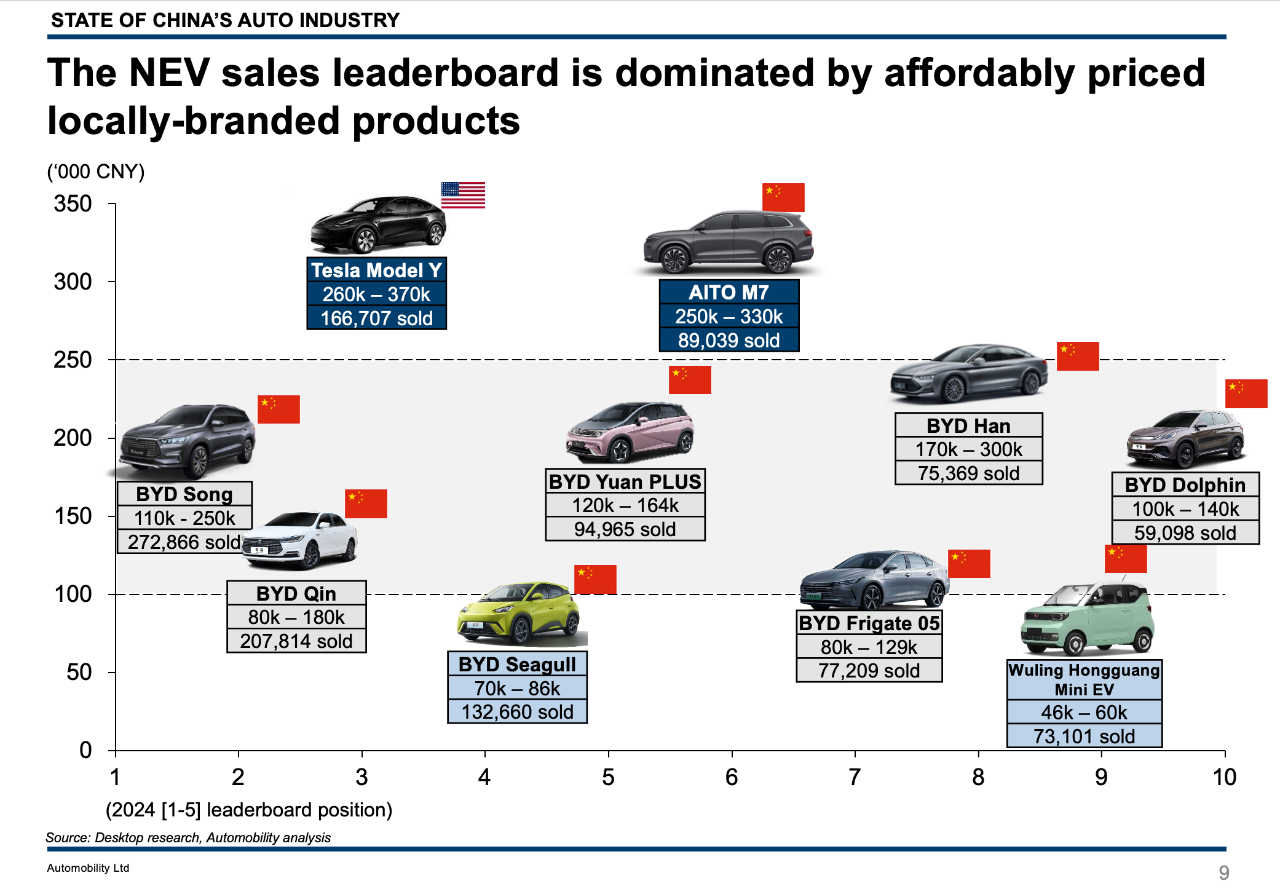

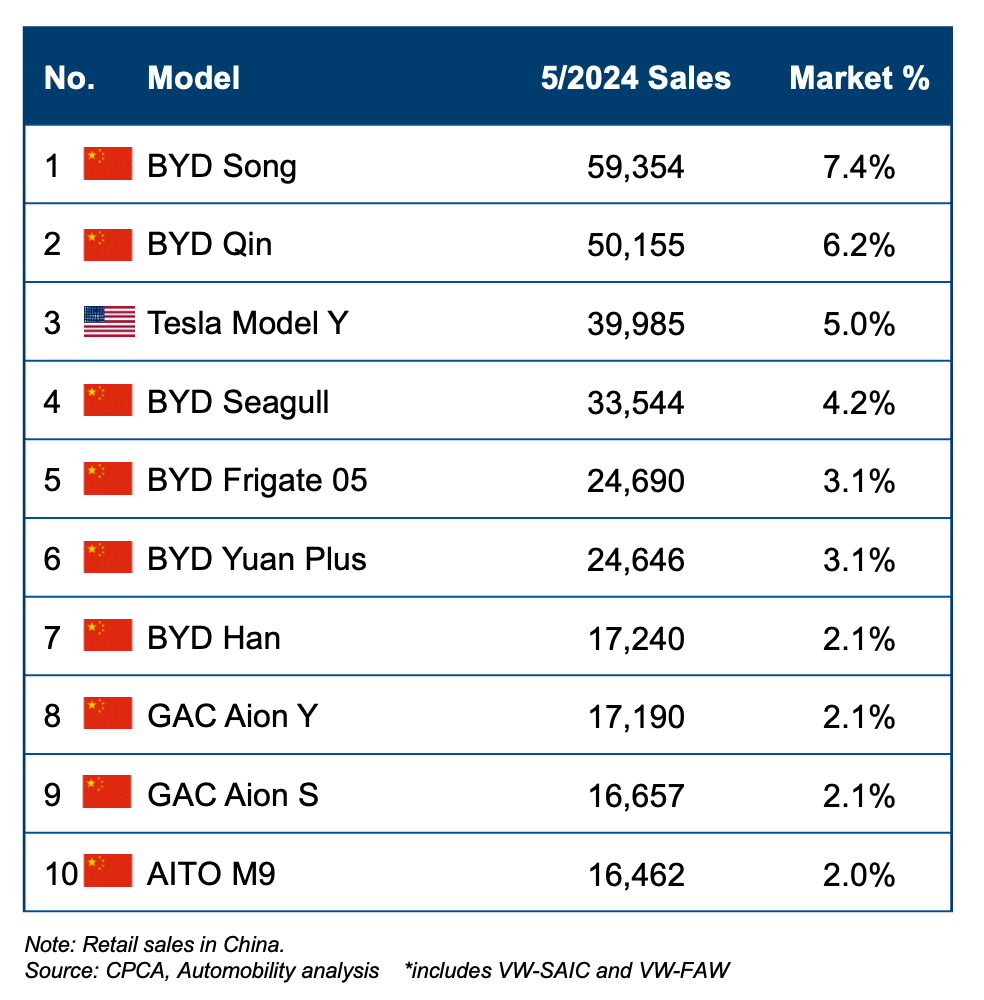

Affordably priced vehicles dominate the top 10 list of best-selling NEVs. At current exchange rates [1 USD = 7.26 CNY], Chinese branded NEVs are competing favorably on price versus ICE vehicles while offering far more technology.

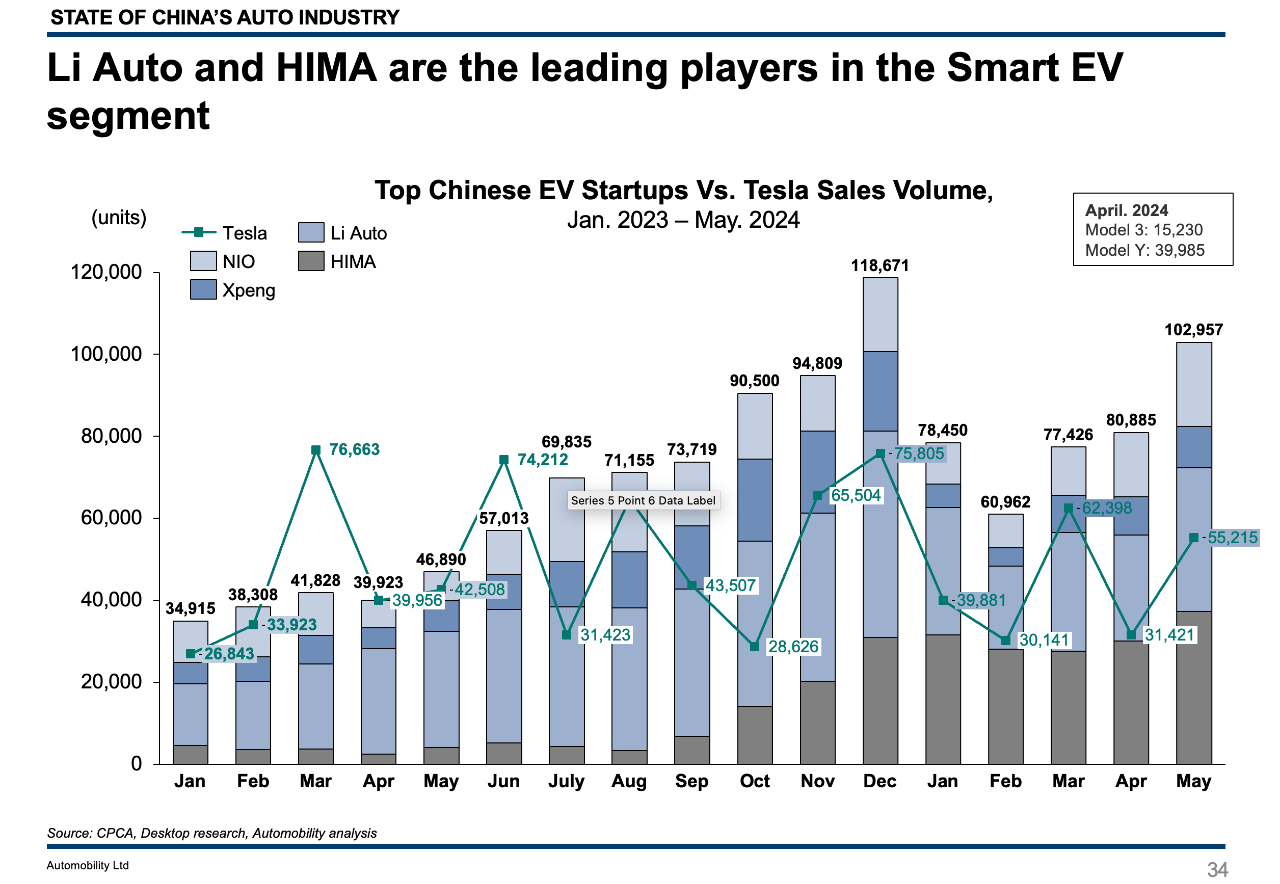

In fact, the strength of Huawei’s entry in the Smart EV lane can be seen when we combine the sales of its HIMA (Harmony Intelligent Mobility Alliance) brands. HIMA includes brands that use Huawei’s Harmony OS platform design and Intelligent Connectivity features, led by AITO. HIMA includes products manufactured by BAIC (under the Stelato brand) and Chery (under the Luxeed brand), among others.

Huawei is proving that “smartness” matters in China – especially when coming from a smart device maker. We will keep a close watch on Xiaomi as they also bring a similar set of capabilities to a market that values smartness.

We have recently talked about this on a recent ShanghaiZhan podcast where I shared my impressions from the 2024 Beijing Auto Show with my Selling to China co-author Bryce Whitwam:

(Copy and Paste the link to your browser: https://podcasts.bcast.fm/e/v8w416rn-the-2024-beijing-autoshow-an-auto-industry-wake-up-call-with-bill-russo)

A New Competitive Reality

Chery replaced Volkswagen Group as a top-10 NEV sales leader, leaving Tesla as the only multi-national brand on this 2024 year-to-date list. 3 legacy brands including Geely, Chang’an and Chery appear on both top-10 lists proving that legacy companies can make the transition.

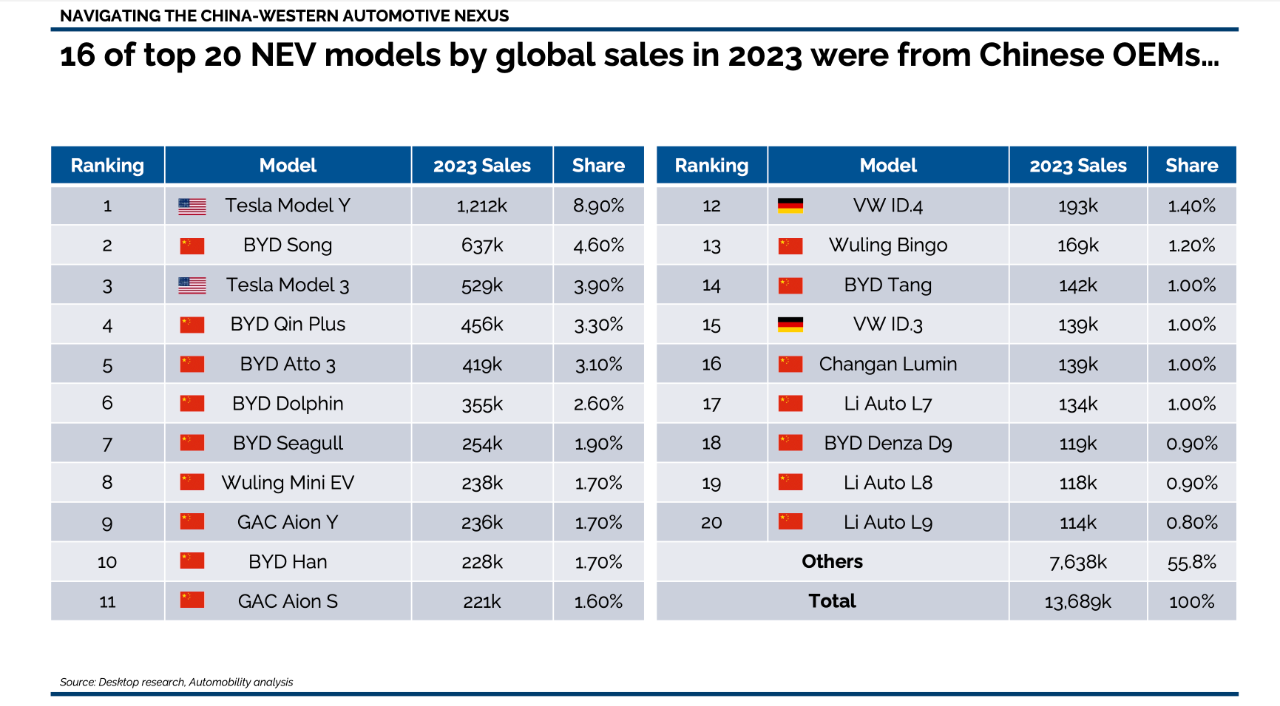

Chinese brands clearly dominate the race to electric mobility in China as well as globally, with 16 of the top 20 NEV models sold around the world produced by Chinese companies.

Why American Automakers Are Failing In China

(Copy and Paste the link to your browser [VPN required]: https://www.youtube.com/watch?v=LiamzUP6rjo)

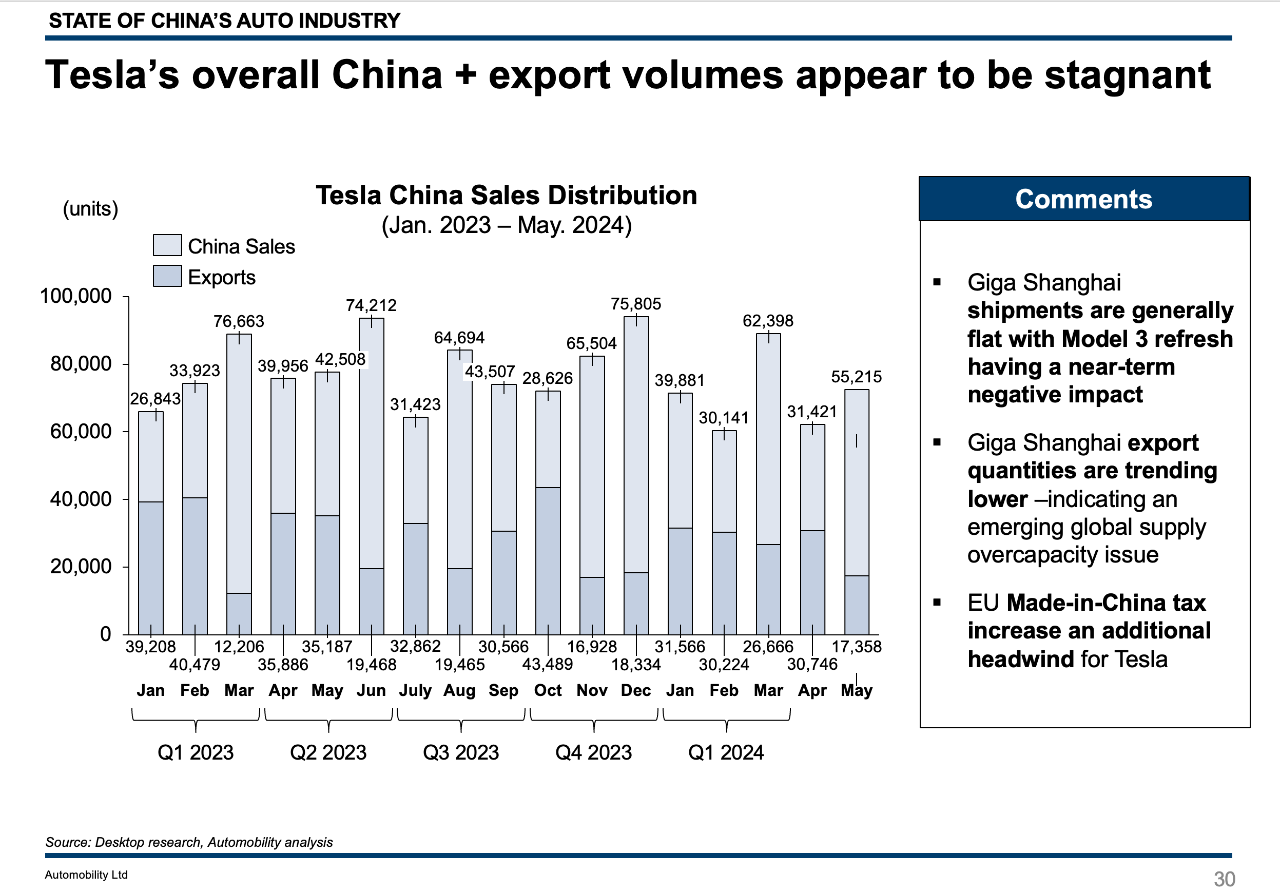

As noted earlier, Tesla sales in China have stagnated in the face of Chinese domestic competition. With few new products in the pipeline and capacities being added internationally, it is unclear whether Tesla China volumes can recover in the near-term.

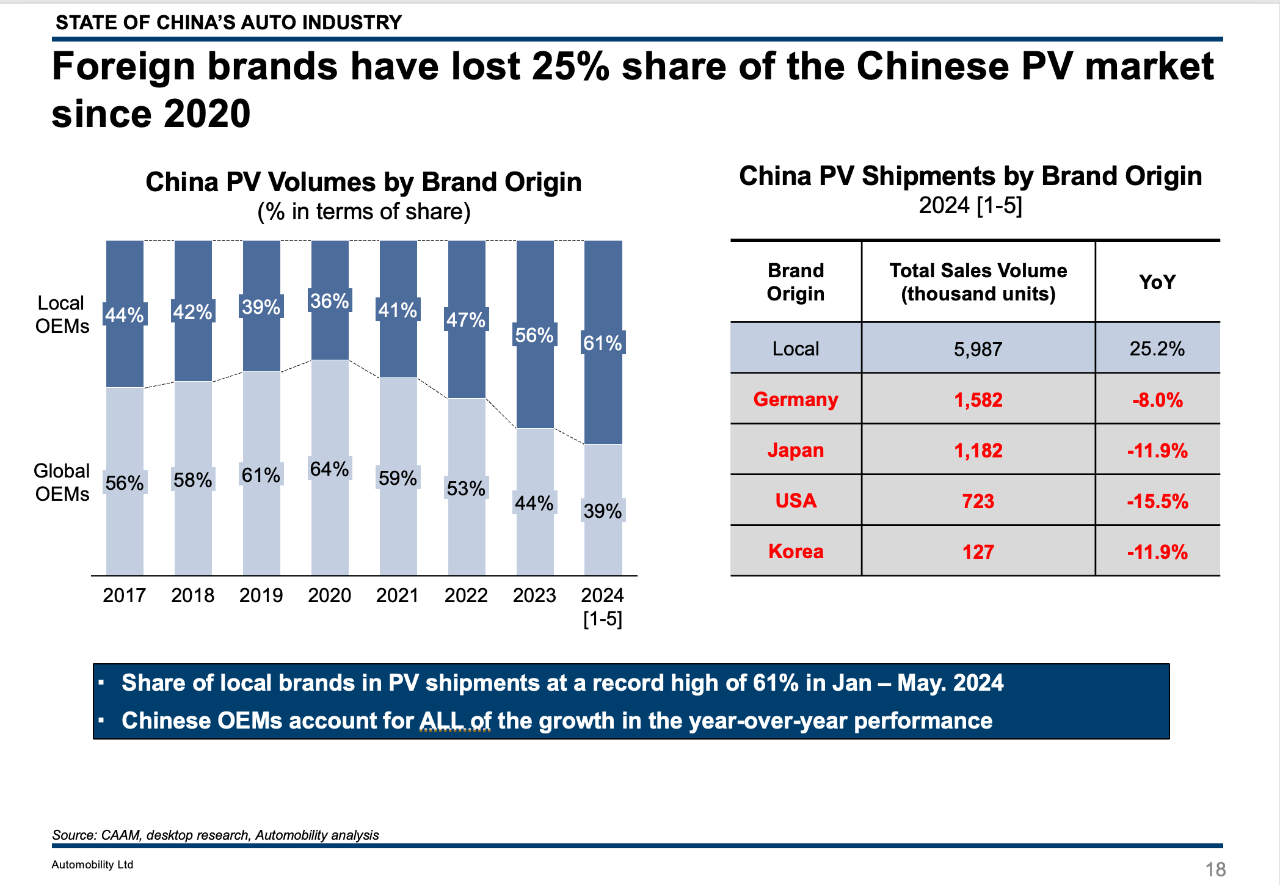

Given their dominance of the expanding NEV segment, Chinese brands now command 61% share of passenger vehicles market in China.

Join us on Tuesday, June 18 at 9am China time for our monthly State of China Auto Market webinar, hosted by the American Chamber of Commerce in Shanghai. Use the QR code in the link to register.

Webinar | State of China Auto Market Monthly Briefing (June)

I will also be speaking at China Crossroads together with Dieter Verstreken, VP for China Strategy at Melexis where we will share their perspectives on Cars and Chips: Outlook for Mobility Innovation in China at China Crossroads event on Tuesday June 18th, 2024 at 19:30 – 21:00.

China Crossroads: Outlook for Mobility Innovation in China

You can follow us for regular updates on these online channels by scanning the QR codes:

If your organization would like a custom briefing on the State of China’s Auto Market, please reach out to us at info@automobility.io

About Bill Russo

Bill is a contributing author to the book Selling to China: Stories of Success, Failure, and Constant Change (2023), where he describes how China has become the most commercially innovative place to do business in the world’s auto industry – and why those hoping to compete globally must continue to be in the market.

About Automobility

Contact us by email at info@automobility.io

Sorry, the comment form is closed at this time.