01 Feb State of China’s Auto Market – January 2024

Two Growth Vectors: Made-in-China Exports and New Energy Vehicles

While it is by far the world’s largest car market, China is no longer the growth engine of the global automotive industry.

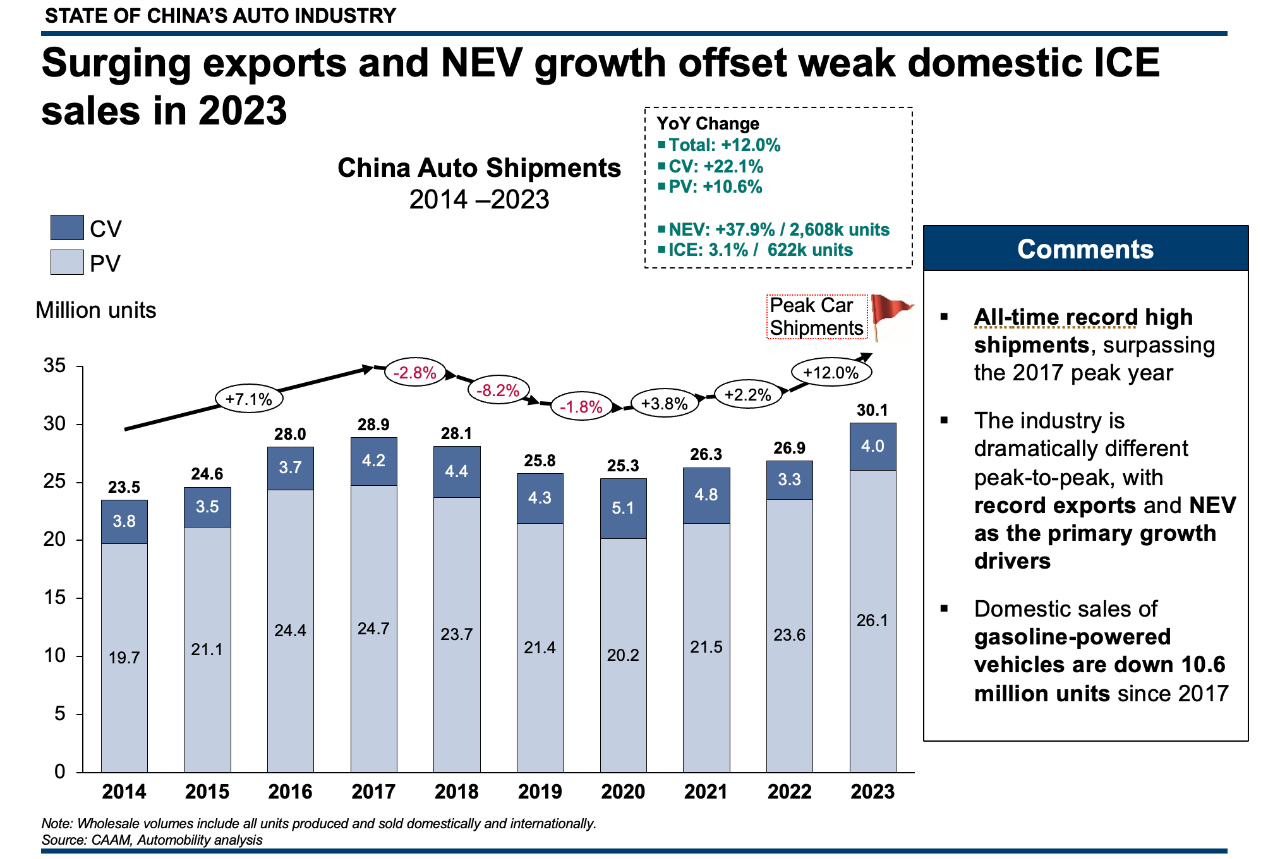

Record 2023 shipments of over 30 million units make an eye-catching headline and the chart below shows a healthy 5.9% compound annual growth of shipments since 2020. However, this masks the underlying weakness in the domestic sales, which has fueled the search for two remaining growth vectors: Made-in-China Exports and New Energy Vehicles.

As shown here, shipments of NEVs in China were 9.5 million units in 2023. The 30.1 million total includes 4.9 million vehicles that were exported from China, of which 1.2 million were NEVs.

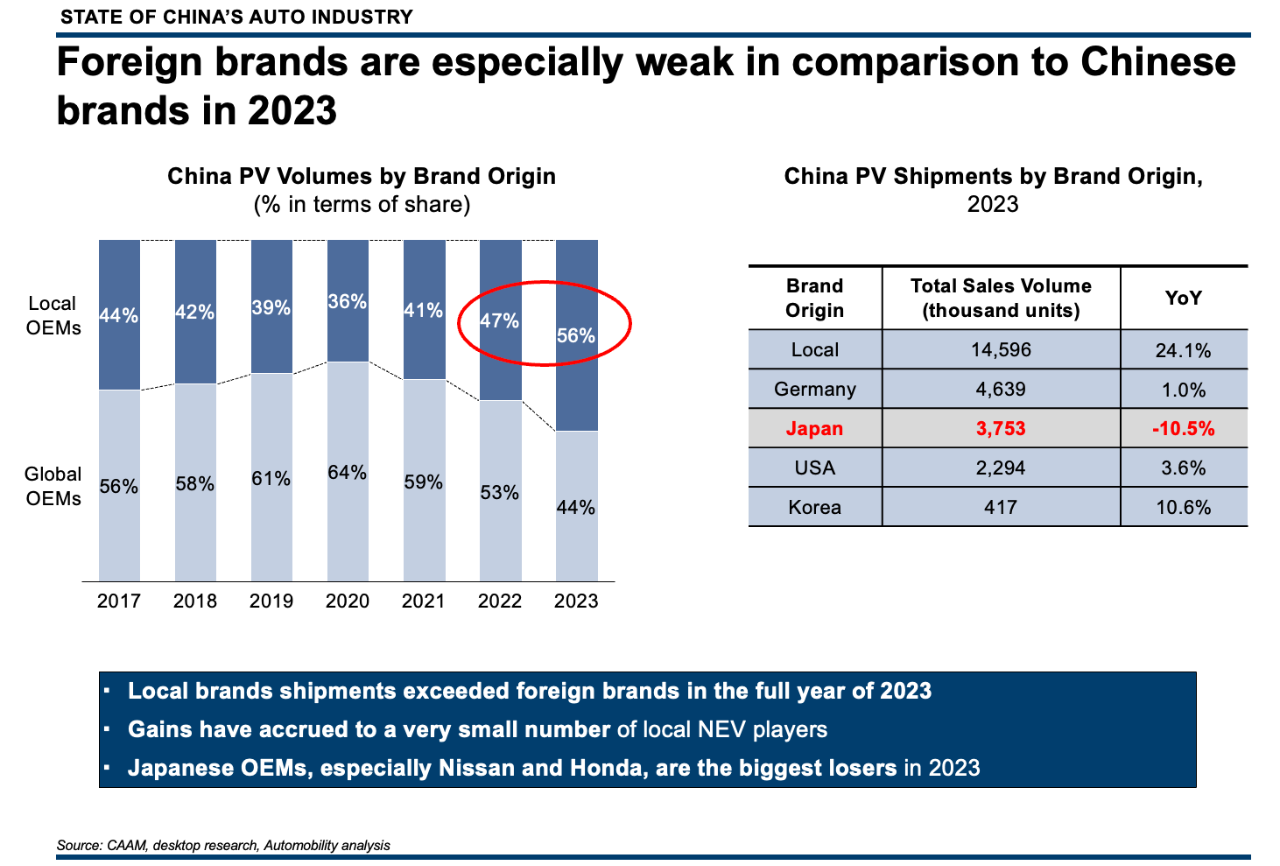

Extracting Made-in-China exports from the above totals reveals the domestic sales weakness. Since 2017, domestic sales have slid by compound annual rate of 1.8%, with ICE sales sliding at 7.5%. The only domestic growth over this period is in the New Energy Vehicle segment, rising exponentially at a 47.7% rate in an otherwise weak domestic sales market.

While the China market was expected to mature and slow down, the reversal of growth has caught both local and global carmakers by complete surprise. Many believed it to be a temporary “speed bump” that would rebound after the COVID economic shock. Thus far, this rebound has not happened.

Growth Vector 1: Made-in-China Exports

China exported 4.9 million finished vehicles in 2023, surpassing Japan to become the largest automobile export nation on the planet. This represents a year-over-year increase of ~58%, and a nearly 5X increase in export volume since 2020. Always with an ambition to go global, an export pivot became imperative with weakening demand in the domestic market. Opportunistically, China seized the opportunity sell ~17% of these vehicles in Russia last year, as global carmakers withdrew from that market since the outbreak of war in Ukraine.

Chinese brands are gaining significant share in several markets, with top destinations including Mexico, Australia, Thailand, the Middle East and Europe.

Interestingly, over 75% of Made-in-China exports are vehicles powered by gasoline. This is a reflection of two things:

– China is sitting on a lot of excess ICE capacity, and exports keep factories running that would otherwise be idle with potentially massive job losses

Exports of Made-in China EVs are increasing as well, but not nearly as fast as exports of ICEs. This fact is often lost in the media coverage of the China auto export story. As shown below, ICE exports rose by nearly 1.3 million units from last year, while NEV exports increased by just over a half million units.

Of these NEV exports, Made-in-China Teslas represent about 29% of the total.

Apparently 75% of those inbound missiles are ICE duds in the eyes of the media and protectionist governments, as they take note of the strength of Chinese EV brands.

As China exports steadily rise, consumers around the world will gain exposure to the competitiveness of Chinese brands, regardless of how they chose to power the wheel.

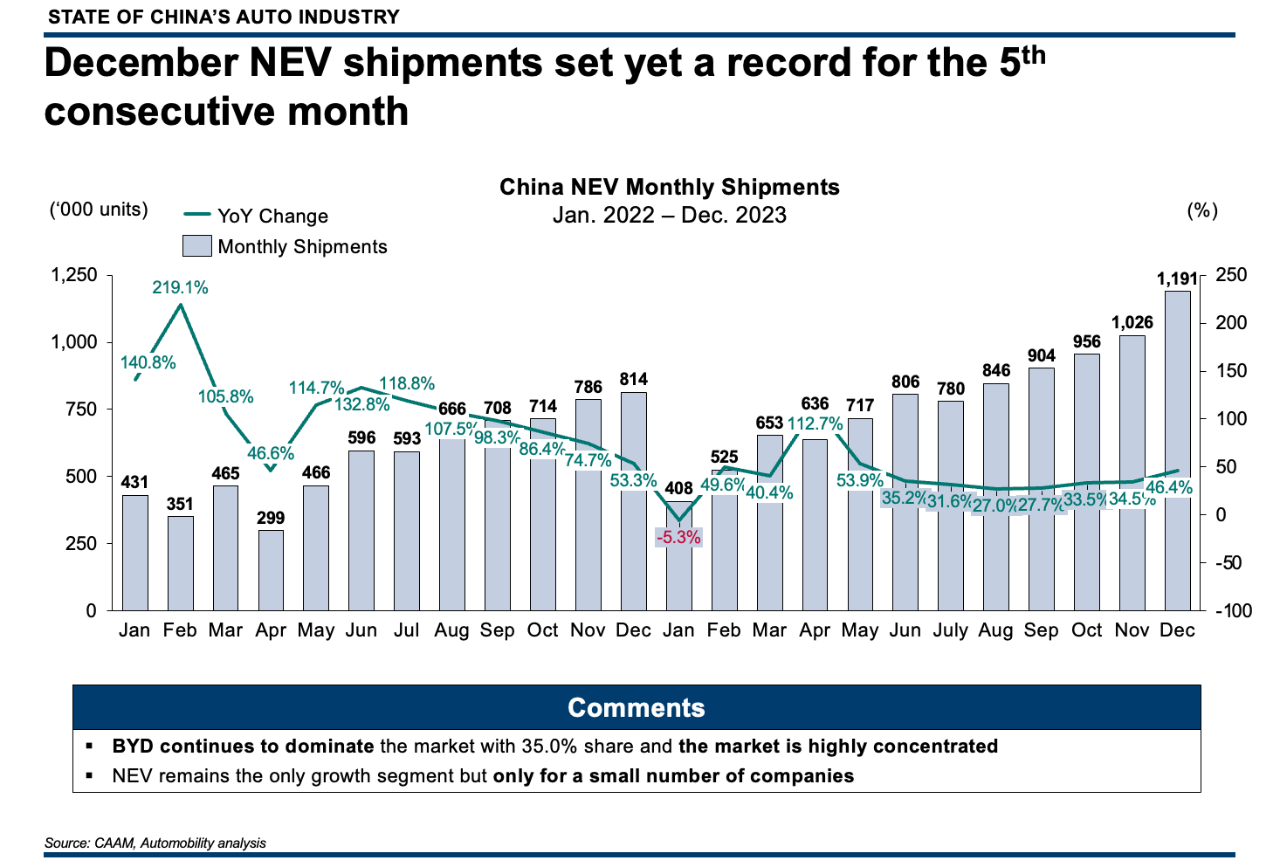

The continued expansion of New Energy Vehicles’ share of both shipments and sales continued in 2023, with shipments of nearly 9.5 million units. NEVs represent nearly one-third of vehicles produced in China, with volumes in 2023 that were 38% higher than 2022.

BEV and PHEV volumes are at record levels, rising steadily through the year, and NEV percentage of shipments ended the year at 37.7% in December, while ICE sales remained relatively flat through the second half of the year.

December NEV shipments approached 1.2 million units in December, setting a record for the 5th consecutive month in a highly concentrated segment.

Sales of Plug-in Hybrid Electric Vehicles (PHEVs) continue to rise, setting a record for the 7th consecutive month – and growing 77% year-over-year. BYD (51%) and Li Auto (15%) dominate this segment, but other local carmakers are expanding now into this high growth category. PHEVs offer high flexibility as they can be charged off-grid. BYD has shown that PHEVs can be engineered at a lower cost and price since they require fewer batteries and can be configured with a cost effective ICE engine as a backup charger that brings extended range.

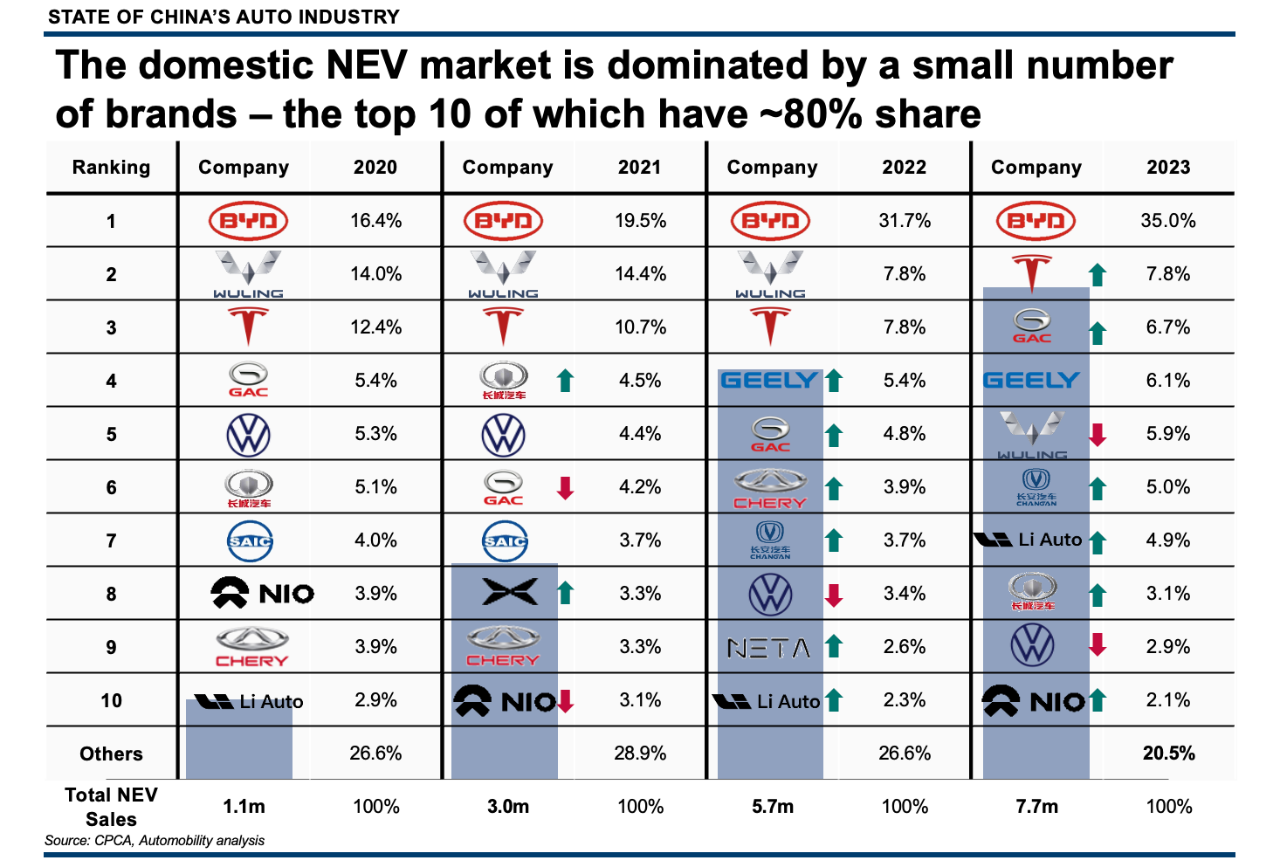

A notable feature of the passenger vehicle NEV sales leaderboard has been how little it changes over time. While the market has grown by 7X in size since 2020, eight of the companies listed on the 2020 leaderboard are still on the top 10 list 2023. The only new top 10 list entrants are Geely and Chang’an. SAIC and Chery fell out of the top 10, but both of these companies rank #1 and #2 in exports. This is not coincidental, as exports are a countermeasure to domestic sales weakness.

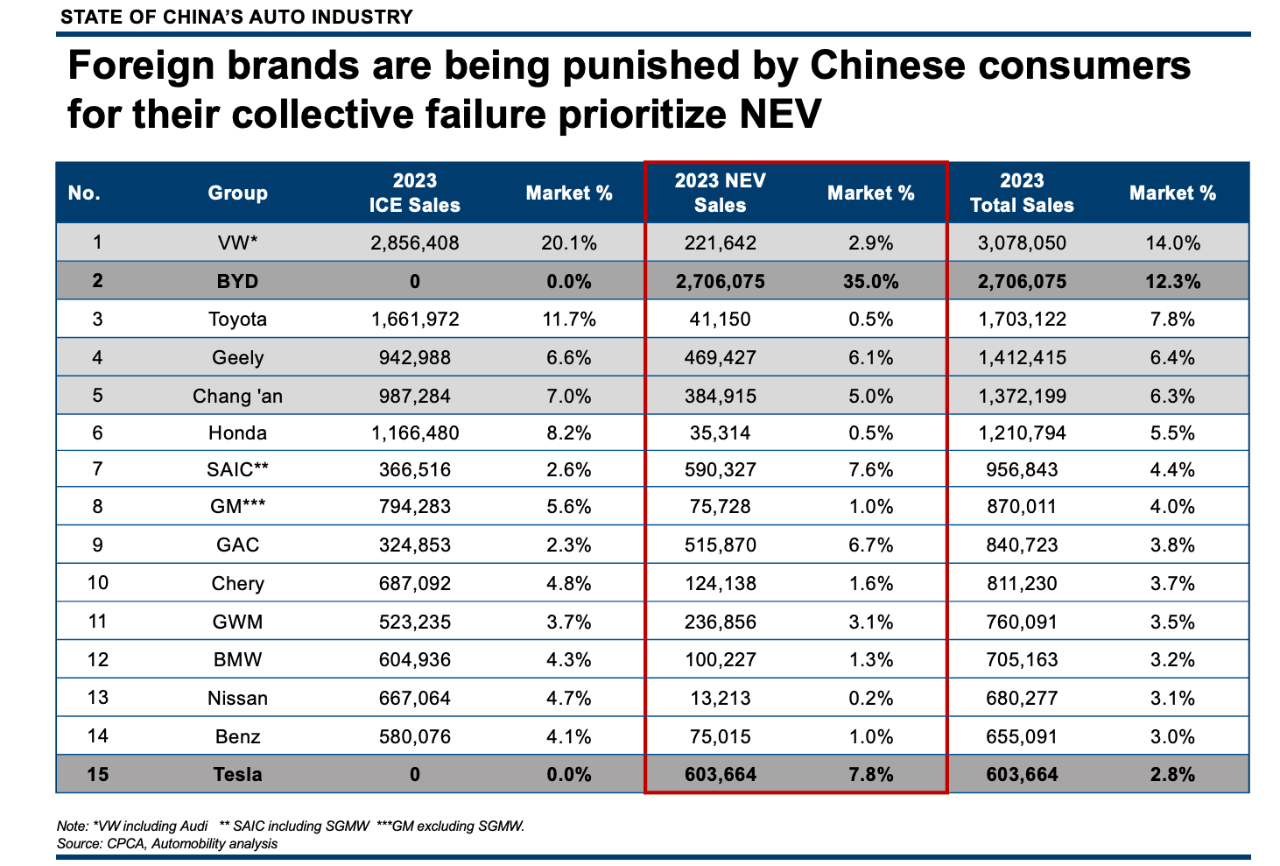

The dominance of Chinese brands in the NEV market is very clear and sustainable over time. Tesla and VW are the leading foreign NEV brands in China, but now collectively hold 10.7% share of NEV sales, a combined loss of 7% share since 2020. There is no evidence to suggest that this trend can be reversed.

There are few movements on the 2023 NEV sales leaderboard since our last report, with BYD holding 6 of the top 10 selling models in the country. BYD’s BEV price leader Seagull was launched in mid-2023, and secured the 6th position in total annual sales.

Several noteworthy observations:

- The Top 10 companies command 79.5% of the NEV market

- The Top 5 companies command 61.5% of the NEV market

- BYD commands 35.0% of the NEV market

Additional points to note:

- #1 BYD outsells #2 Tesla by over 2.1 million units, and #10 NIO by nearly 2.54 million units.

- Wuling is the only top 10 brand with single digit growth in sales, facing new low-priced competition in 2023.

What Can We learn from Tesla’s Journey in China?

Tesla sparked retail consumer interest in electric vehicles in China. I highlighted this in my chapter of the book Selling to China: Stories of Success, Failure & Constant Change, titled China’s Auto Industry: The Race to a Sustainable Future.

Selling to China: Automotive Industry [AUDIO INTERVIEW]

NOTE: Contact us at info@automobility.io to order the book.

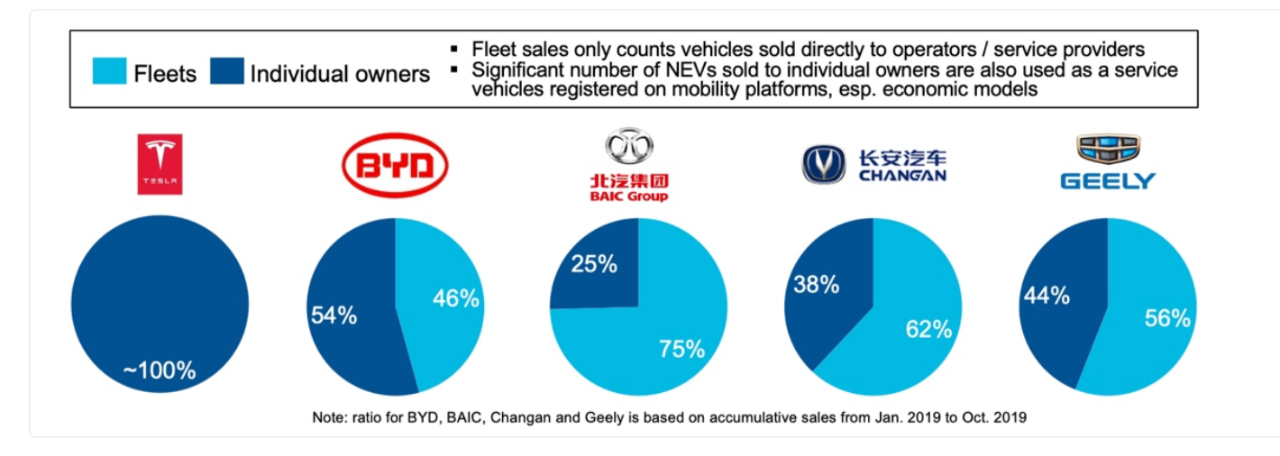

The mobility services segment played a critical role in the introduction of EVs, mainly driven by easier access to license plates for electric vehicles. As of June 2019, there were close to 1 million NEVs registered with Didi, representing 35% of the total electric vehicle population across China.

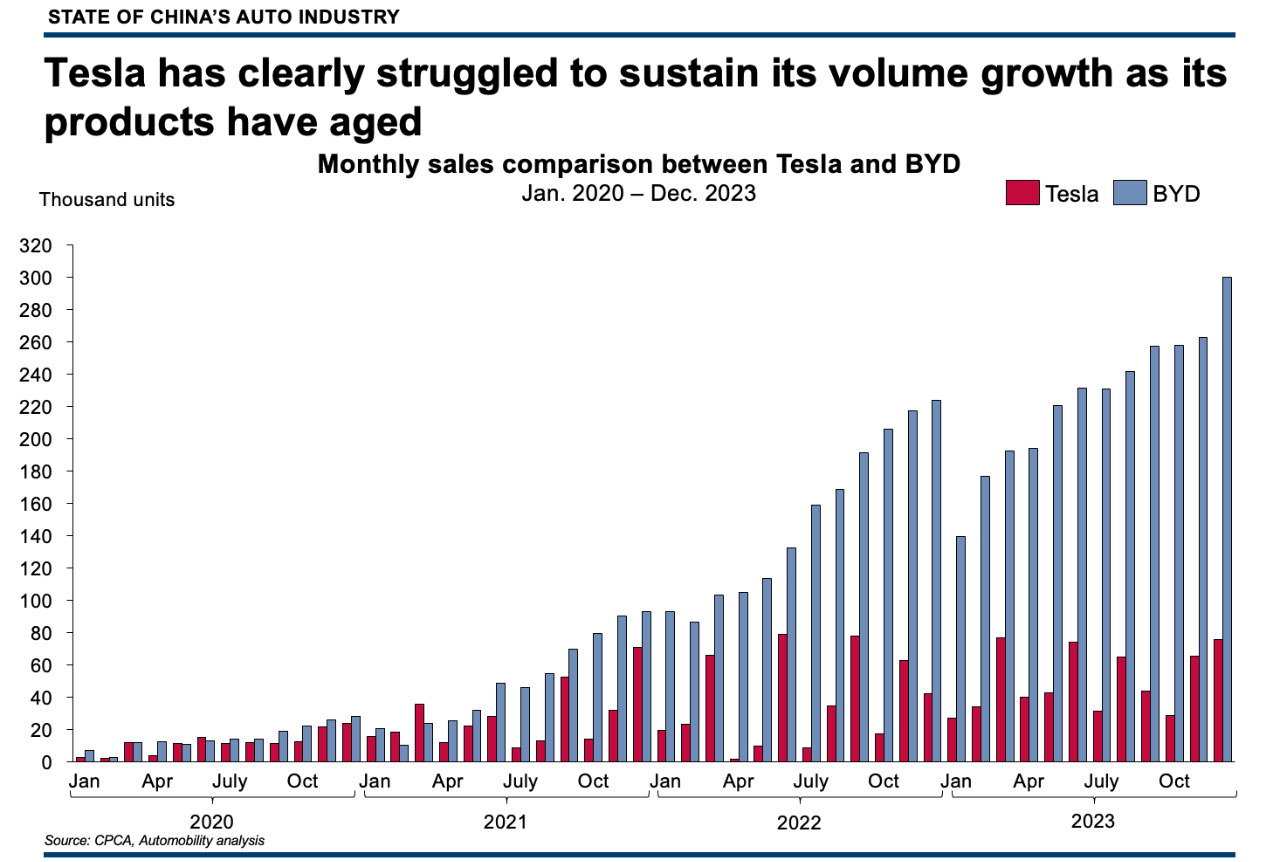

This all changed when Tesla opened its Gigafactory in Shanghai, offering retail consumers the opportunity to shop and buy an EV from the global EV pioneer. Chinese brands began to offer competitively priced and well-configured alternatives which are proving popular among retail consumers. A comparison of the rise in Tesla’s sales versus the market leader BYD is shown here.

By leveraging its global scale and China footprint, Tesla initiated a price war in China in 2023 in an effort to sustain its sales. While Tesla has maintained its share from 2022 in China, it overall Made-in-China production volume has flatlined. Export volumes have been trending lower as new capacity is added in Berlin, Austin Mexico.

The End of the ICE Age?

Are we exaggerating when we say it is “The End of the ICE Age”, as reported in the Summer edition of AmCham Shanghai INSIGHTS magazine?

The End of the Ice Age [AmCham Interview VIDEO]

Global automakers and suppliers have some difficult questions to answer:

– If China is no longer the growth engine of the global automotive industry, where will growth be found going forward?

– How will the excess capacity problem be resolved in China? [NOTE: for Chinese carmakers, the answer is simple: export excess ICE to markets that still buy them like Russia, Africa, Asia Pacific and Latin America, and export affordable NEVs to the world]

– Will Chinese consumers consider NEVs from traditional multi-national carmakers?

– Why did we not take the NEV development seriously? Can we and should we get back in the game or can we change it to regain a competitive edge?

– Is Made-in-China going global a threat or can we “flip the script” and turn it into an opportunity?

In his role as AmCham Shanghai’s Automotive Committee chairman, Bill Russo will host the Look Back & Look Ahead: Automotive Industry 2024 on Tuesday, January 30. He will be joined by industry analyst Lei Xing, the co-host of the China EVs and More Podcast as well as Yu Zhang, Managing Director of Auto Foresight. They will share and debate their views on 2023 results and the outlook for 2024 and beyond.

AmCham Look Back & Look Ahead: Automotive Industry 2024

January 30, 2024 Tuesday

8:30 AM – 10:30 AM (GMT+8)

You can follow us for regular updates on these online channels by scanning the QR codes:

If your organization would like a custom briefing on the State of China’s Auto Market, please reach out to us at info@automobility.io

About Bill Russo

Bill is a contributing author to the book Selling to China: Stories of Success, Failure, and Constant Change (2023), where he describes how China has become the most commercially innovative place to do business in the world’s auto industry – and why those hoping to compete globally must continue to be in the market.

About Automobility

Contact us by email at info@automobility.io

Sorry, the comment form is closed at this time.