06 Jan The World Street Journal : Global Automakers Turn to China for EV Lessons

Media Source : The World Street Journal

Volkswagen, Nissan to speed up making electric vehicles and better compete

with local rivals

By Yoko Kubota

Nov. 27, 2023 at 7:00 am ET

HEFEI, China — Volkswagen engineers in one of China’s electric-vehicle hubs are looking to the country’s automotive industry for clues about how to speed up manufacturing and beat back local rivals in the world’s biggest auto market.

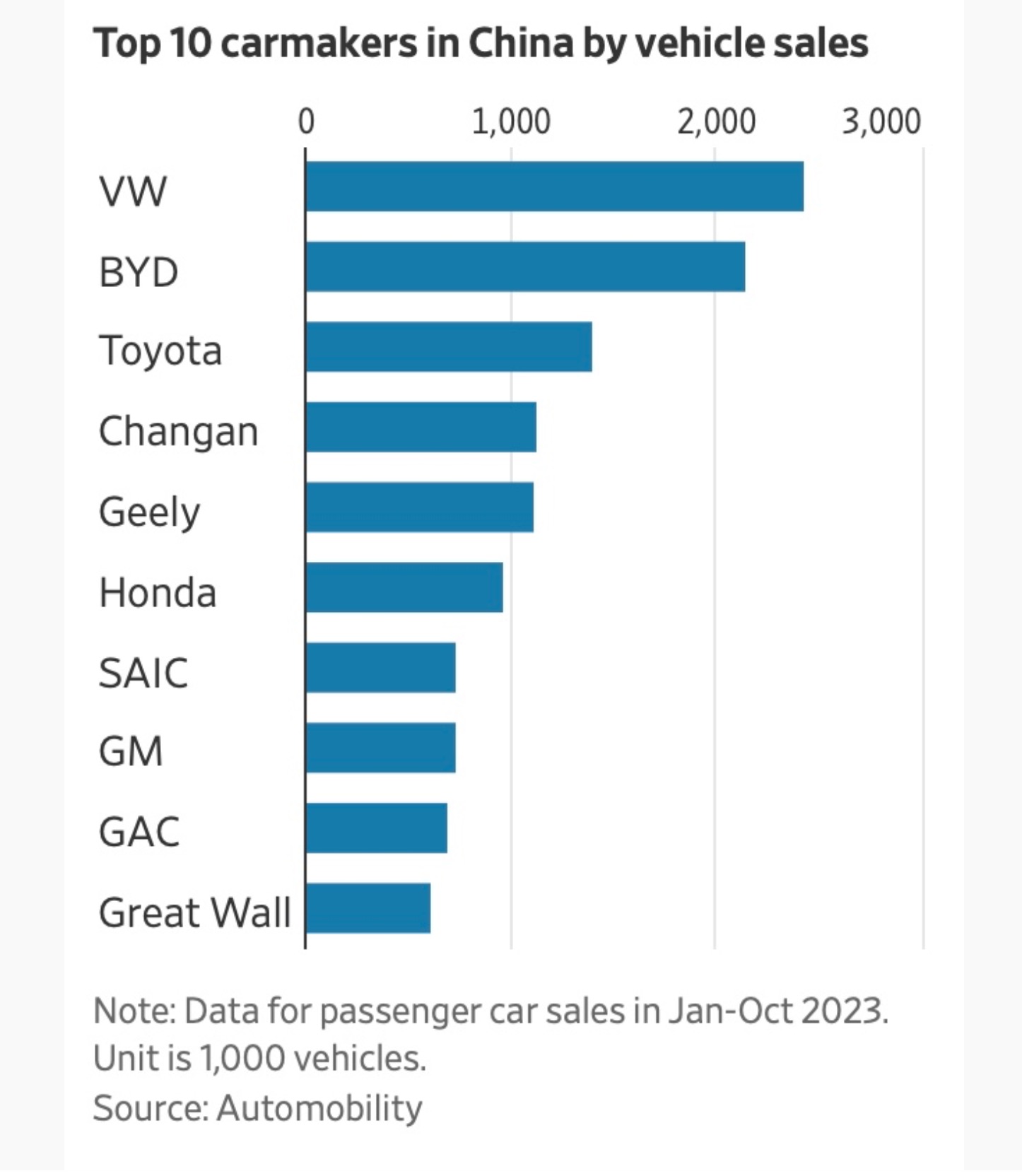

The German automaker has long been the number one manufacturer in a market dominated by gasoline- powered vehicles, but it has been losing market share as China’s market turns electric. It is now trying to figure out how to compete with upstart Chinese makers that can roll out good, affordable and highly digital electric cars—and do so in a third less time.

Nissan Motor is similarly trying to produce cars faster by deploying tips it learned from a Chinese joint venture. Toyota Motor is bringing in engineers from its Chinese partnerships to better develop electric and smartcars.

This shift carries implications, not just for China’s market—where domestic carmakers account for around three-quarters of EV and plug-in hybrid sales—but also on global manufacturers’ home turf. China’s EV manufacturing methods, suppliers and digital technology could permeate global carmakers.

To head off what could become an onslaught of cheaper, sleeker Chinese electric vehicles, the U.S. has steep tariffs and the European Union is investigating Chinese subsidies to EV makers.

In the past, Volkswagen made cars in Europe and brought them into China with some adjustments, said Ralf Brandstätter, who heads Volkswagen’s China business. That approach no longer works because customer requirements in the electrified and more digital China market have become too different.

“We need to be more agile and focused,” he said last week at Volkswagen’s EV production, development and procurement hub in Hefei, west of Shanghai. The company will develop cars for China in the country while working with Chinese partners and making more decisions locally, he said.

The changes will help Volkswagen’s goal of being among the top three carmakers in China in 2030, Brandstätter said.

That is a downsized ambition for a company that has been leading car sales in China for decades. Homegrown BYD is chasing down its lead through sales of its pure electric and hybrid vehicles.

Some global automakers are already retreating or resetting their course. Japan’s Mitsubishi Motors is ending production in China, while Jeep-maker Stellantis stopped producing vehicles in China.

Ford Motor pulled the plug on its electric car direct-sales business.

For Volkswagen, pulling back isn’t on the table. China is its biggest market, accounting for around 40% of vehicle sales.

The German automaker’s grip started to loosen several years ago, as it struggled to produce popular electric vehicles.

Volkswagen takes a little less than four years to get a new product to the market, while Chinese companies are able to do so in a little more than 2. years, Brandstätter has said. Now it is aiming to cut its vehicle development process to about 2. years, he said.

That would be achieved through a bundle of actions, some of which are inspired by the Chinese way.

One is to use more Chinese components obtained from speedy local suppliers, rather than relying on German ones. From display and media systems to EV batteries and headlights, Volkswagen said sourcing these items from Chinese suppliers will cut development time by roughly 30% and costs by between 20% to 40%.

Chinese suppliers have significantly improved in quality, durability and technology in the last four years or so, Volkswagen executives said.

Local suppliers work with leading domestic carmakers and are a major part of China’s electric and intelligent vehicle ecosystem, which industry executives and experts say is a head above the rest.

Volkswagen is also investing billions of dollars in local companies to get its hands on cutting-edge Chinese technology. Those include Chinese EV startup XPeng and battery maker Gotion High-Tech as well as Horizon Robotics, which makes automotive software and chips focused on autonomous driving, and ThunderSoft, which makes operating systems and software for smart cockpits.

Volkswagen has also made management structure changes to move faster. At Hefei, the team will have the authority to approve components locally to save time going back and forth with headquarters in Wolfsburg, Germany.

The team in Hefei is developing a new electric-vehicle platform for entry-level cars for the China market, set to be launched in 2026. By 2030, the carmaker plans to offer 30 electric models in China.

Nissan tries to break the mold

Nissan is also trying to speed things up to reverse sliding sales. It has picked up a few tips from Venucia, a local brand by Nissan and its Chinese joint venture partner Dongfeng Motor. One of those is how to move more quickly with vehicle testing.

Traditionally, Nissan waited months for some molds to be completed before using them to build test vehicles, a person with knowledge about the matter said. Now in China, the Japanese carmaker is in the process of using prototype molds instead.

To ensure quality, Nissan simultaneously plans to use more digital technologies, such as 3-D printers or virtual testing, to conduct additional tests, the person said. By 2026, Nissan plans to release under its badge four EV and plug-in hybrid models in China, developed at its R&D center in the country, as well as six more under local badges with its joint venture.

A Nissan spokesperson said that the company acknowledges its joint venture has built strong capabilities, and that any testing meets Nissan’s global standards.

Toyota has shifted the focus of its China R&D center to electric and smartcars, and is bringing on more engineers from its joint ventures for projects there.

Like Volkswagen, Toyota said in July that it would seek local suppliers, is revising component design and upgrading its production and manufacturing technology to cut costs in intelligent electric vehicles.

Many foreign brands fell behind in product cycles in China because they didn’t prepare early enough for the electrification trend that took off around 2020—and to catch up will take years, said Bill Russo, CEO of Automobility, a Shanghai-based strategy firm.

For now, many may have to rely on cost cutting and price discounts to boost sales, he said.

Write to Yoko Kubota at yoko.kubota@wsj.com

↑ Global Automakers Turn to China for EV Lessons

Sorry, the comment form is closed at this time.