26 May State of China’s Auto Market – May 2025

Written by Bill Russo, Founder & CEO of Automobility Ltd.

We’re excited to announce the upcoming release of our next “Auto Insider” podcast episode, titled “The Butterfly Effect: How China’s Auto Shift is Reshaping the World.” Join us for an engaging conversation with Dr. Xiaozhi Liu from ASL Auto Tech. Don’t miss out—scan the QR code to subscribe on your preferred platform and stay tuned for the release coming soon!

For a summary of our takeaways from the Shanghai Auto Show, please see the following Automobility Ltd original article and my interview with Bloomberg TV from the show floor.

Auto Shanghai 2025: How China is Rewriting the Rules of the Global Automotive Game

Automobility’s Russo on Tariff Impacts [Bloomberg Video]

Highlights

-

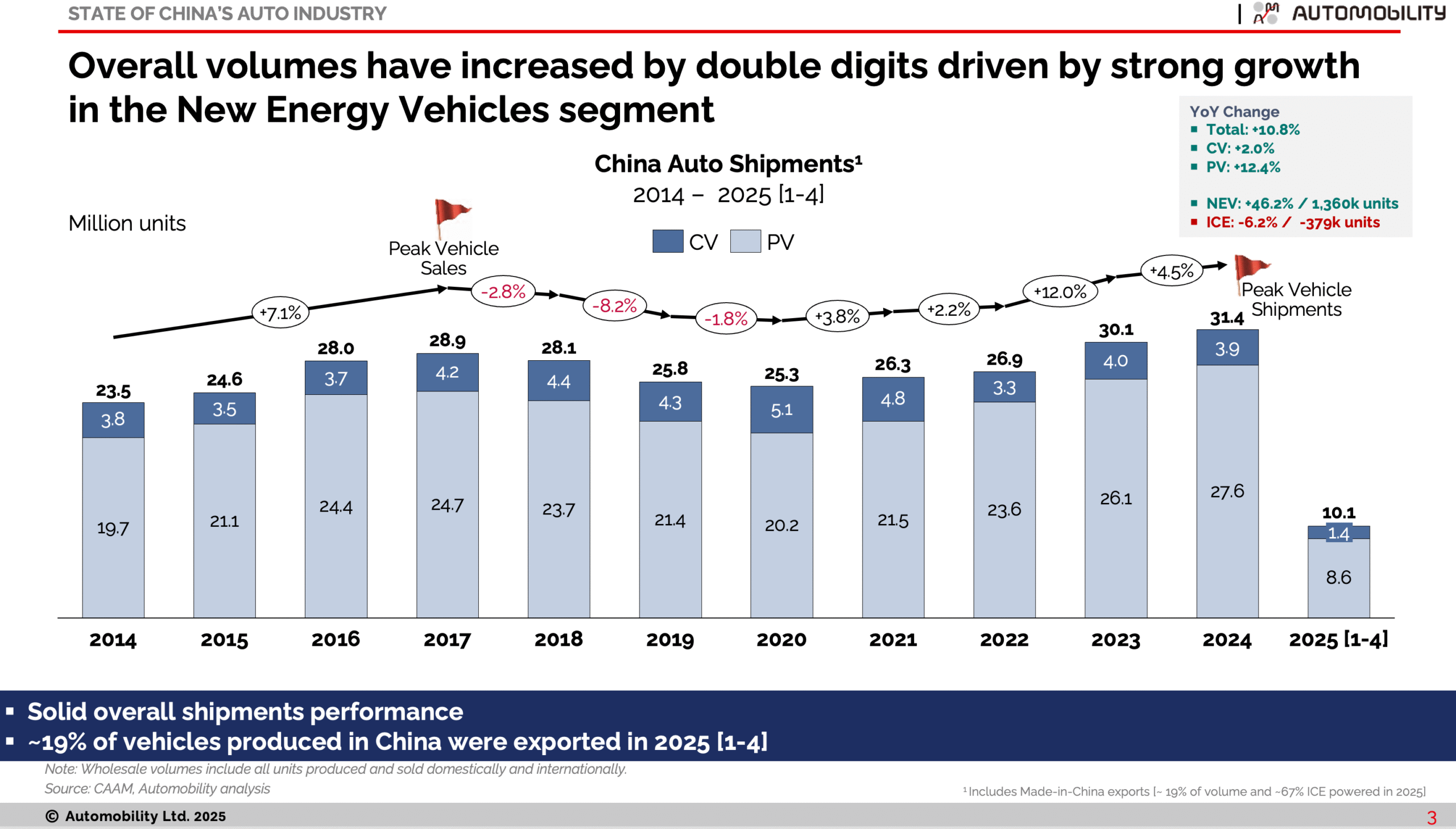

The year-to-date market performance in 2025 reflects a significant positive trend compared to the previous year. Shipments of New Energy Vehicles (NEVs) have surged by an impressive 46.2%, while shipments of gasoline-powered Internal Combustion Engine (ICE) vehicles have decreased by 6.2% as of April.

-

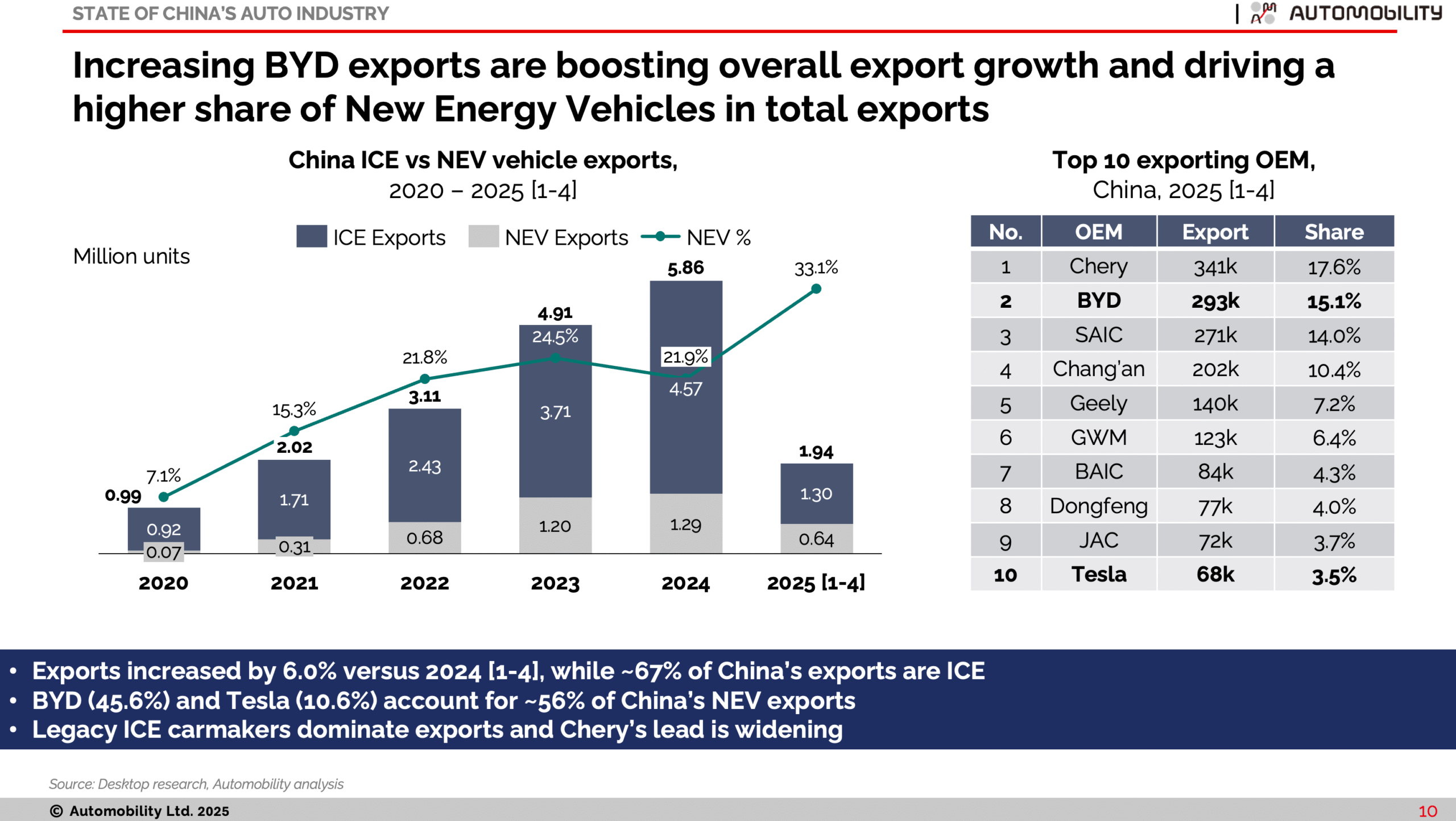

Exports of Made-in-China (MIC) vehicles have increased by 6% compared to last year’s figures, with 19% of all vehicles produced in China being exported so far in 2025. The NEV segment is playing an increasingly important role in these exports, now accounting for 33.1% of the total.

-

BYD, a prominent player in the NEV market, has seen its exports soar by 109% year-over-year, shipping 293,000 units by April. This accounts for a substantial 45.6% of all MIC NEV exports. -

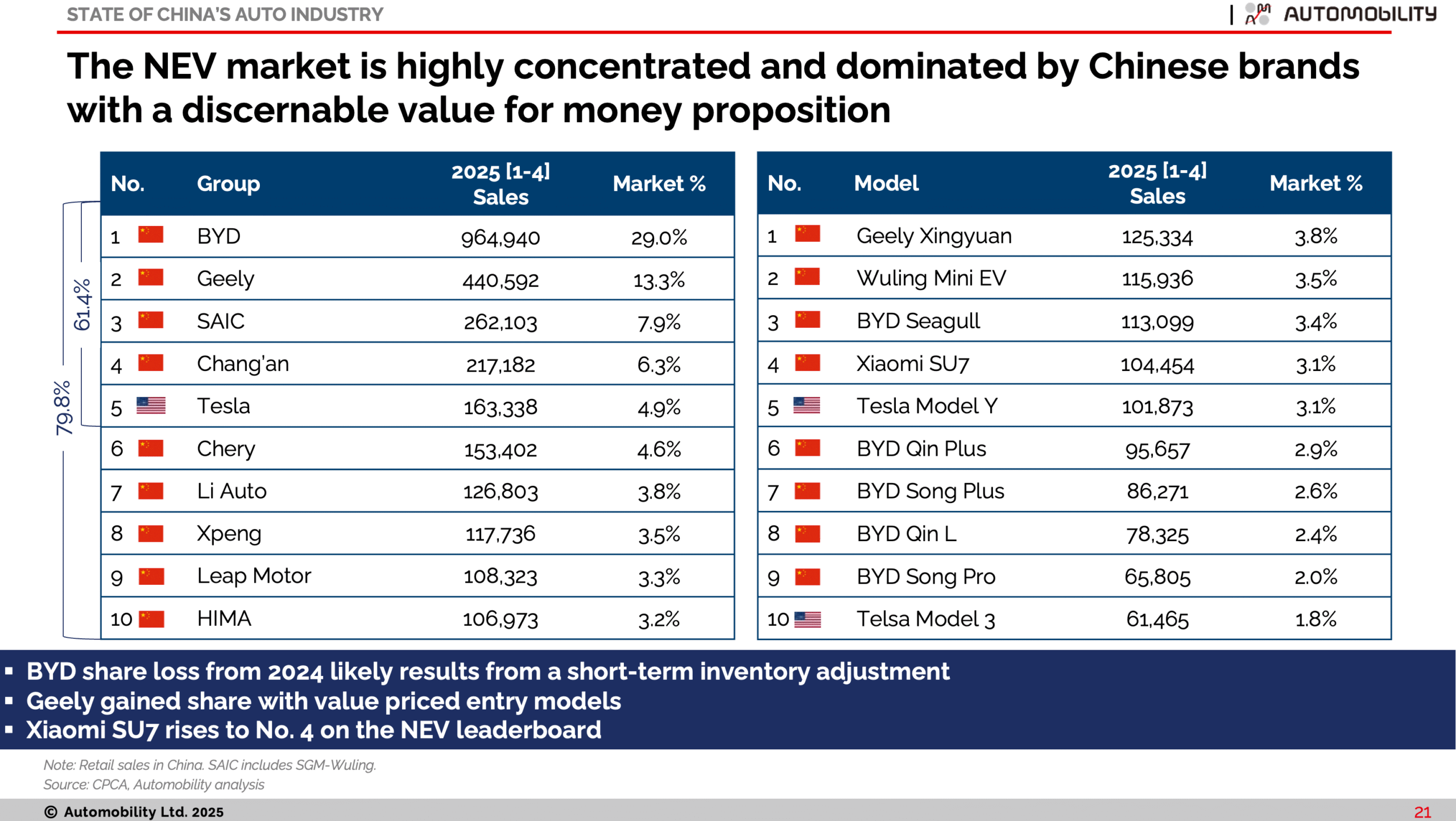

The NEV market share of passenger vehicle sales reached 52% in April, with NEVs dominating sales for the past two months. BYD holds a 29% share of the domestic NEV market. Impressively, nine of the top ten NEV companies are Chinese. -

Among the front-runners in the NEV sector are legacy automakers BYD, Geely, SAIC, and Chang’an, which hold the top four positions. Notably, five of the top six NEV companies previously manufactured gasoline-powered ICE cars before transitioning to NEVs. These companies collectively account for 66% of all NEV sales. -

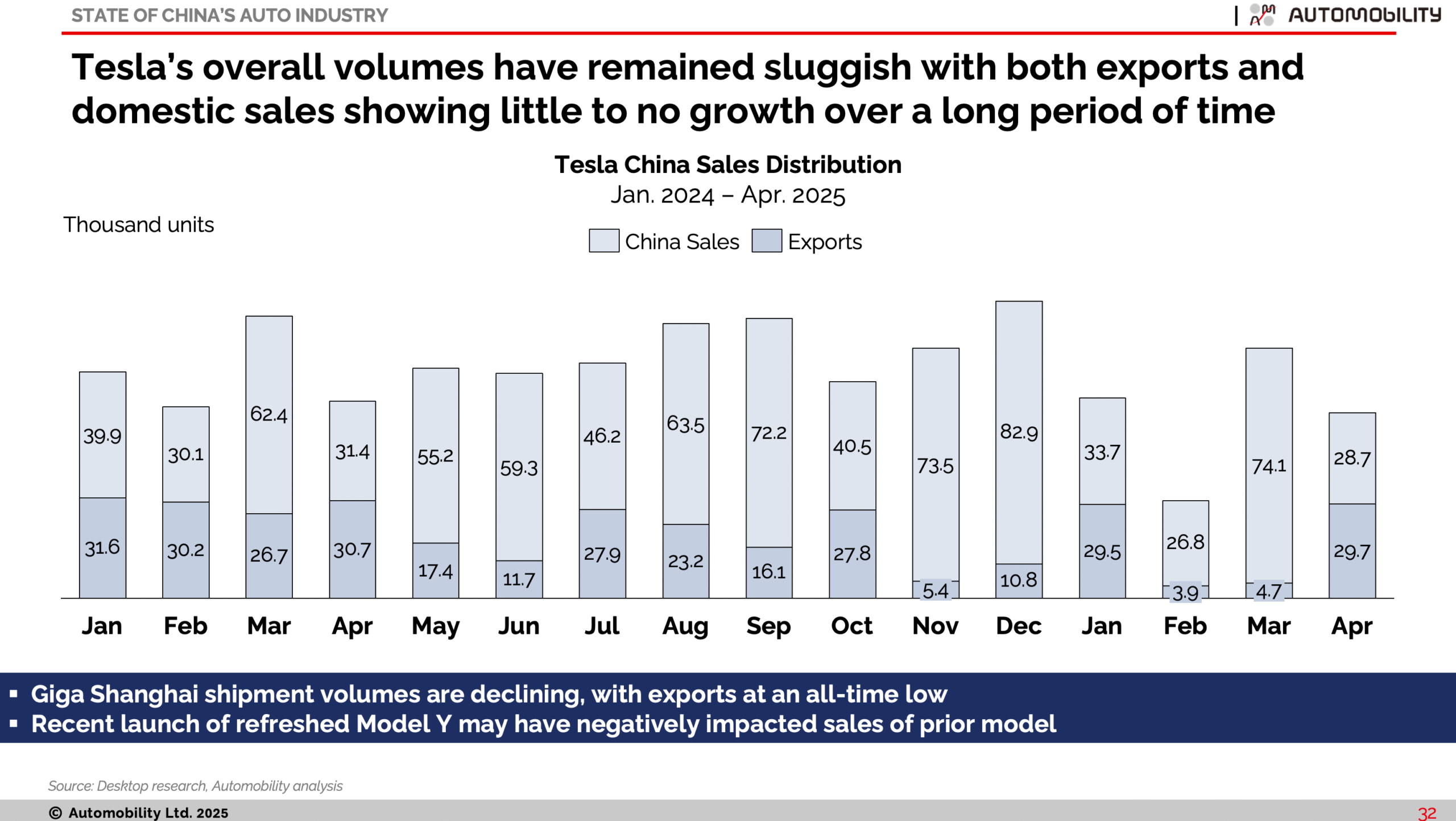

In contrast, Tesla’s volumes have remained stagnant, with no growth in combined export and domestic volumes over an extended period. -

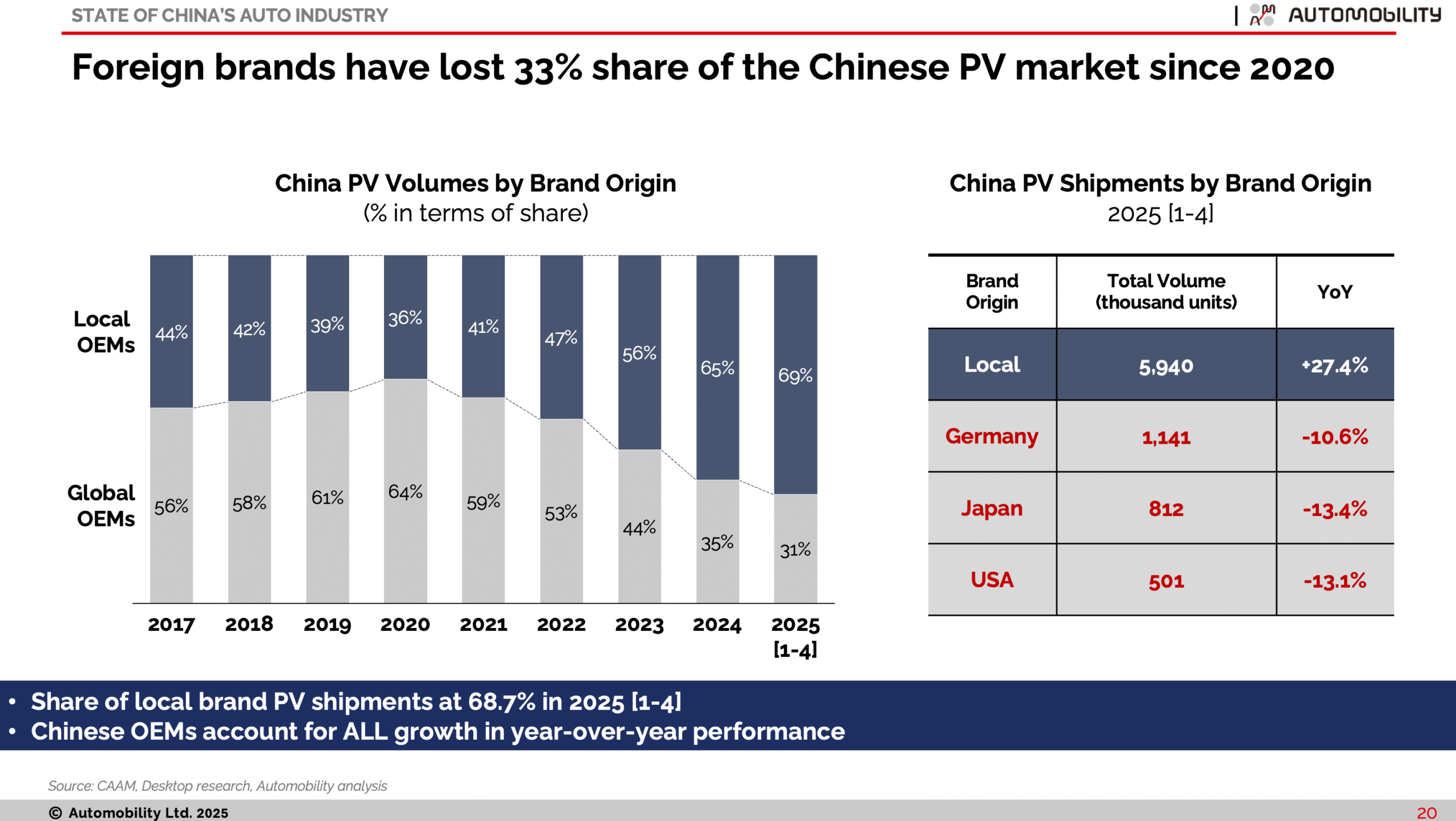

The market share of foreign brands in the Chinese passenger vehicle market has declined to 31%, a drop of 4% from 2024 and a significant decrease of 33% since 2020.

Subsidies and Exports Fuel Growth

Ex-factory shipments experienced a significant growth of 10.8% in the first four months of the year. Domestic sales increased by 9.3%, while exports of Made-in-China products rose by 6%. Combined shipments of passenger and commercial vehicles amounted to 10.1 million units.

Notably, shipments of New Energy Vehicles (NEVs) surged by 46.2%, equating to an increase of 1.36 million units, whereas Internal Combustion Engine (ICE) vehicle shipments declined by 6.2%, a drop of 379,000 units compared to the same period last year. The primary driver of these gains was the passenger vehicle segment, which saw an impressive increase of 12.4% over the previous year.

NEV Share of Exports Rise

In the first quarter of this year, exports of Made-in-China (MIC) products witnessed a 6% increase compared to the same period last year. Notably, BYD significantly boosted its export volumes, more than doubling them to 293,000 units, which represents a remarkable 116.2% growth from the previous year. Consequently, the share of New Energy Vehicles (NEVs) in total exports rose to 33.1%, with a major portion of this growth attributed to BYD’s expanding influence, which now accounts for 45.6% of MIC exports.

In contrast, Tesla’s MIC exports experienced a decline of 42.8%. Despite this decrease, overall NEV exports surged by 52.3% compared to last year’s performance.

NEV Domestic Sales Regain Lead

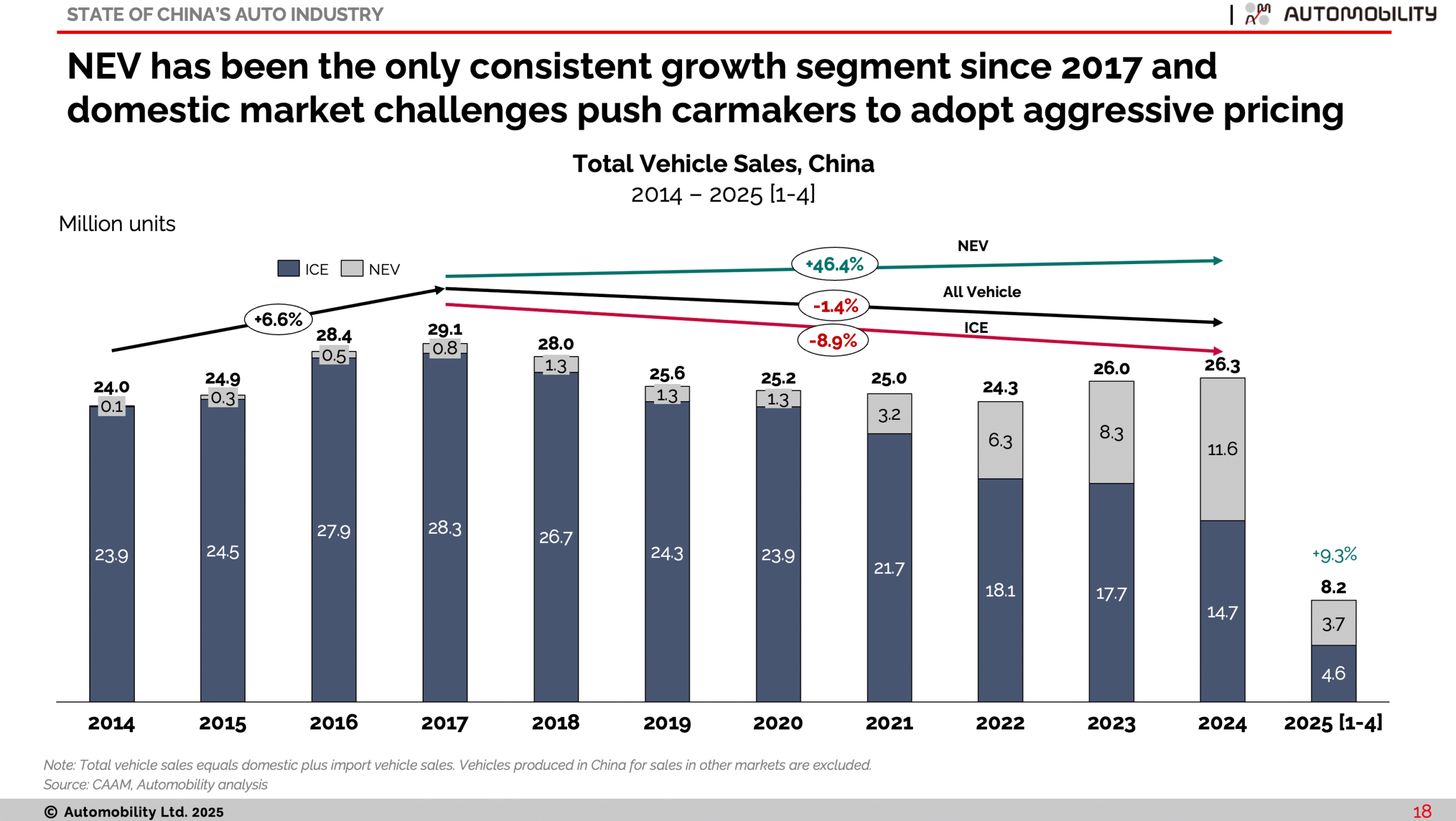

Year-to-date domestic sales have increased by 9.3%, primarily due to the introduction of vehicle replacement subsidies implemented in the second quarter of 2024. Since these subsidies began in April 2024, we anticipate challenges in sustaining double-digit growth for the remainder of 2025.

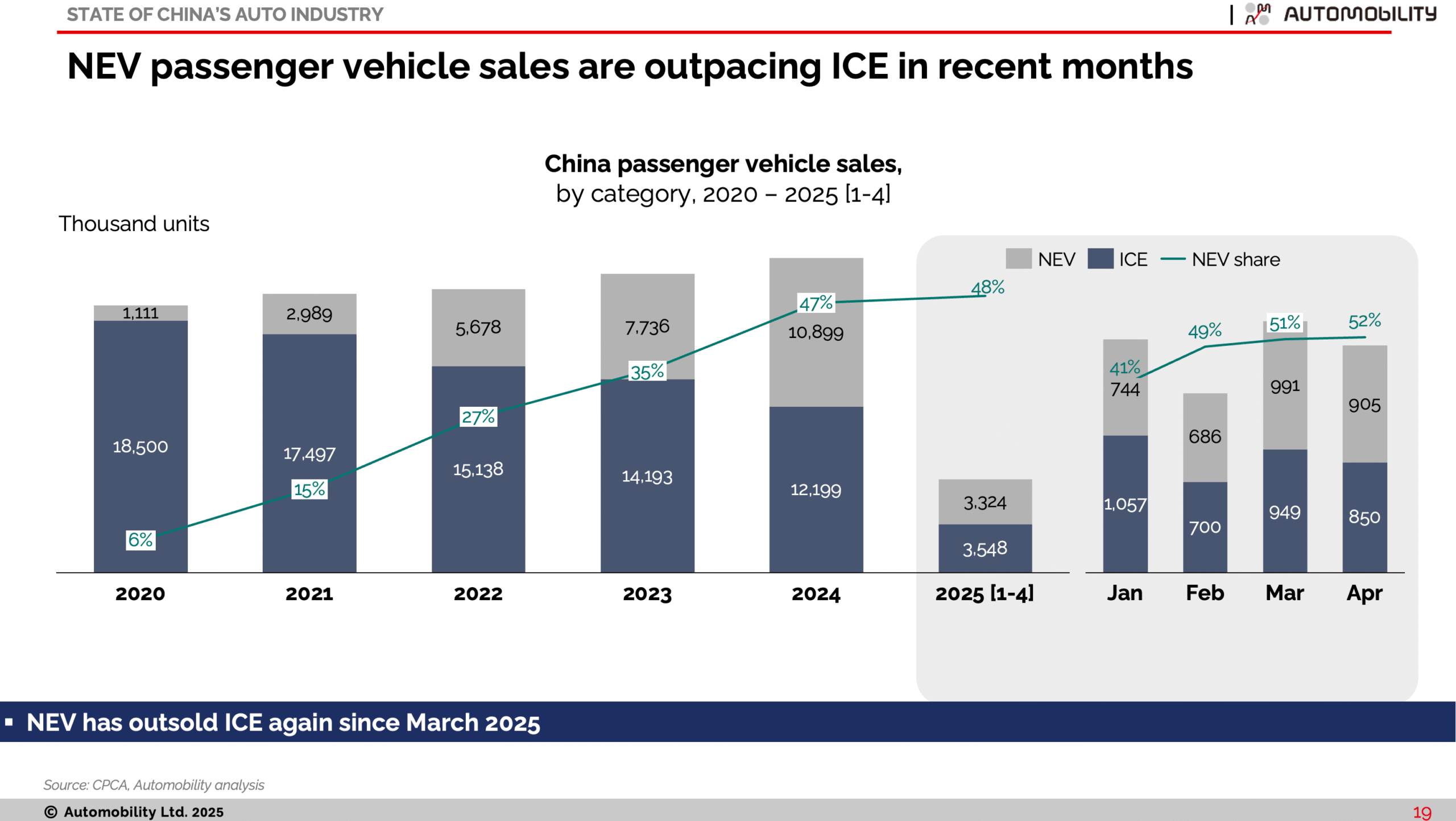

In April, NEVs accounted for 52% of passenger vehicle sales and have dominated the market for the past two months. For the year to date through April, NEVs represent 48% of passenger vehicle sales. We continue to predict that NEVs will surpass ICE vehicles in the passenger vehicle segment for the entirety of 2025, marking a significant historical milestone.

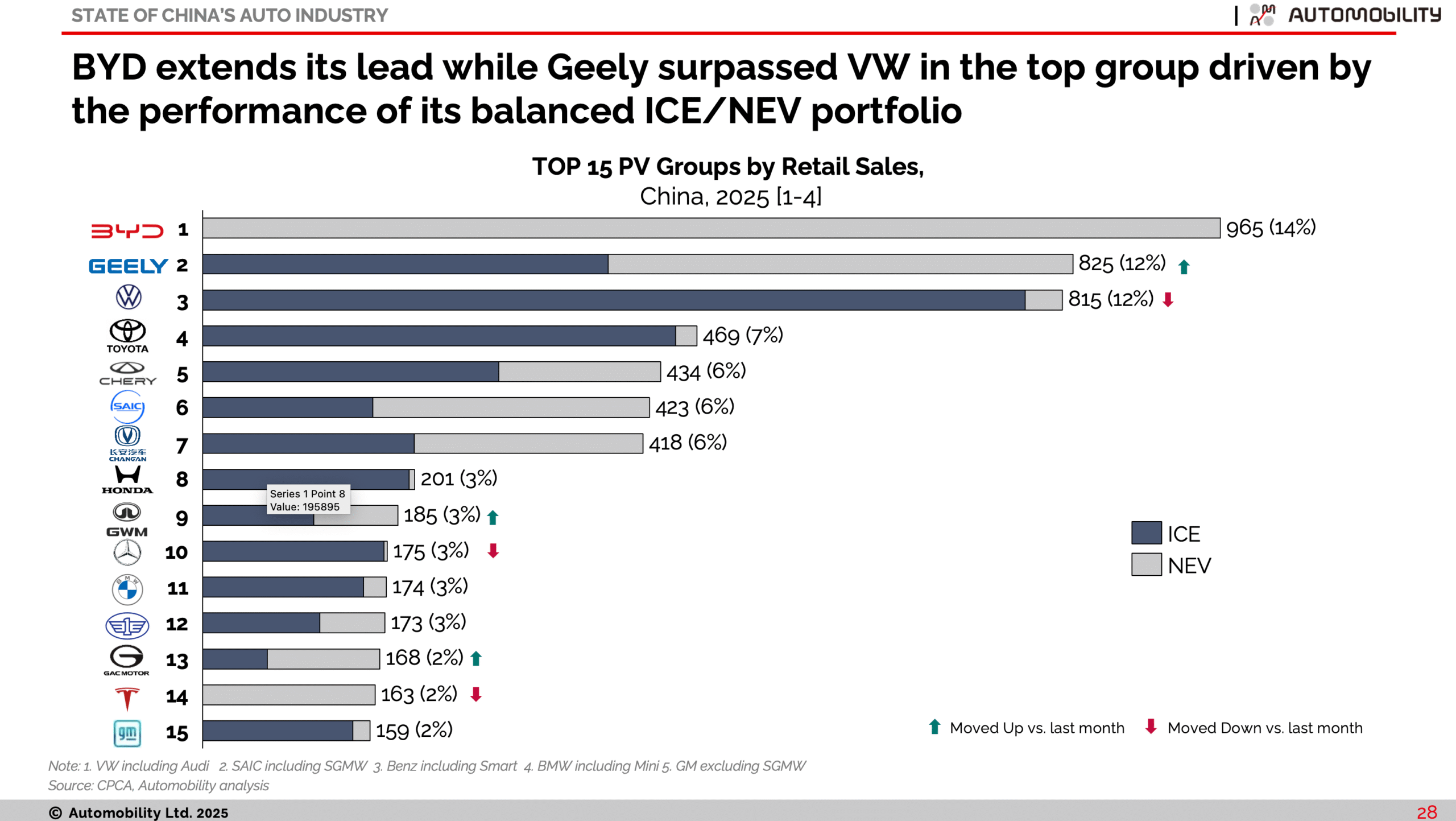

For the first four months of 2025, market leader BYD sold 964,940 units, with NEV share at 29%. Geely group has risen to the 2nd position with 440,592 units sold. Market concentration has intensified, with the top 10 NEV manufacturers commanding approximately 80% of the segment, and the top 5 alone capturing 61.4% of the market. Established companies like BYD, Geely, SAIC, Chang’an, and Chery dominate five of the top six positions in the NEV sector, demonstrating that traditional gasoline internal combustion engine (ICE) manufacturers can successfully pivot to the burgeoning NEV market—at least those based in China!

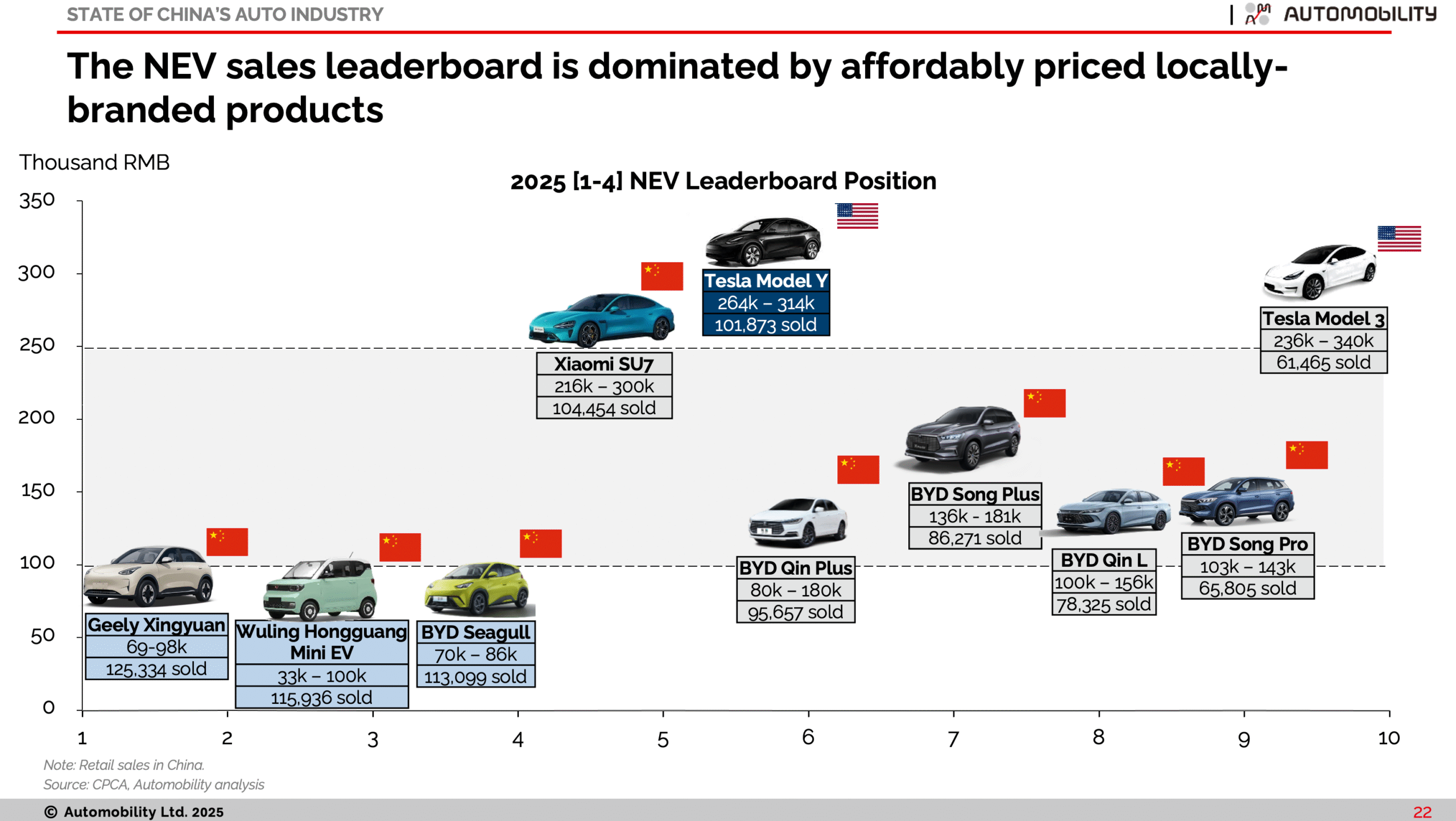

Among the top selling models, Xiaomi SU7 outsold Tesla Model Y for the first time. And while the market launch of their new YU7 model was delayed, Xiaomi was still generating attention with their high performance SU7 Ultra model at Auto Shanghai.

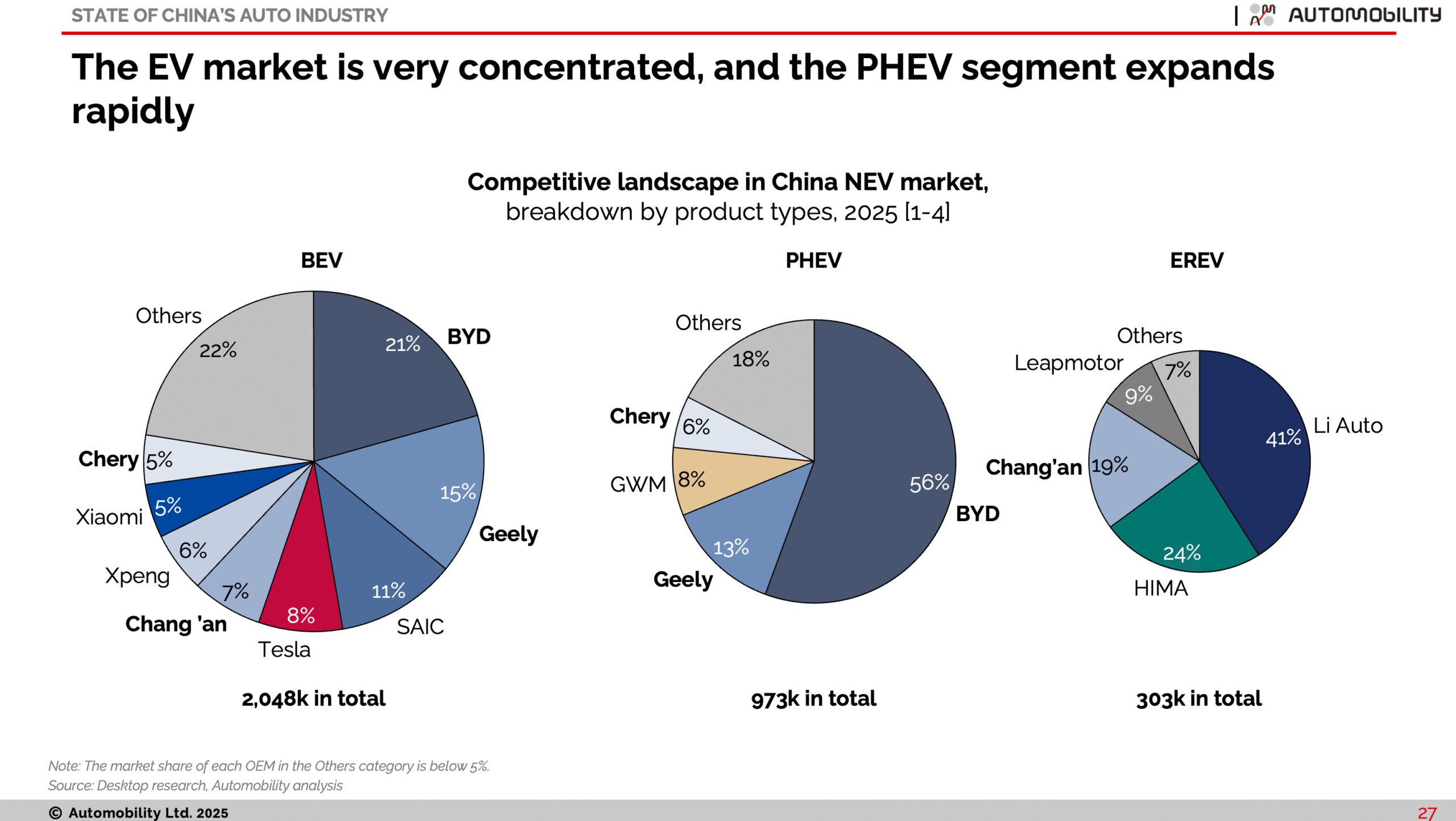

BYD has regained its lead in the BEV sub-segment, although it is now facing intensified price competition from Geely and SAIC Wuling. While BYD remains dominant in the PHEV sub-segment, Li Auto and HIMA’s brand affiliates are leading the popular Extended Range Electric Vehicle (EREV) sub-segment.

Tesla’s performance in China’s NEV market has noticeably weakened. The company’s sales have remained stagnant over a prolonged period, showing no growth in combined export and domestic volumes. Tesla’s share in China’s NEV market has declined to 4.9%, with volumes decreasing by 0.3% in a passenger vehicle NEV segment that has expanded by 35.8% so far in 2025. In this intensely competitive market, where companies are constantly introducing new models, Tesla has not launched a new model since 2021, which is also the last year they participated in a China auto show.

Overall Market Leaders

Chinese brands share of domestic passenger vehicle market share in the first quarter reached 68.7%. Year-over-year growth of Chinese brands was 27.4%, with Japanese brands taking the biggest hit, down 13.4%.

BYD has solidified its position as the market leader by achieving a 14.9% increase in overall volumes compared to last year. Meanwhile, the Geely Group has experienced remarkable growth, surging by 63.6% and surpassing the VW Group to claim the second spot. The market share of foreign brands has diminished significantly, now less than half of what it was in 2020. Among these, only Toyota has bucked the trend, recording a 9.3% increase so far in 2025, whereas Honda has seen a steep decline of 35.5% since last year.

Bill Russo to Deliver Keynote Speech at BNP Paribas’ Global Electric Vehicle and Mobility Conference 2025

I will be delivering the luncheon keynote speech in Hong Kong on May 19 on the topic “How China’s Digital Economy is Transforming the Future of Mobility and Energy”.

Our 3-article compilation on this topic can be downloaded here: How China’s Digital Economy is Transforming the Future of Mobility and Energy. (Copy and paste the link to your browser: https://coats-share-oiq.craft.me/HrAPE88Kgzfn7f)

Earlier in the event, I will also speak on a panel to discuss the question of “Intensifying geopolitical headwinds?” together with Mr. Michael Wu, Co-President, Zhejiang Leapmotor Technology and Mr. Gao Tao, Associate Director – Great China Light Vehicle Production, S&P Global Mobility.

BNP Paribas Global Electric Vehicle and Mobility Conference 2025

Join us on Thursday, June 19 at 9am China time for the monthly AmCham Shanghai for regular State of China Auto Market Monthly Webinar, where we will review the latest market results through February and highlight recent news from the world’s largest and most progressive automotive market.

Webinar | State of China Auto Market Monthly Briefing (June)

-

Western car industry must understand the driving smartphone or be left behind [Børsen]

“It’s crazy. The foreign brands have lost so much. And the loss is across the board. It’s not one brand. It’s all of them. The leaders of the Western auto industry didn’t see the seriousness,” says Bill Russo.

“…it’s not about how many units you sell, it’s about how you can generate revenue from the use of your products. You can take a car like the Xiaomi SU7, which was launched in 2024. It’s disruptive because Xiaomi understands how to monetize a service platform with hundreds of millions of users. If you buy a device from Xiaomi, you’ll download their app. It will collect data and monetize you. Xiaomi’s car is fundamentally not just a car – it looks pretty cool, it looks like a Porsche Taycan – but it’s designed in a fundamentally user-centric way. It has much more focus on interactivity with the passenger and not just the driver.”

Translated article in English (Copy and paste the link to your browser):

https://coats-share-oiq.craft.me/AVArNzPoRMTsAd

Original article in Danish (Copy and paste the link to your browser):

-

China’s electric vehicle revolution reshapes global auto market [HSBC Insights]

Highlighting the scale of China’s transforming auto industry, Bill Russo, Founder and CEO of Automobility Limited, said: “All of the growth of the 21st-century auto industry is in China. In the past five years, local brands have gained significant market share, while foreign brands have lost more volume than they currently sell in China.”

China’s electric vehicle revolution reshapes global auto market (Copy and paste the link to your browser): https://www.gbm.hsbc.com/en-gb/insights/sustainability/chinas-electric-vehicle-revolution-reshapes-global-auto-market

-

Xiaomi Delays Release of First SUV After Fatal Road Accident [Bloomberg]

“The problem with the way self-driving features have been sold is it’s caused people to think that they can be less attentive to the way the car is actually performing,” Bill Russo chief executive officer of Automobility Ltd, a Shanghai-based consultancy, said at the Shanghai auto show on Wednesday.

“You still need to monitor the car. I think that’s what we’re going to hear more of — regulators trying to step in to make sure we’re not calling it autopilot or full self-driving.”

Source (Copy and paste the link to your browser):

-

China’s investments in electric vehicles yield success [ABC News Video]

ABC News’ Britt Clennett got a first-hand look inside China’s success at bringing electric vehicles to the masses with battery technology that rivals or beats American know-how.

China’s investments in electric vehicles yield success (Copy and paste the link to your browser): https://www.youtube.com/watch?v=VoTlfOz5zoM

-

How the EU’s reliance on China has exposed carmakers to trade shocks [Radio France Internationale]

“For the last 30 or so years, the global auto industry has moved toward markets that can lower the overall cost” of cars for sale, Bill Russo, CEO of Shanghai-based car industry watchdog Automobility, told RFI.

Russo said the measures create “additional friction to the system, adding additional costs”, which will result in “less competitive pricing among the domestic industries that have relied on low-cost country sourcing”.

“By increasing costs of components, you’re increasing the price of the vehicle or decreasing margin. When you do that, you shrink your market,” Russo explained.

How the EU’s reliance on China has exposed carmakers to trade shocks (Copy and paste the link to your browser):

-

Porsche slashes outlook as US tariffs, China slump dim prospects [Reuters]

Bill Russo, CEO of Shanghai-based advisory firm Automobility, said Chinese customers of electric cars had been drawn to domestic brands because of their improved technological offering.

“No foreign company believed that the Chinese could somehow build equity that was superior to the foreign brands, especially the Europeans.”

Full article (Copy and paste the link to your browser):

AUTO INSIDER PODCAST

Subscribe to our all-new “Auto Insider” podcast, where I aim to bring you stories from the front-line experience of the pioneers who have devoted themselves to building the future of mobility, and bridging the gaps between past, present and future. Our next episode will post soon.

Our first episode featured industry veteran Jack Cheng, the current Chairman & CEO of M Mobility, a provider of integrated smart solutions utilizing EV and AI technologies.

Auto Insider #1: Jack Cheng on Smart EVs and the Smart Tier 0.5 Supply Chain

Clik here to the Audio Link

Jack’s track record includes CEO of Foxconn’s MIH | Mobility in Harmony Alliance and Co-Founder of NIO a leading Tencent-backed Smart EV maker. Jack also led the China business for Fiat Chrysler Automobiles, the Asia Pacific Business for Magnetti Marelli and served many positions over nearly 2 decades at Ford Motor Company.

You can stream the Auto Insider podcast on your preferred platform – and don’t forget to like and subscribe to be notified of future Auto Insider podcasts! (Please copy and paste the below links to your browser)

YouTube: @AutomobilityLtd

Spotify: AUTO INSIDER

Apple Podcasts: AUTO INSIDER

Youku: AUTO INSIDER

https://v.youku.com/video?vid=XNjQ2NjI1MTQ3Mg%3D%3D

If your organization would like a custom briefing on the State of China’s Auto Market, please reach out to us at info@automobility.io

About Bill Russo

Bill is a contributing author to the book Selling to China: Stories of Success, Failure, and Constant Change (2023), where he describes how China has become the most commercially innovative place to do business in the world’s auto industry – and why those hoping to compete globally must continue to be in the market.

About Automobility

Contact us by email at info@automobility.io

PLEASE NOTE: The information and analysis shared in this newsletter, including the charts and style of materials presented, is the intellectual property of Automobility Ltd. While we share it as a way to serve our existing and new clients, it is not to be used without our express consent and then only with attribution. Any publication, reproduction or other use of this material without the express written consent of Automobility Ltd is prohibited.

Sorry, the comment form is closed at this time.