12 May Nikkei Asia : Chinese automakers reach crossroads after conquering export markets

Media Source : Nikkei Asia

In echo of Japan, offshore production set to increasingly drive foreign sales

CISSY ZHOU, Nikkei Asia

May 3, 2025 06:00 JST

HONG KONG — Facing a surge of Chinese imports driving up its trade deficit, Turkey last June announced a 40% supplementary tariff on new vehicles coming from China.

A month later, BYD, China’s biggest maker of electric and hybrid vehicles, announced it would build a $1 billion factory in Turkey, with production to begin by the end of 2026. The move won BYD an exemption from the country’s new tariff on imports in the interim as well as the promise of duty-free access to EU markets for the new factory’s future output via Turkey’s customs union with the bloc.

For Turkish car buyers like Ali Hakan Karahan, owner of a furniture manufacturer in Istanbul, it was a happy outcome. He bought an imported BYD Seal U hybrid SUV in January for 1.85 million lira ($48,100), a discount of at least 40% off the price of comparable Western models.

“I am in the furniture business, so I know a lot about materials, interior design, material quality,” he said. “This one is almost up to European standards. … The car has everything from seat heating to voice commands.”

Turkey and the EU as well as many other governments have begun imposing steep tariffs on vehicles from China due to the explosive surge in imports from the country over the past four years.

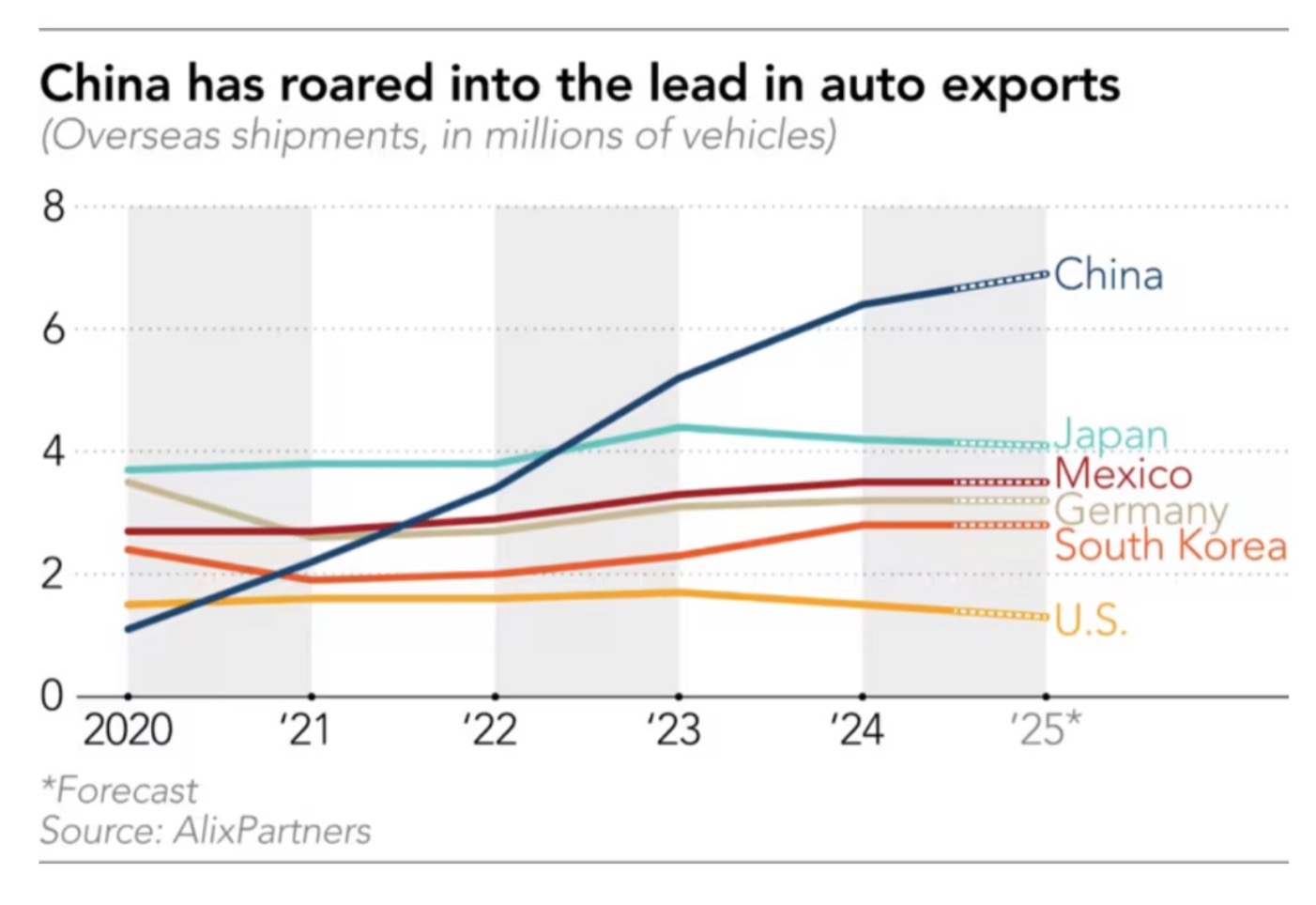

As recently as 2020, China was only the sixth-largest auto exporter globally, but annual sales have since risen almost sixfold. This incredible rise turned China into the world’s largest exporter in 2023. It further built out its lead over Japan, Germany and all other producers last year.

Chinese carmakers are now at the crossroads that their Japanese peers reached four decades ago. Becoming the top source of imports has made them a lightning rod for trade tensions in markets around the world. Many of them are seeking to dissipate the pressure and circumvent tariffs by building local production facilities. This in turn is poised to catalyze a transition in which runaway Chinese auto export growth cools even as the carmakers’ global sales race on.

“Tariffs will not stop the globalization of Chinese carmakers,” said Bill Russo, chief executive of Shanghai- based consultancy Automobility and former head of Northeast Asia for Chrysler. “It in fact accelerates their decisions to invest in building their capacities outside China.”

Japanese carmakers these days produce far more vehicles for international markets offshore than onshore. In 2023, they shipped 4.4 million vehicles overseas from Japan while producing 17.5 million vehicles offshore.

The proportions are currently reversed with Chinese carmakers. Last year, they exported 6.4 million passenger and commercial vehicles from China. As of last August, they operated offshore factories capable of producing around 1.7 million vehicles a year and had confirmed plans or had begun building additional plants that would roughly double that volume, according to calculations by Rhodium Group, a New York-based policy research company.

On Monday, BYD broke ground on a $32 million EV assembly plant in Sihanoukville, Cambodia, where it aims to begin churning out vehicles by year-end. After launching production last year in Thailand and Uzbekistan, BYD is also adding plants in Hungary, Indonesia and Brazil while still hoping to extend its footprint into Mexico and India.

For its part, Geely Holding Group in January opened an assembly plant in Giza, Egypt, the first in Africa or the Middle East for the sprawling conglomerate which includes brands ranging from Volvo to Proton. Other Chinese carmakers are setting up production in places such as Nigeria, Argentina, Malaysia and Vietnam.

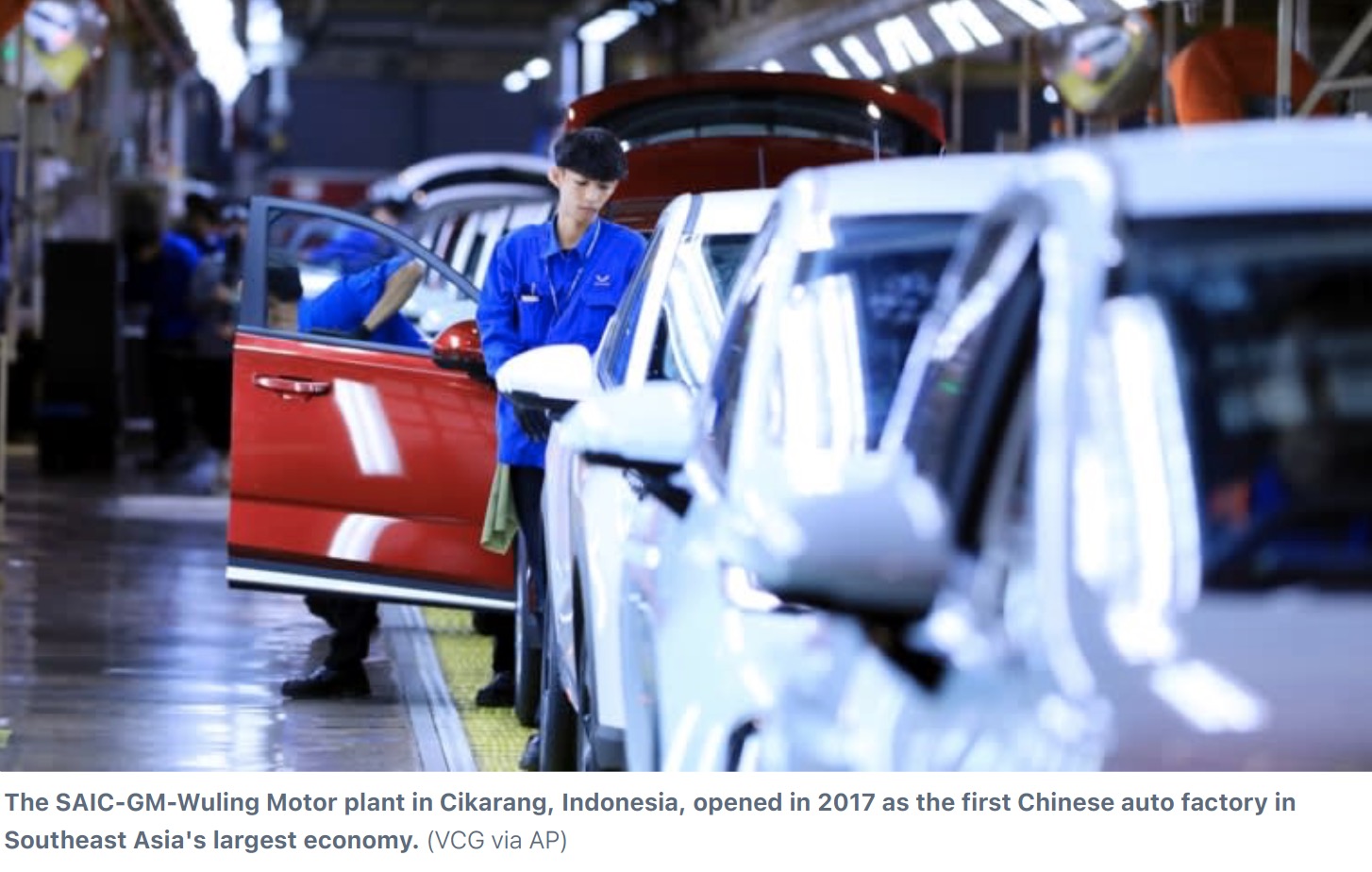

At the Auto Shanghai 2025 show, which wrapped up on Friday, state-owned SAIC Motor unveiled its “Global Strategy 3.0,” which includes plans for a new assembly plant in Southeast Asia, regional hubs in Egypt, Morocco and South Africa, and the rollout of 17 new models for overseas markets.

“Relying on a global strategy, we will have a global perspective while achieving localization to meet local consumer needs and comply with local compliance requirements,” said President Jia Jianxu. “This is the only way to ensure the sustainable development of our global investments.”

The overseas push by SAIC and its peers is the result of a convergence of factors. Sales growth in China’s domestic auto market has leveled off in recent years as the economy has slowed, but production has continued to rise as new entrants race into the market.

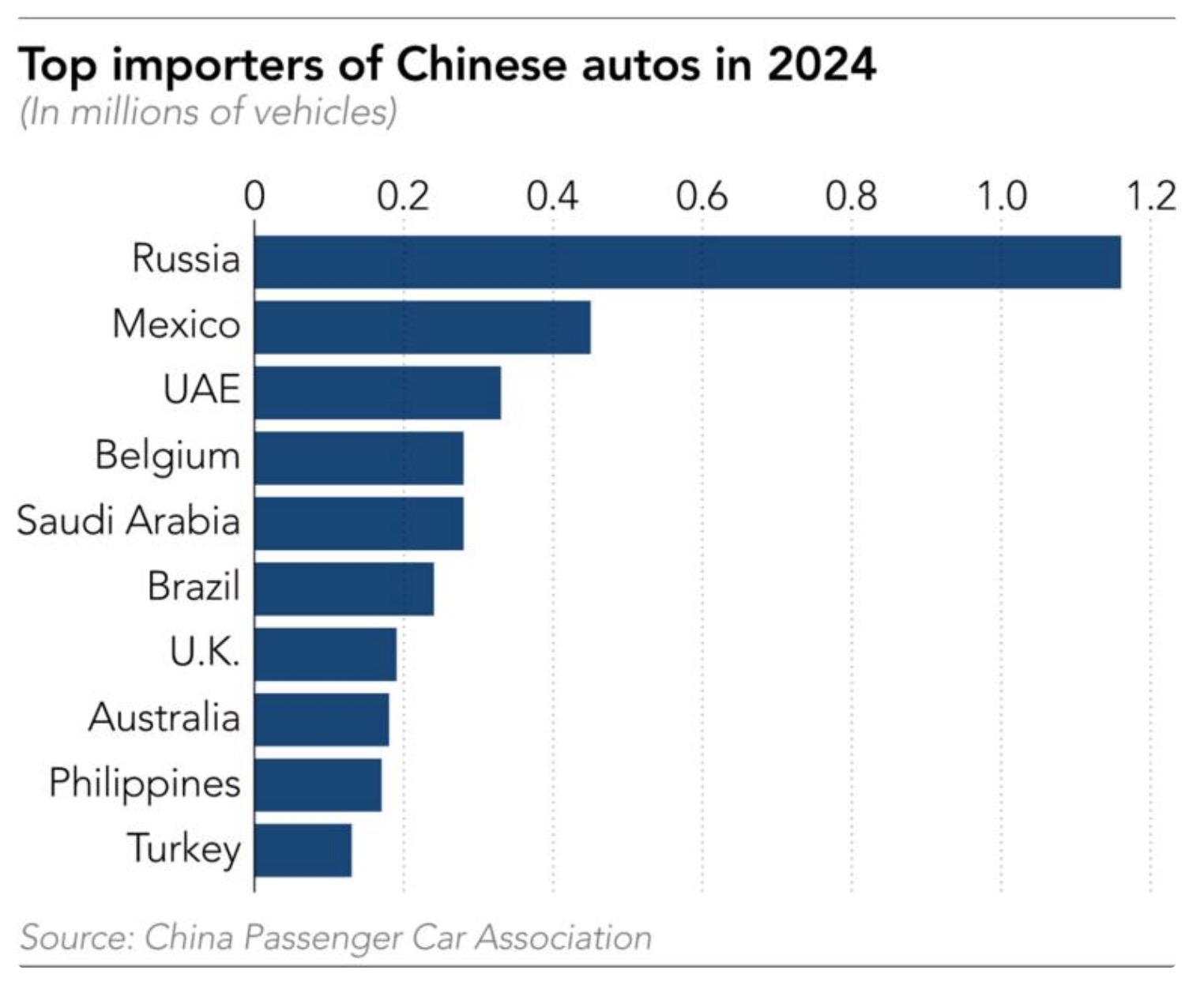

Foreign markets offered the promise of higher profit margins. Shipments to Europe, Russia and emerging markets rapidly took off, with boosts from EU subsidies for EV purchases and the disappearance of other international carmakers from the Russian market due to the Ukraine war.

The sales outlook is no longer quite so bright.

Since 2022, several European countries have cut or eliminated EV subsidies. The EU last year imposed tariffs of up to 45.3% on imports of EVs from China, but hybrids are exempt from the new duties.

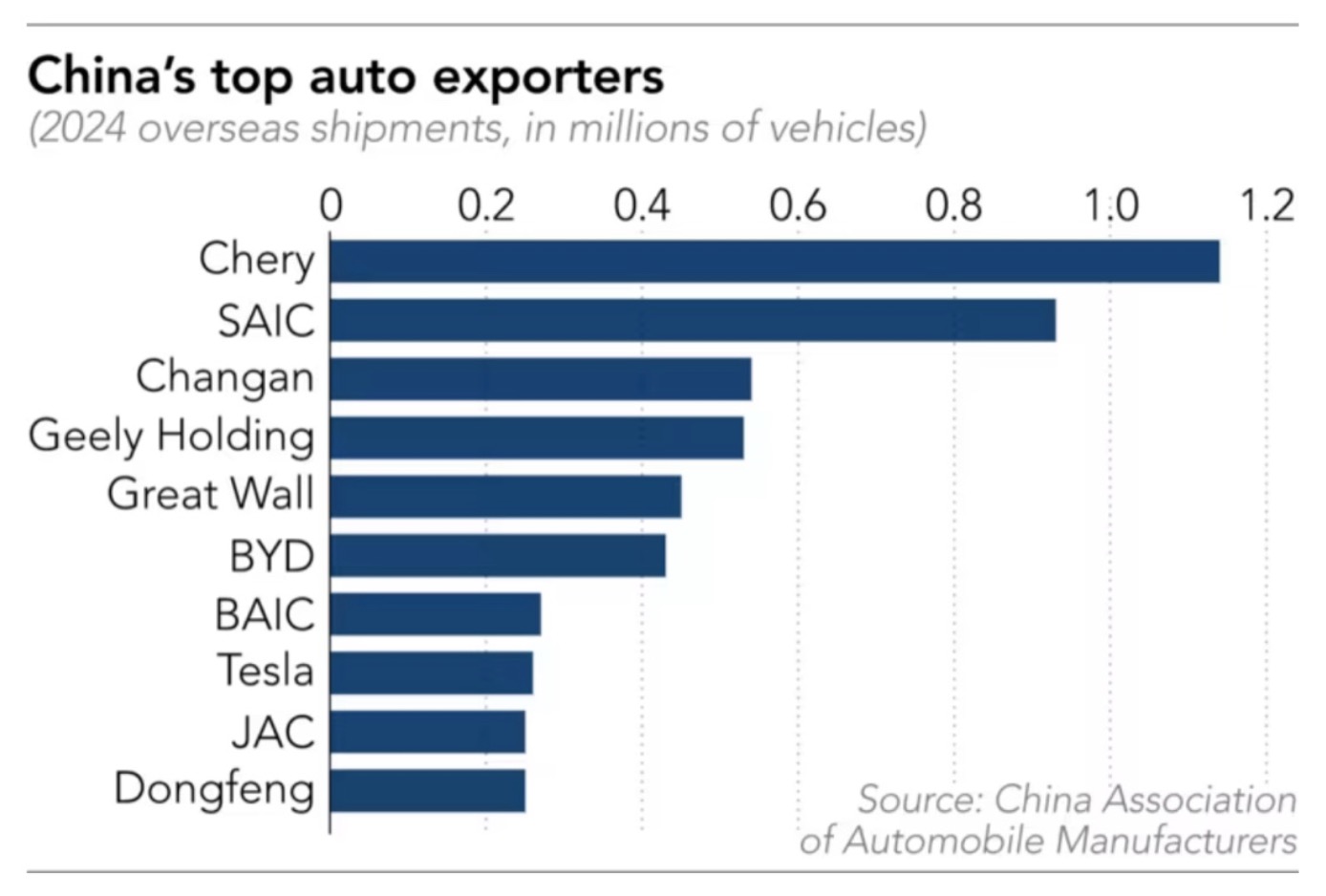

Russia has also raised tariffs on Chinese vehicles while imposing new fees and safety checks. Xu Haidong, deputy chief engineer at the China Association of Automobile Manufacturers (CAMA), expects exports to Russia, the biggest overseas market for his group’s members, will decline at least 30% this year to around 800,000 vehicles. In Mexico, the second-biggest market in 2024, momentum has begun to dissipate too as the country has come under political pressure from the U.S. over Chinese imports.

Consequently, some observers expect Chinese auto export growth to slow further from last year’s reduced pace or even decline.

“Trade barriers are now clearly weighing on China’s auto exports to several major markets, and the drag is only likely to mount this year,” wrote Gavekal Dragonomics analyst Ernan Cui in a January report. As Chinese carmakers are still ramping up offshore production, she said, “auto exports will probably decline in 2025 as a result of these headwinds.”

In some places, local production by Chinese carmakers is already reshaping market dynamics. The ramp- up of EV output in Thailand has dampened imports from China, according to Rhodium Group analysts Gregor Sebastian and Endeavour Tian. They expect some Chinese automakers to begin exports from Thailand to other markets such as Australia and Europe. In a January report, they noted that Chinese carmakers’ share of domestic sales in Thailand reached 12.4% last year, up from 5.3% in 2022.

Surveying policy stances toward Chinese cars, the two analysts calculate that markets accounting for between a quarter and a half of global auto demand will be effectively closed to both Chinese imports and investment in local production by 2027.

The U.S., Canada and India are the main closed markets, but the analysts project that Japan, South Korea and Israel will also cut off Chinese access, noting “substantial U.S. pressure to impose national security- related restrictions” and the desire of the two East Asian nations to protect domestic producers.

Sebastian and Tian forecast that markets accounting for another quarter to a third of global demand will “make direct exports commercially unviable” through tariffs and other trade barriers, adding to pressure on Chinese automakers to produce locally.

At the same time, there are some signs Beijing may be starting to discourage local carmakers from investing in overseas production. Ministry of Commerce officials last year “strongly advised” automotive companies against setting up production in Russia and Turkey while also urging caution about Thailand and Europe, Reuters previously reported.

Chinese observers are comparatively optimistic about the export outlook for 2025. CAMA’s Xu expects overseas shipments to rise by a further 500,000 to 600,000 vehicles this year. Cui Dongshu, secretary general of the China Passenger Car Association, forecasts a 10% rise from last year’s level of 6.4 million vehicles.

“Current global economic momentum is weak, and trade barriers are rapidly increasing,” Cui said. “The spillover effects of Trump’s aggressive tariff policies are expected to be significant.”

As a result, Cui predicts that Chinese automakers may see no growth in international EV shipments in 2025, but he expects overseas sales of traditional vehicles to rise 9%. He sees sales of hybrids climbing 70%, with help from strong demand from EU buyers avoiding EV tariffs.

Many of the factories Chinese automakers are setting up offshore are only for the assembly of vehicles from “knocked down” packages of parts, an approach that the Chinese Ministry of Commerce supports, according to the Reuters report

For the moment, the companies may have little choice. “China does not really have an organized keiretsu system,” said Michael Dunne, chief executive of automotive consultancy Dunne Insights, referring to the networks of suppliers that Japanese carmakers maintain in part through cross-shareholding arrangements. “Will they (Chinese carmakers) source from global suppliers instead of trying to organize their own?”

So far, the answer seems to be “no.”

BYD Chairman Wang Chuanfu told investors at a private briefing in Hong Kong in March that to support plans to double the company’s overseas sales from 2024’s 417,204 vehicles_,_ it will focus on using China-made parts globally, according to attendees at the event.

Similarly, in its draft prospectus in March for a planned initial public stock offering in Hong Kong, Chery Automobile declared, “We believe the knock-down model enables us to quickly enter into new markets and establish a strong market presence while catering to customer needs and preferences and adapting to local laws and regulations.”

Chery, long the leader in overseas shipments among Chinese automakers, opened a joint-venture plant in Barcelona, Spain, in December. It said in its prospectus that it plans to further expand production in Thailand, Vietnam and Malaysia.

Geopolitical tensions may ultimately not prove an insurmountable barrier to Chinese automakers if they do not translate into tariffs or other regulatory curbs.

The Philippines and Australia, which have clashed with Beijing on multiple issues in recent years, have emerged as major importers of Chinese vehicles. A key factor is that neither country is home to a significant domestic auto production sector. Additionally, Manila has been supportive of Chinese car sales as a form of consumption, while Canberra has been keen to boost EV sales to serve its climate goals.

Back in Istanbul, solar energy company operations director Neslihan Dokuman is enjoying the performance of the BYD Atto 3 compact she started driving in March.

“There is a negative perception in Turkey for Chinese products in general so this EV changed my perception a lot,” she said, adding with a laugh, “Our general manager leased a BMW, and I have been telling him mine is better.”

Additional reporting by Sinan Tavsan in Istanbul, Zach Coleman in Tokyo and Wataru Suzuki in Shanghai.

Sorry, the comment form is closed at this time.