18 Mar State of China’s Auto Market – March 2025

Written by Bill Russo, Founder & CEO of Automobility Ltd.

Highlights

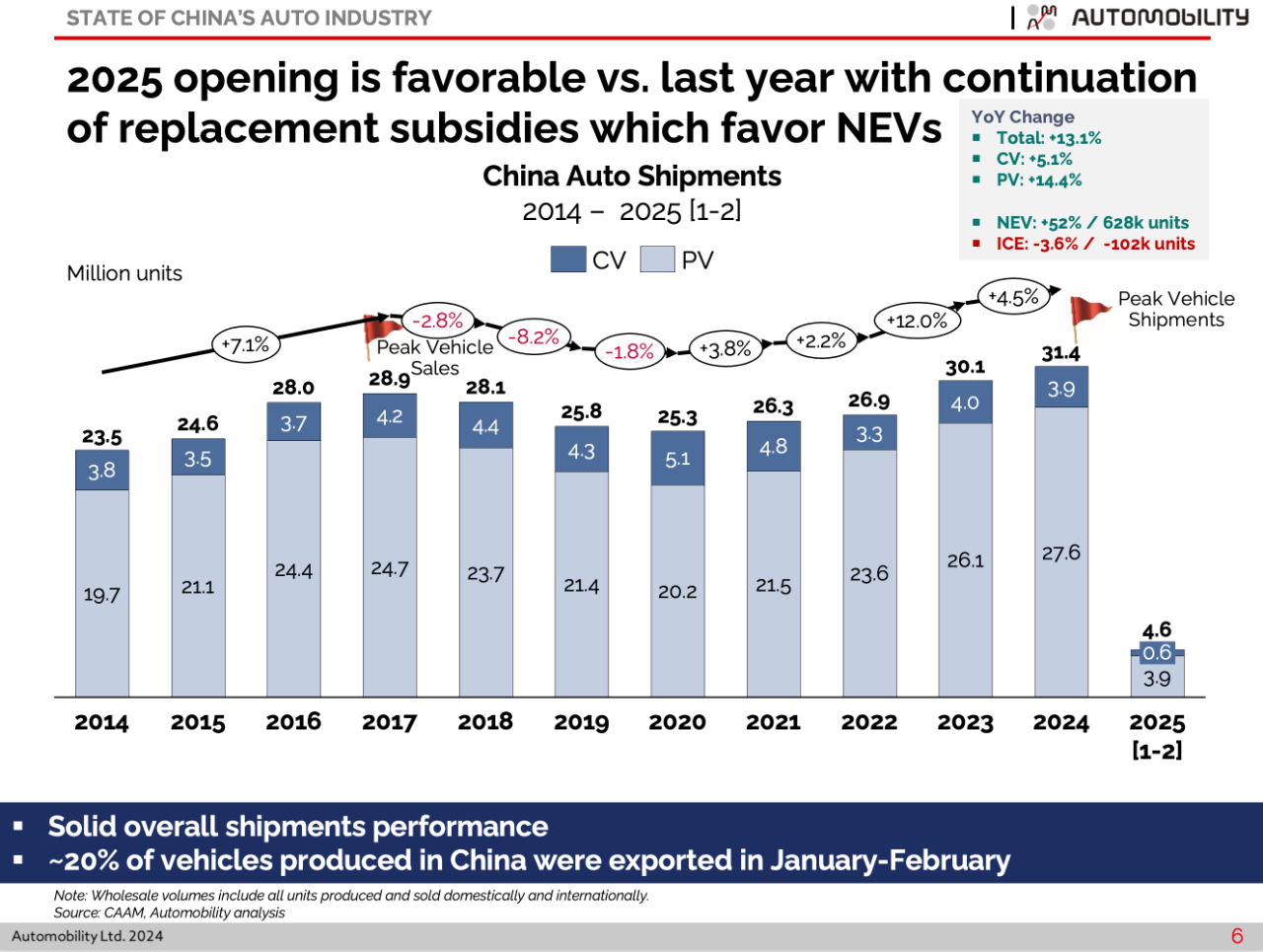

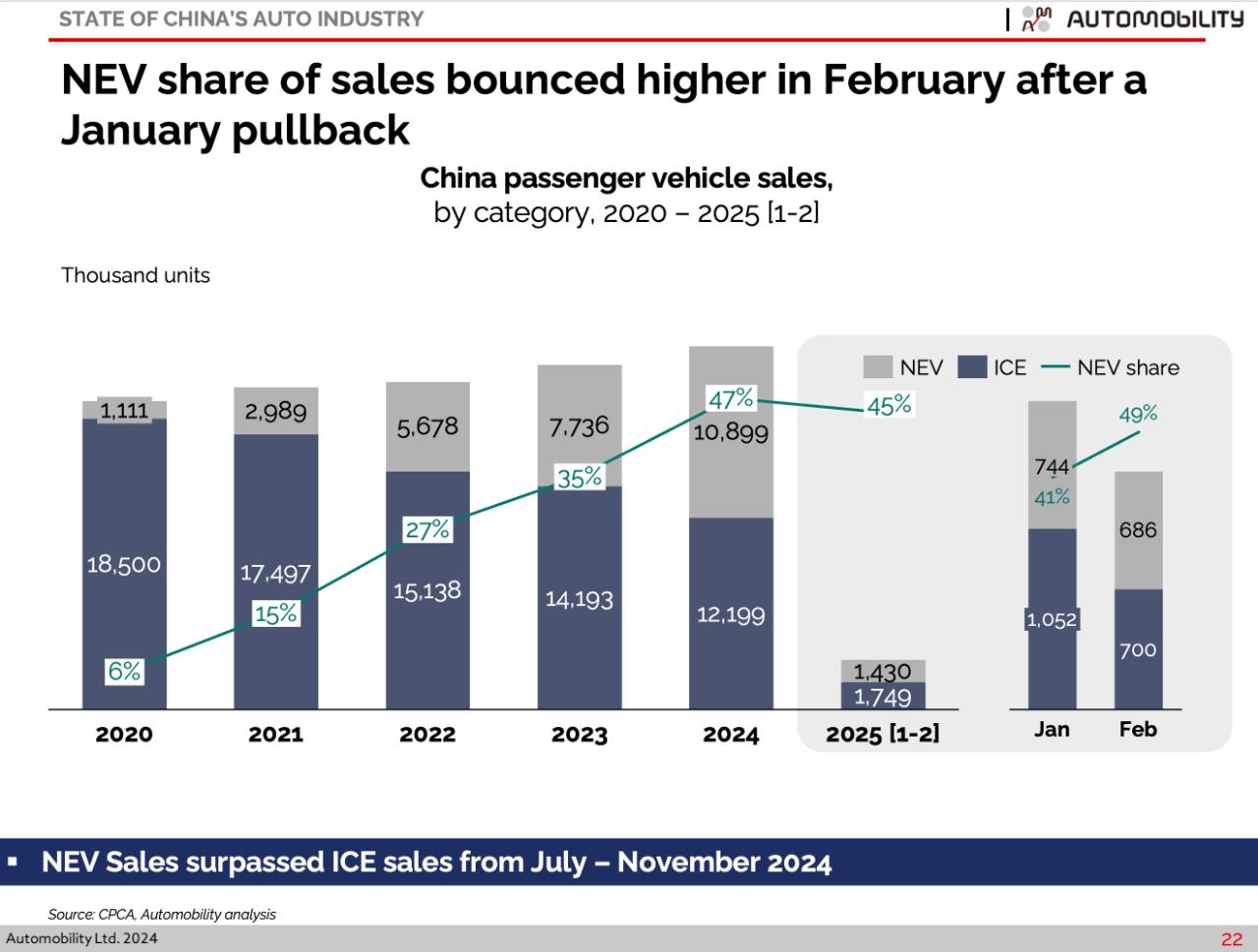

- Year-to-date market performance is favorable in 2025 versus the prior year. New Energy Vehicle (NEV) shipments are up 52%, while gasoline powered (ICE) vehicle sales are down 3.6% versus last year’s January-February period.

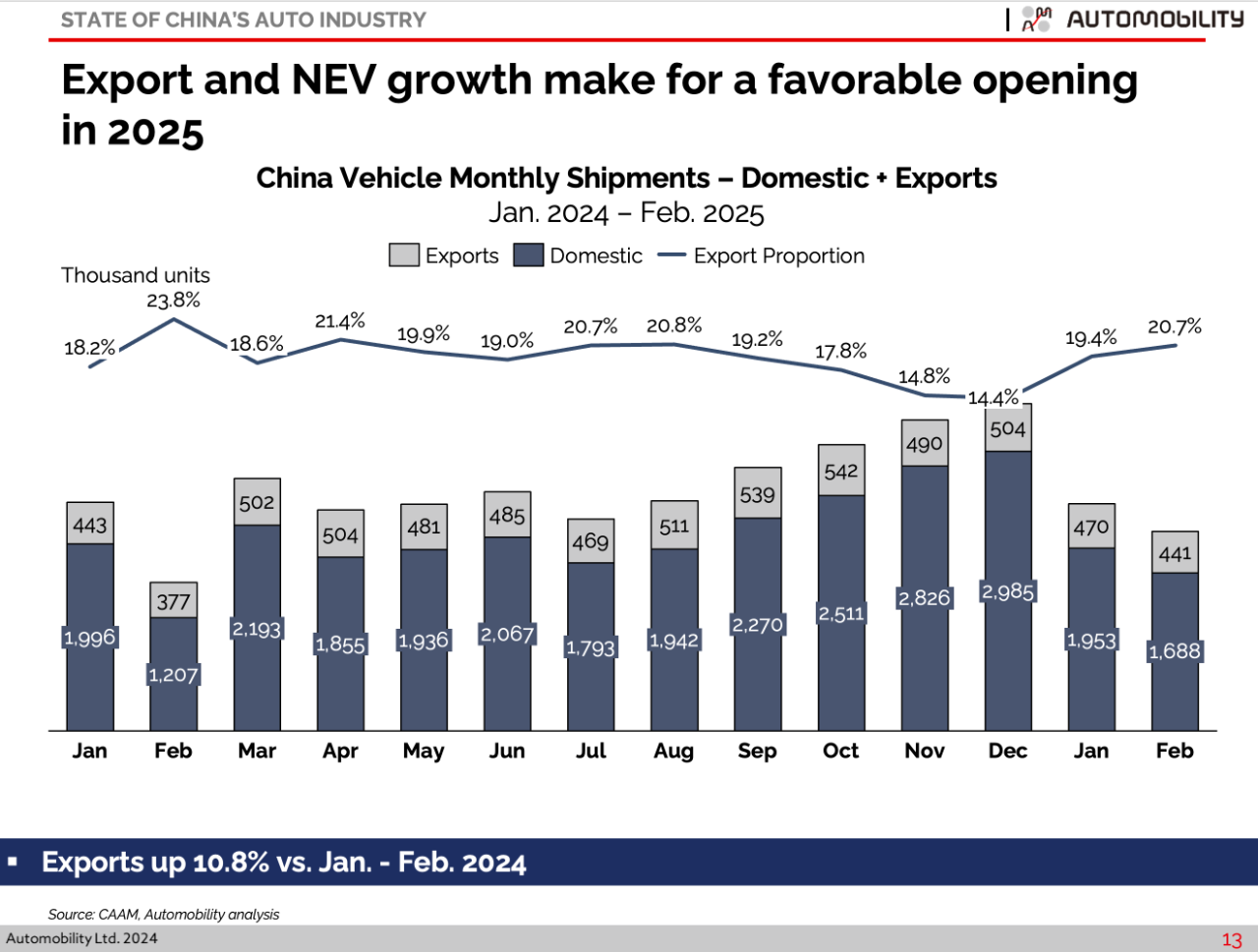

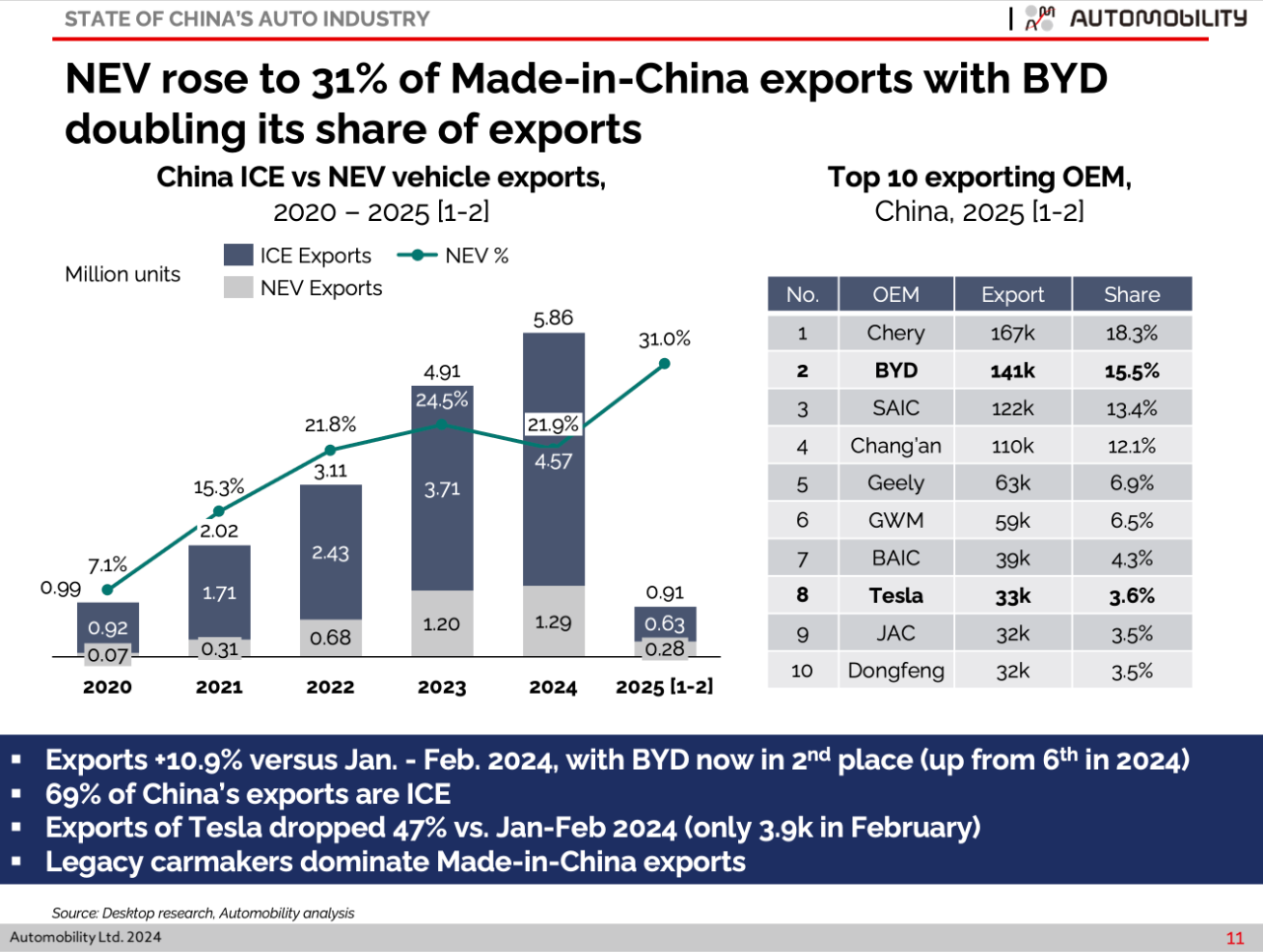

- Made-in-China exports are up 10.9% versus last year’s pace. NEV exports are expanding, although still just 31% of total exports. ~20% of vehicles produced in China were exported over the January-February period.

- BYD is now the 2nd largest car exporter with 15.5% share of exports, behind Chery’s 18.3%. BYD was ranked as 6th largest exporter in 2024. Tesla’s Made-in-China exports plummeted 47% so far this year.

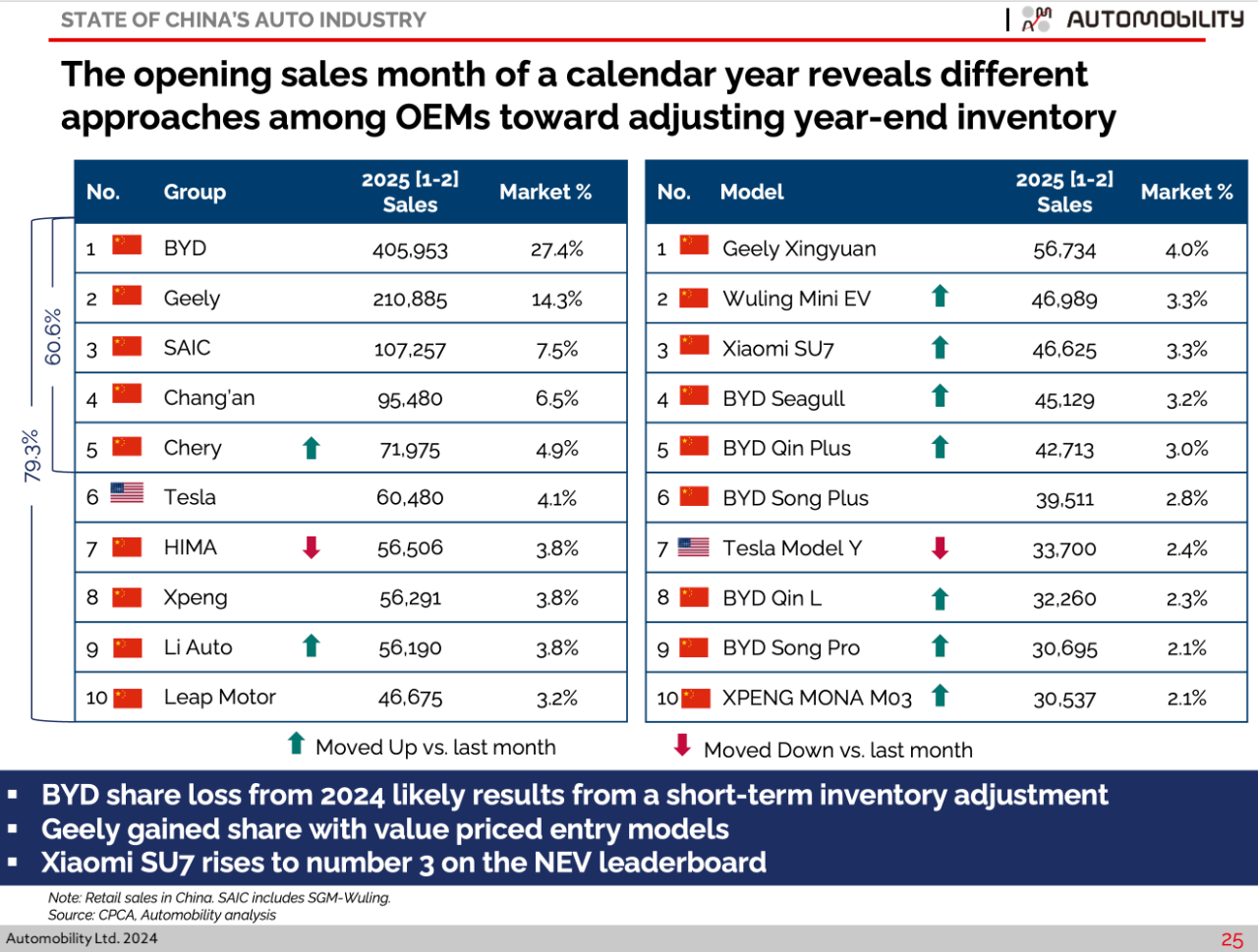

- BYD remains the dominant NEV player with 27.4% segment share, but faces new BEV challenges from Geely (Xingyuan), Xiaomi (SU7) and XPENG (MONA M03).

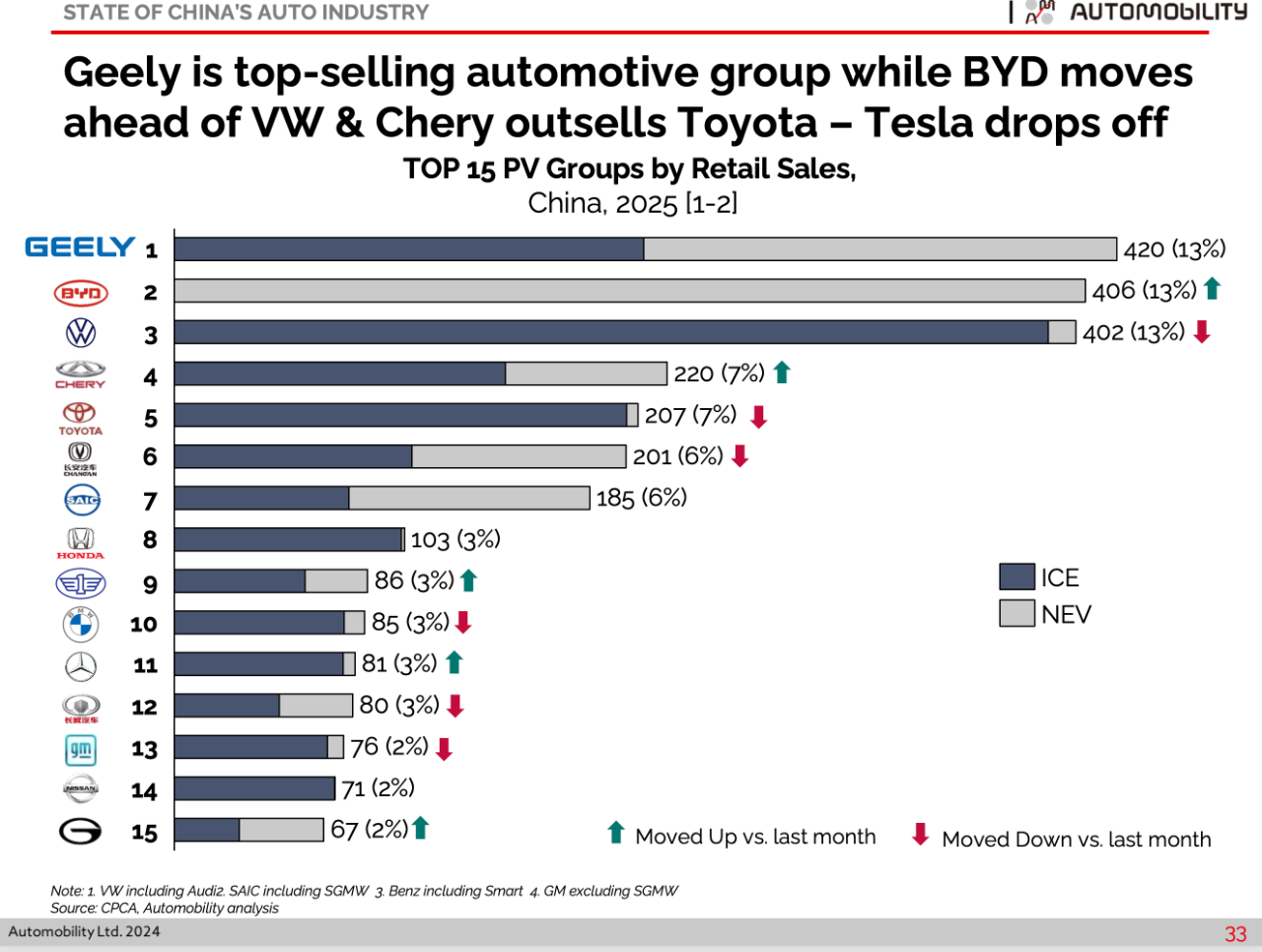

- Geely tops the passenger vehicle market share leaderboard in 2025, with its balanced ICE and NEV brand portfolio. Chery passed Toyota to become the 4th largest passenger vehicle OEM in China.

A Solid Opening with Continuing Replacement Subsidies

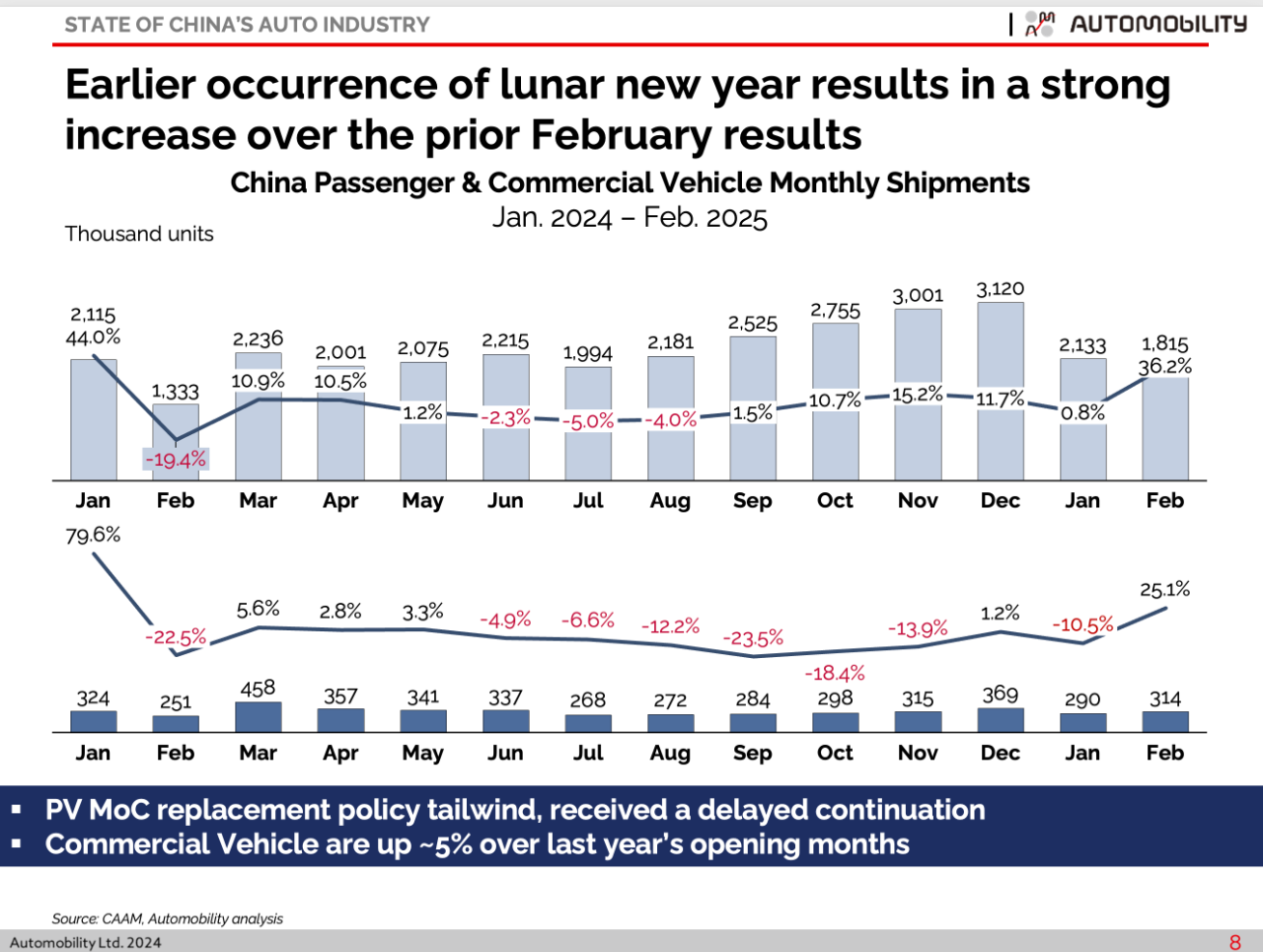

Year-over-year comparisons for the individual months of January and February are difficult to draw because of the timing of the lunar new year holiday, which impacts production schedules and the number of available selling days in a given month. This year’s holiday was earlier and therefore adds a headwind to January performance, which is then offset with a tailwind in February which had more selling days in 2025.

However, combining both months does give us an overall result that appears positive in comparison to last year. Vehicle shipments in January-February reached 4.6 million units, a 13.1% percent increase from the previous year, with NEV shipments up 52% and ICE shipments down 3.6%.

Year-end inventory close-outs and wholesale adjustments are also typical in the opening months, which can make spotting patterns more difficult to discern at the start of the year. However, it is clear that the China market remains focused on exporting as a means to maintain stable production volumes.

Passenger Vehicle shipments were up 14.4% compared with last January-February, and Commercial Vehicle sales were up 5.4%. PV performance was boosted by export growth and continuation of vehicle replacement subsidies which began last year, which slightly favor NEV purchases.

NEV Exports Rising – Led by BYD

Made-in-China exports grew to 20.7% of ex-factory shipments in February. Export volumes are up 10.8% over the 2 month period versus last year.

Made-in China (MIC) exports accounted for 20% of overall production. It is noteworthy that NEV share of exports has risen to 31%, with BYD being the main driver of this increase. BYD now holds 15.5% share of MIC exports, and now accounts for over half of the NEV exports.

It is also notable that Tesla’s MIC exports have dropped 47% from last year’s performance in an export market that grew 10.9% over last year’s same period.

Domestic NEV Sales Trends

Domestic sales in January were 3.64 million units, an increase of 13.6% versus the first 2 months of last year. NEVs comprised 45% of passenger vehicle sales over this period, which is slightly below the 47% share of 2024. The slight reduction may result from several factors related to an aggressive sell-down of Internal Combustion Engine (ICE) inventory at the start of the year, along with prioritization of NEV capacity allocation to export markets in the early months of 2025.

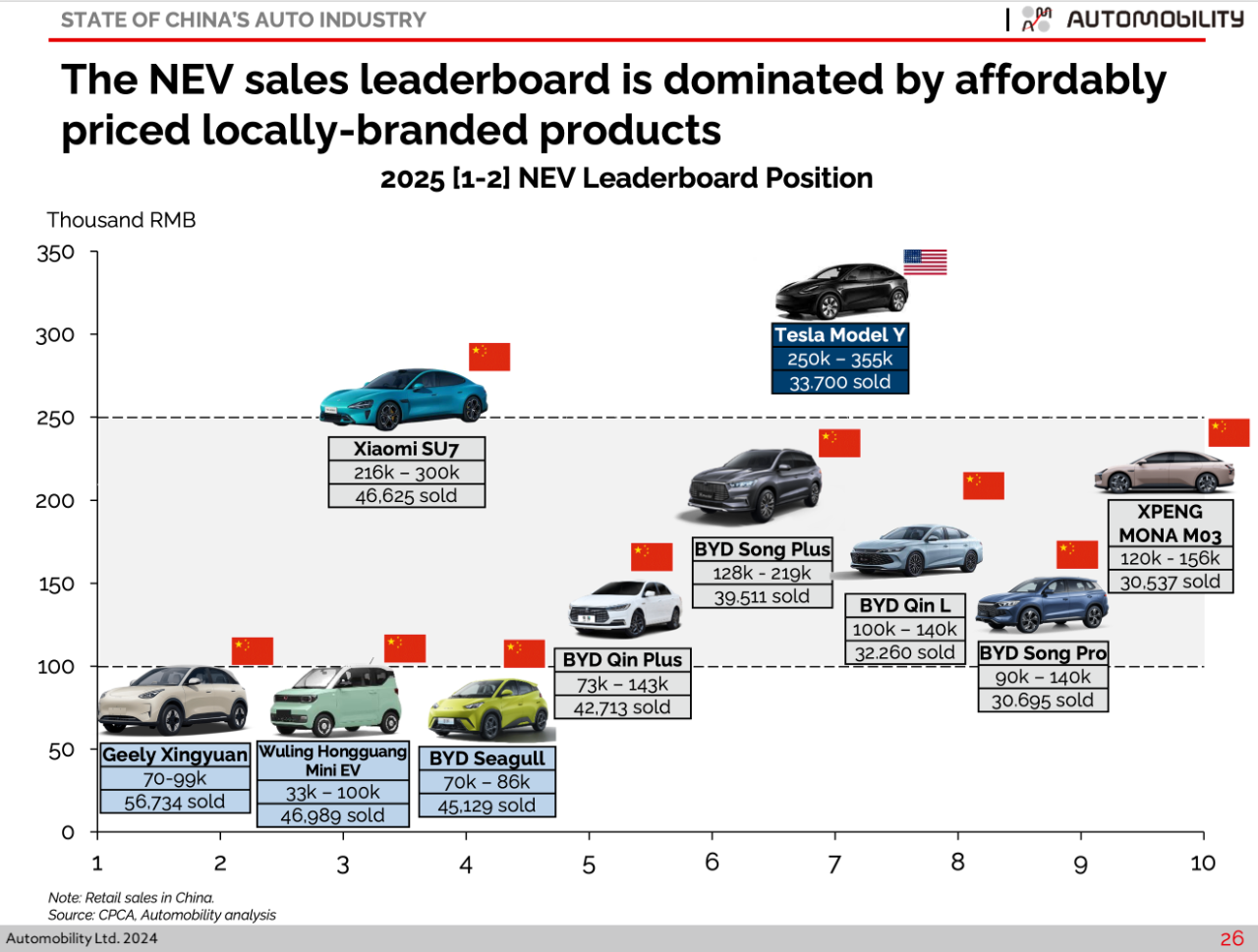

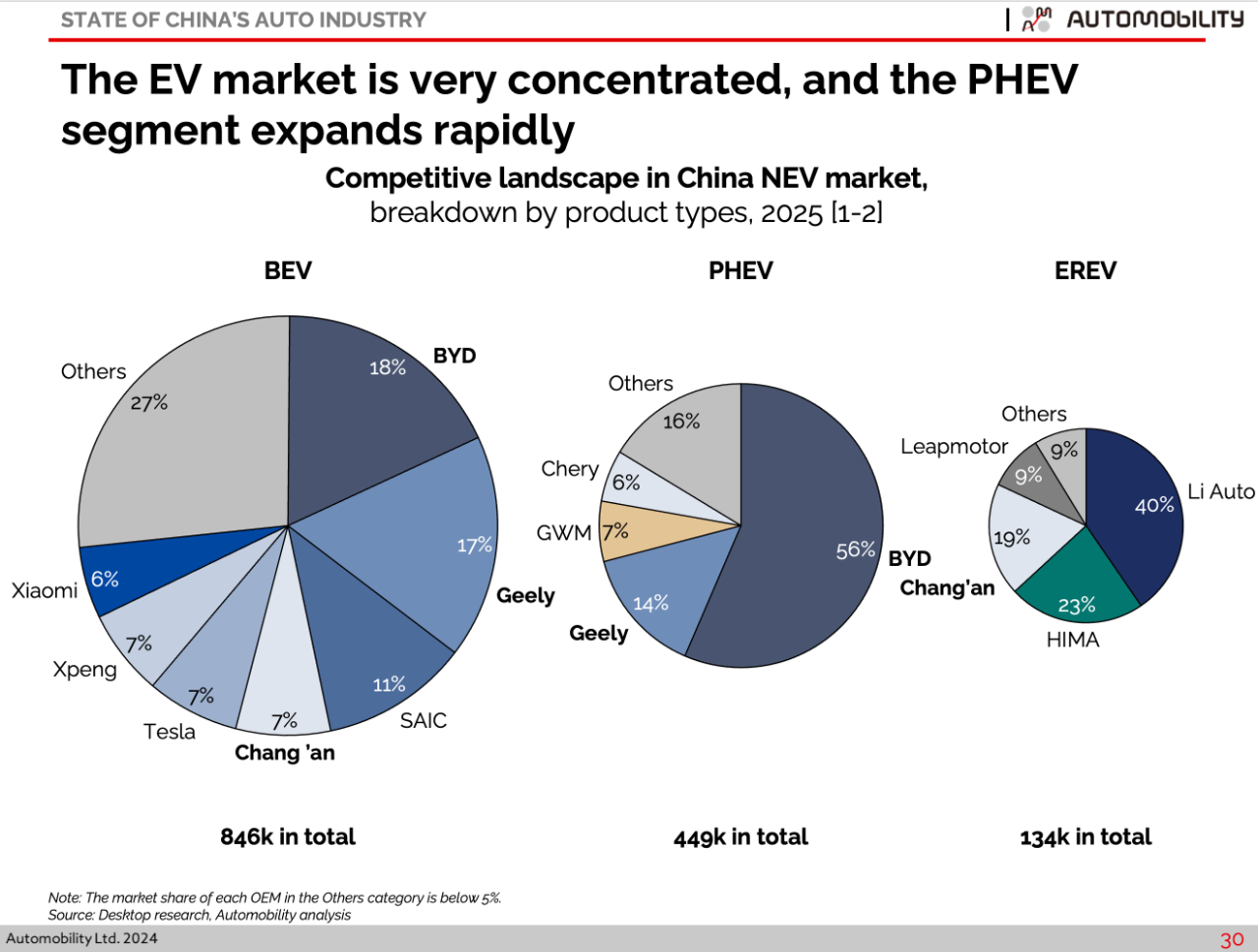

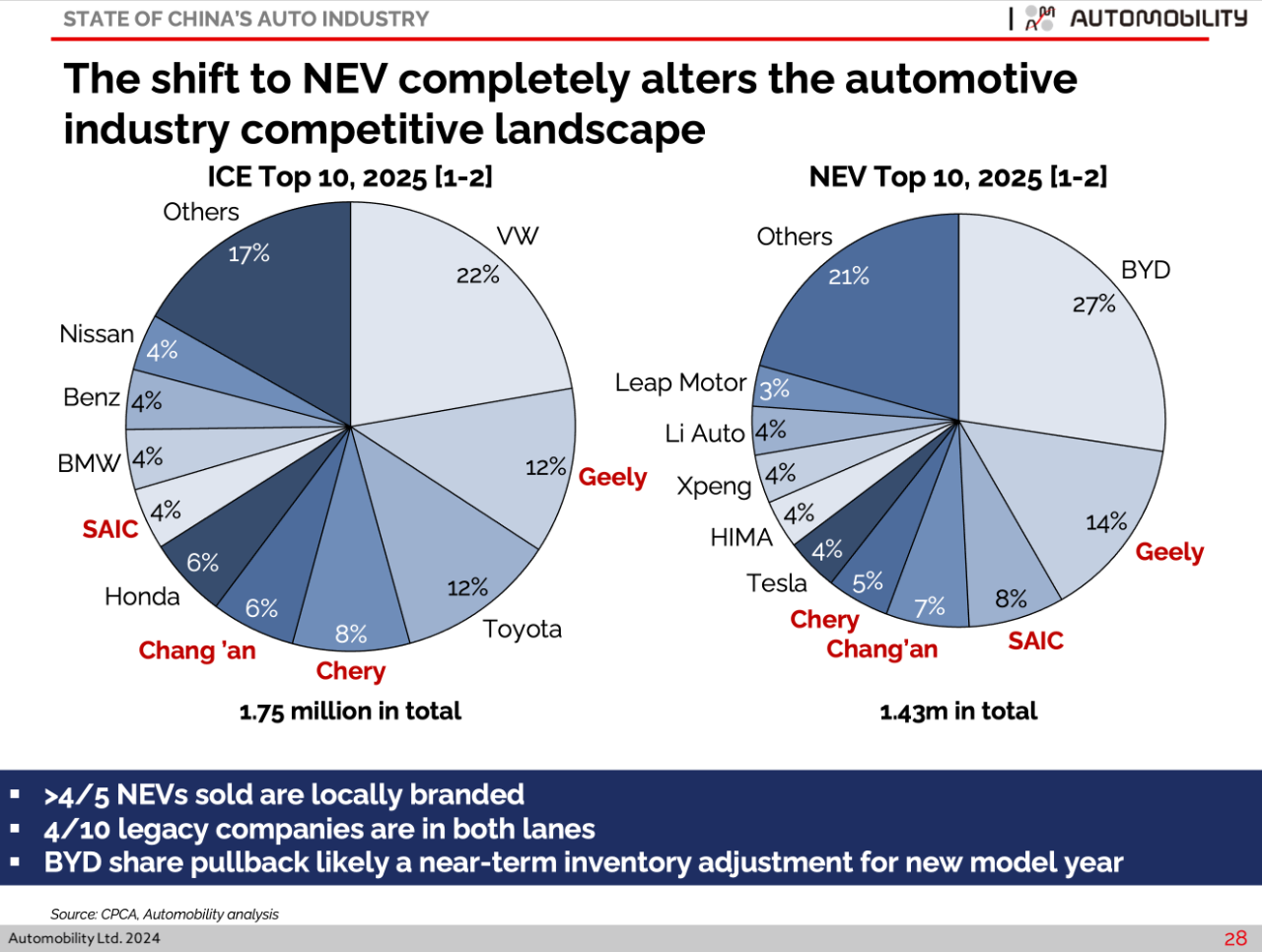

For the first two months of 2025, BYD sold 405,953 units, with NEV share at 27.4%. While BYD holds a significant lead over the NEV competition, they are facing new challenges in the pure Battery Electric Vehicle (BEV) sub-segment from Geely (Xingyuan), Xiaomi (SU7) and XPENG (MONA M03).

Geely scored the largest gains, increasing its share to 14.3% with Xinguan becoming the top-selling model in China over the past 2 months.

Xiaomi’s SU7 placed 3rd in sales at 46,625 units (3.3% share), a remarkable performance for the first car produced by the company. Xiaomi’s prices at the high end of the range for Chinese high-volume products and offers evidence that Chinese brands are not just racing to the bottom of the price pyramid, but rather can offer well-configured products at affordable prices.

Xpeng’s MO3 offered under the MONA brand also made its first appearance on the top 10 list for the Chinese smart EV maker, selling 30,537 units so far in 2025.

BYD regained its lead in the BEV segment, passing Geely who led the BEV sub-segment in January. However, it is clear that BYD is facing a 2 pronged BEV competitive squeeze from 2 sides: low priced entry models like the Geely Xingyuan and Wuling Hongguang Mini EV, and mid-priced offerings from Xpeng MONA M03 and Xiaomi SU7, along with lingering competition from Tesla.

BYD remains dominant in the PHEV sub-segment, while Li Auto and HIMA’s brand affiliates lead in the popular Extended Range Electric Vehicle (EREV) sub-segment.

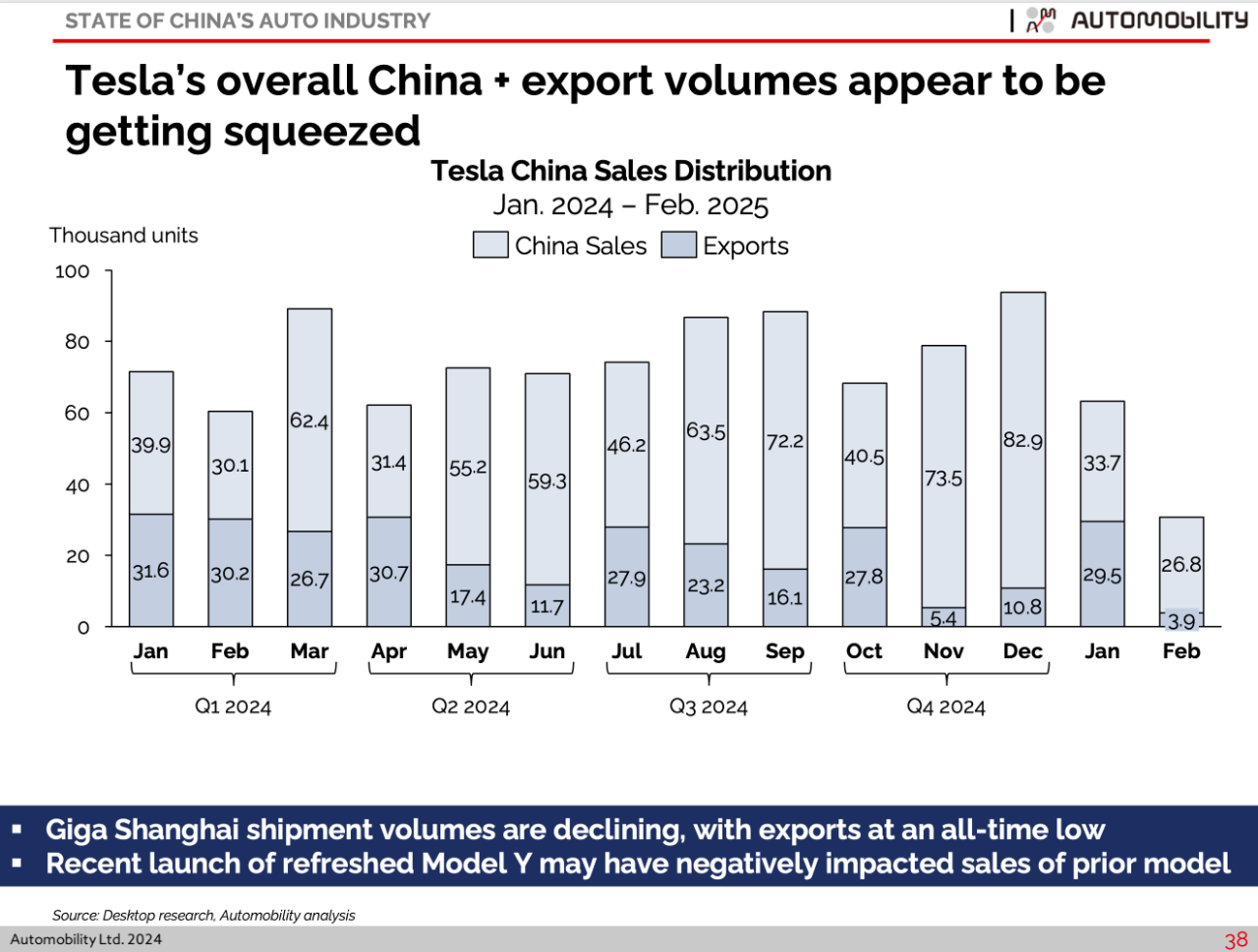

Tesla volumes are under significant pressure in China in 2025. Domestic sales over the first 2 months declined 14% to 60,480 units so far in 2025. Tesla’s refreshed Model Y was recently launched in late February, which likely had a negative impact on the sales of the prior model.

Tesla’s Made-in-China exports declined 47% over this period to 33,400 units, with February’s 3,900 units as its worst performance since the launch of the Shanghai Gigafactory.

Overall Market Leaders

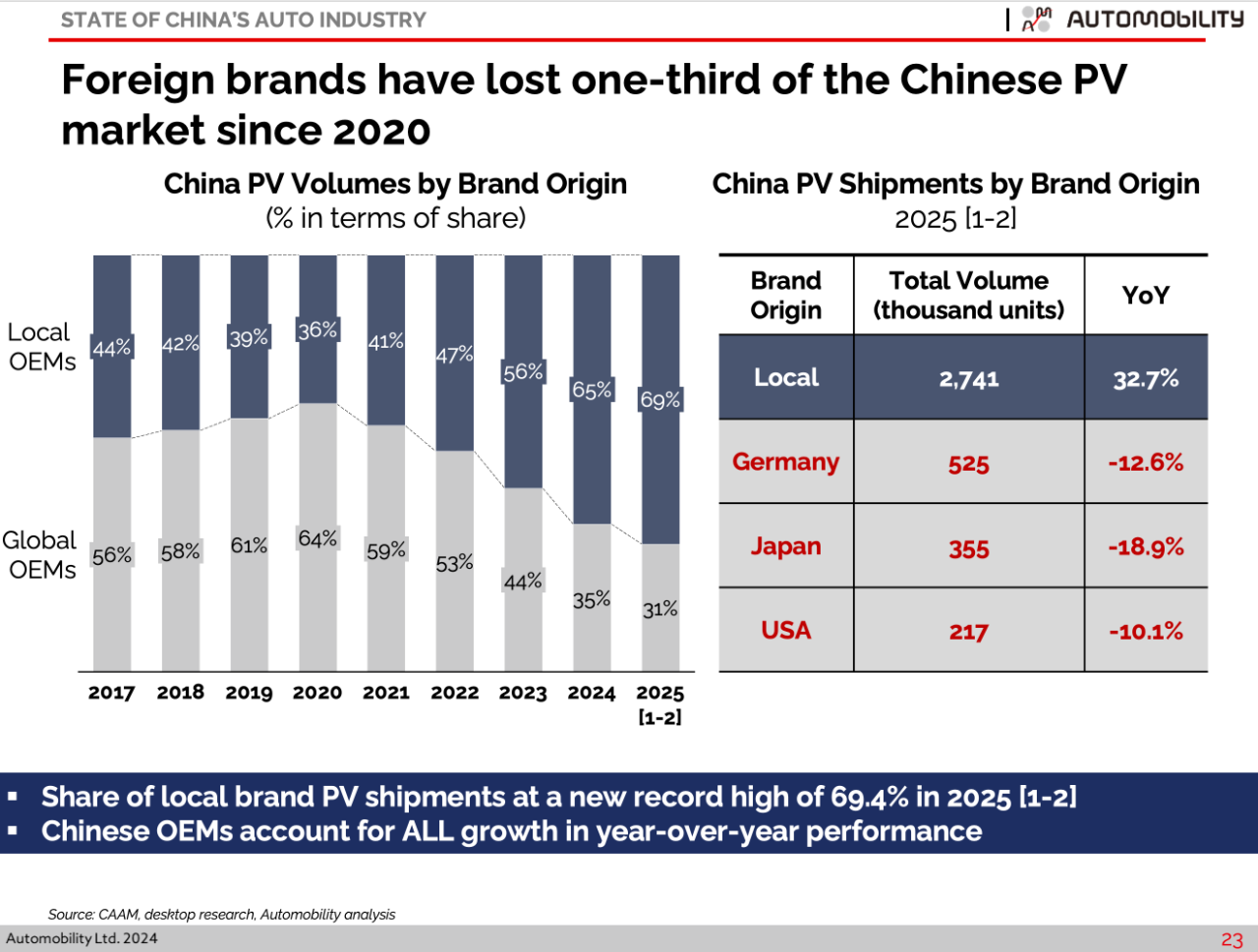

Chinese brands recorded their highest ever share of domestic passenger vehicle market share in the first two months of 2025, reaching an all-time high of 69.4%. Year-over-year growth of Chinese brands was 32.7%, with Japanese brands taking the biggest hit, down 18.9%.

While foreign brands continue to lose overall share as Chinese brands dominate the NEV segment, it is also evident that Chinese brands are also gaining share in the gasoline ICE powered vehicle segment. Geely now outsells Toyota with their ICE vehicles.

This, combined with their growing strength in the NEV segment results in Geely positioned as the top ranked OEM in overall passenger vehicle sales thus far in 2025. Chery also passed Toyota to become the 4th largest passenger vehicle OEM in China by leveraging their balanced ICE and NEV brand portfolio.

Weak sales performance in 2025 has resulted in Tesla falling to 16th place on the passenger vehicle sales leaderboard (60,480 units).

Webinar | State of China Auto Market Monthly Briefing (March)

Bill Russo to Keynote at IDA Conference in Copenhagen, Denmark – April 10

Bill Russo will be a keynote speaker at the Electricity in Road Transport conference hosted by the IDA [Danish Association of Engineers] in Copenhagen, Denmark on the topic of our recent paper “From Smart EV to Smart Grid: Building the Internet of Energy Ecosystem”. He will provide insight into the nature of the Chinese market and what the competitive situation looks like in China – The world’s largest car market. He will provide insights on the development of transport and energy, and in particular China’s current expansion of its energy system with enormous amounts of solar and wind energy, and what the interaction with the transport market in an electrified future looks like. This includes energy storage and V2G (Vehicle-to-Grid).

The full program: https://ipaper.ipapercms.dk/IDA/Netvaerk/Selskaber/ida-automotive/elivejtransporten/

Here is a our original article in English and Chinese:

Bill Russo to Speak at HSBC Global Investment Summit – March 25-27

Automobility Founder & CEO Bill Russo will speak on a “EVs on the Move” panel on the afternoon of March 26 in Hong Kong. Panelists will discuss China’s spectacular advances in EV technology and how they are transforming the global market.

Eliot CAMPLISSON, Co-Head of Global Research, Asia-Pacific, HSBC

-

Shocking the System: Why China is Dominating the Electric Vehicle Race [VIDEO]

Shocking the System: Why China is Dominating the EV Race [VIDEO]

-

Tesla Is Losing Ground Against Its Biggest Rival in China [Wall Street Journal]

(Please copy and paste the link to your browser:

https://www.cnbc.com/2025/01/06/tesla-china-sales-2025-as-competition-heats-up-.html)

If your organization would like a custom briefing on the State of China’s Auto Market, please reach out to us at info@automobility.io

About Bill Russo

Bill is a contributing author to the book Selling to China: Stories of Success, Failure, and Constant Change (2023), where he describes how China has become the most commercially innovative place to do business in the world’s auto industry – and why those hoping to compete globally must continue to be in the market.

About Automobility

Contact us by email at info@automobility.io

PLEASE NOTE: The information and analysis shared in this newsletter, including the charts and style of materials presented, is the intellectual property of Automobility Ltd. While we share it as a way to serve our existing and new clients, it is not to be used without our express consent and then only with attribution. Any publication, reproduction or other use of this material without the express written consent of Automobility Ltd is prohibited.

Sorry, the comment form is closed at this time.