02 Mar State of China’s Auto Market – February 2025

Written by Bill Russo, Founder & CEO of Automobility Ltd.

January Results

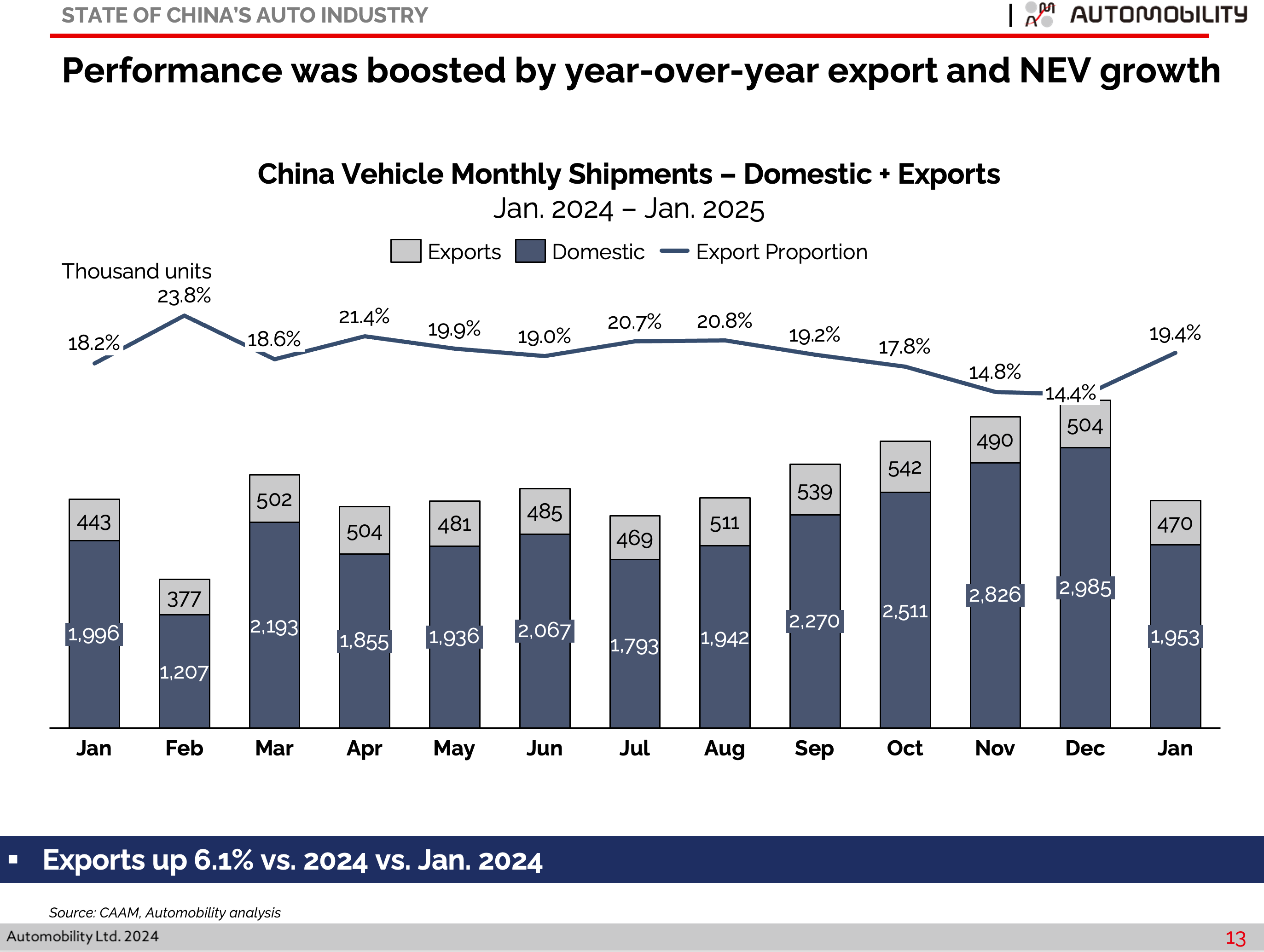

- Year-over-year comparisons are less meaningful in January and February due to timing of lunar new hear holiday, which was 13 days earlier in 2025. Considering this, January’s 2.4 million ex-factory shipments and 470 thousand Made-in-China exports were a solid overall performance.

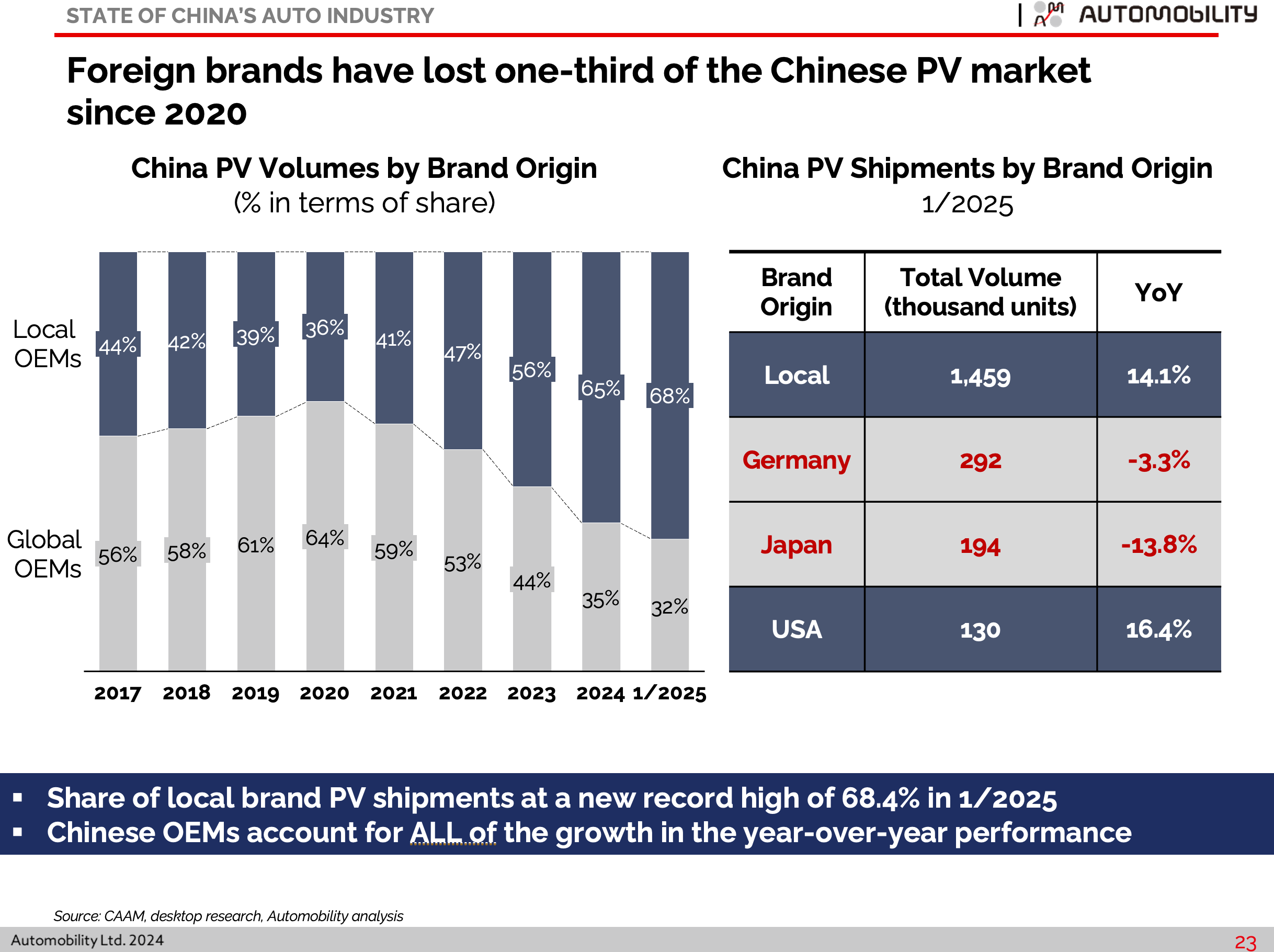

- Continuation of trade-in subsidies and aggressive pricing tactics helped Chinese brands achieve 68% share of the passenger vehicle segment.

- BYD rose to number 2 ranking on export leaderboard, and fell to number 3 in domestic passenger car market share.

- Geely topped the January market share leaderboard, with 3 of the top 10 best-selling NEVs.

- Chinese brands sold 68% of all passenger vehicles in China in January

The Pole Position

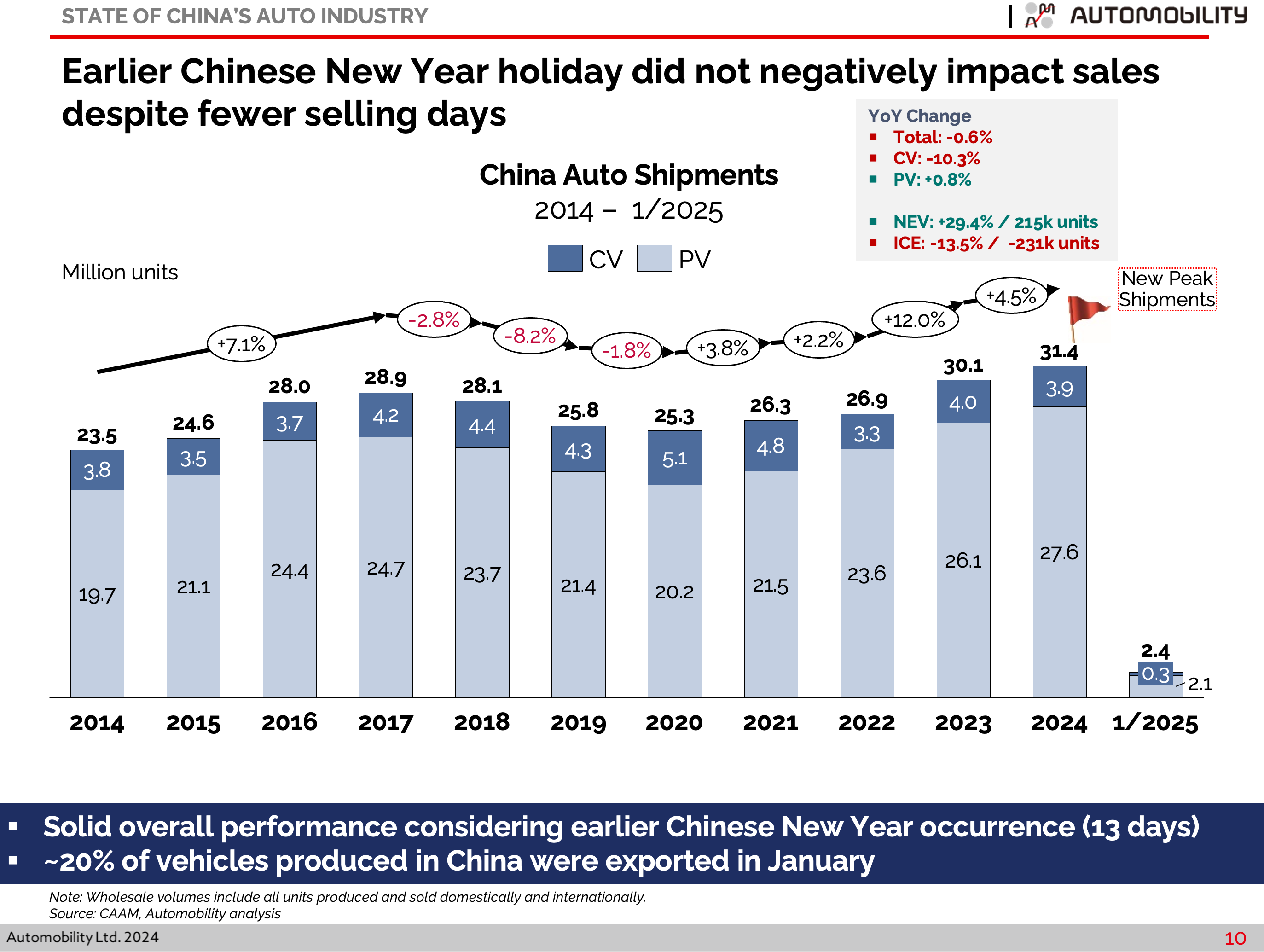

The starting point of any new calendar year begins with the prior year’s performance. China built and shipped a record 31.4 million vehicles in 2024, representing more than one-third of all vehicles produced in the world. China also produced a record 12.9 million New Energy Vehicles, and 11.6 million of these were sold in China. More than two-thirds of the world’s New Energy Vehicles were made in China.

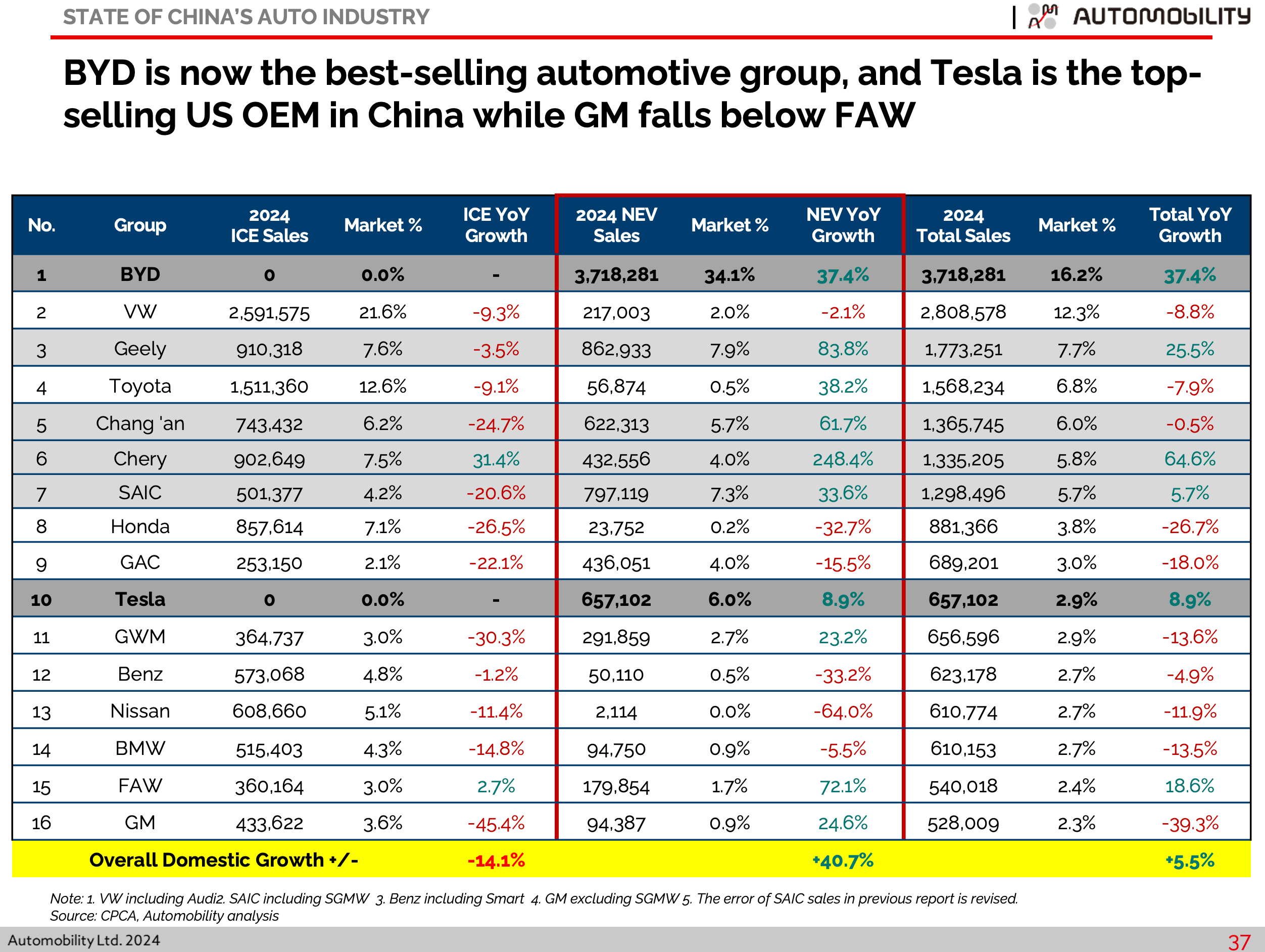

BYD finished first in the 2024 race with a 3.9% overall retail share lead over over Volkswagen and an 8.5% advantage over Geely.

For the New Energy Vehicles segment, BYD dominated with 34.1% segment share, far ahead of Geely group with 7.9%.

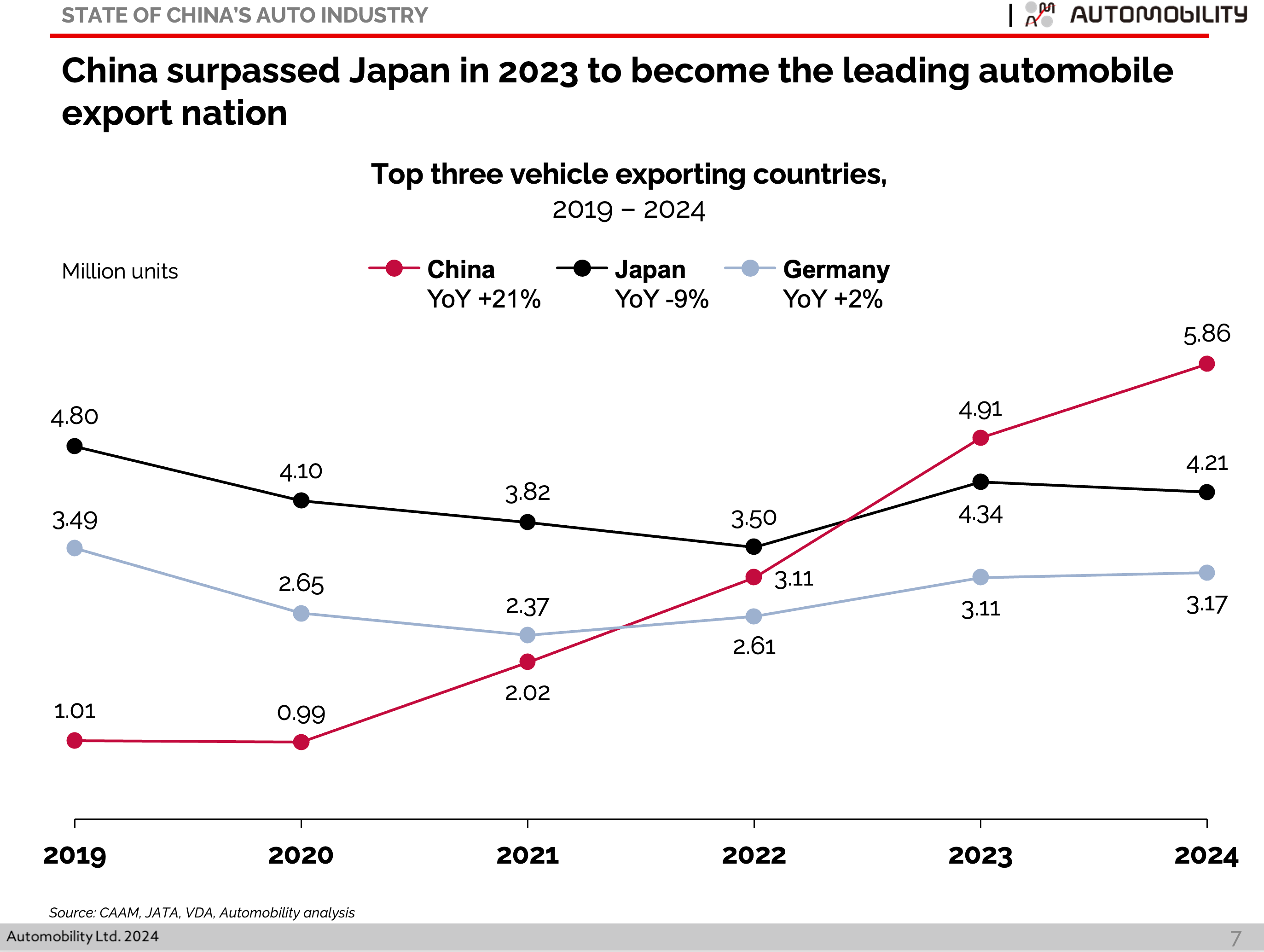

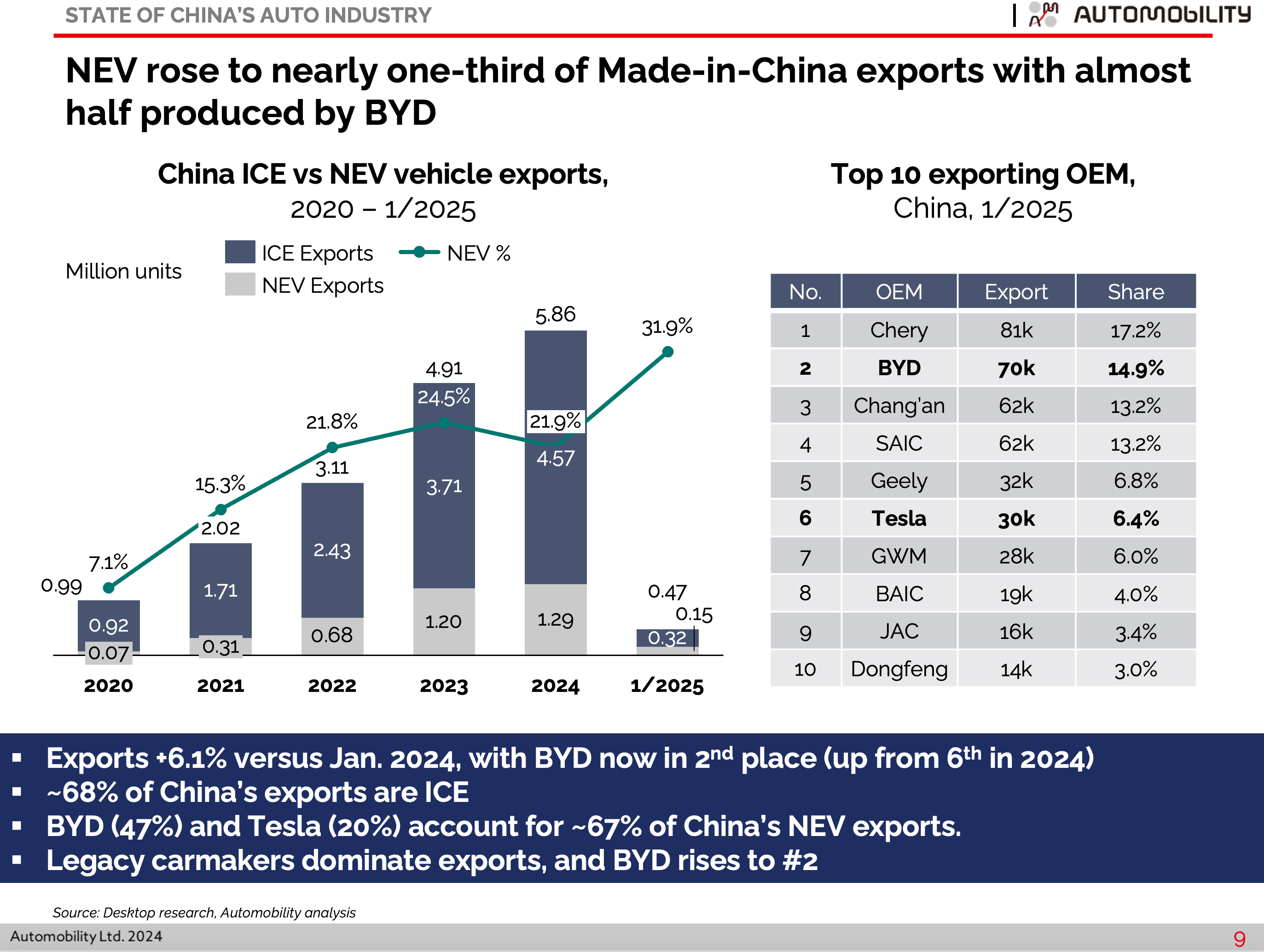

China expanded its lead as the world’s leading export nation, with 5.86 million Made-in-China vehicles sold overseas in 2024.

Now, let’s turn the page and look at the first month of the 2025 campaign.

A Solid Opening in 2025

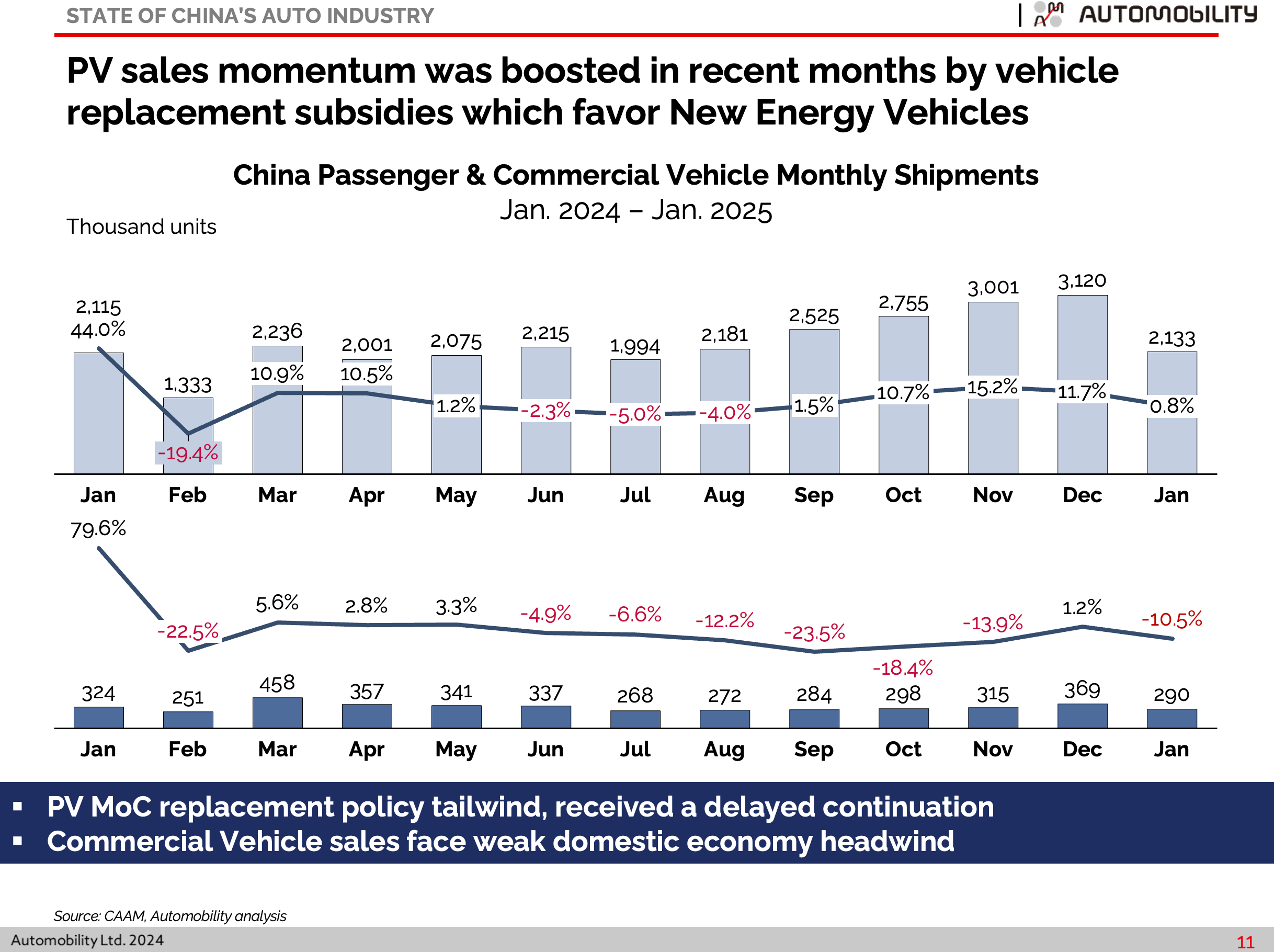

Vehicle shipments in January reached 2.4 million units, a 0.6 percent decrease from the previous January, with NEV shipments up 29.4% and ICE shipments down 13.5%. It is important to note that there were fewer selling days in 2025 versus last year due to the earlier lunar new year holiday.

A pullback in sales is a very typical pattern for January owing to several factors such as a year-end inventory close for the manufacturers, along with adjustments that are made for new model year product launches. This is often the time when pricing strategies and incentives are also being reset for the new calendar year.

Considering the earlier new year holiday occurrence, Passenger Vehicle shipments were down just 0.8% compared with last January, whereas Commercial Vehicle sales were down 10.5%. PV performance was boosted by export growth and continuation of trade-in subsidies which began last year.

BYD Exports Rising

Made-in-China exports bounced back to 19.4% of ex-factory shipments in January. Exports have become a key source of growth for a Chinese market that has struggled with significant domestic growth challenges in recent years, resulting in overcapacity (especially for gasoline powered vehicles).

NEV share of exports rose to 31.9% in January, with BYD moving into second position on the export leaderboard. BYD’s share of NEV exports rose to 47%. BYD and Tesla represent two-thirds of all the electrified vehicles exported from China.

Domestic Sales Trends and Market Leaders

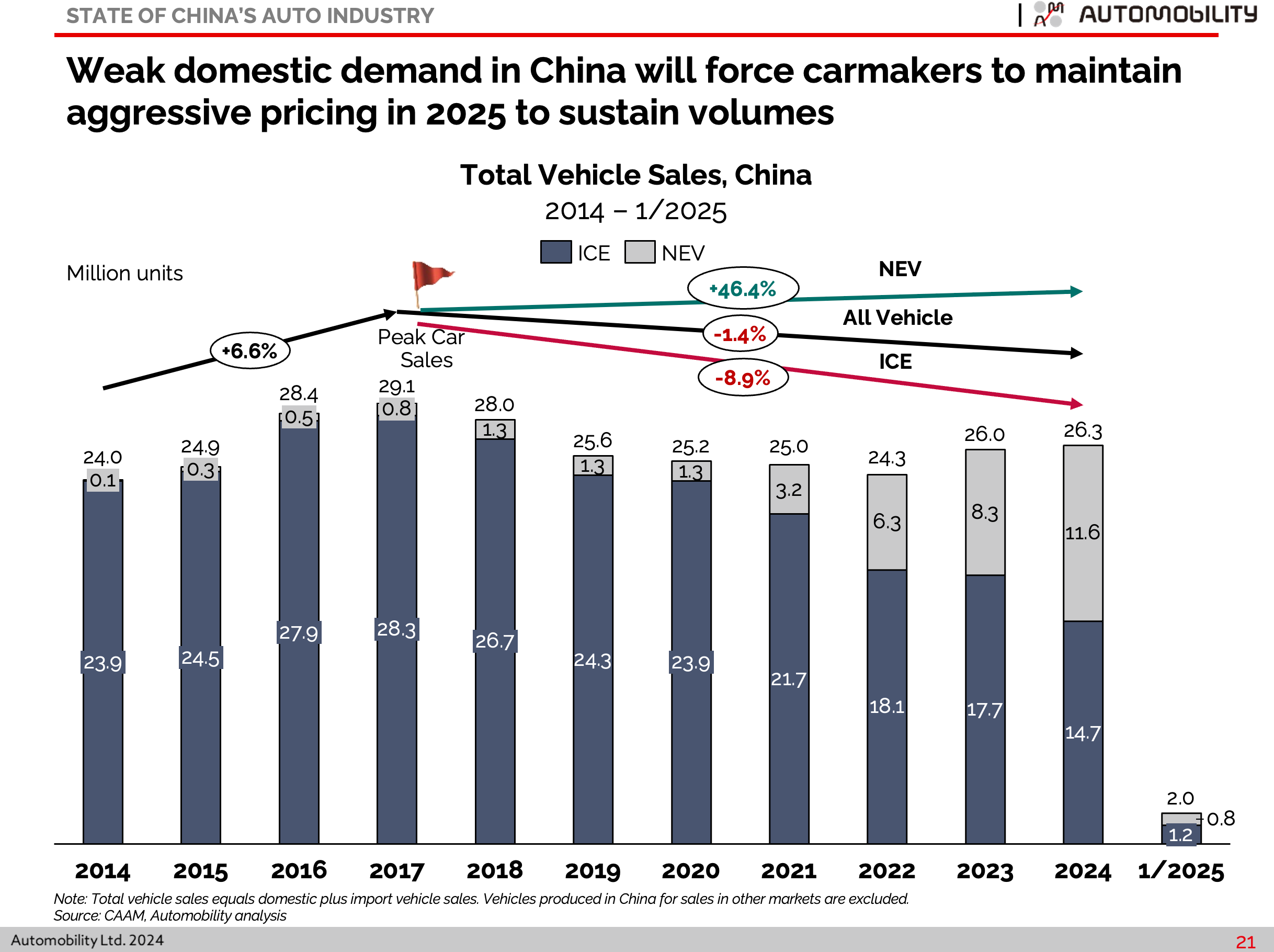

The China automotive market has relied on exports to drive growth in recent years. The peak year for domestic sales in China was 2017, when 29.1 million vehicles were sold. Since that time domestic growth as been limited to NEVs, which rose to 11.6 million units (44.1% share) in 2024. Sales of ICE vehicles have declined by 13.5 million units in that period.

Domestic sales in January were 1.953 million units, and NEVs comprised 41% of passenger vehicle sales. The slight reduction may result from several factors related to an aggressive sell-down of ICE inventory at the end of the year, along with prioritization of NEV capacity allocation to export markets in January.

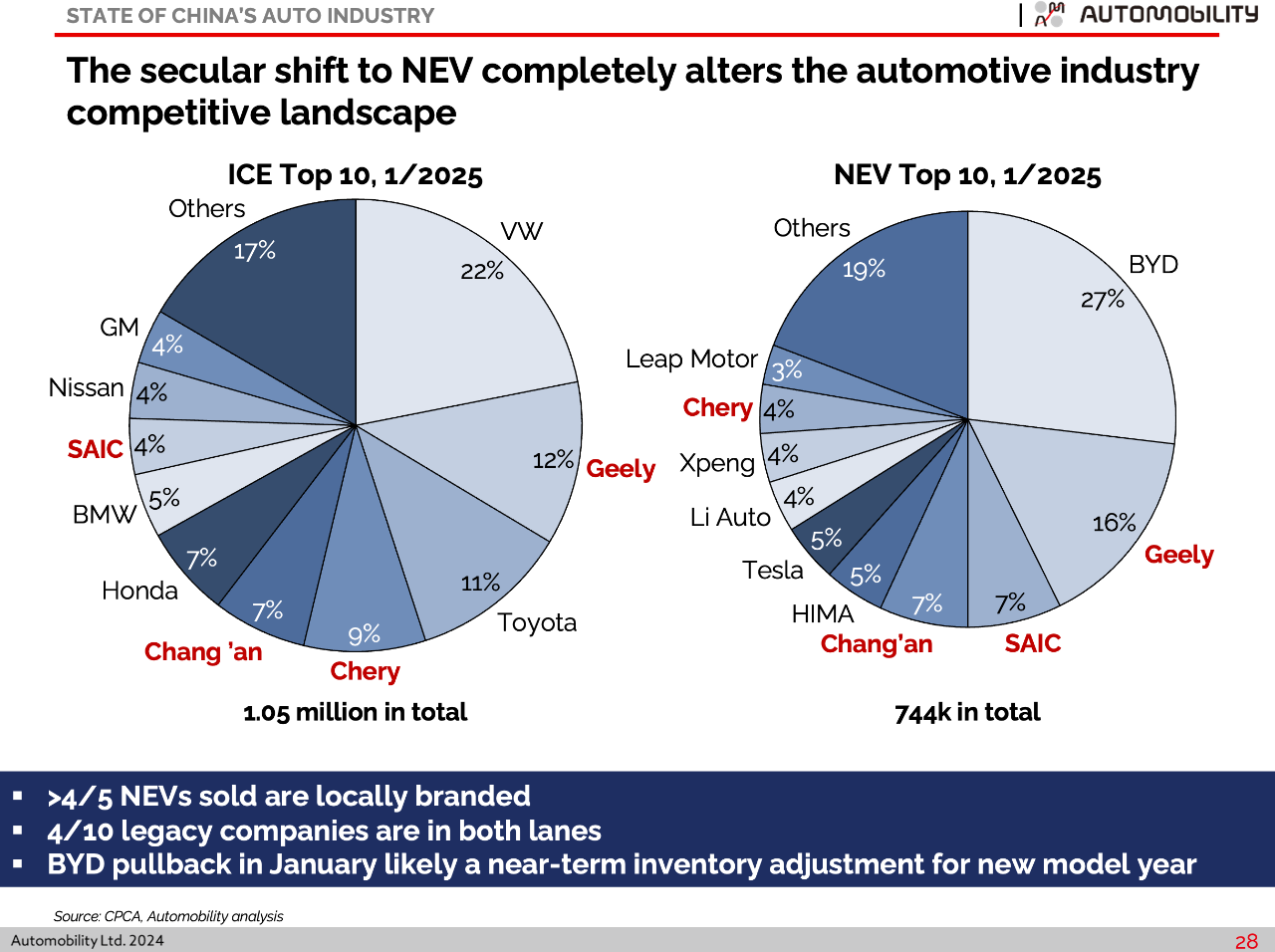

Chinese brands recorded their highest ever share of passenger vehicle sales in January, achieving a new monthly record of 68.4%. Since 2020, foreign brands have ceded one-third of the passenger vehicle market to the local brands.

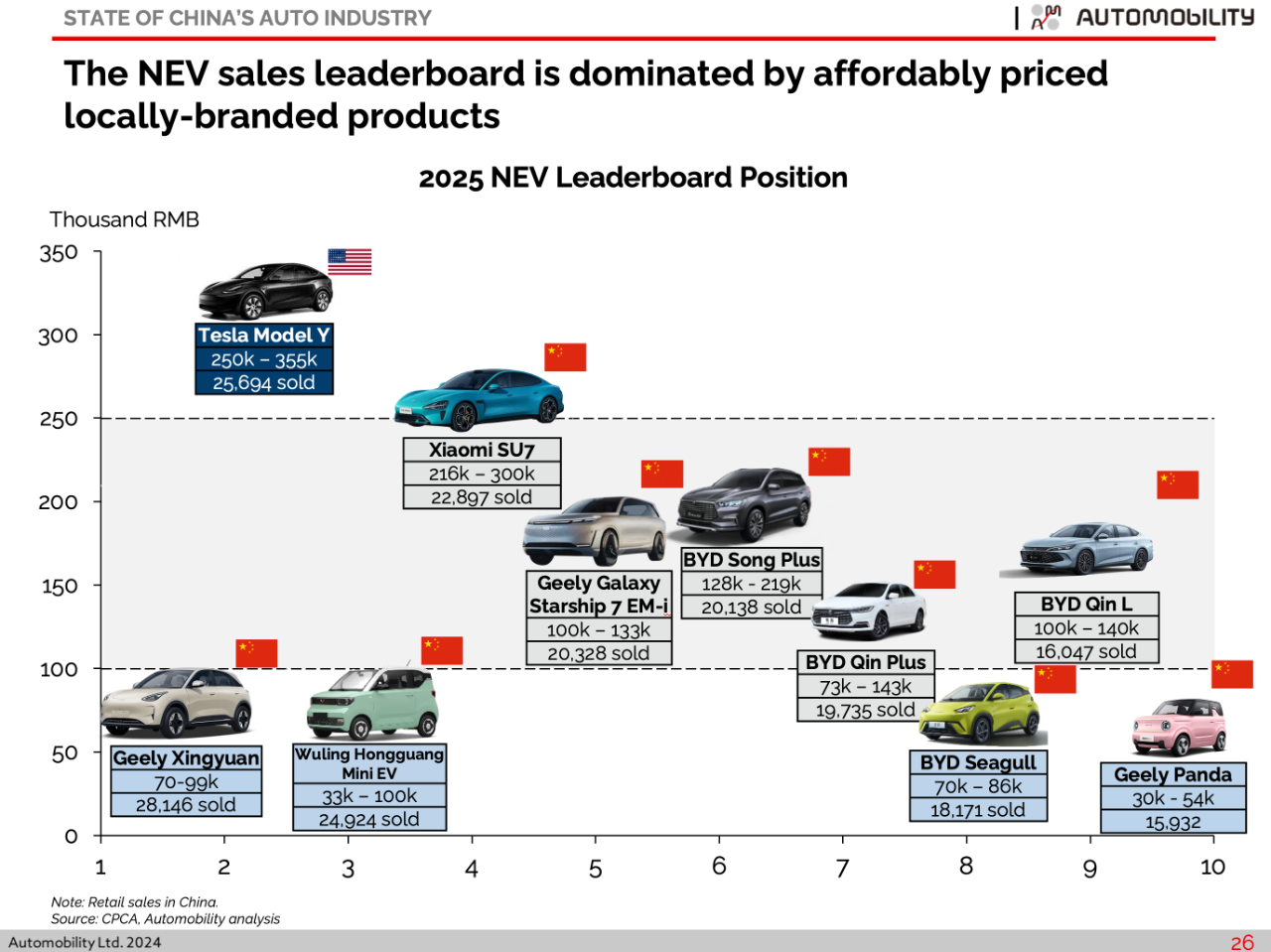

From 2021 through 2024, the passenger vehicle NEV market grew from 3.0 to 10.9 million units, with Chinese brands holding 9 of the top 10 positions on the leaderboard.

Only Tesla remains on the top 10 list, and they have fallen back to 4th place while holding 6% share of the NEV market. BYD held a commanding lead with 34.1% of the market in 2024.

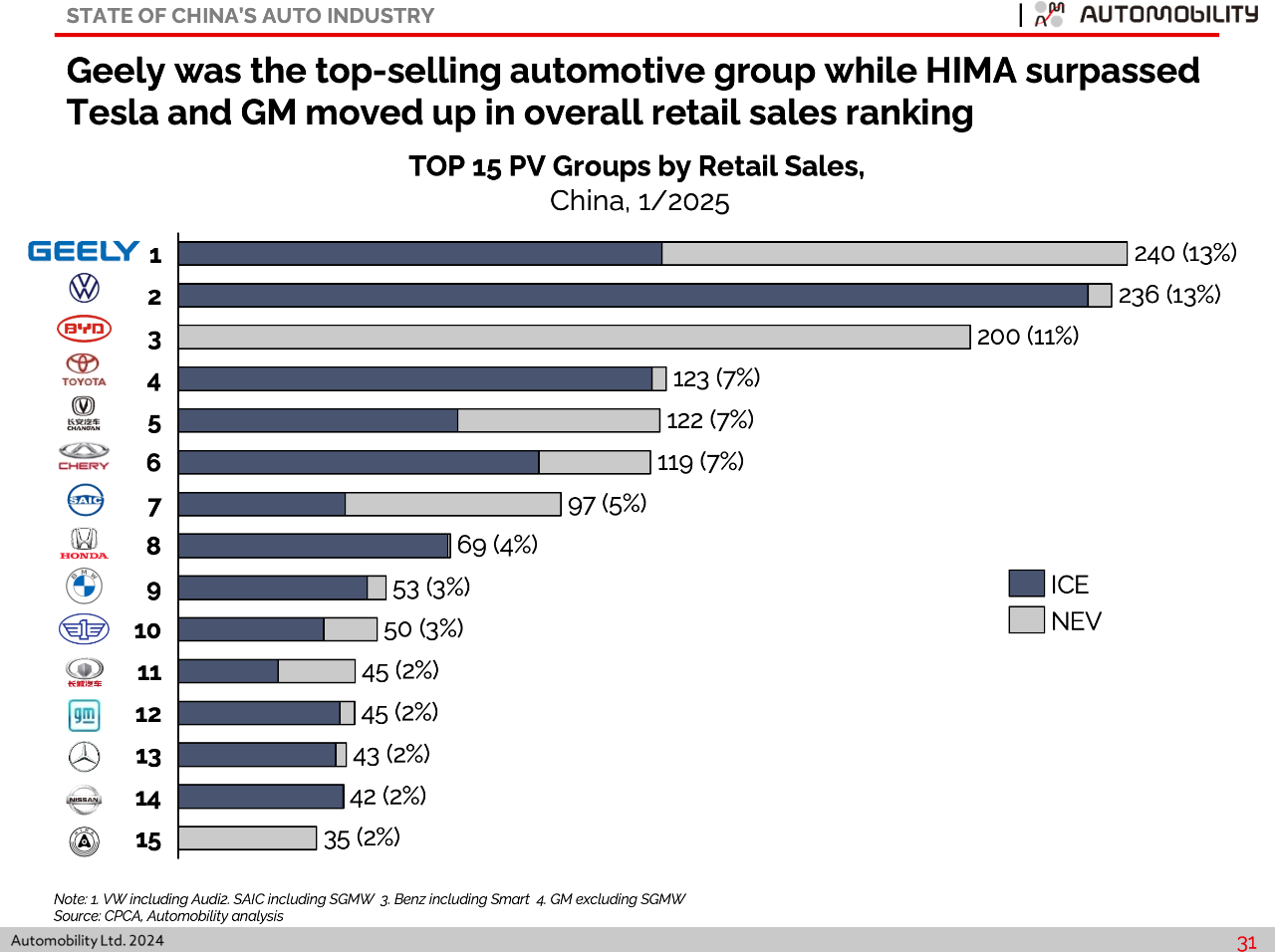

For the first month of 2025, BYD sold 200,242 units, with NEV share falling to 26.9%. Geely scored the largest gains, doubling their share to 15.8% with 3 models on the list of top 10 best-selling NEV nameplates.

Xiaomi’s SU7 placed 4th with sales of 22,897 units (3.1% share) – the first appearance on the top 10 list for the Chinese smart device brand.

The top 10 leaderboard is dominated by brands that can deliver affordable technology below RMB 250,000 (<USD 35,000), and some of the high volume models are sold at a fraction of this price.

While BYD remains the overall market leader, Geely outsold BYD in the Battery Electric Vehicle (BEV) sub-segment with their highest-ever volumes for the sub RMB 100,000 (<USD 13,735) offerings. BYD dominates the PHEV sub-segment, while Li Auto and HIMA’s AITO brand are the leaders in the Extended Range Electric Vehicle (EREV) sub-segment.

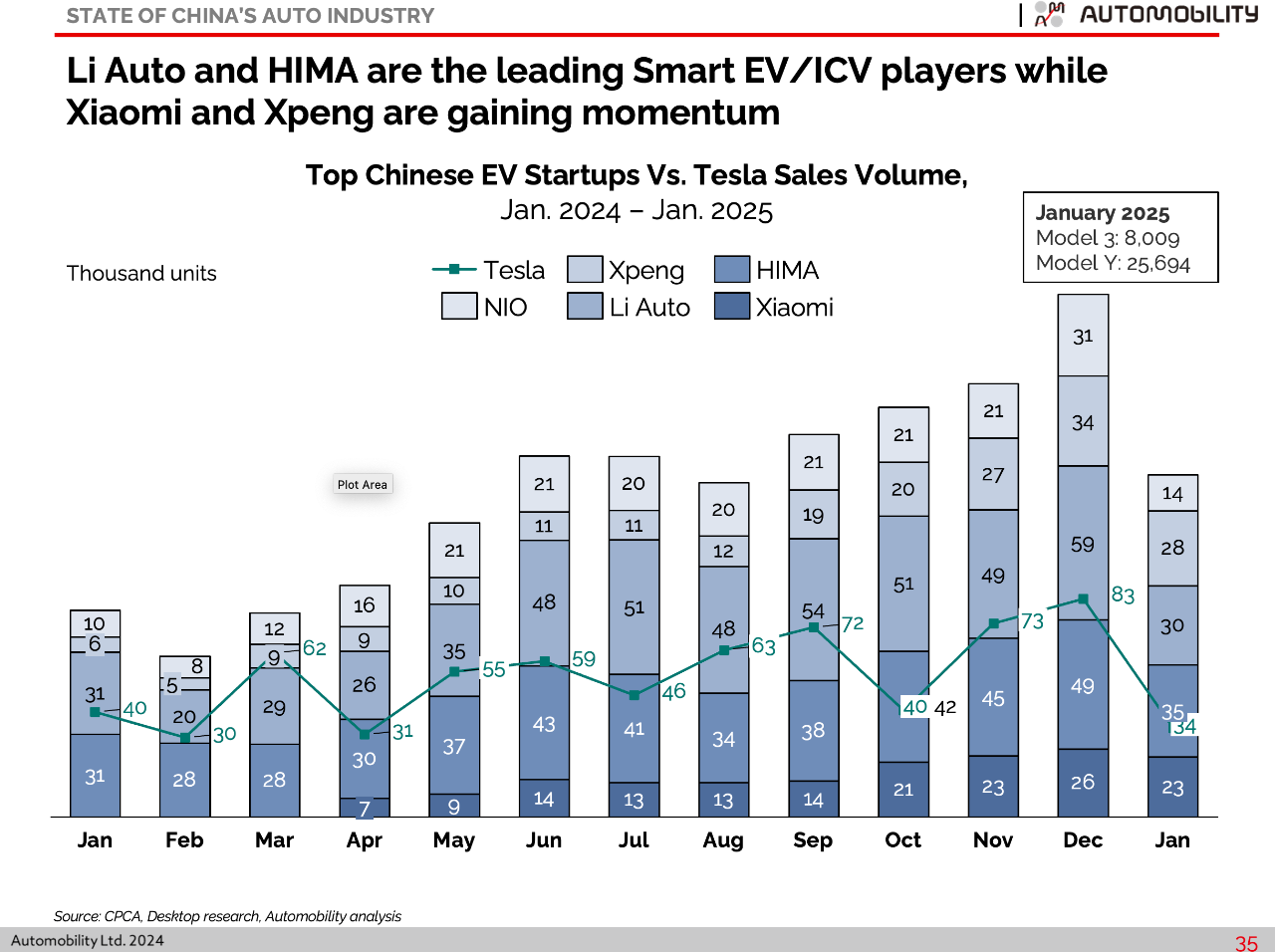

Also worth noting that sales of the Chinese Smart EV/Intelligent Connected Vehicle (ICV) startups are up significantly in January compared with one year ago. This is largely driven by the popularity of the products with digital features that are being produced by Huawei’s HIMA (Harmony Intelligent Mobility Alliance), Xiaomi and Xpeng. Sales for this group of technology players are growing and several may break away and ultimately challenge traditional mass market players by offering a more compelling set of features for consumers seeking a “smart phone on wheels” mobility experience.

All together, the top 15 PV groups have a new leader, with Geely group outselling all other carmakers in January, with an almost even split between NEV and ICE sales. In general, Chinese brands are rising on this list as NEV expands, and foreign brands remain stuck in the shrinking ICE lane.

Join us on Thusday, February 20 at 9am China time at the American Chamber of Commerce in Shanghai for regular State of China Auto Market Monthly Briefing, where we will review the latest market results through January and highlight recent news from the world’s largest and most progressive automotive market.

Webinar | State of China Auto Market Monthly Briefing (February)

EVENTS SUMMARY

AKL Summit Dealer Conference, Helsinki Finland – February 13

Bill Russo was recently a keynote speaker at the AKL Summit 2025 in Helsinki, Finland on “The Path to Globalization of China’s Automotive Industry” and its impact on global automotive logistics players, dealers, distributors and service providers around the world.

Here is a link to a translated version of the article published pre-event (Please copy and paste the link to your browser): https://coats-share-oiq.craft.me/YWHOIpq8Pzy0Q8

And here is a summary of the event with photos: Bill Russo Speaks at AKL Summit in Helsinki

And here is the Automobility original article titled “The Path to Globalization of China’s Automotive Industry”

UBS Global China Conference – January 14

Look Back and Look Ahead – Automotive Industry Outlook in 2025 & Beyond

Recap: Automotive Industry Outlook 2025 | Amcham (Please copy and paste the link to your browser: https://www.amcham-shanghai.org/article/recap-automotive-industry-outlook-2025)

-

The Foot Soldiers Steering China’s EV Ambitions Abroad [Sixth Tone]

Emerging markets in Southeast Asia, Central and South Asia, the Middle East, Africa, and Latin America will gravitate toward the affordable solutions leading Chinese carmakers can offer, says Bill Russo, founder and CEO of advisory firm Automobility Limited.

“The rapid growth in demand for Chinese cars in these regions offers evidence that this is already happening,” he said. An emphasis on driver — and passenger — comfort is one of the factors that makes Chinese cars competitive beyond simply their prices, according to Russo.

Brands are used to catering to Chinese consumers, for whom driving experience is no longer the main purchase criteria; companies also compete on “smart” customizable in-car experiences like entertainment screens, voice controls, and massage seats.

“This provides an opportunity for Chinese brands to reallocate these smart EV configuration capacities to the global markets, where gasoline-powered vehicles with limited digital content are still most common,” said Russo.

-

GM’s 100-year-old China business can’t keep up with the EV boom there [Fortune]

Bill Russo, who used to lead Chrysler’s efforts in China, thinks Chinese carmakers have realized something about cars in the 2020s—they’re basically phones on wheels. “Chinese consumers expect the EV to be a smart device. The Chinese companies have that idea. They’re demonstrating it, and they’re dominating it.”

Bill Russo, founder of Automobility Ltd in Shanghai, believes that China’s goal of promoting the “unified large market” is to pave the way for economic transformation by eliminating the existing cronyism and over investment and other disadvantages to build a more competitive market economy system. This initiative aims to move China’s economy towards a healthier and more sustainable future development path.

(Please copy and paste the link to your browser:

https://www.voachinese.com/a/china-attempt-to-build-a-unified-market/7938037.html

-

US engineers decisive split in global auto market [Reuters]

https://www.breakingviews.com/considered-view/us-engineers-decisive-split-in-global-auto-market/?SID=666b151cd3f1413715088a67&save=save&content_alert_status=Ready%20Soon&utm_source=Sailthru&utm_medium=email&utm_campaign=us-china-car-war_-hong-kong-take-private-deals-wed_-15-jan-2025-05_07-asrivastsav&utm_term=BV%20-%20Asia%2C%20EMEA%20and%20US%20Daily)

- Why Elon Musk’s China Ties Are DOGE’s Biggest Conflict Of Interest [Forbes]

https://www.forbes.com/sites/alanohnsman/2025/02/06/elon-musk-china-ties-doge-conflict-of-interest/)

About Bill Russo

Bill is a contributing author to the book Selling to China: Stories of Success, Failure, and Constant Change (2023), where he describes how China has become the most commercially innovative place to do business in the world’s auto industry – and why those hoping to compete globally must continue to be in the market.

About Automobility

Contact us by email at [email protected]

PLEASE NOTE: The information and analysis shared in this newsletter, including the charts and style of materials presented, is the intellectual property of Automobility Ltd. While we share it as a way to serve our existing and new clients, it is not to be used without our express consent and then only with attribution. Any publication, reproduction or other use of this material without the express written consent of Automobility Ltd is prohibited.

Sorry, the comment form is closed at this time.