31 Oct The Third Wave of Disruption: Autonomous Mobility on Demand

October 7, 2024

By Bill Russo, Jackie Tang and Jayce Lu

Over the past decades, China’s internet economy has witnessed exponential growth, primarily driven by the widespread adoption of the mobile internet. This pivotal shift has democratized internet access across diverse demographics, sparking an era of unprecedented digital integration that has reshaped everyday life and laid the groundwork for rapid technological and economic transformation. The explosive growth of smart devices and mobile applications has fueled a rapid expansion in online services, reshaping industries across the board. As these advancements in the internet economy intersect with the automotive sector, they unlock tremendous opportunities for innovative mobility solutions.

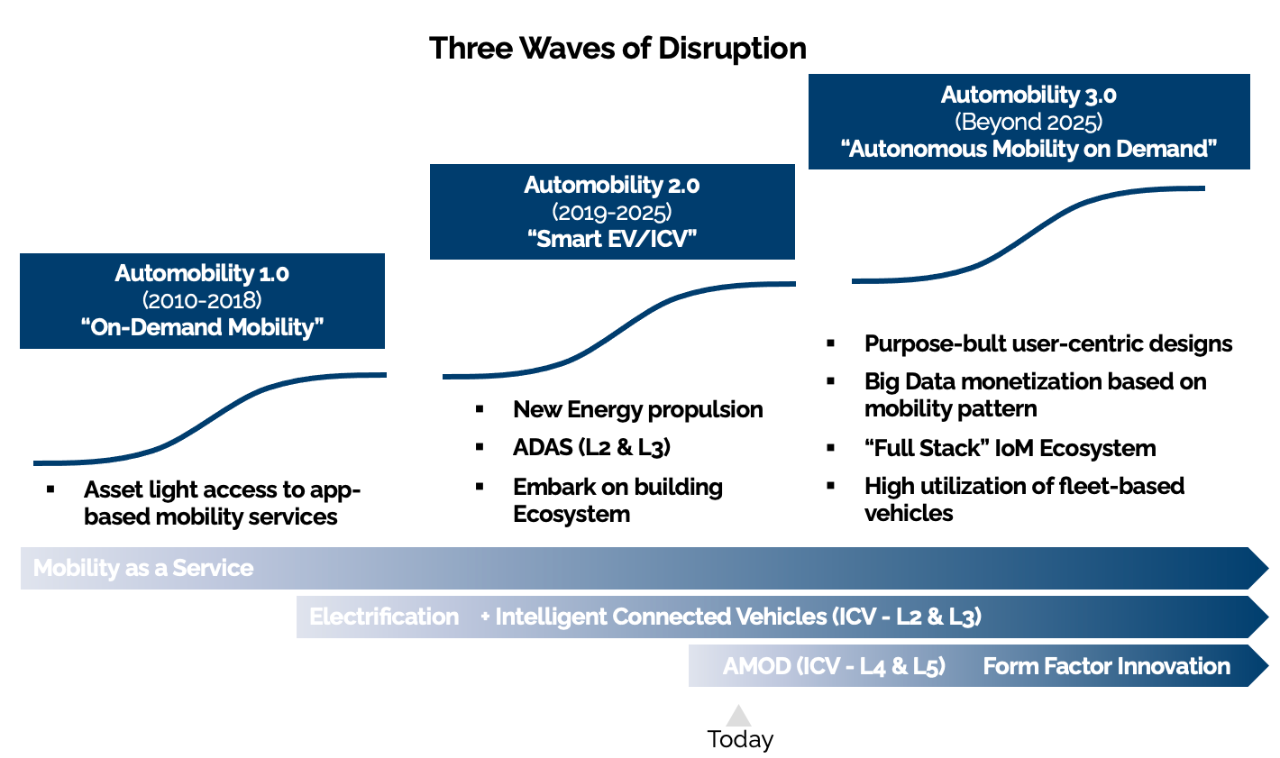

Our 2021 article The Rise of Smart Electric Vehicles and the Digital Internet of Mobility introduced the ’Three Waves of Disruption’ framework (See Figure 1) which offered a timeline for the scaling of these Internet of Mobility (IoM) technology waves in China. We also described how digital IoM advancements transform the industry business model, requiring a complete rethinking of the way to deliver value to the market. To succeed, automotive industry players must expand their focus from the product – the automobile – to the utility derived from the product – “automobility”.

Known as a ‘super-scaler,’ China has showcased an unparalleled ability to adapt and scale new digital IoM technologies in commercial applications, which can eventually influence global industry practices. As a result, China is far ahead of the rest of the world and is entering the Third Wave of Automobility Disruption, which we call the Autonomous Mobility on Demand (AMOD) era.

Source: Automobility analysis

Three Waves of Automobility Disruption

The 3 waves of this “Automobility Revolution” form the underlying thesis of our company since we were founded in 2017. This thesis has proven to be an accurate prediction of how the business model is transformed by technology – which is manifesting far faster in China than elsewhere.

We live in an era where big data is used to provide personalized services that are often accessed through a smart device, powered by the mobile internet. These smart device technologies are now being incorporated into the devices that transport people and goods, which will revolutionize the business of how these mobility devices are monetized. This began with app-based on-demand mobility solutions, which scaled rapidly in China in the Automobility 1.0 era.

Mobility services provide access to daily life needs and conveniences, linking us between the places we live, work and play. Multi-modal traffic systems, parking infrastructure, charging stations, public services have all become available through on-demand platforms, bringing investments from the internet giants and device players.

China’s auto sector has fully embraced the “Smart EV” or “Intelligent Connected Vehicle (ICV)” in the Automobility 2.0 era. As a result, we are witnessing a rapid acceleration of the commercialization of new energy vehicle (NEV) propulsion technology and advanced driver assistance systems (ADAS), making mobility safer, more economical and partially freeing the driver from the mundane task of actuating the vehicle.

This will lead to the Automobility 3.0 autonomous mobility on demand (AMOD) era, where people (robo-taxi) and goods (robo-delivery) movements are automated. Of course, driver-actuated mobility will coexist with such devices, but the overall economic advantages of smart, autonomous vehicles will spark large-scale commercial deployment.

In the Automobility 3.0 era, vehicles will be designed with purpose-built, user-centric features, tailored to the needs of passengers and goods transportation. Big data collected from mobility patterns will be monetized, driving personalized services and optimizing efficiency. The development of a “full stack” Internet of Mobility (IoM) ecosystem will fully integrate vehicles, infrastructure, and cloud platforms, enabling seamless, data-driven mobility solutions. Fleet-based autonomous vehicles will achieve high utilization, reducing operational costs and increasing efficiency across the mobility landscape.

Source: Automobility analysis

This “Internet of Mobility” revolution is happening faster in China and at an unprecedented scale, guided by supportive government policies and backed by investments from the world’s largest digital economy.

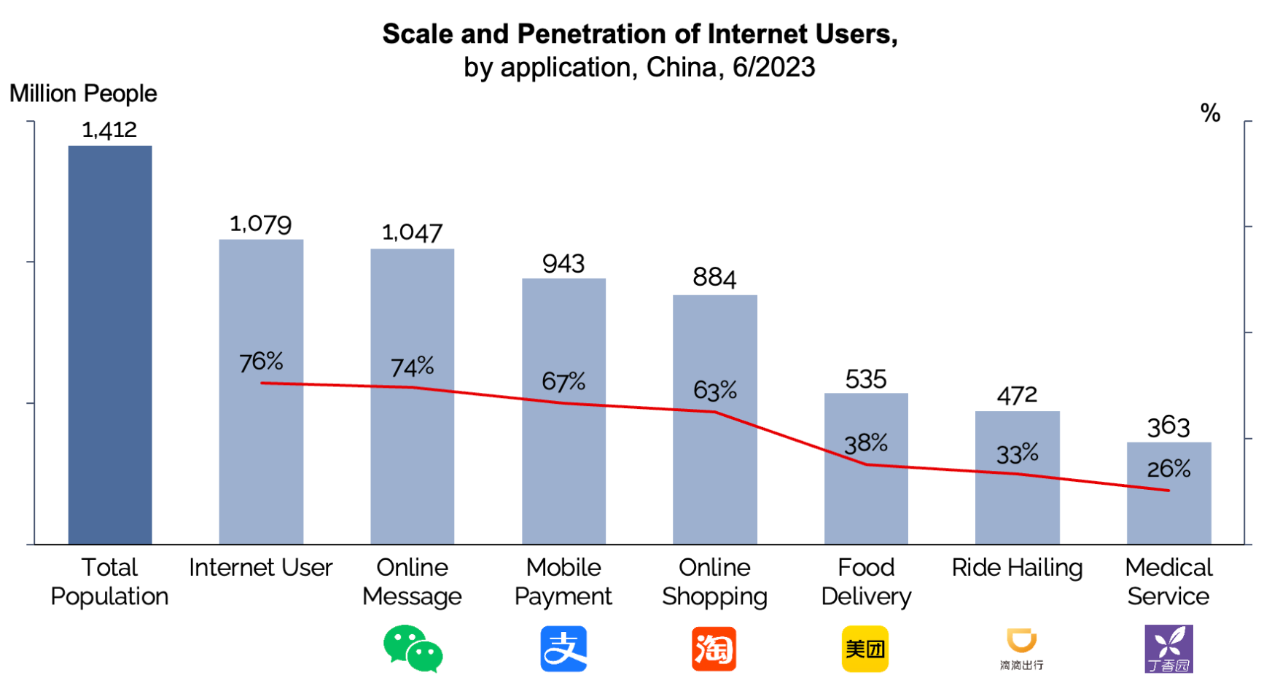

With the rise of the mobile internet, smart devices have become a de-facto way for the more than 1 billion internet users in China to conveniently access services where mobility is required – these include ride hailing, e-commerce, and food delivery (see Figure 3).

Source: CNNIC, Automobility analysis

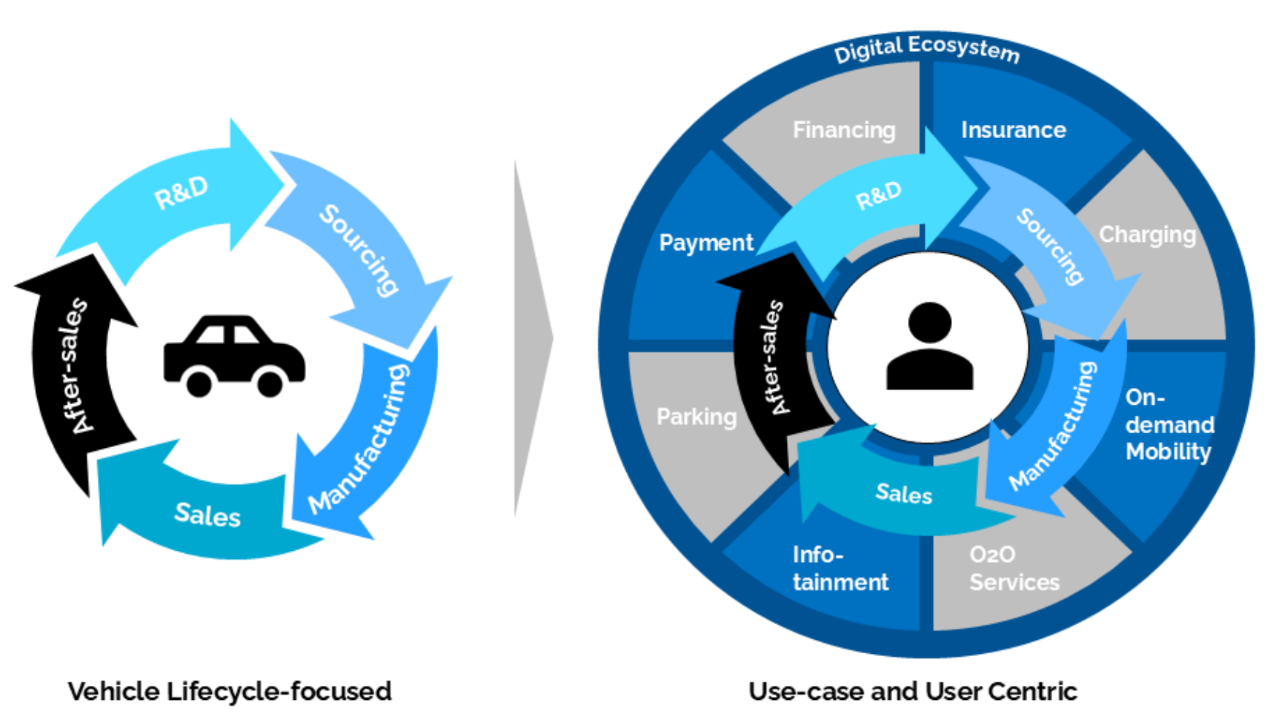

As key stakeholders in the mobility value chain, internet companies exert a transformative force on the traditional automotive value chain. Internet-backed mobility players place user-centric mobility services – not just product hardware sales and service – at the center of their value chain (see Figure 4) , while prioritizing the monetization of services that can be delivered through their app-enabled digital ecosystems.

Source: Automobility analysis

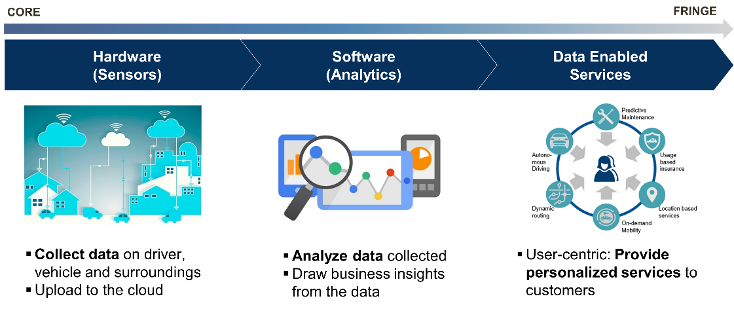

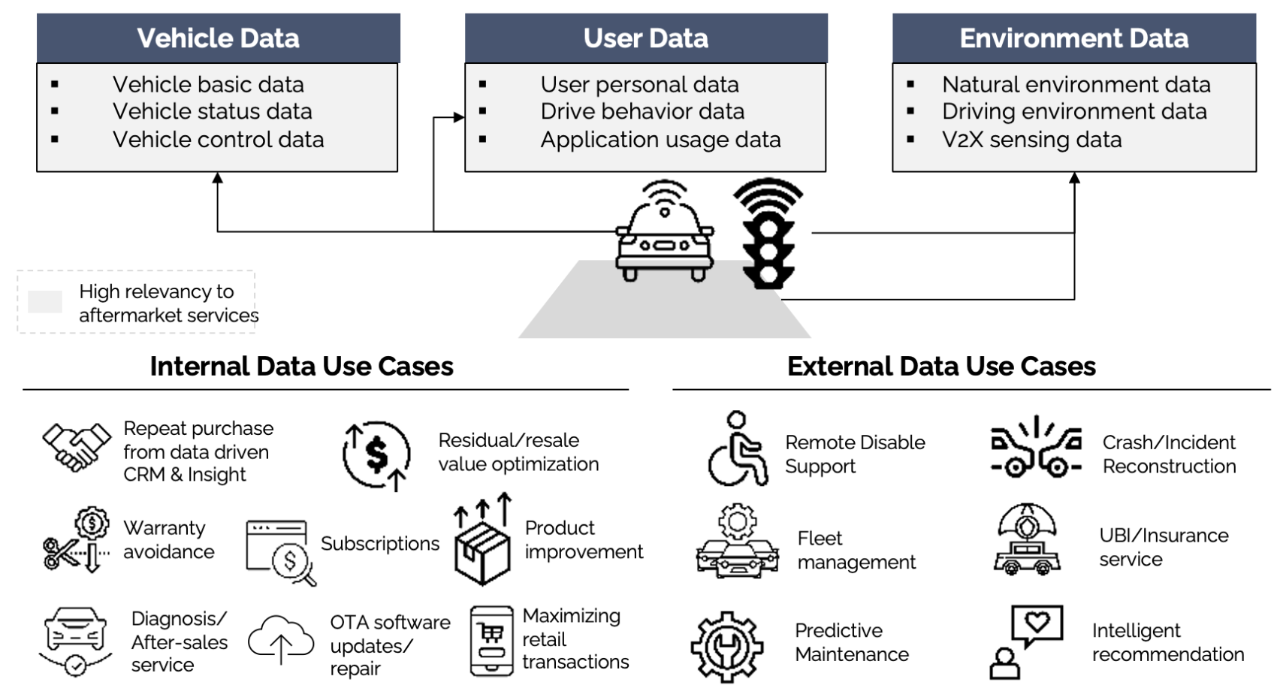

This places higher emphasis on configuring the vehicle with internet-era features which optimize the ability for an Intelligent Connected Vehicle to aggregate vehicle and user data in order to unlock new recurring revenue streams (see Figure 5).

Source: Automobility analysis

Backed by the world’s largest digital economy, Chinese car makers are redefining premium as vehicles designed to deliver upgraded in-cabin user centric experiences, often leveraging internet-era features and technology. By doing this, they are able to generate recurring after sales revenues linked to their digital ecosystem. Several of China’s digital natives are also building the operating systems for the Intelligent Connected Vehicle. Examples include Huawei’s Harmony OS, Xiaomi’s MiOS, Alibaba’s AliOS, among others.

Consequently, features that unlock unique digital experiences for all occupants – have become essential among Chinese consumers. While still important, driving experience is no longer the main purchase criteria. Brands that are late to recognize the importance of digital experience are left with a much weaker market position compared with a few years ago.

Autonomous driving technology is a revolutionary technology in the automotive industry, heralding a major change in future transportation methods. Autonomous vehicles can independently perceive the surrounding environment, make decisions, and execute driving tasks through advanced sensors, controllers, actuators, computing platforms, and communication technologies, achieving safe and efficient vehicle operation. According to the Society of Automotive Engineers (SAE) standards, autonomous driving technology is divided into multiple levels, from No Driving Automation (Level 0) to Full Driving Automation (Level 5).

China’s autonomous driving industry is rapidly advancing, fueled by a combination of cutting-edge technology, significant investments in urban infrastructure, and guided by policy support. The building blocks of this development were described in our 2020 paper Competing in China’s Autonomous Mobility on Demand (AMOD) Future.

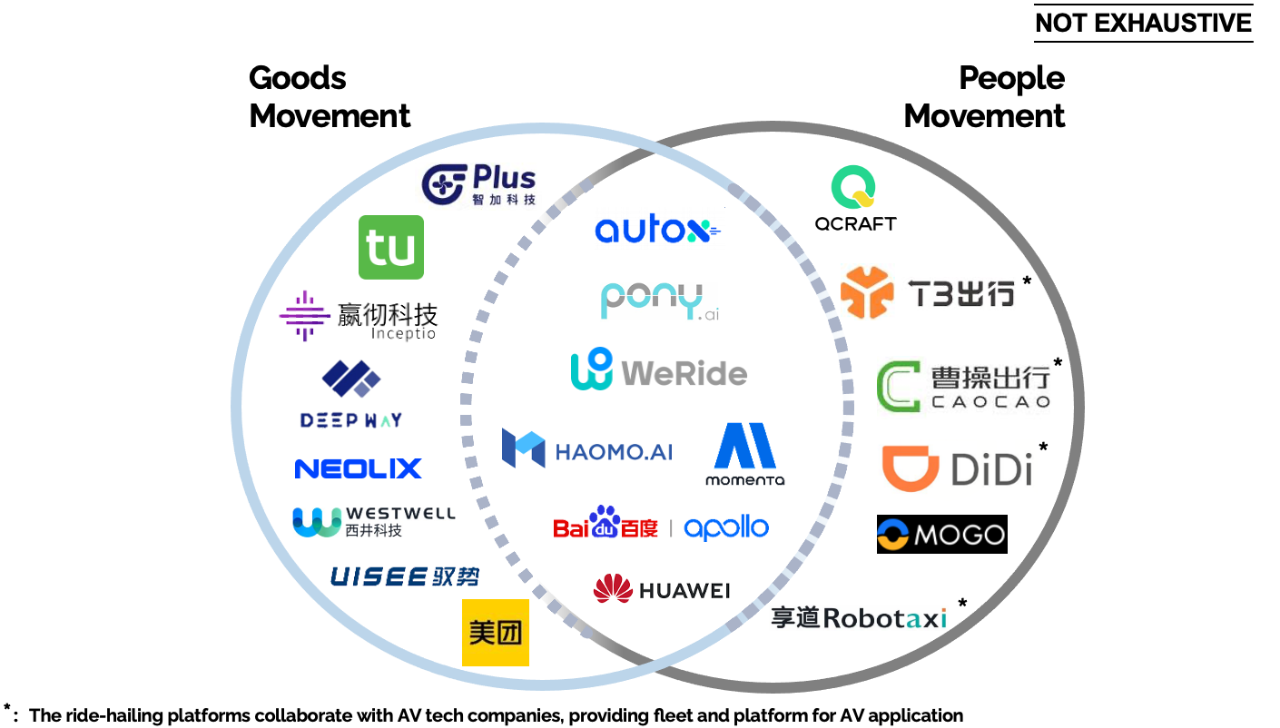

China’s AMOD competitive landscape is characterized by a diverse ecosystem of companies developing solutions for both goods and people movement, with many firms striving for full-stack autonomy – integrating software, hardware, data analytics, and cloud services.

The rise of e-commerce in China has driven the demand for autonomous logistics solutions. Companies like Plus, Deep Way, and Inceptio are leading the development of autonomous trucks, targeting long-haul logistics and freight operations. Autonomous trucks can operate 24/7 without rest, significantly reducing operational costs and increasing efficiency. Startups like Neolix and Meituan are focusing on urban logistics, deploying autonomous delivery vehicles for last-mile deliveries in dense cities.

The autonomous taxi sector is another significant area of focus, with companies like Pony.ai, Baidu Apollo and AutoX leading in this space (see Figure 6). These companies are running trials of robo-taxis in cities like Guangzhou and Beijing, aiming to scale up their services as the technology matures and regulations evolve.

Source: Automobility analysis

In addition, the adoption of autonomous technology and its applications is not confined to China; we are now observing an emerging trend of these innovations expanding abroad through cross-border partnerships, offering accessible and affordable mobility solutions worldwide.

For example, on September 25, 2024, WeRide, a global leader in autonomous driving technology, and Uber, the world’s largest mobile mobility and delivery technology company, announced the establishment of a strategic partnership to jointly promote the deployment of WeRide’s autonomous vehicles on the Uber platform in the United Arab Emirates. The partnership is set to officially take effect by the end of this year in Abu Dhabi, the capital of the UAE. A fleet of WeRide autonomous vehicles will be available on the Uber App, offering services to consumers (see Figure 7). This strategic partnership between WeRide and Uber marks a significant step forward in the integration of autonomous vehicle technology into mainstream transportation services. The choice to initiate this collaboration in the United Arab Emirates suggests a focus on regions that are open to adopting new technologies and have the infrastructure to support such innovations. This move is likely to enhance the reputation of both companies as innovators in the field of autonomous driving and could pave the way for broader adoption of self-driving vehicles in the future.

Source: WeRide Announcement

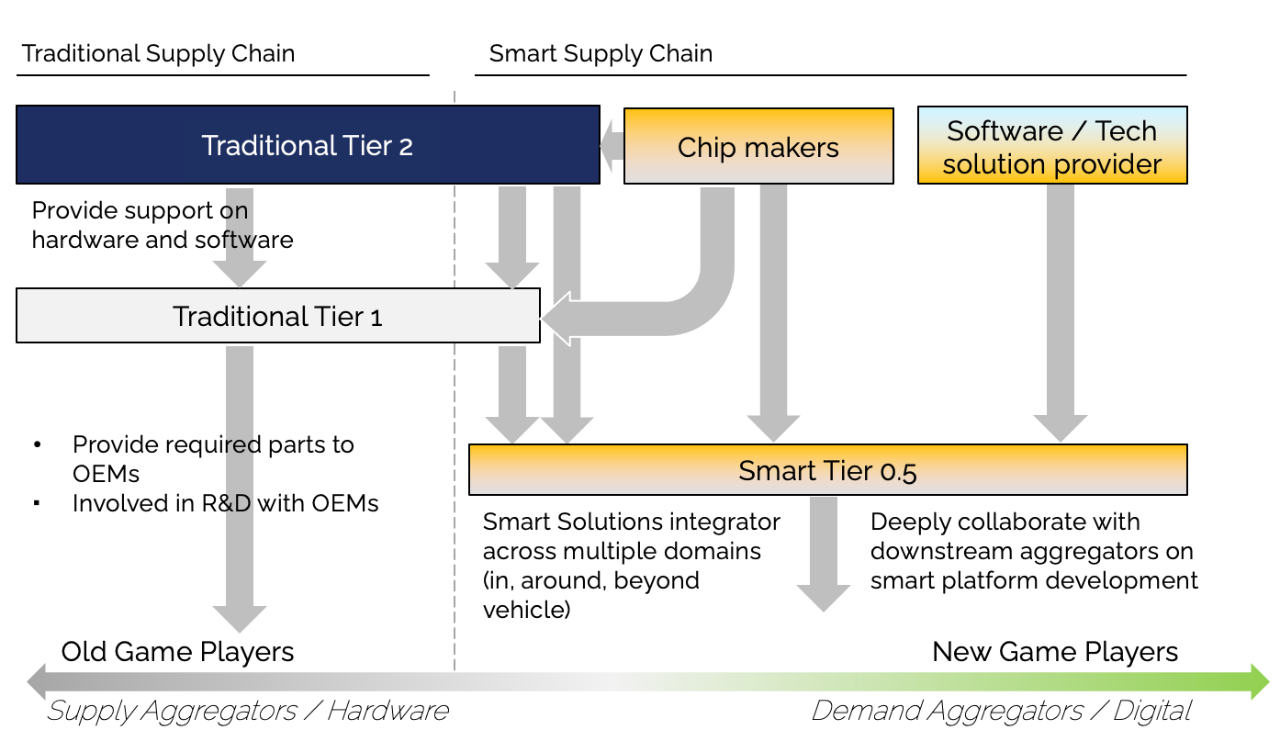

Autonomous driving encompasses a sophisticated ecosystem of both hardware and software, involving components like sensors, processing chips, operating systems, and AI algorithms. Around the globe, companies are working to integrate upstream and downstream resources, forging collaborations between chipmakers like Nvidia and software platforms such as Baidu Apollo. On the hardware side, sensors such as LiDAR, radar, and cameras play a critical role in perceiving the environment, while the software side manages essential functions like driving control systems, perception algorithms, and data processing platforms to ensure safe and efficient operation.

This close integration of hardware and software is reshaping the automotive industry, particularly in the development of ADAS (Advanced Driver Assistance Systems). Previously, vehicles had standalone features like lane-keeping assist or adaptive cruise control, but the convergence of these systems now allows for smarter, more coordinated functionality. Automakers and tech companies are moving toward full-stack solutions where sensors, actuators, and AI-driven decision-making software are co-designed to operate seamlessly together. This integrated approach not only enhances the performance of autonomous systems but also accelerates the progression toward fully autonomous driving, creating safer, more efficient vehicles that blur the lines between traditional hardware and software roles.

The autonomous driving industry involves a wide range of software and hardware technology stacks. Currently, in China, local suppliers have emerged in every segment of the autonomous driving technology stack. In the core value chain, some companies already have the potential to become Tier 1 or even Tier 0.5 suppliers (see Figure 8).

Source: Automobility analysis

Key risks in the autonomous driving supply chain include technological restrictions, particularly shortages in chips and high-end sensors, and disruptions due to global crises like the pandemic and geopolitical tensions. To mitigate these risks, companies are accelerating the development of local supply chains and advancing domestic research capabilities.

As we have explored, the rapid evolution of the internet economy and its intersection with automotive advancements have significantly shaped the automotive landscape in China. However, what happens in China will not stay in China. As the world’s largest automotive market, the transformations originating in China are poised to profoundly influence global auto industry competitive dynamics. To remain competitive and relevant in this evolving landscape, it is crucial to adopt a user-centric mindset and embrace a more service-oriented approach to mobility. This approach will be key to navigating the future of transportation, as we move towards a more connected, electrified, and autonomous Automobility 3.0 era.

About the Authors

Bill Russo is the Founder and CEO of Automobility Limited. His over 40 years of experience includes 15 years as an automotive executive with Chrysler, including over two decades of experience in China and Asia. He has also worked nearly 12 years in the electronics and information technology industries with IBM and Harman. He has worked as an advisor and consultant for numerous multinational and local Chinese firms in the formulation and implementation of their global market and product strategies. Bill is also currently serving as the Chair of the Automotive Committee at the American Chamber of Commerce in Shanghai.

Contact Bill by email at bill.russo@automobility.io

Jackie Tang is an Associate at Automobility Limited.She has over a decade of professional experience, including 6 years in consulting, specializing in the automotive and digital sectors, and 5 years in the mobility and autonomous driving industry. She possesses a deep understanding of China’s automotive industry, particularly in the areas of shared, electrified, connected, and autonomous transformations. Jackie has also led several pioneering “0-1” projects, from the design of innovative business models to their successful implementation.

Contact Jackie by email at jackie.tang@automobility.io

Jayce Lu is a Consultant at Automobility Limited. He has over 6 years of professional experience includes 3 years as an auditor with PwC handling IPOs and audits for automotive, energy and aviation industries. He has worked as an investor at a venture capital firm specializing in Fintech investments. Jayce is currently working as a consultant at Automobility in consulting and investment advisory, serving numerous multinational firms and startups in their strategies and fundraising activities.

Contact Jayce by email at jayce.lu@automobility.io

About Automobility

Automobility Limited is global Strategy & Investment Advisory firm based in Shanghai that is focused on helping its clients to Build and Profit from the Future of Mobility. We help our clients address and solve their toughest business and management issues that arise in midst of fast changing, complicated and ambiguous operating environment. We commit to helping our clients to not only “design” the solutions but also raise or deploy capital and assist in implementation, often together with our clients.

Contact us by email at info@automobility.io

PLEASE NOTE: The information and analysis shared in this article, including the charts and style of materials presented, is the intellectual property of Automobility Ltd. While we share it as a way to serve our existing and new clients, it is not to be used without our express consent and then only with attribution.

Sorry, the comment form is closed at this time.