08 Sep The Financial Times : Elon Musk’s China dream stalls as hybrids rush past Tesla

Media Source : The Financial Times

Consumers shift to plug-in models from local rivals such as BYD

September 6, 2024

by Edward White in Shanghai

Chinese car buyers are shunning Tesla as rival manufacturers flood the world’s largest car market with

more advanced electric vehicle models.

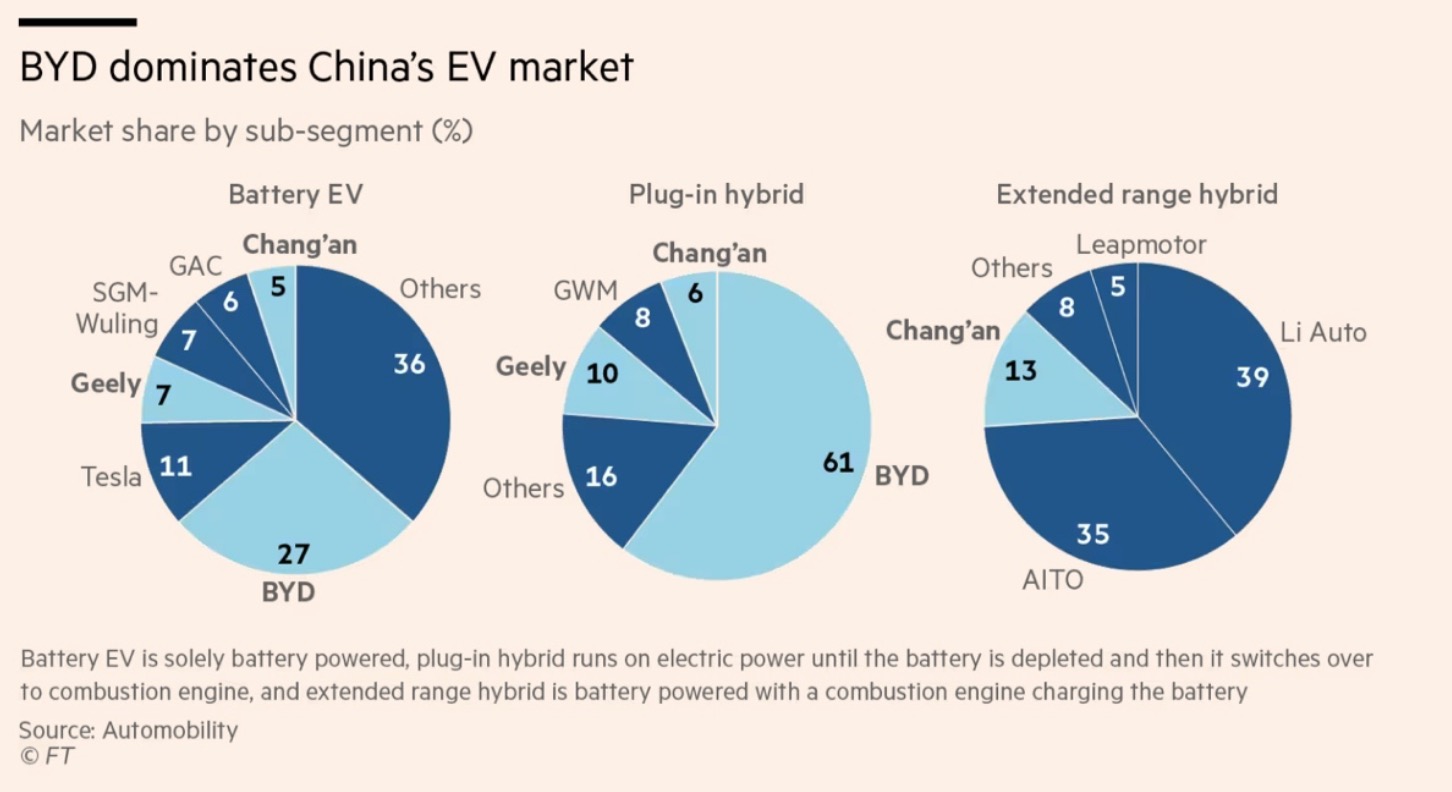

The US company’s share of Chinese EV sales, including battery and plug-in hybrids, slipped to 6.5 per cent in the first seven months of the year from almost 9 per cent a year earlier, according to data from Shanghai consultancy Automobility.

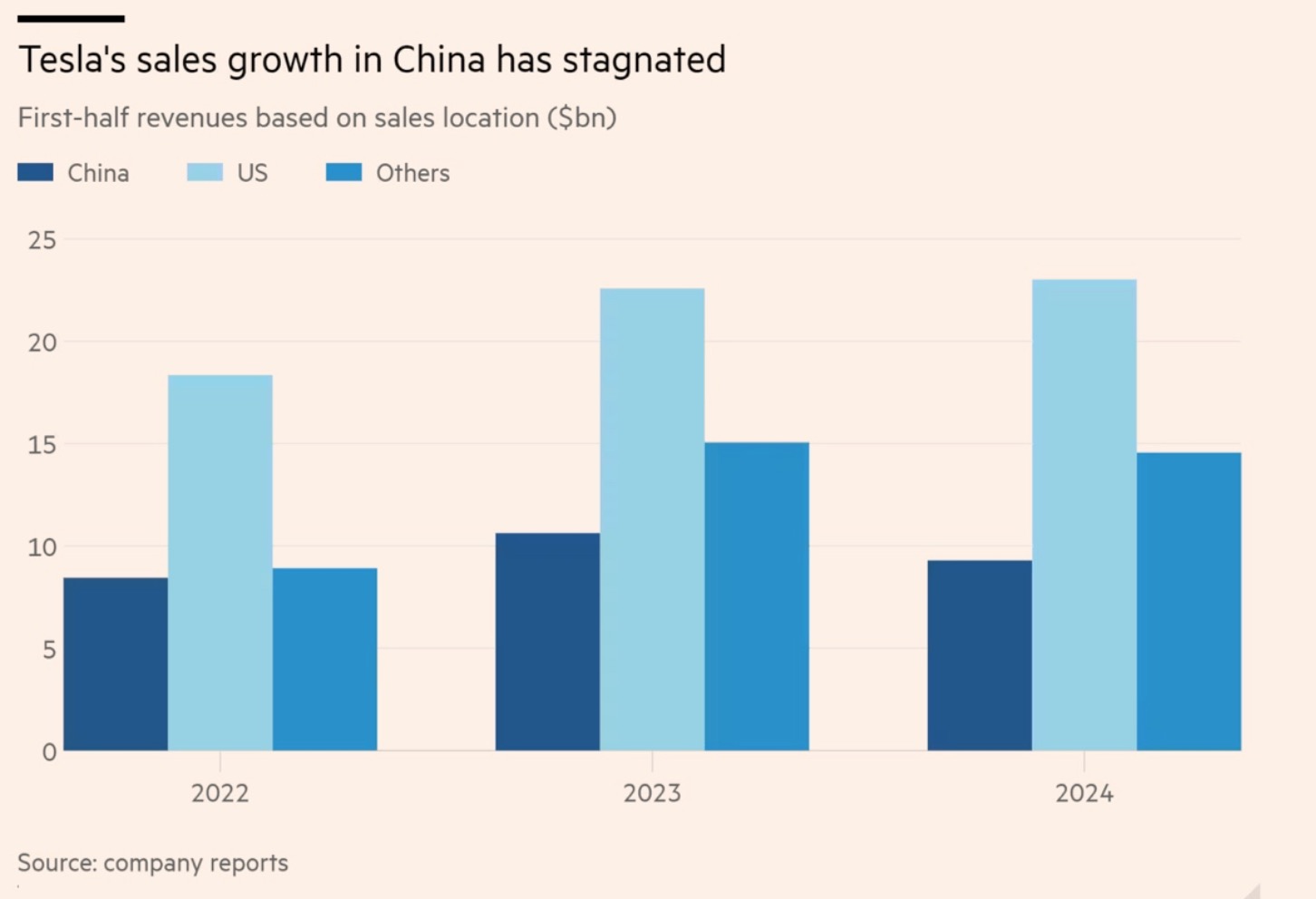

Elon Musk’s company, whose first-half Chinese sales of $9.2bn were down from $10.6bn in 2023, has not released a new EV in China since 2019, while other carmakers are launching more than 100 new models in the country this year alone.

“It is going to be very challenging — about impossible — for Tesla to take sales from any competitor without any new products,” said Tu Le, founder of consultancy Sino Auto Insights.

Tesla’s troubles come as China’s EV sales have grown more than 30 per cent this year, buoyed by a near-90 per cent jump in sales of plug-in hybrids, according to Automobility. The technology combines a smaller battery with a back-up fuel-powered engine. Tesla did not respond to a request for comment.

As Tesla’s sales fall, Chinese rivals, including Warren Buffett-backed BYD, are capitalising on the rush for hybrids. The models were initially conceived as a transition technology, but in China, they also benefit from generous EV subsidies and their popularity has forced companies focusing solely on battery-only cars to reconsider their line-ups.

Tina Hou, who leads China auto research for Goldman Sachs, said EV sales growth was increasingly coming from outside the so-called first-tier cities of Beijing, Shanghai, Guangzhou and Shenzhen. “More and more incremental sales will come from the lower-tier cities. Their charging infrastructure is not as strong, so people will have more range anxiety,” she said.

Bill Russo, the former head of Chrysler in China and founder of Automobility, said Chinese carmakers have quickly met the growing, post-pandemic demand for family cars with a longer driving range. Low-cost, bigger plug-in cars have proved popular for vacation and weekend trips, he said: “Access to charging stations weighs heavily into purchase consideration.”

Shenzhen-based BYD, which controls the biggest share of the plug-in market, has released two hybrid models this year with a mileage of 2,100km from a single charge and one tank of petrol — more than three times the range of Tesla’s Model S.

In August, Volkswagen-backed Xpeng, which has focused solely on batteries, conceded it was “closely studying” new hybrid technologies, while Geely’s Zeekr EV unit said it would release its first hybrid next year.

Tesla last unveiled a new EV, the Model Y, in the world’s largest car market in 2019 © Wu Hao/EPA-EFE

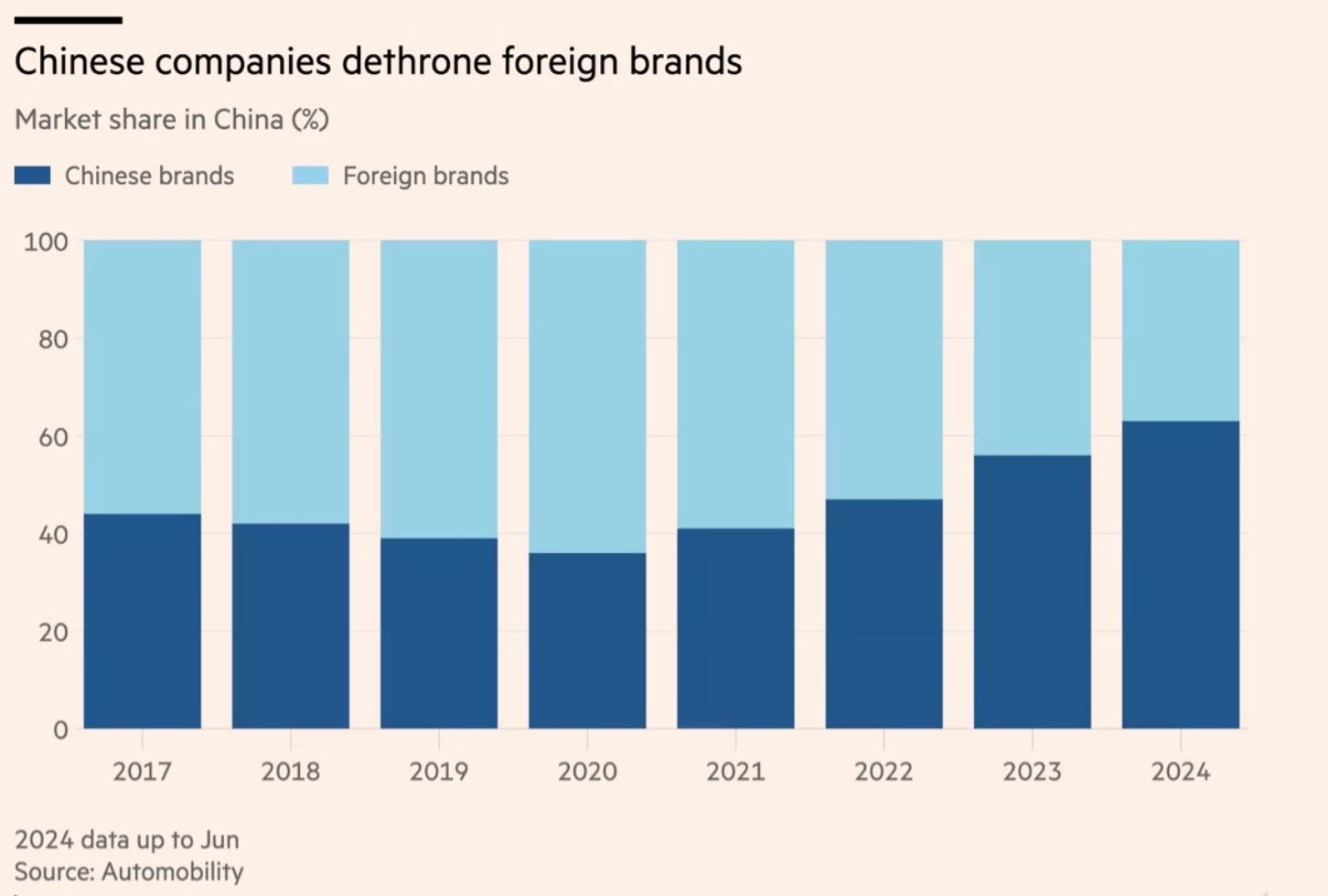

The growth of low-cost hybrid EVs in China is exacerbating the demise of foreign auto groups, which have been slow to pivot from internal combustion engines. Chinese brands’ share of domestic car sales has risen to a record high of above 60 per cent this year, said experts.

Still, Lei Xing, the founder of Chinese consultancy AutoXing, said Tesla’s decision to offer interest-free loans in China this year has helped limit the fallout. “Maintaining flat growth is a win in the current bloodbath,” he said.

Against this backdrop, analysts said that Musk was under increasing pressure to convince Chinese regulators to give the green light to Tesla’s semi-autonomous driving software — dubbed FSD, or “full self- driving”, a potentially lucrative new revenue stream for the company.

Musk, whose business empire also includes SpaceX and social media platform X, believes deploying the technology is central to future success, including in the nascent robotaxi market. He has prioritised its development above releasing a long-delayed, low-cost EV, known unofficially as the Model 2.

In late April, the billionaire flew to Beijing and met Li Qiang, President Xi Jinping’s number two. The trip appeared to help Tesla ease Beijing’s regulatory concerns over data security compliance and pave the way for access to Chinese mapping and navigation systems. Experts said it signalled Beijing’s approval of Musk and his technology plans.

Yuqian Ding, a Beijing-based analyst with HSBC, said there have been positive signs from Tesla’s local partners that the carmaker’s self-driving platform is moving closer to release. The software would be available to more than 1.6mn Tesla cars in China.

How much of the company’s platform will be available in China remains “heavily debated”, said Ding,

adding that most of Tesla’s Chinese rivals are working on similar technologies.

Analysts note that exports from Tesla’s Shanghai factory, which account for about 20-30 per cent of production, are helpful as a buffer against any Chinese slowdown.

However, Tu Le of Sino Auto Insights said it was difficult to see Tesla building “any momentum” in China without new products to compete with the growing menu of Chinese battery EVs and plug-ins, or a sudden change of heart from Beijing over self-driving regulation.

“I think there is some wishful thinking from Elon. I wouldn’t be surprised if before the end of the year he comes over again and tries to massage the FSD launch into China,” he said.

SOURCE: https://www.ft.com/content/5efcef9f-645d-44cb-96cf-9cd19719d4aa

Sorry, the comment form is closed at this time.