28 Sep State of China’s Auto Market – September 2024

Posted at 14:18h

in

Newsletter

by editor

Comments from Bill Russo, Founder & CEO of Automobility Ltd.

WHERE WE STAND IN 2024

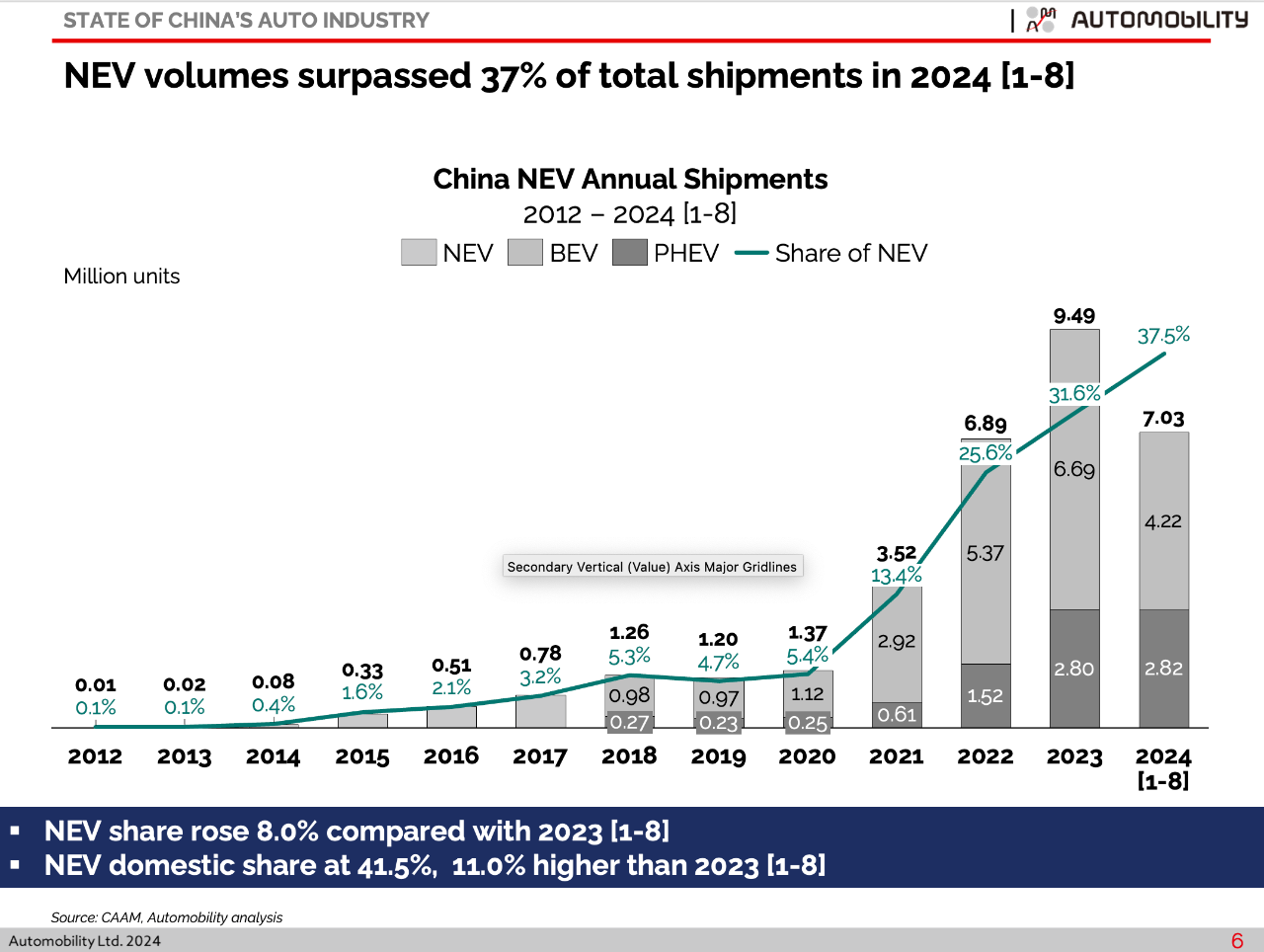

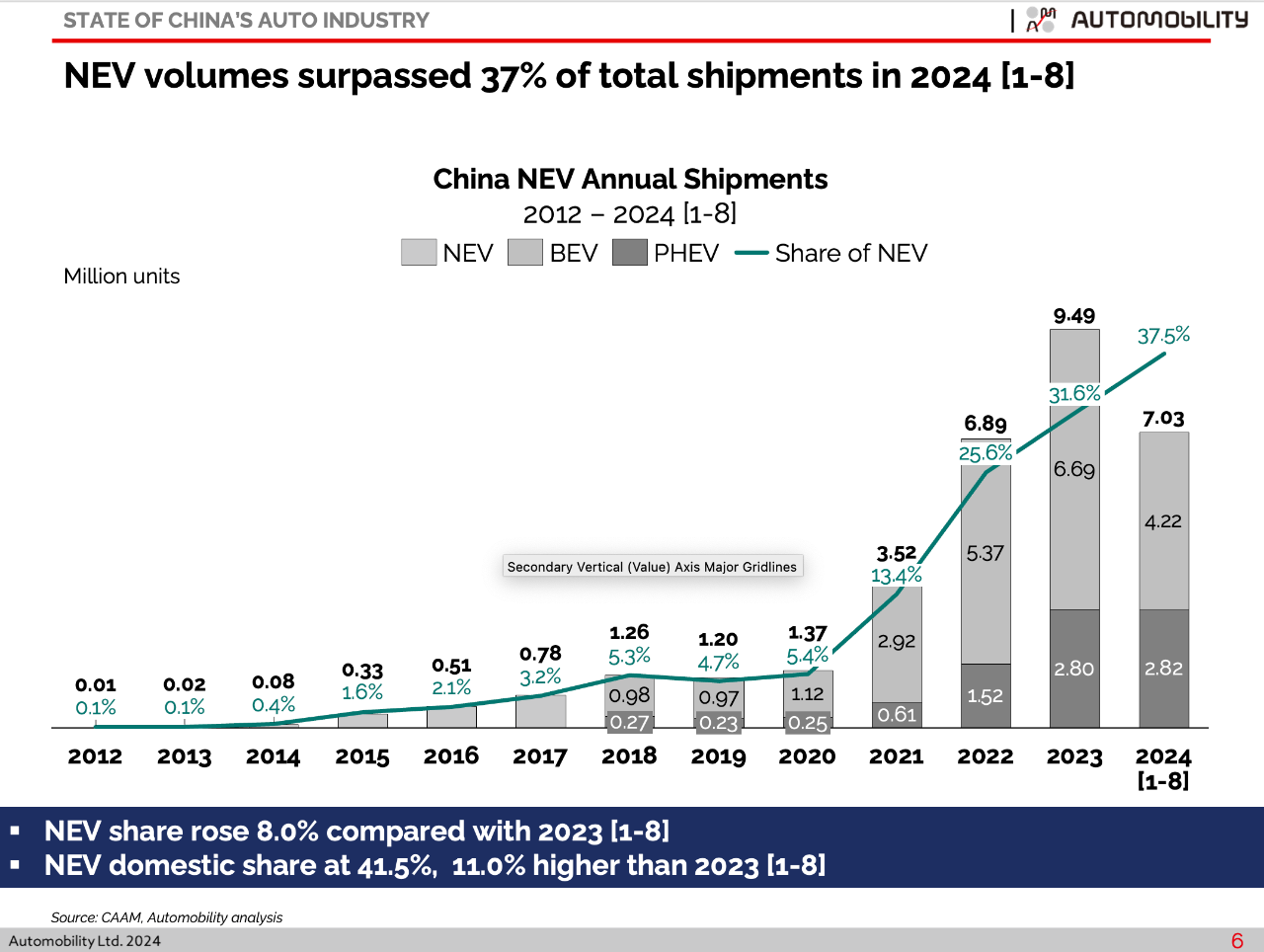

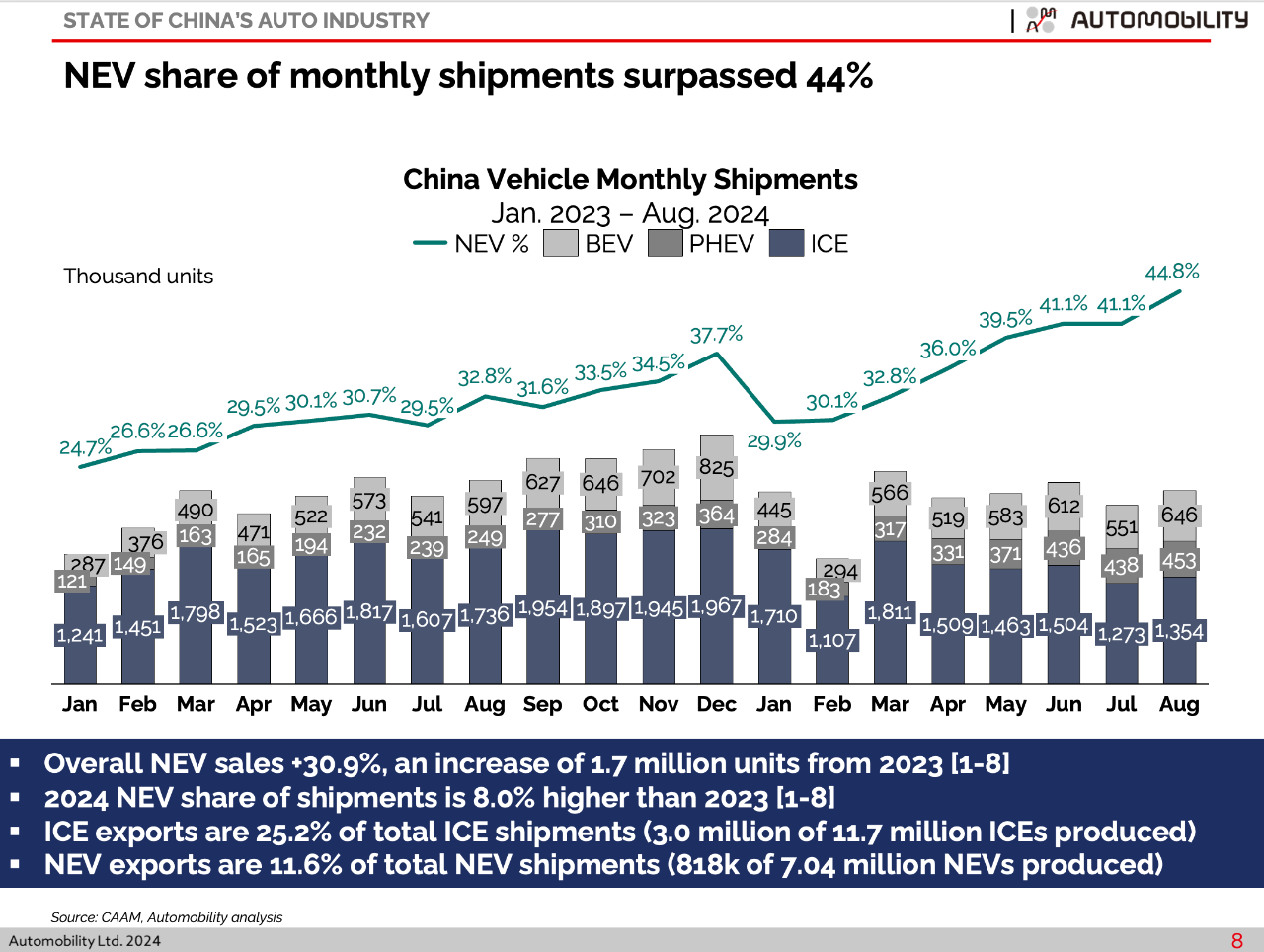

- New Energy Vehicle share continues to expand, comprising ~38 % of all vehicles produced in China in 2024, with monthly share of shipments ~45% in the month of August.

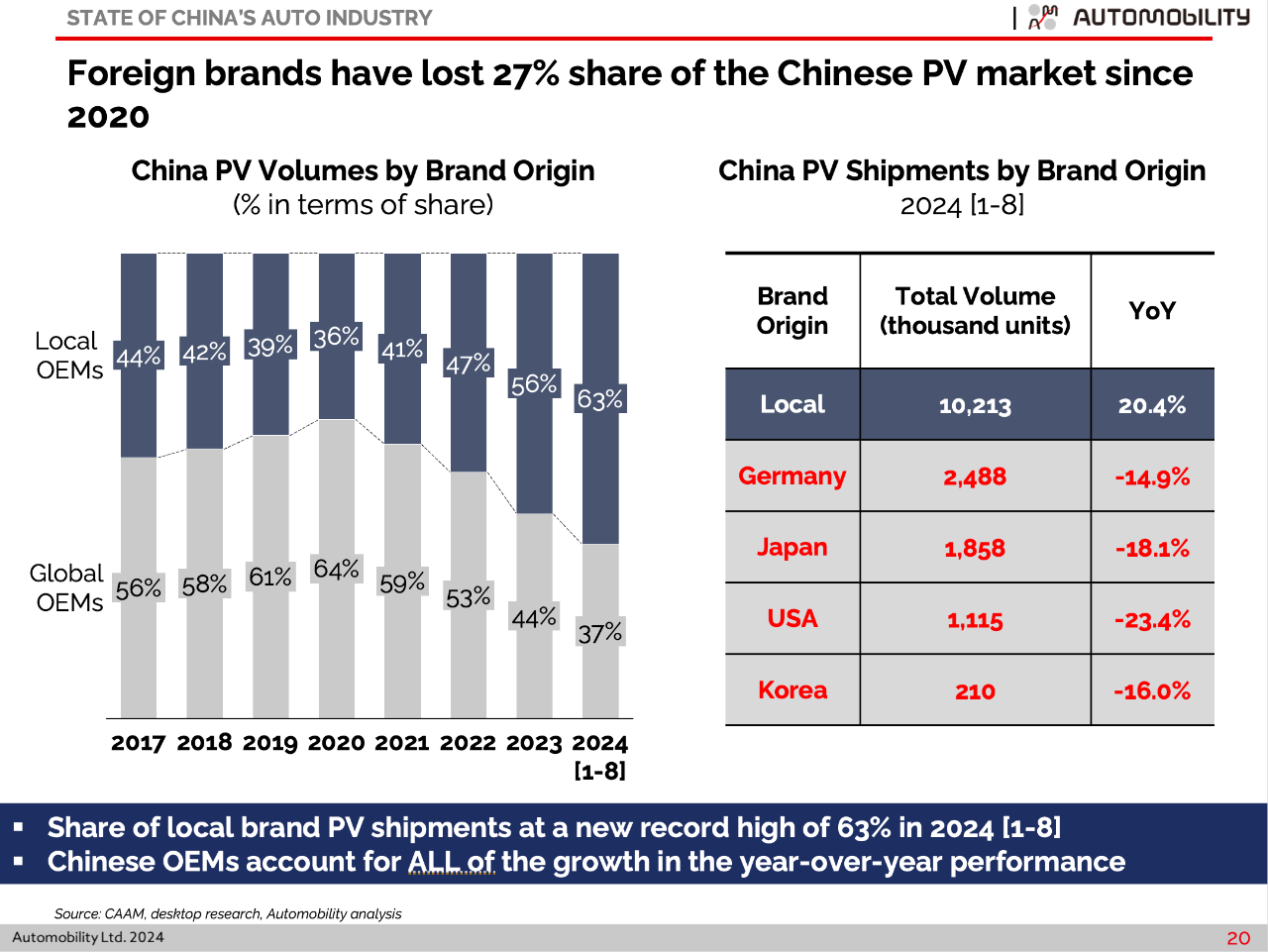

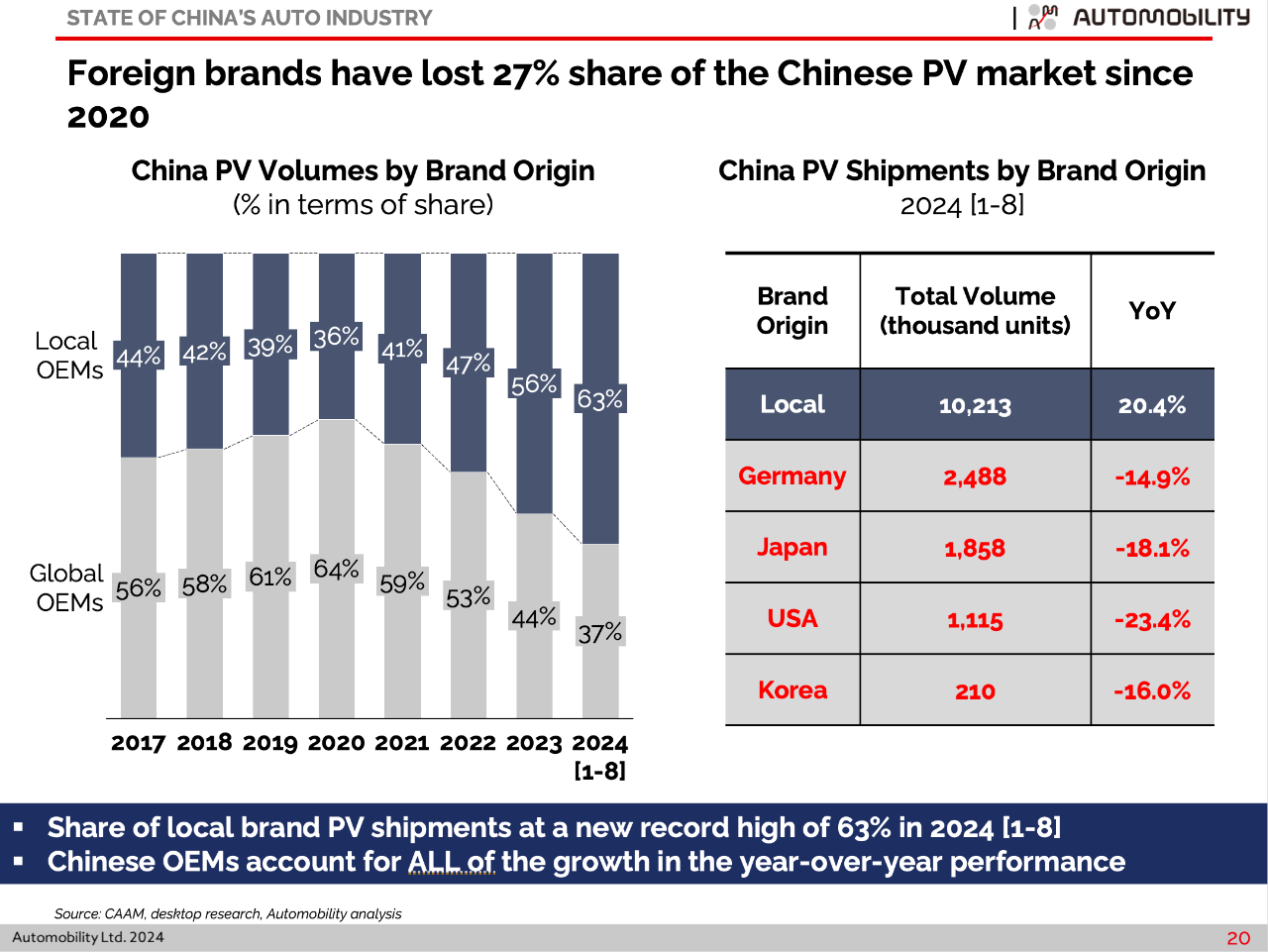

- Chinese brands command 63% share of domestic passenger vehicle sales, up 27% since 2020.

-

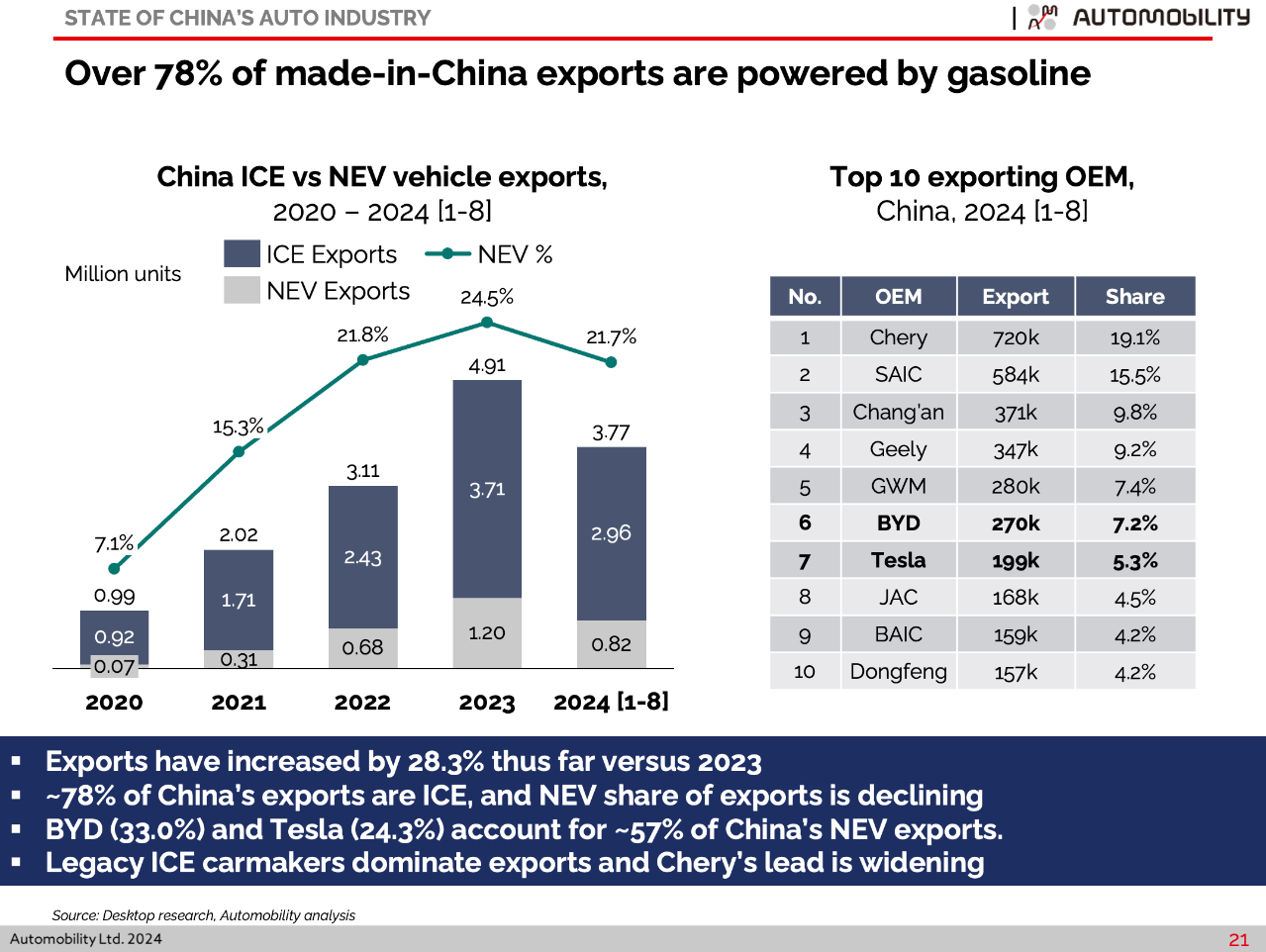

3.77 million Made-in-China vehicles were exported through August, an increase of 28.3 percent over the same period of 2023. Over 78% of vehicles exported from China are gasoline powered.

-

2.82 million Plug-in Hybrid Electric Vehicles were shipped through August, surpassing the full year total from 2023.

-

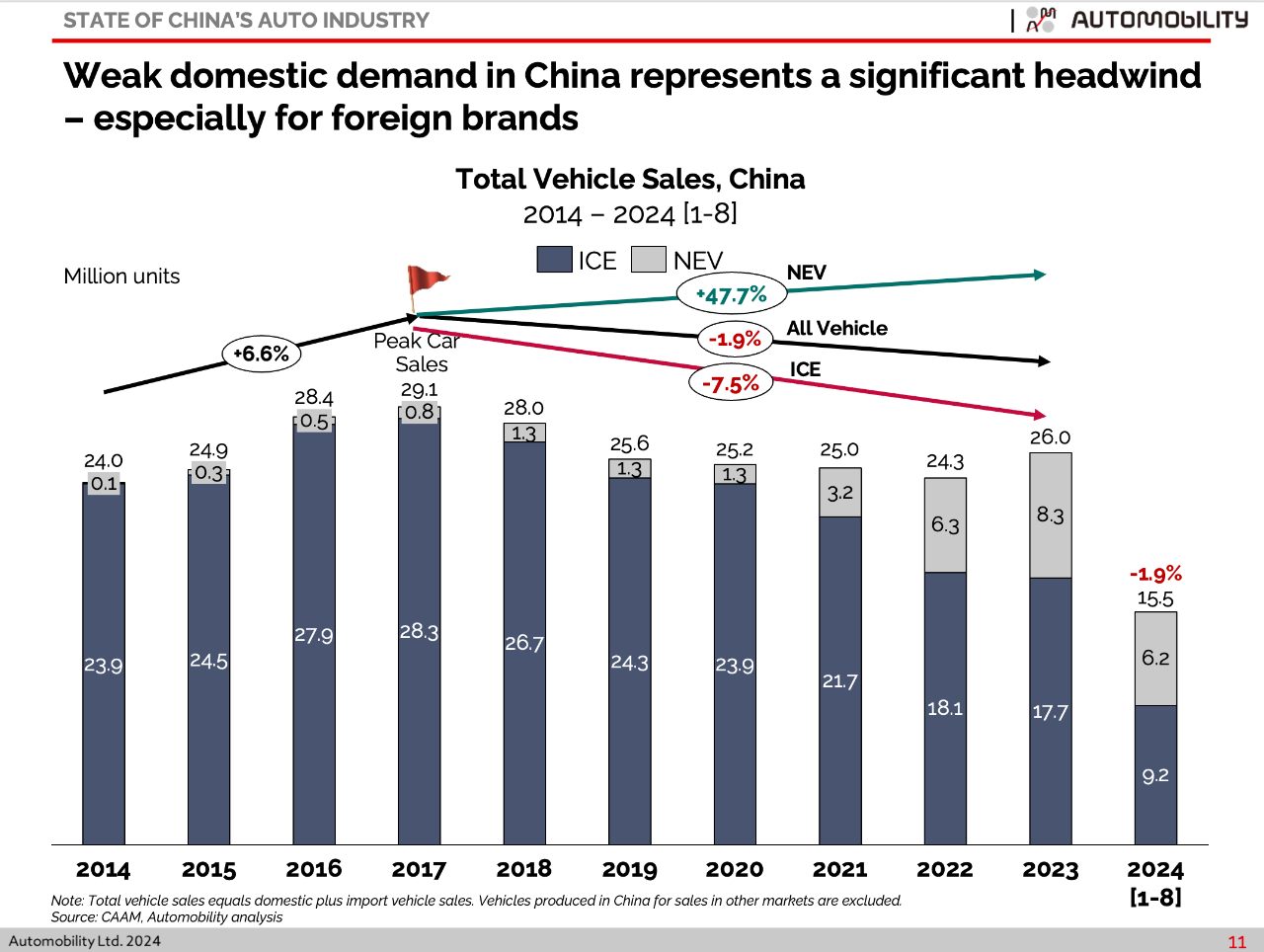

Overall domestic vehicle sales are down 1.9%, with 15.5 million cars sold in China through August.

-

BYD had it best sales month, with ~380,000 domestic sales, surpassing 2 million units of domestic sales through August. BYD’s full year domestic NEV share is 34.6% and overall market share is 15.3%.

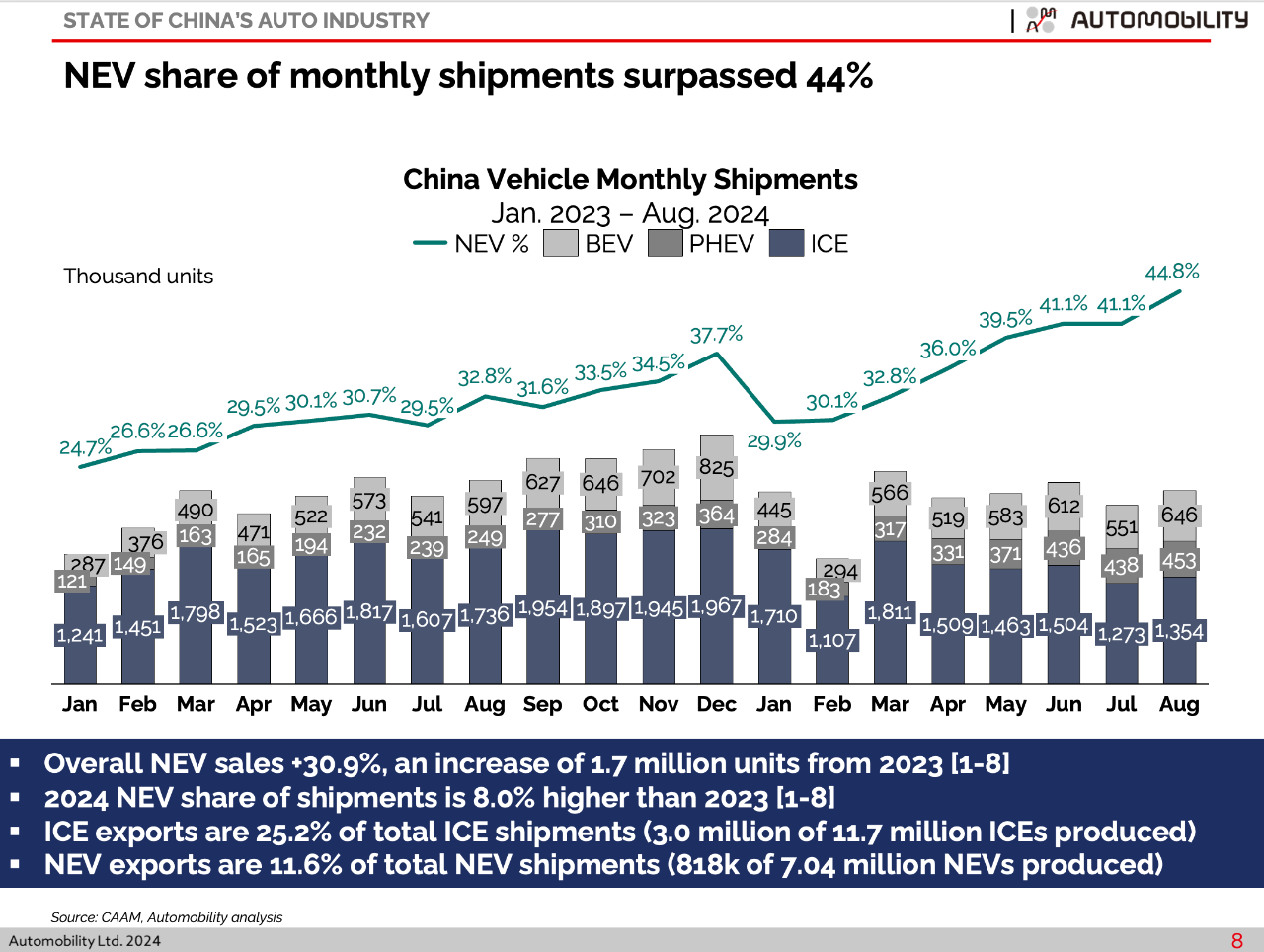

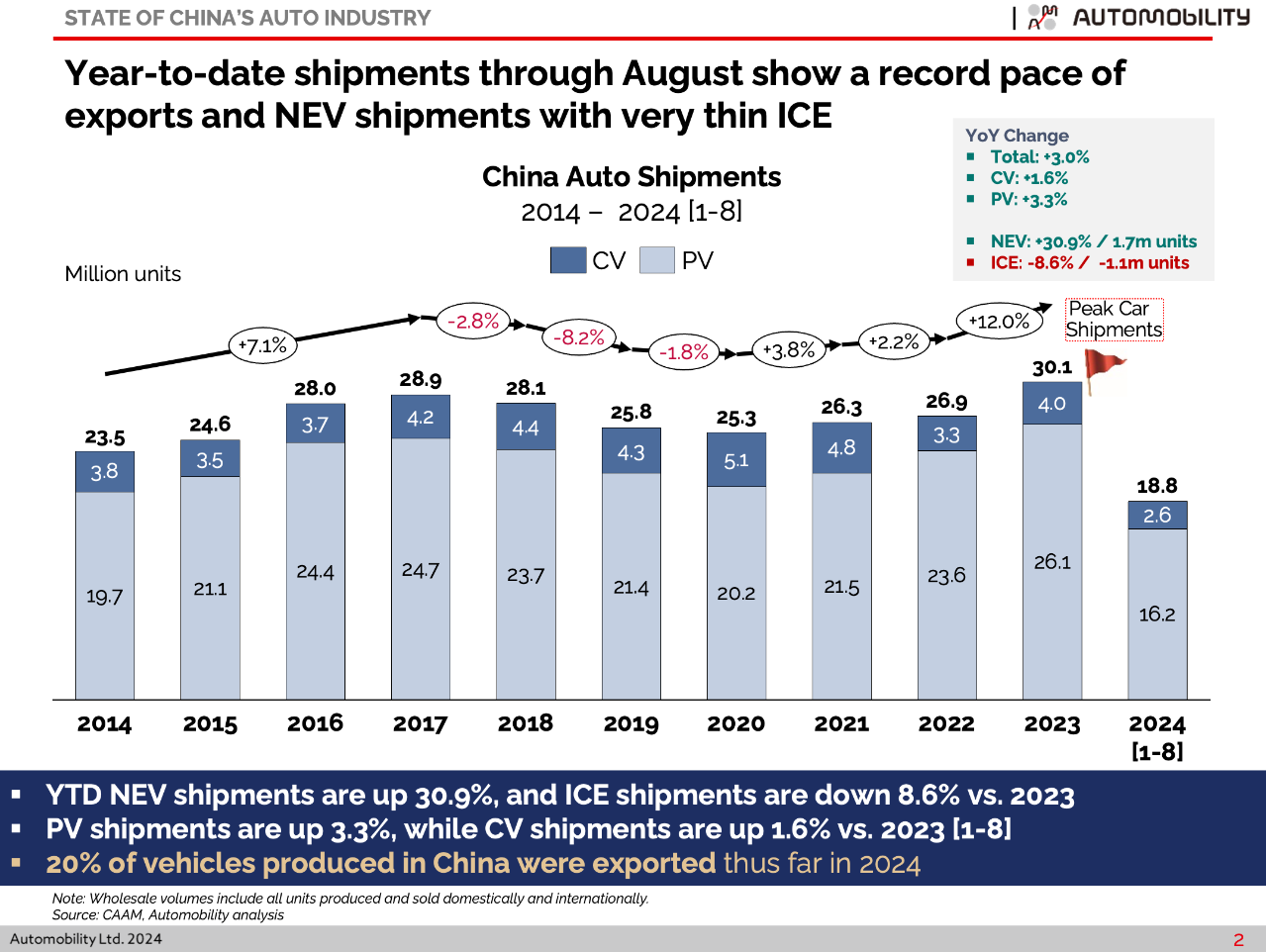

Thin ICE

The weak performance of the overall market continues through August. Shipments are up 3.0% through August, driven by the two reliable growth vectors including a 30.9% increase in NEV shipments and a 28.3% rise in exports versus the same period from last year. Shipments of vehicles powered purely by an Internal Combustion Engine (ICE) are down 8.6%. The 18.8 million units produced through August includes ~3.8 million Made-in-China (MIC) vehicles that were exported from China (~20% of total volume).

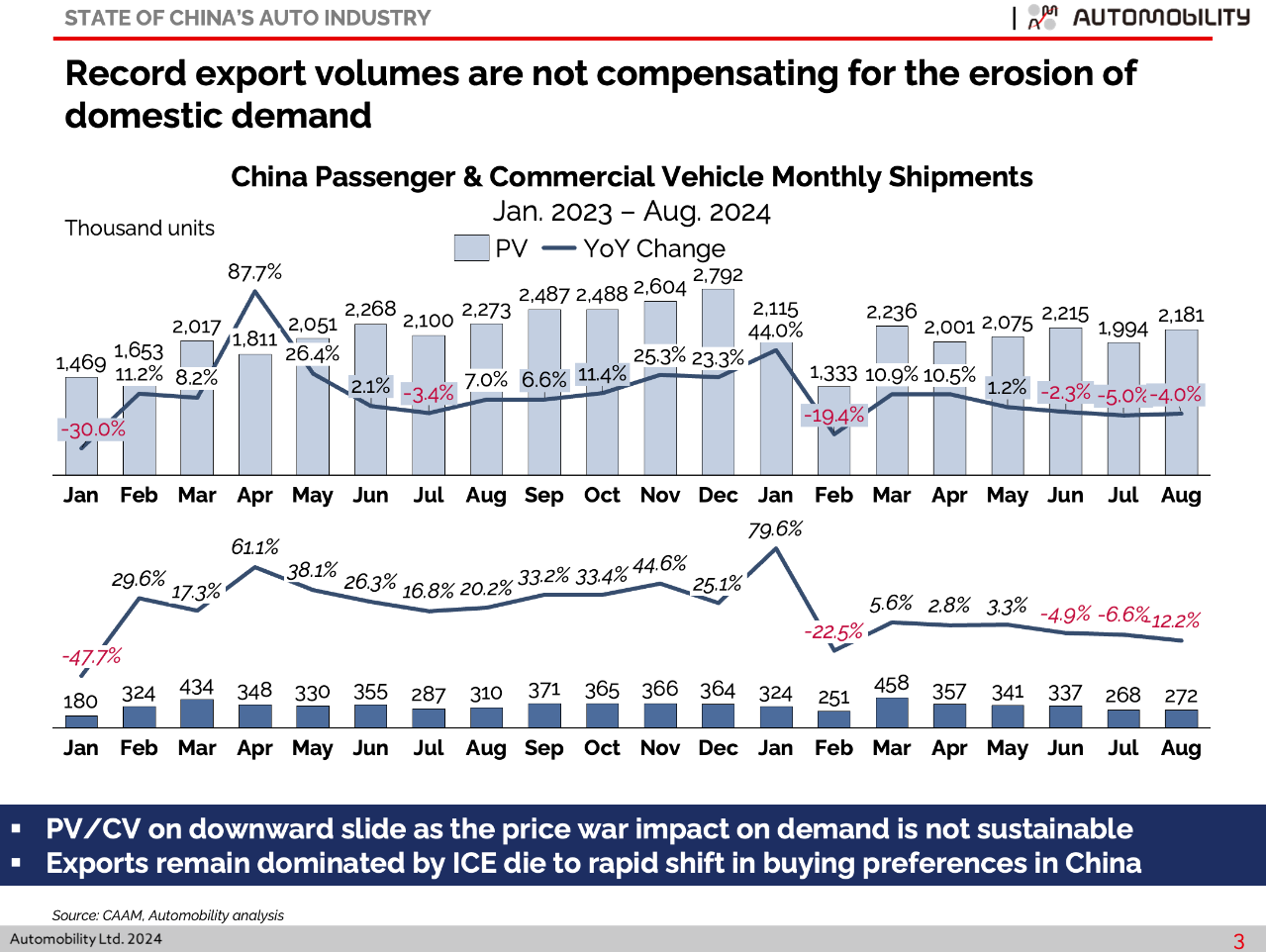

Monthly shipment volumes have been on a downward glide path for both passenger and commercial vehicles since Chinese New Year. It seems that aggressive pricing moves after Chinese New Year have pulled demand ahead and are not generating sustainable momentum for the overall market in the 3rd quarter.

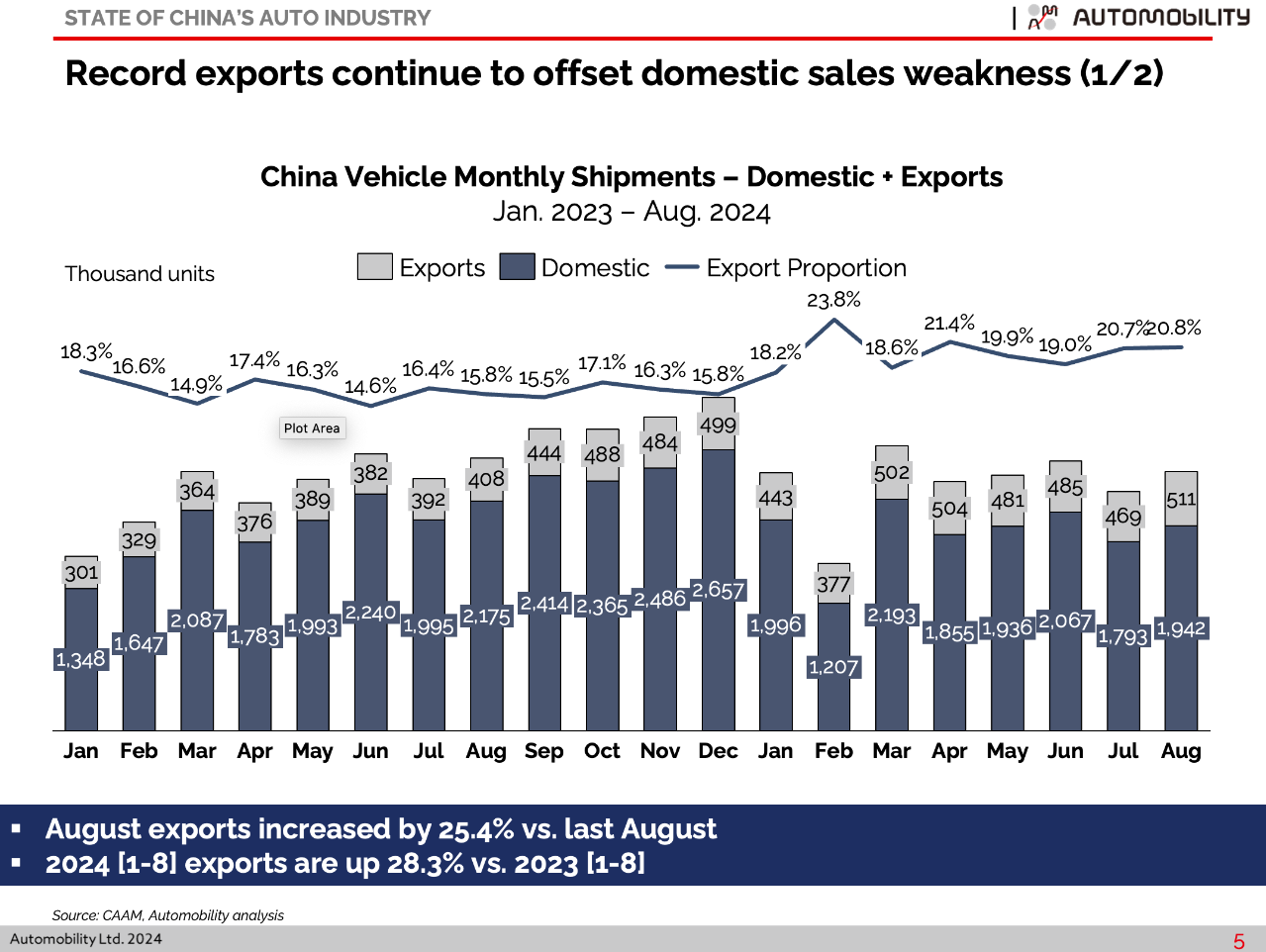

Monthly MIC export volumes set an all-time record of 511,000 units, reaching 20.8% of all vehicles produced. Through August, exports are up 28.3% versus record volumes from last year. With weakening domestic sales, excess capacity has become a huge concern for most carmakers – especially for ICE powered vehicles. Exporting excess capacity has become a safety valve to relieve this pressure.

MIC exports total 3.77 million units through August, and will easily surpass the 4.91 million units shipped from China last year. The share of ICE powered vehicles is now increasing, with Chery now holding a significant lead over SAIC as the leading MIC exporter.

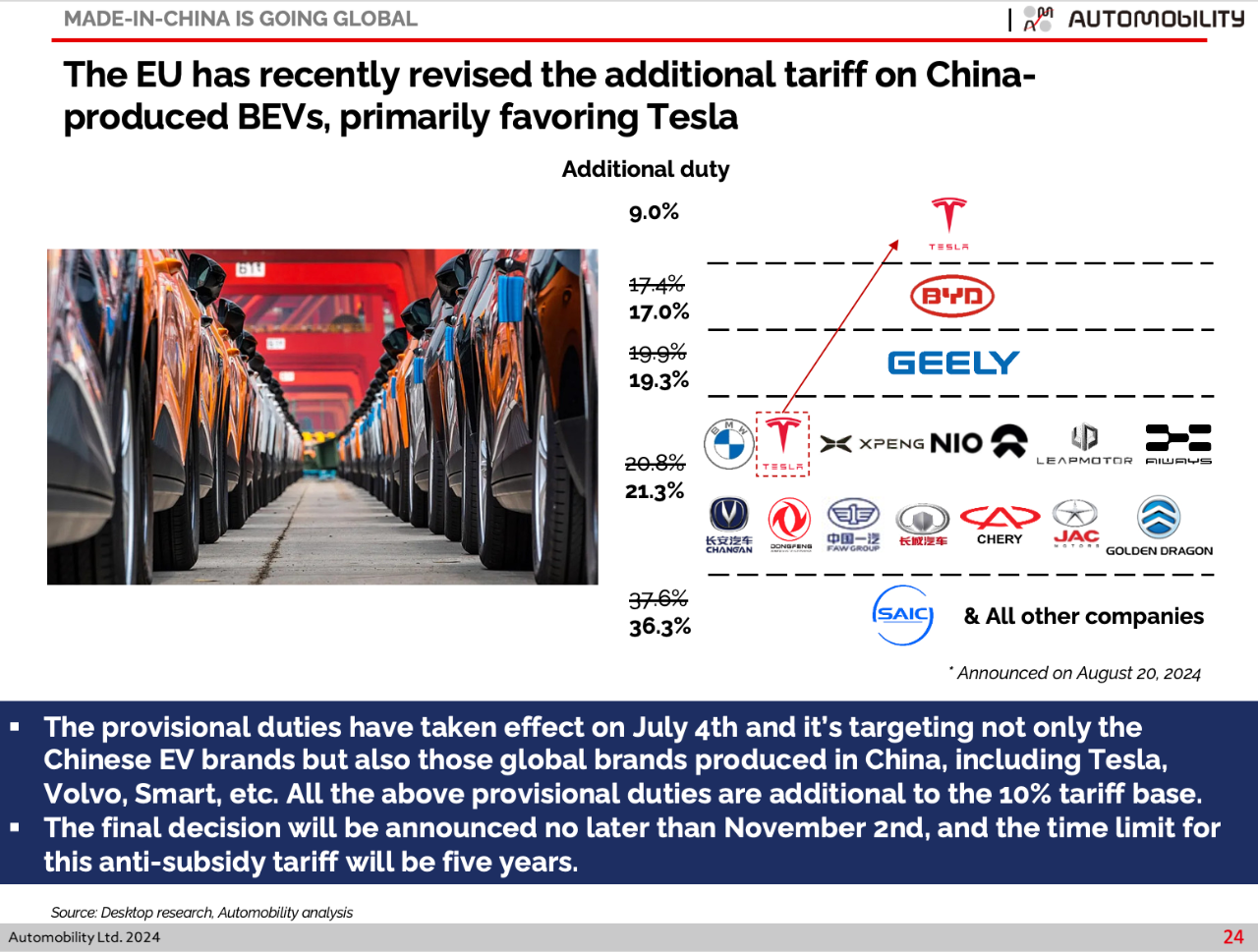

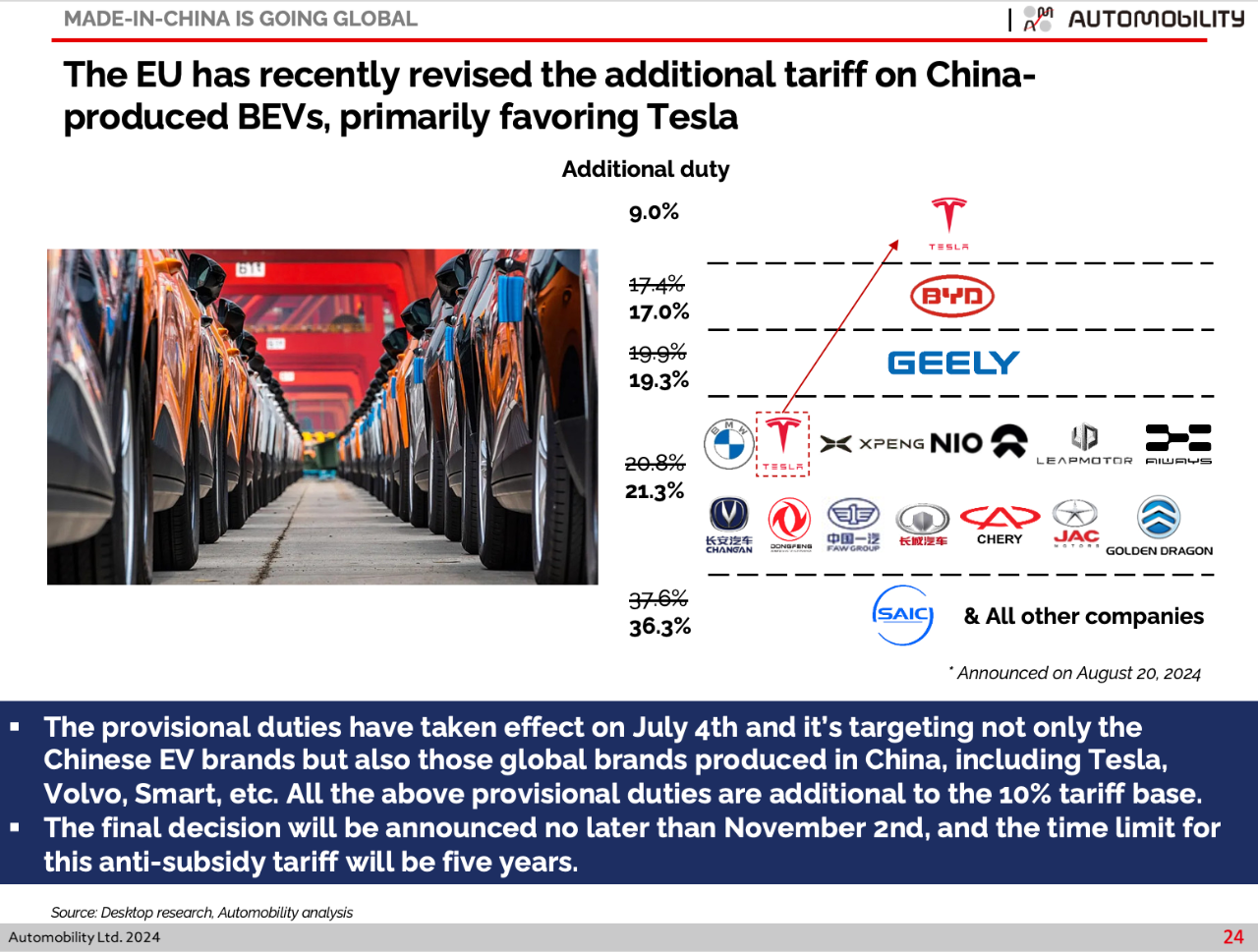

BYD and Tesla comprise 57% of the 820,000 NEV exports. Interestingly, BYD (+17%) and Tesla (+9%) have been given the lightest additional tariff penalty by the European Union.

NEV Volumes – Powered by ICE?

While China had for more than a decade promoted the investment in new energy vehicles and related infrastructure, there had been very limited consumer demand for these vehicles. Before 2020, most NEV sales were to fleets serving public transportation, government services, taxi or ride hailing fleets and were heavily subsidized. Tesla’s entry into the EV market in China market sparked retail consumer interest in electric vehicles, which helped increase retail consumer demand across the entire sector.

China’s Energy-saving and New Energy Vehicle Technology Roadmap 2.0, which was released on October 27, 2020, provided guidelines for intelligent connected vehicle, new energy vehicle and assisted and autonomous vehicle deployment over a 15-year period. The expectation at that time was for NEV sales to reach 20% in 2025 – of which 90% would be pure battery electric vehicles (BEV).

NEV shipments topped 7 million units through August, and will likely exceed 11 million units in 2024. Interestingly, 2.82 million Plug-in Hybrid Electric Vehicles were shipped through August, surpassing the full year total from 2023.

NEV Volumes – Powered by ICE?

While China had for more than a decade promoted the investment in new energy vehicles and related infrastructure, there had been very limited consumer demand for these vehicles. Before 2020, most NEV sales were to fleets serving public transportation, government services, taxi or ride hailing fleets and were heavily subsidized. Tesla’s entry into the EV market in China market sparked retail consumer interest in electric vehicles, which helped increase retail consumer demand across the entire sector.

China’s Energy-saving and New Energy Vehicle Technology Roadmap 2.0, which was released on October 27, 2020, provided guidelines for intelligent connected vehicle, new energy vehicle and assisted and autonomous vehicle deployment over a 15-year period. The expectation at that time was for NEV sales to reach 20% in 2025 – of which 90% would be pure battery electric vehicles (BEV).

NEV shipments topped 7 million units through August, and will likely exceed 11 million units in 2024. Interestingly, 2.82 million Plug-in Hybrid Electric Vehicles were shipped through August, surpassing the full year total from 2023.

While NEV sales are far ahead of the 20% target, the unexpected outcome is that PHEVs are far more popular among consumers than anticipated. For the fourth consecutive time, PHEV sales set a new monthly record at 453,000 units, and are up 86% for the year thus far.

While NEV sales are far ahead of the 20% target, the unexpected outcome is that PHEVs are far more popular among consumers than anticipated. For the fourth consecutive time, PHEV sales set a new monthly record at 453,000 units, and are up 86% for the year thus far.

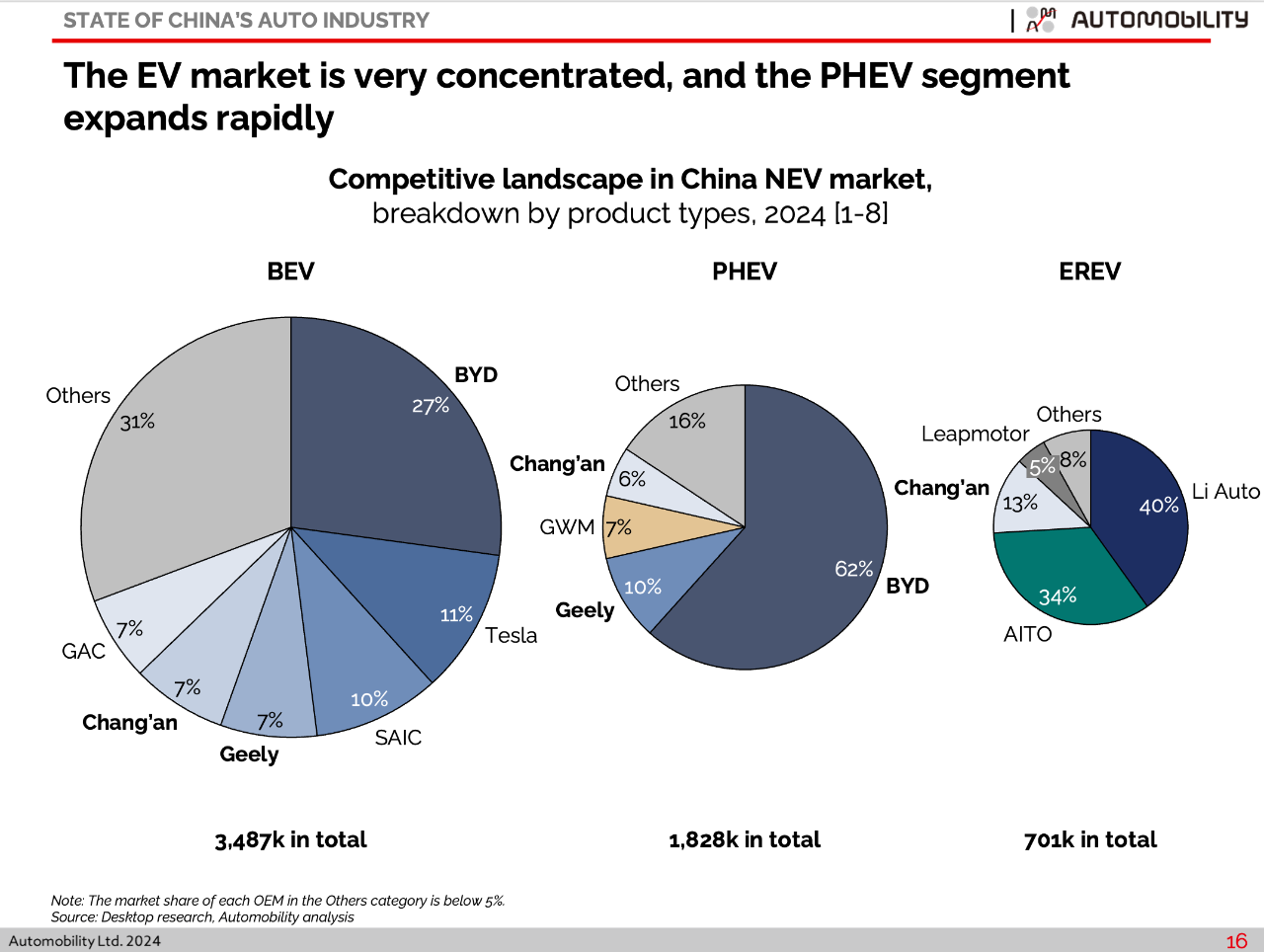

Initially allowed as a loophole to permit legacy carmakers to use existing capacity to get into the NEV game, it is evident that consumers prefer a vehicle that offers the flexibility of a car powered with either a charging pole or gas pump. In addition, PHEVs operate with fewer battery cells as they offer just enough range for daily use. As a result, they can be cheaper to make – provided the ICE engine is purpose-built for its diminished role as backup charger to extend driving range.

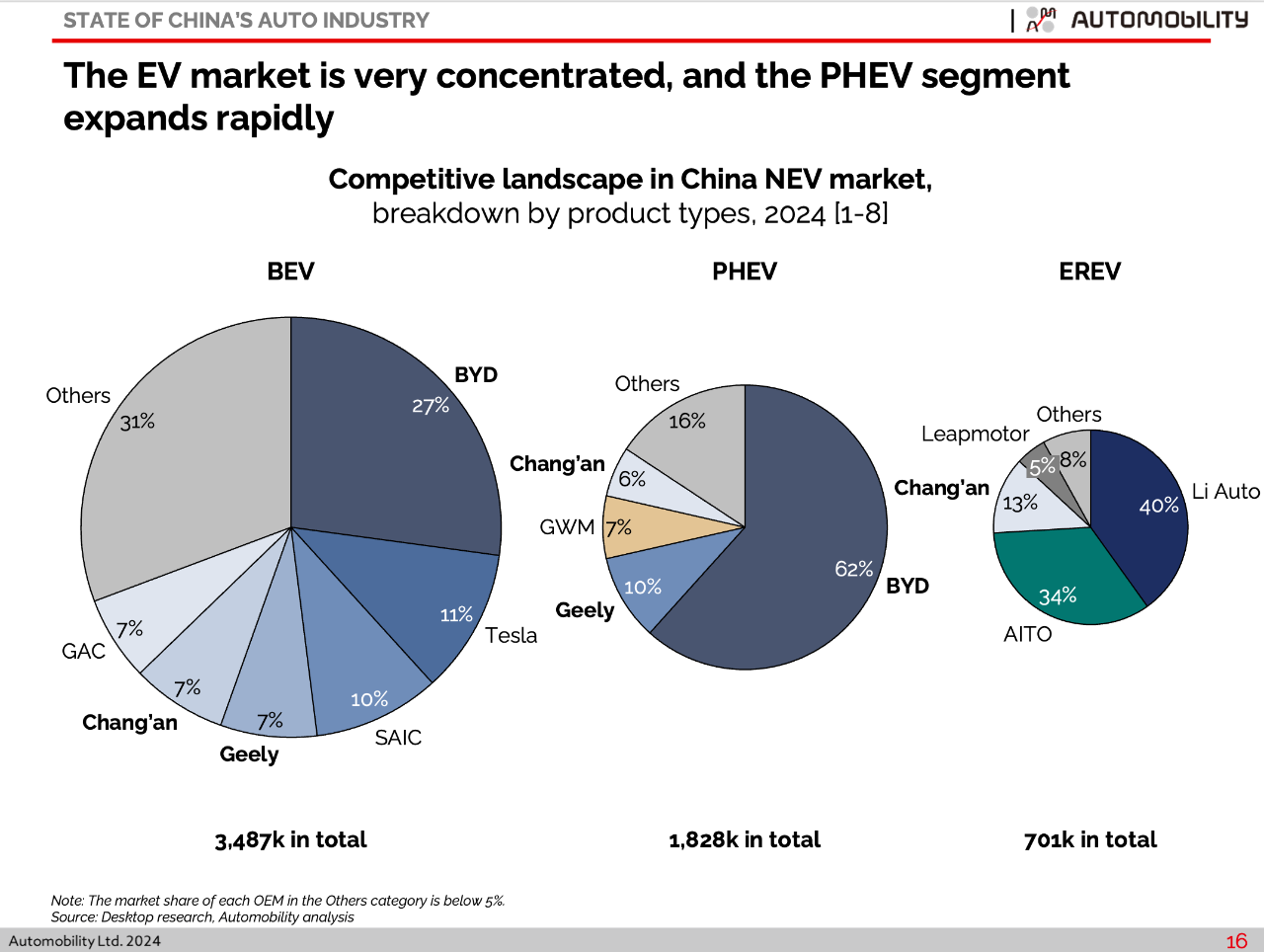

Chinese carmakers own the PHEV market. BYD dominates the parallel PHEV sub-segment with 62% share. Li Auto and Huawei’s AITO are the clear leaders in the Extended Range (EREV) sub-segment, taking nearly three-quarters of this high growth sub-segment.

Initially allowed as a loophole to permit legacy carmakers to use existing capacity to get into the NEV game, it is evident that consumers prefer a vehicle that offers the flexibility of a car powered with either a charging pole or gas pump. In addition, PHEVs operate with fewer battery cells as they offer just enough range for daily use. As a result, they can be cheaper to make – provided the ICE engine is purpose-built for its diminished role as backup charger to extend driving range.

Chinese carmakers own the PHEV market. BYD dominates the parallel PHEV sub-segment with 62% share. Li Auto and Huawei’s AITO are the clear leaders in the Extended Range (EREV) sub-segment, taking nearly three-quarters of this high growth sub-segment.

Sales Summary through August

When exports are removed from the figures, domestic sales are down 1.9% through August. However, combining these figures masks the truly biggest issue facing the global automakers: the collapse of the domestic ICE market in China.

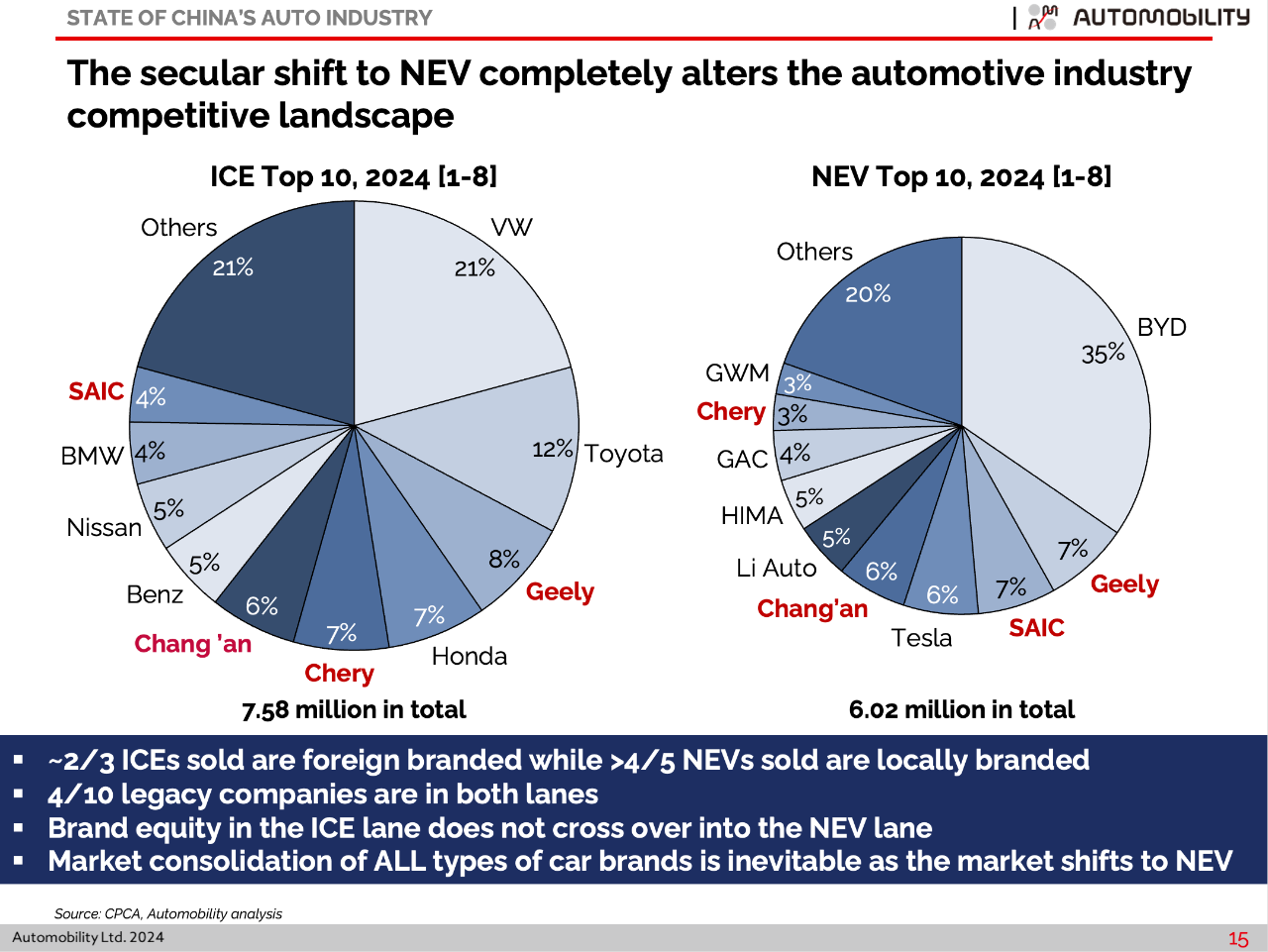

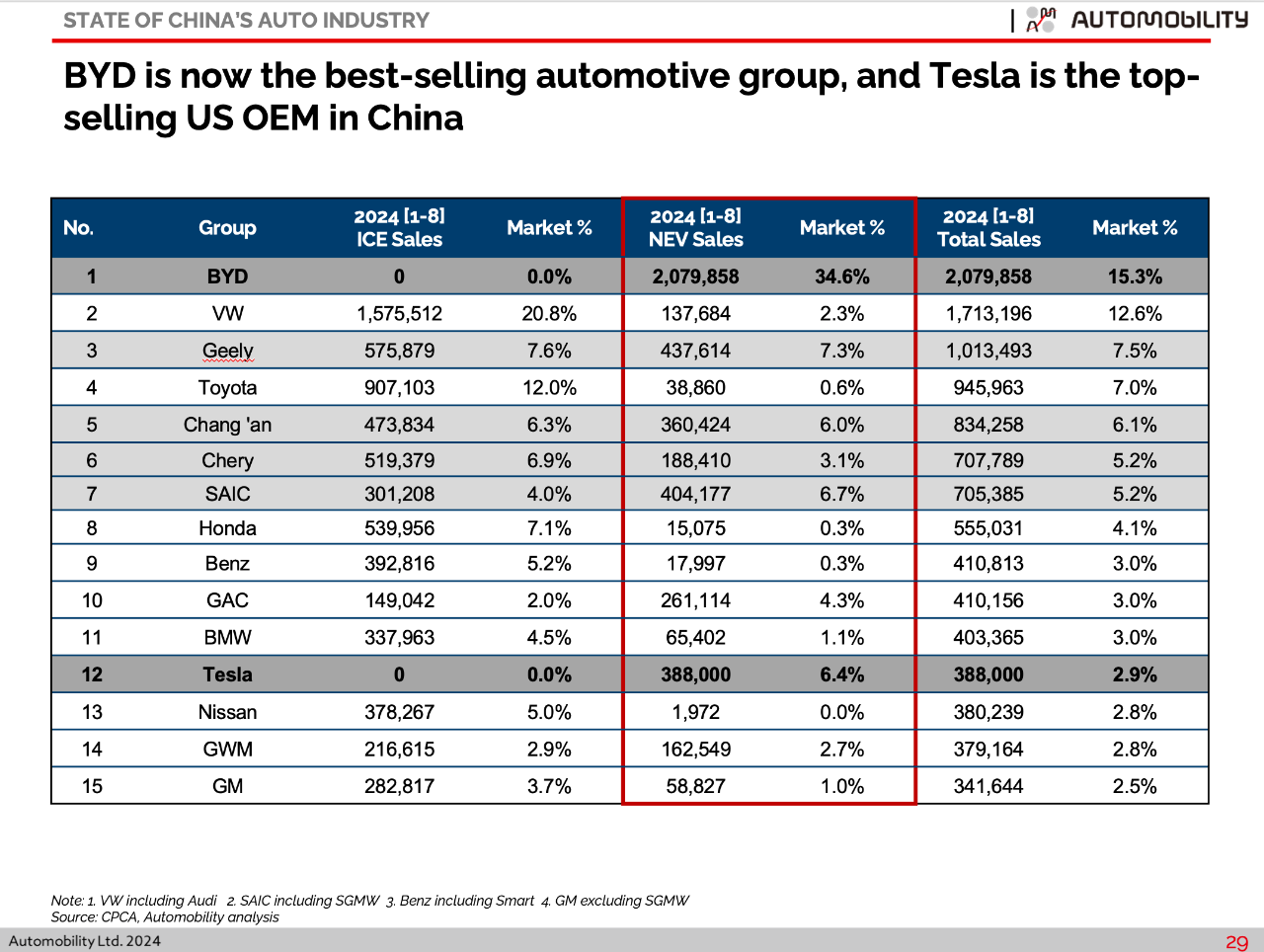

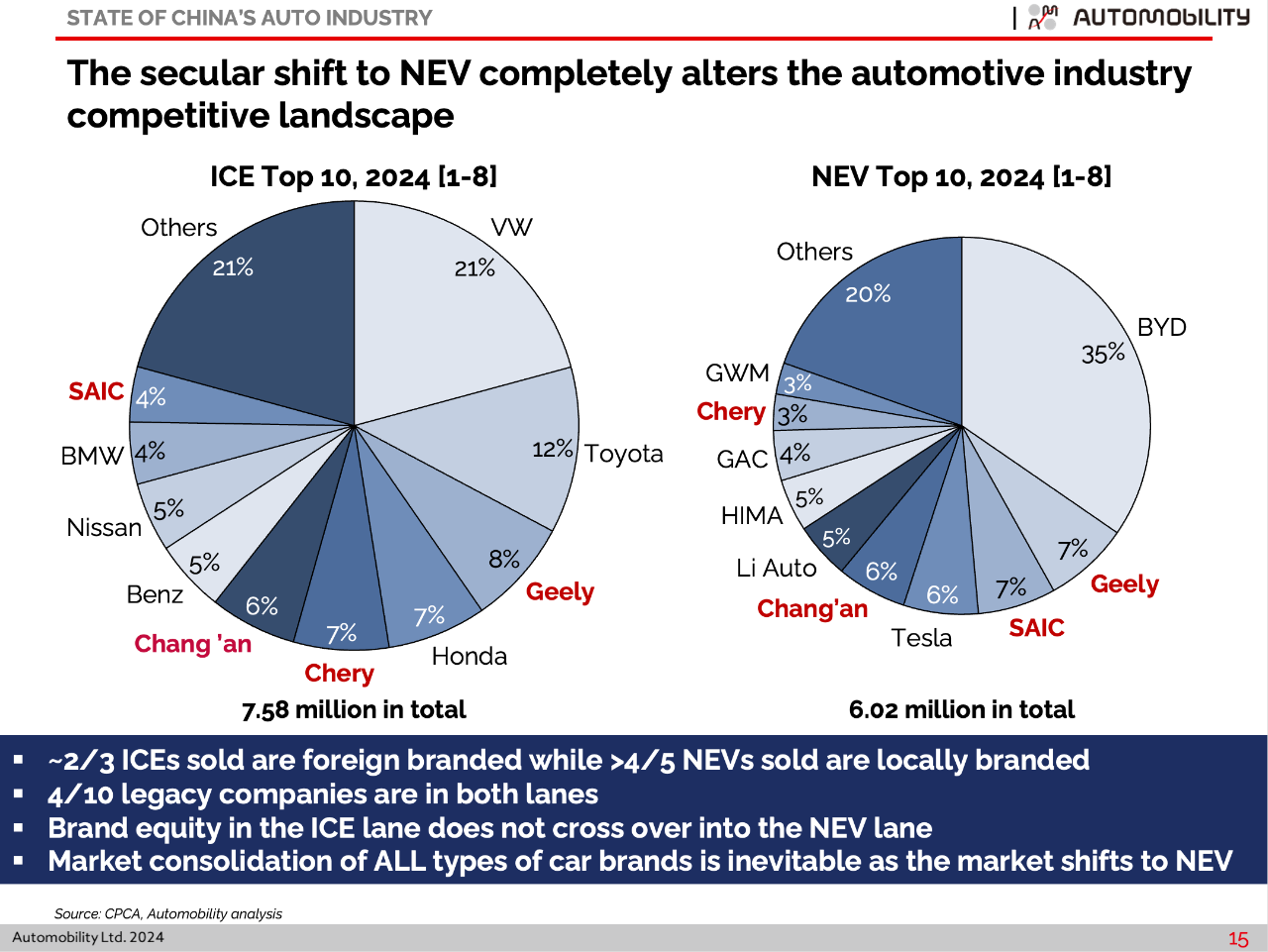

Viewed on a combined basis, BYD is the clear leader in the market, with 15.3% overall share, widening their lead over Volkswagen, which has fallen to 12.6%. Foreign carmakers remain stuck in the shrinking ICE lane.

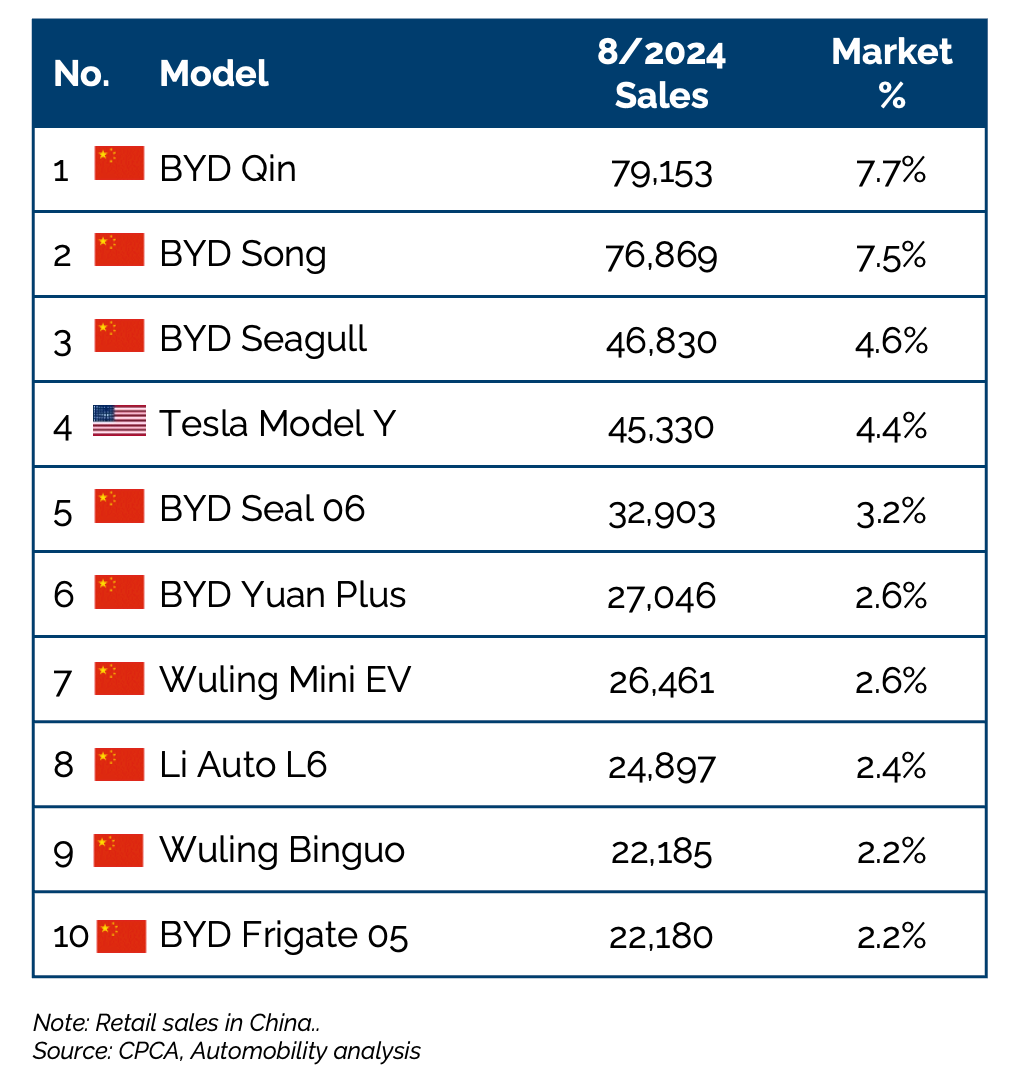

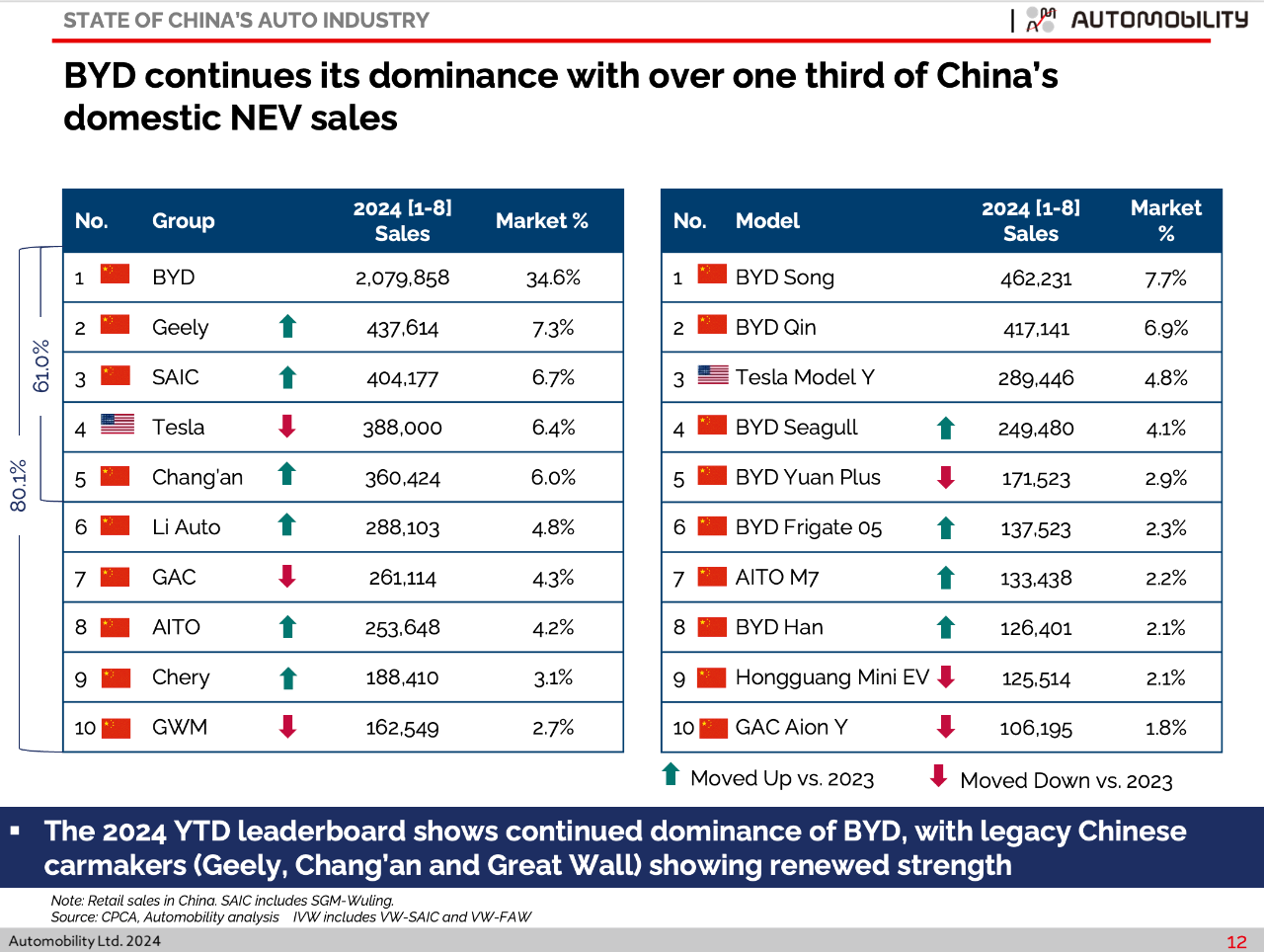

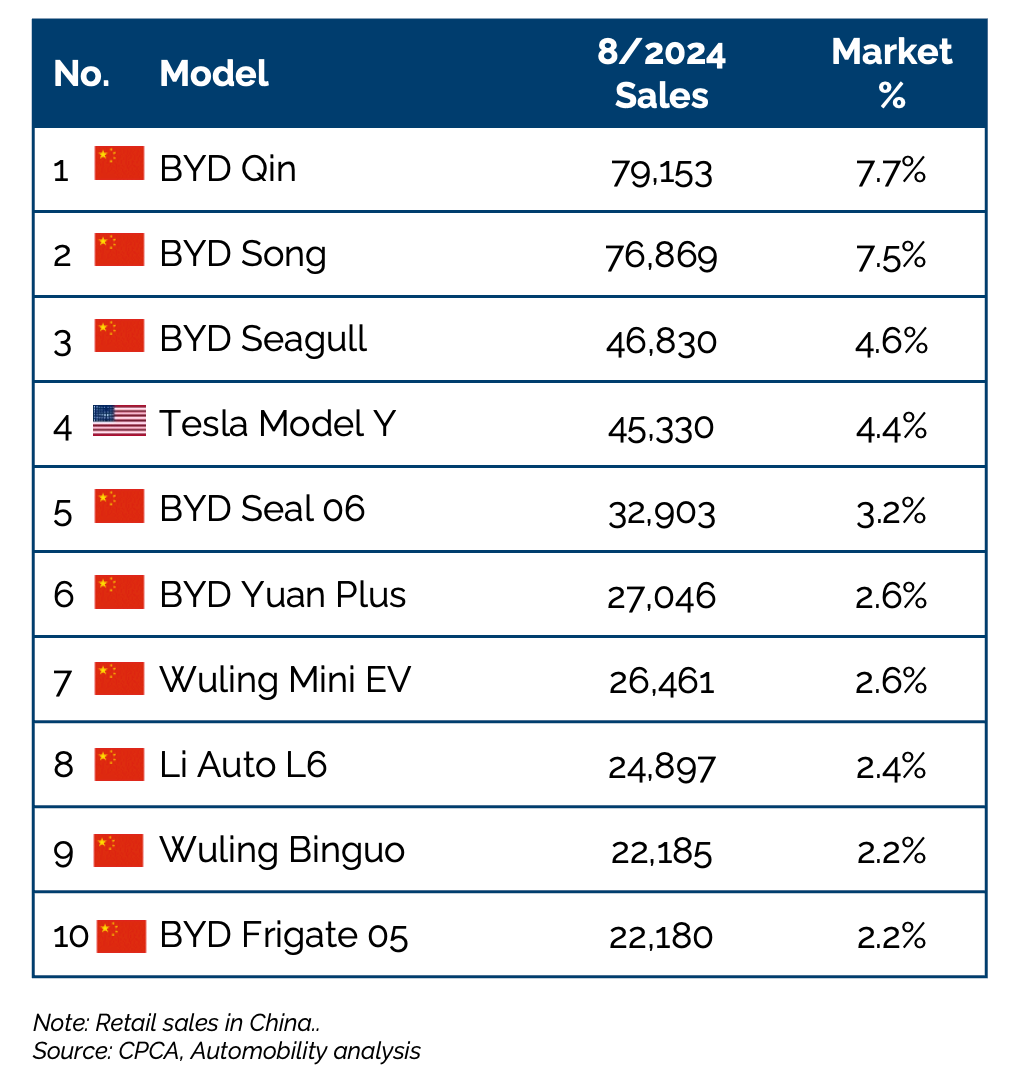

BYD’s lead widened in August, now boasting ~35% share of China’s NEV market. BYD has 5 of the top 6 and 6 of the top 8 best selling nameplates in the market.

Sales Summary through August

When exports are removed from the figures, domestic sales are down 1.9% through August. However, combining these figures masks the truly biggest issue facing the global automakers: the collapse of the domestic ICE market in China.

Viewed on a combined basis, BYD is the clear leader in the market, with 15.3% overall share, widening their lead over Volkswagen, which has fallen to 12.6%. Foreign carmakers remain stuck in the shrinking ICE lane.

BYD’s lead widened in August, now boasting ~35% share of China’s NEV market. BYD has 5 of the top 6 and 6 of the top 8 best selling nameplates in the market.

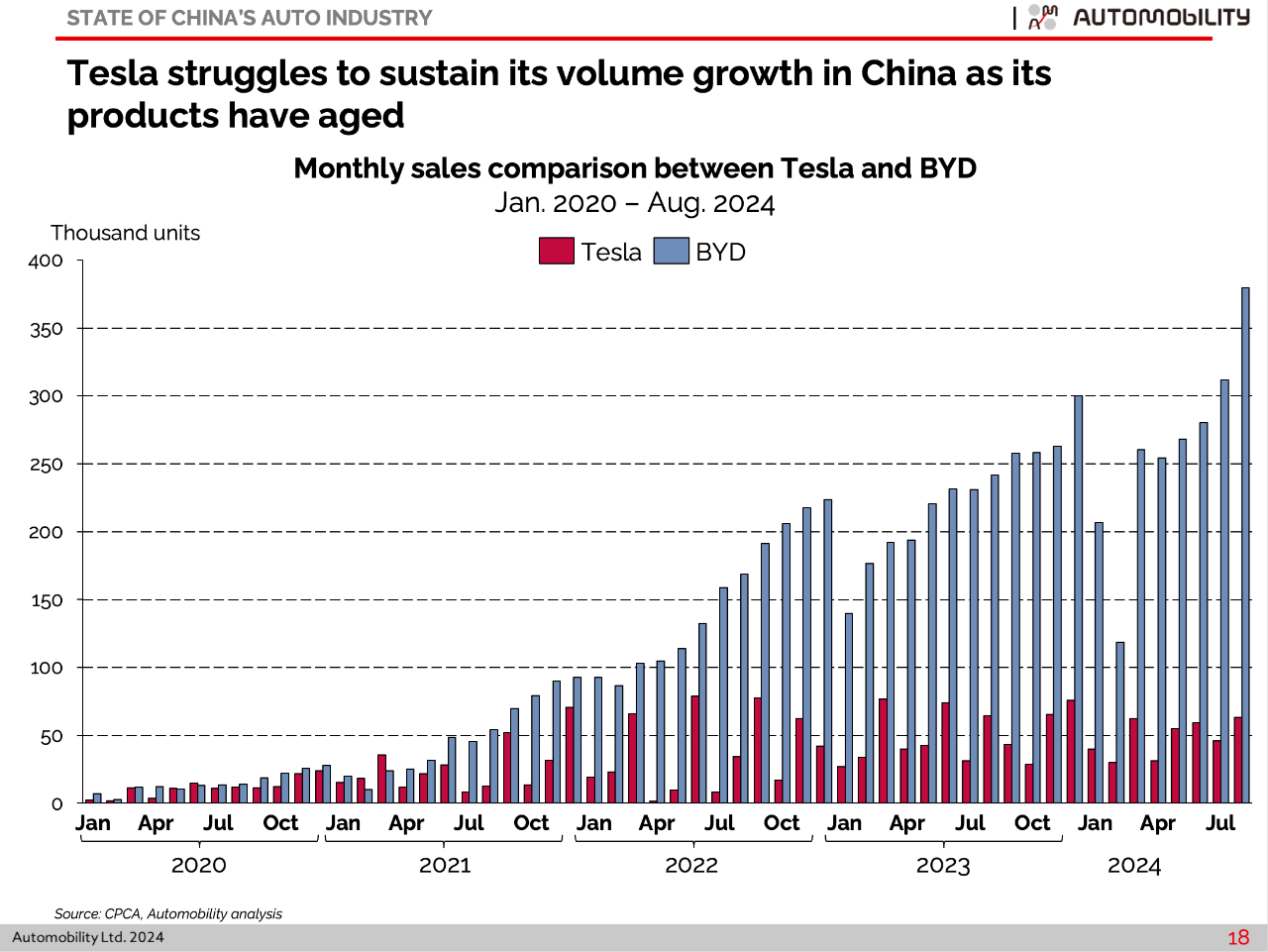

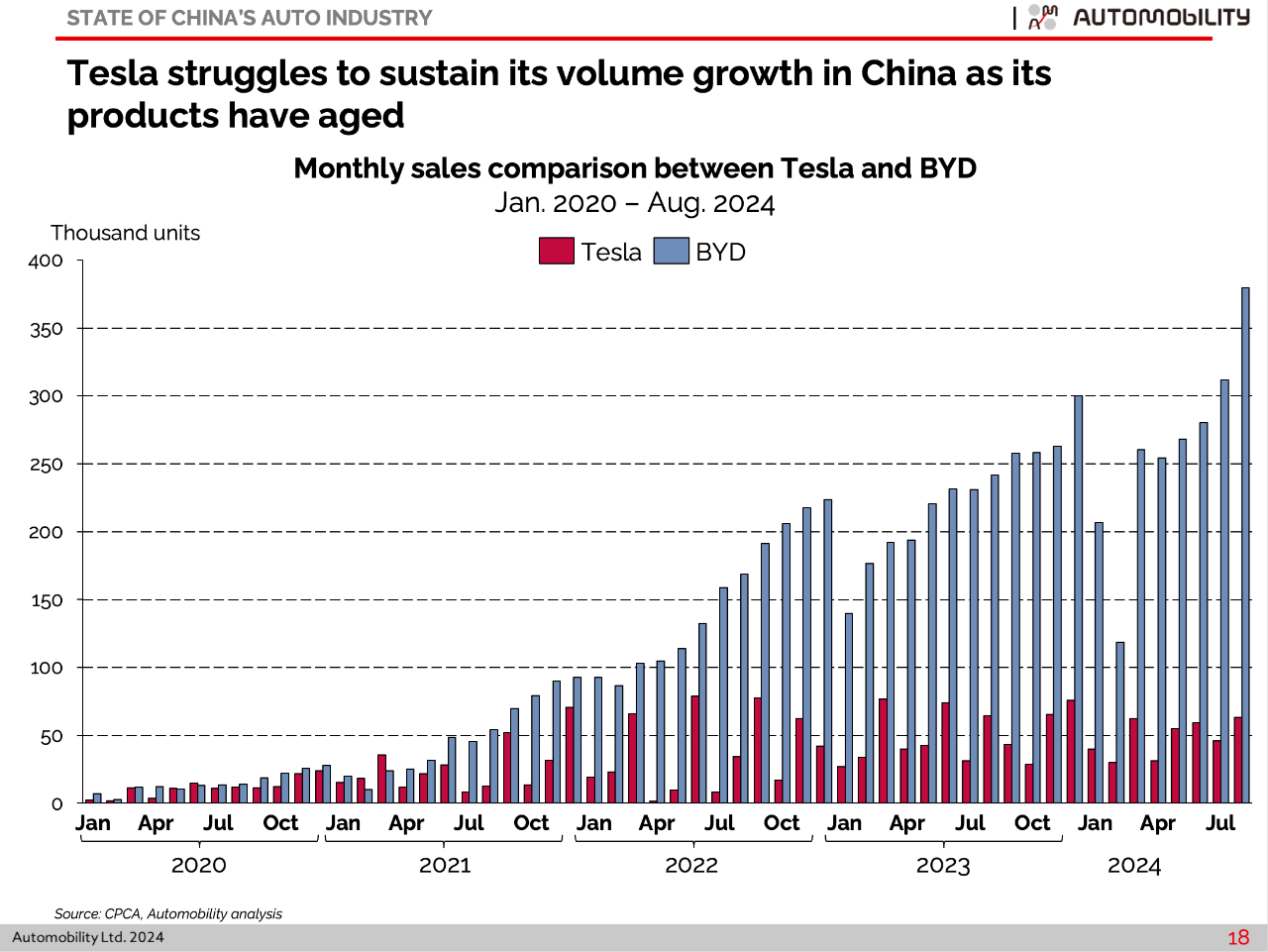

Tesla is the only foreign branded carmaker among the NEV leaders in 2024, but their sales have stagnated as the market for pure BEV vehicles remains flat. As shown in the chart below which dates back to 2020, Tesla sales peaked in 2022, while BYD sales have continued their steady climb.

BYD holds the top 3 positions on the top 10 NEV models leaderboard, as well as 5 of the top 6 best selling models. Other than BYD, Tesla’s Model Y came in 4th place, Wuling took 7th and 9th place with their Honguang MiniEV and Binguo BEV offerings. Li Auto’s L6 took 8th place.

BYD holds the top 3 positions on the top 10 NEV models leaderboard, as well as 5 of the top 6 best selling models. Other than BYD, Tesla’s Model Y came in 4th place, Wuling took 7th and 9th place with their Honguang MiniEV and Binguo BEV offerings. Li Auto’s L6 took 8th place.

After the Storm: Competing in China’s New Automotive Landscape

This was the title I gave to the 2024 AmCham Shanghai Automotive Conference, as developments in the market are sweeping away any vestige of the dominance of the legacy carmakers. Its time to step back and re-assess the entire approach and determine a way forward in what is emerging as an entirely new game. For those who missed, please have a look at our recap linked below:

2024 AmCham Automotive Conference

On September 10, I was very privileged to chair the AmCham Shanghai signature 2024 Automotive Conference After the Storm: Competing in China’s New Automotive Landscape at The Westin Bund Center Shanghai, where I was joined by industry experts to explore key trends and emerging opportunities in the era of the Intelligent Connected Vehicle. Over 100 attendees joined the all-day event.

Recap | AmCham Shanghai 2024 Automotive Conference

Through August, passenger vehicle NEV sales surpassed 6 million units and the segment is clearly dominated by local brands. Sales of pure ICE are shrinking rapidly and foreign brands must adapt or face elimination as this market continues its downward spiral.

Since 2020, foreign brands have lost 27% share of the Chinese passenger vehicle market. Sales of non-Chinese brands are down by double digits year-over-year, regardless of brand origin. At the same time, local brand PV sales have increased over 20% versus 2023 – in a market that is down 2% versus last year.

Since 2020, foreign brands have lost 27% share of the Chinese passenger vehicle market. Sales of non-Chinese brands are down by double digits year-over-year, regardless of brand origin. At the same time, local brand PV sales have increased over 20% versus 2023 – in a market that is down 2% versus last year.

Join us on Tuesday, October 22 at 9am China time for our monthly State of China Auto Market webinar, hosted by the American Chamber of Commerce in Shanghai.

Webinar | State of China Auto Market Monthly Briefing (October) | AmCham Shanghai (Scan the below QR to register)

Automobility Original Articles

This month, we published 2 original articles describing how the China market is impacting the global automotive industry.

The first is From Smart EV to Smart Grid: The Internet of Energy Ecosystem (linked below in both English and Chinese), describes how the rapid market adoption of NEVs has bolstered China’s capabilities in vehicle-related supply chains and also extends the utility of the vehicle as an asset within the energy infrastructure. This includes the “local area” charging infrastructure as well as the “wide area” energy management systems, ultimately integrating vehicles into the ‘Internet of Energy’ ecosystem — a comprehensive network where Smart EVs become an asset within the overall energy landscape.

From Smart EV to Smart Grid: Building the Internet of Energy Ecosystem

从智能电动汽车到智能电网:构建能源互联网生态

The second article is titled The Path to Globalization of China’s Automotive Industry [2024], and it provides a reflection on how far the China auto market has come since I wrote an article with the same title in 2009. This article written 15 years ago predicted the emergence of Chinese brands as global players, and described a plausible path for this to occur. China surpassed Japan in 2023 to become the world’s largest exporter of vehicles, and surpassing this milestone represents an appropriate time to revisit this topic.

The Path to Globalization of China’s Automotive Industry [2024 Edition]

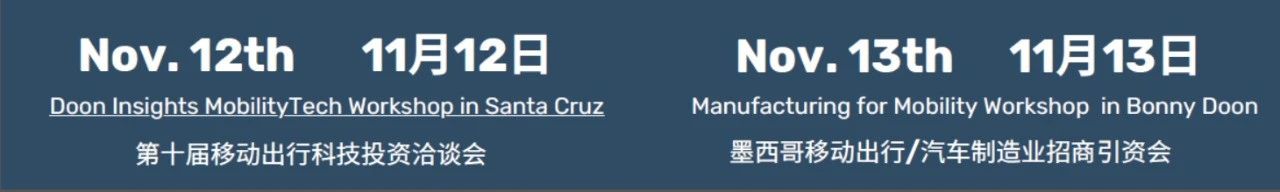

Automobility to Sponsor Doon Insights’ Mobility Tech Workshops

On November 12th, the 10th annual Mobility Tech Workshop will delve into the latest trends and challenges in the mobility sector. The workshop will feature a lineup of 10+ promising startups and discussion panels on “The State of the Global Battery Supply Chain” and “From Private Placement to IPO: The New Path for Mobility Tech.” The program will also include 10+ “Something on My Mind” (SOMM) interactive mini sessions, led by industry leaders, investors, and technologists. This year’s event will take place at the scenic Cocoanut Grove in Santa Cruz, with an evening reception in Bonny Doon, allowing attendees to experience both the coastal and mountainous landscapes of California.

On November 13th, we are excited to introduce a new workshop, Manufacturing for Mobility in Mexico. This event will focus on Mexico’s emerging role as a near-shoring hub for EV production and the mobility supply chain. Industry experts and a delegation of policymakers, industrialists, and investors from Mexico will discuss the benefits of the USMCA, supportive Mexican government policies, and Mexico’s strategic importance in the global automotive and aerospace industries. This workshop will take place in Bonny Doon, CA.

Scan the below QR for details and register:

AUTOMOBILITY MEDIA

- Motor Trend: Reimagining Transportation: Coding the Car 2.0

On September 10, Motor Trend Group released their program titled Reimagining Transportation: Coding the Car 2.0 on the importance of software in the mobility device architecture. We have been anticipating and speaking on this very topic for many years, and I was proud to contribute to this outstanding report:

Reimagining Transportation | Coding the Car 2.0 | MotorTrend

-

TechNode BUZZ: The Race to a Sustainable Future

On September 4th I spoke at the inaugural TechNode event held in Shanghai, on the topic of my chapter of Selling to China: Stories of Success, Failure & Constant Change. A recording of my remarks can be viewed here:

TechNode BUZZ: The Race to a Sustainable Future

-

Bloomberg TV: The China Show

On August 21, I made a guest appearance on The China Show on Bloomberg TV, where I spoke on the weaker conditions that are ahead for many carmakers, except those growing abroad aggressively.

Bill Russo Interview on China Going Global [VIDEO]

-

Tesla faces tough competition in China and slow EV adoption in the U.S., investment advisory firm says

Tesla CEO Elon Musk could be hoping to get support to “slow the advance of the competition he is facing in China,” said Bill Russo, founder and CEO of Automobility, a strategy and investment advisory firm.

Tesla faces tough competition in China and slow EV adoption in the U.S., investment advisory firm says

-

How can China make EVs that sell for less than $20,000?

China has about 100 or so electric vehicle brands. Five EV brands, which include BYD and Tesla, account for 60% of the market, according to the Shanghai-based strategy and investment firm, Automobility. An ongoing price war in China has driven EV prices lower. Plus, there is weak domestic consumer demand.

How can China make EVs that sell for less than $20,000?

(Copy and paste to your browser:

“Many of the Chinese companies are starving, and that’s another reason why they want to go global,” Automobility’s founder and former head of Chrysler’s northeast Asia division, Bill Russo, said.

-

Elon Musk’s China dream stalls as hybrids rush past Tesla

Chinese car buyers are shunning Tesla as rival manufacturers flood the world’s largest car market with more advanced electric vehicle models.

The US company’s share of Chinese EV sales, including battery and plug-in hybrids, slipped to 6.5 per cent in the first seven months of the year from almost 9 per cent a year earlier, according to data from Shanghai consultancy Automobility Ltd.

Bill Russo, the former head of Chrysler in China and founder of Automobility, said Chinese carmakers have quickly met the growing, post-pandemic demand for family cars with a longer driving range. Low-cost, bigger plug-in cars have proved popular for vacation and weekend trips, he said: “Access to charging stations weighs heavily into purchase consideration.”

Elon Musk’s China dream stalls as hybrids rush past Tesla

(Copy and paste to your browser: https://www.ft.com/content/5efcef9f-645d-44cb-96cf-9cd19719d4aa)

You can follow us for regular updates on these online channels by scanning the QR codes:

If your organization would like a custom briefing on the State of China’s Auto Market, please reach out to us at info@automobility.io

If your organization would like a custom briefing on the State of China’s Auto Market, please reach out to us at info@automobility.io

About Bill Russo

Bill Russo is the Founder and CEO of Automobility Limited, and is currently serving as the Chairman of the Automotive Committee at the American Chamber of Commerce in Shanghai. His over 40 years of experience includes 15 years as an automotive executive with Chrysler, including 21 years of experience in China and Asia. He has also worked nearly 12 years in the electronics and information technology industries with IBM and Harman. He has worked as an advisor and consultant for numerous multinational and local Chinese firms in the formulation and implementation of their global market and product strategies.

Bill is a contributing author to the book Selling to China: Stories of Success, Failure, and Constant Change (2023), where he describes how China has become the most commercially innovative place to do business in the world’s auto industry – and why those hoping to compete globally must continue to be in the market.

About Automobility

Automobility Limited is global Strategy & Investment Advisory firm based in Shanghai that is focused on helping its clients to Build and Profit from the Future of Mobility. We help our clients address and solve their toughest business and management issues that arise in midst of fast changing, complicated and ambiguous operating environment. We commit to helping our clients to not only “design” the solutions but also raise or deploy capital and assist in implementation, often together with our clients.

Contact us by email at info@automobility.io

PLEASE NOTE: The information and analysis shared in this newsletter, including the charts and style of materials presented, is the intellectual property of Automobility Ltd. While we share it as a way to serve our existing and new clients, it is not to be used without our express consent and then only with attribution. Any publication, reproduction or other use of this material without the express written consent of Automobility Ltd is prohibited.

Sorry, the comment form is closed at this time.