17 Sep From Smart EV to Smart Grid: The Internet of Energy Ecosystem

By Bill Russo, Jackie Tang and Jayce Lu

Since the beginning of this century, China has adopted electrification of mobility as a national strategy to enhance its energy security. The country currently imports about 70% of its oil, making it heavily dependent on foreign energy resources — a risky situation in a period of growing geopolitical uncertainty. Reducing reliance on imported energy resources has therefore been a long standing strategic priority for China. Over the past decade, efforts to develop intelligent new energy vehicle (NEV) supply chain capabilities have driven down costs and improved user experiences, addressing significant barriers that previously hampered large-scale New Energy Vehicle (NEV)* commercialization.

The rapid market adoption of NEVs in recent years has not only bolstered China’s capabilities in vehicle-related supply chains but it also extends to downstream utility of the vehicle as an asset within the energy infrastructure. This includes the “local area” charging infrastructure as well as the “wide area” energy management systems, ultimately integrating vehicles into the ‘Internet of Energy’ ecosystem — a comprehensive network where Smart EVs become an asset within the overall energy landscape.

The exponential rise of New Energy Vehicles in China

Over the past two decades, China’s NEV development has evolved rapidly. Prior to 2009, the focus was on advancing the automotive sector with an emphasis on promoting investments and experimentation in the electrification of the mobility sector.

In 2009, the Chinese government continued to stimulate the market by announcing a tax cut on smaller cars and offering incentives on vehicle sales in rural areas. In the same year, the government issued an automotive industrial policy with eight development goals for 2009 to 2011. The goals were designed to ensure the steady growth of automobile production and sales in China, and provide support for new energy vehicles research, aiming to leapfrog the developed markets with newer and more efficient propulsion technologies.

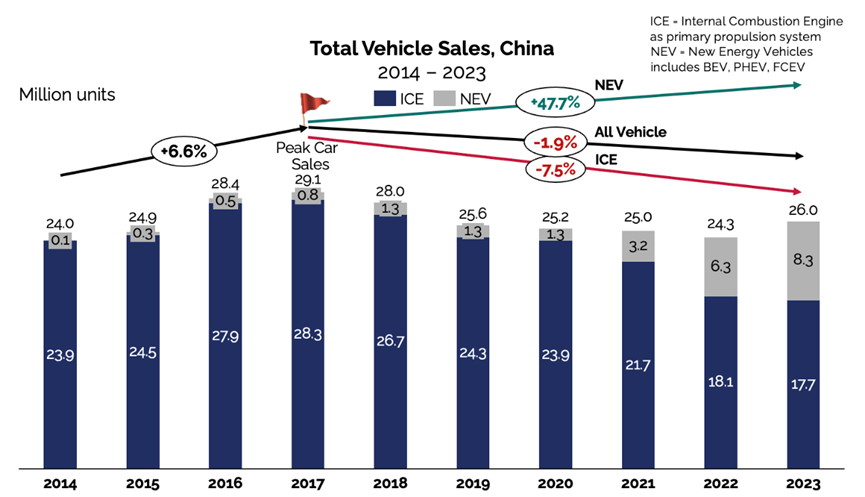

Vehicle sales expanded through 2017 (see Figure 1) with a gradual adoption of NEV, driven mainly by heavily incentivized fleet purchases. It is notable that 2017 was also the peak year for domestic automobile sales, and NEV sales were a mere 2.7% of the overall market.

Since 2018, China has transitioned from a subsidy-driven model to a more mature approach, shifting from a subsidized push to fleets to a more market-led retail pull. In that year the National Development and Reform Commission (NDRC) revealed that foreign ownership limits on automakers would be phased out over a 5-year transition period. This cap would first be eliminated on foreign investment in New Energy Vehicles, followed by the elimination of the cap for all types of ventures by 2023. In May 2018, Tesla announced a vehicle assembly manufacturing agreement with the Shanghai government to build its Gigafactory 3 in the Lingang free trade zone. Chinese authorities provided cheap land and low-interest loans, expecting in return that Tesla would groom local suppliers and spur the Chinese EV industry.

Notably, the establishment of Tesla’s Gigafactory in Shanghai in 2019 significantly stimulated the entire EV supply chain in China by introducing attractively priced and well-equipped electric vehicles to the market. Meanwhile, the emergence of new Chinese EV entrants and traditional OEMs increasingly tapping into the EV market with groundbreaking technologies and models has further diversified and enriched the ecosystem. This vibrant competition and innovation have been crucial in promoting the widespread adoption of EVs across China. In July 2024, monthly sales of NEVs surpassed those of pure gasoline-powered passenger vehicles for the first time.

Three waves of disruption in China’s automotive industry

Focusing exclusively on electrification would not comprehensively describe the revolution that is taking place in China’s mobility sector – within which China’s internet economy is exerting a transformational force.

China’s emerging advantage is no longer purely derived from government policy and foreign investment. China has passed an inflection point and is experiencing a secular and generational shift in how mobility demand is served, with a corresponding exponential rise of Smart EV technology.

We are at the early stage of mobility revolution sparked by entrance of internet and communications technology (ICT) players in the mobility sector. The internet population in China reached nearly a billion users by the end of 2020, providing a huge market for services-oriented demand aggregation. Virtually all of China’s population is served by mobile internet platforms that provide services that involve people or goods movement – and the internet economy is actively investing to optimize the economics of services that invoke some form of mobility.

Entrepreneurial private enterprises have emerged from the digital economy to invest in mobility innovation. As a result, the information and internet technology revolution that started in the late 20th century is now acting as an accelerating force for mobility innovation. The creation and commercialization of the consumer-oriented internet has transformed devices we interact with daily into service-oriented, software-defined platforms.

Digital platform players including China’s internet giants (Baidu, Alibaba and Tencent) and smart device makers (Huawei and Xiaomi) are investing heavily to create smart solutions that unlock new recurring revenue streams linked to mobility, energy and other online and offline services.

China’s digital economy is setting the pace for an entirely new services-centric business model where “new game” commercial opportunities are created. This “new game” is highly embedded in the digital ecosystem and will change the car from a device monetized primarily when sold to a device monetized in multiple ways over its productive life cycle. New Game players often emerge from digital ecosystems and have experience monetizing other software-defined smart devices, and are highly efficient aggregators of services that are accessed through smart devices.

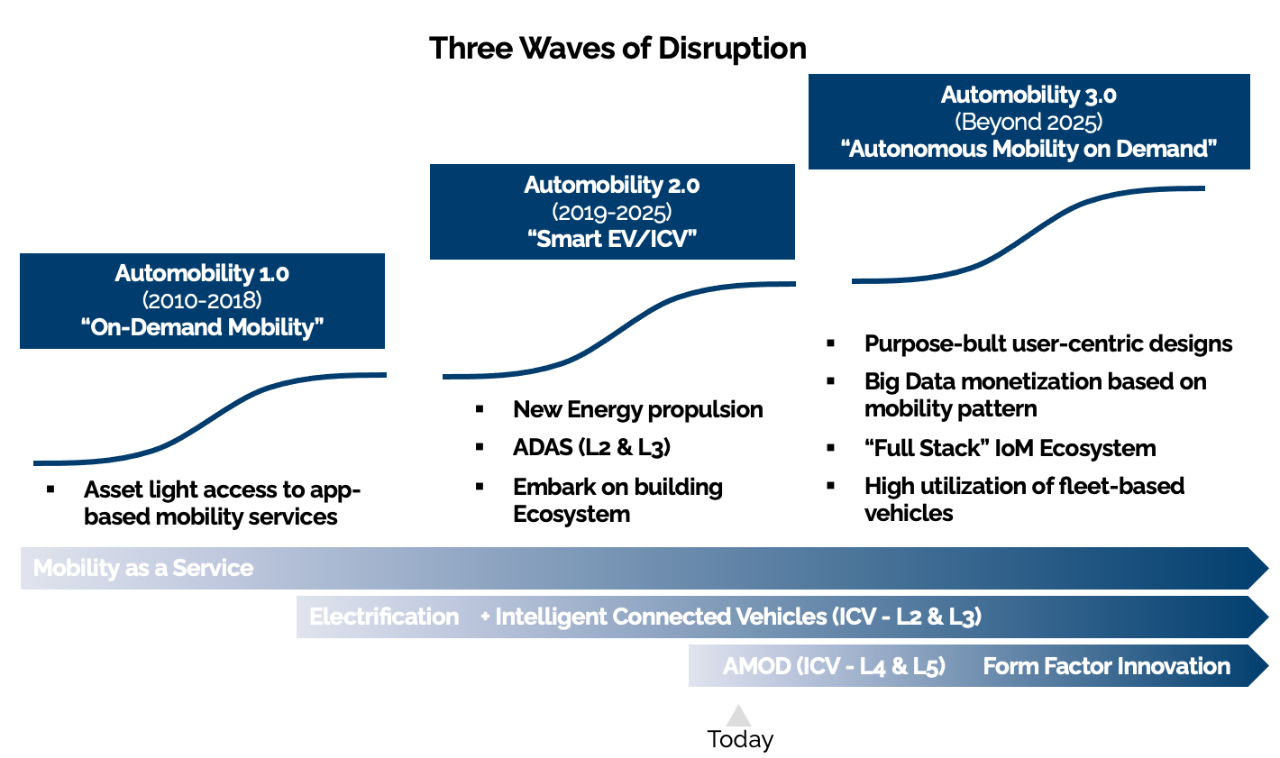

The disruptive forces that are emanating from China and its automotive industry are not merely a shift in propulsion technology. Through a combination of state-backed support alongside entrepreneurship and the massive scale of its mobility and internet sectors, China is transforming the mobility sector through three stages of development (see Figure 2). These waves, which were initiated and scaled in China, have democratized mobility by making mobility solutions more affordable and accessible.

Figure 2 | The Three Waves of Automobility Disruption

We live in an era where big data is used to provide personalized services that are often accessed through a smart device, powered by the mobile internet. These smart device technologies are now being incorporated into the devices that transport people and goods, which will revolutionize the business of how these devices are monetized. This began in the with app-based on-demand mobility solutions, which scaled rapidly in China in the Automobility 1.0 era.

Mobility-related services provide access to daily life needs and conveniences, linking us between the places we live, work and play. Multi-modal traffic systems, parking infrastructure, charging stations, public services have all become available through on-demand platforms, bringing with it investments from the internet giants and device players.

China’s auto sector has fully embraced the “Smart EV” or “Intelligent Connected Vehicle (ICV)” era in the Automobility 2.0 era. As a result, we are witnessing a rapid acceleration of the commercialization of new energy vehicle (NEV) propulsion technology and advanced driver assistance systems (ADAS), making mobility safer, more economical and partially freeing the driver from the mundane task of actuating the vehicle movements.

This will lead to the Automobility 3.0 autonomous mobility on demand (AMOD) era where people (robo-taxi) and goods (robo-delivery) movements are automated. Of course, driver-actuated mobility will co-exist with such devices, but the overall economic advantages of smart, autonomous vehicles will spark large-scale commercial deployment.

With its large and commercially aggressive digital economy, China is effectively transforming the traditional product-centric automotive industry business into a services-centric Internet of Mobility business model.

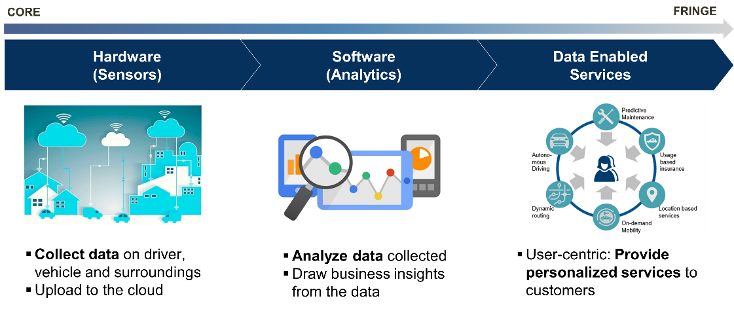

When the vehicle is conceptualized as a smart device, it collects information on the users, the vehicle, and its surroundings. All the data generated from the vehicle and users can be uploaded to the cloud for analytics to better provide data-enabled services to users in vehicles (see Figure 3).

Figure 3 | Internet of Mobility Data Monetization

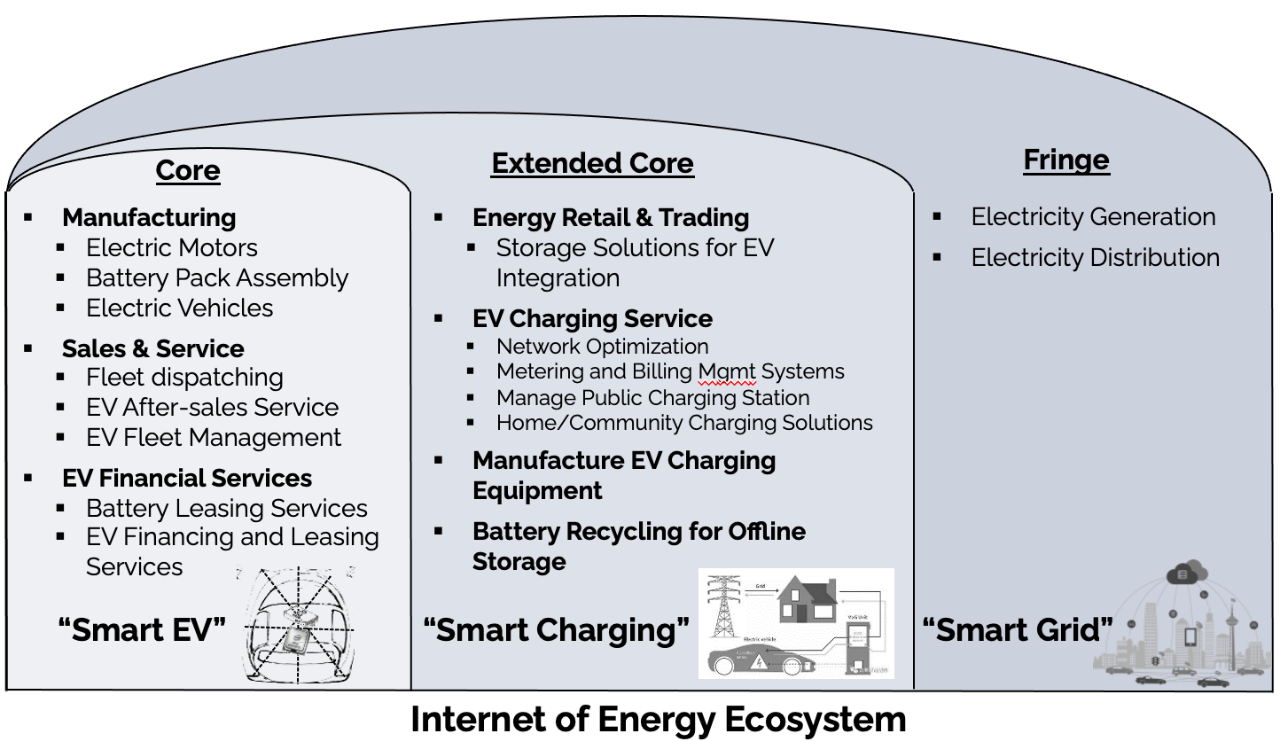

The emergence of the Internet of Energy Ecosystem

In our October 2021 paper titled How the Smart EV Powers the Transition to Smart Energy Management we introduced the concept of the “Internet of Energy Ecosystem”. Since then, we have observed a clear development trend extending from the core of smart EV technologies to the fringe areas of the smart grid. Electric vehicles are increasingly functioning as distributed energy storage units within this ecosystem, enabling not just energy storage but also dynamic energy communication with the grid. This integration enhances grid stability and increases the penetration of renewable energy sources, reflecting a transformative shift where EVs contribute to a more resilient and flexible energy management system.

In this evolving landscape, innovative business models are emerging that go beyond the core Smart EV ownership experience to tap into fringe Smart Grid revenue streams (see Figure 4). Smart EV makers are actively providing proprietary charging solutions to deliver better EV user experiences and brand recognition. For instance, NIO is a pioneer and strong advocate for battery swapping technology through its NIO Power initiative. Its innovative Battery-as-a-Service (BaaS) model allows users to select battery sizes based on daily needs and upgrade as technology advances, ensuring optimal vehicle performance and range. Additionally, by decoupling the battery cost from the vehicle purchase price, NIO has made its BEVs more affordable. NIO has also been a pioneer in Vehicle-to-Grid (V2G) technology since 2019, deploying V2G stations in pilot cities to further integrate EVs into the energy ecosystem.

EV Charging Infrastructure in China

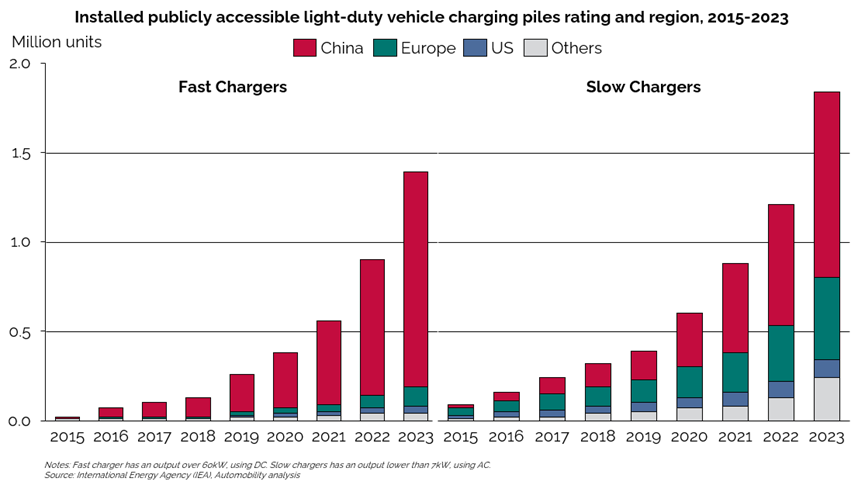

China leads globally in the deployment of EV charging infrastructure, with significant growth in both fast and slow chargers (see Figure 5). By 2023, China had dramatically increased its number of chargers, outpacing Europe and the US. The ratio of NEVs to public chargers has remained steady, while private home chargers have improved in availability. Fast charging is preferred, with a high market concentration among leading operators.

Source: International Energy Agency (IEA), Automobility analysis

Innovation in Local Energy Management via V2G

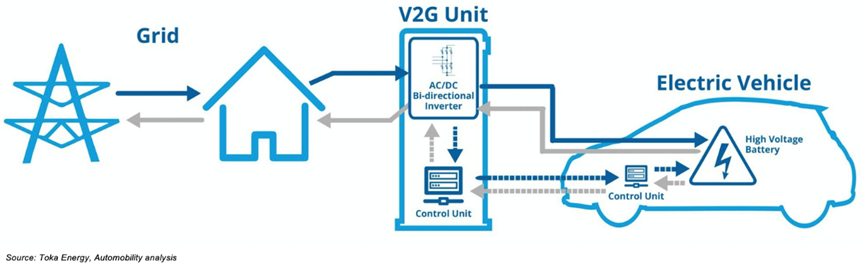

With increasing adoption of electric vehicles and expanded installation of personal charging stations, significant challenges have emerged for residential community power infrastructures. Unmanaged charging can strain power grids. In the short term, employing a Time-of-Use (ToU) Pricing mechanism to guide orderly charging is advisable. This approach encourages EV owners to charge during off-peak hours, which not only offers lower electricity rates but also reduces the load during peak demand periods, thereby helping to stabilize the grid and optimize energy consumption patterns. In the mid-term, the introduction of Vehicle-to-Grid (V2G) and Distributed Energy Resources (DERs) will enhance the flexibility of power management significantly (see Figure 6). In the long term, substantial grid upgrades will be essential and should be planned in advance to accommodate future demands.

Electric vehicles can serve as mobile energy storage units. With V2G technology, EVs can facilitate bidirectional charging, allowing them not only to draw power but also to feed it back into the grid, thus balancing electricity usage during peak times. Implementing V2G functionality requires technical upgrades, including an updated Battery Management System (BMS) that supports bidirectional charging and manages the two-way energy flow. Additionally, onboard chargers and communication protocols must be upgraded to ensure seamless and efficient grid integration. Charging stations also need enhancements to include bidirectional capabilities and must be equipped with intelligent management systems and advanced communication interfaces to effectively manage this bidirectional energy flow.

However, integrating V2G technology presents several challenges. The technical complexity of modifying existing EV and grid infrastructures represents a significant hurdle. Moreover, frequent charging and discharging can accelerate battery degradation, impacting the long-term viability and cost-effectiveness of EVs. Economic considerations are also pivotal, as a financial model that justifies the costs associated with battery wear and infrastructure upgrades is still in development. Lastly, ensuring the safety of bidirectional energy transactions is crucial to prevent potential risks to both the vehicles and the grid.

Figure 6 | Vehicle-to-Grid (V2G) and Distributed Energy Management

Distributed Energy Resources, Virtual Power Plants and the Future of Urban Energy Management

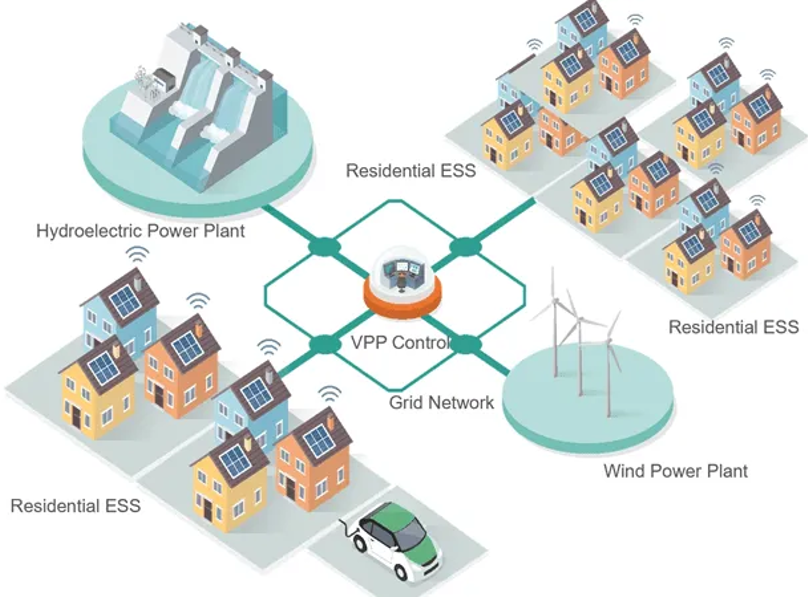

Figure 7 | Virtual Power Plants

Virtual Power Plants (VPPs) represent a transformative approach in modern energy management by integrating DERs from industrial and residential sectors to optimize and monetize regional energy assets. VPPs utilize intelligent software to coordinate numerous small-scale energy resources in real time, enhancing efficiency and responding swiftly to fluctuations in demand. For example, Shanghai’s Huangpu District’s VPP initiative, which began in 2016, has demonstrated significant success in integrating and managing loads in both commercial buildings and residential communities.

Figure 8| Commercial Building Operation and Residential Demand Response Platform

The future of urban energy management and the growth of the Internet of Energy will increasingly depend on the strategic integration of these technologies and active participation from various stakeholders. The overall energy transition is a prolonged process that relies on a top-down approach to enact complex grid reforms. This strategy is essential for effectively transforming urban energy management through innovation and collaboration, paving the way for a more sustainable and efficient urban energy ecosystem.

Bill Russo is the Founder and CEO of Automobility Limited. His over 35 years of experience includes 15 years as an automotive executive with Chrysler, including over two decades of experience in China and Asia. He has also worked nearly 12 years in the electronics and information technology industries with IBM and Harman. He has worked as an advisor and consultant for numerous multinational and local Chinese firms in the formulation and implementation of their global market and product strategies. Bill is also currently serving as the Chair of the Automotive Committee at the American Chamber of Commerce in Shanghai.

Jackie Tang is an Associate at Automobility Limited.She has over a decade of professional experience, including 6 years in consulting, specializing in the automotive and digital sectors, and 5 years in the mobility and autonomous driving industry. She possesses a deep understanding of China’s automotive industry, particularly in the areas of shared, electrified, connected, and autonomous transformations. Jackie has also led several pioneering “0-1” projects, from the design of innovative business models to their successful implementation.

Jayce Lu is a Consultant at Automobility Limited. He has over 6 years of professional experience includes 3 years as an auditor with PwC handling IPOs and audits for automotive, energy and aviation industries. He has worked as an investor at a venture capital firm specializing in Fintech investments. Jayce is currently working as a consultant at Automobility in consulting and investment advisory, serving numerous multinational firms and startups in their strategies and fundraising activities.

Contact Jayce by email at jayce.lu@automobility.io

Sorry, the comment form is closed at this time.