24 Aug State of China’s Auto Market – August 2024

Comments from Bill Russo, Founder & CEO of Automobility Ltd.

2024 HALF YEAR HIGHLIGHTS

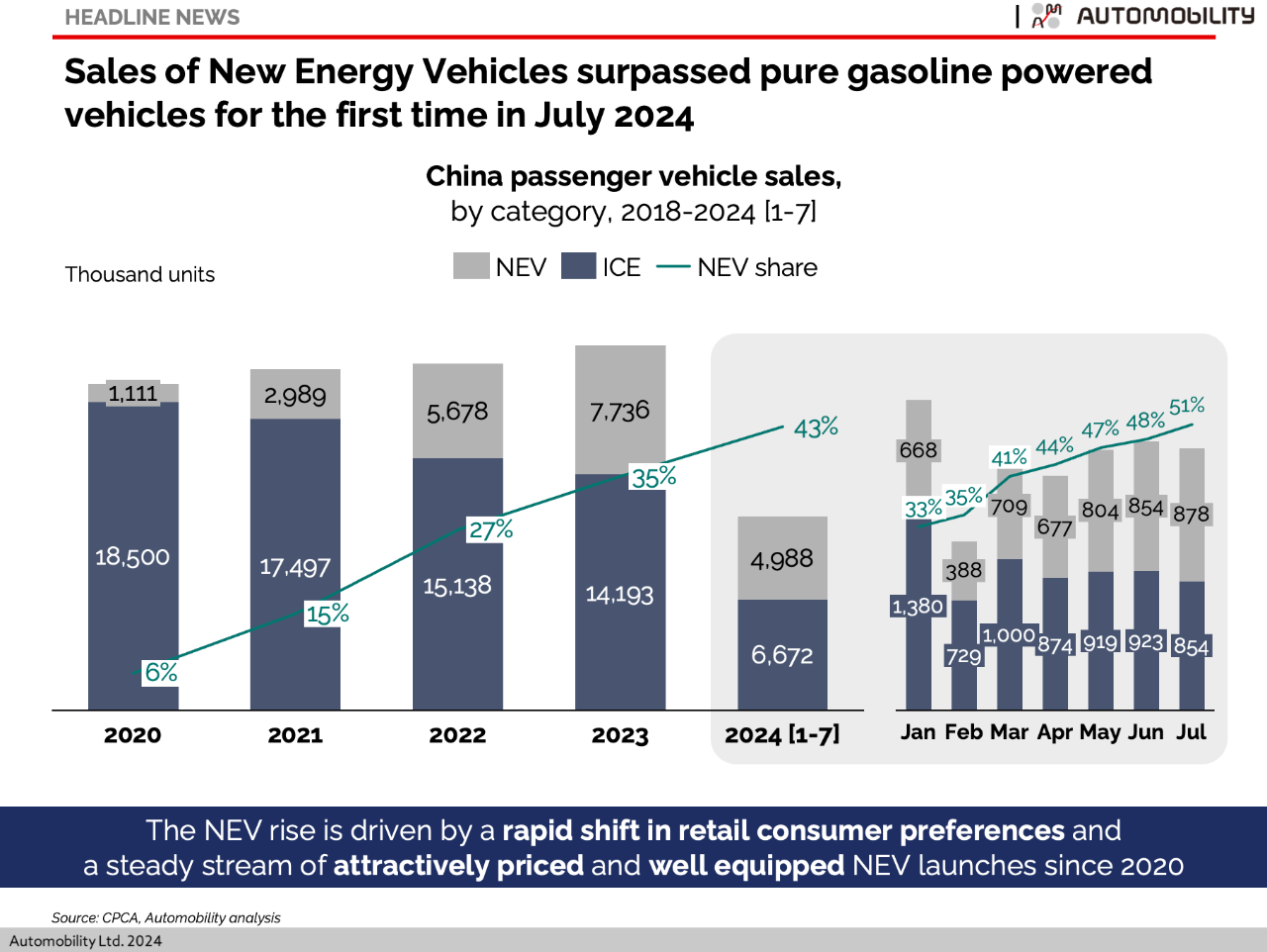

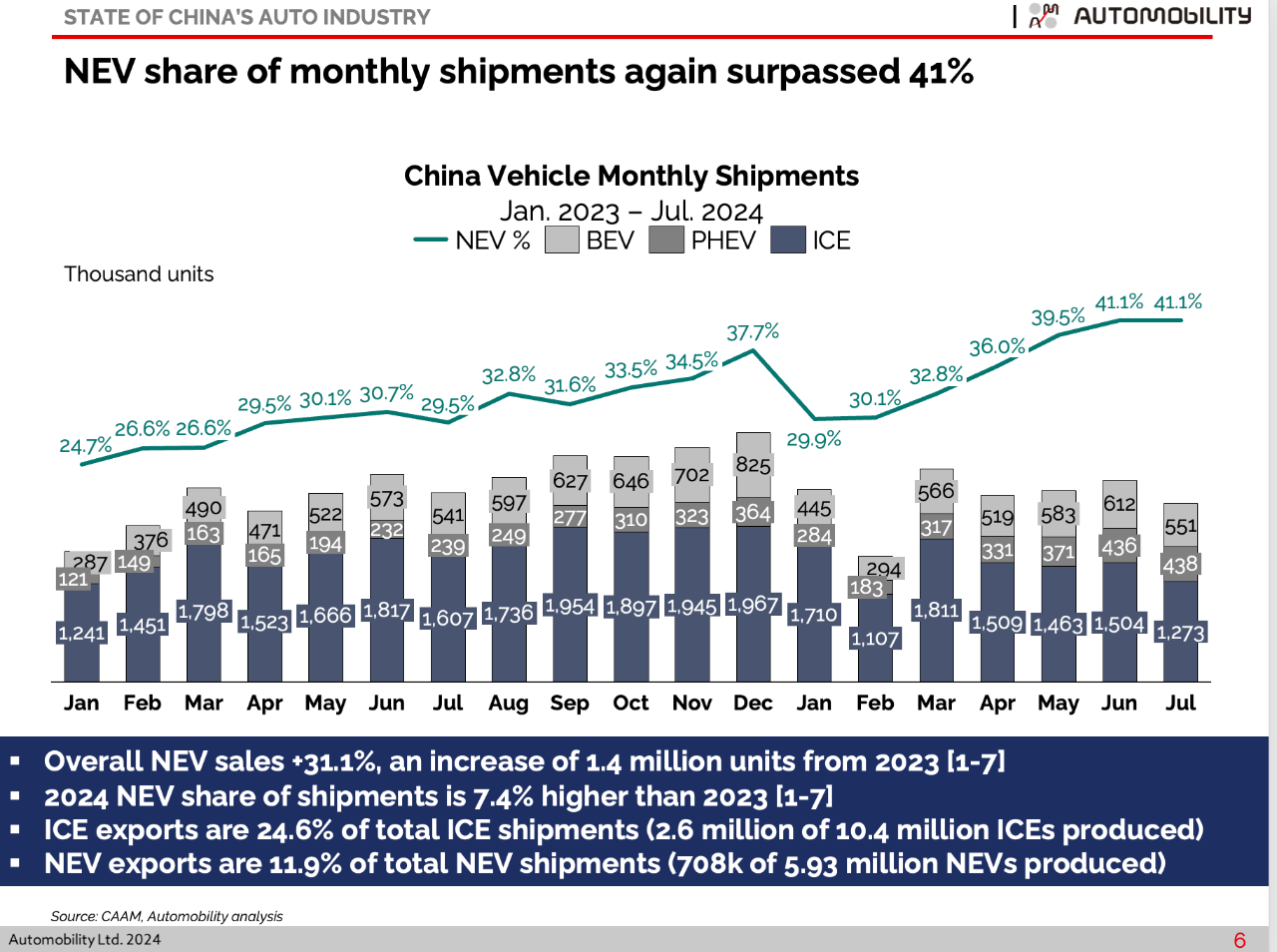

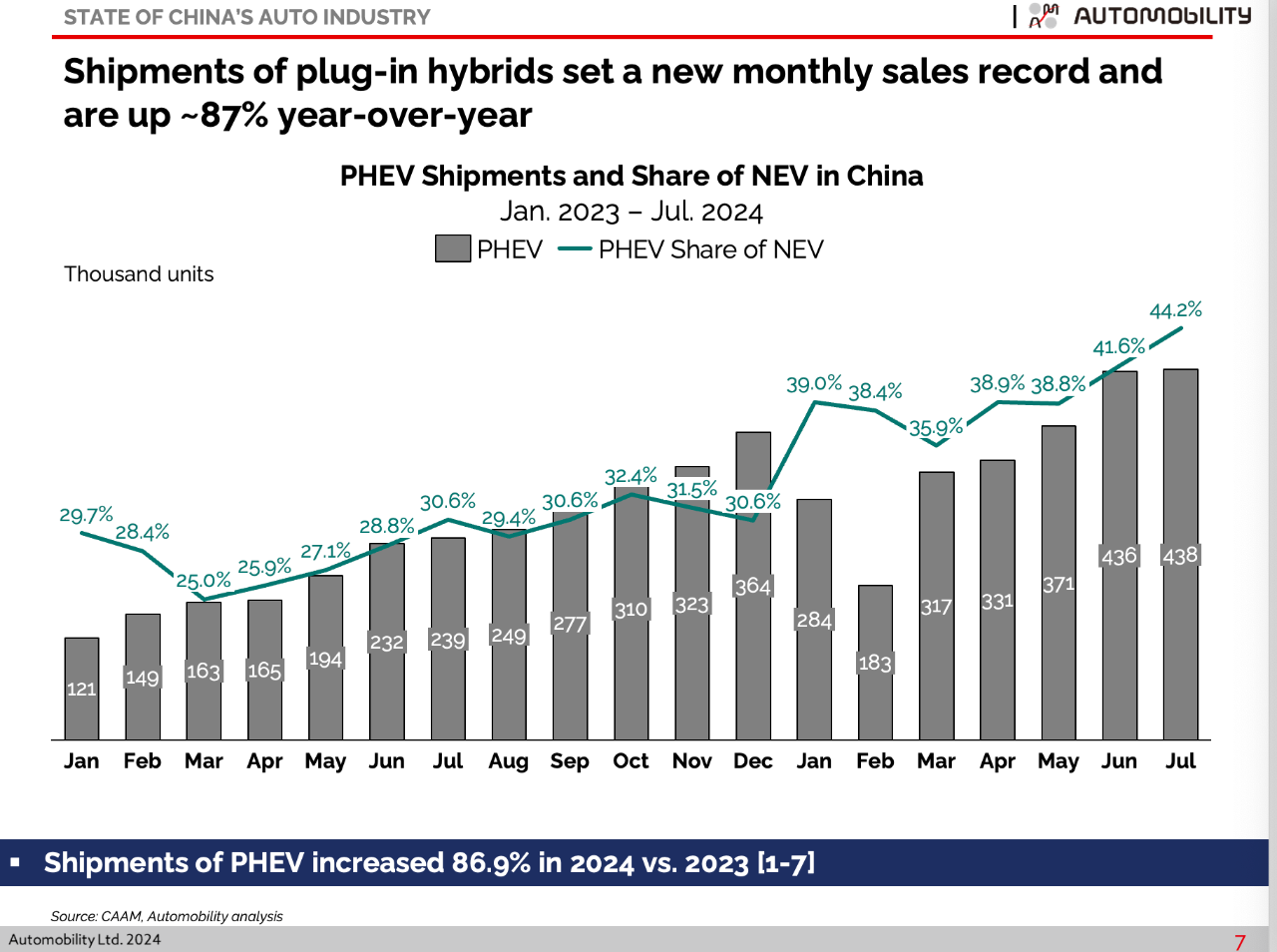

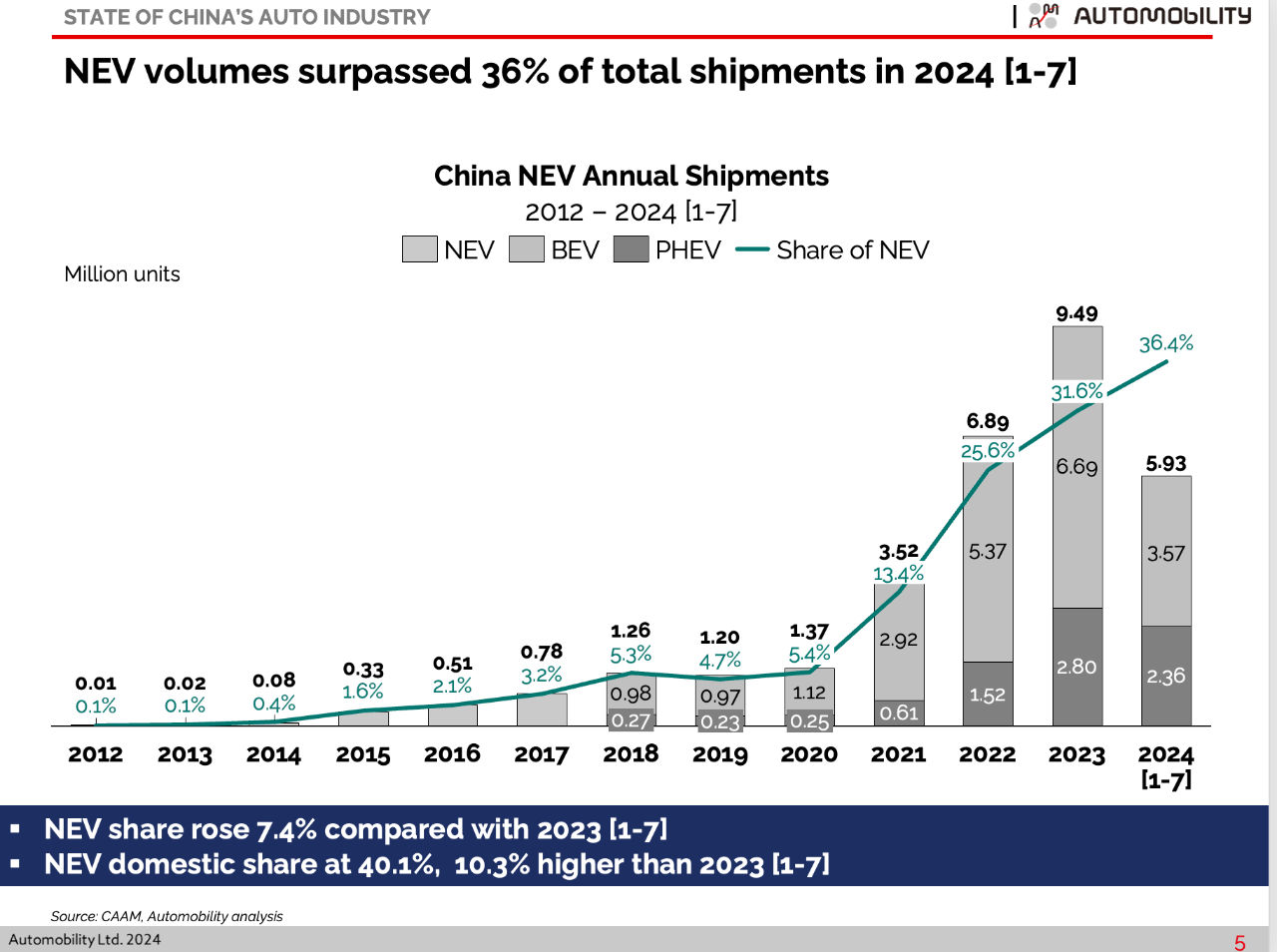

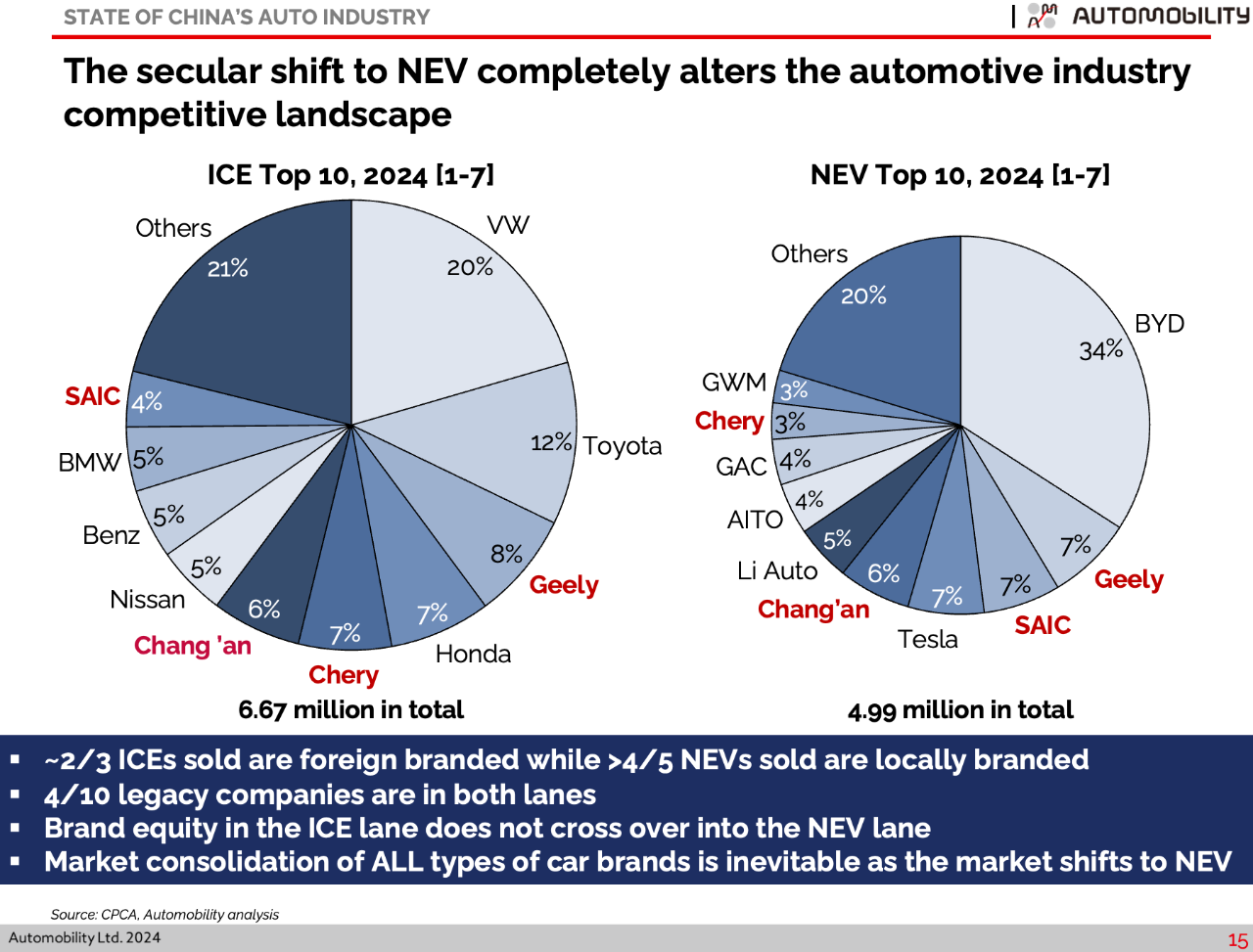

- NEV passenger vehicle sales surpassed gasoline powered vehicles for the first time on a monthly basis in July.

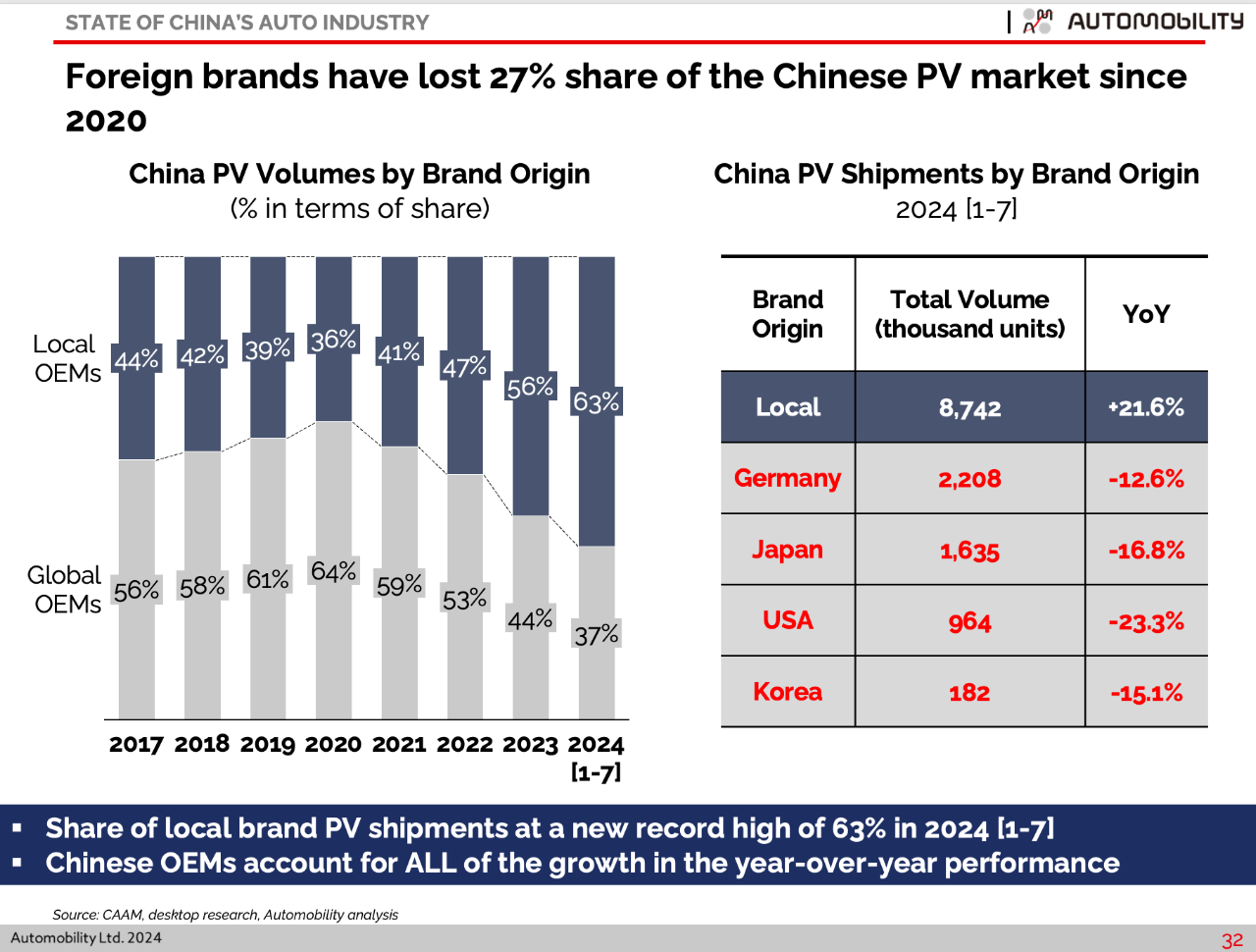

- Chinese brands now hold 63% share of the passenger vehicle market, an increase of 27% since 2020.

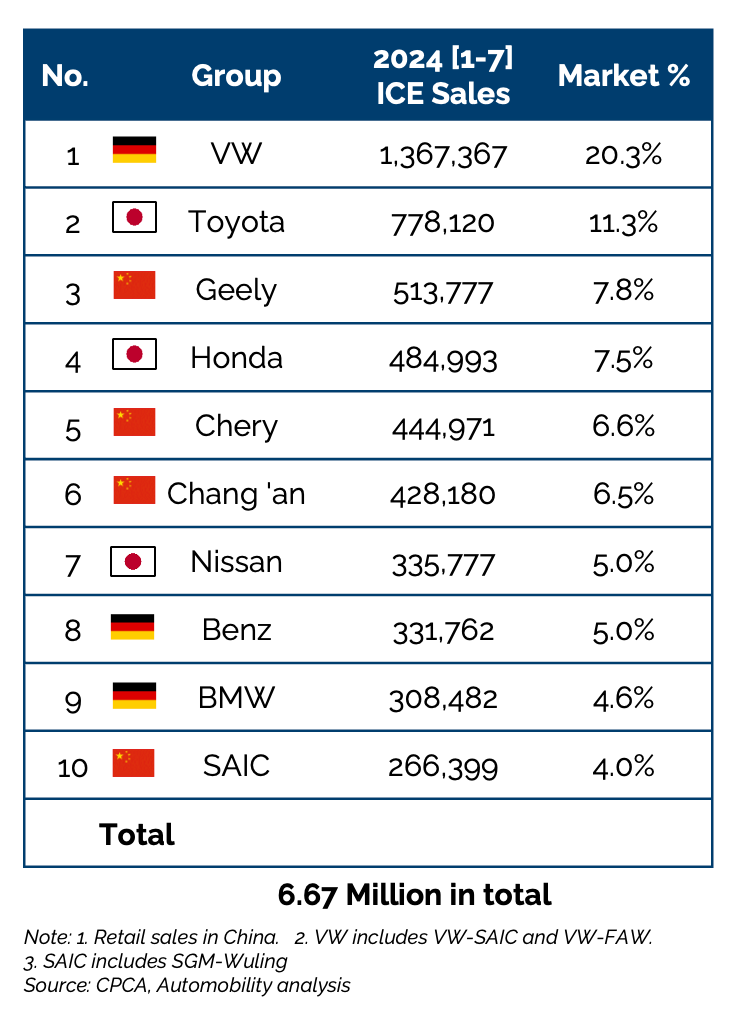

- In addition to their NEV dominance, Chinese brands are also gaining strength in the larger-but-shrinking ICE lane. Geely, Chery and SAIC have all recorded ICE market share gains.

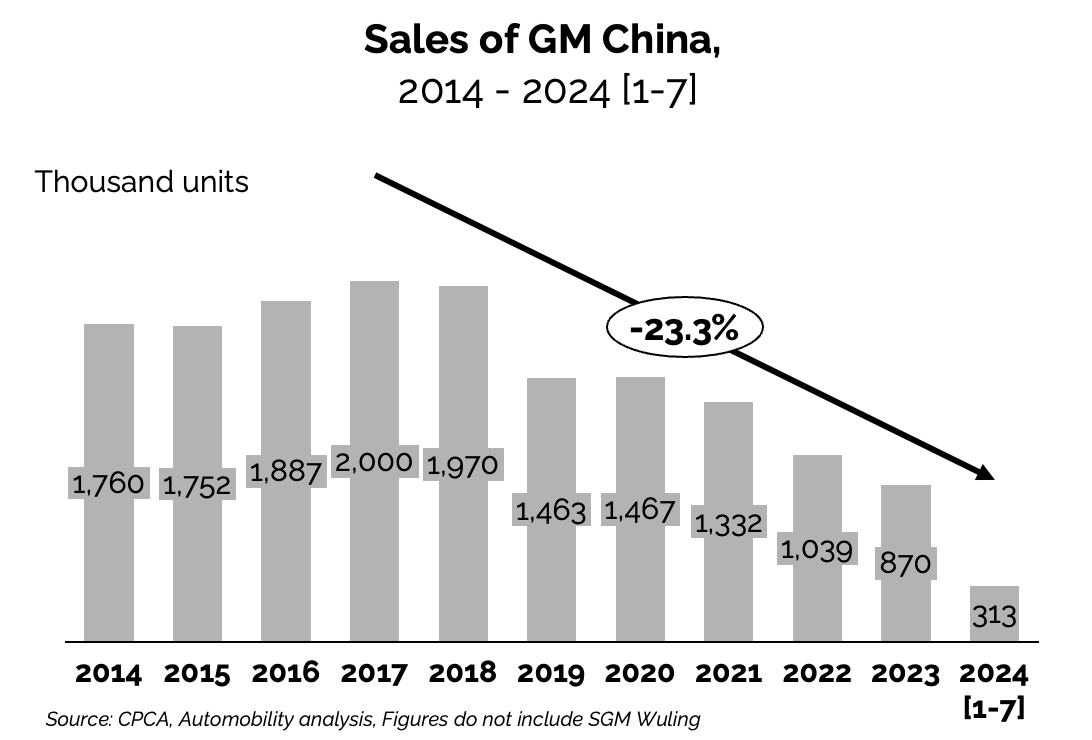

- General Motors has fallen off the top 10 list of companies selling gasoline powered vehicles, replaced on that list by SAIC.

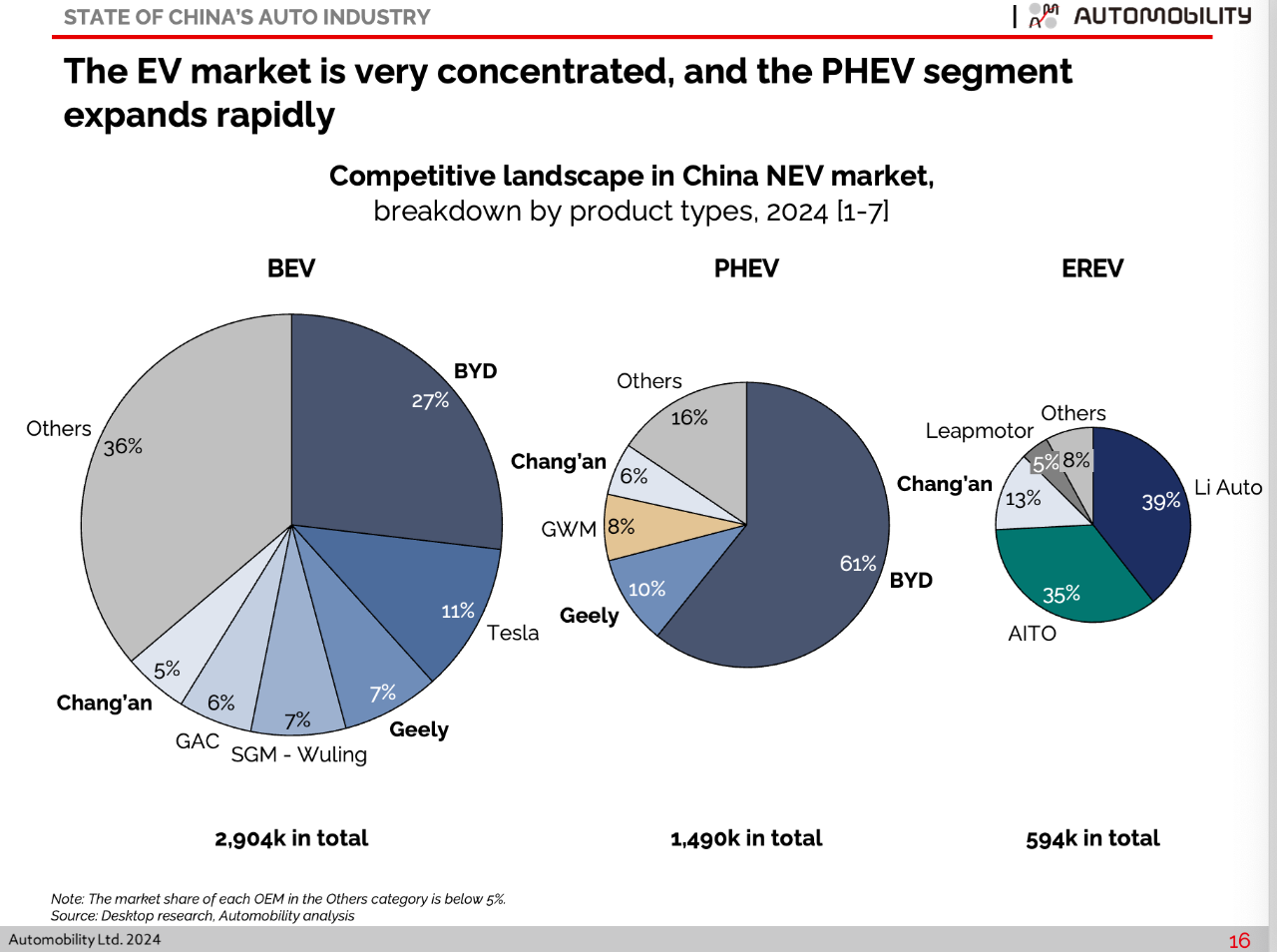

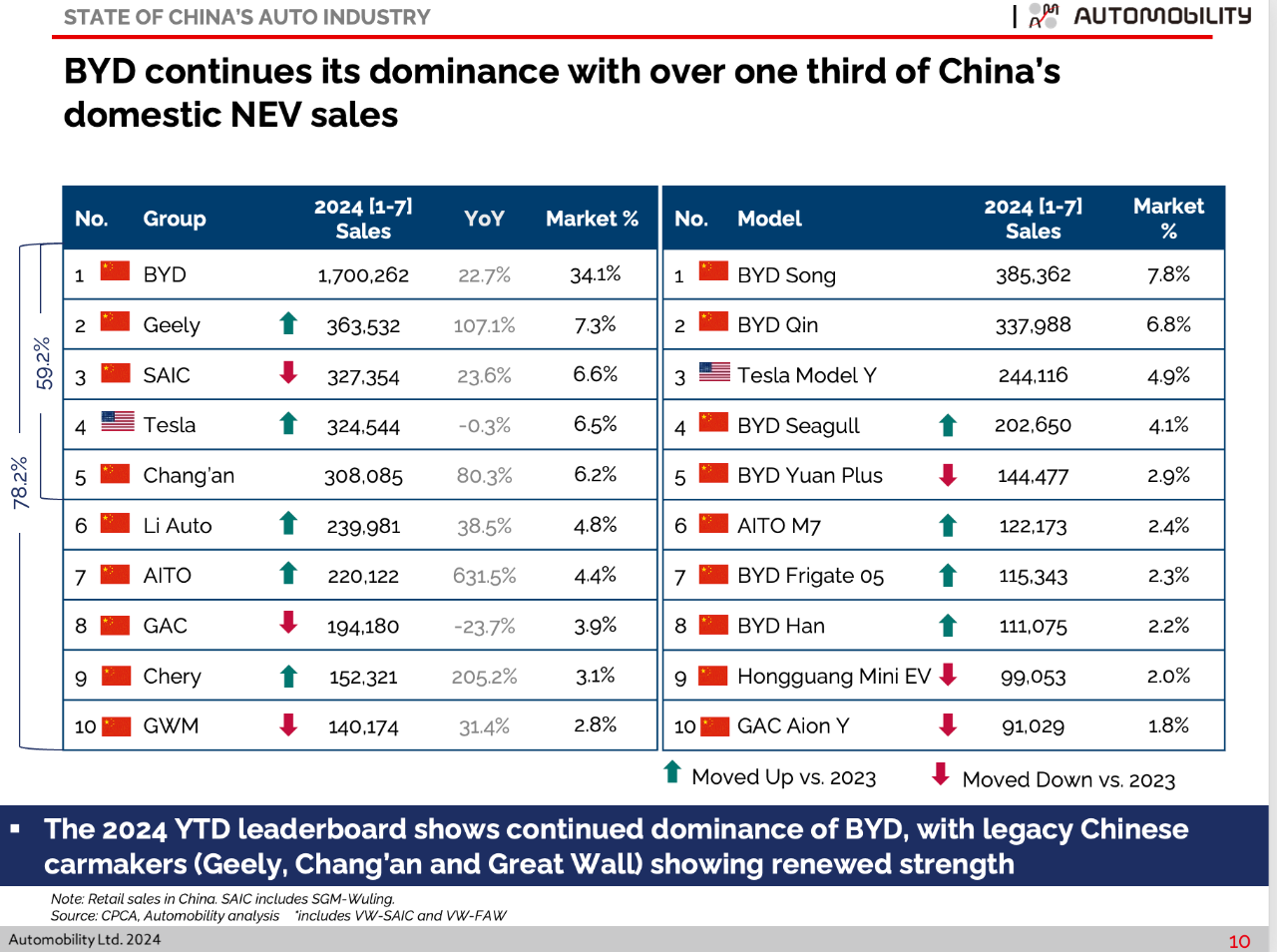

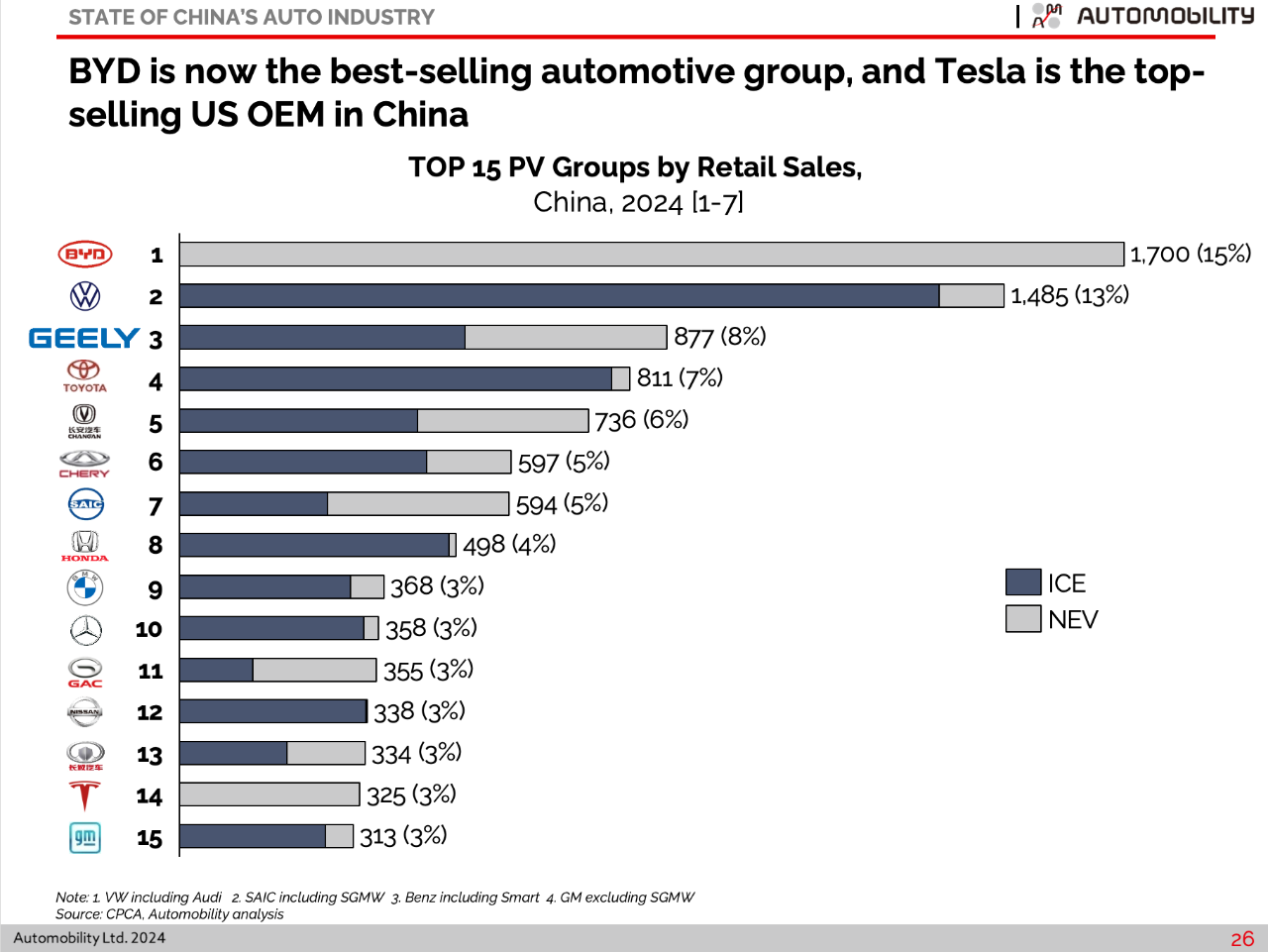

- BYD strengthened its domestic performance with 7 of the top 10 selling NEV nameplates in July, with their segment share increasing to 34.1% for the year.

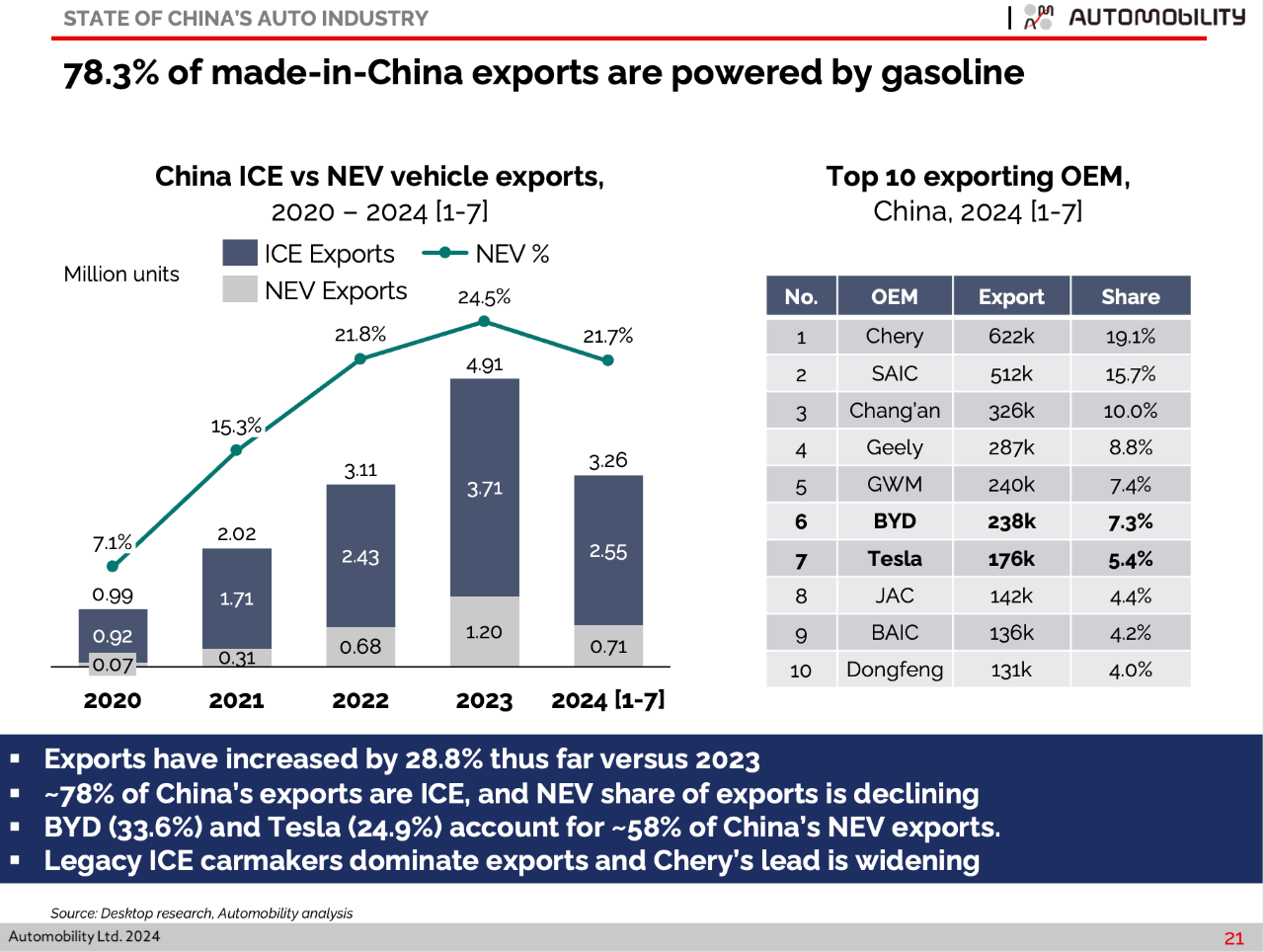

- 20% of vehicles manufactured in China are now exported, 78% of exports are gasoline powered.

A Decade Ahead of Schedule

CNBC made an effort to explain why this shift is happening and I was very pleased to contribute to their piece on how the Chinese EV market differs from the approach taken in the rest of the world.

How BYD, Nio And Other Chinese EVs Compare To Tesla [CNBC VIDEO]

In a nutshell, it is our view that Chinese consumers of electric vehicles are technology shoppers – and seek vehicles with smart device features that speak to a more connected and app-oriented population of users.

Such cars are designed not simply to be driven, but to be experienced as smart devices. Every set of eyeballs matter – not just the driver’s.

While my comments were used in the piece, it still came off as a “let’s drive a few cars and talk about them in the way we evaluate traditional driving machines”.

You can do that…but it falls short to highlighting the bigger wave of disruption emanating from China: the advent of the Intelligent Connected Vehicle, which just happens to be powered by electricity (because 140 years is long enough to go with gasoline propulsion).

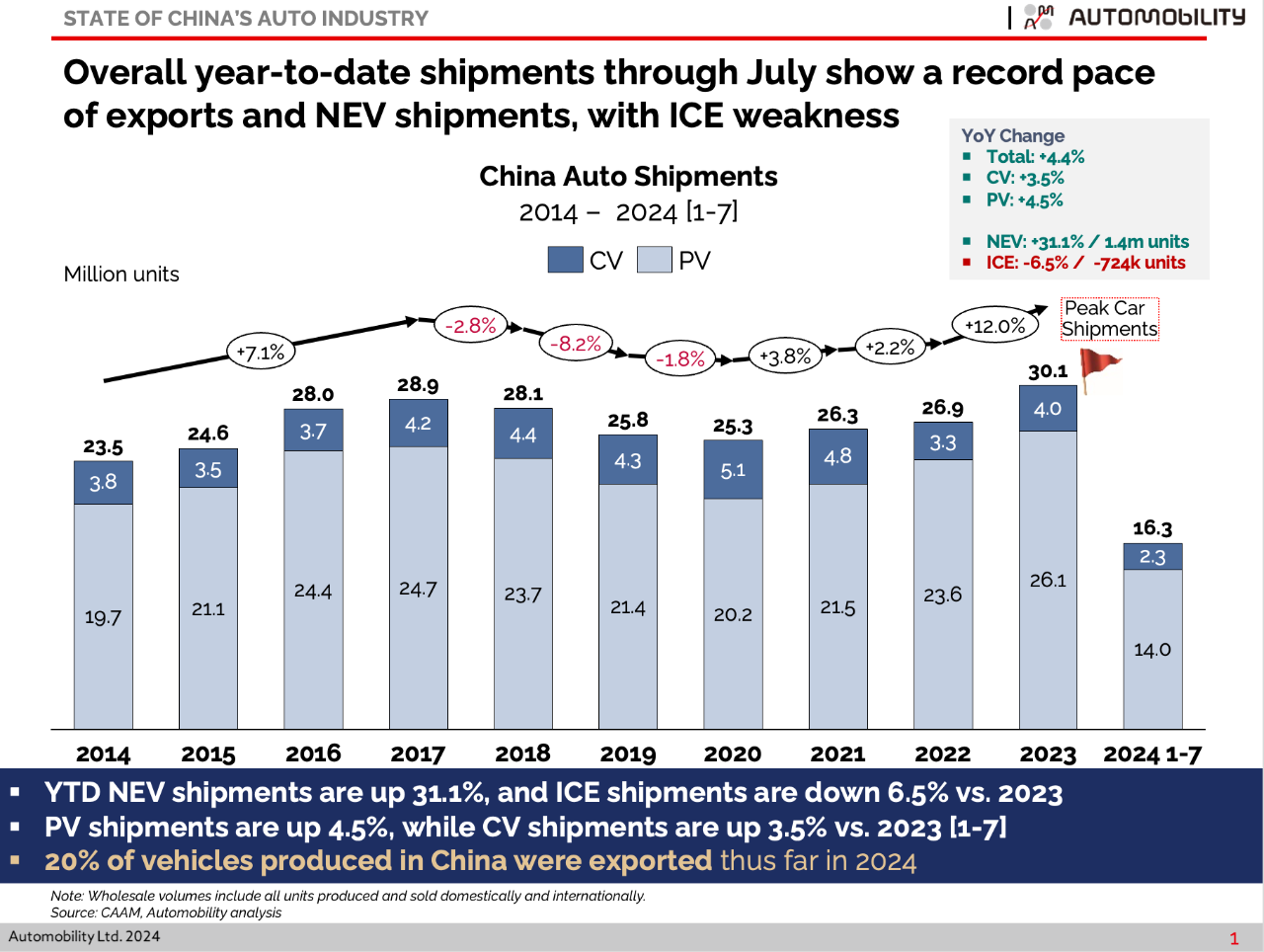

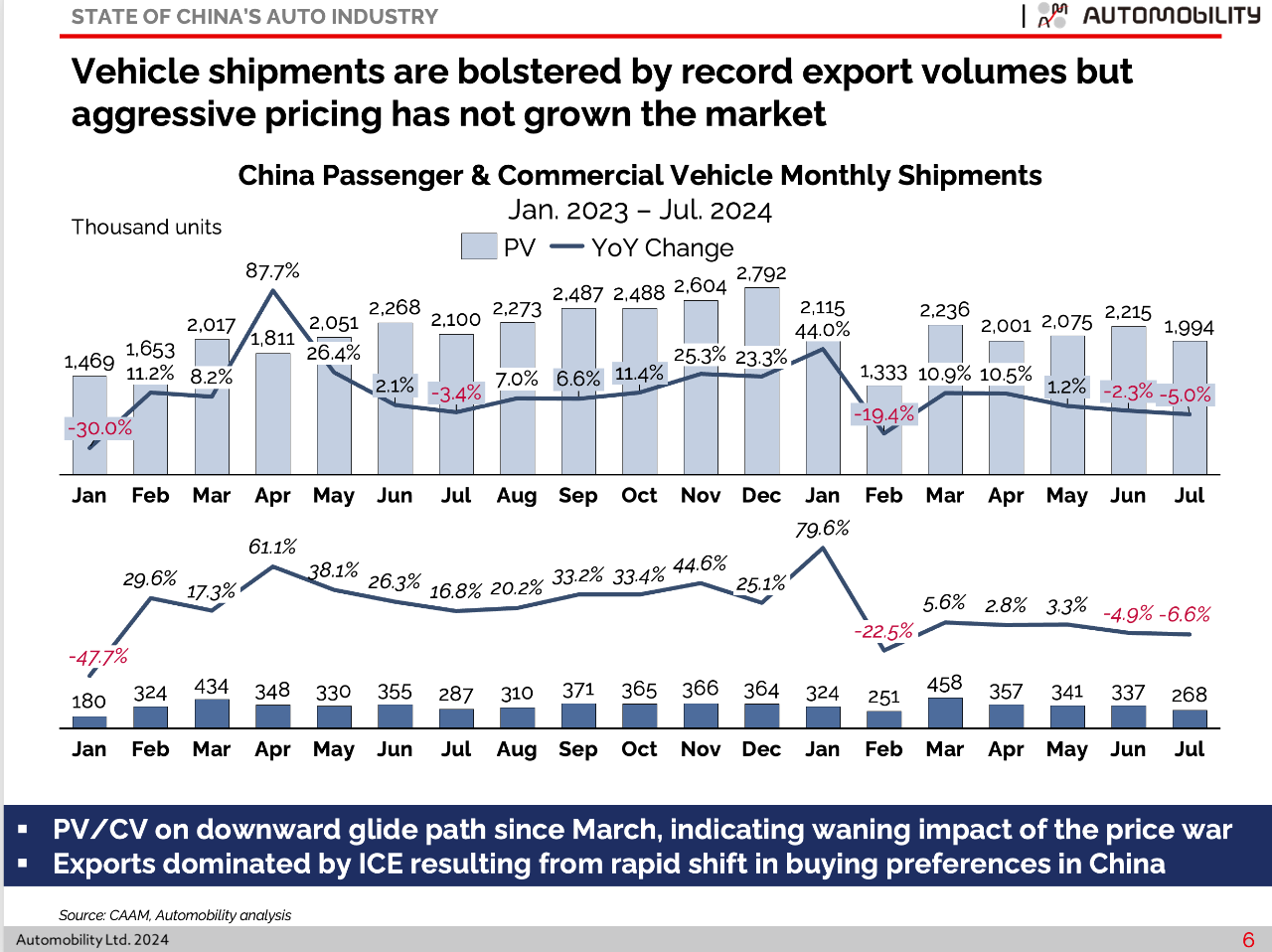

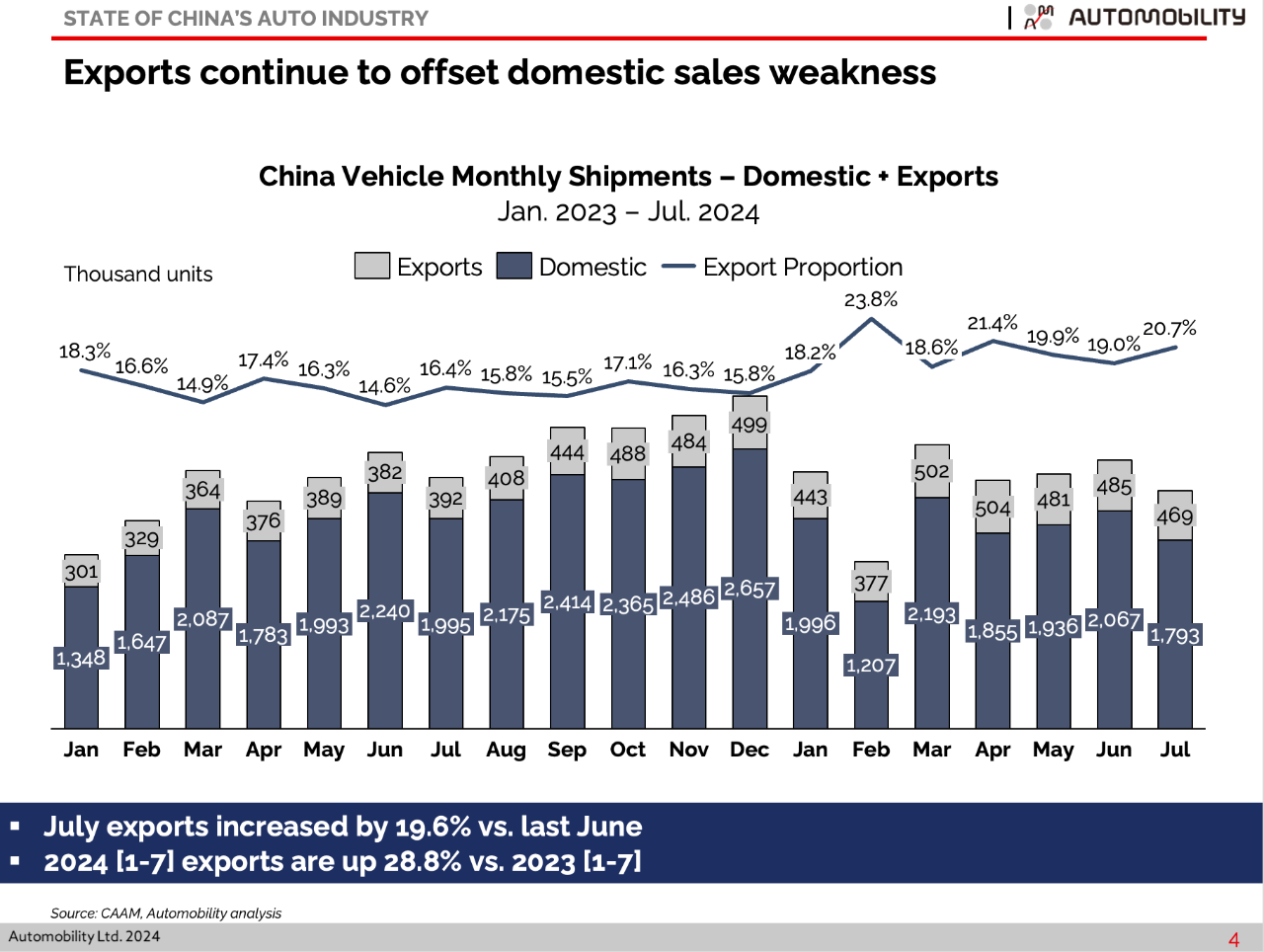

The second half of 2024 began with weak domestic sales performance in July. While shipments are up 4.4% through July, the main contributors are the 31.1% increase in NEV shipments and a 28.8% rise in exports versus the same period from last year. ICE shipments are down 6.5%. One out of every five cars produced in China this year was exported for sale in another country.

Monthly shipment volumes have been on a downward glide path for both passenger and commercial vehicles since Chinese New Year. This is particularly concerning as it seems that the price war which was re-ignited by BYD after the holiday has not expanded the market. Rather, it has accelerated the shift in consumer preference from ICE to NEV as value-oriented shoppers seek discounts in a weak economy.

As Made-in-China (MIC) ICE products lose their appeal among domestic consumers, these products are increasingly sold to overseas markets. One out of every five MIC cars are now sold outside of China, and over 78% of MIC exports are powered by gasoline.

MIC exports have become a solution to a growing problem of overcapacity in a China market that has not grown since 2017. This problem is most acutely felt in the rapidly shrinking ICE segment, which is why sales of vehicles of this type dominate the export numbers.

With monthly exports averaging around a half-million vehicles per month since March, we expect total MIC exports to approach 6 million units in 2024.

An interesting corollary to the rise of Chinese brand NEV dominance is that clear momentum is evident in the performance of Chinese brands in the ICE segment. This could be in part be attributable to a general increase in brand equity for Chinese brands among Chinese consumers. With more Chinese brands on the road, consumers are more willing to consider the purchase of a Chinese branded product independent of its propulsion system. The top 10 ICE list now includes 4 Chinese companies, with Chery moving into the 5th position, and SAIC jumping ahead of GM into the top 10 list.

Webinar | State of China Auto Market Monthly Briefing (August)

https://amcham-shanghai.glueup.cn/event/2024-amcham-shanghai-automotive-conference-%e4%b8%8a%e6%b5%b7%e7%be%8e%e5%9b%bd%e5%95%86%e4%bc%9a%e6%b1%bd%e8%bd%a6%e8%ae%ba%e5%9d%9b-44168/

On November 12th, the 10th annual Mobility Tech Workshop will delve into the latest trends and challenges in the mobility sector. The workshop will feature a lineup of 10+ promising startups and discussion panels on “The State of the Global Battery Supply Chain” and “From Private Placement to IPO: The New Path for Mobility Tech.” The program will also include 10+ “Something on My Mind” (SOMM) interactive mini sessions, led by industry leaders, investors, and technologists. This year’s event will take place at the scenic Cocoanut Grove in Santa Cruz, with an evening reception in Bonny Doon, allowing attendees to experience both the coastal and mountainous landscapes of California.

On November 13th, we are excited to introduce a new workshop, Manufacturing for Mobility in Mexico. This event will focus on Mexico’s emerging role as a near-shoring hub for EV production and the mobility supply chain. Industry experts and a delegation of policymakers, industrialists, and investors from Mexico will discuss the benefits of the USMCA, supportive Mexican government policies, and Mexico’s strategic importance in the global automotive and aerospace industries. This workshop will take place in Bonny Doon, CA.

Scan the below QR for details and register:

AUTOMOBILITY MEDIA

-

Tesla faces tough competition in China and slow EV adoption in the U.S., investment advisory firm says

Tesla CEO Elon Musk could be hoping to get support to “slow the advance of the competition he is facing in China,” said Bill Russo, founder and CEO of Automobility, a strategy and investment advisory firm.

Tesla faces tough competition in China [CNBC VIDEO]

-

Multinationals sound alarm over weak demand in China

Bill Russo, the former head of Chrysler in China and founder of Automobility, said foreign automakers, excluding Tesla, “collectively failed to pivot when confronted with changing Chinese consumer preferences” towards electric vehicles.

Please copy and paste the link to your browser: https://www.ft.com/content/8e2f415b-46bb-473f-9c26-474322e372f2

-

Tariff hike fears drive Chinese EV sales

Please copy and paste the link to your browser:

Bill is a contributing author to the book Selling to China: Stories of Success, Failure, and Constant Change (2023), where he describes how China has become the most commercially innovative place to do business in the world’s auto industry – and why those hoping to compete globally must continue to be in the market.

About Automobility

Contact us by email at info@automobility.io

PLEASE NOTE: The information and analysis shared in this newsletter, including the charts and style of materials presented, is the intellectual property of Automobility Ltd. While we share it as a way to serve our existing and new clients, it is not to be used without our express consent and then only with attribution. Any publication, reproduction or other use of this material without the express written consent of Automobility Ltd is prohibited.

Sorry, the comment form is closed at this time.