21 Jun State of China’s Auto Market – May 2024

Comments from Bill Russo, Founder & CEO of Automobility Ltd.

PLEASE NOTE: The information and analysis shared in this newsletter, including the charts and style of materials presented, is the intellectual property of Automobility Ltd. While we share it as a way to serve our existing and new clients, it is not to be used without our express consent and then only with attribution. Any publication, reproduction or other use of this material without the express written consent of Automobility Ltd is prohibited.

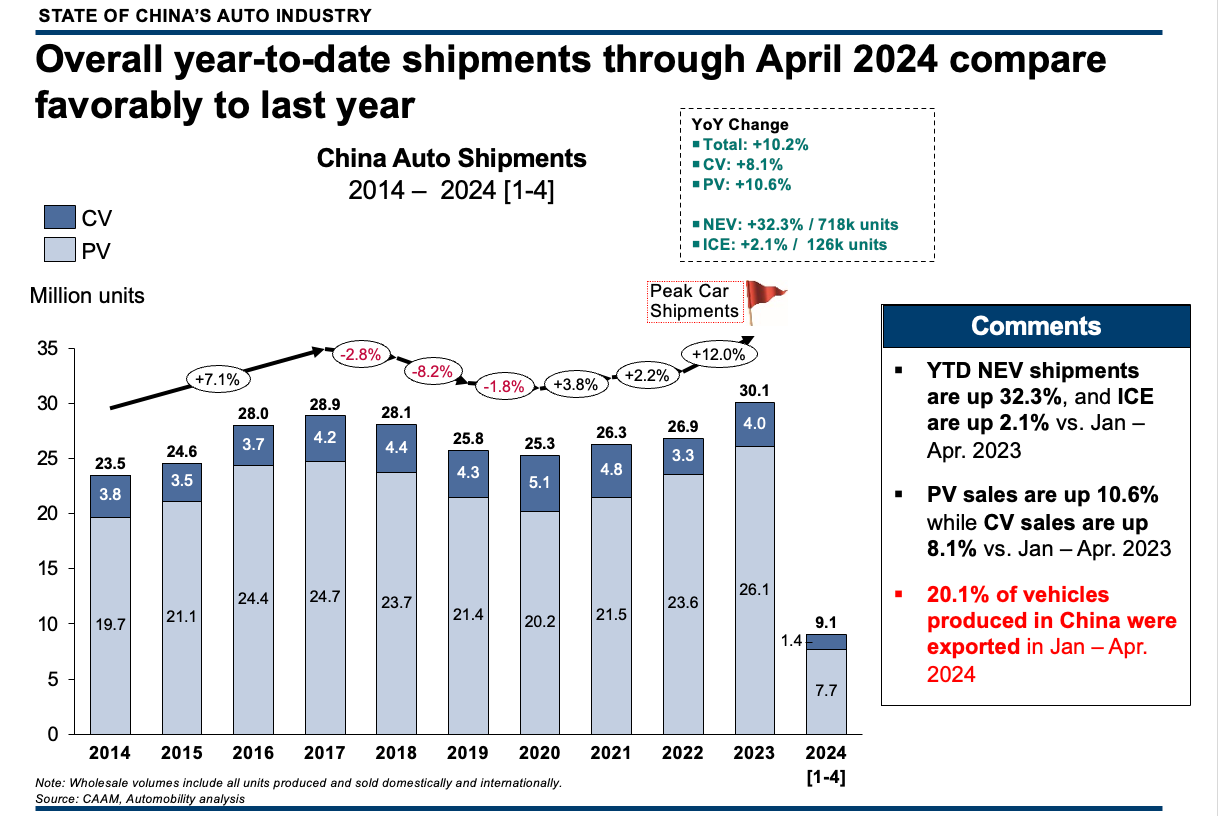

2024 YEAR-TO-DATE HIGHLIGHTS

- Through April, shipment volumes are running over 10% ahead of 2023

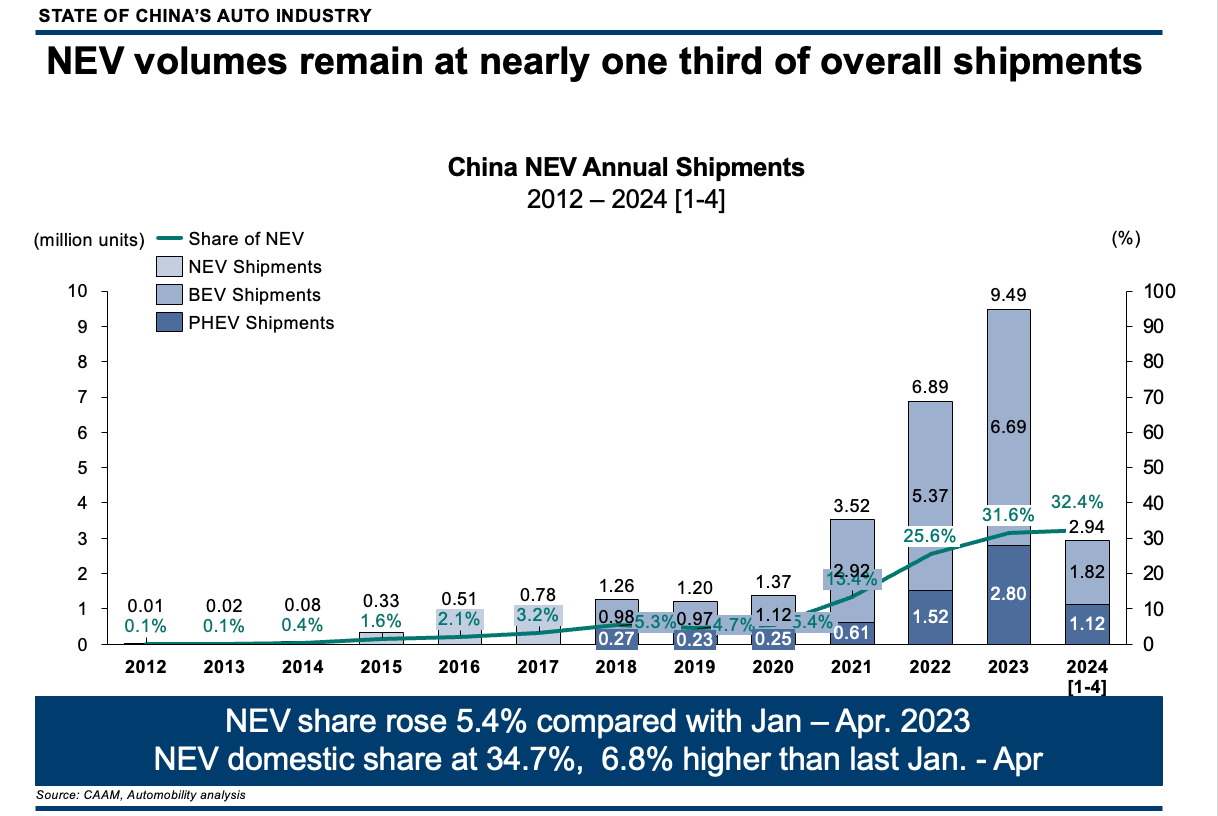

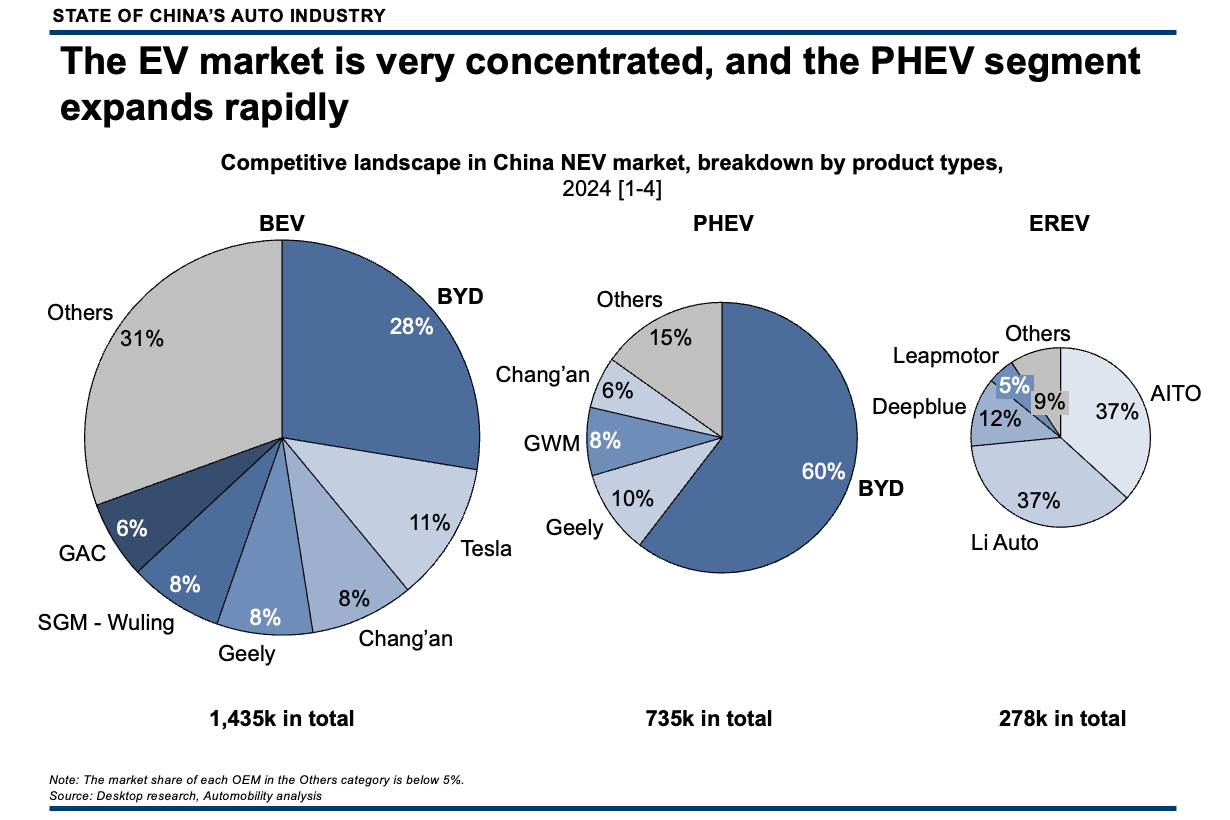

- NEV remains the only growth segment in China

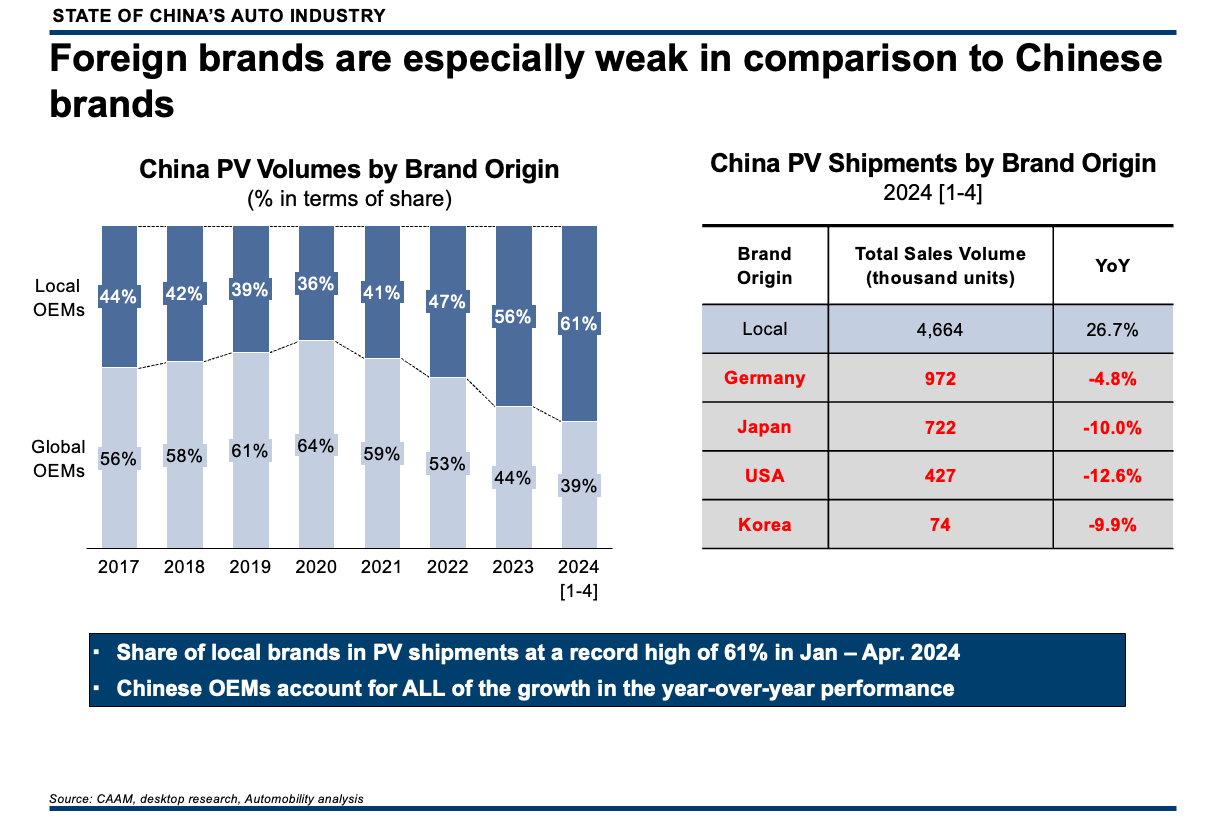

- Foreign brand share of domestic PV sales are 39% and have fallen by 25% since 2020

- One of every five cars made in China are now being exported

Our apologies for the late publication of this newsletter, but we were quite busy recently due to the Beijing Auto Show and a trip to Europe, where I had the privilege of sharing the developments in the China market at 2 important dealer conferences. I spoke on May 14 in Verona, Italy at Quintegia’s Automotive Dealer Day event on the topic “Mobility, Dealers and EVs: the Whole Industry is Transforming, are We?”.

On May 16, I also spoke in Copenhagen, Denmark at the Confederation of Danish Industry’s Automotive Dealer Conference on the topic “China’s Automotive Industry and The Race to A Sustainable Future”, which is also the topic of my chapter of the book “Selling to China: Stories of Success, Failure and Constant Change”. It is gratifying to know that the world outside of China is hungry to learn from the people working directly in China.

I also hosted multiple delegations at the Beijing Auto Show, and shared my impressions of the show and the recent US move to impose tariffs on Chinese EVs and components on recent media interviews and podcasts:

Bloomberg TV Live from Auto China:

Automobility Founder & CEO Bill Russo was interviewed live by Stephen Engle at the Beijing Auto Show on “Bloomberg Markets: Asia”

- 2024 Beijing Autoshow: A Global Industry Wake-up Call [CLIP 1/2]

-

2024 Beijing Autoshow: A Global Industry Wake-up Call [CLIP 2/2]

According to this week’s guest, automobile industry expert Bill Russo, this year’s Autoshow China, held in Beijing, was a wake-up call to the global automobile industry. China has clearly leapfrogged the global auto industry, making products that aren’t just transportation vehicles but literally smartphones on wheels. According to Russo, the global auto industry is still living in the 20th century. With the EV tariffs looming in the U.S., are Westerners deprived of owning the next and best iPhone?

– How can Chinese EV auto companies stay competitive With so many new NEV brands?

Bill & Bryce’s Book: “Selling To China:” https://amzn.to/3UXBrVQ

April Domestic Pullback with Record Exports

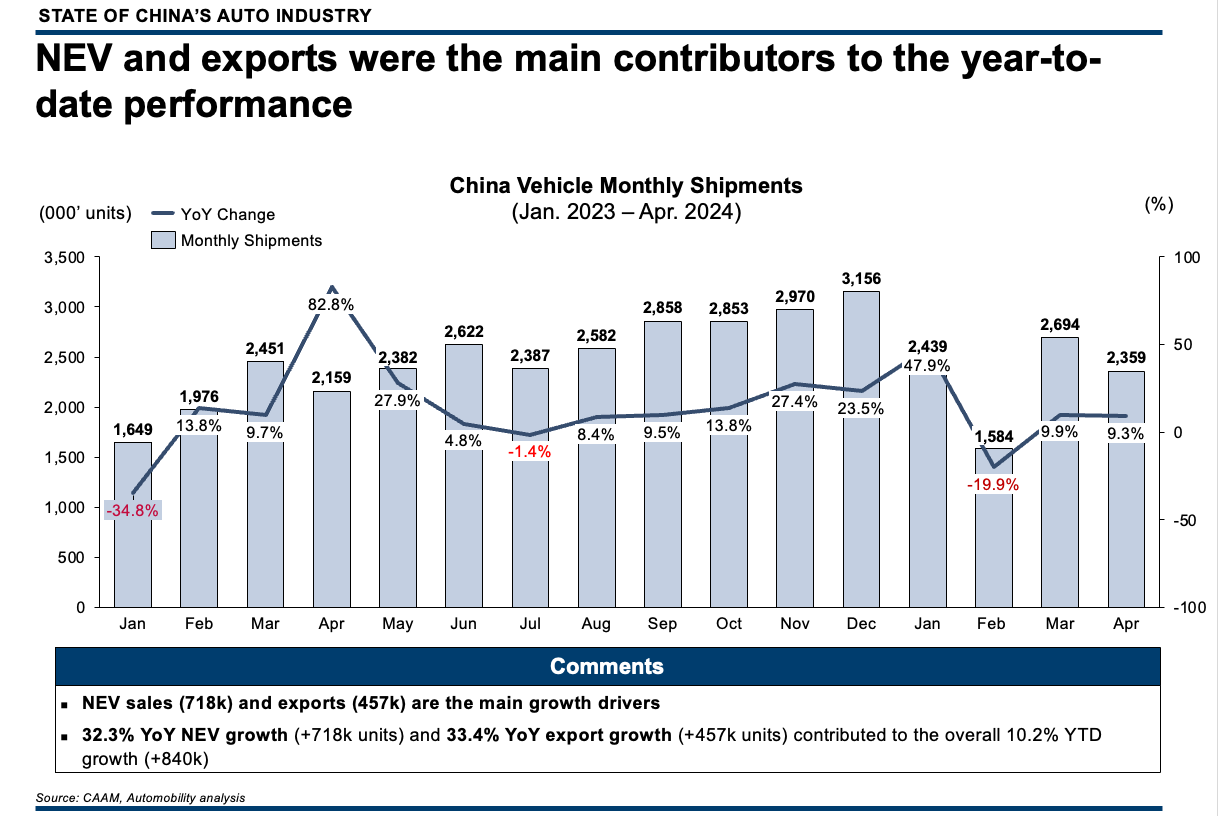

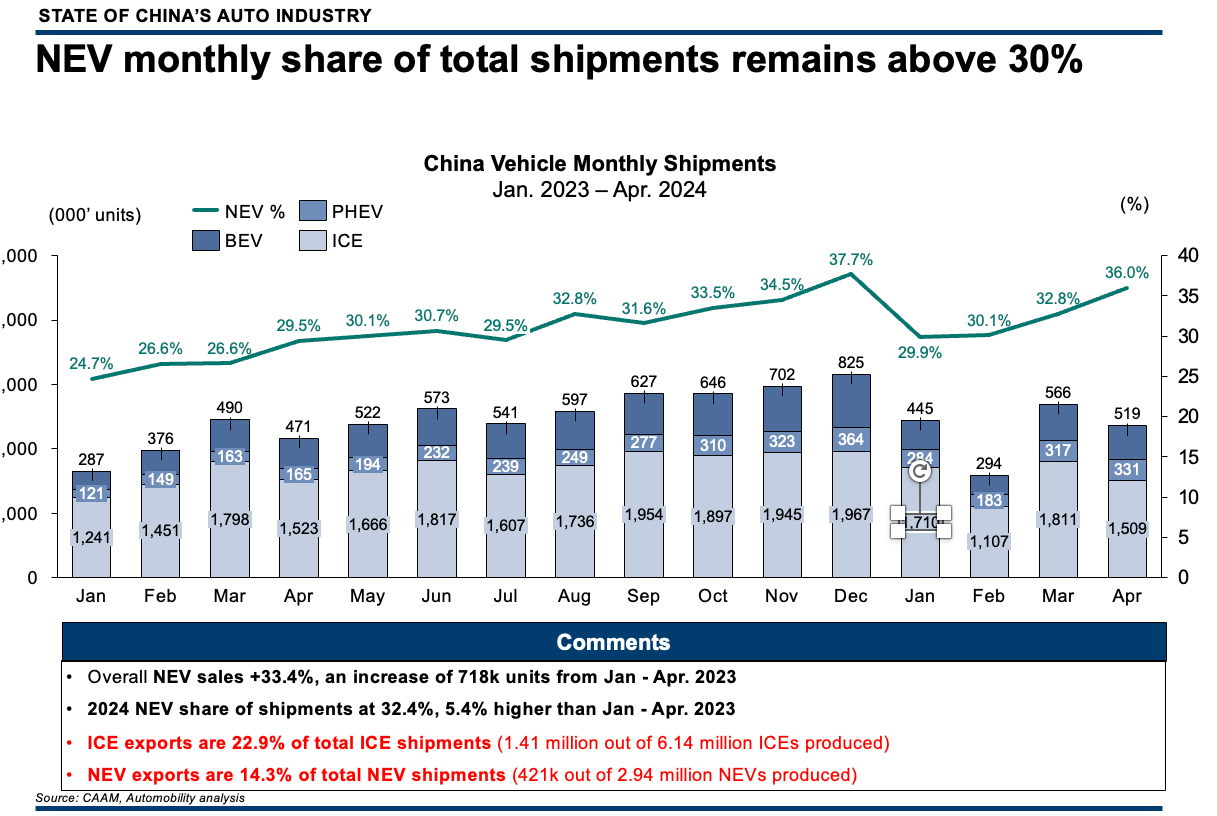

Ex-factory shipments through April are up 10.2%, with vehicle shipments reaching 9.1 million units. NEV shipments are up 32.3% and ICE shipments up 2.1%. Export volumes continue to bolster these numbers with more than 1 in 5 Made-in-China vehicles having been exported.

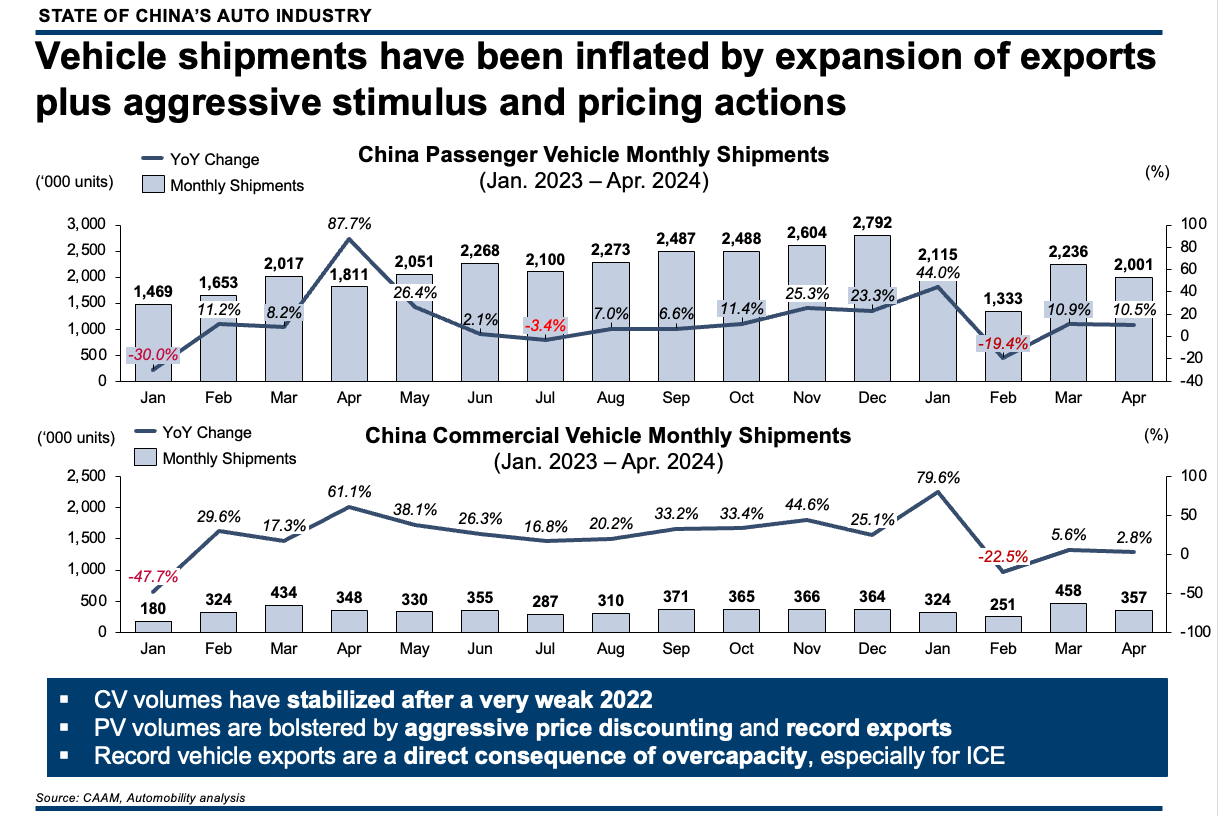

Viewed on a monthly basis, we saw a pullback in shipment volumes across PV and CV segments, although both were ahead of volumes from last April.

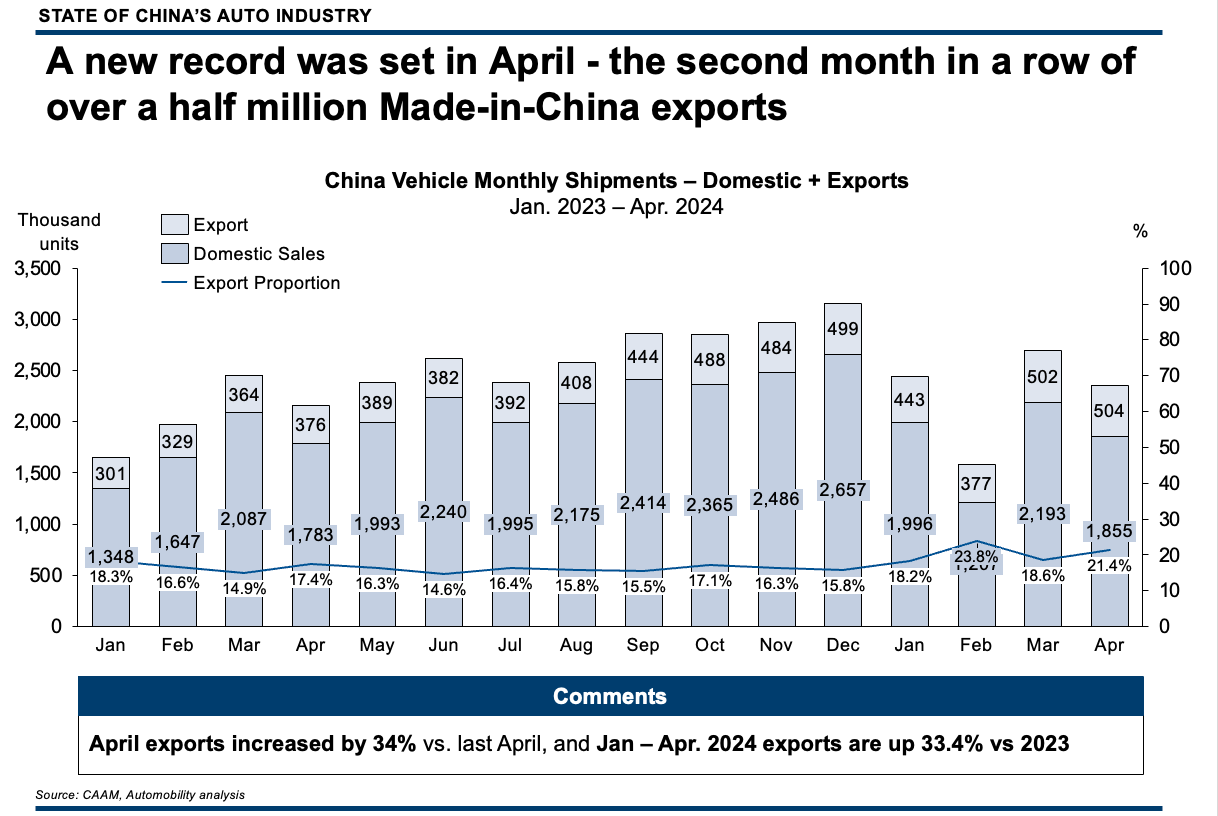

April shipments were up 9.3% over the prior April, with 2.36 million units produced. New Energy Vehicle shipments in April were 850,000 of this total, along with 504,000 units destined for sales outside of China.

Exports of Made-in-China vehicles set a new monthly record in April, with 504,000 units shipped, an increase of 34% versus last April. This was the second consecutive month where made-in-China exports exceeded a half million units.

Exports on Blistering Pace in 2024

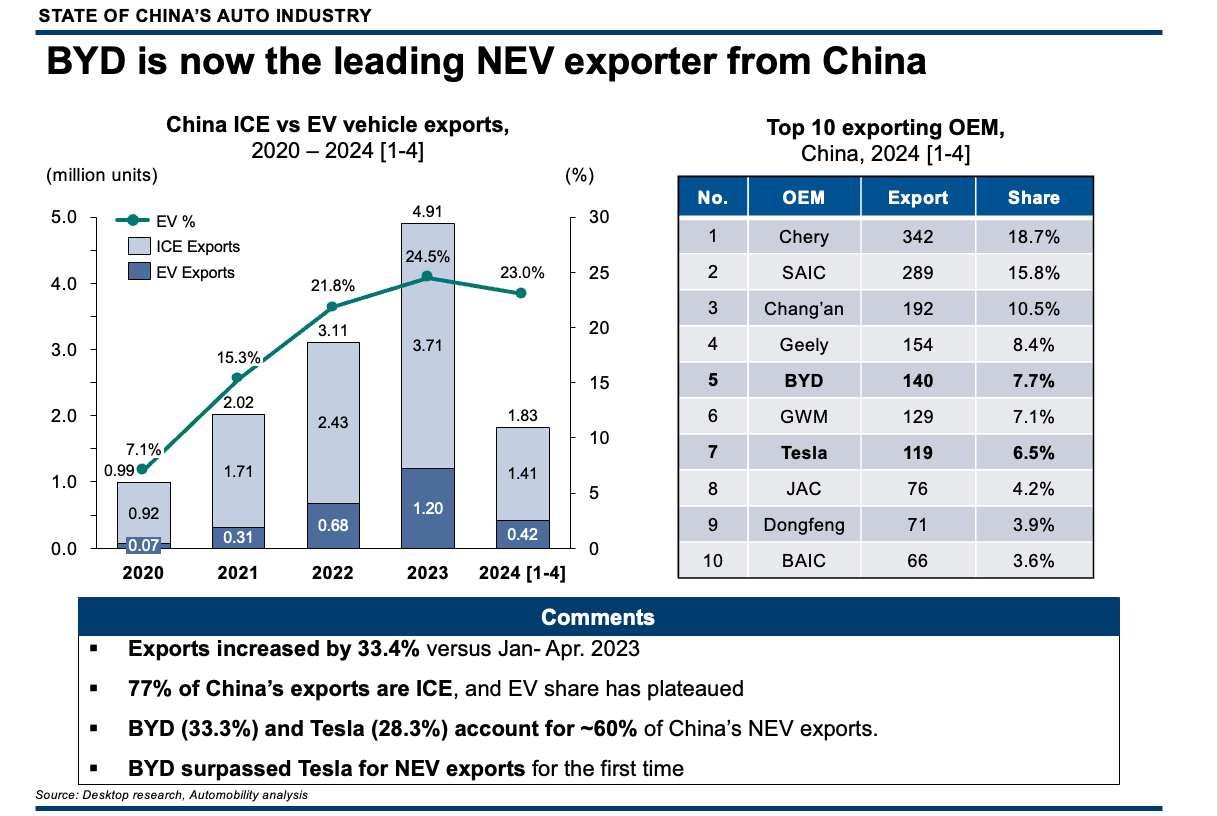

Made-in-China exports increased 33.4% in the first four months of 2024 versus last year’s same period. 20% of all vehicles produced in China in the first four months of 2024 were earmarked for sale outside of China, offsetting a lingering weakness in domestic demand, which were especially weak for pure internal combustion engine (ICE) vehicle.

BYD is the leading NEV exporter, widening its lead over Tesla. BYD exported 140,000 electric vehicles from China through April, representing one-third of NEV exports. BYD and Tesla have combined for 62% of EV exports from China in 2024.

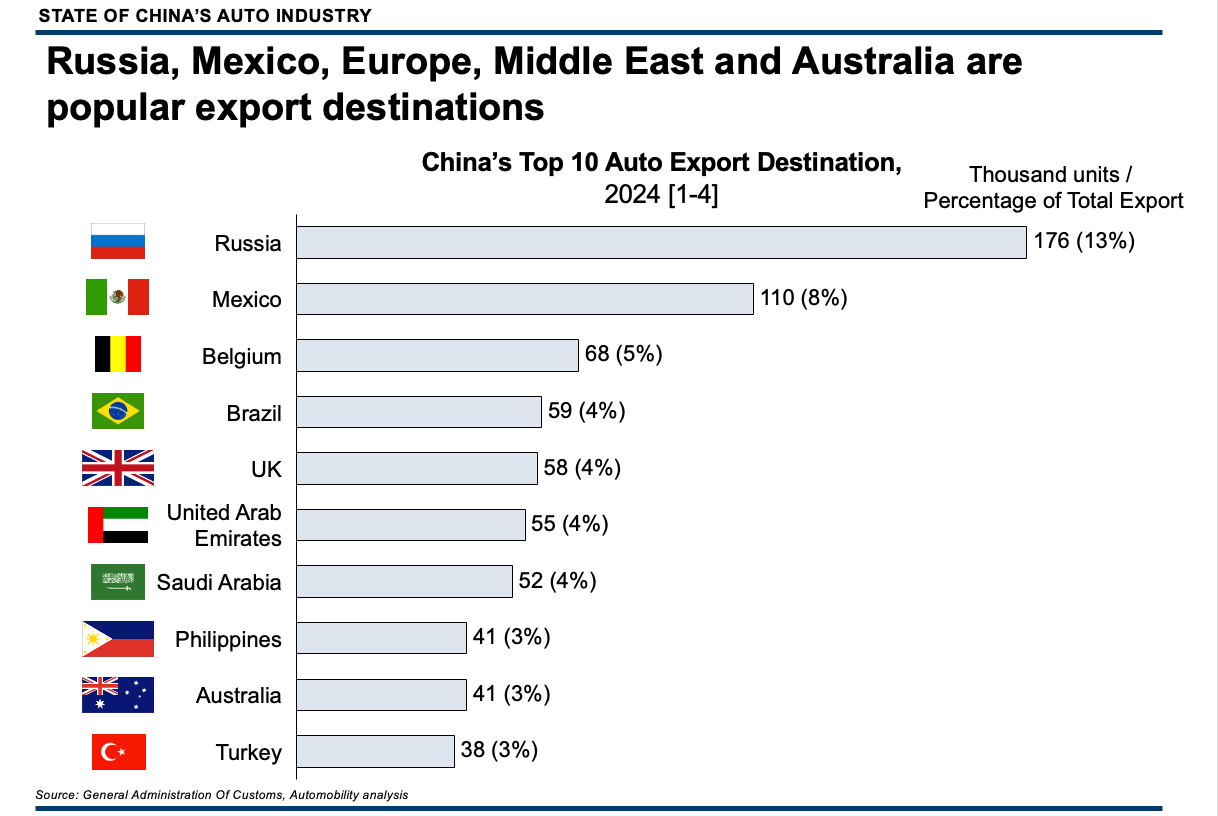

Russia remains the top export destination for made-in-China vehicles, with 13% of the total volume. other popular destinations include Latin America, Europe, the Middle East and Australia.

Sacrificing Margins for NEV Growth

NEV Sales Leaderboard and BYD’s Price-Led Resurgence

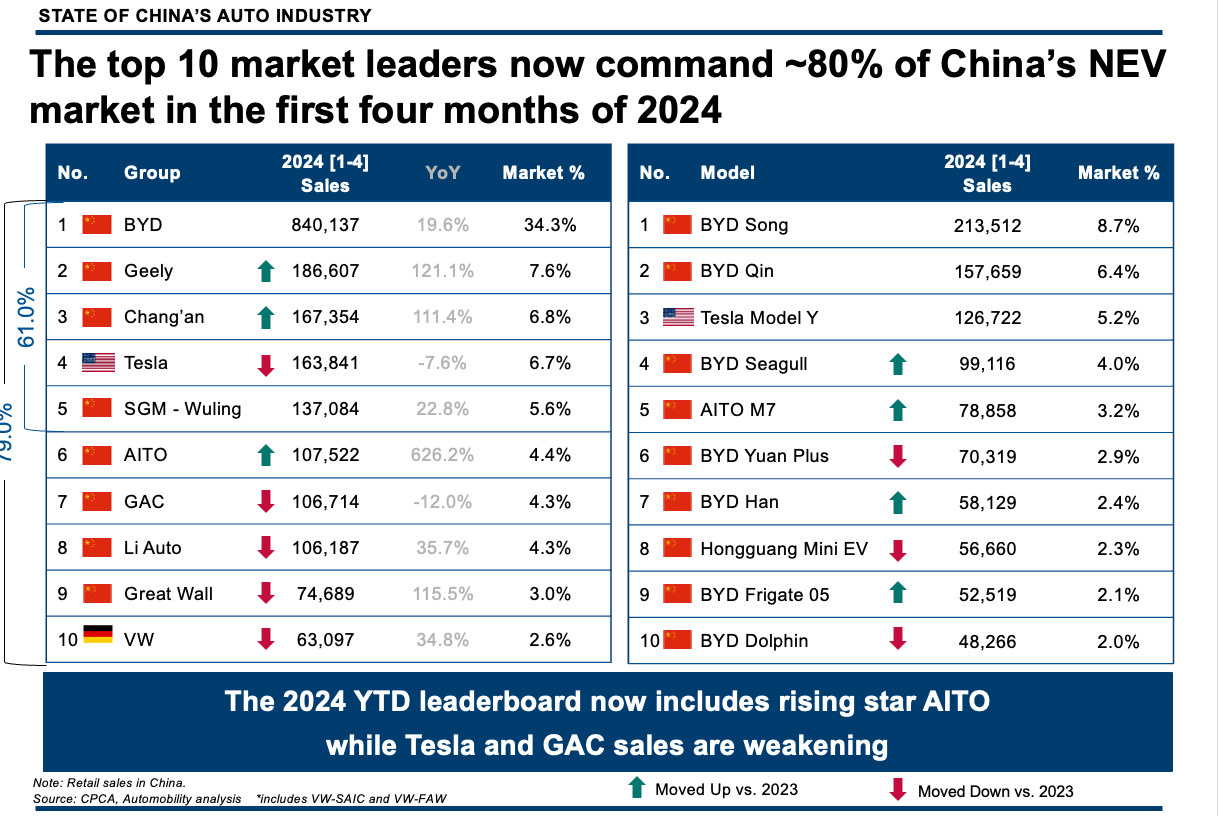

Since our last report, BYD has regained an additional 1.2% NEV market share, which is a direct result of their aggressive price reductions since Chinese New Year. BYD share was 34.3% through April, with 7 of the top 10 best selling NEV models in China. Geely, Chang’an and Huawei’s AITO brand have also recorded impressive gains in 2024, with Tesla and GAC showing year-over-year declines in domestic sales.

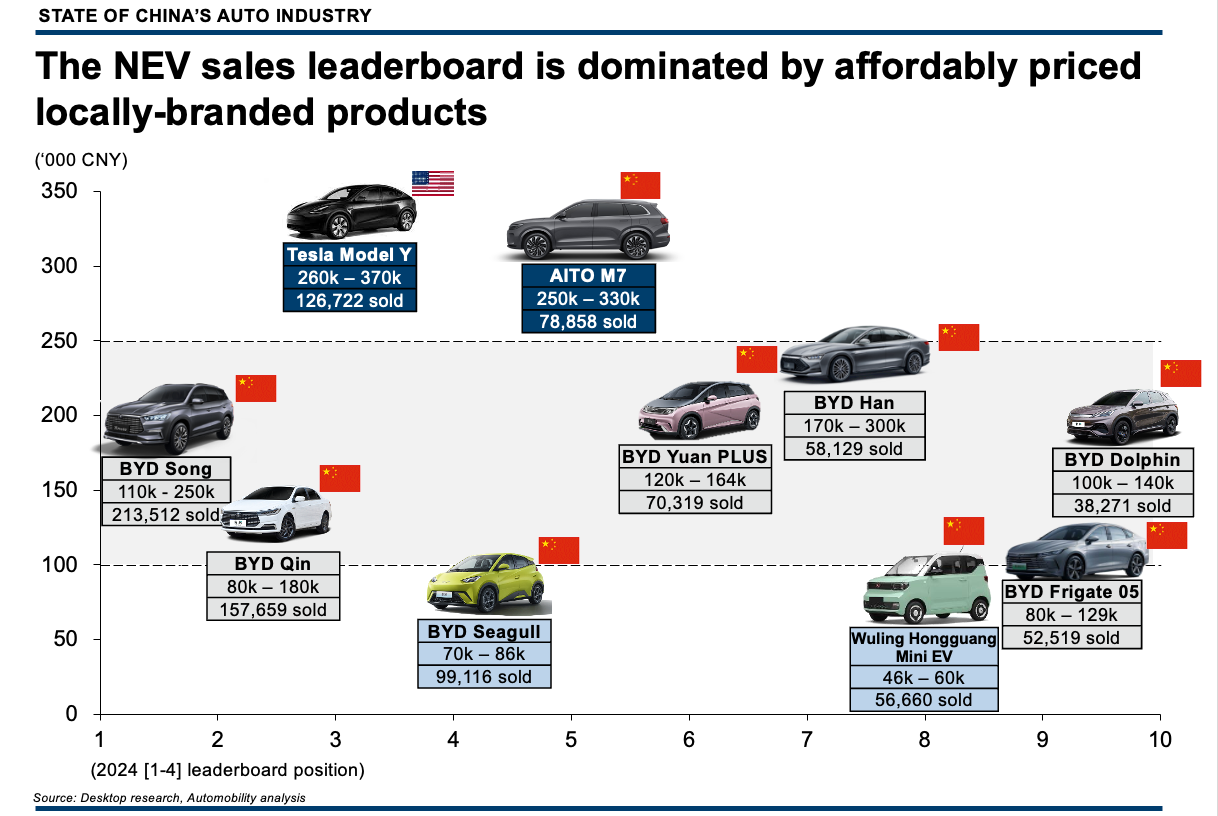

Affordably priced vehicles dominate the top 10 list of best-selling NEVs. Chinese branded NEVs are competing favorably on price versus ICE vehicles while often offering a superior technology-oriented value proposition.

For the month of April, BYD still has 6 of the top 7 best-selling NEV models in China, with the affordably priced BYD Seagull now moving ahead of Tesla Model Y at the top selling pure BEV in China.

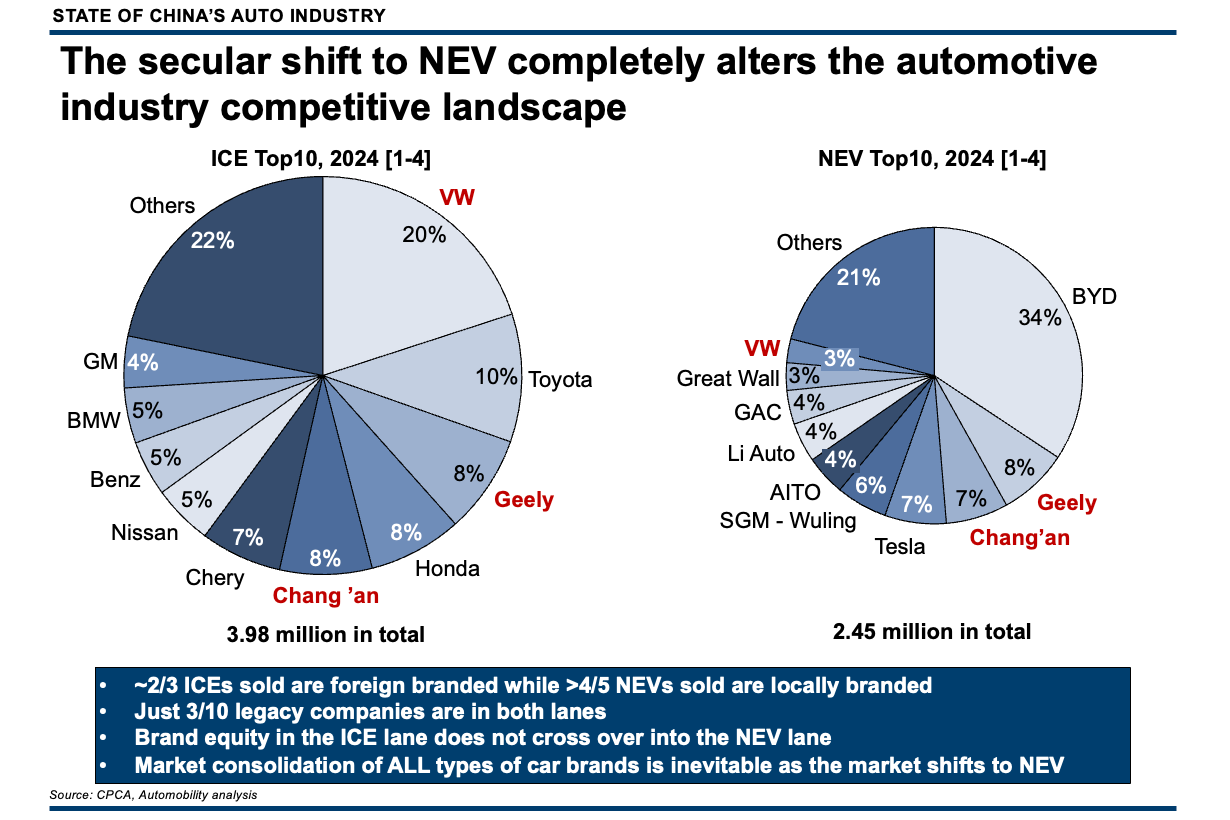

ICE is Melting Foreign Brands

The top 10 passenger vehicle NEV leaderboard only has just 2 foreign companies: Tesla (4th place – 7%) and Volkswagen (10th place – 3%). While the leaders continue to struggle in China’s only current growth segment, the situation is much worse for virtually all other foreign companies. All foreign carmakers are discovering that retail consumers in China are gravitating to Chinese brands because they represent something new and technically relevant as market preferences have shifted.

Another key trend we are watching within the NEV sub-segments is the growing popularity of plug-in hybrid (PHEV) and Extended Range Electric Vehicles (EREVs). Both of these vehicle types bring the added convenience of using a small ICE engine to recharge the battery – improving the flexibility of how the car may receive its energy and reducing range anxiety. This is proving to be popular, especially for family-oriented SUVs and MPVs.

China’s Auto Industry – The Race to a Sustainable Future

The automotive industry has historically been a major driver of innovation and economic development. We are currently facing a shift in the center of gravity for the industry, as new trends and technologies have commercialized at scale faster in China. Policymakers and industry leaders need to pay attention to this if we in the West intend to sustain leadership in mobility innovation, which has historically been a key driver of economic growth and job creation.

We are facing a secular and generational shift in the automotive and mobility sector. The rise of connected, electric, and autonomous cars requires that key stakeholders control critical technologies and supply chains. These stakeholders include national governments and industries that depend on this sector for their economic sustainability. Over the past decades, China has skillfully navigated its way to leadership in the commercialization of innovative technology solutions linked to the future of mobility.

-

Register Now: 2024 China Auto Chongqing Summit (CACS2024)

-

立即报名 | 2024中国汽车重庆论坛 重要嘉宾及议程 Register Now | CACS2024 Final Agenda

About Bill Russo

Bill is a contributing author to the book Selling to China: Stories of Success, Failure, and Constant Change (2023), where he describes how China has become the most commercially innovative place to do business in the world’s auto industry – and why those hoping to compete globally must continue to be in the market.

About Automobility

Contact us by email at info@automobility.io

Sorry, the comment form is closed at this time.