04 May State of China’s Auto Market – April 2024

Comments from Bill Russo, Founder & CEO of Automobility Ltd.

PLEASE NOTE: The information and analysis shared in this newsletter, including the charts and style of materials presented, is the intellectual property of Automobility Ltd. While we share it as a way to serve our existing and new clients, it is not to be used without our express consent and then only with attribution. Any publication, reproduction or other use of this material without the express written consent of Automobility Ltd is prohibited.

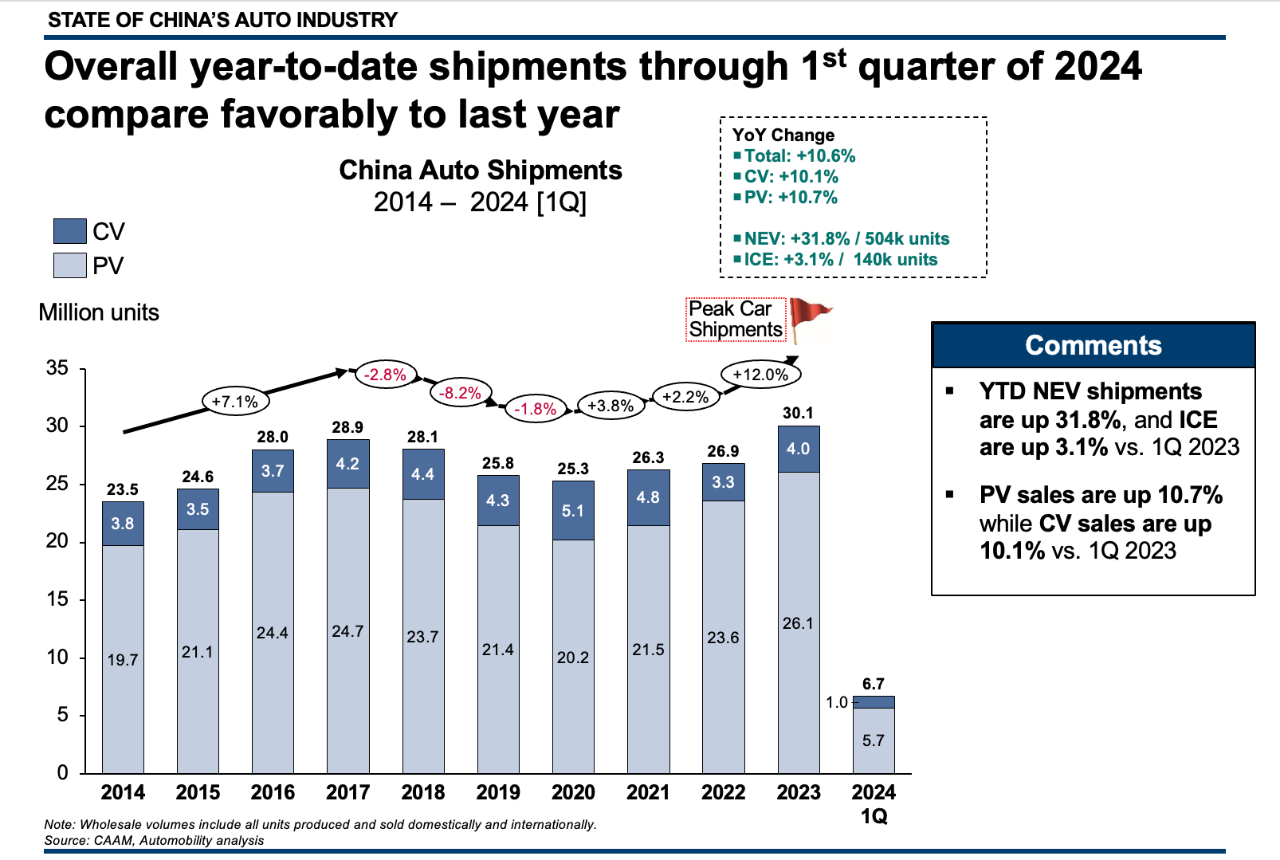

1st QUARTER HIGHLIGHTS

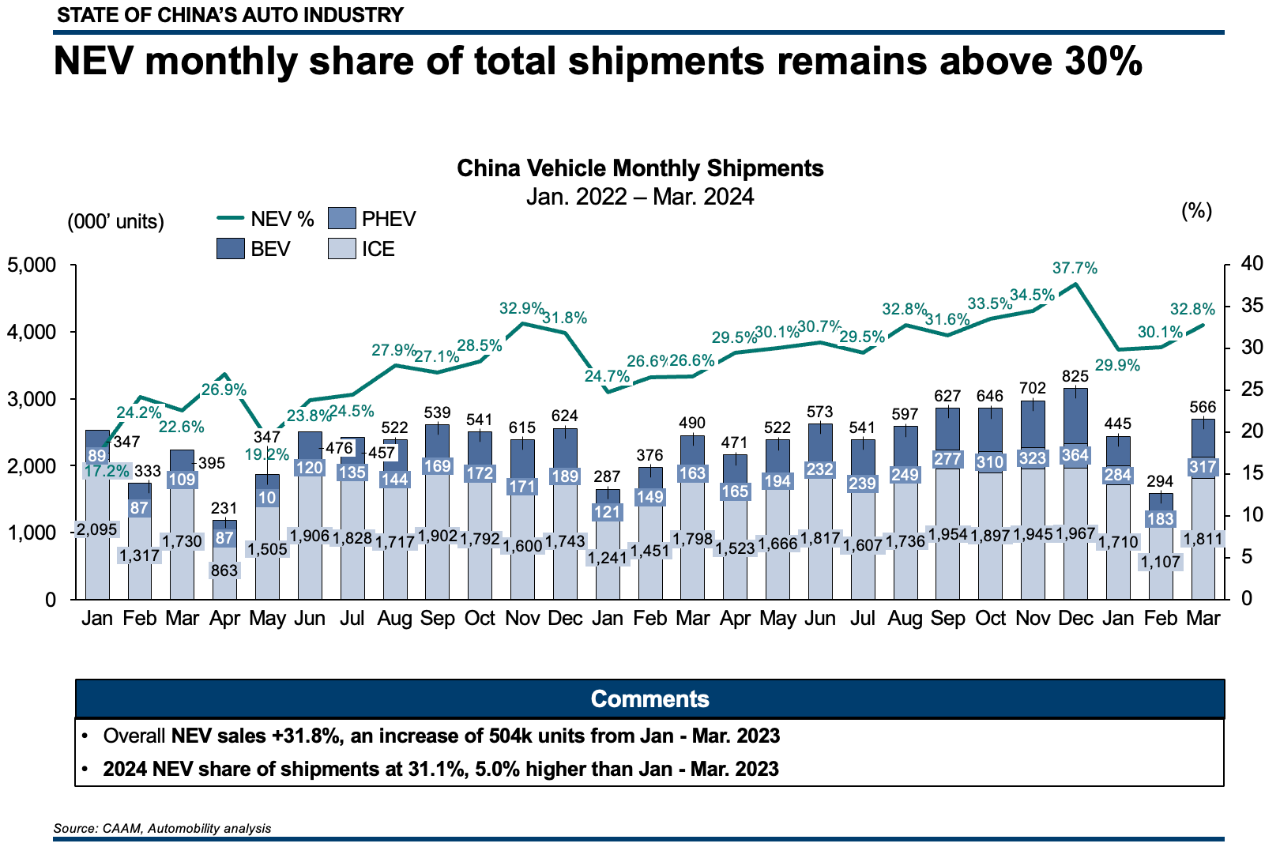

- NEV continues to expand in share of domestic PV sales

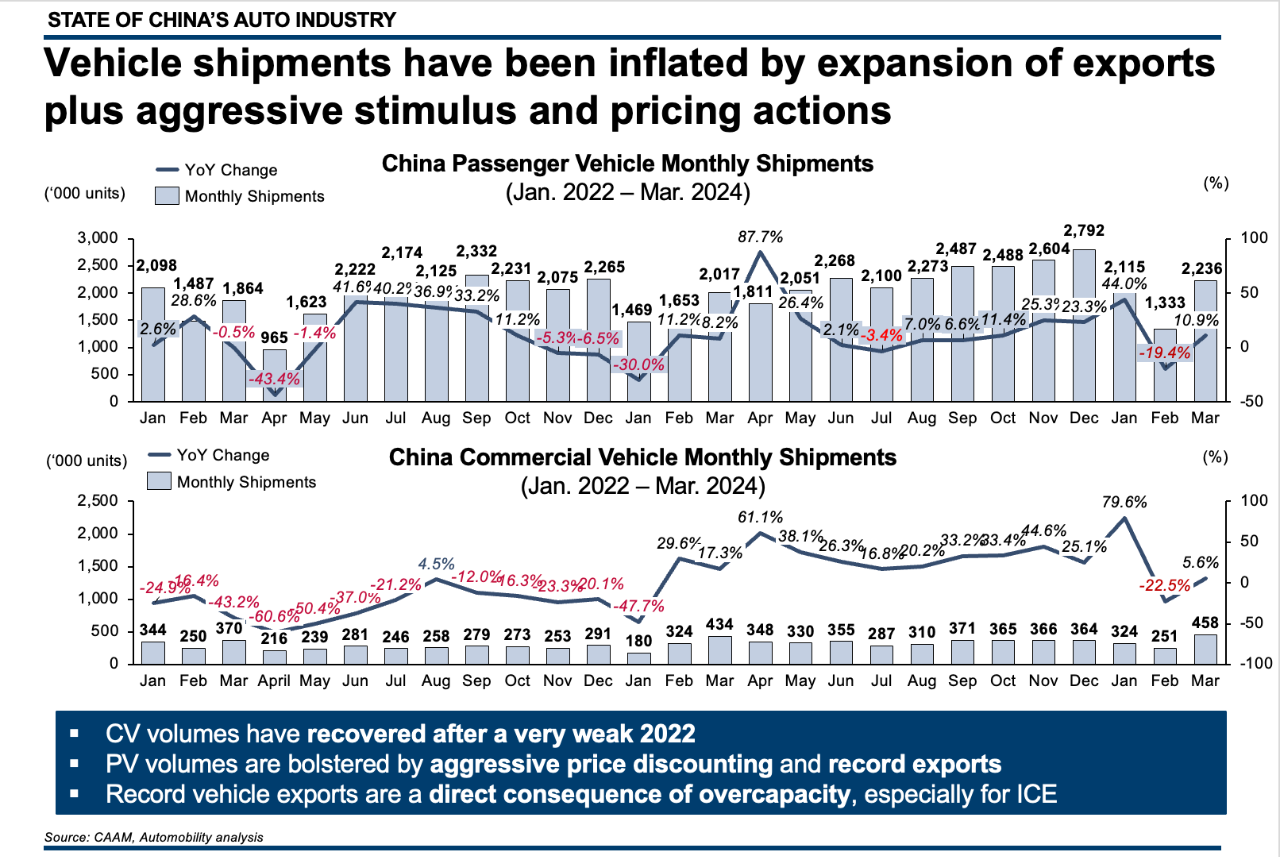

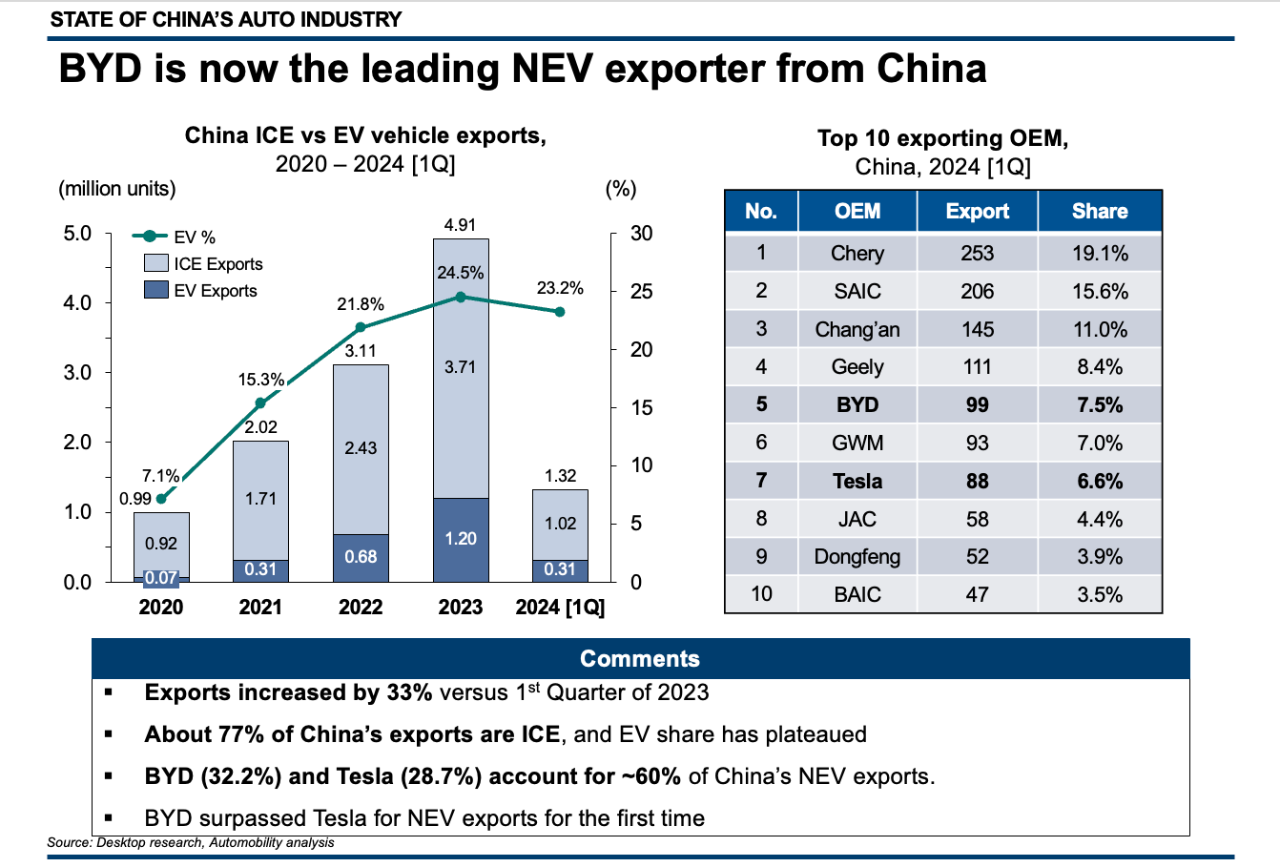

- Vehicle exports from China surpassed 500k units in a single month for the first time

- 77% of vehicle exports from China are powered by gasoline engines

- Aggressive pricing moves have allowed BYD to expand its share of New Energy Vehicle [NEV] sales and grow the overall segment in March

- BYD surpassed Tesla as the leading Made-in China NEV exporter for the first time

We are looking forward to the return of the Beijing Auto Show this week, kicking off with Media Days April 25 – 26. The Auto China exhibition is held annually, with Beijing and Shanghai alternating as the host city. The last time this show was held in Beijing was in 2020, as the 2022 exhibition was cancelled due to continuing concerns of Coronavirus.

Hyper-Competitive Domestic NEV Segment

As the main growth segment for the China auto industry, leading players continue to wage an unconventional war by offering more-and-more technology features at lower-and-lower prices. This has helped the NEV segment to rapidly cannibalize domestic share, forcing ICE production to be redirected overseas, as noted earlier.

The NEV market is dominated by Chinese brands and now represents over one-third of sales in the China market. 2.09 million NEVs were produced in the 1st quarter, an increase of 6.7% over the 1st quarter of last year.

With aggressive pricing moves made after the lunar new year, the NEV segment continues to eat into the ICE lane, as illustrated by the flat monthly performance of ICE shipments over the extended time period shown below, and the consistent rise in NEV share of vehicles produced.

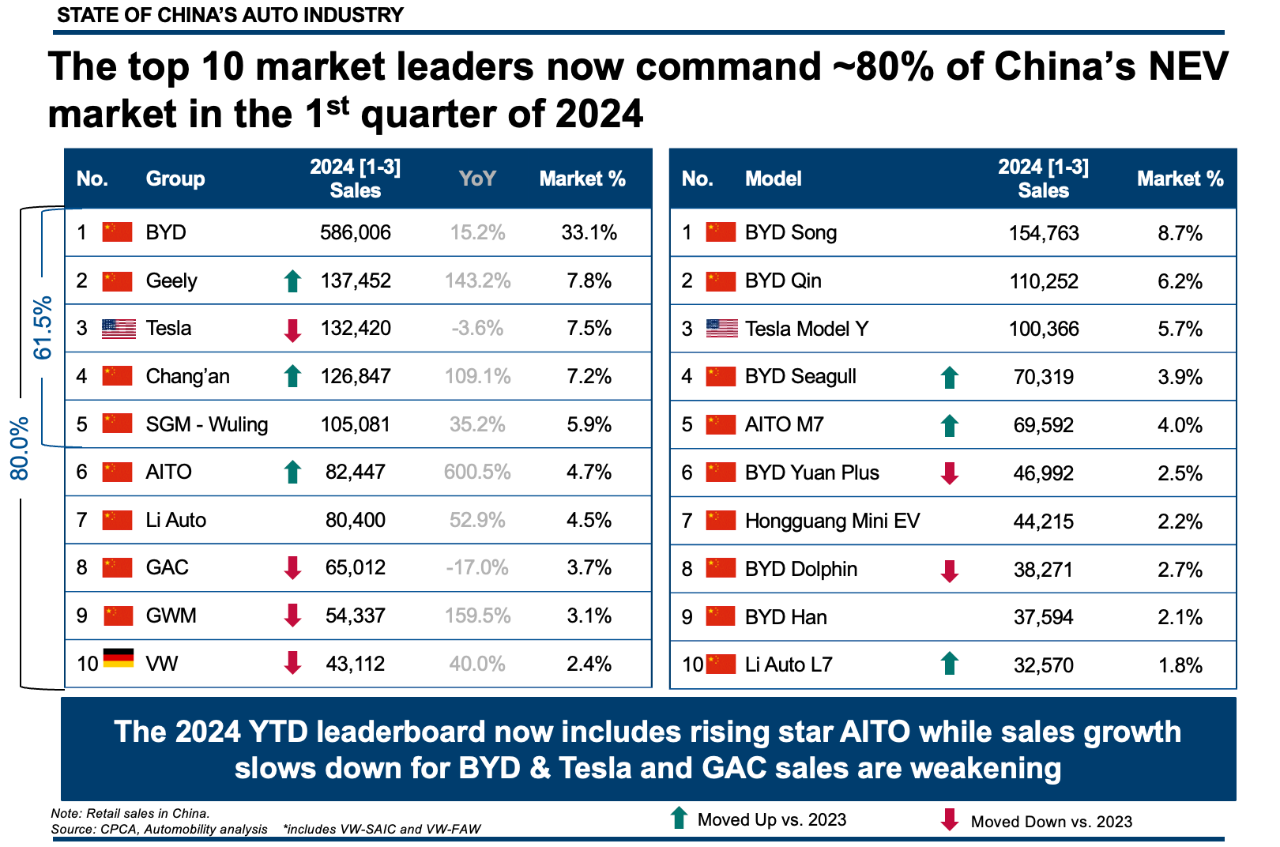

NEV Sales Leaderboard and BYD’s Price-Led Resurgence

Last month, we reported that when faced with rising competition from Geely, Chang’an, AITO and Great Wall (especially in the PHEV/EREV segment), BYD share of sales had fallen from 35% to 30.8% in the opening 2 months of 2024. After their recent pricing moves, BYD has recovered to 33.1% in year-to-date sales. Notable weakness can be seen in the performance of Tesla and Guangzhou Auto Company (GAC) so far this year.

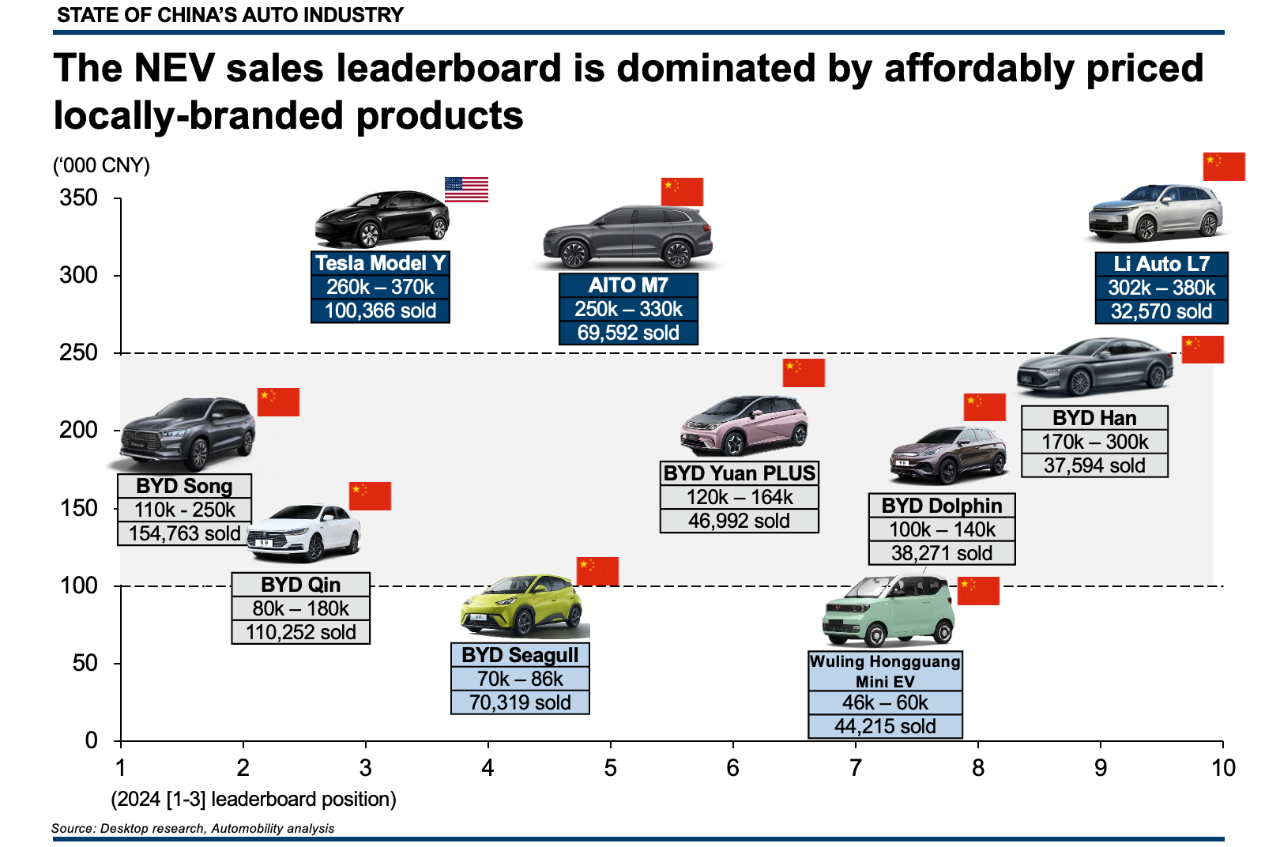

Affordably priced vehicles dominate the top 10 list of best-selling NEVs. At current exchange rates [1 USD = 7.24 CNY], Chinese branded NEVs are competing favorably on price versus ICE vehicles while offering far more technology. Well-equipped BEVs like the BYD Seagull are now under US$10k, so it is no wonder why Tesla has reportedly shelved its plans for a US$25k Model 2.

For the month of March, which follows the recent pricing reductions, BYD now has 6 of the top 7 best-selling NEV models in China, adding the Frigate 05 to their already impressive list of top-selling models.

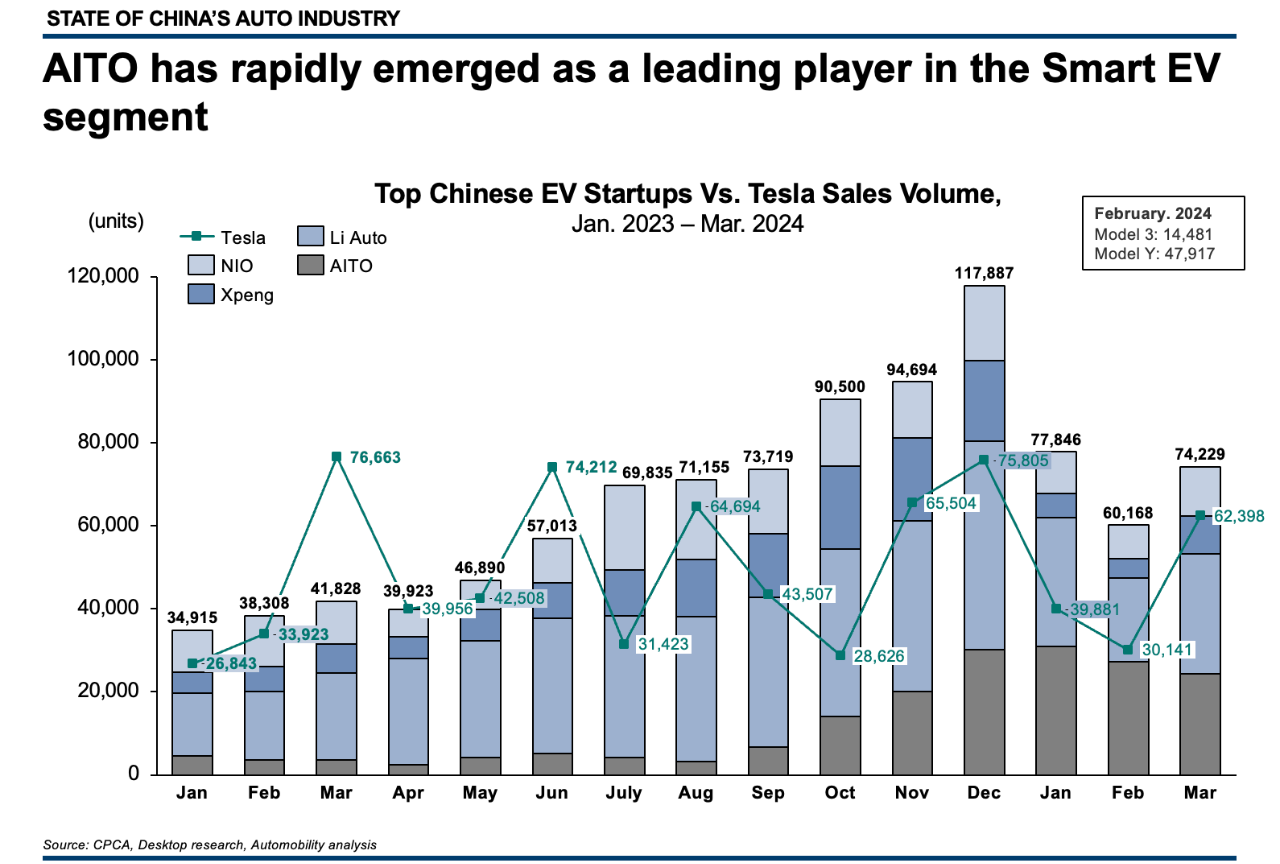

The continuing strength of Huawei’s AITO brand is also noteworthy, having taken significant share of the Smart EV sub-segment with their hot-selling M7 extended range EV offering. We believe this is in part due to the relevance of “smart device” makers to the Chinese EV consumer.

This consumer relevance can also be observed in the market response to the launch of the Xiaomi SU7 in late March. Weekly sales of the SU7 surpassed its facing competitors (Zeekr 001, Tesla Model 3, Xpeng P7, etc.) in the second week after its start of delivery.

A New Competitive Reality

The list of top 10 passenger vehicle NEV brands only has 2 foreign players: Tesla and Volkswagen. Both of them are struggling to sustain performance in China, in spite of great efforts. With 20% share of the ICE market, Volkswagen has learned that their 40 years of brand equity translates to an order-of-magnitude (10X) lower share in the NEV segment, in spite of having very competitively priced offerings in China.

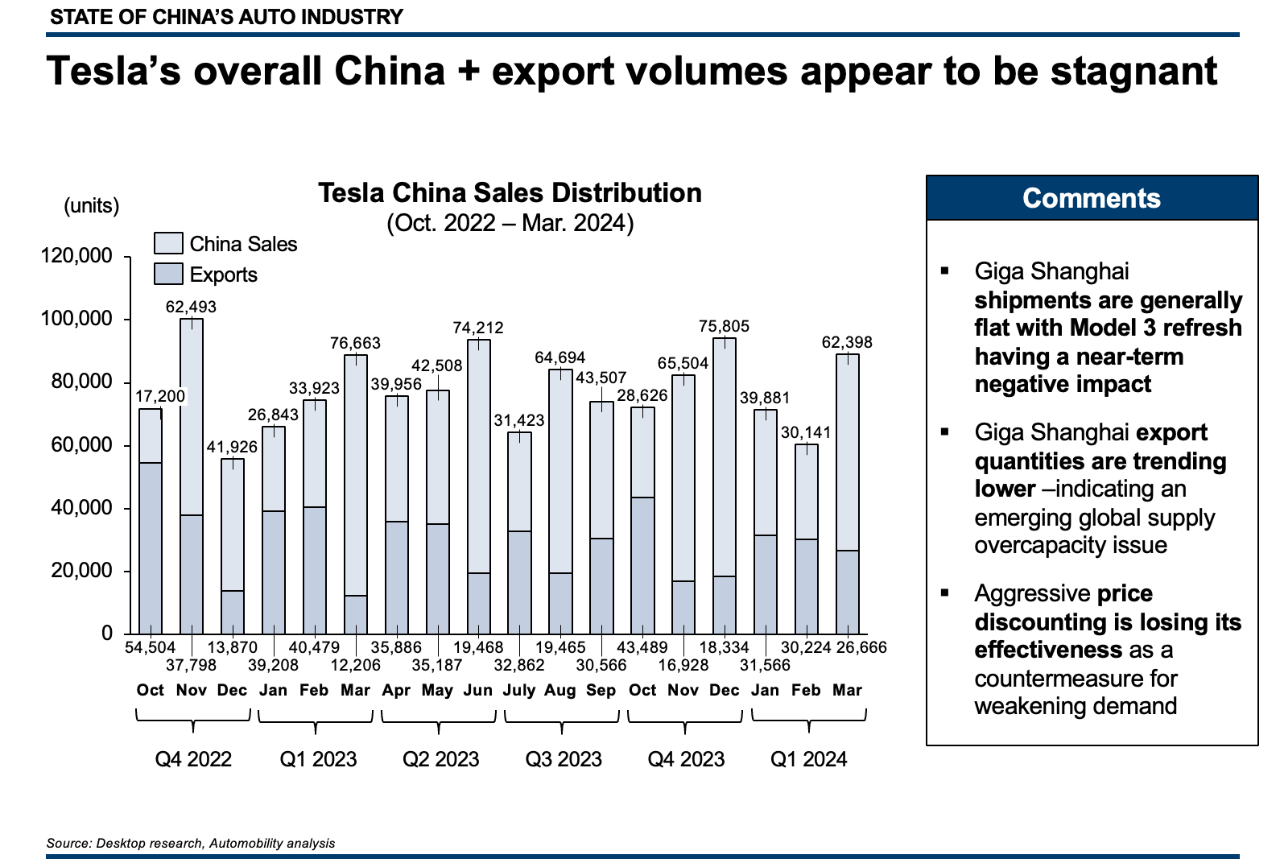

At the EV global pioneer, Tesla is largely responsible for having sparked the wave of passenger vehicle EV interest in China, which began in 2020 – the year Tesla launched their Shanghai jjjgigafactory. However, Tesla sales have stagnated in the face of Chinese domestic competition, as seen in the chart below. As Chinese EV makers expand internationally, this will likely put additional pressure on their growth prospects.

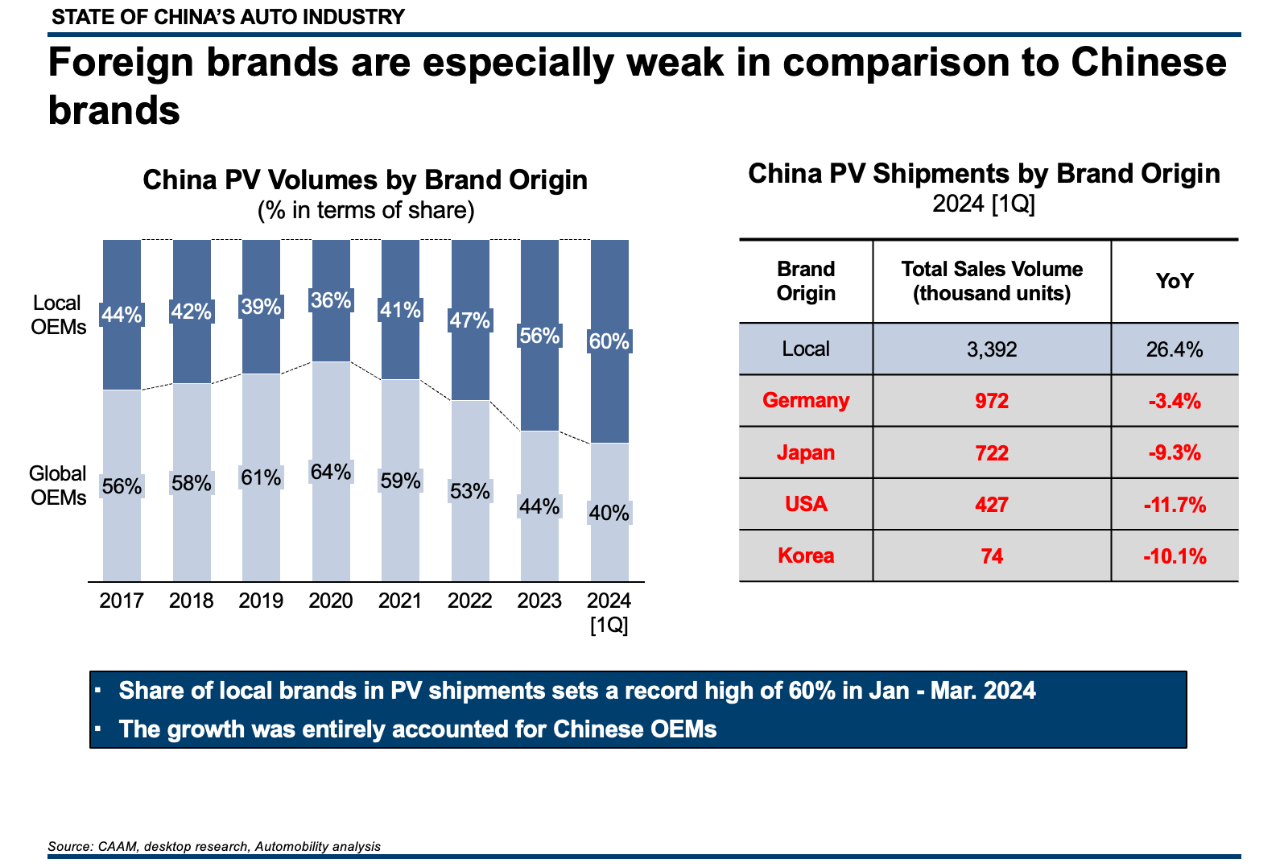

With their dominance of the expanding NEV segment, Chinese brands now command 60% share of passenger vehicles market in China, forcing foreign mass-market brands to search for a countermove to regain relevancy in the world’s largest car market.

Let’s see what they have to say at the Beijing Auto Show this week!

Webinar | State of China Auto Market Monthly Briefing (April)

About Bill Russo

Bill is a contributing author to the book Selling to China: Stories of Success, Failure, and Constant Change (2023), where he describes how China has become the most commercially innovative place to do business in the world’s auto industry – and why those hoping to compete globally must continue to be in the market.

About Automobility

Contact us by email at info@automobility.io

Sorry, the comment form is closed at this time.