31 Mar State of China’s Auto Market – March 2024

Hyper-competition Triggers Price War II

Comments from Bill Russo, Founder & CEO of Automobility Ltd.

As we have highlighted in our February newsletter, China’s automotive market is contending with a number of headwinds exiting 2023:

-

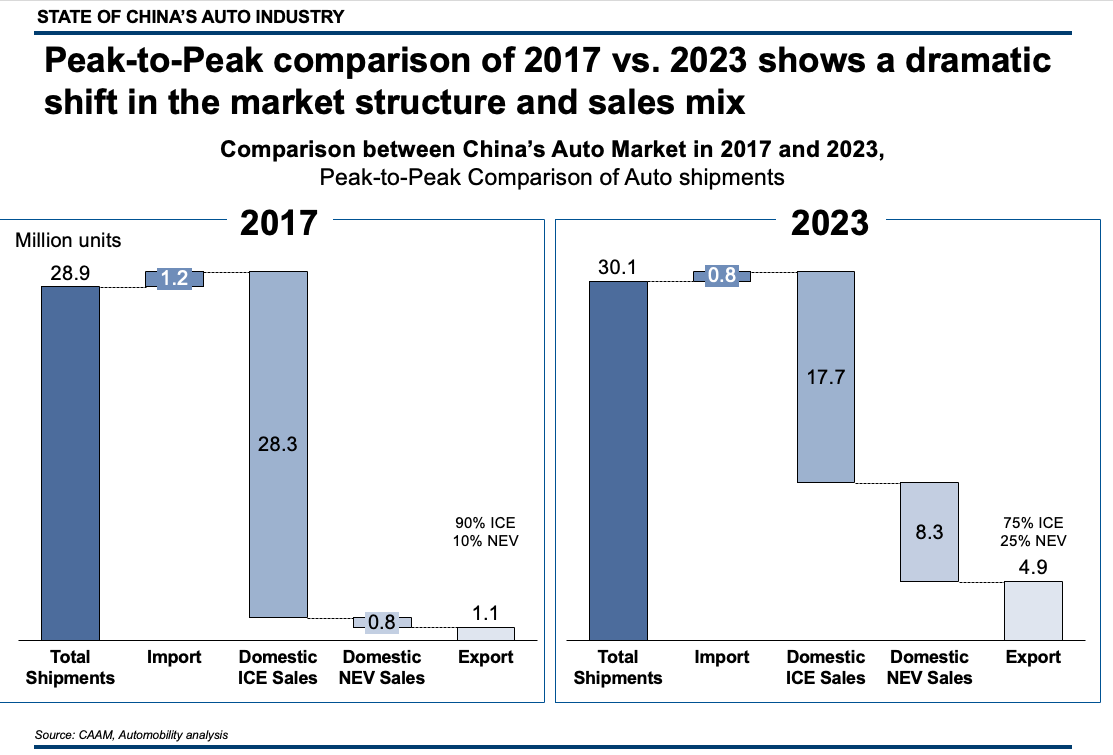

Multi-year decline in sales volumes of Internal Combustion Engine (ICE) powered vehicles (down 11 million units from 2017 – 2023). -

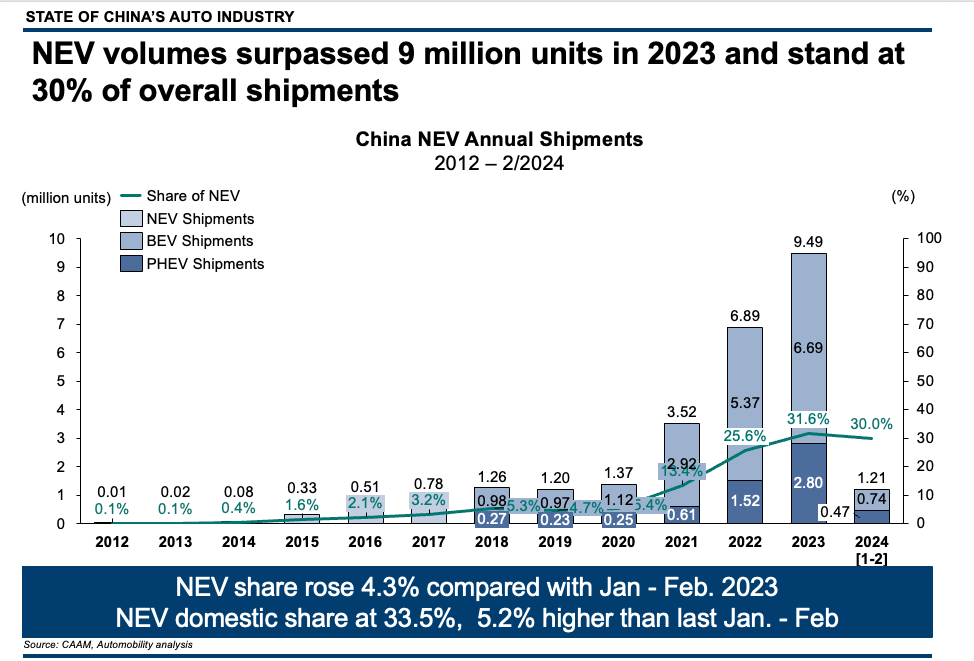

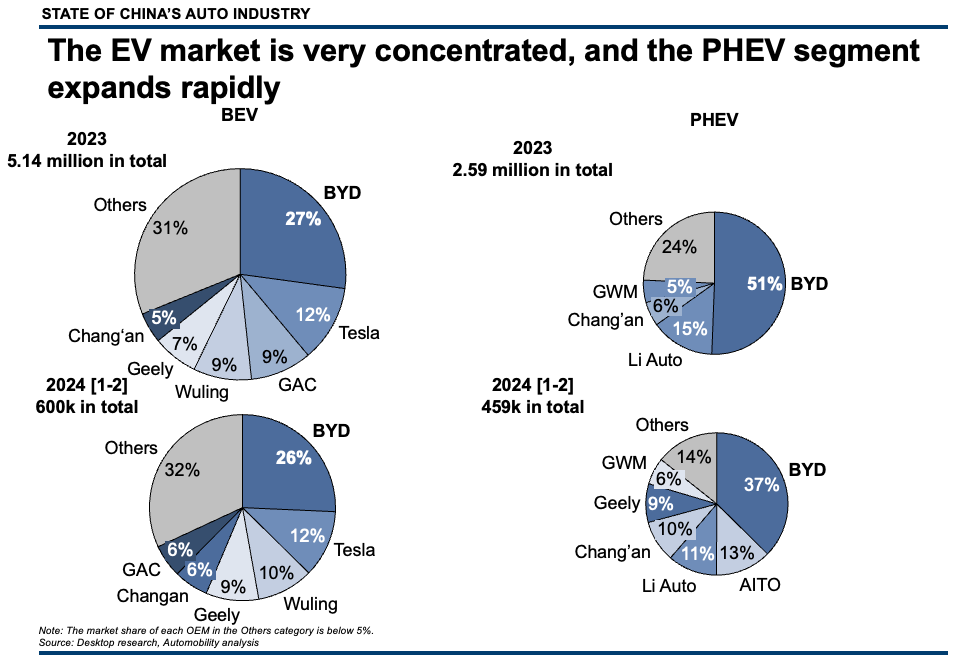

A highly concentrated New Energy Vehicle (NEV) market (which grew by 8.3 million units from 2017 – 2023). -

High growth in the Plug-in Hybrid (PHEV) category, historically dominated by BYD. - Structural overcapacity in a market where domestic sales are down (over 3 million units from 2017 – 2023), resulting in a push to export the excess capacity from China to overseas markets (with exports up by 3.8 million units from 2017 – 2023).

All of these conditions set the stage for the competitive landscape entering 2024.

Enter the (Year of the) Dragon

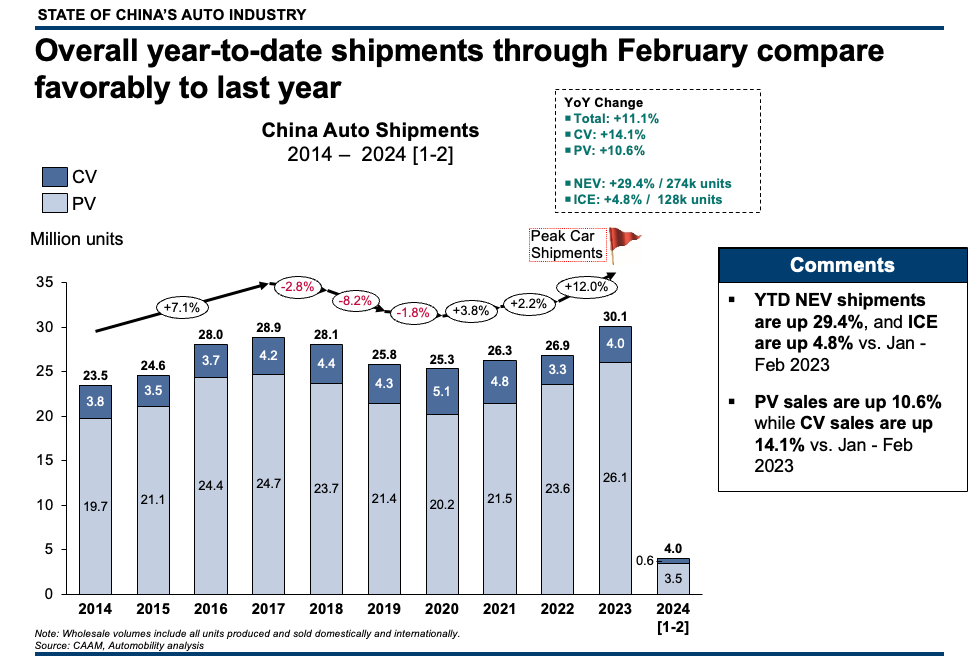

Through February, vehicle shipments reached 4.0 million units, an 11.1 percent increase from the prior year-to-date period. NEV shipments are up 29.4% and ICE shipments up 4.8%.

On the surface, this seems like a solid opening for the Year of the Dragon.

Digging a bit deeper, we see that while domestic sales were up over 200,000 units over this period while exports were up by a similar amount, and hit a record 23.8 percent of overall production in February.

Clearly, Made-in-China exports act as the safety valve to relieve oversupply pressure that persists within China’s automotive industry.

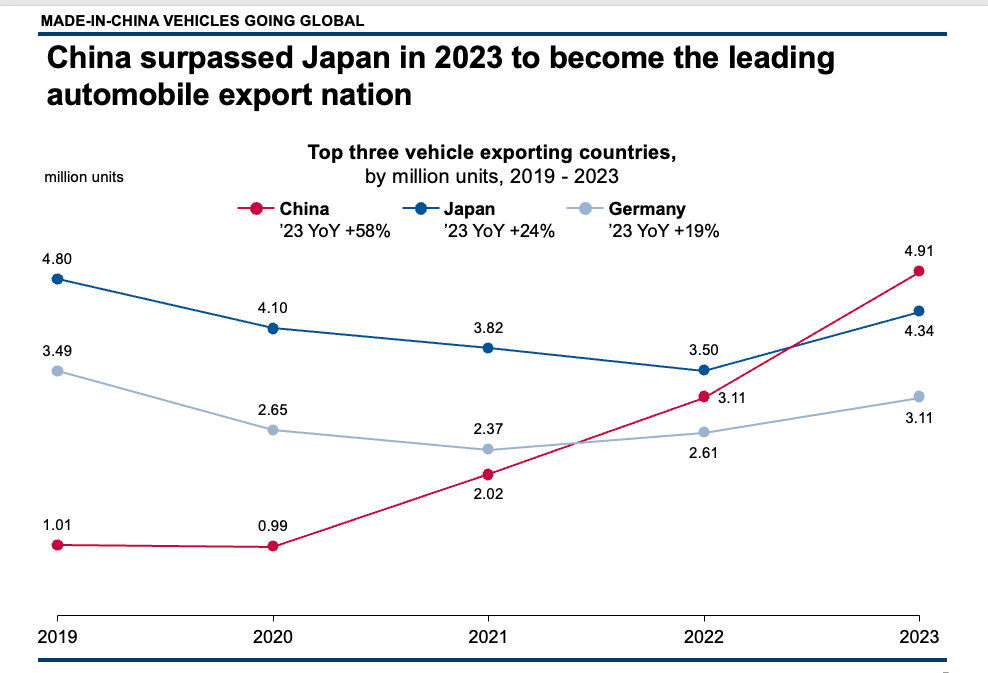

Exiting 2023, China stood as the leading automobile export nation in the world, surpassing Germany in 2022 and Japan in 2023. Given the continued demand weakness and hyper-competitive conditions that exist among the competitors in China, we can expect a continued rise in exports in 2024.

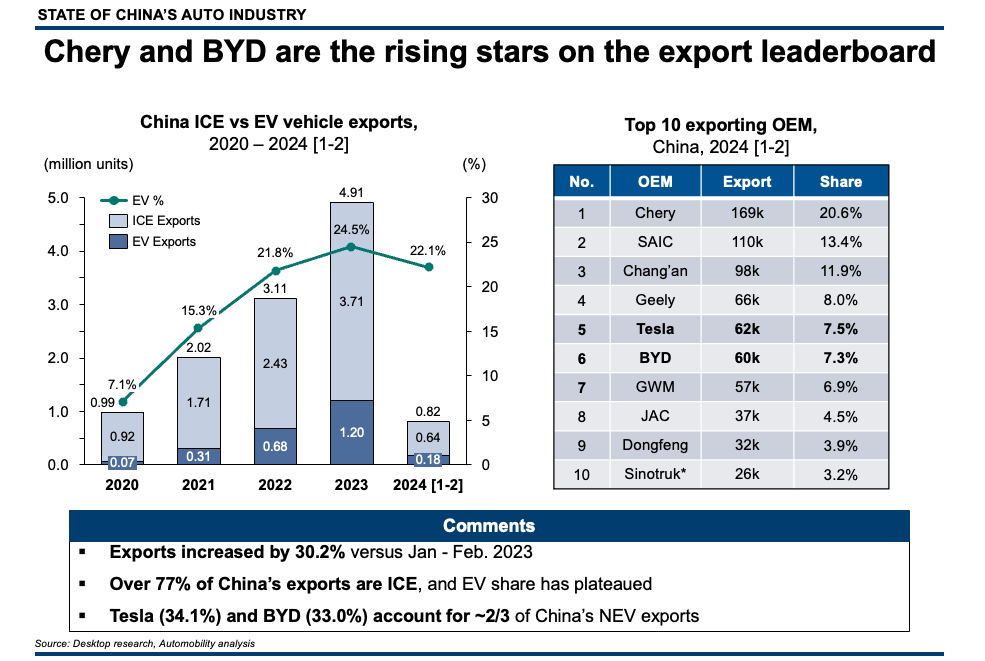

Made-in-China exports increased 30.2% in the first two months of 2024 versus last year. Interestingly, the NEV share of the exports actually declined from 24.5 to 22.1 percent, which we believe is because:

- Oversupply pressure is higher in China for ICE versus NEV

- Most overseas consumers are still not fully ready to embrace the EV

- Chinese brands are hungry to recapture growth and will accelerate their overseas move in a period of domestic weakness

- The Chinese value proposition of affordability is very exportable (For both ICE and NEV)

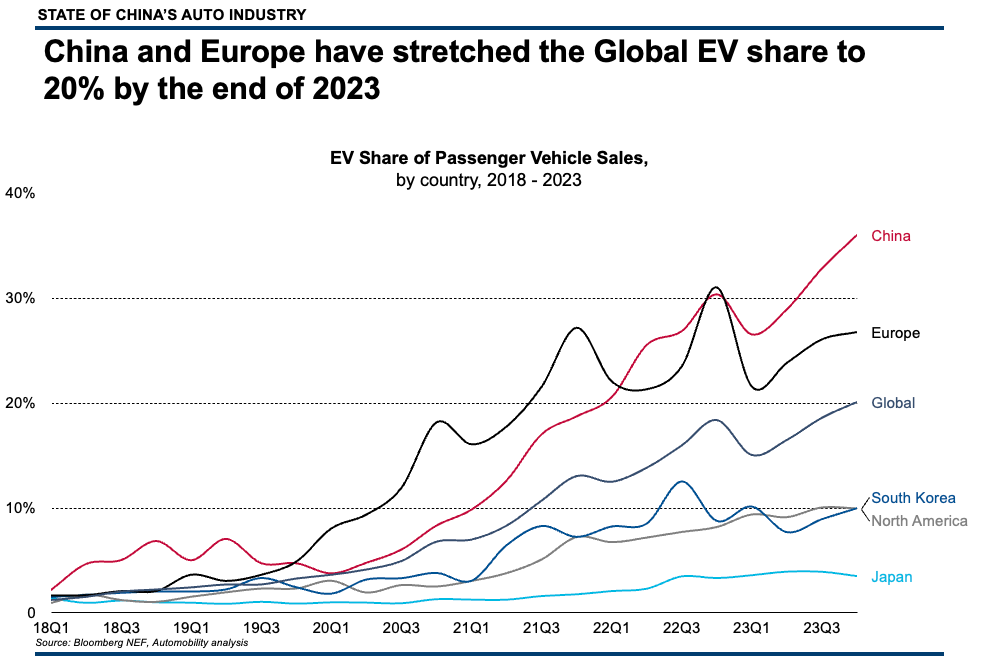

Bloomberg New Energy Finance recently published the EV penetration level among the leading car producing nations, which highlighted the lead China has achieved in EV commercialization with about one-third of all cars sold (versus a global average of 20%). The only other region above the global average is Europe with EV penetration over 25 percent – a large percentage of which are Made-in-China Teslas.

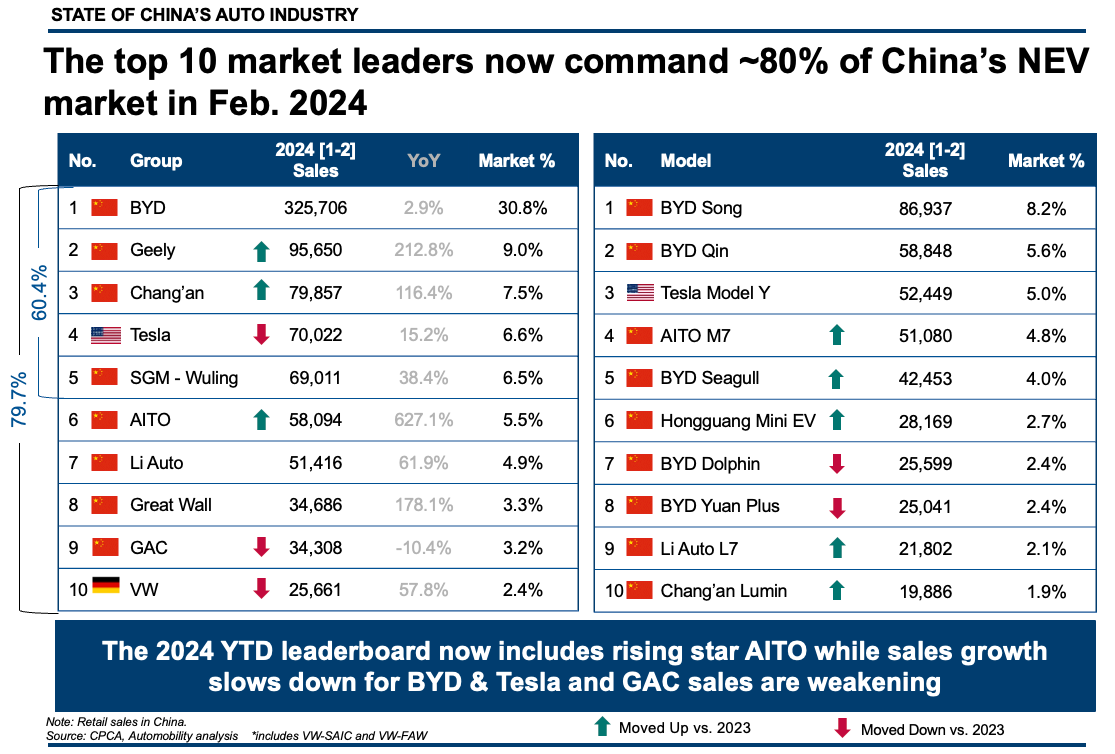

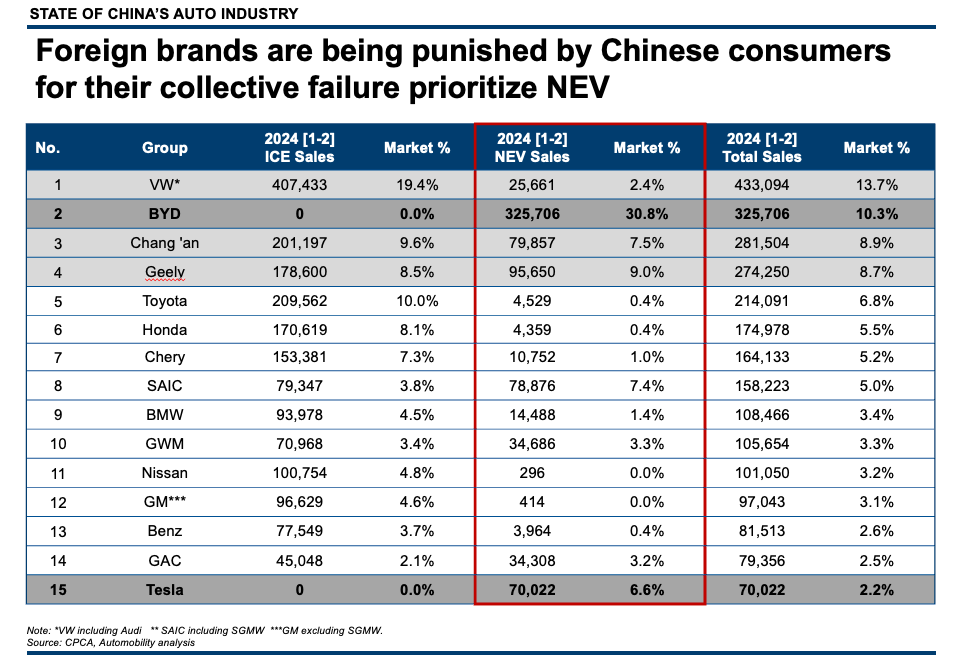

With two months in the 2024 books, we begin to see some interesting developments in the competitive landscape. The leaderboard at the end of 2023 had BYD dominated at 35% of all NEV sales and 6 of the top 10 selling nameplates.

- BYD’s NEV share declined from 35% to 30.8%

- Chang’an and Geely moved into the #2 and #3 slots, surpassing Tesla

- Huawei’s AITO catapulted onto the list into #6, with their very popular M7 landing at #4 best selling NEV

-

GAC fell to #9 with both of their top-selling vehicles falling off the nameplate leaderboard

The growing pressure from PHEV competition from the likes of AITO, Geely, Chang’an and Great Wall is a contributing factor to the re-emergence of the price war in China, let this time by BYD.

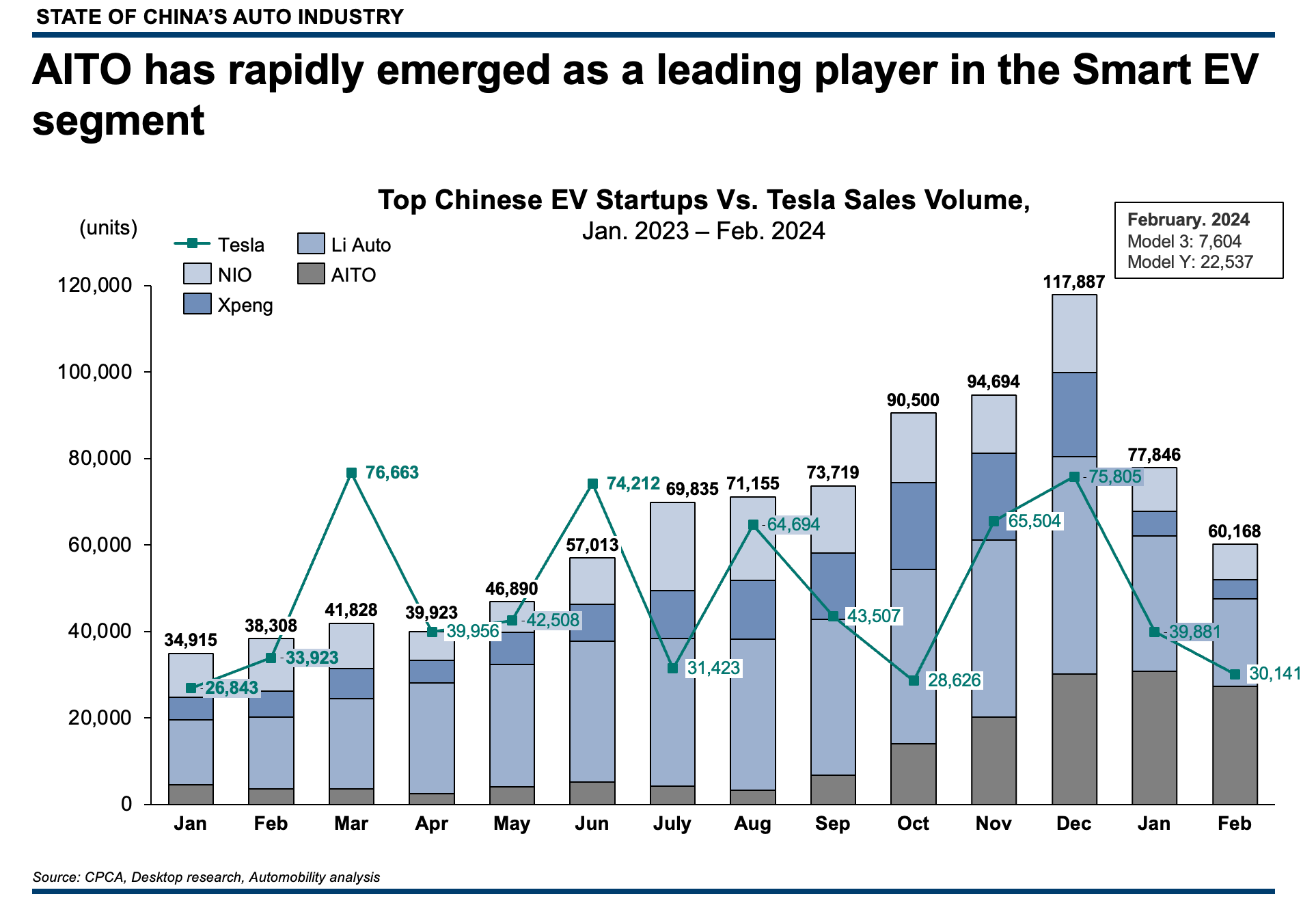

It is also remarkable to compare the rise of Huawei’s AITO brand, which is proving to be a true disruptive force in the Smart EV category, now rivaling Tesla in monthly sales and surpassing Li Auto.

Sold alongside Huawei’s other smart consumer electronics devices, we believe this signals a wide acceptance in China of well known Chinese consumer electronics brands among NEV purchase intenders.

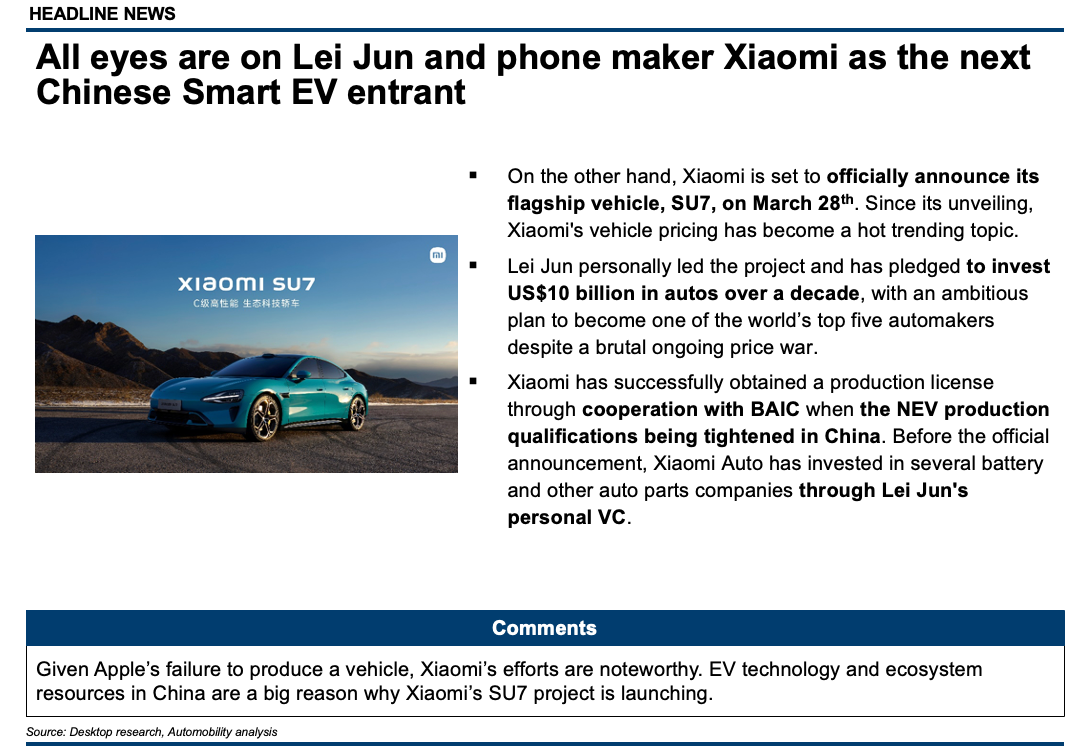

We will watch very closely as Xiaomi enters the market with their new SU7 offering this month. The entry of Chinese smart device makers into the automotive industry stands in sharp contrast to the recent cancellation of Apple’s “Project Titan” development effort.

An Altered Competitive Landscape

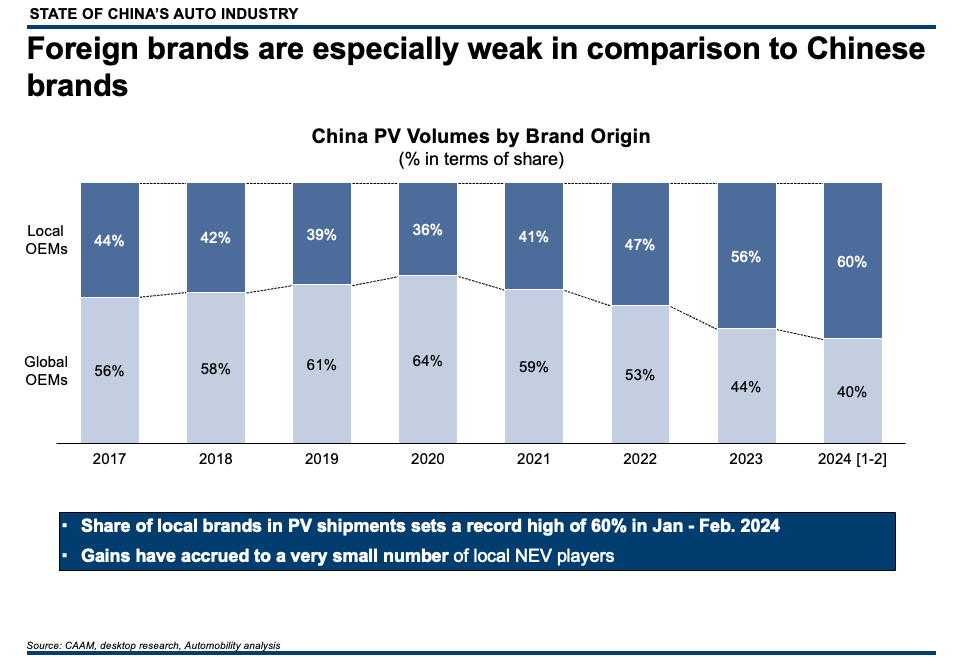

Foreign brand share of the China passenger vehicle market remains at an all-time low of 40%, with gains accruing to a small number of local players.

While this is by no means the end of foreign brand relevance in China, they clearly being punished by Chinese consumers for their collective failure to prioritize the NEV segment, or by approaching it in a “premium” and in a way that carries over too much of the ICE design, content and business model legacy. The impact of this is rather obvious when we look at the top 15 overall market leaders.

Chinese consumers are increasingly embracing NEVs produced by Chinese carmakers. The problem is there are far too many Chinese companies chasing a market that is not able to absorb all of that they can produce – driving Chinese companies to go global even faster.

About Bill Russo

Bill is a contributing author to the book Selling to China: Stories of Success, Failure, and Constant Change (2023), where he describes how China has become the most commercially innovative place to do business in the world’s auto industry – and why those hoping to compete globally must continue to be in the market.

About Automobility

Contact us by email at info@automobility.io

Sorry, the comment form is closed at this time.