11 Mar State of China’s Auto Market – February 2024

Structural Overcapacity Drives Focus on Exports and Price Discounts

Comments from Bill Russo, Founder & CEO of Automobility Ltd.

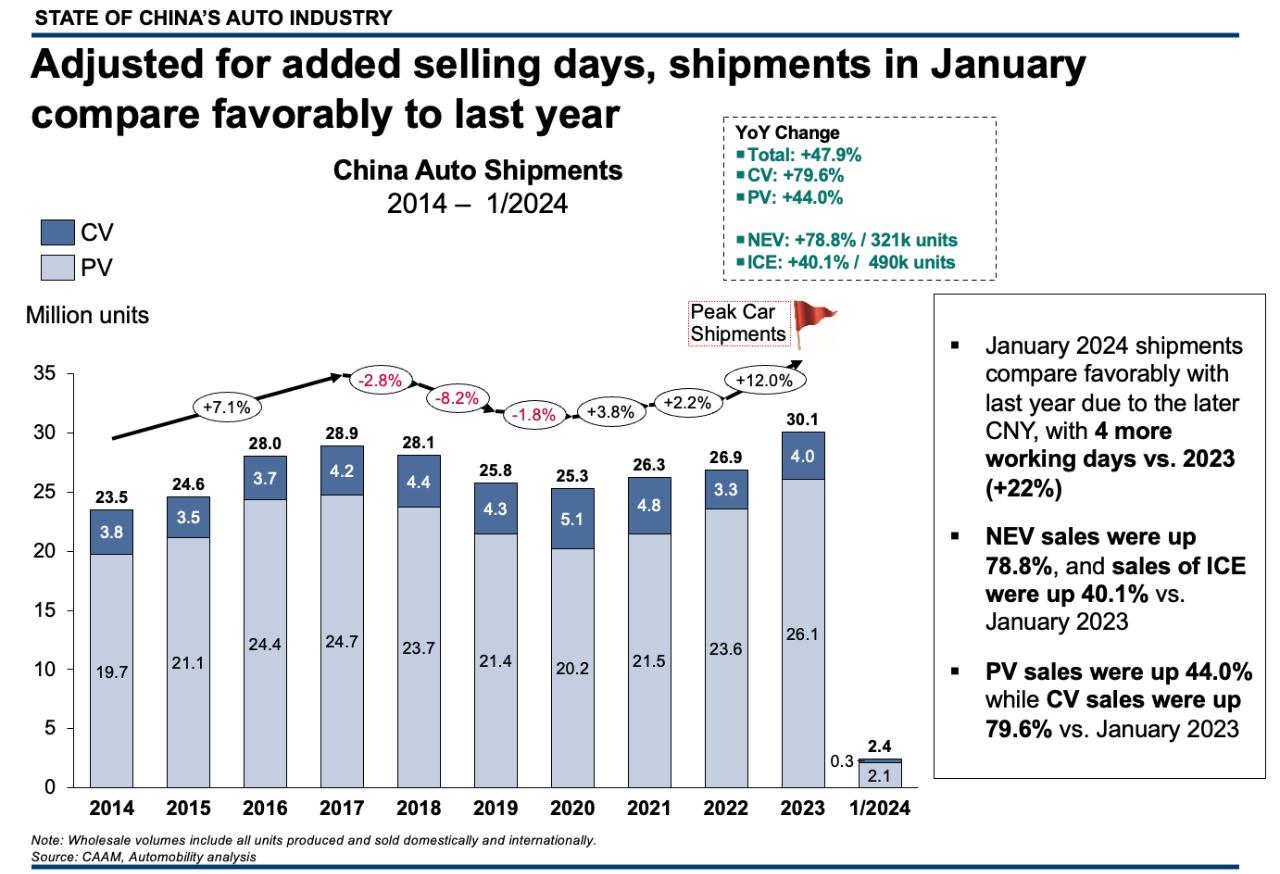

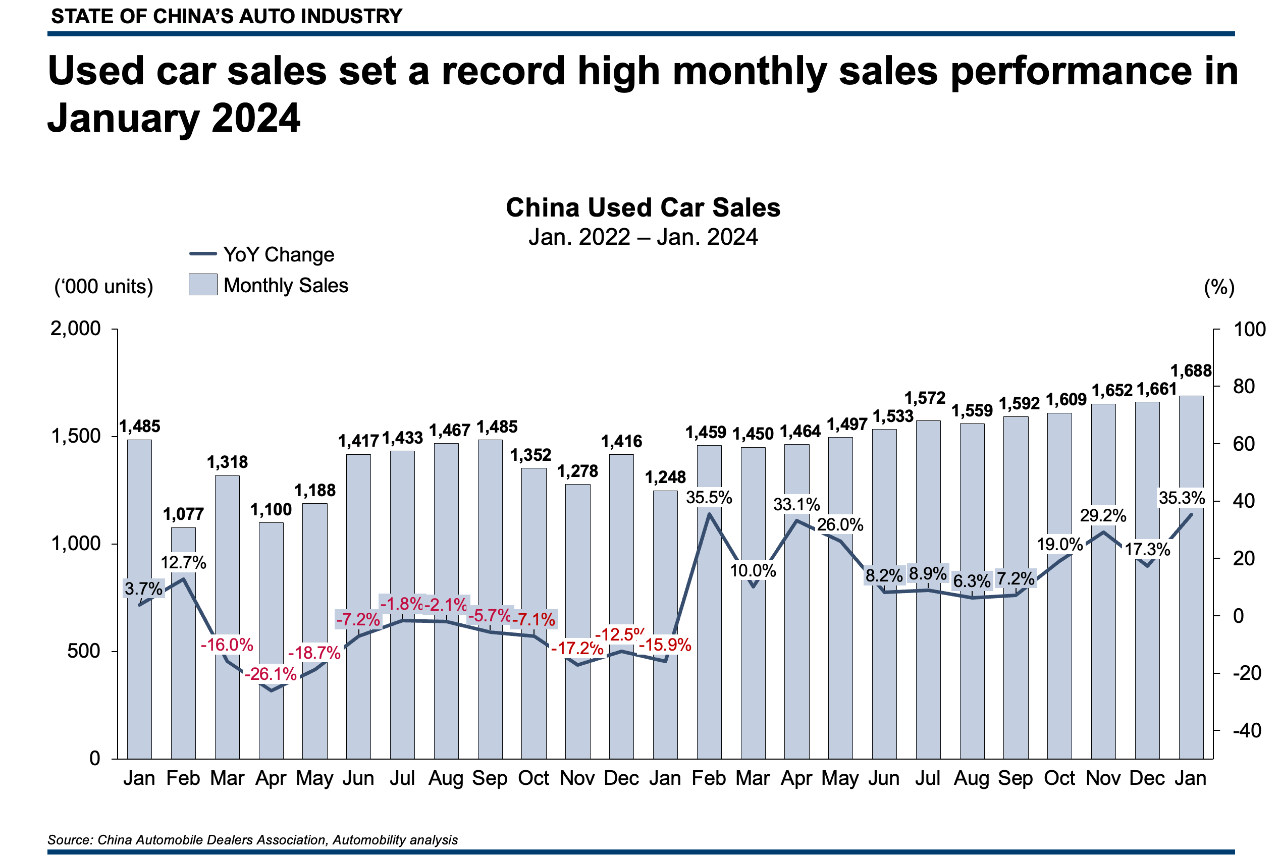

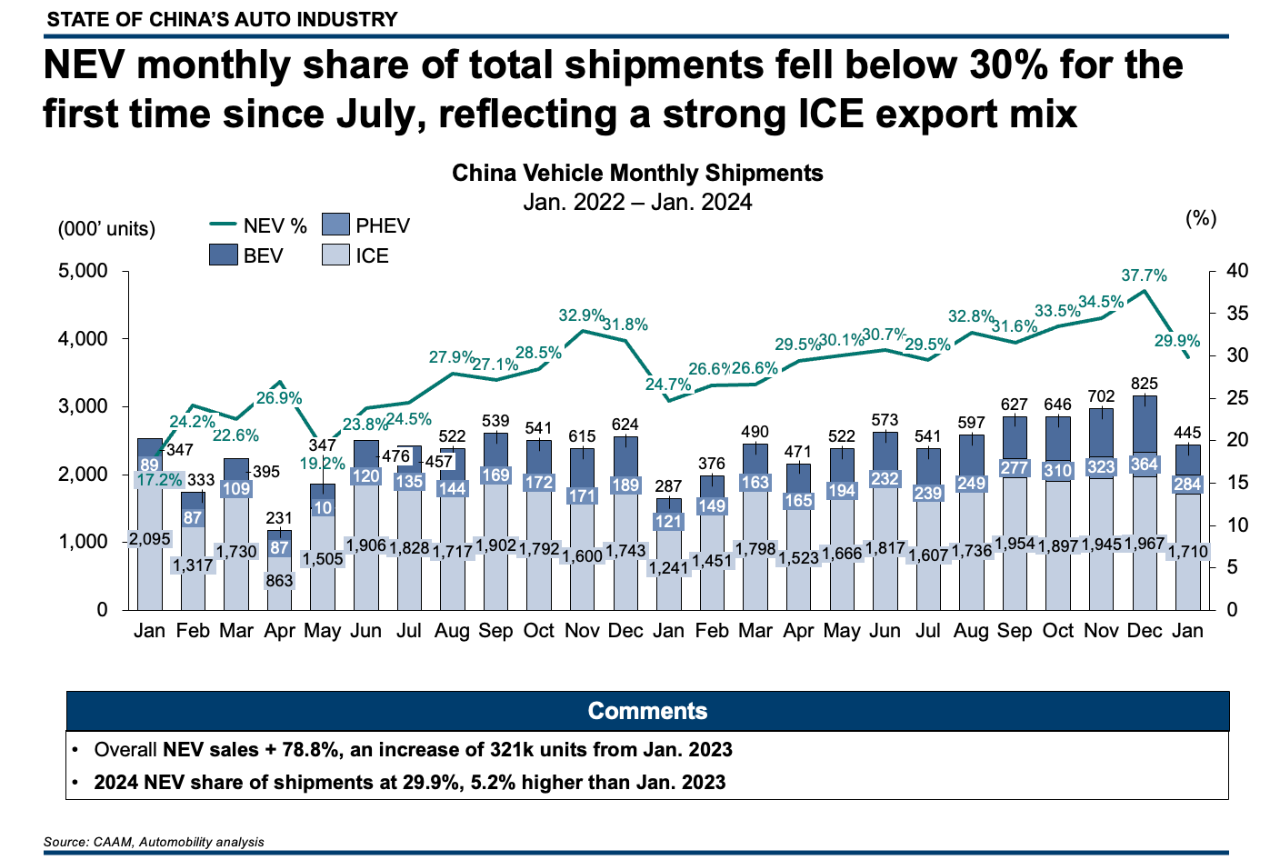

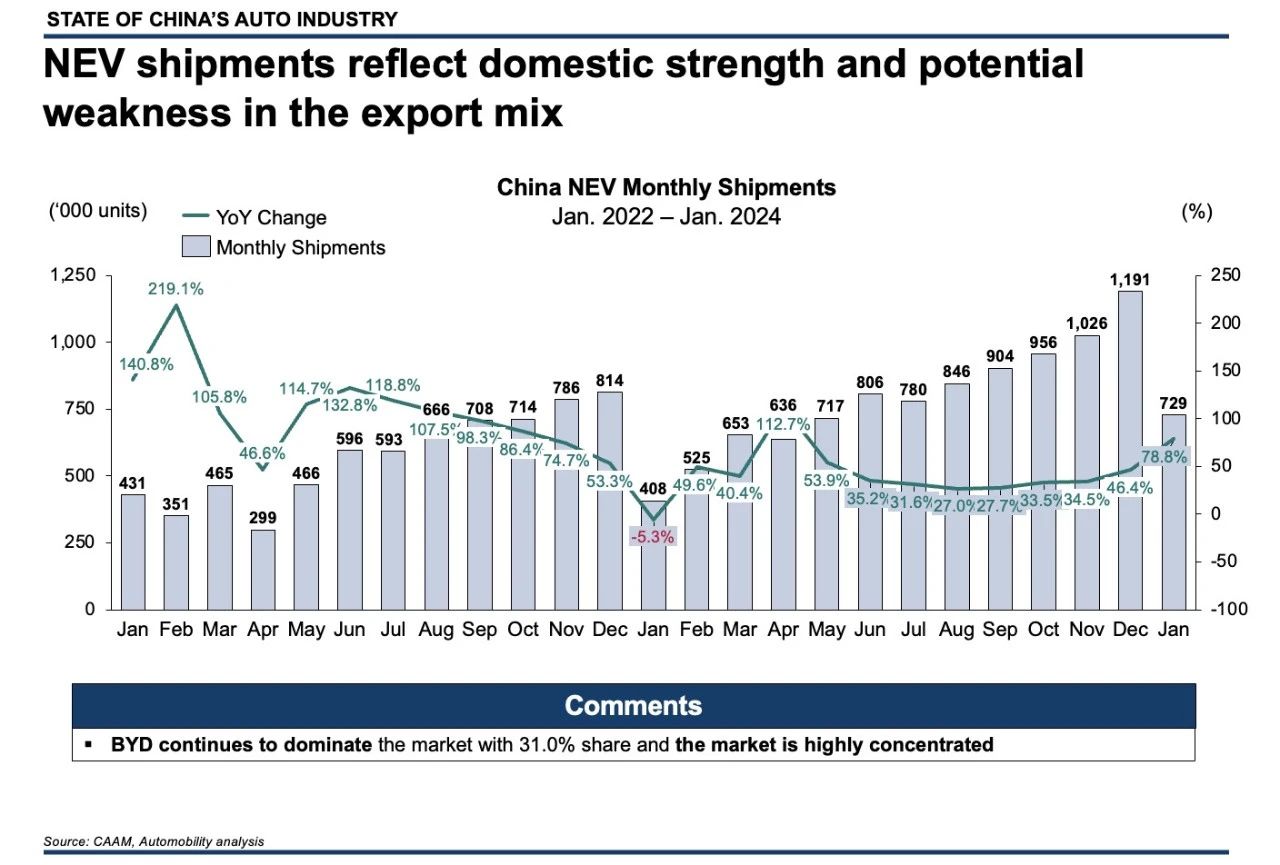

Vehicle shipments in January reached 2.4 million units, a 47.9 percent increase from the previous January, with NEV shipments up 78.8% and ICE shipments up 40.1%. It is important to note that there were 22% more selling days in 2024 versus last year due to the later Lunar New Year holiday.

NEV includes Battery Electric Vehicles (BEV), Plug-in Hybrid Electric Vehicles (PHEV), and Fuel Cell Electric Vehicles (FCEV)

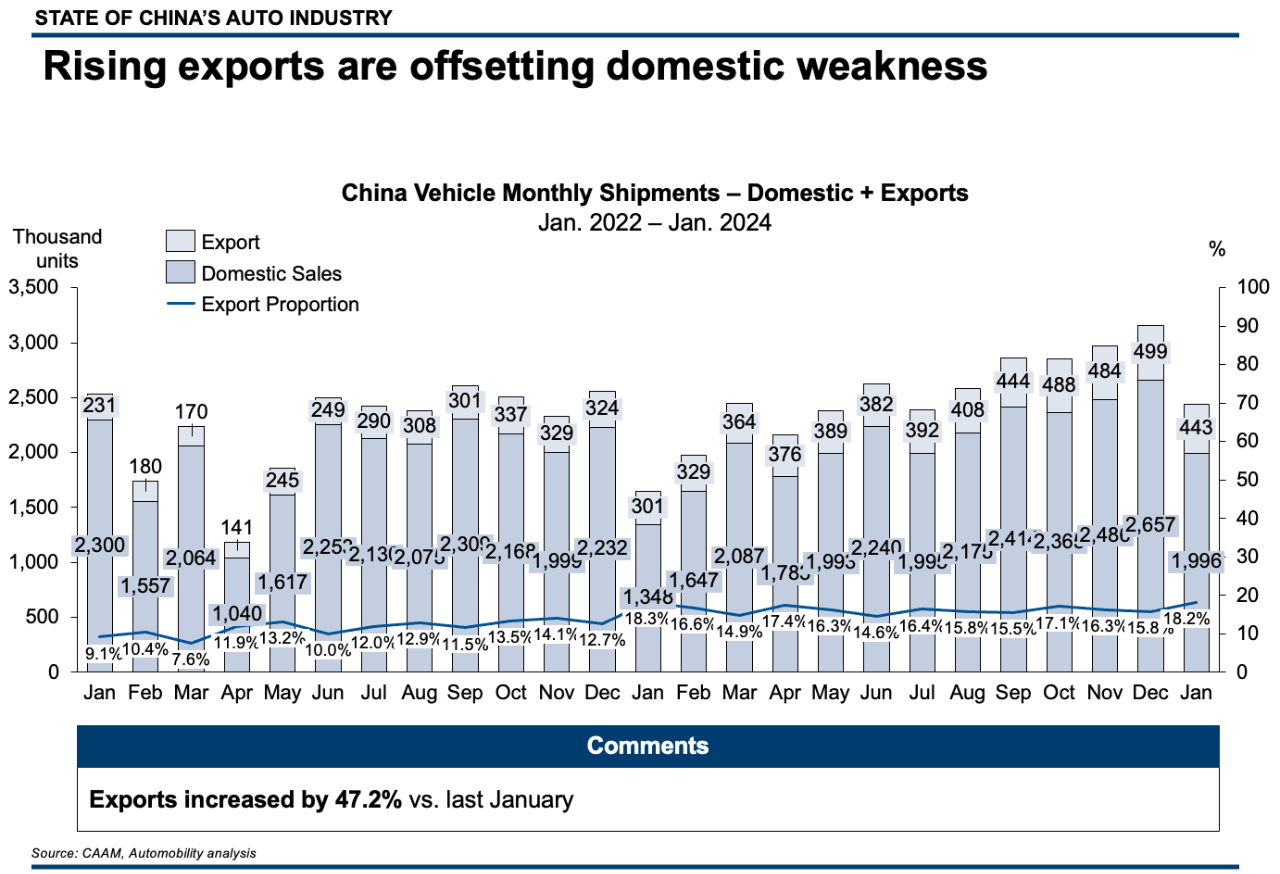

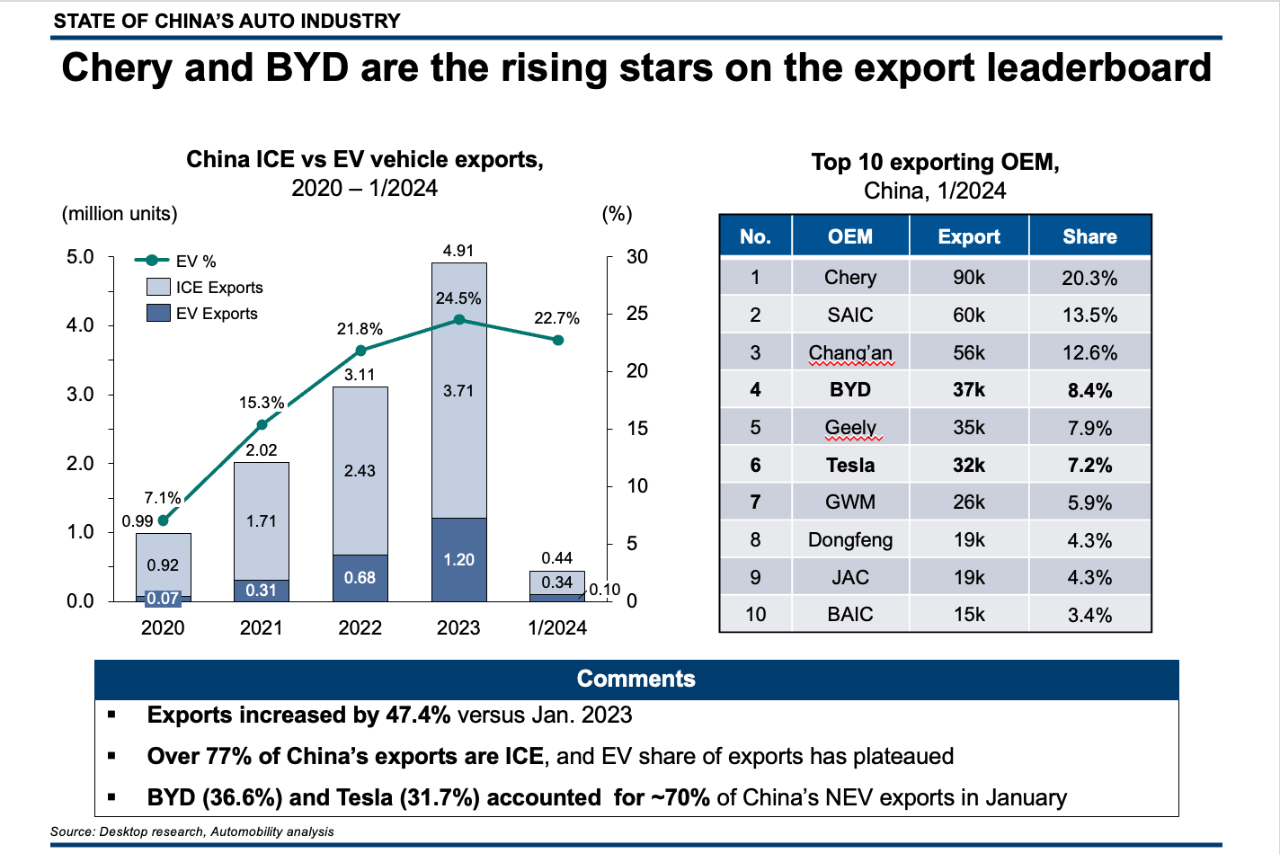

Export Mix is Dominated by ICE, Fueled By Excess Capacity

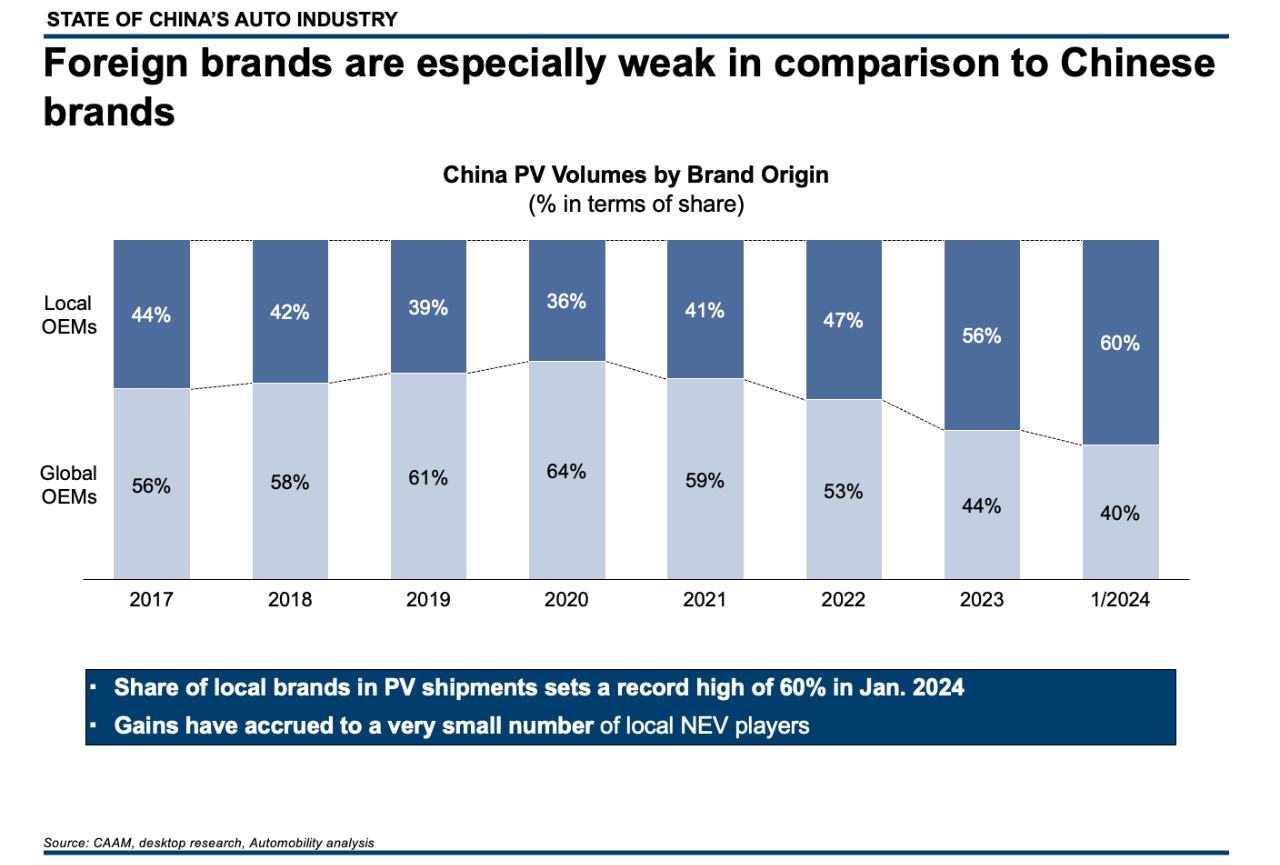

As we covered in the January edition of this State of China Auto Market newsletter, domestic sales of ICE powered vehicles in China has fallen by 11 million units over the six-year period from 2017-2023. Over this same period, NEV sales rose by 7.5 million units. This rapid demand shift has created a tremendous supply imbalance for both local and foreign-branded carmakers who were slow in adjusting to the changes in consumer preference.

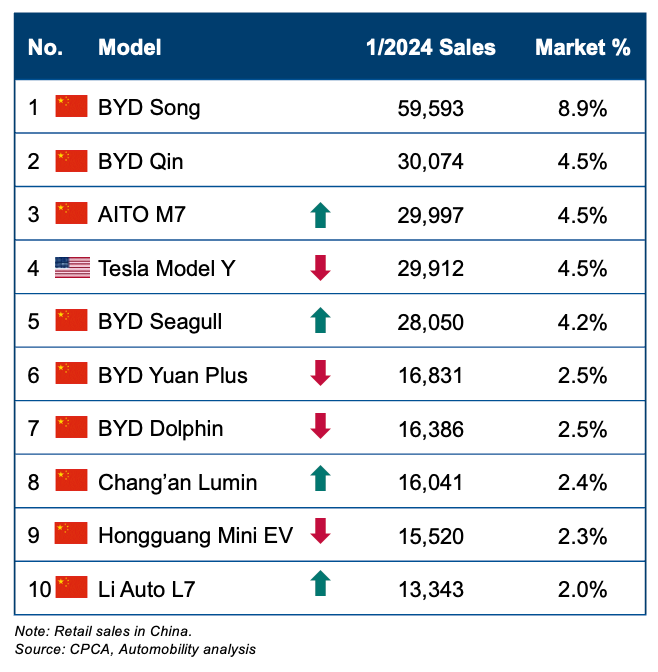

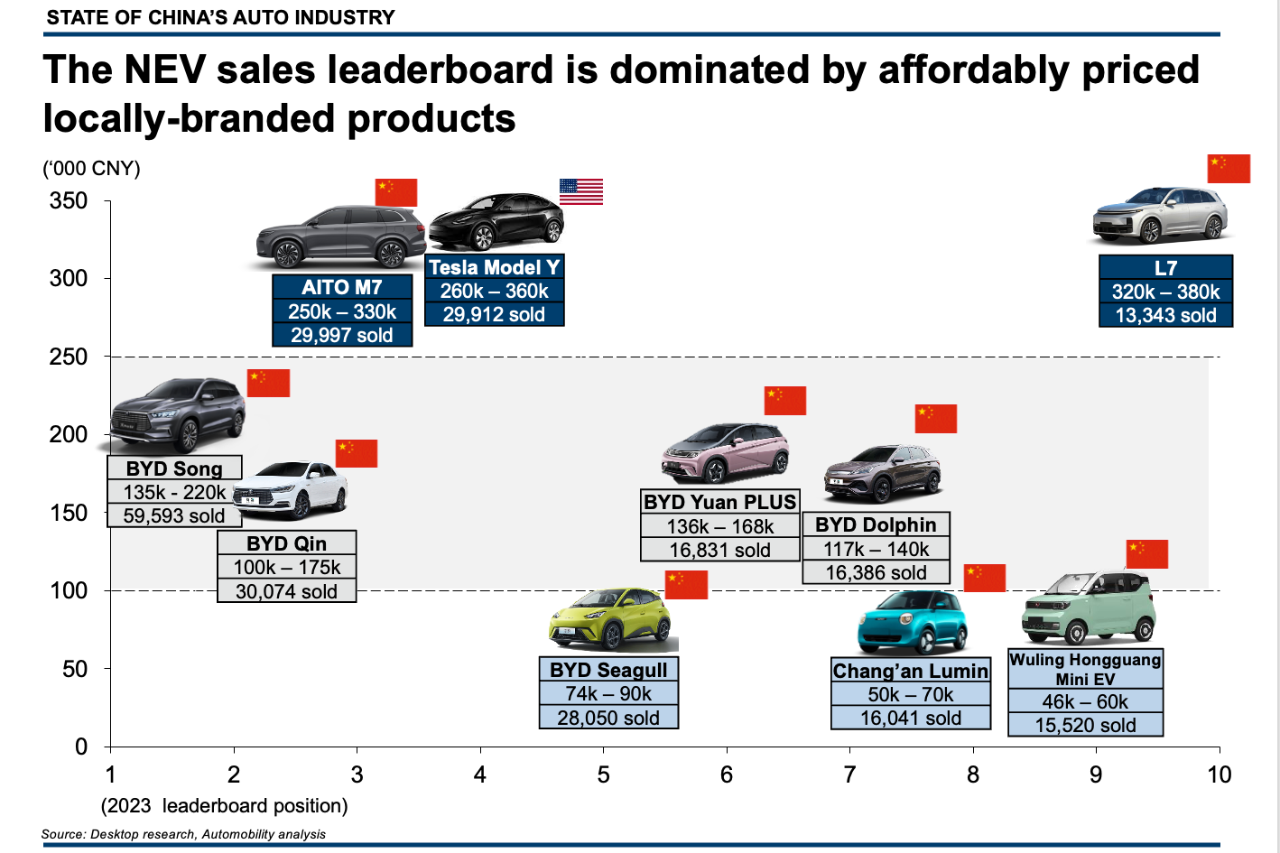

NEV Sales Leaderboard

With only one month so far in the 2024 books, it would not be appropriate to signal any new overarching trends, but we can highlight some indicative movements. Let’s start by showing where we ended the full year of 2023, where BYD dominated with 35% of all NEV sales and 6 of the top 10 selling nameplates.

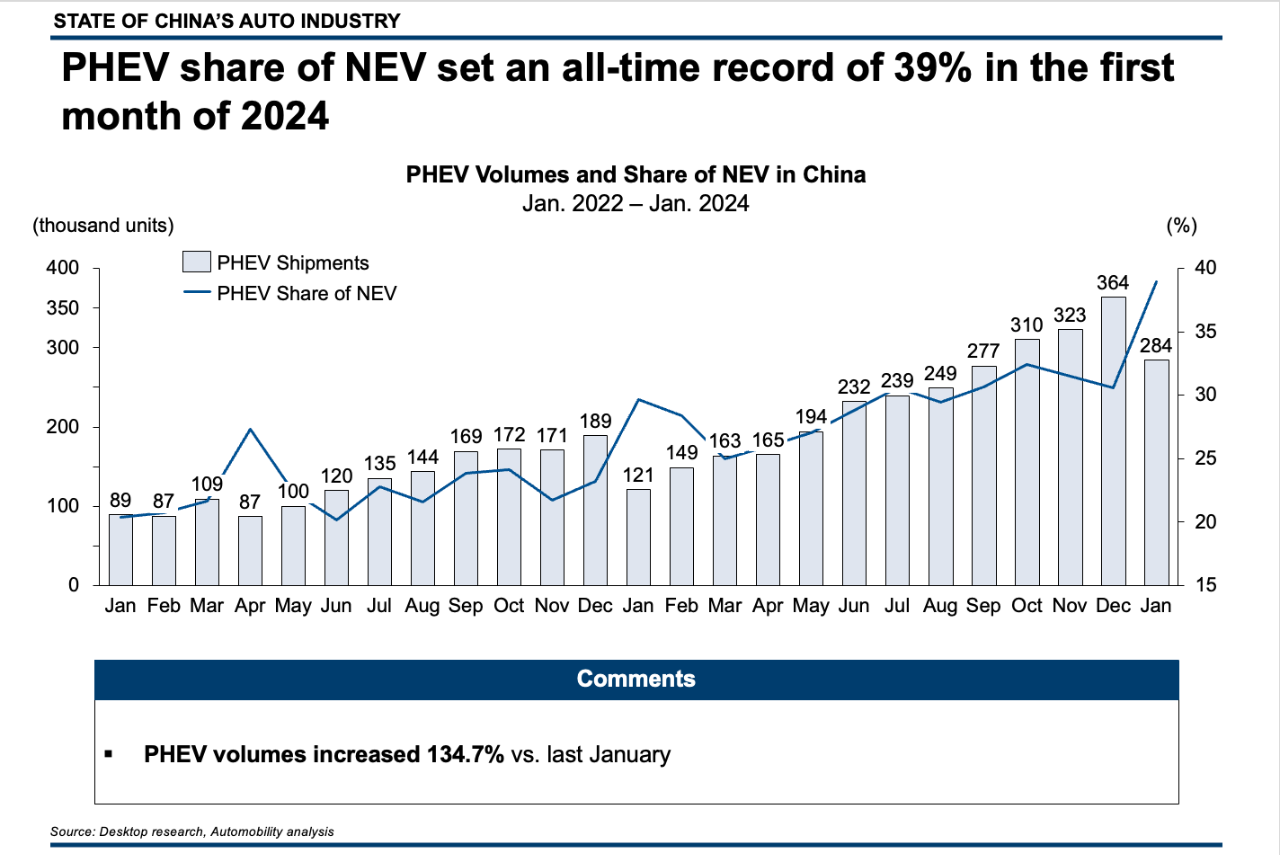

The NEV retail sales leaderboard for January includes noteworthy movements. Very notable is the strength of the recently launched AITO M7 Plug-in hybrid SUV, with nearly 30,000 units sold at a price that competes very well segment leader Li Auto L7. Tesla Model Y fell to 4th place (down from 3rd), and BYD Qin-DMi lost market share within the PHEV category, perhaps prompting BYD to take a 20% price reduction on the base model of their top-selling sedan.

Chang’an’s very low-priced Lumin also was added to the leaderboard while BYD Han fell off the Top 10 list.

The January Top 10 NEV Group sales leaderboard includes some noteworthy positional changes with significant segment share increases from Geely and Chang’an, and declines for BYD, Tesla and GAC. AITO moves onto the leaderboard in the number 7 slot, and NIO fell off the top 10 list.

The top 10 group companies command nearly 80% of the NEV market in China, implying significant overcapacities also exist among the dozens of other weaker NEV players in the market.

Top 10 NEV Corporate Group – January Retail Sales

Foreign brand share of the China passenger vehicle market slipped even further in January, now at an all-time low of 40%.

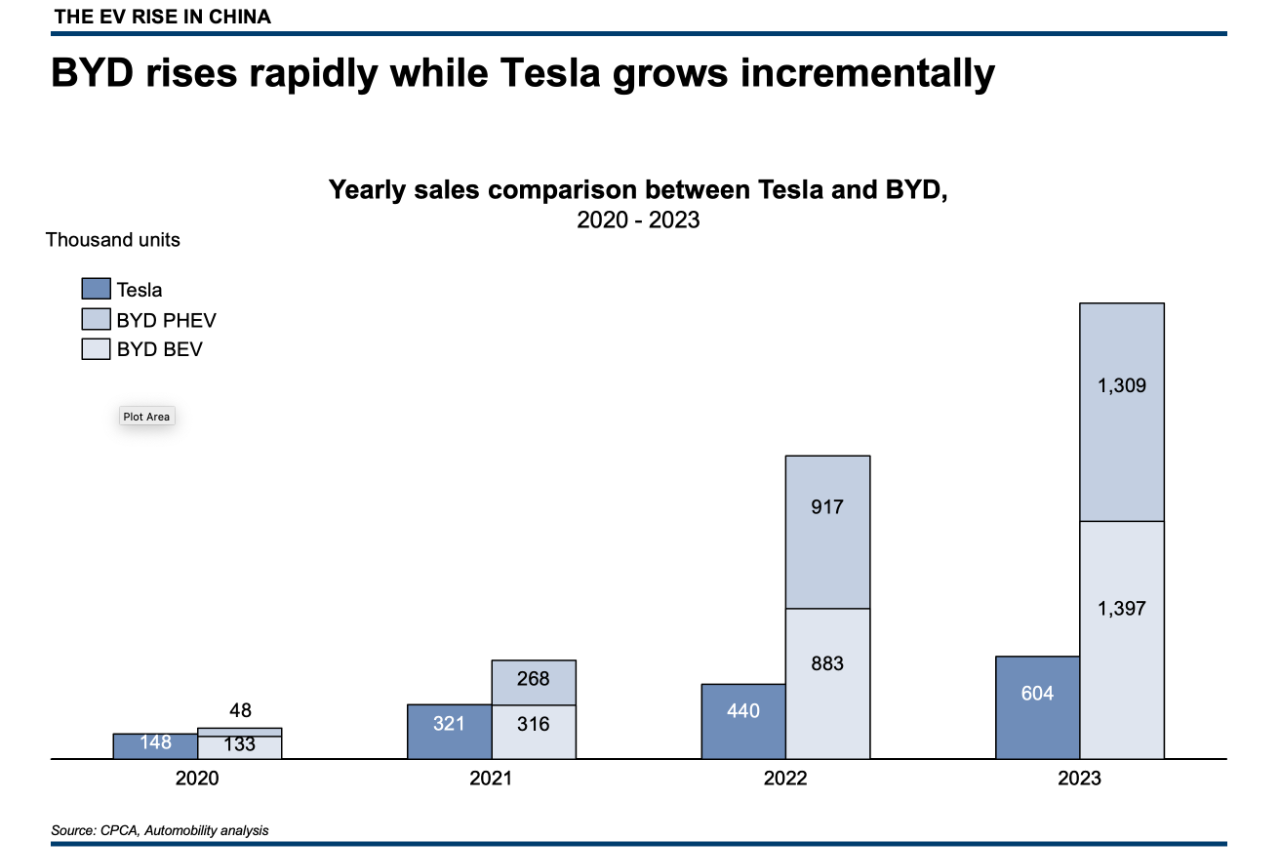

BYD vs. Tesla

-

Chinese EV giant BYD overtakes Tesla, but can it crack the U.S. market? (Please copy and paste the link to your browser: https://coats-share-oiq.craft.me/VsMvAtKSUSJ3hi )

As shown below BYD’s BEV sales surpassed Tesla in China in 2022:

BYD now faces increased local competition in the PHEV segment, and their recently Qin DMi pricing reduction signals that they are willing to sacrifice margins to keep their volumes high.

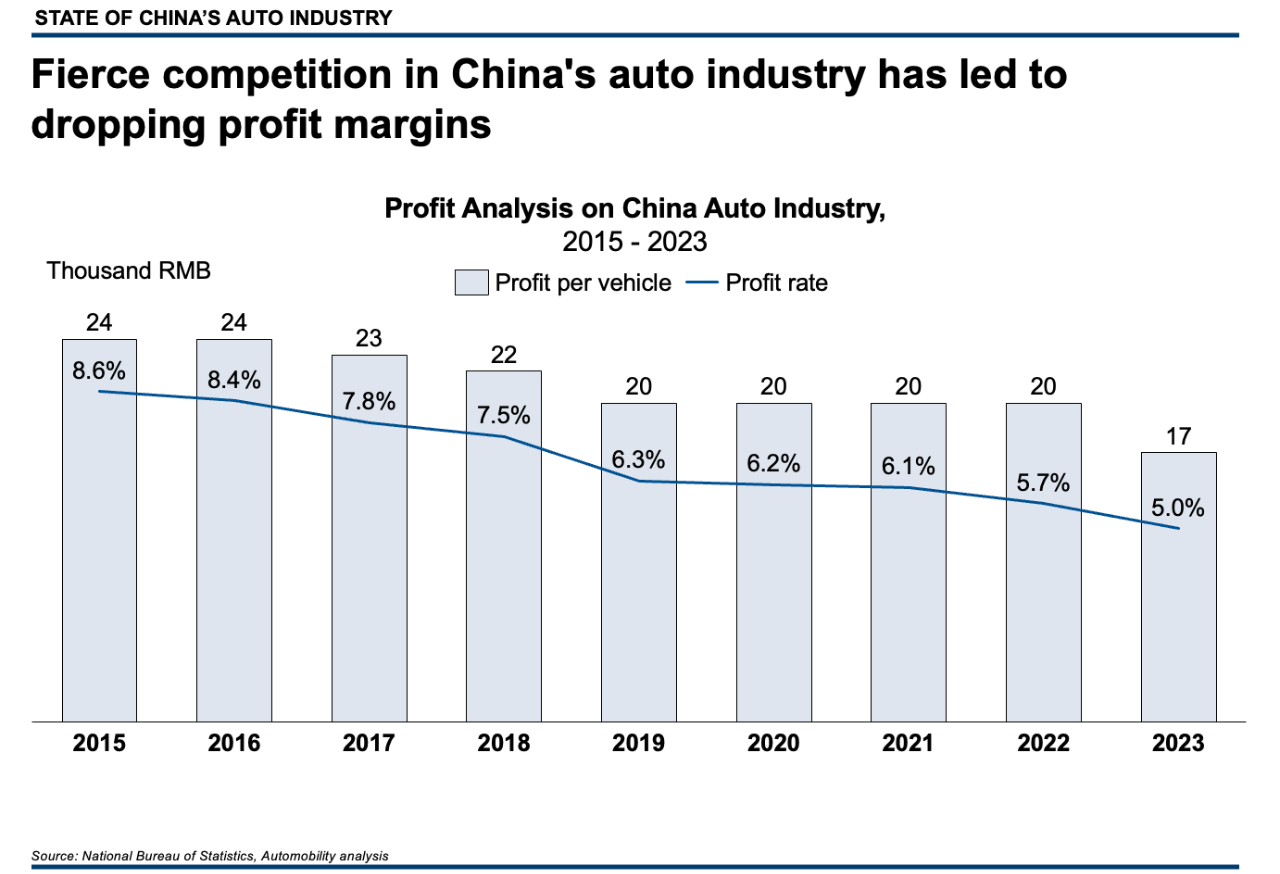

While the NEV segment is where the volume growth is in China, it is also clear that it has been very difficult to achieve profitability in a segment where the two global leaders are willing to engage in a price war to sustain volumes. The rules of engagement in China’s NEV game are such that companies lacking the technology capabilities and supply chain advantages must be prepared to endure significant pain to build such capabilities if they ever hope to gain a beachhead.

About Bill Russo

Bill is a contributing author to the book Selling to China: Stories of Success, Failure, and Constant Change (2023), where he describes how China has become the most commercially innovative place to do business in the world’s auto industry – and why those hoping to compete globally must continue to be in the market.

About Automobility

Contact us by email at info@automobility.io

Sorry, the comment form is closed at this time.