06 Jan State of China’s Auto Market – December 2023

Comments from Bill Russo, Founder & CEO of Automobility Ltd.

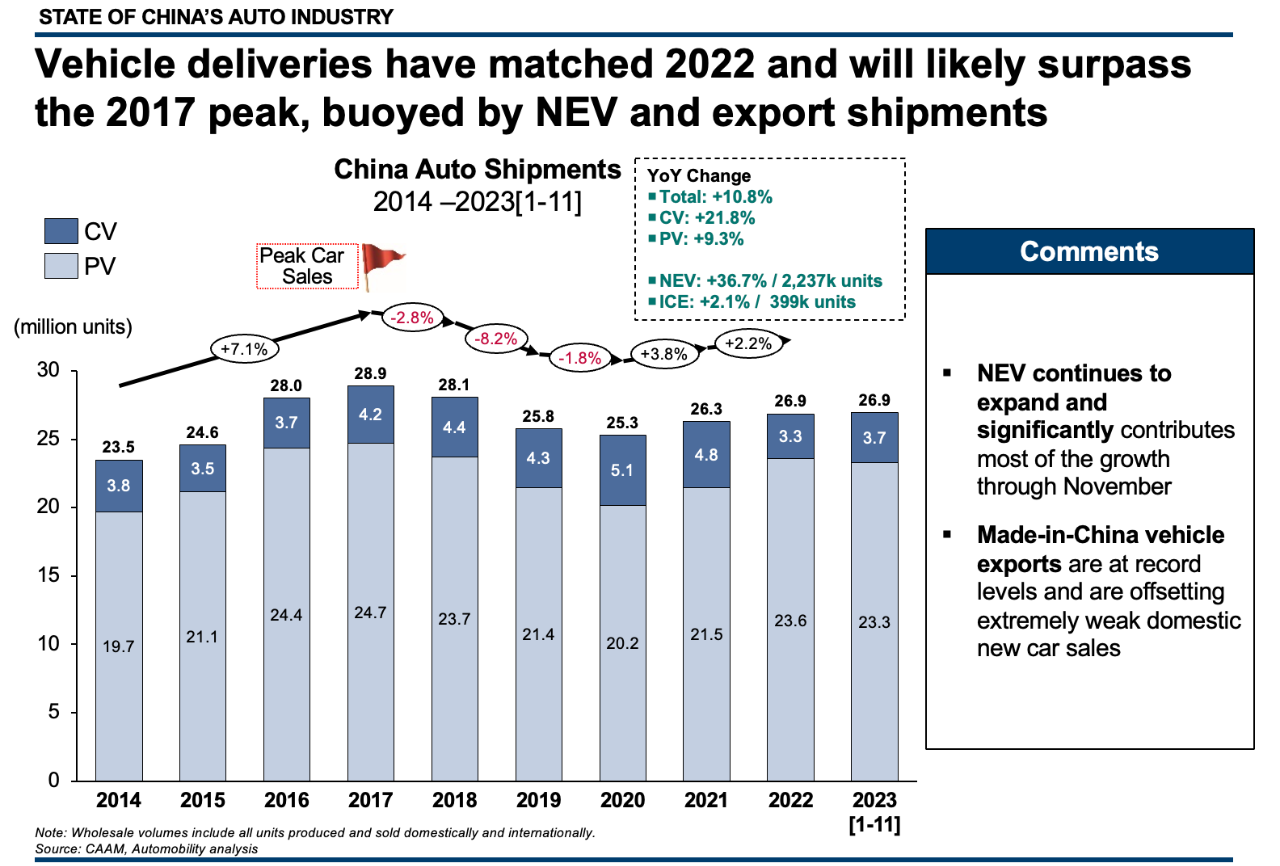

Year-over-Year Shipments Changes from January to November:

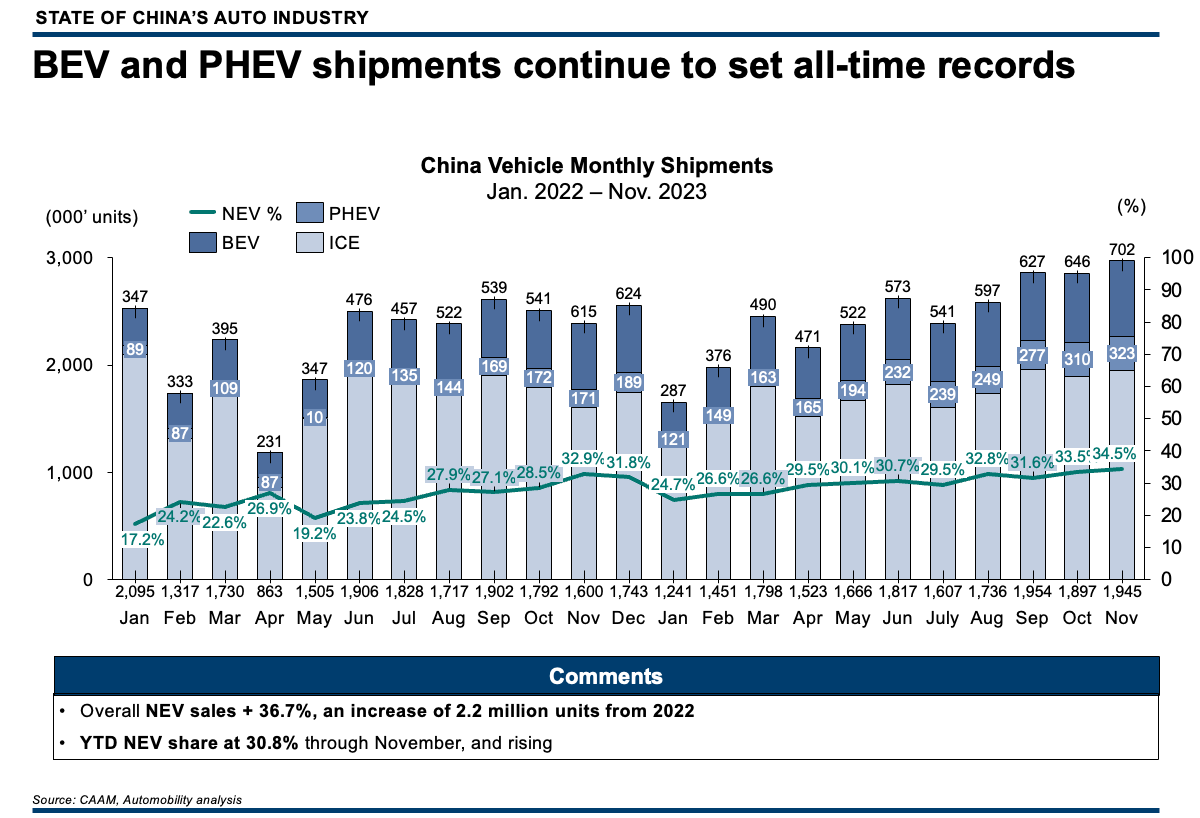

NEV +36.7%

ICE +2.1%

2023 Shipments Surpass Full Year 2022 in 11 Months

Overall volumes through November 2023 (inclusive of domestic and export shipments) have matched the full year of 2022 and are poised to surpass the previous peak year of 2017 by the end of December. Full year shipments may approach or surpass 30 million units.

This appears to be a major recovery and return to growth in China, but it is important to underscore that the growth is fueled by a year-over-year 36.7% growth in New Energy Vehicle Sales, and 58.4% growth in Made-in-China exports.

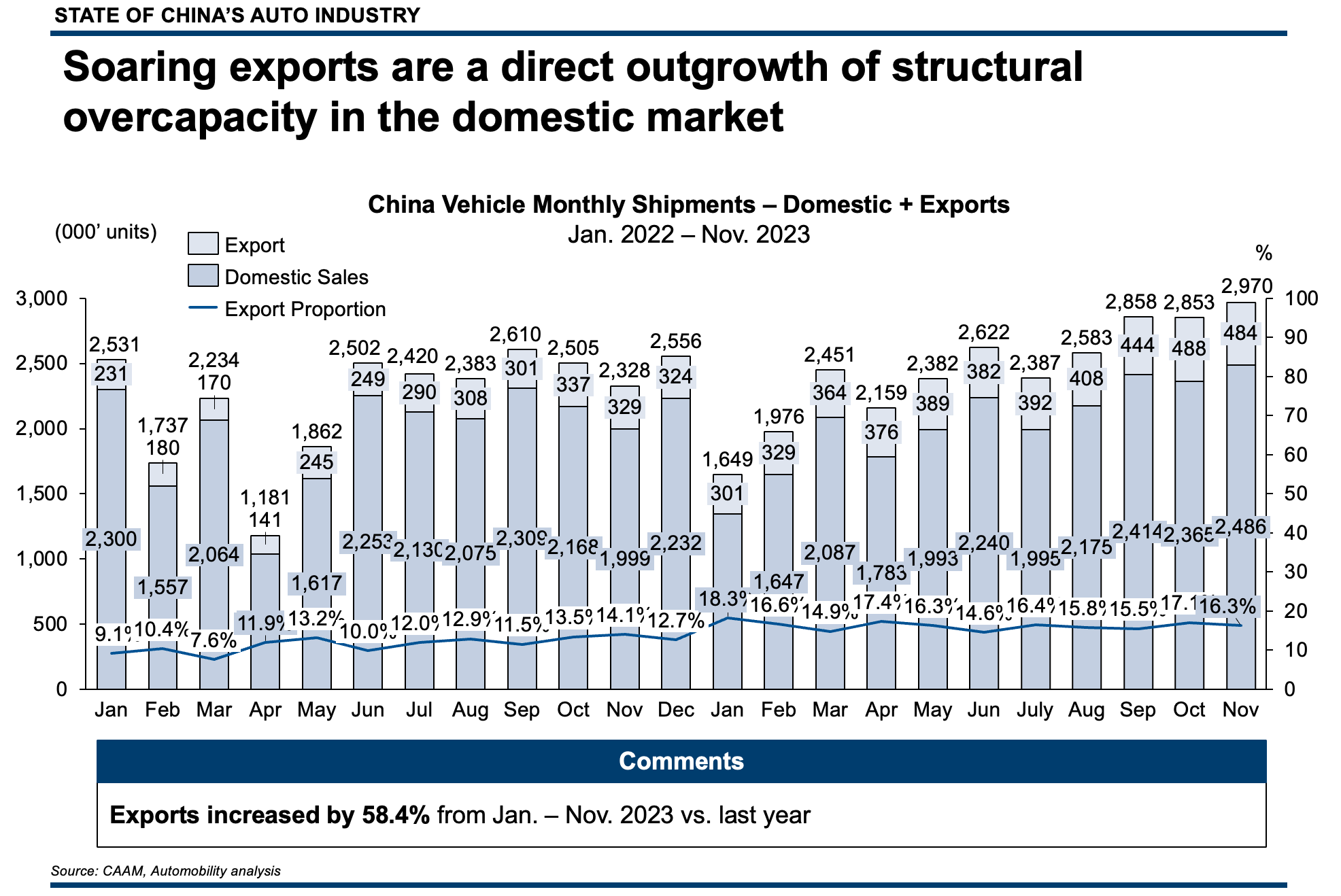

Made-in-China Carmakers Go Global to Recapture Growth

Extracting exports from total shipments, it is clear that domestic sales are relatively flat, and structural overcapacity – especially for Internal Combustion Engine (ICE) powered vehicles – remains a major challenge for Chinese carmakers.

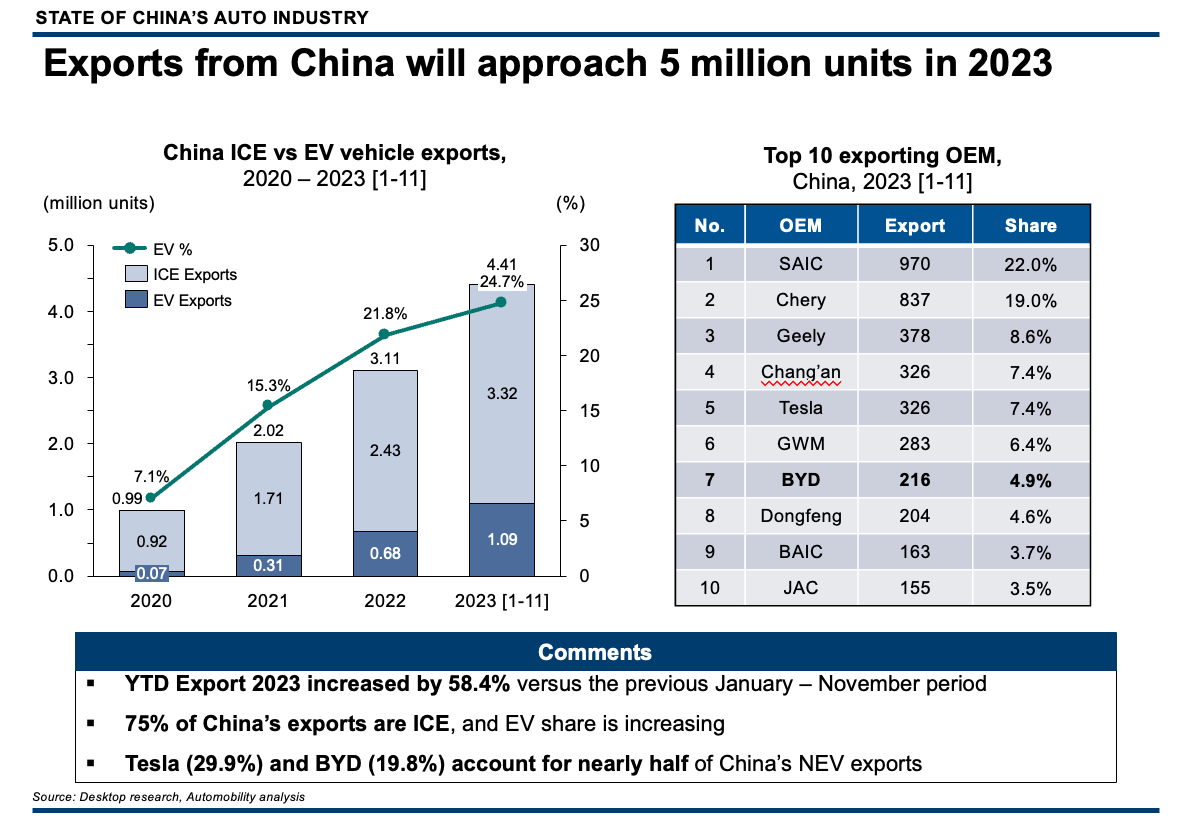

Already surpassing Japan as the world’s leading automotive exporter this year, Made-in-China exports shattered the previous year’s record already last month and stand at 4.41 million units through November. Driven by a growing overcapacity challenge, especially for ICE powered vehicles, Chinese car exports have nearly quintupled since 2020.

While the rise of affordable Chinese EV exports are making global carmakers nervous, prompting protectionist governments to consider trade restrictions, it should be noted that more than 75% of Chinese exports are ICE-powered vehicles. EV exports from China stand at 1.09 million units, of which 328,000 units (~30%) were shipped from Tesla’s Shanghai Gigafactory.

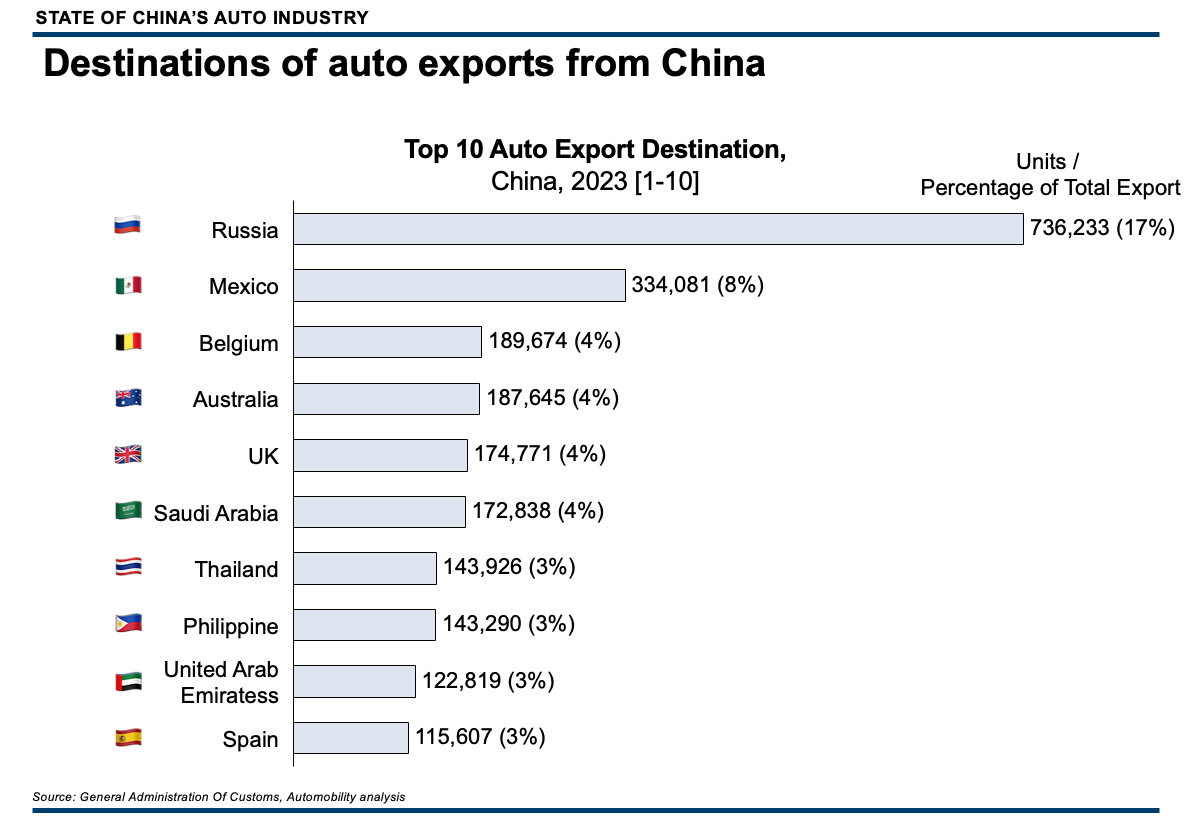

Through October, the top export destinations for Made-in-China vehicles are Russia (17%) and Mexico (8%). Europe, Middle East, and other Asia Pacific markets are also importing large quantities of vehicles from China.

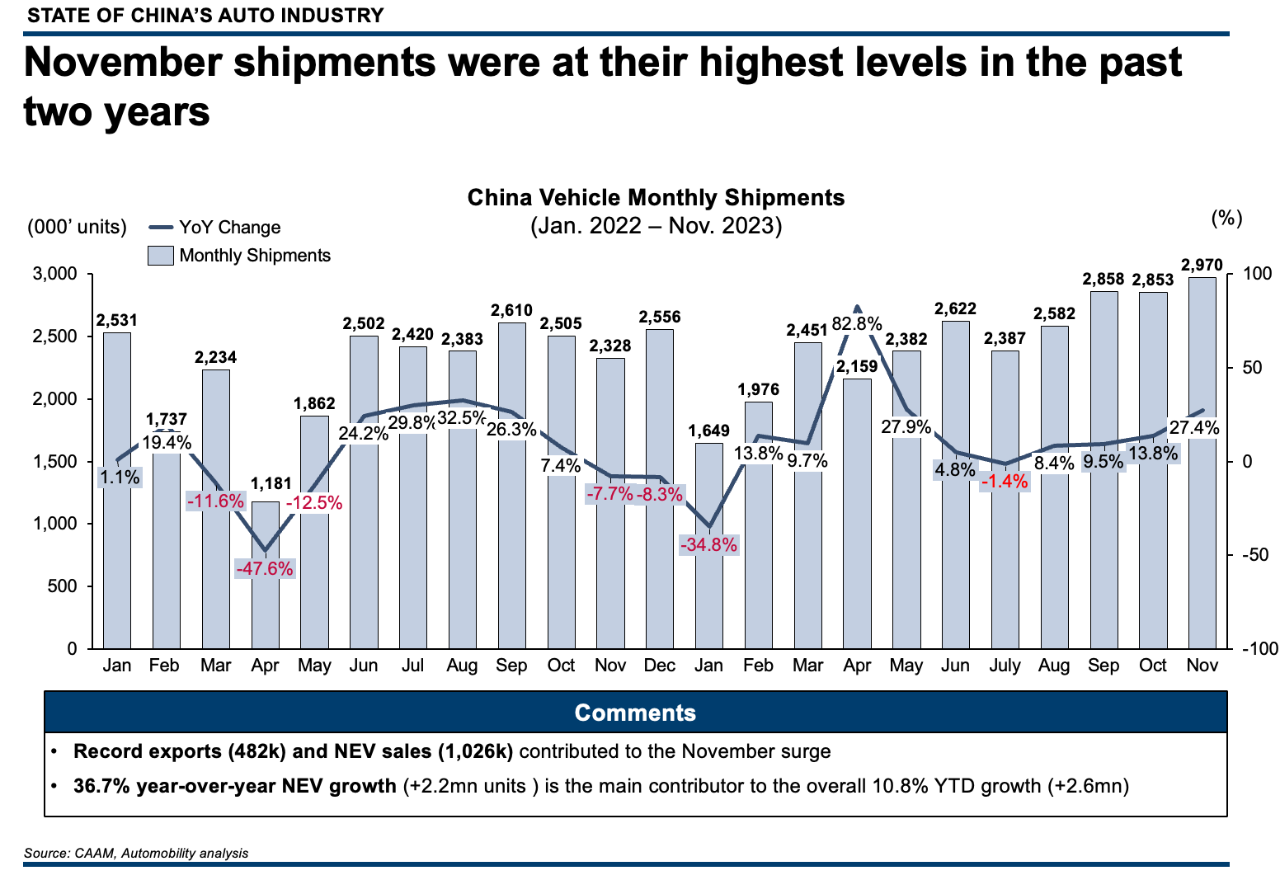

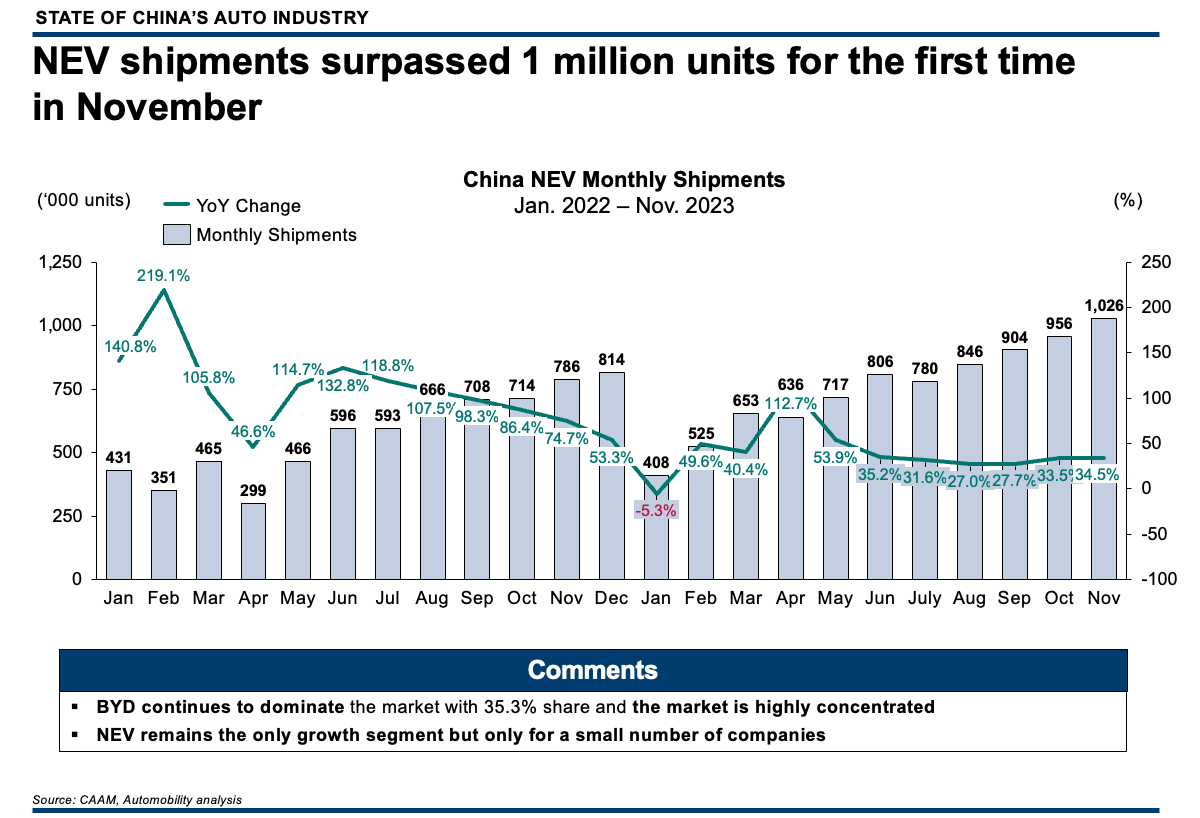

NEV Sales Top 1 Million Units in a Single Month

The steady rise of consumer interest in Chinese-made New Energy Vehicles continued in November, with shipments surpassing 1 million units for the first time. To put this figure in perspective, China shipped in 1 month slightly less than the number of electric cars sold year-to-date in the United States.

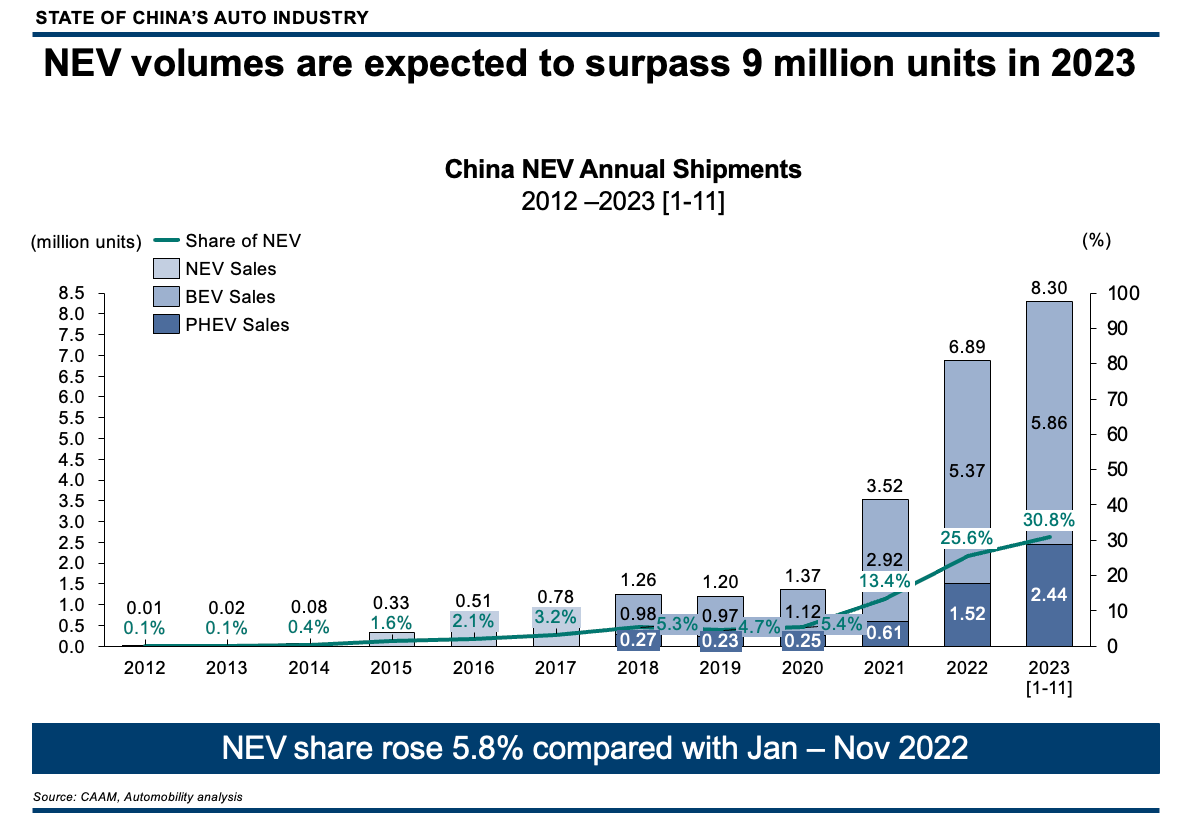

Total NEV shipments stand at 8.3 million units, representing a 30.8% share of the cars produced in China in 2023. Of this total, 5.86 million were Battery Electric Vehicles (BEVs) and 2.44 million were Plug-in Hybrid Electric Vehicles (PHEVs) – both new records.

Viewed on a monthly basis, both BEV and PHEV sales have consistently set monthly sales records, with NEV overall monthly share at 34.5% in November. Within these figures, the growing popularity of PHEV is noteworthy, now representing one-third of NEV shipments.

November NEV Sales Leaderboard

The NEV retail sales leaderboard for November includes some up and down positional moves, but is still dominated by BYD with 6 of 10 models on the board. In fact, BYD holds 5 of the top 6 positions, with only Tesla’s Model Y (at number 2) entering the top ranks.

Of note, BYD Song replaced BYD Qin in the top spot, and GAC’s Aion Y lost momentum falling from the 5th to the 9th position. However, the same 4 companies have remained the only entrants on the leader board throughout 2023.

Top 10 NEV Models

November Retail Sales

The November Top 10 NEV Group sales leaderboard has one new entrant, with AITO moving into the number 10 position, replacing Xpeng in 10th place on the leaderboard. Positional moves include Tesla moving back to second place, and LI Auto overtaking GACin overall monthly sales.

Top 10 NEV Corporate Group

November Retail Sales

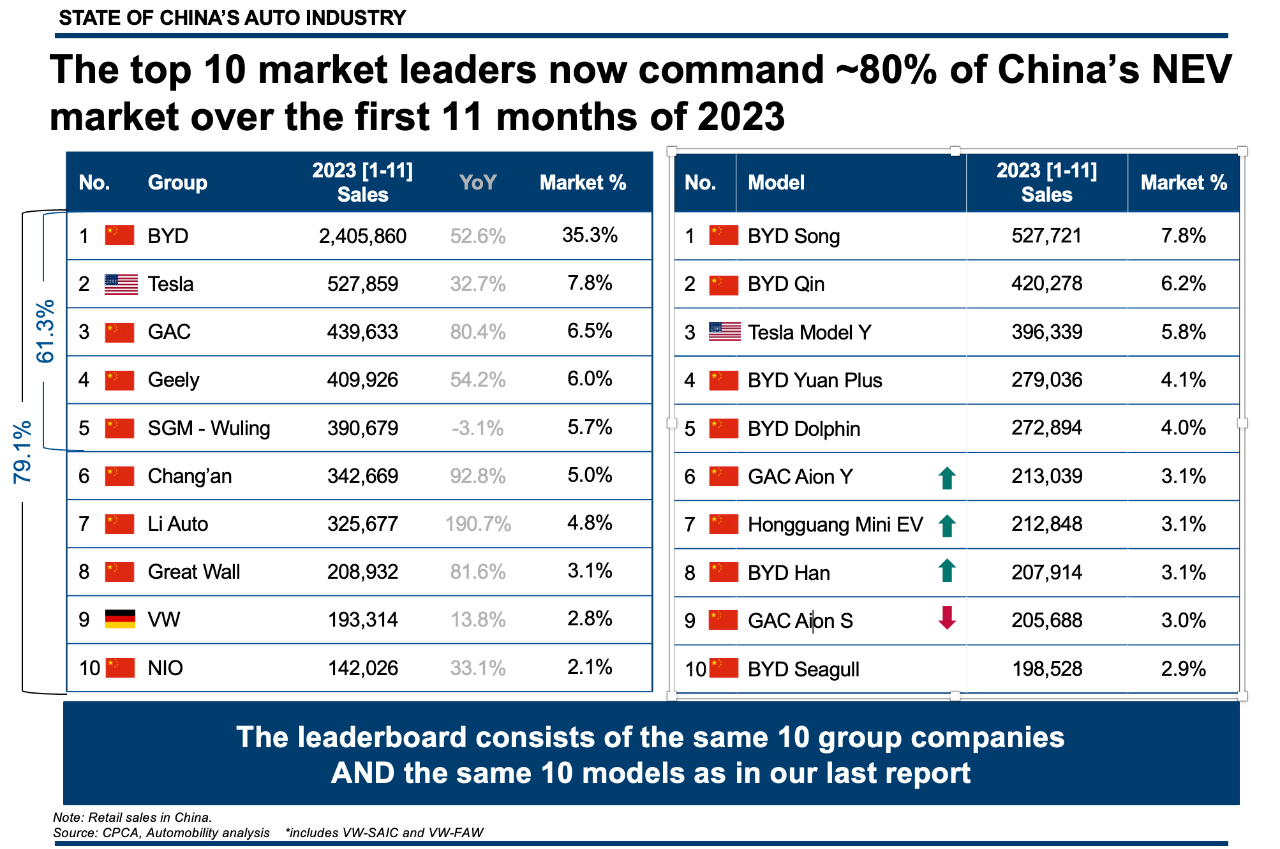

2023 Overall NEV Sales Leaderboard through November

Chinese brands continue to dominate the NEV sales leaderboard in 2023, and the top 10 NEV Sales Leaderboard for 2023 has the exact same group companies and nameplates as reported last month. This has been consistently the case throughout 2023, reflecting the concentration that exists in the market.

Several noteworthy observations:

- The Top 10 companies command 79.1% of the NEV market

- The Top 5 companies command 61.3% of the NEV market

-

BYD commands 35.3% of the NEV market

Additional points to note:

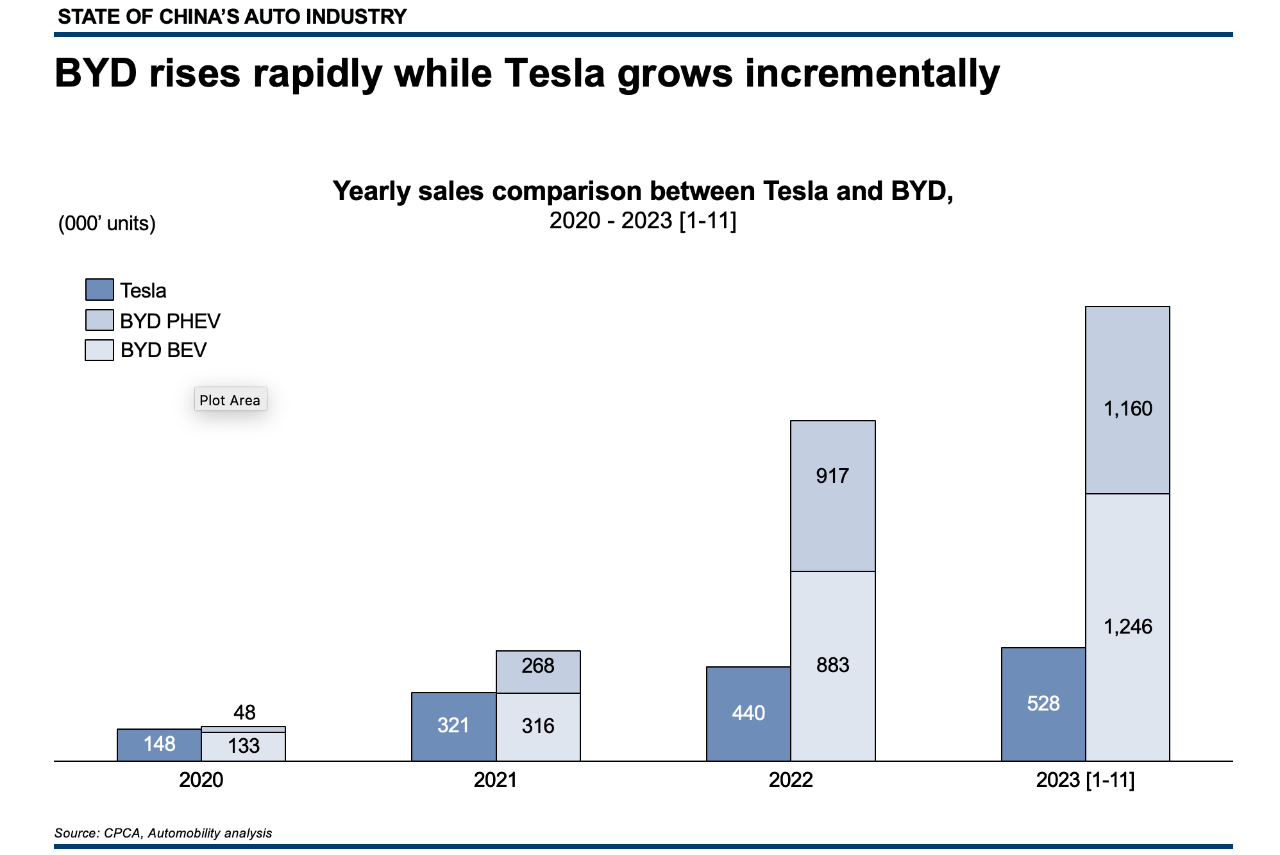

- #1 BYD outsells #2 Tesla by over 1.87 million units, and #10 NIO by over 2.3 million units.

- Wuling remains the only top 10 brand with declining sales, facing new low-priced competition in 2023.

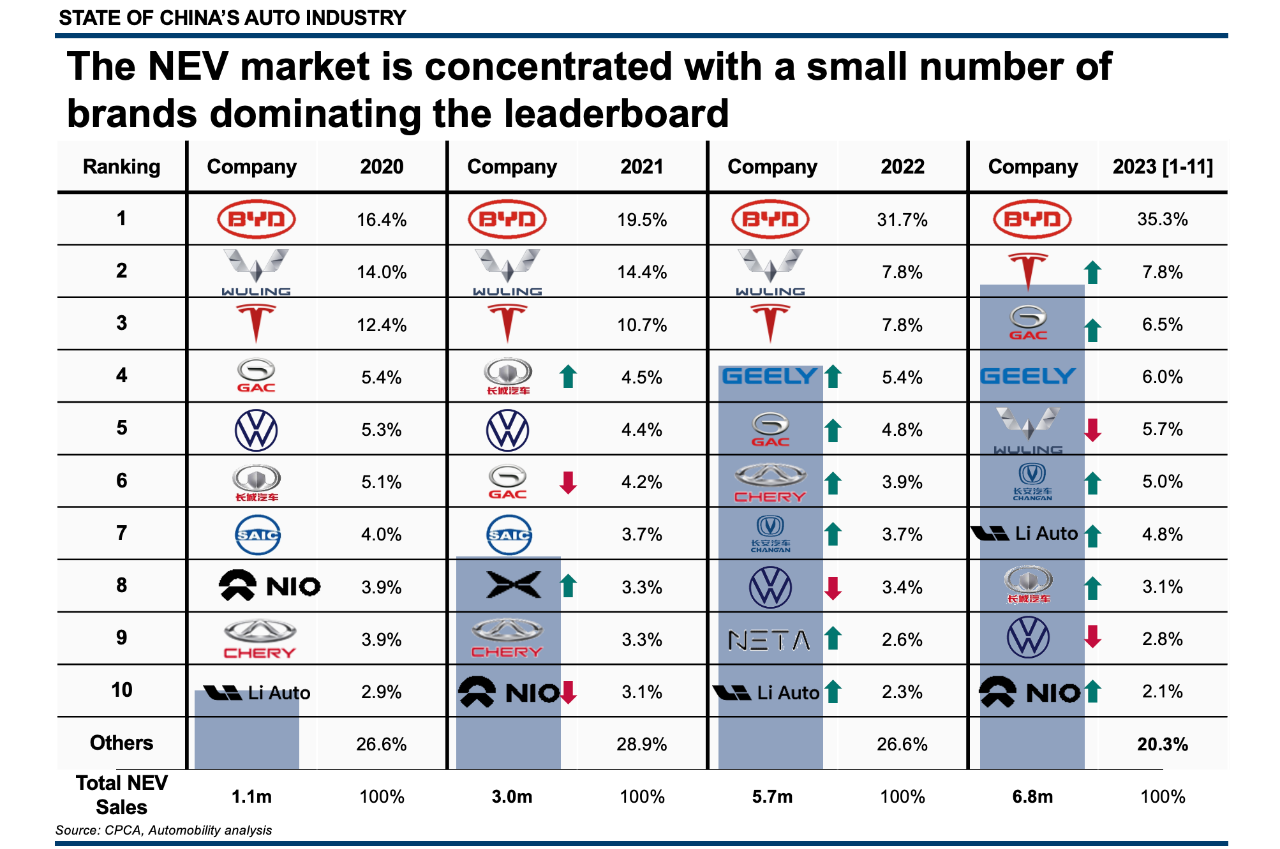

Viewed over several years, BYD has been the perennial market leader, dominating with its affordably priced BEVs and popular PHEVs. While there is some limited positional movement, there is little evidence over multiple years that new brands are capable of challenging the dominance of the leaders in the race to an electric future.

Chinese Brands Gain 20% in 3 years

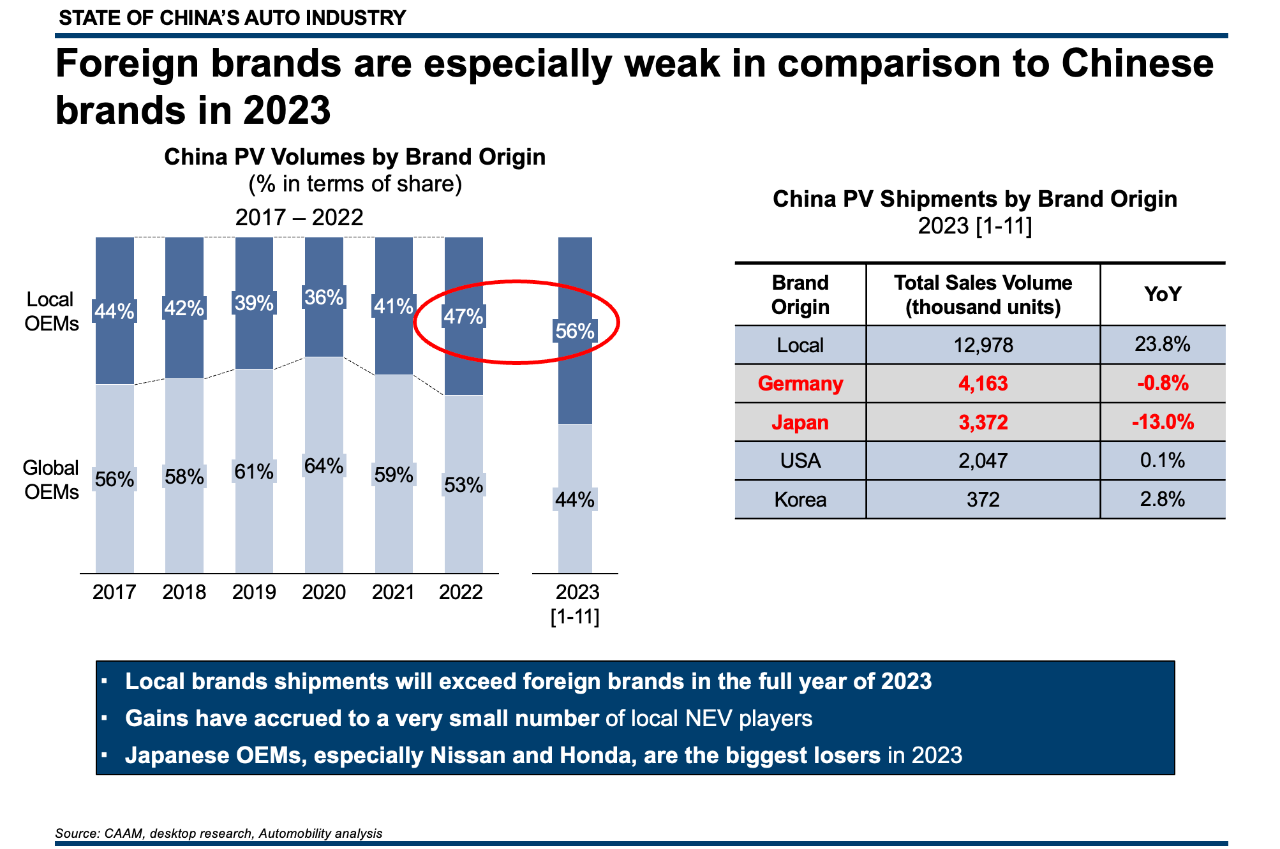

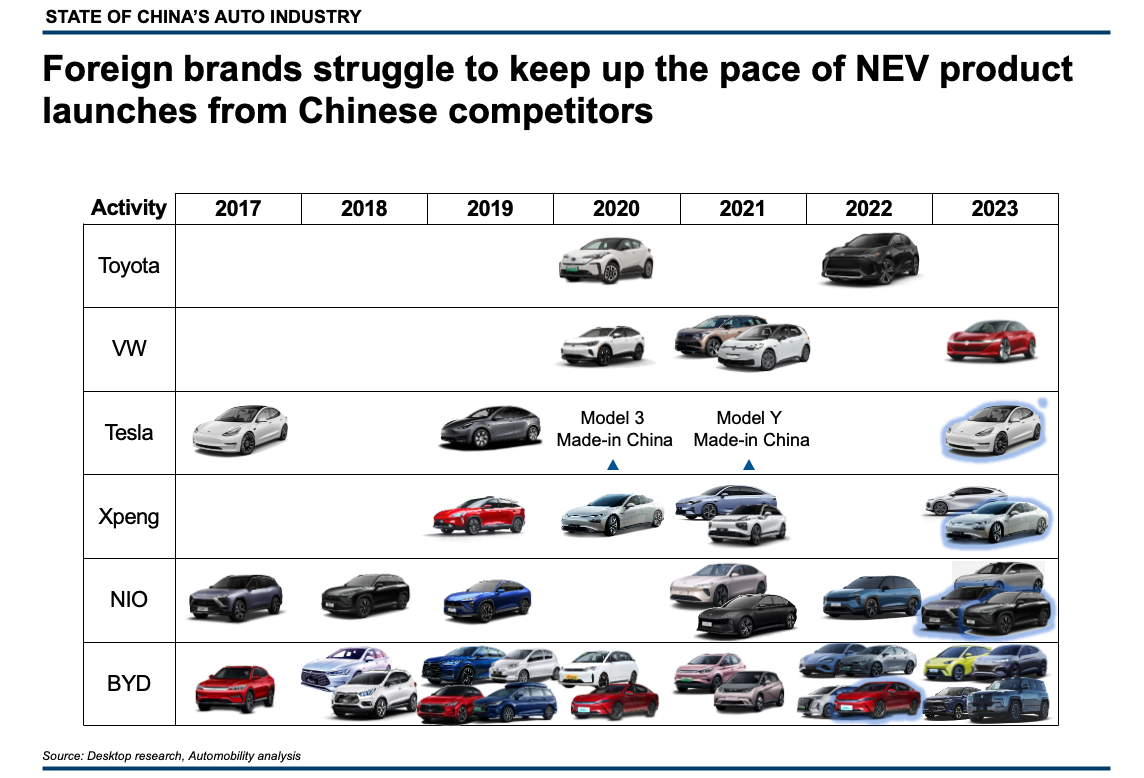

Foreign brand PV market share has fallen to 44% in 2023, down from 64% in 2020, the year when retail consumer preference began to shift in favor of EVs. With the exception of Tesla, foreign brands were caught flat-footed as they did not anticipate the market shift and are rapidly losing relevance. German and Japanese brands, long considered as having the highest degree of brand loyalty, have begun to feel the negative impact of this development on their China business.

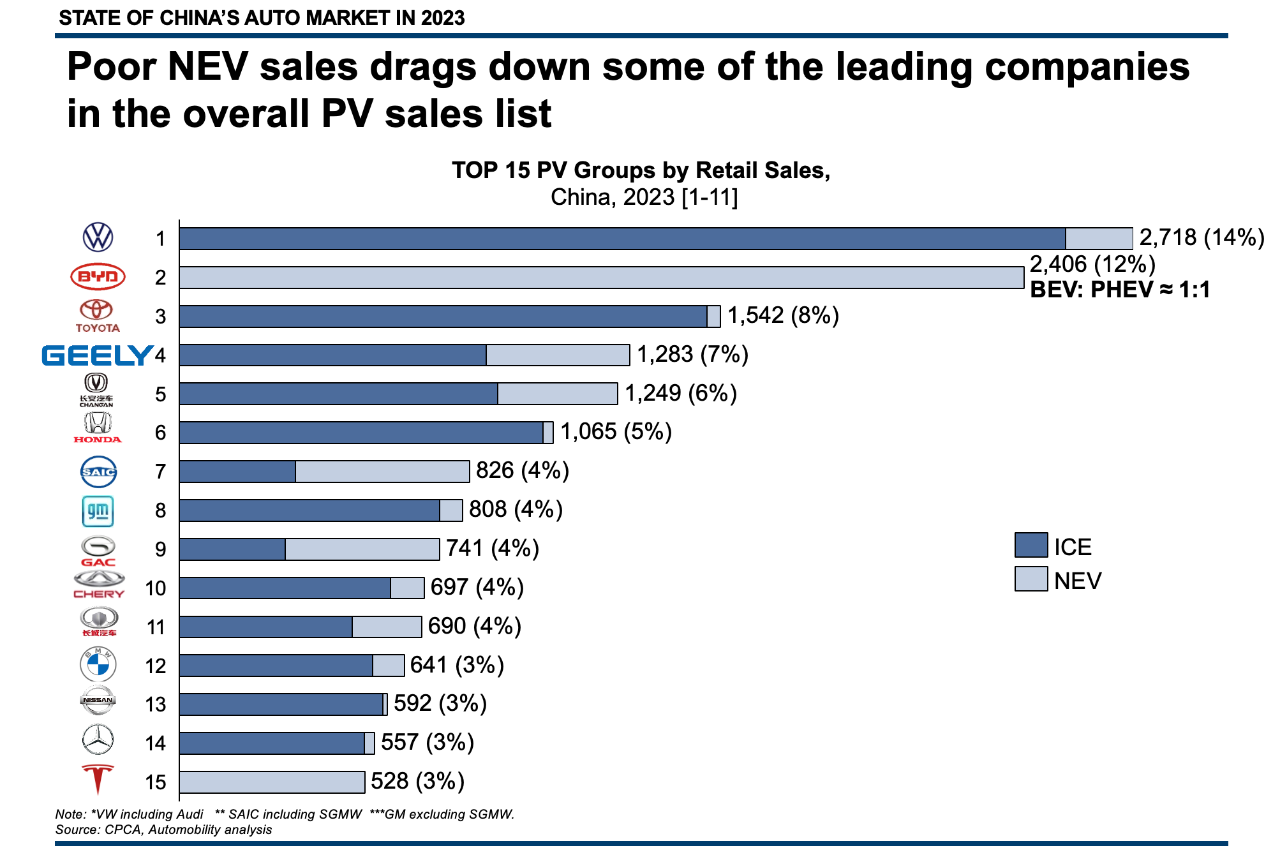

Comparing the top 15 group companies by retail sales in China, it it clear that Chinese brands have moved up in rank by virtue of their participation in the NEV segment.

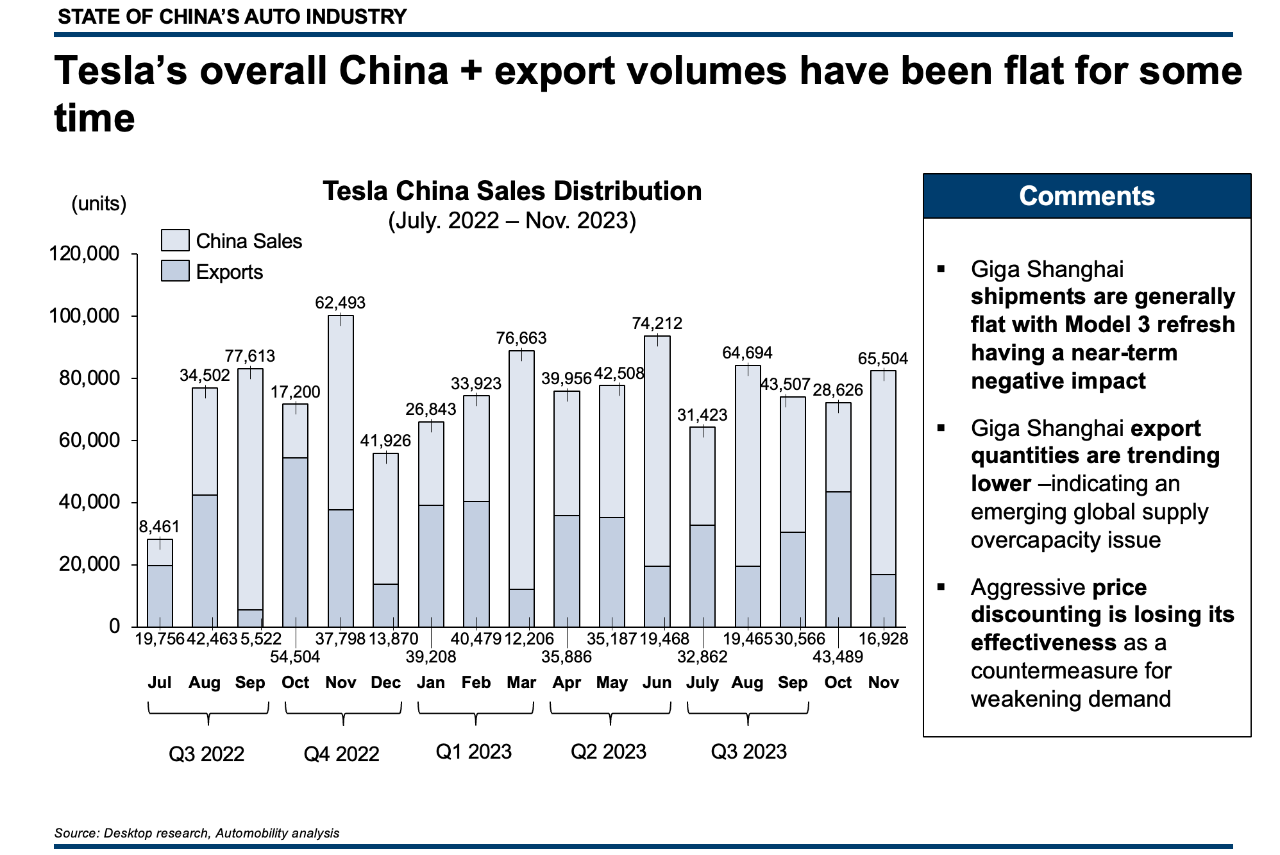

Tesla remains the foreign brand exception, managing to more than triple their business since 2020. However, Tesla has had to be very aggressive on price in order to hang on to their 7.8% share of the NEV market.

In spite of their aggressive pricing tactics, it is very clear that BYD and several other Chinese companies are very capable of delivering more affordable and well-contented models that are gaining consistent market traction. Tesla’s 2 models are struggling to keep up with the cadence of Chinese EV product launches.

While Tesla is a clear leader among the multi-national players, their story is rather mixed in China, with their combined domestic and export volumes moving horizontally recently. Tesla will need new models if they ever hope to recapture growth in China.

– Will the recent actions by the Biden Administration to restrict the ability of China to localize its supply chain in the United States?

– What will be the impact of recent tariff and trade reviews on the ability of Made-in-China cars going global?

– What new partnerships of investments are needed for foreign brands to remain relevant in China?

– EV’s are not scaling rapidly anywhere except in China. Will they ever, or will foreign brands give up the race?

A FEW MORE THINGS

I was very proud to receive the 2023 Contribution Award on behalf of the Automotive Committee at the Annual General Meeting of the American Chamber of Commerce in Shanghai.

Automotive Committee Receives 2023 Contribution Award

Join us on Tuesday, December 19 at 9am China time for our monthly State of China Auto Market webinar, hosted by the American Chamber of Commerce in Shanghai. Use the QR code in the link to register.

Webinar | State of China Auto Market Monthly Briefing (December)

You can follow us for regular updates on these online channels by scanning the QR codes:

If your organization would like a custom briefing on the State of China’s Auto Market, please reach out to us at info@automobility.io

About Bill Russo

Bill is a contributing author to the book Selling to China: Stories of Success, Failure, and Constant Change (2023), where he describes how China has become the most commercially innovative place to do business in the world’s auto industry – and why those hoping to compete globally must continue to be in the market.

About Automobility

Contact us by email at info@automobility.io

Sorry, the comment form is closed at this time.