16 Jul The Wall Street Journal : In China, the Era of Western Carmakers Is Over

Media Source : The Wall Street Journal

Foreign brands lose share to Chinese rivals, driven by local manufacturers’ lead in electric vehicles, as Beijing’s industrial policy pays off

By Yoko Kubota and Selina Cheng

10 JUL 2023

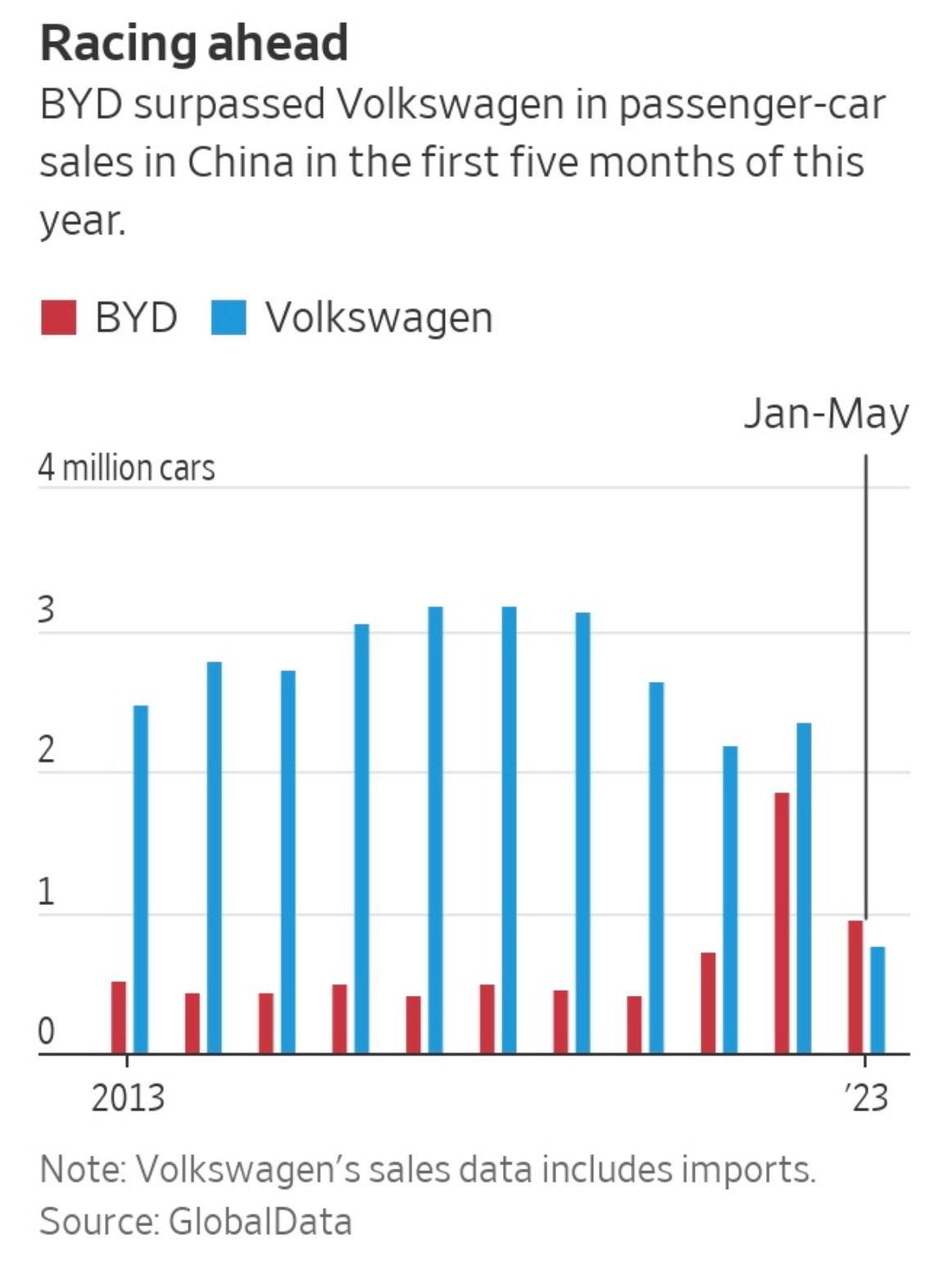

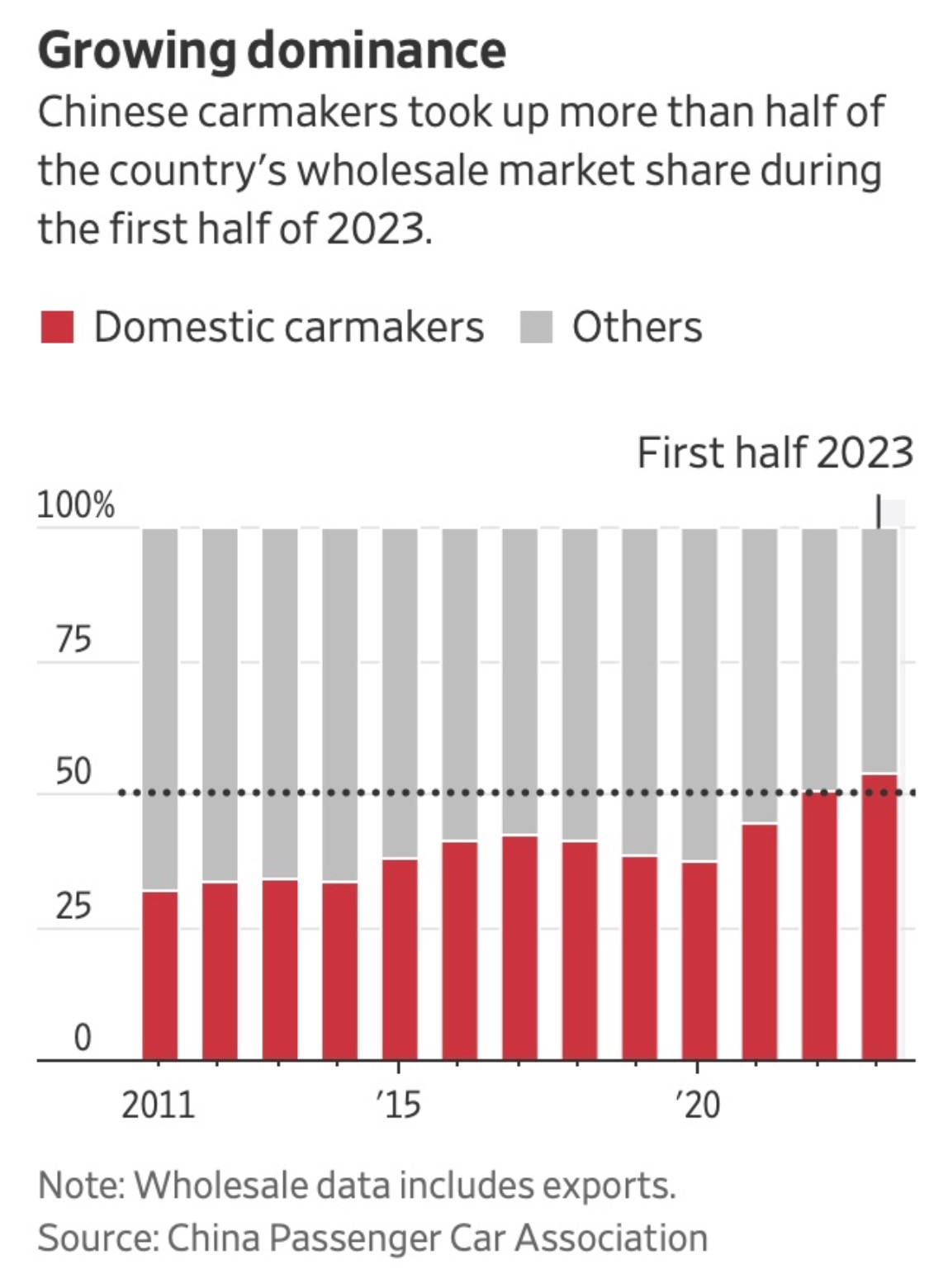

BEIJING—Sales of homegrown passenger-car brands in China are consistently eclipsing those of their Western rivals, signaling the growing influence of the country’s electric-vehicle makers—and a triumph for Beijing’s industrial policy.

Local brands captured 54% of China’s wholesale car market in the first six months of 2023, from 48% a year earlier, the China Passenger Car Association said Monday. That is the second consecutive time local brands have surpassed foreign ones on a half-year basis, according to Cui Dongshu, the industry body’s secretary-general. Wholesale figures include vehicle exports.

Western carmakers have dominated China since they were first allowed to set up joint ventures with local partners decades ago. Some made a fortune as the country sped past the U.S. to become the world’s biggest auto market. But as homegrown brands solidify the trend of outselling foreign rivals, the era of Western dominance is over.

China’s auto revolution is being driven by its commanding lead in battery powered and plug-in hybrid cars —the only types of vehicle for which demand has been consistently growing. Led by BYD, nine local manufacturers were among China’s 10 bestselling electric-vehicle makers in June, according to CPCA data. Tesla was the only foreign carmaker on the list.

Led by BYD, nine local manufacturers were among China’s 10 bestselling electric-vehicle makers in June.

PHOTO: CFOTO/ZUMA PRESS

Sales of electric and plug-in hybrid passenger cars jumped 44% in the first half of 2023 to more than 3.5 million vehicles, making up around a third of total sales that grew almost 9% over the same period, the data showed. Some industry experts predict electric cars will outsell gas-fueled ones in China in the next four years. In the U.S., electric vehicles’ market share was 7% in the first half, after sales surged 50% to 557,330 units.

China’s pursuit of electrification since 2009 has turned the country from a follower of automotive trends into the recognized leader in new-energy vehicles—and one that global carmakers increasingly say they want to learn from. And they must, if they hope to compete in the Chinese market, says Stephen Dyer, a Shanghai-based auto consultant at AlixPartners.

In past decades, global automakers including Volkswagen and General Motors piled into China, seeking growth to offset slowdowns in the U.S., Europe and other mature markets.

But after China’s auto sales topped out in 2017, the market became a headache for many of those carmakers still relying on sales of internal-combustion motors. In 2022, sales of internal-combustionengine vehicles were roughly 8 million lower than at the 2017 peak, according to Shanghai-based consulting firm Automobility. Meanwhile, the recent speed of China’s transition caught Western companies by surprise.

“Japanese, American and European automakers all have this sense that they were too late to make the initial moves,” Honda’s Chief Operating Officer Shinji Aoyama said at April’s Shanghai auto show. “We’re now in a phase of trying our best to catch up.”

Whether the foreign brands can slow the momentum of their Chinese rivals quickly enough remains to be seen.

Ford promised in 2017 that by 2025, all the vehicles made by its main joint venture will come in electrified versions. But after sales of its Mustang Mach-E electric didn’t take off, Ford said it is reducing investments into China. Honda, which now offers five battery-electric models in China, is speeding up its electrification plan there by five years, aiming to sell only electric vehicles in the country by 2035. Even so, Chinese brands are rolling out new models more quickly, winning more consumers.

Foreign carmakers can no longer succeed simply by bringing in global models, or what is popular overseas.

Volkswagen is pushing to develop more in China. It plans to hire 2,000 developers for a new center in China to speed up its product cycle, while its software unit plans to this year expand the head count of experts in China by 400 to 1,200.

The rise of China’s EV makers is another victory for Beijing’s industrial policies, following high-speed rail, solar panels and batteries.

To build the EV market, China bankrolled local manufacturers and subsidized sales, prodding the industry along with production targets and tighter emissions standards. For a few years, only EVs with Chinesemade batteries were eligible for subsidies as the government set out to control more of the supply chain.

An early focus on electrifying public transport and government fleets ensured EV makers revenue—and data and experience to improve. At the same time, China created a nationwide charging network.

In 2015, electric vehicles took center stage in Beijing’s so-called “Made in China 2025” plan to become a world leader in that and other future industries.

Tax incentives and other inducements spurred demand. Buyers of electric vehicles could skip lengthy waits for license plates that were rationed in some cities, and circumvent rules that limited when gasfueled cars could be used.

Beijing’s industrial policy carried a high price. Scott Kennedy, a researcher of China’s economic policies at the Washington-based Center for Strategic and International Studies, estimates China spent roughly 1.25 trillion yuan, equivalent to about $173 billion, to support the new energy vehicle sector between 2009 and 2022.

After a decade in which China’s EV sector failed to spark, Beijing brought in Tesla, changing its rulebook by allowing the company to make cars without a joint venture partner. In late 2019, Tesla began to deliver made-in-China cars. By making EVs desirable and pushing suppliers to meet its global standards, Tesla ignited consumer demand in China.

Since then, the street scene in big cities has changed: The green number plates that designate battery powered and plug-in hybrid vehicles zip past often. During a recent 15-minute period on a street in Beijing’s central Maizidian neighborhood, about one out of six vehicles that passed had green number plates, including most of the taxis and buses.

For the first five months of the year, 45% of vehicles sold in Shanghai were electric or plug-in hybrids, Volkswagen said. In less developed cities, the transition has been slower.

BYD, backed by billionaire investor Warren Buffett, stopped making cars powered solely by gasoline in March last year. The company sold over 1.2 million electric vehicles and plug-in hybrids in China in the first six months of 2023, almost double from a year earlier. More than half of those were plug-ins.

The automaker offers a range of models, including the Seagull, a four-seater electric hatchback with a starting price around $10,000, and an off-road SUV under its new luxury Yangwang brand that costs around $138,100. Startup Li Auto, stands out alongside BYD in growing plug-in hybrid sales.

Meanwhile, sales of U.S.-listed NIO and Xpeng have dropped in recent months amid cutthroat price cutting.

While China has many EV brands, the market is likely to consolidate. Only 25 to 30 of more than 160 Chinese electric car brands are likely to remain in business by 2030, AlixPartners estimates.

Chinese carmakers are also going global. The country surpassed Japan in the first quarter of 2023 as the biggest exporter of vehicles, though about three-quarters of the 1.1 million autos shipped abroad were internal-combustion-engine models, Automobility data show.

BYD this month said that it will open an EV complex in Brazil, while state-owned SAIC said it plans a plant in Europe. SAIC and Great Wall Motor are manufacturing in Thailand, where BYD and several other Chinese carmakers said they plan factories.

Qianwei Zhang contributed to this article.

Write to Yoko Kubota at yoko.kubota@wsj.com and Selina Cheng at selina.cheng@wsj.com

Copyright ©2023 Dow Jones & Company, Inc. All Rights Reserved.

Appeared in the July 11, 2023, print edition as ‘China’s EV Makers Erode West’s Edge’.

↑ In China, the Era of Western Carmakers Is Over

Sorry, the comment form is closed at this time.