20 Mar State of China’s Auto Market – March 2023

EV Price War Engulfs the Entire Auto Industry

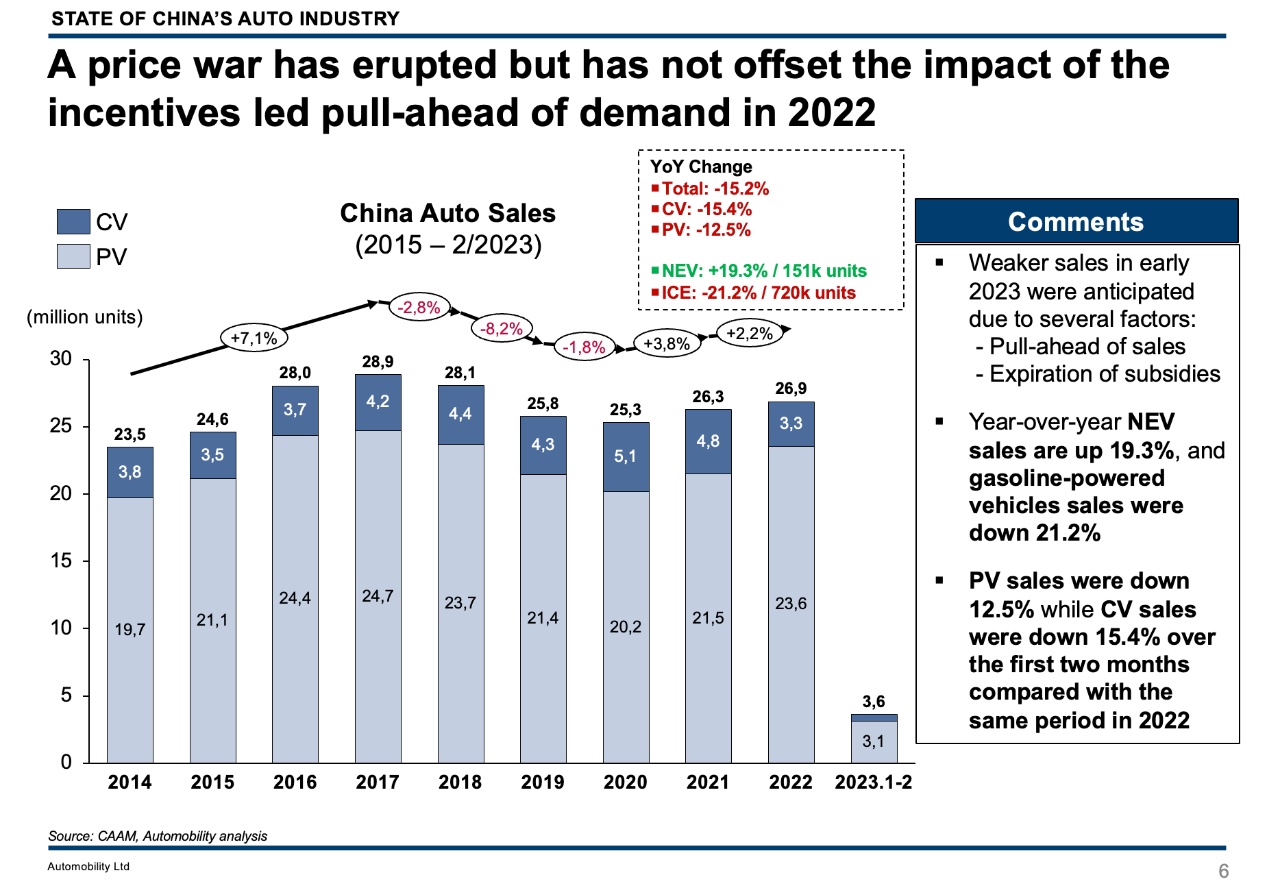

Discounts are not offsetting weakened consumer demand

Comments from Bill Russo, Founder & CEO of Automobility Ltd.

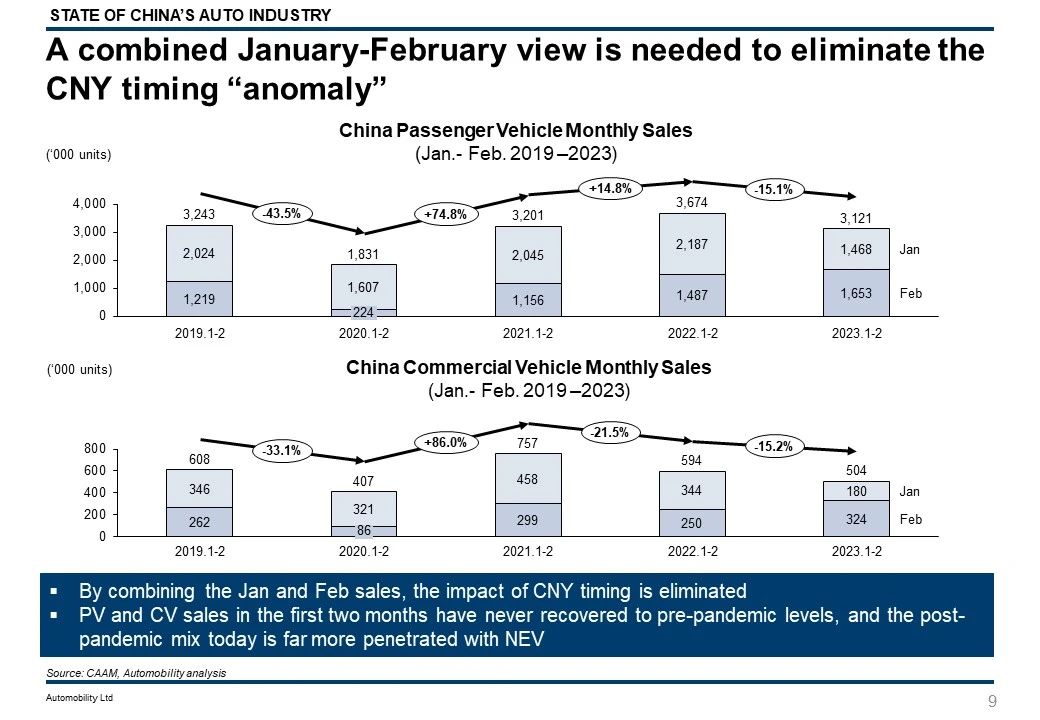

Early Weakness Expected in 2023

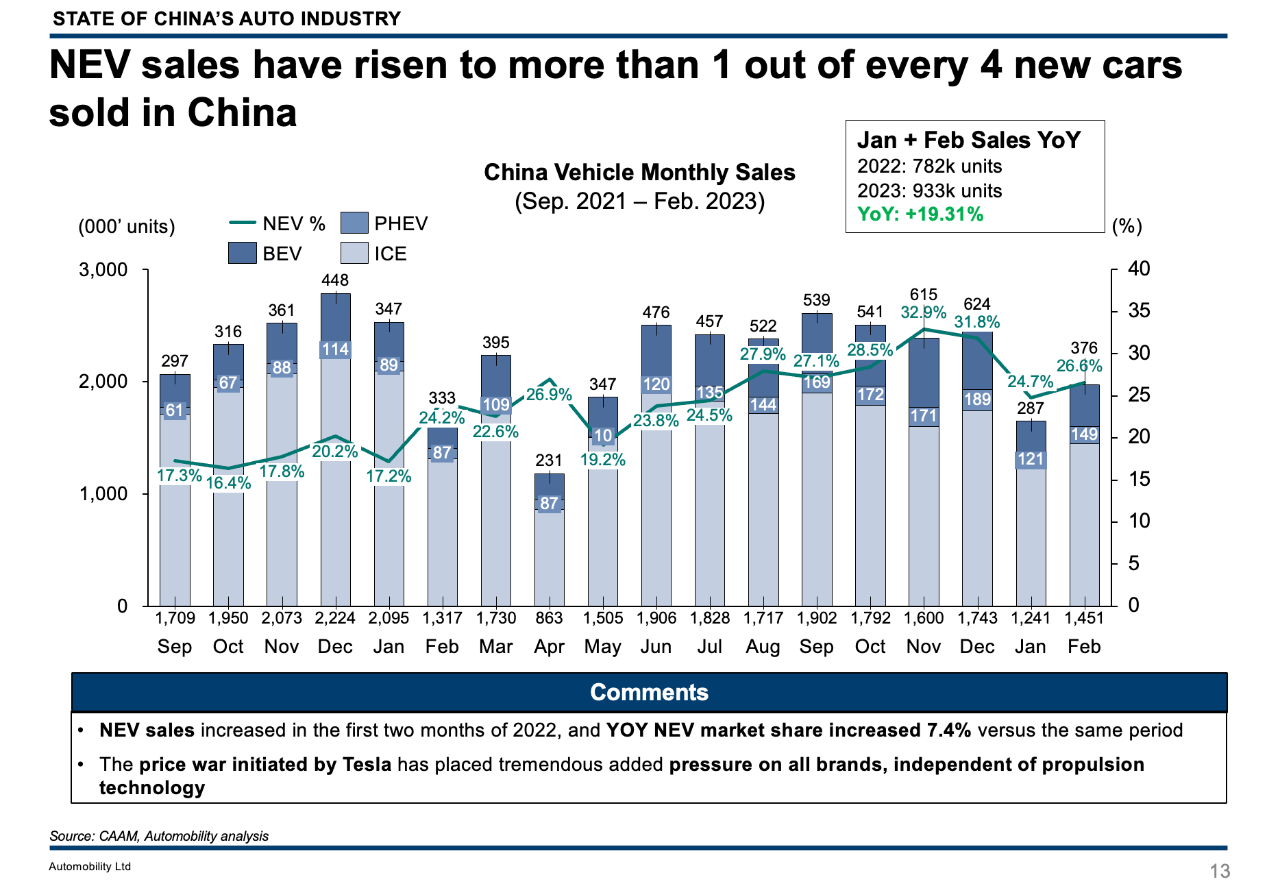

As a result, NEV share of sales for the first two months of 2023 reached 25.7%, a 7.4% increase from 2022. Again, this was propped up with a price war.

As a result, NEV share of sales for the first two months of 2023 reached 25.7%, a 7.4% increase from 2022. Again, this was propped up with a price war.

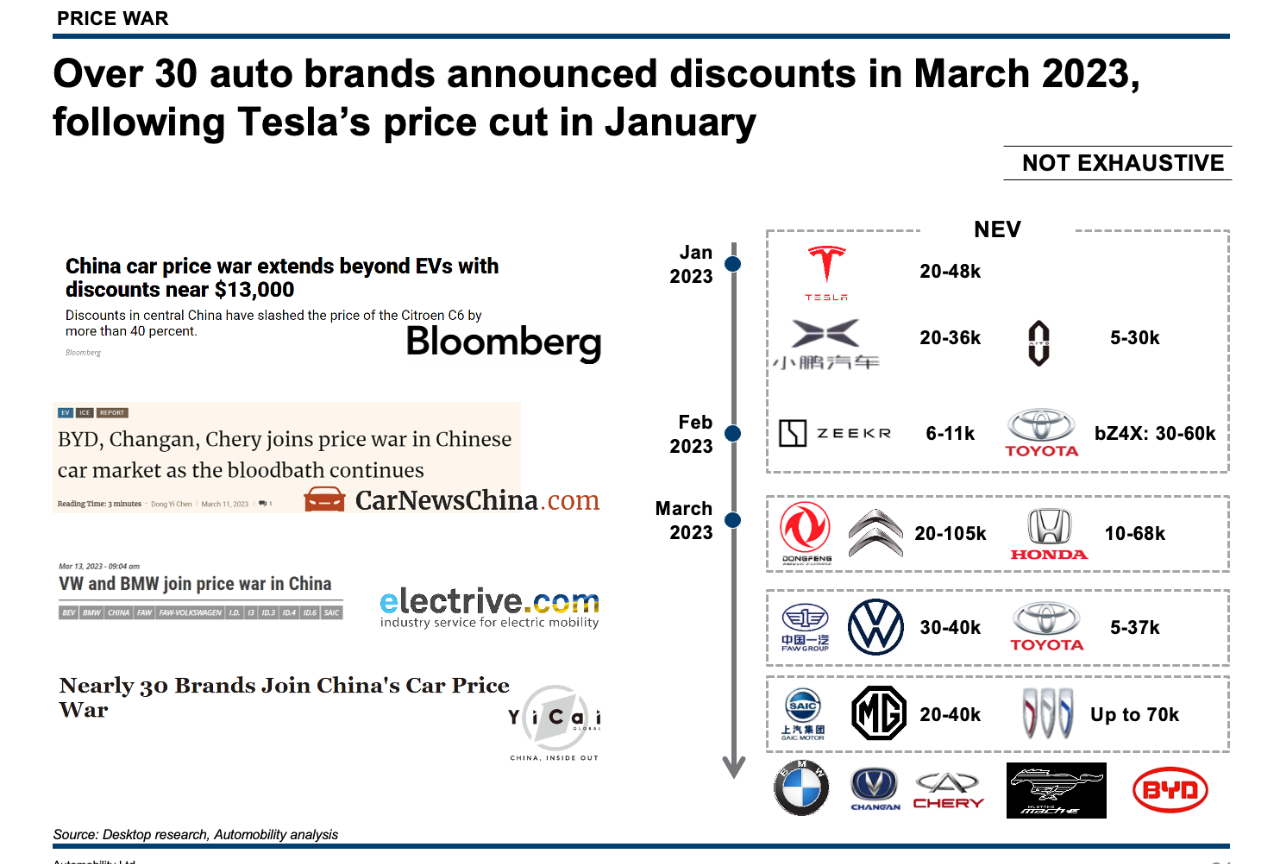

Tesla was the brand that sparked the price war in early January, with average selling price discounts ranging from 20-48k RMB. Since that time an increasing number of both NEV and ICE brands have been engulfed by the price war in China.

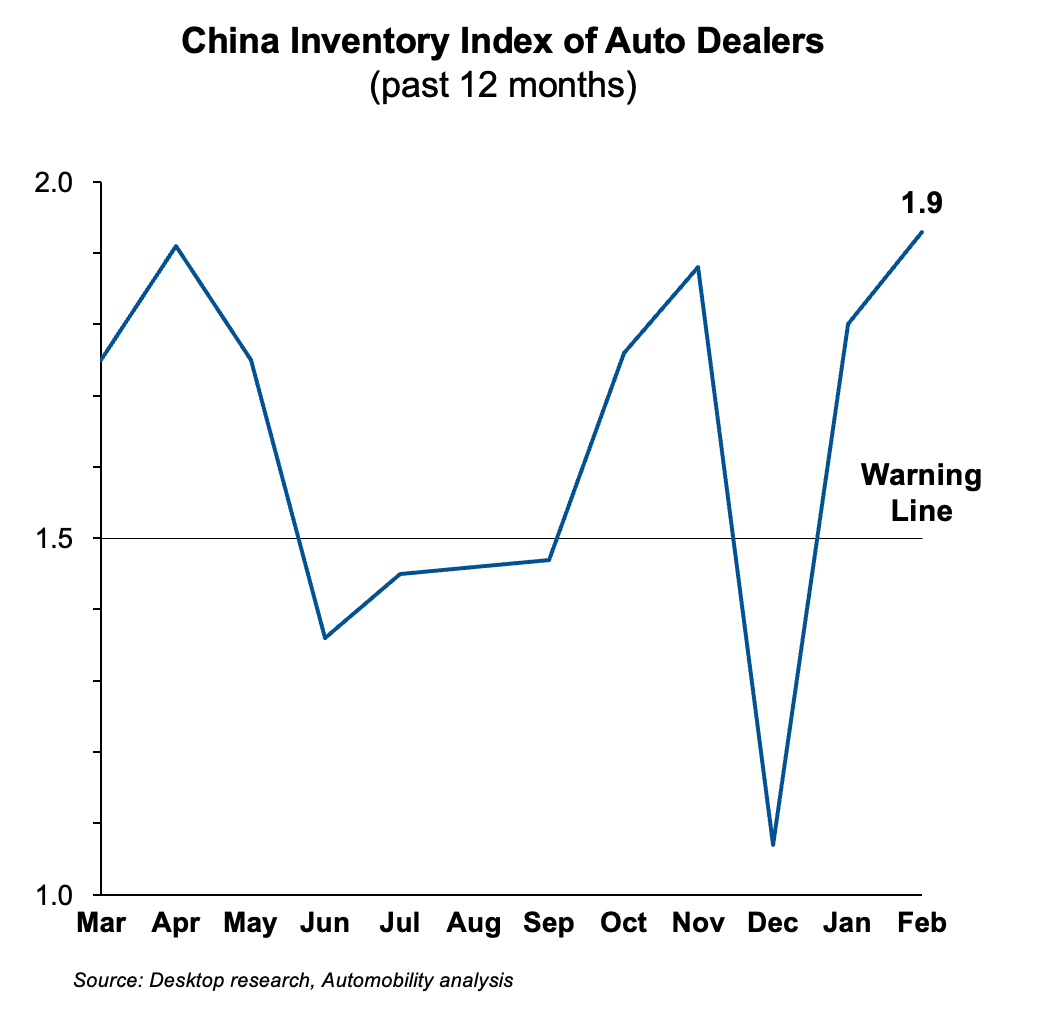

The chart below illustrates the spike in inventory in early 2023, which is a motivating factor in the decision to engage in the price war to squeeze out excess inventory.

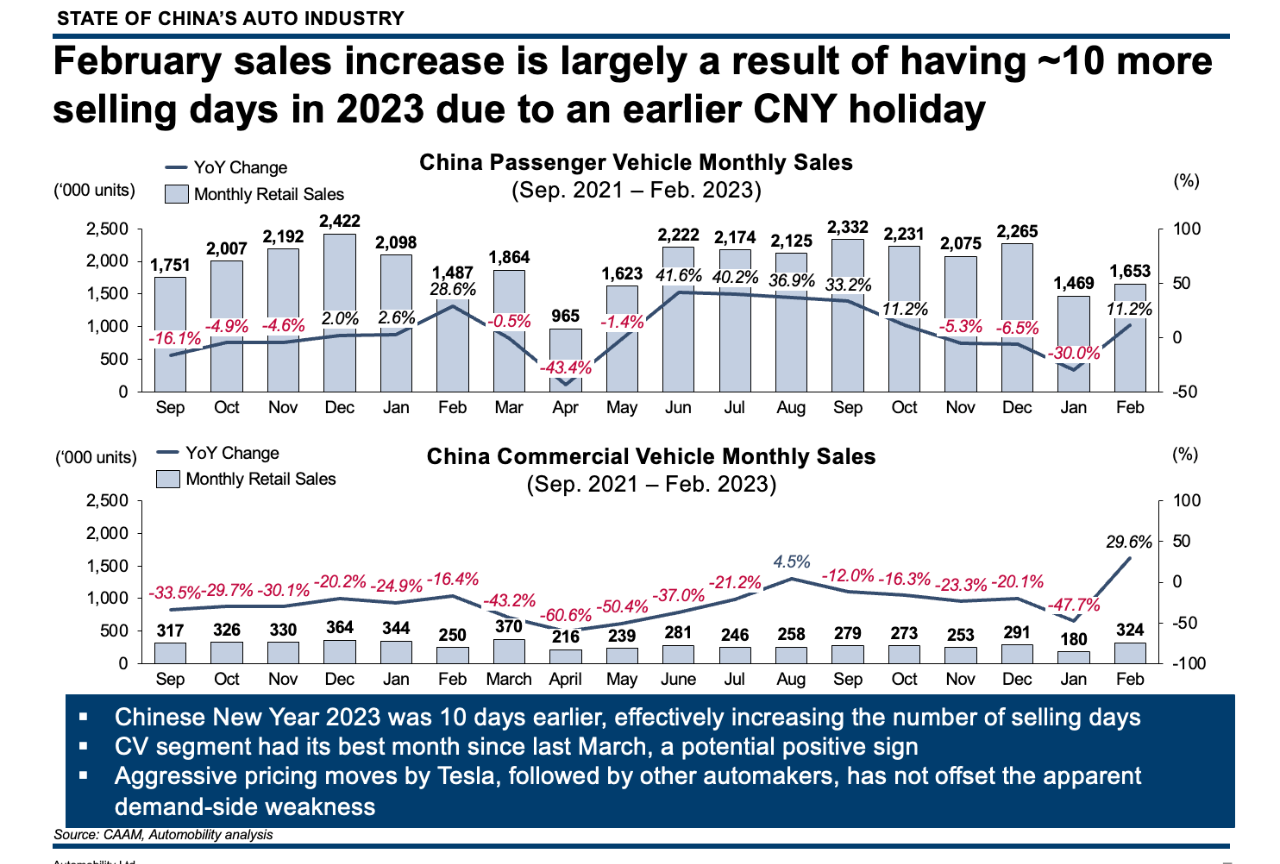

A Bounce in Commercial Vehicle and Used Car Sales

When total vehicle sales are viewed by segment, we can see that commercial vehicle sales in February had their best absolute sales performance since March 2022, perhaps an early sign of recovery in this segment.

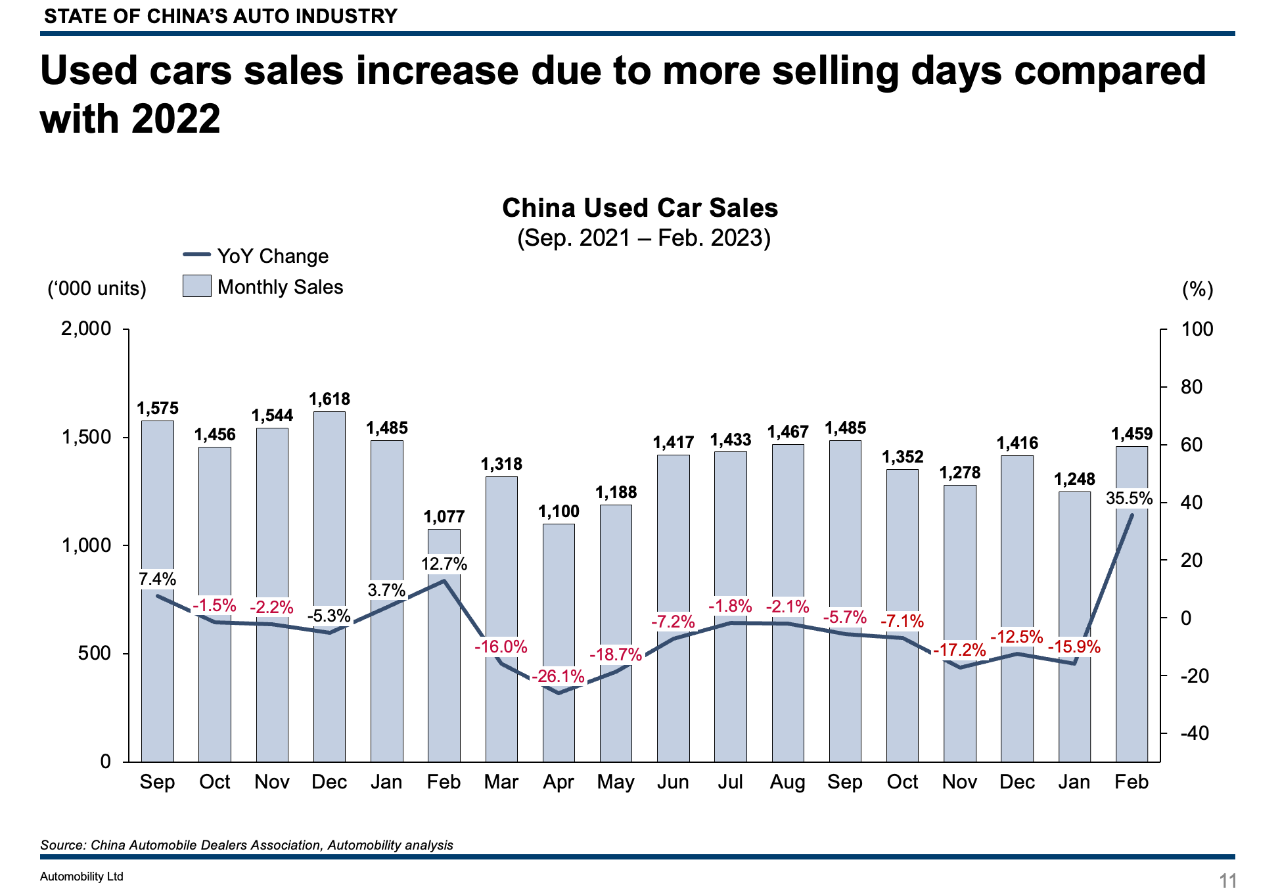

Sales of used vehicles also bounced up 35.5% in February which is primarily a result of the increase in selling days. This is also an indication that consumers are shopping for affordable transportation in a period of economic weakness.

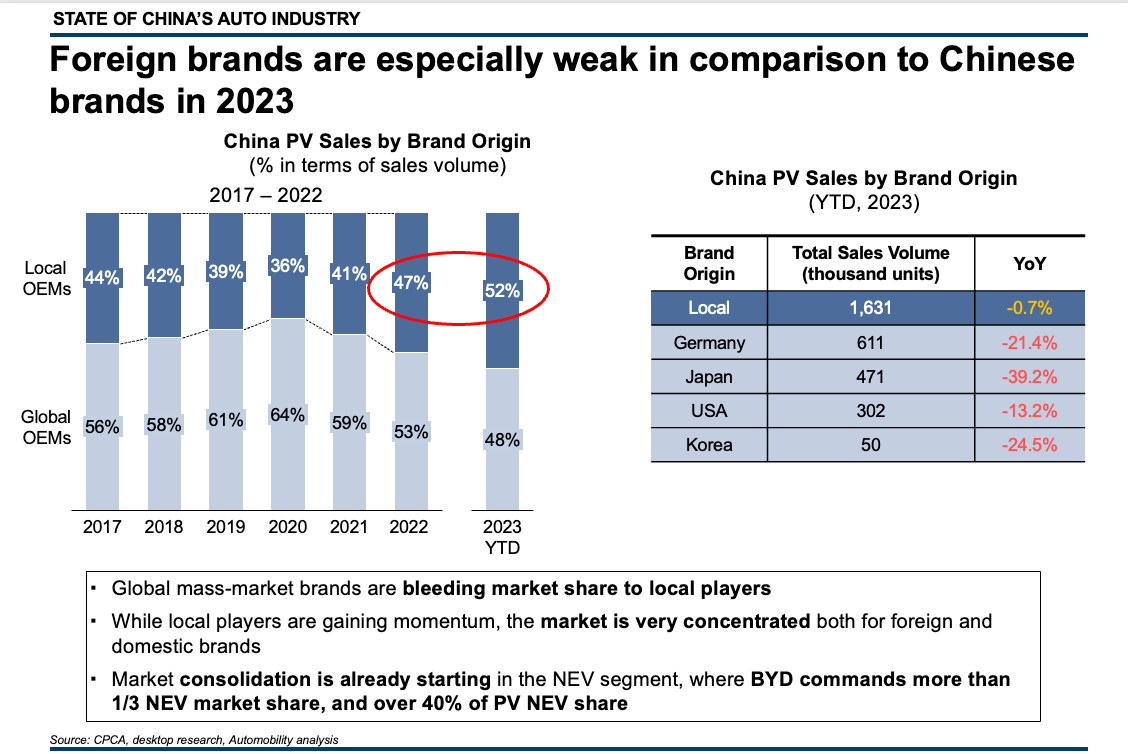

There is no other way to describe what is happening other than a catastrophic decline in performance of multi-national ICE brands in China. As noted earlier, the overall market for January-February is down 15.2%. However, in this period, local Chinese brand sales are down just 0.7%.

With the exception of Tesla, sales of foreign branded cars have declined precipitously and now represent 48% share of the market. Foreign brands are clearly bleeding market share and we therefore expect 2023 to be the first full calendar year in which local brands outperform global brands in terms of PV sales volume.

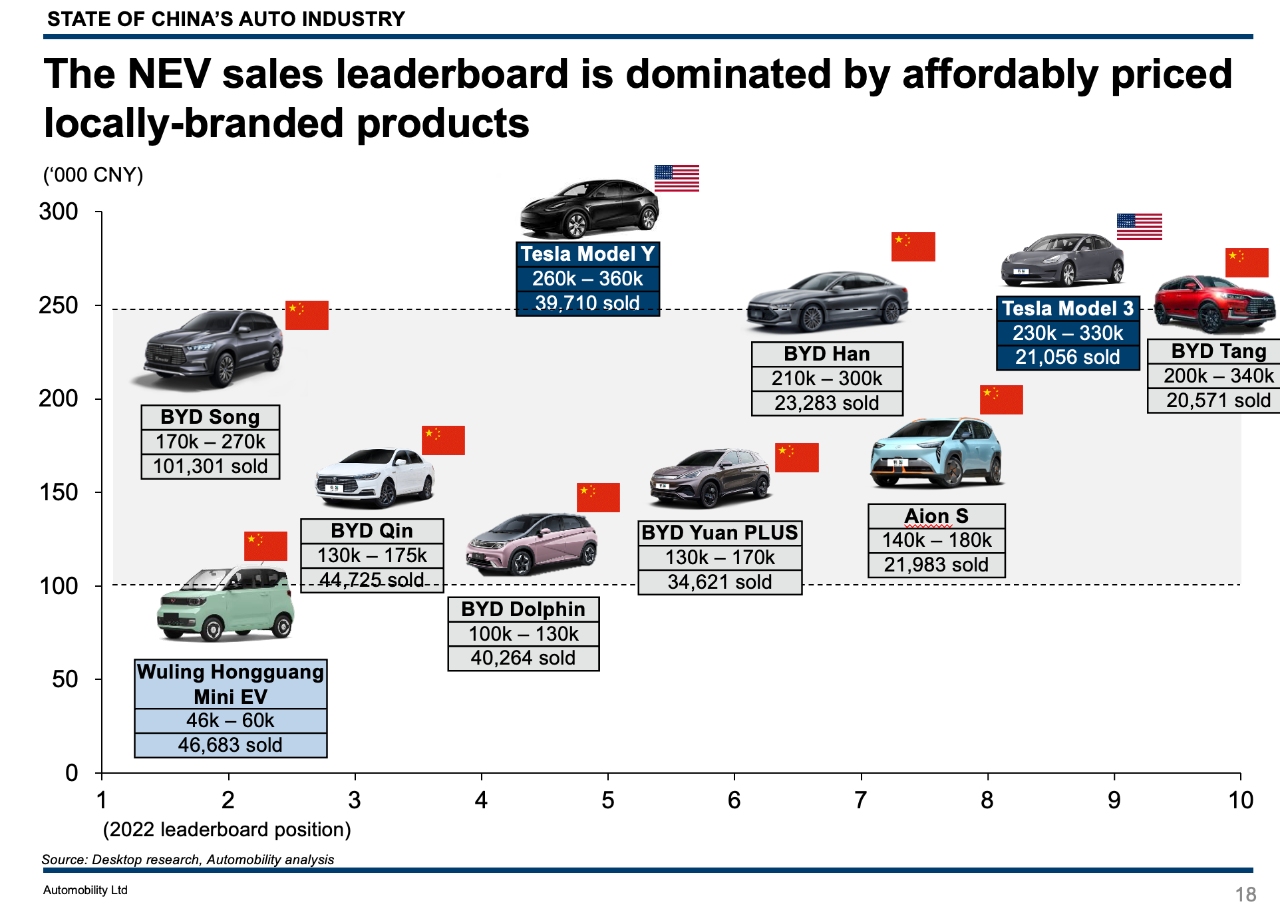

NEV Leaderboard

Even with aggressive pricing actions initiated by Tesla, BYD continues to dominate the NEV sales leaderboard. Remarkably, BYD’s share has risen during this period to over 40%, while selling more than 5 times the number of units over Tesla in China so far in 2023.

Other Chinese brands including Chang’an (142.2%), GAC (64.1%), Li Auto (53.6%), and NIO (30.9%) posted impressive sales gains from last year. This is primarily a result of new product introductions in 2022 and 2023 – and Tesla has not launched a new model in China since the Model Y in 2021.

Competing in China’s Hyper-competitive NEV Market

Staying relevant in China’s NEV market requires:

– Efficient supply chain management, especially around batteries and semiconductors

– A steady new product launch cadence

– A clearly understood brand value proposition

If any of the above are weak, the company will ultimately resort to price discounts as a way of selling down excess capacity. Unfortunately, all of this signals structural weakness in the market which will challenge ALL NEV and ICE brands to remain profitable in China’s hyper-competitive market.

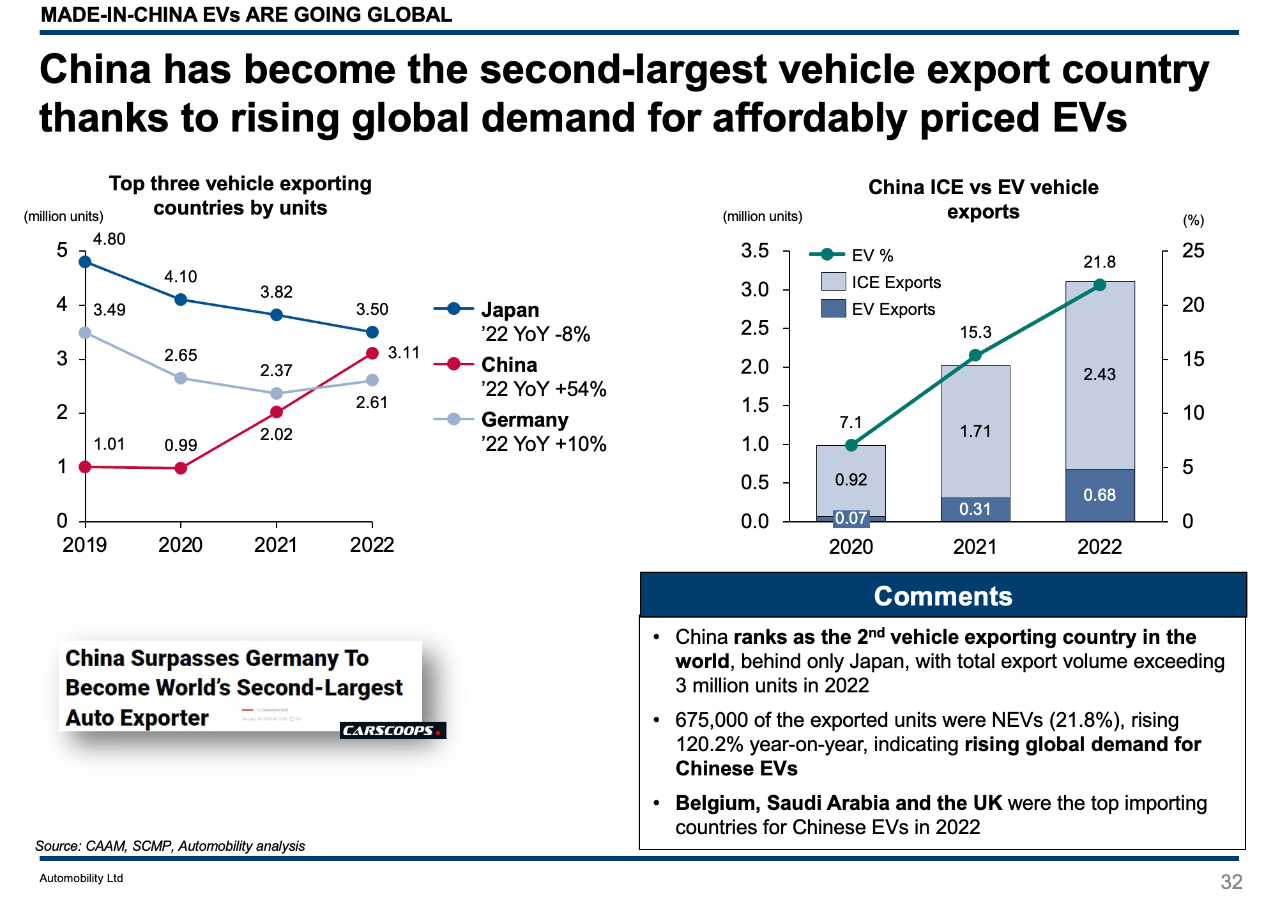

China Becomes Second Largest Automotive Export Nation

How does China’s overcapacity condition get corrected?

– Expect aggressive price discounting in the near-term to stimulate demand and sell-down growing inventories

– The China government will eventually put some form of incentives back in the market to protect against factory closings and job losses

– Companies that are underperforming in China will seek to export abroad.

– Weaker ICE and EV brands will ultimately capitulate and either exit the market or be acquired

As a consequence, export volumes from China have tripled in two years, with China surpassing Germany as the second largest automotive export country in the world. EVs represent 21.8% of these exports, and this is expected to rise. In 2023, we expect China to surpass Japan and become the largest automotive export nation in the world.

Several questions to consider:

– Tesla launched a price war to stimulate demand for older models, avoid over-supply, and claw back market share. Yet, their market share so far in 2023 is below their historic performance from 2020-2022. What can be done to recover the lost market share?

– Will the price war accelerate consolidation of weaker EV and ICE brands?

– Will the price war accelerate the decline of ICE brands, and which ones are most likely to follow Stellantis and Acura to the exits?

– The NEV market is far more concentrated than ICE. Will this continue to be the case?

In his role as AmCham Shanghai’s Automotive Committee chairman, Bill Russo will host the State of China Auto Market webinar on Tuesday, March 21.

If you wish to join the next monthly AmCham Automotive Committee webinar on the State of China’s Auto Industry, you can register here:

Webinar | State of China Auto Market Monthly Briefing (Mar)

March 21, 2023 Tuesday

9:00 AM – 9:45 AM (GMT+8)

About Bill Russo

About Automobility

Our partners are former senior executives at large corporations and/or senior consultants at leading management consulting firms. We believe clients would benefit the most from a combination of consultants with substantive experience in consulting and in line management.

Therefore, we organize ourselves into a core team augmented by an extensive “extended team members” with a large variety of skills and expertise.

Contact us by email at info@automobility.io

Sorry, the comment form is closed at this time.