16 Mar Fortune : The tiny EV with more China sales than Tesla is taking the market by storm

Media Source : Fortune

28 JAN 2022

by Eamon Barrett

FORTUNE

In the riverside city of Liuzhou, in China’s southern Guangxi province, almost 30% of the cars sold in 2020 were electric vehicles (EVs). But the most popular car on the streets isn’t a Tesla or a Nio or any of the other U.S.-listed EV makers. It’s the Wuling Hongguang Mini EV: a locally made pod of a vehicle with a bright candy-colored coating. It has two doors, zero frills, and is the second-best-selling EV brand in China.

“It is the surprise of the EV world,” says TuLe, founder and CEO of auto industry consultancy Sino Auto Insights. “No one on the Wuling team who launched this model knew it was going to be a winner. I think they saw potential, but not that sales would be sustained for over a year.”

As vehicles shift from gasoline-powered to electric, auto analysts forecast that cars of the future will be more smartphones on wheels than actual driving machines. In China, as elsewhere, Tesla has led the industry in upgrading cars into roving entertainment vestibules. But the staggering success of the Wuling Mini EV shows there is still a large contingent of car buyers who value the destination a little more than the journey and want a cheap vehicle to move from point A to point B. With no high-tech specs or zero-to-60 stats to speak of, the Mini EV has charmed fans with its utility and customizable exteriors. It’s part car, part fashion accessory-the Vespa of EVs.

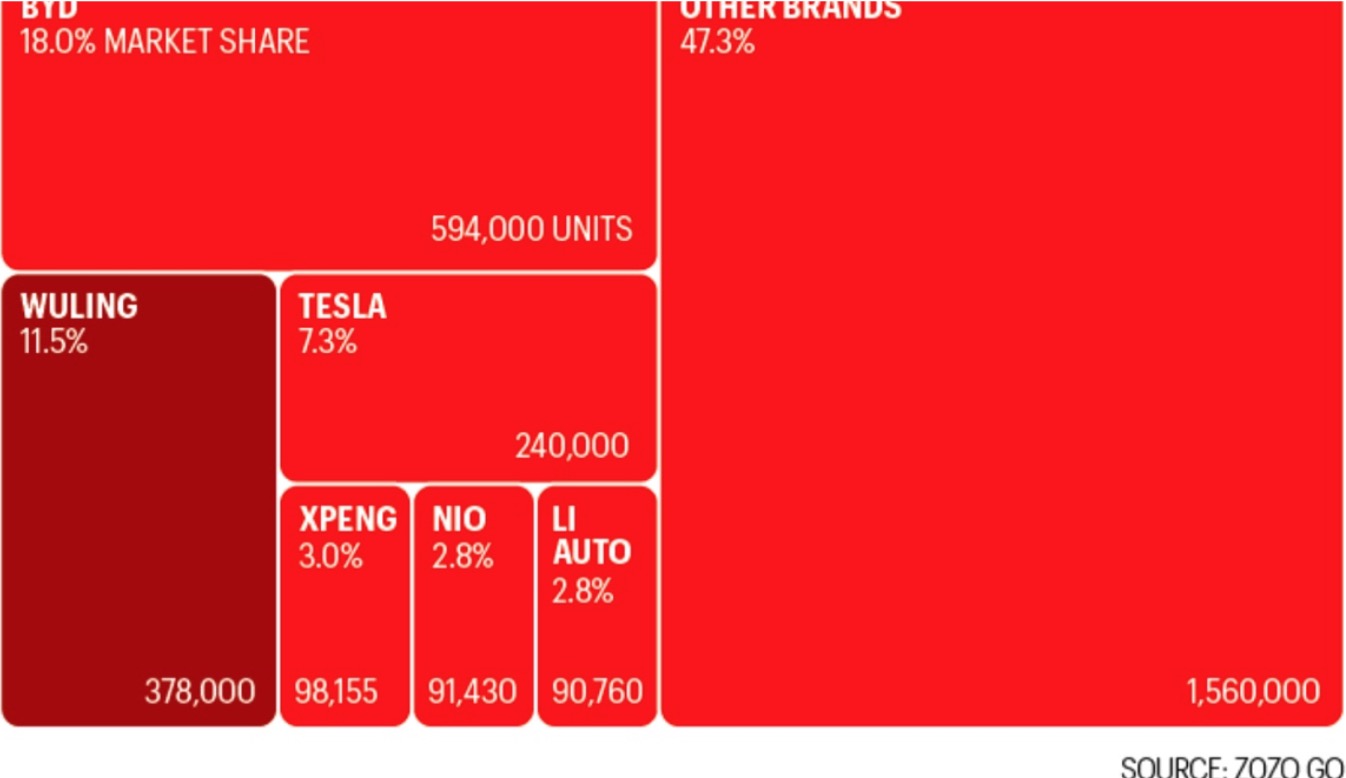

Wuling, a joint venture between Chinese state-owned automakers SAIC and Guangxi Auto and U.S. giant General Motors, launched the Mini EV in July 2020. A month later, it stole pole position as the bestselling EV in China, with 13,000 units sold in August. In all of 2021, the manufacturer sold 378,000 Mini EVs, making the simple compact car China’s second-most-popular electric-vehicle brand-beating Tesla and ranking just below the Warren Buffett-backed BYD.

Underpinning Wuling’s success is the cutesy car’s endearing price. A basic model starts at $4,500, substantially less than the cheapest models from Tesla, local rival Nio, and BYD, which cost $40,000, $57,000, and $33,000, respectively.

Wuling has a pedigree for producing cheap cars. In the early 2000s, the $5,000 Wuling Sunshine microvan became the de facto transport for China’s tradespeople and, circa 2010, the third-best-selling vehicle in the world. Twenty years later, Wuling has again struck gold-or rather pinks, purples, and baby blues-with a budget-friendly EV that immediately won an 11% share of China’s fractured EV market, which had 300 players last year.

At such a low price, the Mini EV is a decidedly low-tech automobile. The three-meter-long hatchback has a radio and a USB charging point, but it doesn’t have a touch-screen control panel like Tesla and Nio, and it certainly doesn’t have autopilot. It does come with a rearview camera and parking sensors, but the Wuling’s flimsy shell skimps on safety features like airbags.

New Wuling Mini EVs roll off the production line at a Qingdao, China, plant.

The Mini EV wasn’t designed to cruise down highways or zip from city to city. Its battery life is a fraction of its more premium counterparts, with a full-charge range of 105 miles and a max speed of 62 miles per hour. (A Tesla Model S can travel 400 miles and tops out at 200 mph.) According to Wuling, the Mini EV is “an alternative to walking,” tailored expressly for roving around the urban sprawl of China’s newer, less developed cities, where public transportation is sparse.

“Personal space has become more important in a post-COVID world. To a person who is on a bus or a train, a Didi [taxi] is an upgrade, because it’s less crowded. Then you look at the Wuling Mini, and it’s appealing to that same demographic seeking an upgrade,” says Bill Russo, founder and CEO of industry consultancy Automobility.

Tesla still dominates China’s flashy tier 1 cities-commercial hubs with high costs of living, like Shanghai and Beijing. But the Mini EV has tapped into the mass market in lower-tier cities, like Wuling’s hometown, Liuzhou, where car buyers can’t afford the luxury of a Tesla. According to China’s National Bureau of Statistics, the average household disposable income in Liuzhou’s Guangxi province is $5,400 a year-oneseventh the cost of a Tesla.

And while the Mini EV doesn’t feature bells and whistles, it does come with stickers or full body decals that owners can personalize. In Liuzhou, one Wuling owner decked out her EV to look like the cat bus from hit Japanese animated movie My Neighbor Totoro. Other drivers opt for Pokémon decals or vibrant color schemes that match their personal style.

“Wuling has done an amazing job in marketing, customization, and keeping its brand fresh,” Le says.

Wuling has done all that and turned a profit, even with its low sticker price.

THE LITTLE EV THAT COULD

Eighteen months after launching, sales of the Wuling Mini EV-with its no-frills interior

and low cost-have outpaced higher-tech rivals like Tesla.

In December, during an exhibition organized by the Japan Management Association, professor Masayoshi Yamamoto of Japan’s Nagoya University disassembled a Mini EV into its component parts. Yamamoto found that beneath the buggy’s cheery veneer, the nuts and bolts of the car are mostly “off-the-shelf” items-meaning there isn’t a lot of expensive, proprietary tech weighing on Wuling’s overhead.

Yamamoto estimated the material and labor costs of the Mini EV, which event organizers bought for $6,000, were roughly $4,200. That would leave Wuling with a healthy 30% profit margin.

Wuling declined to comment for this article.

Wuling has demonstrated China’s thirst for a low-cost, mass-market EV. but it’s also left itself vulnerable to competition, and rivals have noted the brand’s success.

In August, after Nio CEO William Li visited a Wuling manufacturing site, Nio said it would launch a more affordable EV model, too, though Li insisted the cheaper Nio wouldn’t compete with the Mini EV.

German automaker Daimler plans to introduce a China-made version of its Smart car this year. The Smart car, which debuted in the late 1990s, was conceptually a precursor to the Mini EV and might have drawn inspiration from Japan’s boxlike “kei cars,” too. But its cramped design never gained traction in Europe owing to its hefty $25,000 retail price. Daimler will launch the Smart marque in China through its joint venture with Chinese manufacturer Geely.

But Le reckons few challengers, local or foreign, will be able to match Wuling on price. For starters, Le says, SAIC is a state-owned company, which typically means it can operate at a loss without having to answer to shareholders. Meanwhile, private and, particularly, foreign auto brands bear higher overhead costs-mostly owing to the expense of running decisions through larger multinationals-that Le says may prevent them from making a car quite so cheap. And even if they do, Wuling was there first.

“Wuling has earned its place in the market as the cute car that packs an enormous punch,” Le says. “But there is a huge market for this.” China’s EV sales rose from 1.3 million to 3.3 million units last year. And they’re expected to double again this year, Le says.

This article appears in the international edition of the February/March issue of Fortune with the headline, “The surprise of the EV world’ is pocket-size.”

SOURCE: https://fortune.com/2022/01/28/wuling-mini-ev-car-specs-price-mini-electric-vehicle-teslachina/

Sorry, the comment form is closed at this time.