22 May State of China’s Auto Market – May 2023

Market Weakness Prevails in the Aftermath of Price War

The ICE Age is ending in China – will foreign brands survive the transition?

Comments from Bill Russo, Founder & CEO of Automobility Ltd.

The 20th Shanghai International Automobile Industry Exhibition was held from April 18 to 27, 2023. This was the first time since 2019 that executives from foreign automakers visited an auto show in China and were greeted with a dramatically different reality than existed just a few short years ago.

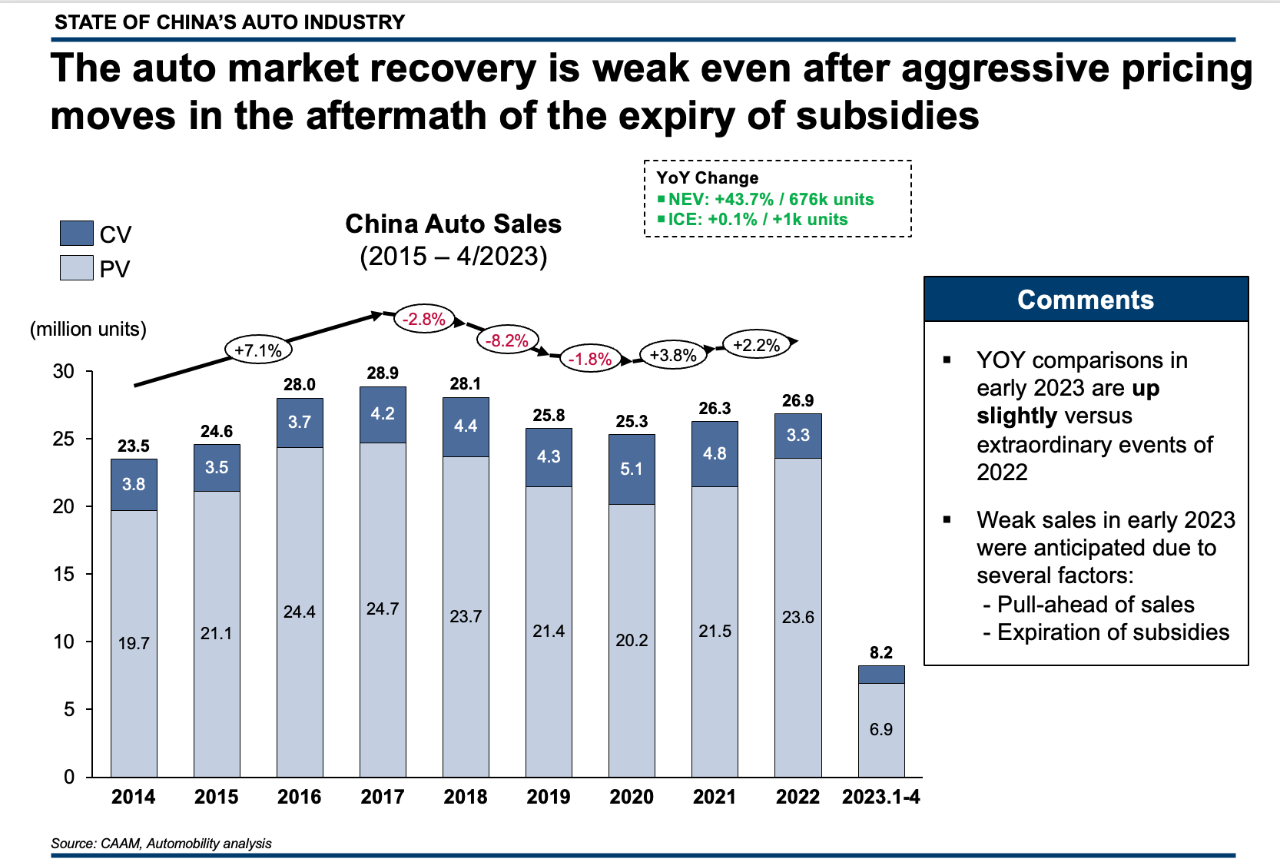

Sales of gasoline powered cars have fallen by 8.1 million units from 2017 through 2022. Sales of New Energy Vehicles (BEV + PHEV + FCEV) grew by 6.1 million units over the same period, with a huge inflection point in 2020 coinciding with the opening of Tesla’s Shanghai Gigafactory, which sparked retail consumer interest in electric vehicles.

Given that product cycles are 5+ years in the automotive industry, it is not surprising that legacy ICE carmakers were not prepared for such an abrupt secular shift in consumer preference. And they certainly were not ready for the likes of the emerging local competitors in China that now command over 80% share of NEV sales, with BYD commanding over one-third of the market.

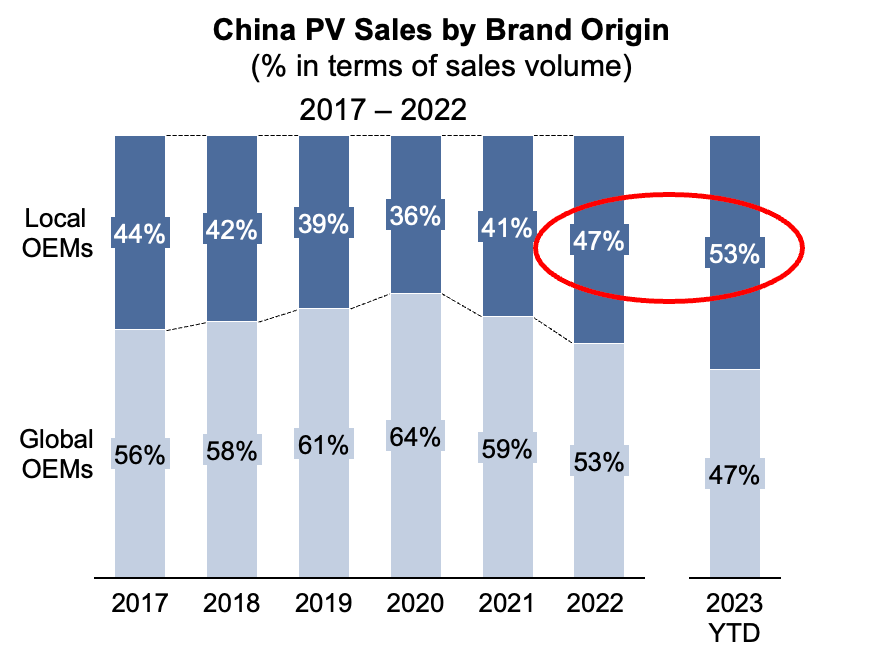

The net result of this is that Chinese brands now sell 53% of passenger vehicles in China in 2023, a gain of 17% since 2020.

For a deeper analysis of our takeaways from the Shanghai Auto Show, please see the following Automobility Ltd original article and an interview I conducted with Dr. Edward Tse from Gao Feng Advisory Company:

Seven Takeaways from the 2023 Shanghai Auto Show [Automobility article]

What Shanghai Auto Show Means for Us [Bill Russo interview]

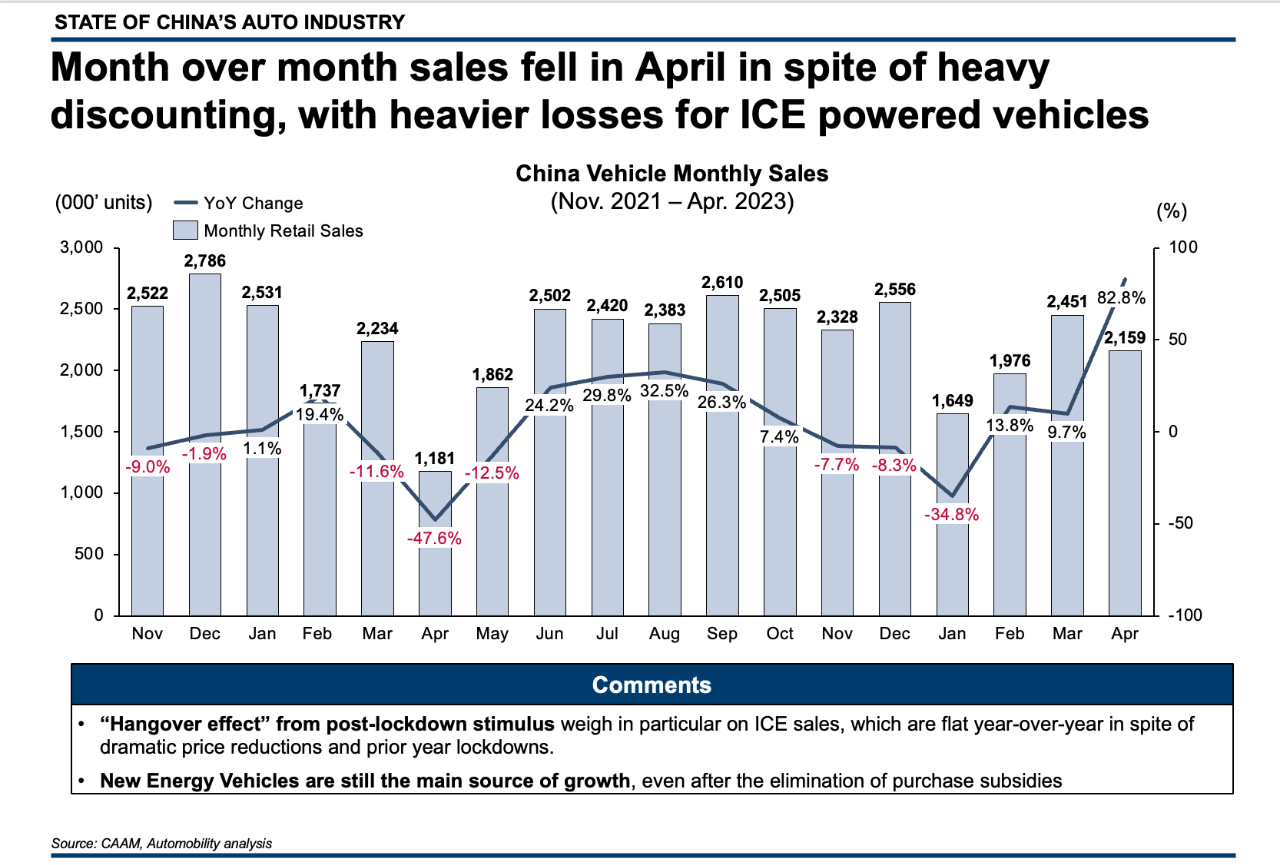

April Car Sales Down from Prior Month

Let’s first make a strong point so we are not repeating this as we look at the April and YTD sales figures: for this Month and the next several months, it is meaningless to focus on year-over-year sales due to the anomalous impact of zero-COVID on sales in 2022. The sales pattern in 2022 was not normal at all, with weak sales in the 2nd quarter, and a stimulus-fueled recovery in the second half. Instead, we should focus on month-to-month movements – and by this measure, April 2023 sales can only be characterized as poor.

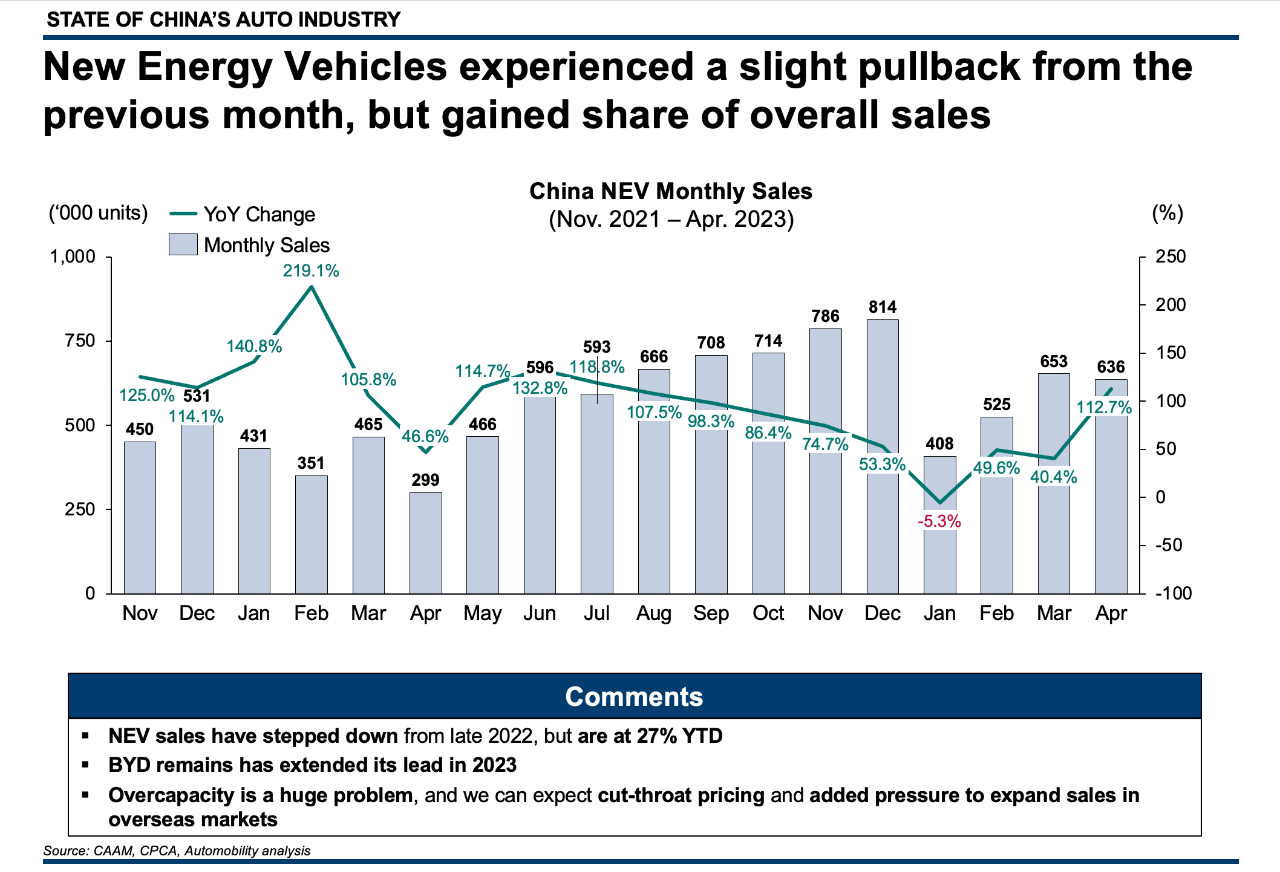

2.2 million cars were sold in April, and 8.2 million cars and trucks were sold from January to April 2023. Since the expiration of ICE tax stimulus and certain NEV purchase subsidies, a price war and heavy discounting has occurred. However, monthly selling rates have not matched those of the second half of 2022. This clearly indicates demand-side market weakness that is not offset with heavy price discounts. We see this as a “hangover effect” from post-lockdown stimulus measures taken in 2022, which is having a disproportionately negative impact ICE sales. As NEVs become cheaper, the ICE price advantage is eroded.

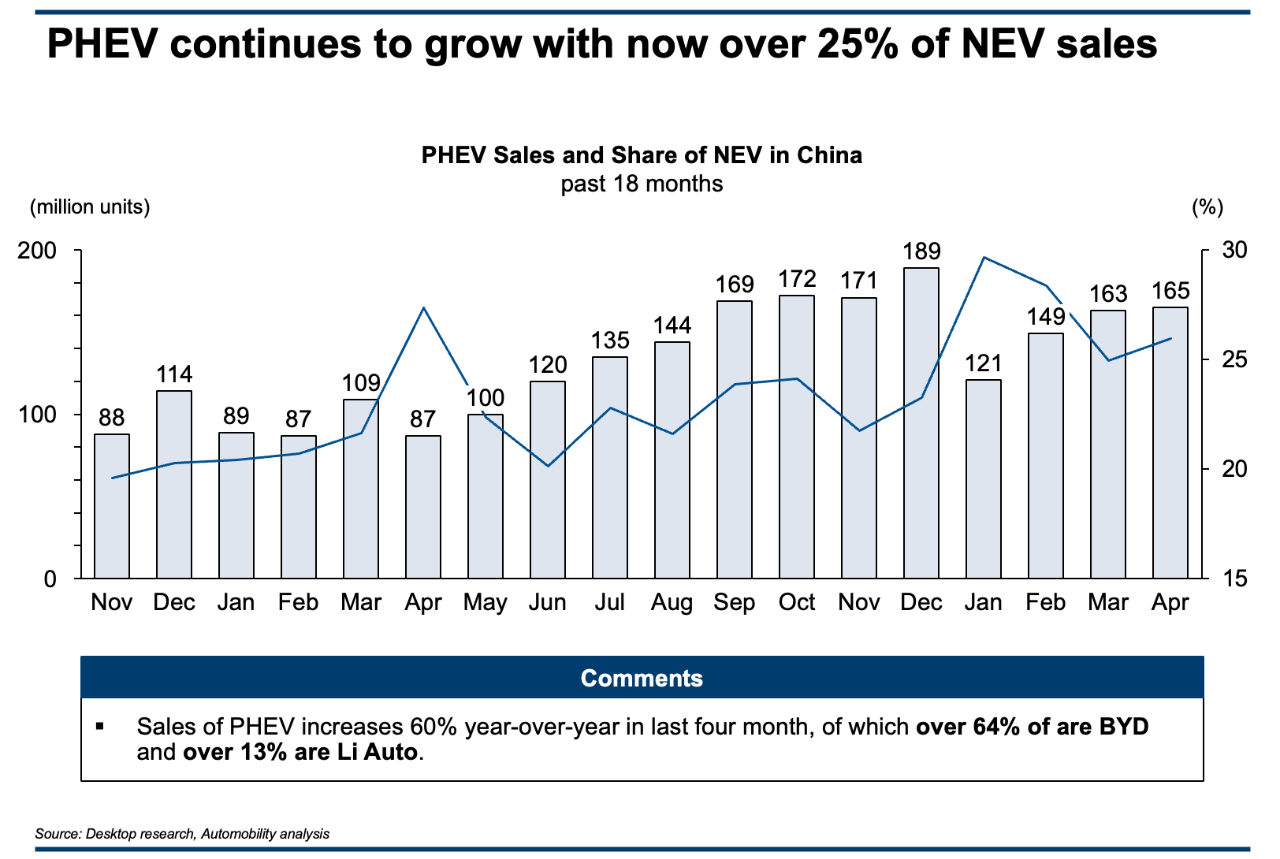

New Energy Vehicles Grow in Share and PHEVs Remain Popular

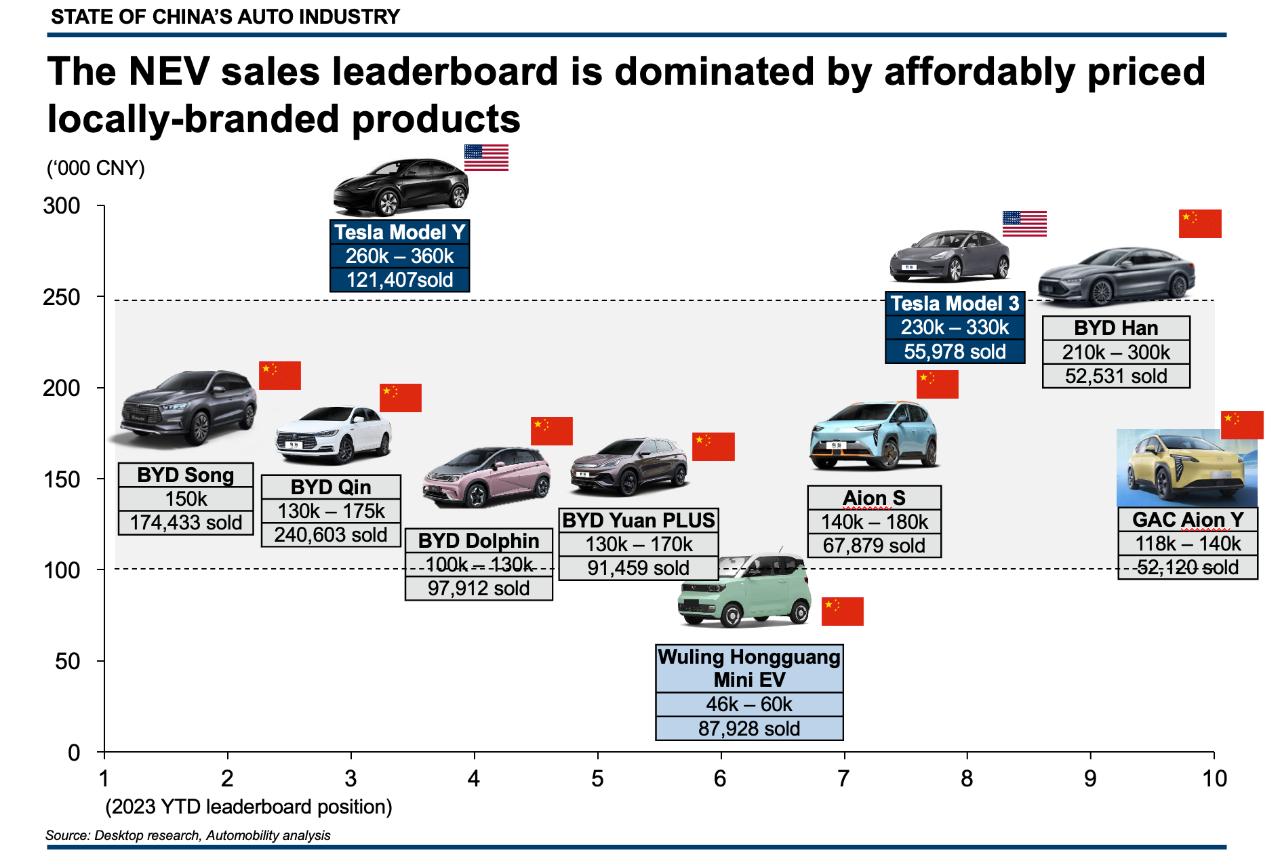

NEV Sales Leaderboard

The April leaderboard indicates how consolidated the China market has become, as it includes the products of just 4 carmakers.

Five products from BYD include four from the Dynasty series (Qin, Song, Yuan and Han), and one from the Ocean Series (Dolphin). Once launched, we expect the very affordable BEV BYD Seagull to rocket to the top of the list.

Other leaderboard entries include Tesla’s Model Y, where very few sales happened last April due to the lockdown at Giga Shanghai. Also included are the Aion Y and Aion S from Guangzhou Auto Company (GAC) and Wuling’s very inexpensive Honguang Mini EV and their newly launched Binguo. It appears that the Honguang Mini EV sales are in decline, in no small part owing to showroom cannibalization from the entry of the Binguo.

April NEV Leaderboard

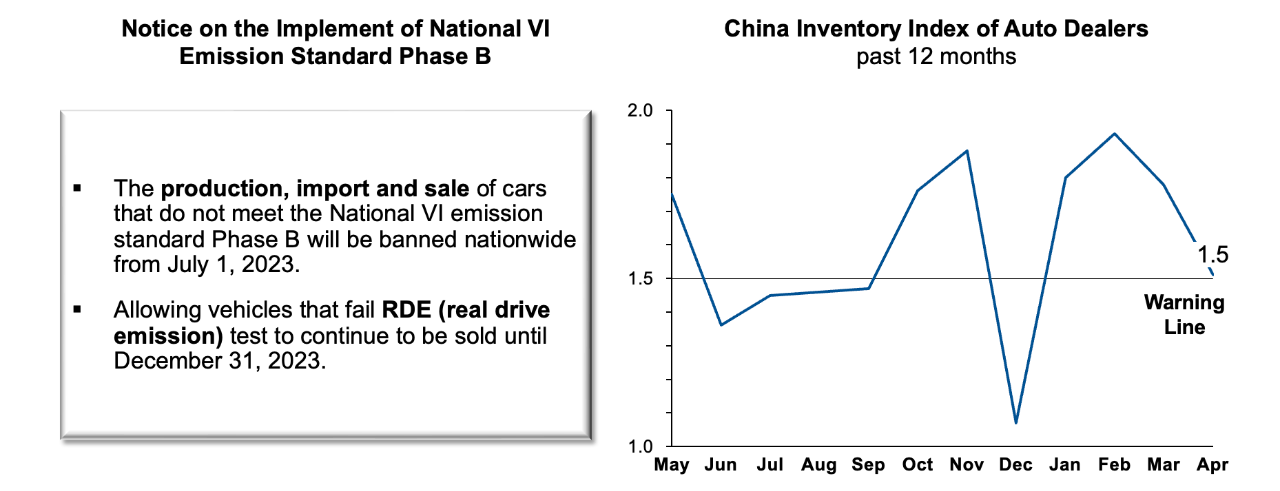

China “Kicks the Can” on China VIBowing to the collective pressure from ICE carmakers who are facing a perfect storm of headwinds from the shift to NEV as well as a price war, the China government effectively delayed the enforcement of the China VI emission standard on vehicles that are already in inventory. Such cars can be certified and sold until December 31, however, after July 1st, vehicles that do not meet the new standard neither be produced nor imported to China.

China “Kicks the Can” on China VIBowing to the collective pressure from ICE carmakers who are facing a perfect storm of headwinds from the shift to NEV as well as a price war, the China government effectively delayed the enforcement of the China VI emission standard on vehicles that are already in inventory. Such cars can be certified and sold until December 31, however, after July 1st, vehicles that do not meet the new standard neither be produced nor imported to China.

This provides some relief for manufacturers as they attempt to sell-down their pipeline of finished vehicles that do not meet the emission standard.

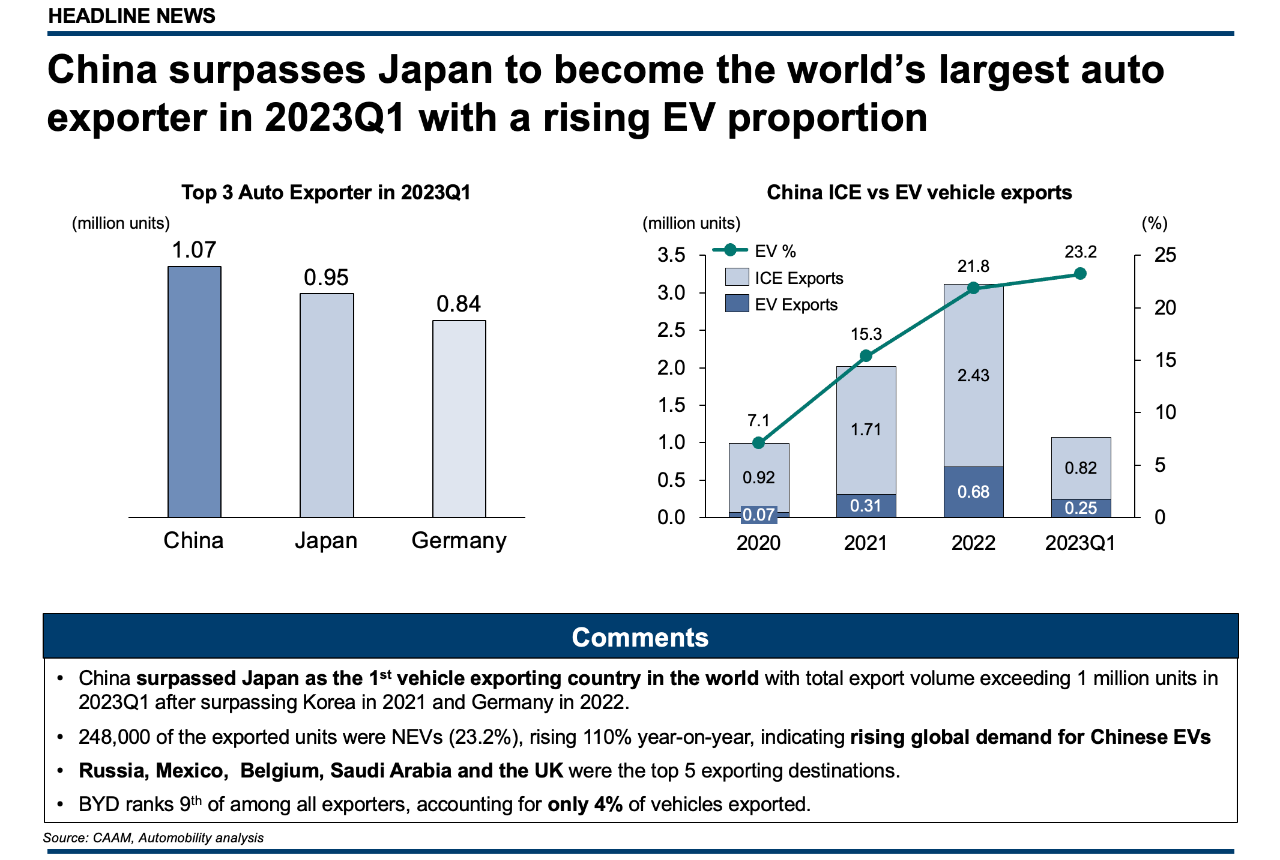

China Surpasses Japan as Top Car Export Nation

As a final note, and sure to capture headlines, China surpassed Japan in car exports in the first quarter of 2023. China exported 1.07 million cars in the 1st quarter, well ahead of the 950,000 cars exported from Japan, with 23.2 percent being of the electric variety.

While surely this will be spun as a positive story of the rise of China as an automotive powerhouse, it should also be noted that the top destination for these exports was Russia, which prior to the Ukraine war was previously being served primarily by European brands. We also believe that the weakening demand outlook in China is forcing Chinese manufacturers to prioritize overseas sales as a “safety valve” to relieve overcapacity pressure.

Chinese car exports will surely continue to rise as the NEV mix increases, as there is demand from other international markets for affordable electric vehicles.

Several questions to consider:

– How and when will the China NEV market consolidate? Who will be the likely survivors?

– Which foreign carmakers are likely the next to exit China?

– What will the supply chain look like in the aftermath of the transition? Will the global Tier-1 and Tier-2 companies remain relevant in the new Smart EV game?

– Which Chinese brands are most qualified to be global carmakers?

– Is China sending their best companies to the global markets, or are they the ones that are weakest in China?

In his role as AmCham Shanghai’s Automotive Committee chairman, Bill Russo will host the monthly State of China’s Auto Market online webinar on Tuesday, May 23, at 9am in China.

Webinar | State of China Auto Market Monthly Briefing (May)

About Bill Russo

About Automobility

Our partners are former senior executives at large corporations and/or senior consultants at leading management consulting firms. We believe clients would benefit the most from a combination of consultants with substantive experience in consulting and in line management.

Therefore, we organize ourselves into a core team augmented by an extensive “extended team members” with a large variety of skills and expertise.

Contact us by email at [email protected]

Sorry, the comment form is closed at this time.