24 Aug State of China’s Auto Market – August 2022

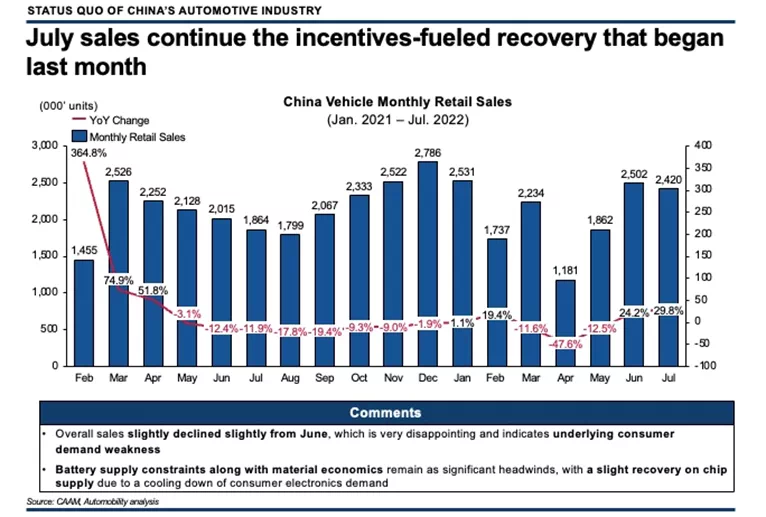

July sales continue an incentives-fueled recovery that began last month

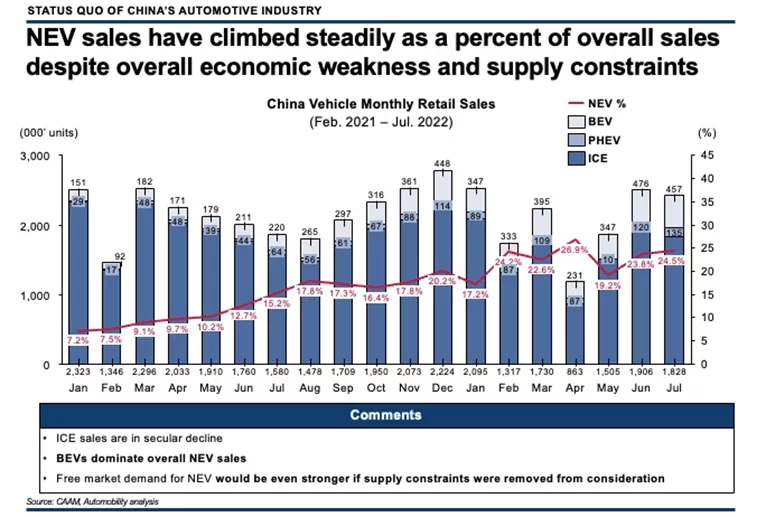

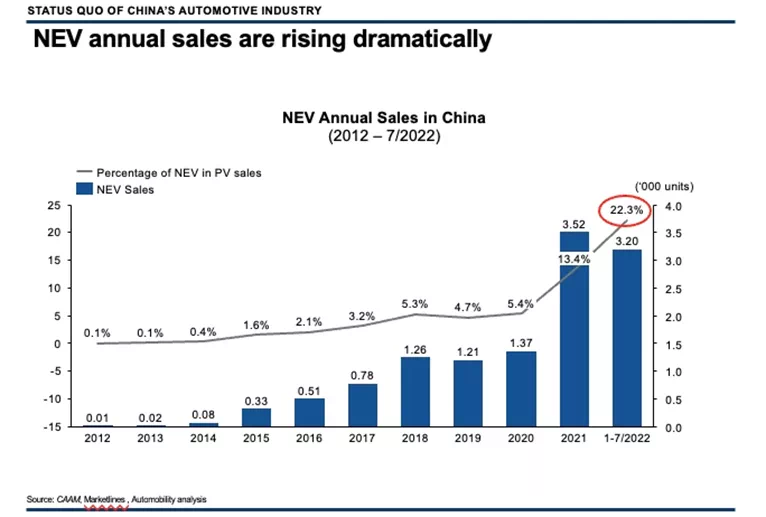

NEV July share of sales climbs to 24.5% and stands at 22.3% in 2022

Comments from Bill Russo, Founder & CEO of Automobility Ltd.

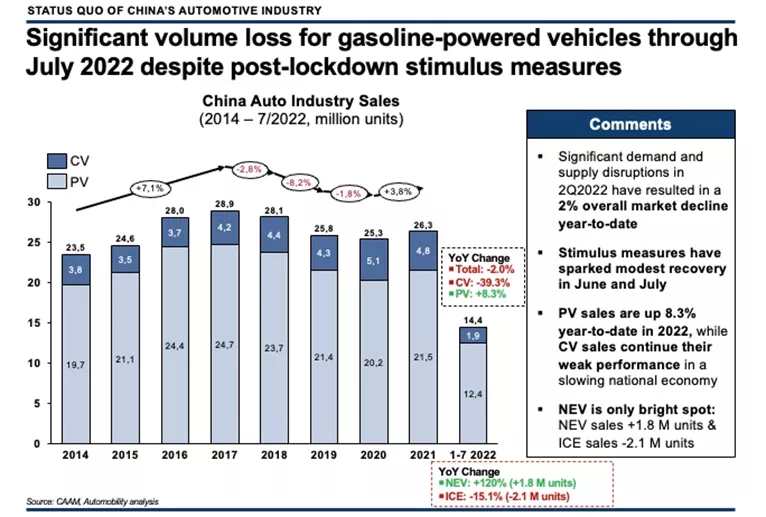

Auto sales in July continued to point to a modest recovery that is largely attributable to post-lockdown stimulus measures and continued expansion of New Energy Vehicle (NEV) sales. Through seven months, 2022 sales are down 2% with Passenger Vehicle sales up 8.3% and Commercial Vehicle sales down a whopping 39.3% versus 2021.

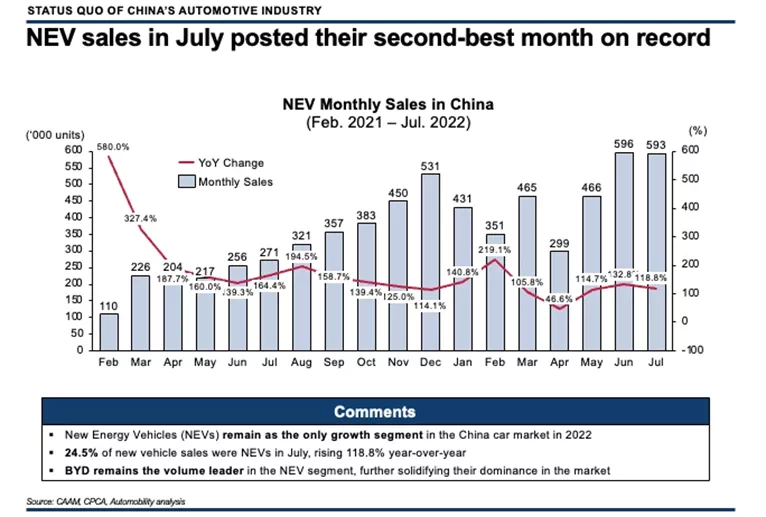

NEV sales remain the lone bright spot, with a unit sales increase of 1.8 million units. Sales of internal combustion engine (ICE) vehicles have declined by 2.1 million units compared to the same period last year.

On the bright side, NEV sales remain the only growth story in the market, rising to 24.5% share of sales. This is despite being challenged with the same chip supply headwinds that have been challenging for the auto industry. The chart below shows the sales mix of Battery Electric Vehicles (BEV), Plug-in Hybrid Electric Vehicles (PHEV) as well as ICE for the past 19 months, with the stealily rising NEV share.

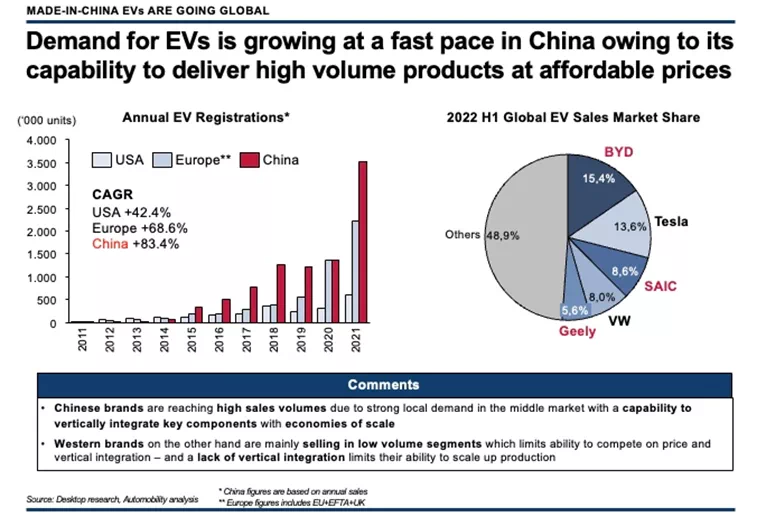

The dramatic shift in favor of electric vehicles becomes more apparent when looking back over a decade, as shown below. NEV share in 2022 stands at 22.3%, a near quadrupling of share over the past 2 years.

July NEV sales posted its second best performance in history, rising 118.8% year-over-year.

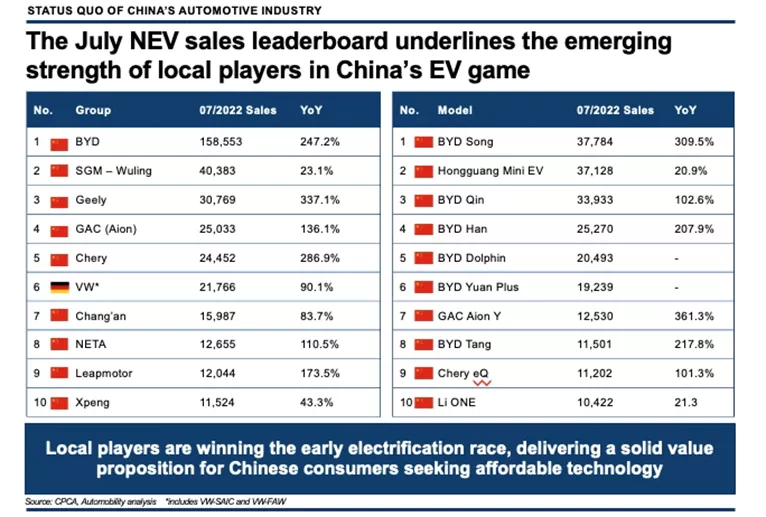

BYD continues its dominance of the NEV market with more July sales (158,553 units) than the next six companies on the leaderboard combined, while boasting 6 of the top 10 best selling NEV nameplates in China. The only foreign brand appearing on the leaderboard is VW, which sold 21,766 units from their two JVs with SAIC and FAW.

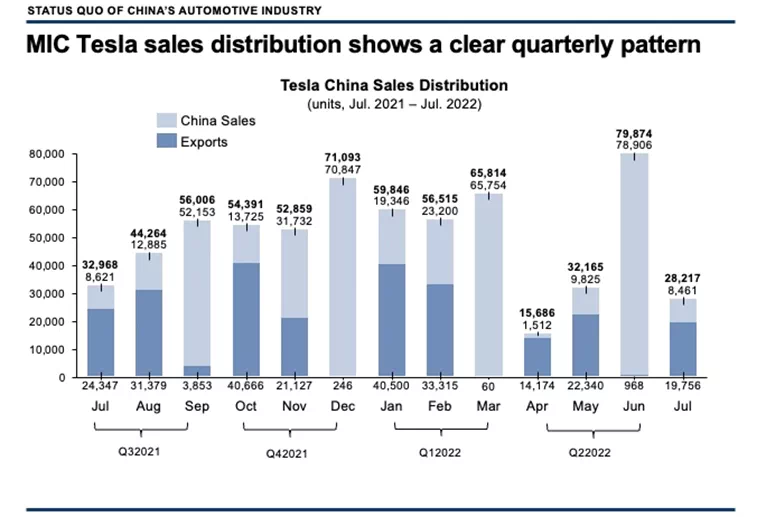

Tesla production fell in July due to a factory upgrade and does not appear on the July China sales leaderboard. Tesla shipped 28,217 vehicles from its Shanghai Gigafactory in July, selling 8,461 of these vehicles in China. In a now very clear pattern, Tesla prioritizes exports from China in the first month of every quarter.

- CATL declared plans to build batteries in Debrecen, Hungary, with a total investment of no more than 7.34 billion euros and annual capacity of 100 GWh.

- Great Wall Motor signed a strategic partnership with the largest car dealer group in the EU, Emil Frey. Emil Frey will distribute Great Wall’s Ora and Wey brands in Germany, beginning with the Ora Funky Cat compact EV in the fourth quarter of this year. Meanwhile, the Wey brand will launch in Germany with the Coffee 01 plug-in hybrid SUV.

- After successfully launching its first EV – ATTO 3 in Australia, BYD has declared the establishment of a new retail and servicing dealer group in Australia, a partnership between EV Direct (current dealership partner of BYD in AU) and Eagers Automotive (one of the oldest automotive dealer group in AU), to fast-track the rollout of its EVs around the country by providing national wide retail and aftersales services.

Clearly, unlike Las Vegas, what happens in China will not stay in China.

Several questions to consider:

– How sustainable is the June-July recovery?

– Will stimulus measures backfire and starve the market of consumers in 2023, as has happened with the recent collapse of Commercial Vehicle sales?

– What can foreign brands do to get in the EV game in China?

– As the China market slows, will this accelerate China’s efforts to expand internationally?

– Will the USA’s CHIPS and Science Act provide the spark needed to get the US in the new game?

– Will European and American consumers buy a Chinese EV?

– Will geopolitical tensions limit Chinese ability to compete internationally?

If you wish to join our next monthly AmCham Automotive Committee webinar on the State of China’s Auto Industry, you can register here:

Webinar | State of China Auto Market Monthly Briefing (August)

August 24, 2022 Wednesday

9:00 AM – 9:45 AM (GMT+8)

About Bill Russo

Bill Russo is the Founder and CEO of Automobility Limited, and is currently serving as the Chairman of the Automotive Committee at the American Chamber of Commerce in Shanghai. His 40 years of experience includes 15 years as an automotive executive with Chrysler, including 18 years of experience in China and Asia. He has also worked nearly 12 years in the electronics and information technology industries with IBM and Harman. He has worked as an advisor and consultant for numerous multinational and local Chinese firms in the formulation and implementation of their global market and product strategies.

About Automobility

Automobility Limited is global Strategy & Investment Advisory firm based in Shanghai that is focused on helping its clients to Build and Profit from the Future of Mobility. We help our clients address and solve their toughest business and management issues that arise in midst of fast changing, complicated and ambiguous operating environment. We commit to helping our clients to not only “design” the solutions but also raise or deploy capital and we can assist in implementation, often together with our clients. We put our clients’ interest first and foremost. We are objective and don’t view our client engagements as “projects”; rather as long-term relationships.

Our partners are former senior executives at large corporations and/or senior consultants at leading management consulting firms. We believe clients would benefit the most from a combination of consultants with substantive experience in consulting and in line management.

Therefore, we organize ourselves into a core team augmented by an extensive “extended team members” with a large variety of skills and expertise.

Contact us by email at [email protected]

Sorry, the comment form is closed at this time.