09 May Electric vehicle subsidy extensions offer little relief to Chinese automakers

S&P Global, April 29, 2020

- Author: Soon Chen Kang

- Theme: Retail & Consumer Products

China’s decision to extend subsidies and exemptions for electric and plug-in hybrid vehicles until 2022 is unlikely to significantly boost sales in this category, given the stronger effects the government’s wider initiatives to stimulate consumption will have on traditional gasoline-powered models.

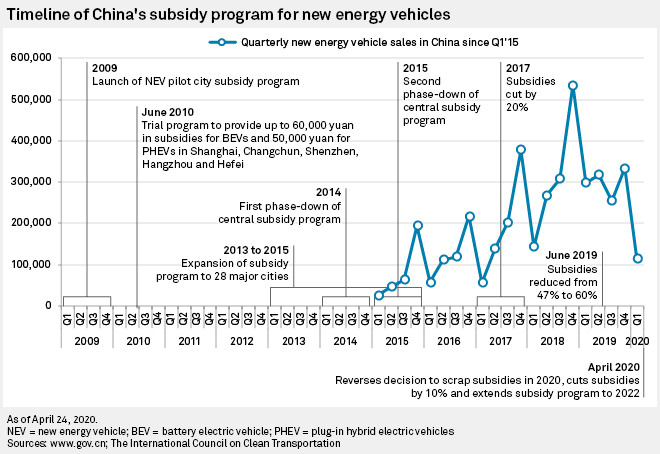

The Chinese finance ministry earlier in April said it would reduce the subsidies by stages, rather than scrapping the subsidies and tax exemptions altogether by the end of 2020 as planned. It will start from a 10% cut in 2020 to a 30% reduction in 2022. The subsidies will apply only to cars worth less than 300,000 yuan, meaning that many EVs produced by foreign manufacturers will not qualify.

The announcement came after sales of new energy vehicles, or NEVs, plunged 56.4% in the first quarter amid a 42.4% overall decline in the auto sector, according to figures released by the China Association of Automobile Manufacturers.

The NEV sector has previously enjoyed rapid growth thanks to a subsidy rollout that began in 2015. However, sales fell 4% in 2019 after incentives were reduced by up to 60% from June that year.

Yet the goal of promoting less polluting vehicles seems to have taken a backseat to the government’s key concern: reviving consumption following the unprecedented lockdown of Chinese cities in January and February to curb the coronavirus outbreak.

Cash incentives offered by local governments to boost sales of all cars send a clear political signal that the government is keen to reboot consumption for the broader economy, Jefferies analysts wrote in a research note. It is likely that the handouts will increase demand for internal combustion engine, or ICE, models rather than NEVs.

“I think right now the Chinese government is more concerned about the overall economy, and I’m guessing that their thinking is that as the ICE sector begins to grow again, it will pull the NEV sector out,” said Tu Le, managing director at Sino Auto Insights. Plummeting oil prices also lessens the appeal of switching to NEVs, Le added.

Furthermore, car buyers now face fewer restrictions in purchasing gasoline cars after some city governments raised the quota of license plates. The Shanghai city government, for instance, announced that it will add 40,000 additional license plates to its annual quota for 2020. A limited number of license plates are issued in big cities such as Shanghai and Beijing to curb air pollution.

Since NEVs have often been the second choice of car buyers who failed to obtain license plates, relaxed restrictions will dent sales of this segment, said Stephen Dyer, managing director at consultancy AlixPartners.

Other factors, such as confidence in the range of NEV models and convenience of charging, will keep gasoline cars as the preferred option of car buyers, said Le.

“The extension of subsidies will dampen the fall in sales, but the NEV market will still largely rely on policy-led incentives before sustainable growth can occur,” said Bill Russo, founder and CEO of consultancy Automobility.

The economic fallout from the coronavirus pandemic is likely to deter big-ticket purchases in 2020. S&P Global Ratings forecasts an 8% to 10% decline in China car sales this year and has noted a rise in delinquencies in auto loan asset-backed securities in China during January and February.

Sales of NEVs may well fare worse. Ries Strategy Positioning Consulting expects sales volumes in the category to fall by 10% to 20% year over year. Jefferies has revised its outlook to a 10% year-over-year drop in NEV sales, taking into account the likelihood that fleet purchases from ride-hailing companies would fall as this sector was hit over fears of the spreading coronavirus outbreak.

Although car sales jumped 300% in March compared to February, the China Passenger Car Association said consumer sentiment dipped again in the latter weeks of March over concerns of a second wave of infection and the escalating COVID-19 outbreak in the U.S. and Europe.

The overall decline in consumer confidence will outweigh the emergence of new car buyers keen on having their own vehicles to avoid exposure to infectious diseases, said Dyer.

Tesla weighs in

A further challenge for Chinese NEV manufacturers is the growing threat posed by Tesla Inc. The U.S. company began delivering Model 3 sedans built at its new Shanghai Gigafactory in January and has rapidly gained a foothold in the world’s largest electric-car market. Sales reached 10,160 units in March, compared to 3,900 units in February. Jefferies analysts estimate that the market share of Tesla’s China-made models will increase to 7.5% in 2020.

CEO Elon Musk announced during an April 29 earnings call that the company would cut the price of its Model 3 in China to qualify for the subsidies, a move that will heap pressure on local EV manufacturers on both sides of the 300,000-yuan threshold and possibly trigger a price war.

“The intention of policies in China is always about helping local manufacturers of electric vehicles, but again, I don’t think it is possible to structure in a way that prevents foreign companies from going that way to qualify for subsidies,” said Automobility’s Russo. “In fact, they may have to, to keep their market share.”

Tesla will have more room to lower prices further if it can localize more of its production and therefore reduce costs, said Sino Auto Insights’ Le. The carmaker was reported to be in talks with Chinese battery producer Contemporary Amperex Technology Co. Ltd. to supply lithium iron phosphate batteries to its Shanghai plant.

Chinese EV-makers in the premium segment, such as NIO Ltd. and the Alibaba Group Holding Ltd.-backed Xpeng, are more likely to feel the effects of Tesla’s growth and could be squeezed out of the market, analysts said.

NIO, which sells cars that cost more than 300,000 yuan, said it would continue to offer subsidies under the rate and conditions before the new policy until May 31. But the startup sold just 1,533 units in March and has faced liquidity concerns. On April 29, it announced a 7 billion-yuan cash injection by a group of state-backed investors.

Yet 300,000 yuan is still more than most Chinese car buyers can afford, Le said. Chinese mass-manufactured NEV models by the likes of Berkshire Hathaway Inc.-backed BYD Co. Ltd. are in a different category of competition since they are generally priced well below 300,000 yuan.

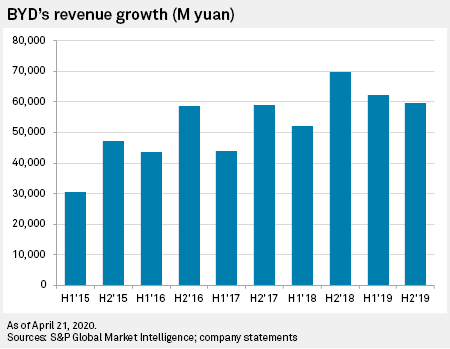

These brands can still bank on a boost to sales volume under the current policy, said Russo. BYD reported an 85% drop in first-quarter net quarter after sales of its NEV models fell 70%.

However, the easing of subsidies and the ramp-up of NEV production by foreign carmakers such as Tesla and Volkswagen AG will ultimately lead the Chinese NEV segment into a market correction, said Liu Kun, senior consultant at Ries.

“The NEV sector is entering into a transition period in the next five years, but we can expect to see a more stable growth after its exponential rise over the past 10 years,” he said.

As of April 29, US$1 was equivalent to 7.08 yuan.

Sorry, the comment form is closed at this time.