20 Feb Why China’s electric-car industry is leaving Detroit, Japan, and Germany in the dust

MIT Technology Review, December-January 2018/2019

China was no good at cars. Then EVs came along.

After the Cultural Revolution of the 1960s and ’70s crippled China’s economy, the country began to open its markets to the outside world. The aim was to bring in technological know-how from abroad that domestic firms could then assimilate. By the early ’80s, foreign automakers were allowed in on the condition that they form a joint venture with a Chinese partner. These Chinese firms, by working with foreign companies, would eventually gain enough knowledge to function independently.

SOURCES: (BATTERY PLANS) BLOOMBERG ; (TOP EV COMPANIES) INSIDE EVS ; (MOVING PARTS) UBS

Or so the theory went. Chinese-produced cars subsequently flooded the market, but they were largely cheap copycats—they looked like foreign-made cars, but the engines weren’t as good. Carmakers in the US and Europe had too much of a head start for China to catch up.

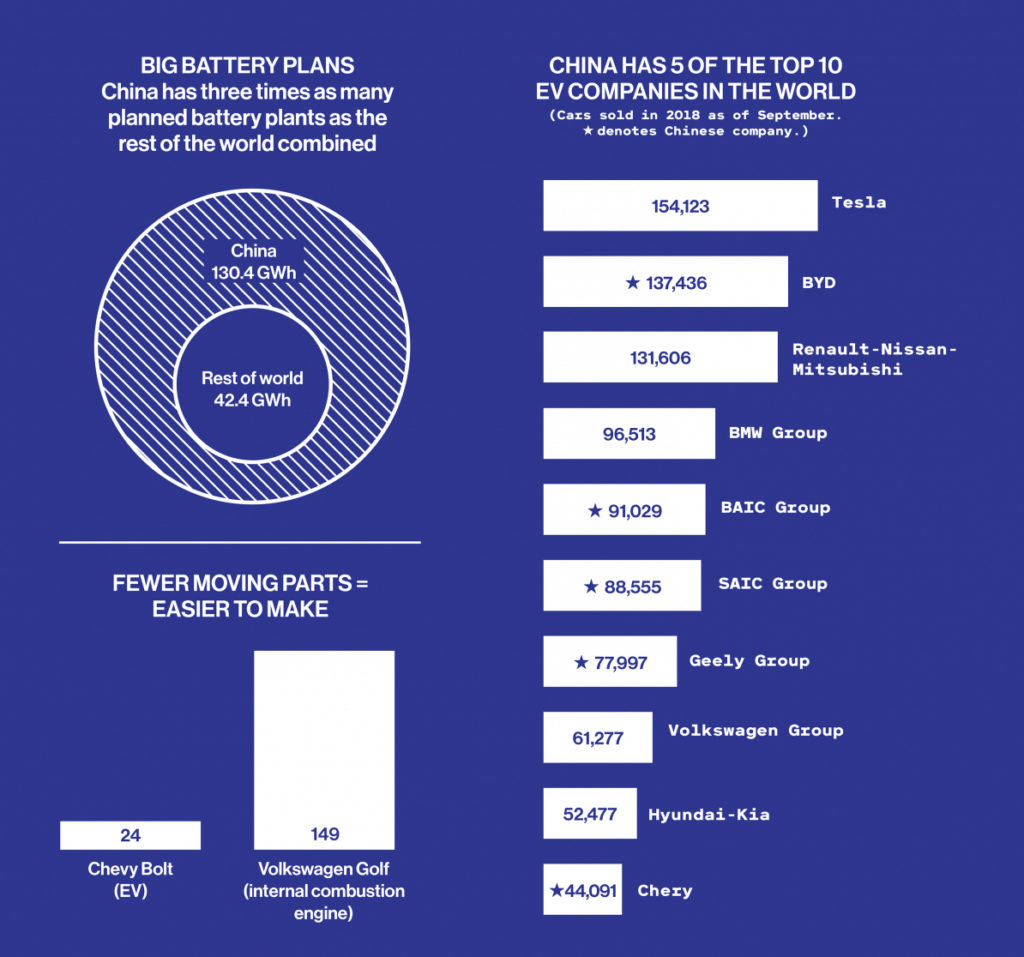

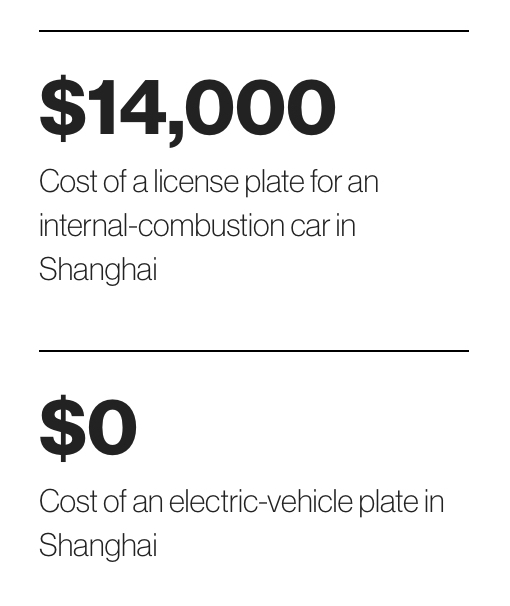

The only way to outdo the rest of the world, then, was to bet on a whole new technology. Enter electric vehicles, which require less mechanical complexity and rely more on electronic prowess. A Chevrolet Bolt’s electric engine contains just 24 moving segments, according to a teardown performed by consulting company UBS. In comparison, a Volkswagen Golf’s combustion engine has 149. Meanwhile, China already had an electronic manufacturing supply chain in place from its years of producing the world’s batteries, phones, and gadgets.

Now the Chinese government is embracing the shift from combustion to electric engines in a way no other country can match. It’s made electric vehicles one of the 10 pillars of Made in China 2025—a state-led plan for the country to become a global leader in high-tech industries—and enacted policies to generate demand. Since 2013, almost 500 electric-vehicle companies have launched in China to meet the government’s mandate and to cash in on subsidies designed to generate supply.

SOURCE: BLOOMBERG

“The world needs a different way of powering the economy,” says Bill Russo, CEO of the Shanghai consultancy firm Automobility. “China recognizes it can’t be dependent on fossil fuels—it will choke on its own fumes.”

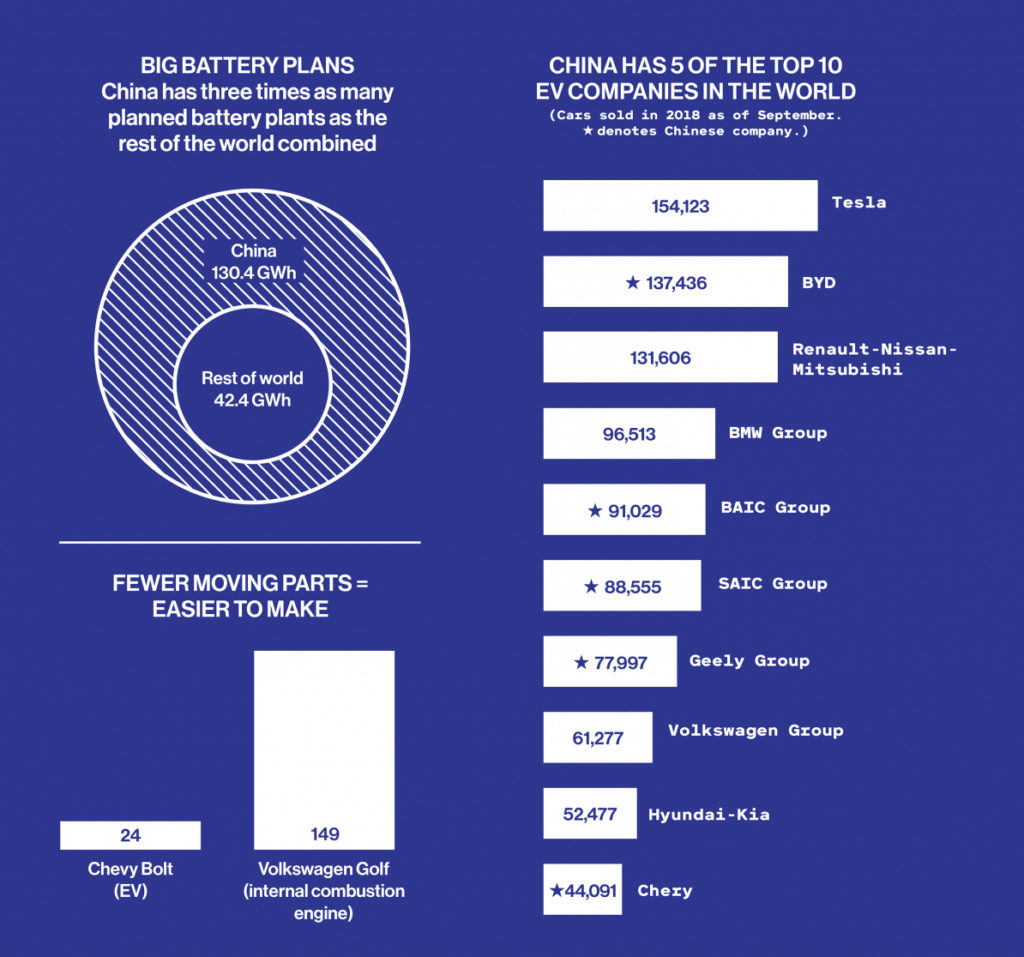

For consumers, the government promised one of the most difficult things to obtain in China’s metropolises: a license plate. To combat pollution, the number of license plates issued each year is strictly limited. Beijing awards them through a lottery, but the chance of getting one in any given year is now 0.2%. Shanghai sells them at an auction with prices of over $14,000, more than the price of many domestically produced cars. Electric-vehicle plates are not only faster to get; they’re free.

China’s breakneck speed has changed the strategies of traditional auto manufacturers. Many are now basing their global strategy for electrification on China’s industrial policy, but the momentum behind China’s companies is hard to match—and that’s a threat to the bottom line for Ford, General Motors, and European carmakers.

“The industry has always been dominated by Japan, the Europeans, and the US,” says Jonas Nahm, an assistant professor of energy, resources, and environment at the Johns Hopkins School of Advanced International Studies. “The center of gravity is shifting very rapidly. I don’t think anyone has figured out a good response to it yet.”

SOURCE: 2020 FORECAST FROM THE WALL STREET JOURNAL

Jordyn Dahl, a freelance writer based in San Francisco, lived in Beijing from 2013 to 2018.

Keith Lomason

Posted at 16:19h, 20 FebruaryHi Jordyn,

I see this article as a decent macro view of how and why China seems to be leading the world in the EV space, but I challenge your title and sub-title because there is much more to the story – and especially to the future of the industry.

Yes, China is leaving all other countries in the dust when counting sales figures, but as you point out, this is largely due to government policies and incentives that are unsustainable in the long-term in China and will not be available (or tolerated) in the international markets.

Your sub-title suggests that China is better at making EVs than they were at making internal combustion engine vehicles (ICE), or better at EVs than foreign OEMs are, and this simply is not accurate – not yet anyways. A car is still a car, and building an electric version properly still requires know-how and processes that most Chinese OEMs have yet to master. Chinese companies have indeed been quick to build capacity due to government subsidies for manufacturers and buyer incentives like the Shanghai license plate situation you bring up, but this is more a reflection of the agility of Chinese companies to react quickly to opportunities in their home market than it is an advancement of Chinese company abilities to build a better vehicle. The majority of Chinese built EVs are still a modified version of an ICE and are not designed from the ground-up to be an EV, and hence are not competitive with EVs designed from the ground-up to be an EV.

I agree with predictions I have seen where China’s dominance in volume will be swiftly challenged as other OEM’s products and foreign infrastructures mature for their EV eco-systems. I also believe that the money and effort being spent by the Chinese government, its State Owned Enterprises, and Chinese private companies on cornering the market in raw materials and manufacturing capacity for batteries is going to result in over-capacity issues in 7-12 years as more efficient energy transfer and storage methods are being developed that will take this long to come to market.

.