01 Apr How Industry 4.0 Enables China’s Automobility Revolution

LinkedIn Pulse, March, 2018

Historical and China Context of Industry 4.0

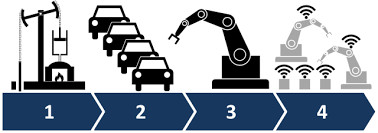

To understand the origins of the term Industry 4.0, it is important to view it from a historical perspective. The invention of the steam-powered loom by Edmund Cartwright in 1784 marked the start of the first industrial revolution (Industry 1.0). It allowed textile making to be done faster than if done by a human, and marked the beginning of mechanized production. The second revolution (Industry 2.0) came a century later and involved new forms of power (electricity), a more specialized workforce, and assembly line mass production methods. A century later, a third revolution (Industry 3.0) led to the incorporation of advanced electronics and information technology in order to improve automation. The fourth (current) stage of the industrial revolution (Industry 4.0) represents the convergence of the Internet of Things (IoT) with the control of cyber-physical systems.

The term Industry 4.0 originated from a high-tech strategy project sponsored by the German government which promoted the computerization of manufacturing. The original intent was to showcase Germany’s ambition to maintan its leadership in advanced manufacturing technology and solutions. Since then, Industry 4.0 principles have spread globally.

Industry 4.0 programs have largely been promoted in industrial economies, and China has made intelligent/smart manufacturing a national imperative. China’s “Made in China 2025” initiative offers a 10-year national plan designed to transform China into a leading high-tech manufacturing power. The term “Made in China 2025” is a clear indication of the country’s intention of securing the competitiveness of its manufacturing sector. Both central and provicial governments are planning to invest to develop infrastructure and upgrade capabilities. For example, funding from China’s Ministry of Industry and Information Technology (MIIT)’s will likely exceed RMB 10 billion. In addition, local authorities will provide an additional RMB 10 billion in financial support from 2016 to 2020. MIIT will also cooperate with China Development Bank to provide financial support for major projects, with an estimated RMB 300 billion of support in the 2016-2020 period.

The Automobility Revolution

The traditional product-centric value chain where suppliers interact with manufacturers who sell to dealers who then sell a product to individual owners is being replaced with a user-centric model where users access and pay for the utility derived from the product. Connected mobility, which we define as “technology-enabled on-demand mobility services for moving people and goods from point A to B”, has become a disruptive, paradigm-changing development in the history of the automotive industry. It requires a complete rethinking of the way to deliver value to the market. Traditional automakers must expand their focus from the product (the “automobile”), to the utility that is derived from the product (“automobility”), and create a business model and digital ecosystem optimized to provide digitally-enabled solutions for both car owners and users.

China exhibits far greater potential to disrupt and lead the automobility revolution compared with other markets for several reasons. First, China’s rapid urbanization has led to significant mobility challenges, as the increasingly urbanized population creates an explosive demand for personal mobility. Second, China has the world’s largest internet population and most Chinese netizens use smart phones to access internet services. Third, the China government plays a key role to encourage innovation in the internet economy with a focus on digital transformation, new energy vehicles and smart cities.

As a result, we are witnessing the onset of what we believe to be a three-phased “Automobility Revolution” in China, which will rapidly transform the competitive landscape. In the Industry 1.0 – 3.0 era, automotive production was a “push system” which delivered products to be sold to an established design. In the Industry 4.0 era, users within a “pull system” will demand a personalized solution and pay for the utility derived from the product.

In China, the Automobility 1.0 phase (from 2012 to 2017) connected traditional cars (driven by humans and powered by an internal combustion engine) to riders using mobile technology. Pay-per-use ride hailing services, including Didi Dache, Kuaidi Dache, Yidao Yongche, Shenzhou Zhuanche and Uber were formed and grew rapidly. Stronger players like Didi Chuxing (a merger between Didi Dache and Kuaidi Dache), backed by technology firms such as Alibaba and Tencent, have become dominant. Other forms of connected mobility services including bike sharing (Mobike, Ofo, and many others) have also emerged and have grown rapidly.

We have recently entered the Automobility 2.0 phase. During this period, we will see cars built specifically for connected mobility services. The defining characteristics of cars used in this manner include high utilization rates and rider-centric features which enable connectivity. We expect such cars to be powered by electricity due to their lower operating cost (especially fuel and maintenance) and include features tailored for riders (more screens, connectivity and content services).

In addition, new business models and upgraded/differentiated on-demand mobility services will emerge to address mobility pain points observed in the Automobility 1.0 phase, including increased congestion, service timeliness, surge pricing, service inconsistency, safety and security concerns, lack of personalization, lack of charging infrastructure, inconvenient parking, etc.

Beyond 2025, we will enter the Automobility 3.0 phase, when autonomous driving technologies will become commercially viable. An accelerated pull from China’s “Internet + Auto” and Smart City investments will result in the initial deployment of professionally managed autonomous mobility services fleets. The future automobility business model can be described by a combination of the terms “personalized, electric, shared and autonomous mobility on-demand”. Mass deployment of autonomous mobility on-demand will occur beyond 2025. Automobility 3.0 is a far more efficient system where instead of owning an under-utilized depreciating asset, people pay for the utility that is derived from the asset.

Key stakeholders including dealers, manufacturers and suppliers, and new mobility solutions companies must think beyond improving their hardware or production facilities, but also learn and digest the implications of Industry 4.0 as a new paradigm for a C2B connected enterprise.

Companies within the Automobility ecosystem (including dealers, manufacturers and suppliers, and new mobility solutions companies) must re-examine how to pursue an Industry 4.0 strategy in order to deliver a sustainable competitive advantage in order to compete in the new business model.

How Industry 4.0 Will Enable the Automobility Revolution

Faster product iterations, shorter development cycles

The Automobility revolution results in a reconfiguration of the value chain, where the vehicle becomes a platform for serving users through a digitally-infused services-centric business model that is enabled by IoT technology. The hardware platform of vehicle must therefore keep up with the speed of software and service iterations. On-demand mobility service providers (especially those backed by internet service companies like Tencent and Alibaba) will seek to leverage these connected mobility platforms to deliver a wide variety of online-to-offline (O2O) services to their users. Asset-light platforms for fast technology and service experimentation will be needed.

Take the example of Mobike, the Tencent-backed Chinese bike sharing startup that penetrated more than 190 cities worldwide, has gone through 3 product development cycles in less than 2 years since its launch in April 2016. The current generation has features, such as airless low-wear tires to fit for the mobility-on-demand use case. Automobility hardware companies will need similar short-cycle development and manufacturing capabilites in order to compete in this new automobility ecosystem.

Industry 4.0 digital factory – a physical operating space, designed for rapid prototyping, modular experimentation, and small-batch manufacturing of products, will deploy Product Lifecycle Management (PLM) methods which leverage a core capability of simulation and virtual production to facilitate true simultaneous engineering of product and process design. With this capability, production can be simulated without investing in expensive soft-tooling of prototypes for trial-and-error pilot production. As a result, production launch and model change-over projects can be anticipated in a virtual environment, to shorten the time needed for factory design, and decrease cost through use of digital model simulation to optimize logistics processes. The development of reality technologies, including Virtual Reality (VR), Augmented Reality (AR) and Mixed Reality (MR) will facilitate process simulation with the ability to relate digital and physical space and easier Human Machine Interface (HMI) design.

Mass customization – “lot size of 1”

The traditional automotive B2C “push system” is obsolete. Under the Industry 2.0 and Industry 3.0 paradigm, standardized production processes and lean manufacturing principles required production processes to be highly routine in order to ensure high quality and productivity. Advanced manufacturing techniques were devised in order to allow flexibility and enable customization of the product within an “envelope” of the product architecture. However, the objective of achieving a “lot size of 1” where every product is customizable, has not been fully achieved.

Industry 4.0 will connect users, equipment and products in real time, allowing factories to produce products that are fully personalized to the individual’s usage patterns and preferences. Internet-of-Things is helping factories to overcome communication barriers amongst various field devices, including machinery, robots, PLCs, and sensors. Information technology (IT) systems and operational technology (OT) systems will merge in a big data environment, where information from the enterprise, supply chain, customer, infrustructure, product and factory integrates seamlessly.

Big data-based machine learning (ML) and deep learning (DL) can help identify patterns and predict trends. We expect future Artificial Intelligence (AI) to be able to make real-time mission-critical decisions in a manufacturing environment with situational awareness, explanation and audit trail with networked cognitive agents.

We envision a future where a “smart car” mobility solution is fully personalized to the individual user’s needs. The Industry 4.0 paradigm will shift towards a Consumer-to-Business (C2B) model where end-users are engaged in an active process where brands work together with designers, and engineers to accelerate product and technology development throughout the value chain via community marketing, innovation brainstorming, crowd-sourced design optimization, flexible production and socialized customer relationship management, as depicted below.

Organizational Implications

Organizations must adapt to the transformation from a B2C product-centric to C2B user-centric business model. Under such conditions, organizational structures need to evolve from a hierarchical “pyramid” to a more horizontal “platform”, where resources can be mobilized quickly and responsive to changing customer needs.

Companies must embrace an ecosystem-based collaboration model for innovation. Established ICT companies, as well as tech startups will be instrumental to the construct of the Industry 4.0 smart factory. As a result, leading businesses are creating incubators and innovation labs while setting up platforms to fund for new ventures in order to build Industry 4.0 ecosystem.

Industry 4.0 companies must build a more diverse talent pool. Beyond the core mechanical and manufacturing engineering talent which has guided the industry for the past century, there will be high demand for electronics and information technology professionals to build the mobility ecosystems and Internet-of-Vehicles solutions, as well as operate and optimize the smart manufacturing system that produces the connected products that serve that ecosystem.

In a world of digital factories, the skills needed in the workforce will change fundamentally. The focus of the workforce will shift from direct production towards indirect production planning, quality, procurement and logistics. In such an environment, people will be more engaged in creative and knowledge work, and less involved in routine tasks which will increasingly be automated.

Looking Forward

China’s auto industry is being digitally disrupted and is rapidly entering the Industry 4.0 era, which will fundamentally transform the business model of the industry, and unlock new ways of delivering value to the end user. The scope of this transformation is far beyond just technological innovation or industrial upgrading, requiring a fundamental re-thinking of the value capture and delivery system of the industry.

Key stakeholders including dealers, manufacturers and suppliers, and new mobility solutions companies must think beyond improving their hardware or production facilities, but also learn and digest the implications of Industry 4.0 as a new paradigm for a C2B connected enterprise.

Automotive companies must re-examine how to pursue an Industry 4.0 strategy in order to deliver a sustainable competitive advantage. The forces of technology change, along with the presence of disruptive Chinese companies with an innovative and experimental mindset make it even more imperative to move quickly. Automotive enterprises must act now to build the capability system, organizational structure and operating model of a business that is ready to compete in the Industry 4.0 era.

About the Authors

Bill Russo is the Founder and CEO of Automobility Limited. He is also the Managing Director and the Automotive Practice leader at Gao Feng Advisory Co. He has lived and worked in China since 2004 and has over 30 years of automotive industry experience. He was previously Vice President of Chrysler North East Asia, where he managed the business operations for the Greater China and South Korea markets.

Bevin Jacob is a Partner & Co-Founder at Automobility Limited with 17 years of experience in Investment Advisory, Business Development, Product Management, Incubation & Engineering of Autonomous Transportation Systems and On-Demand Mobility Services for Car Sharing, Retail, Automotive Infotainment and Telematics business in Greater China, USA, S.Korea & India.

Emily Wang is a Senior Consultant at Automobility Limited with 8 years experience in Business Intelligence and Management Consulting in mainland China and North America, focusing on automotive and mobility market. She has an MBA from Babson College.

onesies for animals

Posted at 12:51h, 23 SeptemberGood post. I am going through some of these issues as well..